EXAM, FIRST SIT

Transcript of EXAM, FIRST SIT

Faculty of Economics and Business Administration

EXAM, FIRST SIT

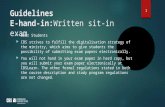

Knowledge test part Course : Microeconomics Code : 103BE, 103BF, 103BX Date : December 23, 2005 Time : 10.15h – 12.15h Location : MECC This part of the exam consists of: 16 Pages (front page included) 80 Questions You are allowed to make use of: Scrap paper and a non-programmable, non-graphical calculator. Norm: You can obtain at the most 80 marks for this part of the exam (one for each correct answer). This score will be added to your score on the open book part of the exam (40 marks at the most). The sum will be divided by 12 and rounded into half points, subject to the requirement that you need 66 points to get a 5.5. Procedure for objections: Objections should be submitted in writing to the course coordinator, Christian Kerckhoffs, before Monday January 16, 15.00h. Christian’s mailbox is at the Quantitative Economics secretariat, TS53, third floor, room A3.10: if closed, you can use the mailbox outside. Be sure to include your ID-number and e-mail address. Objections in any other form (e.g. through e-mail) will be ignored. Particulars: As in any multiple choice exam, there is only one correct answer to each question. Answer the questions on the answer card provided. Before you begin, make sure your exam is complete.

Good luck!

2

Note 1: Always read all the options before choosing one, and then select the best option. Sometimes the final option may read like “all the previous options are correct” or “none of the above”.

Note 2: Unless stated otherwise, Q indicates a market quantity, whereas q indicates a quantity at the

individual level (consumer or firm). A price is typically denoted as P or p. 1) Gasoline prices are known to have a strong impact on the car market. As the price of gasoline rises,

the A) equilibrium price for cars rises. B) equilibrium quantity of produced cars rises. C) supply curve for cars shifts to the left. D) demand curve for cars shifts to the left.

2) In the aftermath of the second Gulf War the UN imposed economic sanctions on Iraq, including a quota on the export of oil. How did the quota affect the world market for oil?

A) The world demand curve for oil shifted to the right. B) The world demand curve for oil shifted to the left. C) The world supply curve for oil shifted to the right. D) The world supply curve for oil shifted to the left.

3) Suppose the demand function is Q = 1.5 – 0.25P. The price elasticity of demand equals H = –2 at the point

A) P = 0.5 ; Q = 1.375 . B) P = 1 ; Q = 1.25 . C) P = 2 ; Q = 1 . D) P = 4 ; Q = 0.5 . 4) The demand function is given by the equation 75.0/2 PQ . At the price of P = 16, the price

elasticity of demand equals A) H = –0.25 . B) H = –0.5 . C) H = –0.75 . D) None of the above.

5) Consider a competitive market. Starting from an initial equilibrium, a specific tax is introduced. In which of the following cases is the entire tax burden carried by the consumers?

A) Supply is perfectly inelastic. B) Demand is perfectly inelastic. C) Demand is perfectly elastic. D) In none of the cases A), B) and C) above.

6) Consider a competitive market. Starting from an initial equilibrium, a specific tax is introduced. In which of the following cases is the entire tax burden carried by the producers?

A) Supply is perfectly inelastic. B) Demand is perfectly inelastic. C) Supply is perfectly elastic. D) In none of the cases A), B) and C) above.

3

7) At the initial equilibrium, a competitive market is characterized by a price elasticity of demand H = –4 and a price elasticity of supply K = 2. Suppose a specific tax of 1 euro per unit of the good is introduced. What is the incidence of the tax on producers?

A) Less than 50%. B) Exactly 50%. C) More than 50%. D) The given information is insufficient information to answer the question.

8) Figure 1 illustrates the consequences of introducing a price floor in a market for agricultural products. Prior to the introduction of the price floor, the equilibrium price was P = 10 and the equilibrium quantity was Q = 60. The government imposes a minimum price of 15 and commits to buying up any excess supply at this price. Which of the following statements is true?

A) The minimum price policy results in an excess

supply of 30 units. B) The cost of the minimum price policy to the

government is 900. C) The price received by producers is 5 per unit

of output. D) None of the statements A), B) or C) is true.

9) Consider again Figure 1 above. The government abandons the minimum price policy and introduces a subsidy of 10 euro per unit, paid to the producers. Which of the following statements is true?

A) The subsidy policy results in an excess supply of 60 units. B) The cost of the subsidy policy to the government is 900. C) The price received by producers is 5 and the price paid by consumers is 15 per unit of the good. D) Both statements B) and C) are true.

10) In Figure 1 above, at the initial equilibrium, demand is A) inelastic. B) elastic. C) unit elastic. D) None of the above.

11) Figure 2 depicts two indifference curves representing an individual’s preferences over two goods (guns and cars). One of the indifference curves corresponds to the utility level of zero, the other one corresponds to the utility level of 1. On the basis of these two indifference curves, which of the following assumptions are violated by this individual’s preferences?

A) Completeness. B) Transitivity. C) More is better. D) Both B) and C) are violated.

Figure 2 C

G

U =1

U =0

P

D

S

Figure 1

10

30 90

5

15

20

12060Q

4

12) An individual’s utility function is given by ZXZXU � ),( . Which of the following statements is false?

A) The utility function represents complete and transitive preferences. B) The indifference curves are straight lines. C) More of good X is better. D) More of good Z is better.

13) Carol’s marginal rate of substitution of good B for A is ABMRS /2� . Which utility function is consistent with this MRS?

A) 5.0BAU � . B) BAU � 2 . C) Neither A) nor B). D) Both A) and B).

14) Figure 3 illustrates George’s optimal choice between cider C and wine W. At the optimal bundle, his marginal rate of substitution of wine for cider is

A) –5 . B) –4 . C) –2 . D) –1 .

15) In Figure 3, A) cider is 5 times more expensive than wine. B) cider is 4 times more expensive than wine. C) wine is 5 times more expensive than cider. D) wine is 4 times more expensive than cider.

16) In Figure 4, wine is again on the vertical axis and cider on the horizontal axis. The initial budget constraint is depicted as a bold line. Suppose the price of cider rises, at the same time income increases, while the price of wine remains unchanged. The resulting budget constraint is

A) L1. B) L2. C) L1 or L2, depending on the magnitude of the

changes in the cider price and income. D) L2 or L3, depending on the magnitude of the

changes in the cider price and income.

W

C

Figure 4

L2

L1

L3

W

C

Figure 3

U

2

10

5

20

5

(Questions 17-21)

All these questions are about a consumer whose utility function is given by 4/34/1),( ZXZXU � .

From this utility function, the demand function for good Z can be found as ZP

YZ43

.

17) At any optimal bundle of goods X and Z, what fraction of the income is allocated to the purchase of

good Z? A) ¼ . B) ¾ . C) ½ . D) The given information is insufficient to answer the question.

18) The demand function for good X is given by the equation

A) XP

YX4

.

B) XP

YX43

.

C) X

Z

PPYX

43 �

.

D) The given information is insufficient to answer the question.

19) The income elasticity of demand for good Z is

A) 243

ZPY

� .

B) ZP4

3 .

C) ¾ . D) 1 .

20) The price elasticity of demand for good Z is

A) 246

ZPY

� .

B) equal to –¾ everywhere along the demand curve. C) equal to –1 everywhere along the demand curve. D) The given information is insufficient to answer the question.

21) Suppose that the price of good X is PX = 1, the price of good Z is PZ = 3, and the income is Y; at these values, according to the demand function for good Z, the optimal bundle involves Z = Y/4. At this optimum bundle, the consumer achieves a utility of

A) Y/4 . B) Y . C) Y 3/4 . D) None of the above.

6

22) Suppose goods X and Z are perfect substitutes. Which of the following statements is necessarily true? A) The marginal rate of substitution is constant along any indifference curve. B) The marginal rate of substitution is zero. C) The marginal rate of substitution diminishes along any indifference curve. D) None of the above.

23) Figure 5 illustrates the optimal choice between food (F) and housing (H). Which of the following statements concerning the two optimum bundles e1 and e2 presented in the figure is true?

A) The price elasticity of demand

for good F is zero. B) The price elasticity of demand

for good H is zero. C) The cross price elasticity of

demand for good H with respect to the price of good F is zero.

D) The cross price elasticity of demand for good F with respect to the price of good H is zero.

24) Consider Figure 5 above. The movement from f1 to f2 represents A) a movement along the demand curve for F. B) an outward shift of the demand curve for F. C) an inward shift of the demand curve for F. D) None of the above.

25) Goods X is called an inferior good if A) the demand for X rises when its price decreases. B) the law of demand is violated. C) the utility decreases as the consumption of X increases. D) the demand for X rises as income decreases.

26) Suppose good X is a Giffen good. Then A) The income elasticity of demand for good X is negative. B) The demand curve for good X is upward sloping. C) Both A) and B) are correct. D) Neither A) nor B) is correct.

Figure 5

f2

H

F

f1 e1

e2

7

27) Figure 6 depicts a part of an income-consumption curve. Which of the following statements is true?

A) Both goods C and F are normal. B) Both goods C and F are inferior. C) Good C is a normal good; beyond some income level,

good F turns from normal to inferior. D) Good F is a normal good; beyond some income level,

good C turns from normal to inferior.

28) Figure 7 illustrates the

consequences of a decrease in the price of housing. The initial budget constraint is L1 and the new final budget constraint is L2. The substitution effect of the change in the housing price is represented by

A) the move from e1 to e2. B) the move from e1 to e3. C) the move from e2 to e3. D) the move from e3 to e2.

29) Consider again Figure 7. The income effect of the change in the housing price is represented by A) The move from e1 to e2. B) The move from e1 to e3. C) The move from e2 to e3. D) The move from e3 to e2.

30) Consider again Figure 7. Which of the following statements is necessarily true? A) housing is an inferior good. B) food is an inferior good. C) housing is a Giffen good. D) food is a Giffen good.

31) In microeconomics, we typically assume that a firm’s ultimate objective is A) to maximize its output. B) to minimize its cost. C) to maximize the returns on capital. D) to maximize its profits.

F

Figure 6

C

Figure 7food

e3

e2

e1

L2 L1

housing

8

32) Consider a firm’s short run production structure. If the average product of labor curve has a maximum, then it will attain it when

A) it crosses the marginal product of labor curve. B) the marginal product of labor is zero. C) the output is maximal. D) the marginal cost of production is minimal.

33) Consider the production function LKLq � . The average product of labor is given by the

equation

A) LKAPL 5.01� .

B) LKAPL � 1 .

C) LKAPL 5.0 .

D) None of the above.

34) As in the previous question, the production function is LKLq � . This function A) satisfies the law of diminishing marginal returns for capital but not for labour. B) satisfies the law of diminishing marginal returns for labour but not for capital. C) satisfies the law of diminishing marginal returns for both factors. D) violates the law of diminishing marginal returns for both factors.

35) Consider again the production function LKLq � . Suppose that the amount of capital is fixed at

K = 1, so that the short-run production function follows as LLq � . The marginal product of labor is given by the equation

A) L

MPL 211� .

B) L

MPL11� .

C) 2LMPL .

D) None of the above.

36) If the isoquants of a production process are as in Figure 8, then the production function describing this process may be given by the equation

A) )(2 KLq � .

B) KLq � . C) Either A) or B). D) Neither A) nor B). L

K Figure 8

2 3

2

3

9

37) Consider a Cobb-Douglas production function ȕĮ LKq � . Which of the following statements is true?

A) The Cobb-Douglas production function has increasing returns to scale if Į + ȕ < 1 . B) The Cobb-Douglas production function has decreasing returns to scale if Į + ȕ < 1 . C) The Cobb-Douglas production function has constant returns to scale if Į + ȕ < 1 . D) The Cobb-Douglas production function has decreasing returns to scale for all values of Į and ȕ.

38) Labour is the only input in the production process and the wage rate is w = 2. If the production function is Lq , then average cost is given by the equation

A) LAC 2/1 . B) LAC /1 . C) qAC /1 . D) qAC 2 .

39) Suppose labour is the only variable input in the production process. If the marginal product of labour is MPL = 2 and the wage rate is w = 3, what is marginal cost?

A) 6 . B) 2/3 . C) 3/2 . D) 1/6 .

40) In order to perform one surgery a hospital needs 6 units of labour L (e.g. surgeons and assistants) and 2 units of capital K (equipment). It is not possible to substitute the inputs for one another. The cost of labour is w = 2 per unit and the cost of capital is r = 1. If q denotes the number of surgeries performed, the long-run cost function is given by the equation

A) C = 12L + 2K . B) ɋ = 6L + 2K . C) C = 8q . D) C = 14q .

41) In the long run, if the average cost curve has a minimum, then it will attain it when A) it crosses the long run marginal cost curve. B) it crosses the average fixed cost curve. C) it crosses the average variable cost curve. D) the total cost of production is minimal.

42) Figure 9 illustrates the long-run expansion path of a firm. If the price of labour L is w = 1 and the price of capital K is r = 2 then, between output levels of q = 1 and q = 2, the firm’s long-run average cost is

A) constant. B) decreasing. C) increasing. D) The given information is insufficient to answer

the question.

KFigure 9

1

2

2

3

q=1 q=2

L

10

43) Consider the firm depicted in Figure 9. If the rental rate falls while the wage rate is unchanged, then the firm’s long-run expansion path

A) shifts up. B) shifts down. C) remains unchanged. D) cannot be depicted on the same diagram.

44) Suppose a firm has a Cobb-Douglas production function 5.05.0 KLq � and the prices of the inputs are w = 1 for labour and r = 4 for capital. The long-run cost expansion path of the firm is given by the equation

A) L = 4K . B) K = 4L . C) L = 2K . D) K = 2L .

45) As in the previous question the production function of a firm is 5.05.0 KLq � and the prices of the inputs are w = 1 for labour and r = 4 for capital. If the firm wants to produce q = 4 units of output, it will use

A) L = 16 units of labor and K = 4 units of capital. B) L = 2 units of labor and K = 8 units of capital. C) L = 4 units of labor and K = 4 units of capital. D) L = 8 units of labor and K = 2 units of capital.

46) Which of the following conditions is not necessary for a market to be perfectly competitive? A) All firms have identical costs. B) Any firm can freely enter and exit the market. C) Transaction costs are low. D) Consumers believe that all firms in the market sell identical products.

47) If a firm is a price-taker, then its A) marginal cost curve is horizontal. B) average cost curve is horizontal. C) marginal revenue does not depend on the price. D) marginal revenue is equal to the price.

48) Suppose a competitive firm, currently in business, suddenly notices that the market price exceeds its marginal cost. What is the best course of action for such a firm?

A) Shut down. B) Decrease production. C) Increase production. D) Decrease the price.

11

49) In the short run a competitive firm should choose to shut down if A) it makes a loss when operating. B) the price is lower than its average total cost. C) the price is lower than the minimum of its average variable cost. D) the price is lower than the minimum of its average fixed cost.

50) The short run supply curve of a competitive firm A) is given by its average variable cost curve. B) is given by its marginal cost curve. C) is given by its marginal cost curve above the minimum of its average cost curve. D) is given by its marginal cost curve above the minimum of its average variable cost curve.

51) Consider a competitive firm as in Figure 10. The market price is P = 3. Which of the following statements is true?

A) The firm makes a profit. B) The firm makes a loss. C) The firm shuts down. D) The firm maximizes its profit by producing

10 units of output.

52) Each firm in a competitive industry has a long-run cost function of qqqC 204 23 �� . Factor prices remain constant when industry output changes. The long-run equilibrium price is

A) P = 10 . B) P = 16 . C) P = 26 . D) P = 32 .

53) Consider the industry discussed in the previous question. What additional information suffices to determine the long-run number of firms that will be active in this market?

A) The firms’ production functions. B) The market’s demand function. C) The consumers’ utility functions. D) None of the answers A), B) or C) is correct.

54) Consider a competitive constant-cost industry. The introduction of a specific tax has the following effects on the long-run equilibrium:

A) The number of firms falls and each firm increases its output. B) The number of firms falls and the output of each firm remains unchanged. C) The number of firms rises and the output of each firm remains unchanged. D) The number of firms rises and each firm decreases its output.

q

Figure 10

AC MC

AVC4

2

10

12

55) In the equilibrium of a perfectly competitive market A) the consumer surplus is maximized. B) the producer surplus is maximized. C) the sum of the consumer surplus and producer surplus is maximized. D) None of the answers A), B) or C) is correct.

56) A binding price ceiling is set on a perfectly competitive market. This policy A) increases consumer surplus; the effect on producer surplus is ambiguous. B) increases producer surplus; the effect on consumer surplus is ambiguous. C) decreases consumer surplus; the effect on producer surplus is ambiguous. D) decreases producer surplus; the effect on consumer surplus is ambiguous.

57) Consider the competitive market represented by Figure 11. Prior to any interventions, the equilibrium price was P = 10 and the equilibrium quantity was Q = 60. Suppose the government introduces a subsidy of 10 euro per unit. Consumer surplus will now equal

A) 75 . B) 300 . C) 675 . D) 900 .

58) Consider again the competitive market represented by Figure 11. As before, assume there is a subsidy of 10 euro per unit. The resulting deadweight loss is

A) 100 . B) 150 . C) 750 . D) 900 .

59) Consider again the competitive market represented by Figure 11. Suppose the government abolishes the subsidy. Instead, it chooses to regulate the market by imposing a minimum price of 15. As a result of this policy, consumer surplus becomes

A) 75 . B) 300 . C) 675 . D) 900 .

60) Consider again the competitive market represented by Figure 11. In addition to imposing a minimum price of 15, the government decides to buy up any excess supply at this price. What is the deadweight loss of this minimum price policy?

A) 100 . B) 150 . C) 750 . D) 900 .

P

D

S

Figure 11

10

30 90

5

15

20

12060Q

13

61) For a monopolistic firm, the supply curve A) coincides with its average cost curve. B) coincides with its marginal cost curve. C) coincides with its marginal revenue curve. D) does not exist.

62) Consider a monopolistic market. At a price of P = 4, the price elasticity of demand is H = –2. The marginal revenue of the monopolist equals

A) –2 . B) 0 . C) 2 . D) 4 .

63) Consider the monopolistic market of the previous question. If the marginal cost of production is 4 for all levels of output, then what is the best course of action from the point of view of the monopolist at hand?

A) Increase the output and increase the price. B) Decrease the output and increase the price. C) Increase the output and decrease the price. D) Decrease the output and decrease the price.

64) A monopolist faces a demand function PQ 5.0100 � , implying an inverse demand function QP 2200 � . If the monopolist charges a uniform profit-maximizing price, then his marginal

revenue function is given by the equation A) 25.0100 PPMR � . B) PMR � 100 . C) QMR 2200 � . D) QMR 4200 � .

65) Consider a monopolist who faces a demand function PQ 5.0100 � and has a constant marginal cost of 40. If the monopolist charges a uniform profit-maximizing price, then his profit-maximizing output is

A) 20 . B) 30 . C) 40 . D) 80 .

66) As in the previous question, consider a monopolist who faces a demand function PQ 5.0100 � and has a constant marginal cost of 40. If the monopolist charges a uniform profit-maximizing price, what is the consumer surplus?

A) 1200 . B) 1600 . C) 1800 . D) 2000 .

14

67) Consider the monopolistic market represented by

Figure 12. If the monopolist charges a uniform

profit-maximizing price, then what is his producer

surplus? A) D . B) D + E . C) B + D . D) B + C + D + E .

68) For a perfectly price discriminating monopolist, the marginal revenue curve

A) is horizontal at the level of the market price. B) lies below the demand curve. C) coincides with the demand curve. D) is not well-defined.

69) Consider a monopolist who faces a demand function PQ 5.0100 � and has a constant marginal cost of 40. If the monopolist is able to perfectly price discriminate, what is the profit-maximizing output?

A) 20 . B) 30 . C) 40 . D) 80 .

70) Consider again the monopolistic market represented by Figure 12. If the monopolist perfectly price discriminates, then what is his producer surplus?

A) D . B) D + E . C) A + B + D . D) A + B + C + D + E .

71) Consider a monopolist applying quantity discrimination. Compared to the case of uniform monopoly pricing, quantity discrimination

A) increases social welfare. B) increases consumer surplus. C) increases the deadweight loss. D) decreases the output.

72) A manufacturer of mobile phones sells its product in Europe and in Asia, with the marginal cost of production being independent of the destination of a specific item. If the demand for mobile phones in Europe is more elastic than in Asia, then an imperfectly competitive producer will

A) sell all mobile phones in Asia. B) charge a higher price in Asia than in Europe. C) charge a higher price in Europe than in Asia. D) sell more phones in Europe than in Asia.

Figure 12

MR

Q

P

A

BC

D E

Qd

MC

15

73) Consider the game represented by Table 1. the numbers in the lower-left and upper-right of the cells refer to the payoffs of players A and B respectively. How many Nash equilibria does the game have?

A) 0 . B) 1 . C) 2 . D) 3 .

74) Table 2 shows a payoff matrix for two firms that must choose between a high price strategy and a low price strategy. The numbers in the lower left and the upper right of the cells refer to the payoffs of firms A and B respectively. Which of the following statements is true?

A) Firm A has a dominant strategy but Firm B has none. B) Firm B has a dominant strategy but Firm A has none. C) Both firms have dominant strategies. D) Neither firm has a dominant strategy.

75) Consider a symmetric Cournot duopoly model with identical firms called A and B. The market demand function is given as PQ 5.0100 � . If firm A sets the output at 20, the residual demand curve for firm B is given by the equation

A) PqB 5.080 � . B) PqB 5.0120 � . C) BqP 22200 � . D) BqP 2180 � .

76) Consider a symmetric Cournot duopoly model with identical firms called A and B having constant marginal cost of 80. As in the previous question the market demand function is given as

PQ 5.0100 � . What is the best response for Firm B if Firm A decides to shut down? A) Abandon the market too. B) Produce 10 units. C) Produce 20 units. D) Produce 30 units.

77) Figure 13 gives a graphical representation of a Cournot duopoly model with firms A and B. The Cournot equilibrium

A) is qA = 2 and qB = 6 . B) is qA = 5 and qB = 5 . C) is qA = 12 and qB = 0 . D) cannot be determined using Figure 13 alone.

Table 1 Player B Strategy 1 Strategy 2

Strategy 1 0 1

1 0 Player A

Strategy 2 1 –1

0 1

Table 2 Firm B Low price High price

Low price 0 10

10 25 Firm A

High price 20 5

10 20

qA

BRA

BRB

2

6

7

10qB

5 12

Figure 13

16

78) Consider again Figure 13. If Firm B were a monopolist, it would produce A) 5 units. B) 7 units. C) 10 units. D) 12 units.

79) Consider a monopolistically competitive market. Which of the following statements about the long run market equilibrium is false?

A) Each firm’s residual demand curve is horizontal. B) Each firm’s marginal revenue equals its marginal cost. C) The price equals average cost. D) Each firm makes zero profit.

80) Consider again a monopolistically competitive market. As more firms (selling identical products or close substitutes) enter the market,

A) each firm’s marginal cost curve shifts up. B) each firm’s average cost curve shifts up till it reaches the residual demand curve. C) each firm’s residual demand curve shifts down. D) each firm’s residual demand curve becomes less elastic.