Evaluation of the Integrated Safeguards System Draft...

Transcript of Evaluation of the Integrated Safeguards System Draft...

Evaluation of the Integrated Safeguards System Draft Inception Report – Annexes

April 2019

Evaluation Task Manager: Monica Lomena-Gelis: [email protected]

Annex 1 - AfDB Integrated (Environmental and Social) Safeguards System – ISS ............................... 1

Annex 2 - ISS in the context of the Bank’s Project Cycle ..................................................... 10

Annex 3. Reconstructed Theory of change of the Integrated Safeguards System ............... 13

Annex 4. Desk validation tool used to assess the projects in relation to ESS requirements. 15

Annex 5. OS2 assessment proposal (compensation/resettlement of affected population) ... 19

Annex 6. Financial intermediaries operations assessment proposal .................................... 33

Annex 7. – Evaluation matrix ............................................................................................... 56

Annex 1 - AfDB Integrated (Environmental and Social) Safeguards System – ISS

Development of the ISS The African Development Bank (the Bank) acknowledges its Integrated Safeguards System as “a cornerstone of its strategy to promote growth that is socially inclusive and environmentally sustainable, and a powerful tool for identifying risks, reducing development costs and improving project sustainability.”1 The system was approved in December 2013 and became effective July 1, 2014 following an extensive review of the existing environmental and social safeguards policies and processes. The review was initiated in light of Board agreement that the safeguards required updating to meet Bank requirements for the management of environmental and social risk in the current Bank portfolio, to support mainstreaming of environmental and social sustainability for Bank financed projects, and to bring them more into line with other development banks. In particular, the Bank was concerned that the Safeguards should be better aligned with the Bank’s new policy priorities, including the High 5’s, and to support the implementation and key operational priorities of the Bank’s Ten-Year Strategy to promote inclusive green growth (2013 – 22) (see Figure 1).

1 Preamble to AfDB’s Integrated Safeguards System, Policy Statement and Operational Safeguards, Safeguards and Sustainability Series, Volume 1, Issue 1 (Dec.2013)

Figure 1. AfDB’s 2013-22 Ten Year Strategy – Key Operational Priorities and relevance of the ISS

Source: Adapted from AfDB Sustainability Series, Volume 1, Issue 1

The safeguards review was conducted using a highly consultative process, in particular through five regional workshops in Nairobi, Lusaka, Libreville, Abuja, and Rabat with a range of stakeholders including governments, private sector and civil society. The main issues addressed were the need for:

increased alignment with the Bank’s new policies and strategies2

adoption of current international good practice, lessons learned and emerging issues, including climate change

adaptability/versatility of policies and practices to evolving lending products and financing modalities3

greater harmonization with other multi-lateral financing institutions4

improved tailoring of approaches to different clients with varying capacity to implement, and

improved internal processes and resource allocation.

The review process highlighted the following specific issues in the application of the safeguards prior to 2013:

high transaction costs associated with the time required to consult diverse and at times contradictory policy documents, with conflicting priorities

uneven coverage of issues resulting in important issues receiving insufficient attention, including social issues

insufficient coverage of emerging issues, such as climate change

uneven coverage of projects owing to resource constraints and lack of focus on certain types of lending

2 The High 5s, and the ten year strategy to promote inclusive green growth in particular 3 Including greater focus on program based lending (PBO) and financing of financial intermediaries (FIs) 4 There is a general move within the world of international project finance to increase harmonization of standards where practical, to simplify co-financing arrangements and to decrease the burden of multiple requirements on Borrowers

difficulties monitoring borrower compliance with requirements

the approval of some investment proposals without sufficient environmental and social due diligence

lack of E&S risk management in the private sector portfolio, with policy based or program lending, and FIs

the absence of sufficient technical information on many projects, to categorize projects effectively according to environmental and social risk

significant shortfalls in categorization of projects within SAP5 (up to 50% prior to 2014) resulting in ongoing compliance failures throughout the project cycle

significant shortfalls in the number of staff available to manage safeguards in conjunction with an expanding portfolio

associated failure to effectively manage E&S risks across the portfolio with the potential for increased numbers of projects to be referred to the Independent Review Mechanism (IRM)

lack of organized archiving system for projects documents especially environmental and social safeguards documents

a range of additional weaknesses and inconsistencies in application of the ESAP including:

o lack of clarity around roles and responsibilities, and steps required o information management for project monitoring or knowledge generation

lack of Borrower capacity to implement the safeguards on projects, requiring more support from Bank staff.

In response to the review, and issues identified, the existing safeguard policies were consolidated into a single Integrated Safeguards System for implementation across the Bank’s entire portfolio, to simplify and standardize the process. Some of the changes included in the ISS were:

improved policy coherence, including a revised and systematic environmental and social assessment process to help ensure strong and efficient management of project risks and impacts

inclusion of emerging issues, such as cultural heritage, climate change, labour, biodiversity and eco-systems services

inclusion of some important social issues including community impact analysis

clear categorization process for projects

more systematic and meaningful consultation, including specific process requirements, as well as a requirement that consultation is to be free, prior and informed (FPIC) and achieve broad community support for projects

introduction of the Integrated Safeguards Tracking System (ISTS) to facilitate verification of project compliance

greater harmonization with Bank’s strategies, national systems and other MDBs

greater clarity on scope, requirements and responsibilities application of the safeguards to all Bank operations including program-based lending

providing budget support, lending for regional or sector investment programs managed by

the client or borrower, and private sector lending including through financial intermediaries and corporate loans

clear policy on how projects trigger specific policy requirements

mandatory Strategic Environmental and Social Assessment (SESA) for upstream operations such as budget support and client management investment programs

use of Environmental and Social Management Frameworks (ESMFs) for regional and sector wide programs

5 SAP is the Bank’s corporate business management software / database system

use of Environmental and Social Management Systems (ESMS) by Financial Intermediaries (FIs) to systematically manage E&S issues, appropriate to the nature and scale of operations

more flexibility in application to accommodate differing requirements of public and private sector projects, especially timelines

increased focus on strengthening country systems

clearly established requirements for resettlement including the contents of a Resettlement Action Plan (RAP), and

clear definition of vulnerable groups, including requirements for assessment and protection

establishment of a central archiving system for all project documents During the develpment of the ISS, and in a paper outlining the strategic choices made by the Bank in the ISS design6, several issues were highlighted as outstanding challenges that needed to be addressed. The following are a sub-set that, based on document reviews and preliminary interviews during the inception phase, may continue to be relevant today:

Ensuring effective implementation of ESMF’s by Borrowers for regional and sector wide programs

Ensuring effective implementation of ESMS’s by FIs

Improving the timely compliance of all Bank operations with the categorisation requirement, and ensuring 100% compliance

Ensuring adequate levels of supervision of ESMP implementation

Providing additional resources and technical capacity where needed to support effective ISS implementation

6 Integrated Safeguards System Working Progress: Strategic Choices made in the design of the ISS (AfDB, March 2012)

Evolution of the Bank’s organizational structure to deliver the Environmental and Social Safeguards

Figure 2. Evolution of the organizational structure dealing with environmental (and social) mainstreaming / safeguards.

Source: Update from previous IDEV (OPEV) evaluation about environmental mainstreaming in the transport sector (2013)

1996-2002

VP-Operations

Environment & Sustainable

Development Unit (OESU)

2002-June 2006

Policy , Planning & Research Complex

Sustainable Development &

Poverty Reduction Unit (PSDU)

Since June 2006

Regional Operations Complex

Sustainable Development

Division

(ORPC.3)

June 2008 to 2017

Presidency, Chief Operating Officer

Compliance & Safeguards Division

(ORQR.3)

Gender & Social Development

Monitoring Division (ORQR.4)

Sector/ Infrastructure Operations Complex

Natural Resources & Environmental Management

Division (OSAN.4)

Environment andClimate Change

Division (ONEC.3)

Climate Change Unit (CCCC)

operational since 2011

(non-affiliated )

Gender, Climate, & Sustainable Development

Unit (OSUS) (unit dissolved in 2010 )

2017 to present

Senior VP Office

Safeguards & Compliance

Department (SNSC)

VP Power, Energy, Climate and Green

Growh

Climate and Green Growth (PECG2)

VP Agriculture, Human and Social

Development

Gender and women empowerment

(AHGC1)

Civil Society and Community Engagement

(AHGC2)

The State of Environmental and Social Safeguards Instruments in the AfDB The new 2013 Integrated Safeguards System (ISS) comprises an Integrated Safeguards Policy Statement, five Operational Safeguards, and two practical guidance notes. This system builds on, consolidates and integrates the individual safeguard policies, procedures and cross cutting policies that were developed in an ad hoc fashion starting in 1999 (see Figure 2). The ISS supersedes the provisions in previous policies on environmental and social safeguards and compliance7.

Figure 3. Evolution of the Integrated Safeguards System

Source: Adapted from 2017 AfDB Safeguards & Compliance Unit presentation

Goal and Objectives of the ISS The goal of the ISS is to promote the sustainability of project outcomes by protecting the environment and people from the potentially adverse impacts of AfDB-financed projects, thereby supporting long term and sustainable development, or green growth, in Africa. Specifically, the safeguards objectives are to:

Avoid adverse impacts of projects on the environment and affected people, while maximising potential development benefits to the extent possible;

Minimise, mitigate, and/ or compensate for adverse impacts on the environment and affected people when avoidance is not possible; and

Help borrowers/clients to strengthen their safeguards systems and develop the capacity to manage environmental and social risks.

Policy Statement The Policy statement defines the objectives of the ISS, and the general commitments of the Bank to the management of environmental and social risks on projects and programs. It also sets out the basic roles and responsibilities of both the Bank and the Borrower. The commitments include:

7 AfDB Safeguards and Sustainability Series, Volume 1, Issue 1 (Dec. 2013) pg. 5

Systematic assessment of impacts and risks

Application of the ISS to the entire portfolio

Proportionality and adaptive management

Transparency, good governance and inclusivity

Protecting the most vulnerable

Promoting gender equality and poverty reduction

Harmonisation and facilitation of donor co-ordination

Compliance monitoring and supervision of safeguards, and strengthening country systems

Country level grievance and redress mechanism

The Bank’s Independent Review Mechanism (IRM)

The Bank’s approach to safeguards compliance and the management of E&S risk

Operational Safeguards The 5 Operational Safeguards (OS) set out the operational requirements for the Borrower.

They are designed to support the integration of the assessment of environmental and social

impacts into operational processes and promote sustainability and long-term development, by

preventing projects from adversely affecting the environment and local communities and

ensuring that risks are properly minimized, mitigated and/or compensated (see Table 2).

The specific objectives of the Operational Safeguards are to:

Mainstream environmental, climate change and social considerations into Country

Strategy Papers (CSPs) and Regional Integration Strategy Papers (RISPs)

Identify and assess the environmental and social impacts and risks – including those

related to gender, climate change and vulnerability – of bank lending and grant-

financed operations in their areas of influence

Avoid or, if avoidance is not possible, minimize, mitigate and compensate for adverse

impacts on the environment and on affected communities

Provide for stakeholders’ participation during the consultation process so that affected

communities and stakeholders have timely access to information in suitable forms

about Bank operations, and are consulted meaningfully about issues that may affect

them

Ensure the effective management of environmental and social risks in projects during

and after implementation, and

Contribute to strengthening regional member country (RMC) systems for

environmental and social risk management by assessing and building their capacity to

meet AfDB requirements set out in the ISS.

Table 1. The five Operational Safeguards and their applicability

Operational Safeguards Applicability and Objectives

OS1: Environmental and

Social Assessment

This overarching Operational Safeguard applies to all projects. It governs the process of determining a project’s Environmental and Social category and associated assessment requirements, scope of application including on a project’s vulnerability to climate change and associated resilience, assessment of vulnerable groups, public consultation and disclosure, grievance and redress mechanisms, and determines the applicability of the Bank’s other Operational Safeguards.

OS2: Involuntary

Resettlement, Land Acquisition, Population Displacement and Compensation

Applies to any Bank-financed operation that causes the involuntary resettlement of people. It is intended to avoid resettlement where feasible or minimize its impact when necessary; and ensure that when people must be displaced, they are treated fairly, equitably and in a socially and culturally sensitive manner. It covers both physical and economic displacement, compensation at full replacement cost, and the requirement that host communities share in development opportunities.

OS3: Biodiversity and

Ecosystem Services

Applies to Bank operations that: (i) are located in any type of “habitat;” (ii) implicate ecosystems which potentially affected stakeholders depend

upon for survival, sustenance or primary income (ecosystems services);

(iii) extract renewable resources as a primary purpose; or (iv) involve the use and commercialization of an indigenous knowledge

system.

This OS outlines the requirements for borrowers to: (i) identify and implement opportunities to conserve and sustainably

use biodiversity and natural habitats; and (ii) observe, implement and respond to requirements for the

conservation and sustainable management of priority ecosystems, including prevention of introduction of invasive alien species.

OS4: Pollution Prevention

and Control, Greenhouse Gases, Hazardous Materials and Resource Efficiency

Intended to foster high-quality environmental performance, and efficient and sustainable use of natural recourses over the life of a project. Includes a specific section on dealing with waste & hazardous materials, and GHGs. Specific requirements and thresholds are set out in the World Bank Environmental Health and Safety Guidelines (EHS Guidelines) and other applicable international standards.

OS5: Labour Conditions,

Health and Safety Designed to help protect workers’ conditions, rights and protection from abuse or exploitation, building on ILO standards, and the UNICEF Convention on the Rights of the Child

Under OS1, projects are categorized according to the potential for the project to have adverse

environmental and/or social impacts on the environment or society (see Table 3). Category 1

projects are those with the greatest likelihood of adverse impact, and are therefore the greatest

focus for resources going forward. Category 2 projects are projects likely to have detrimental

environmental and social impacts and less adverse than those of Category 1. Category 3

projects are projects with no environmental and social impacts. Category 4 applies to Financial

Intermediaries only.

Table 2. Project Categorization under OS 1 Category Description

1 Bank operations likely to cause significant environmental and social impacts, including any

project requiring a Full Resettlement Action Plan (RAP).

2 Bank operations where likely environmental and social impacts are few in number, site-

specific, largely reversible and readily minimized by applying appropriate management and mitigation measures.

3 Bank operations with negligible adverse environmental and social impacts. Following

categorization, no further action is required, though assessments may be beneficial in managing potentially unintended impacts on affected communities.

4 Bank operations involving lending to an FI that lends to or invests in sub-projects that may

produce adverse environmental or social impacts. FIs are required to develop and implement an Environmental and Social Management System (ESMS).

4 FI-A A FI with a portfolio that is deemed high-risk and may include sub-projects that can be

categorized as Category 1.

4 FI-B A FI with a portfolio that is deemed medium-risk and may include sub-projects that can be

categorized as Category 2.

4 FI-C A FI with a portfolio that is deemed low-risk and includes sub-projects that can be categorized

as Category 3 only.

Practical and Technical Guidance In addition to the OS, the Bank developed practical and technical guidance materials to replace older guidance, and to provide support to Bank staff and Borrowers on the implementation of processes and procedures associated with the ISS:

the Environmental and Social Assessment Procedures (ESAP)8, and

the Integrated Environmental and Social Impact Assessment (IESIA) guidance notes (see Figure 2).

The ESAP replaces the 2001 version, and describes the steps required to implement the ISS at every stage of the project cycle, for both public and private sector lending. The IESIA Guidance Notes provide technical guidance for the Bank and its borrowers on specific methodological approaches or standards and management measures relevant to meeting the requirements of the ISS. It includes guidance on aspects of the project cycle where compliance has been weak, general guidance on ESIA, topic-specific guidance relevant to specific themes and requirements, and sector-specific guidance (brief key sheets).

Preliminary information about the ES risk profile of the Bank’s portfolio

IDEV has not found any data about the Environmental and Social risk profile of the AfDB’s ongoing

portfolio. Recent data from the Compliance Division of the Bank (SNSC) estimate that the ongoing

portfolio at the Bank is mostly composed of category 2 projects (42%), followed by category 1 projects

(30%). Category 3 projects represent 28% of the portfolio with data about the environmental

categorization in Bank’s internal database (SAP)9. It is likely that part of the projects without an ES

categorization in the internal database SAP are category 4 projects.

When using the information about the ES categorization reported by SNSC (previously ORQR) in its

Annual Reports, the profile changes a bit, with category 4 projects becoming a higher percentage of the

approvals in recent years (see Figure below). These figures are only estimates. As the data collection

for this exercise demonstrated, a significant percentage of category 4 projects which underwent the ES

categorization projects and were even approved, were finally not signed or cancelled.

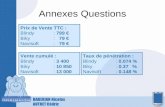

Figure 4. Evolution of the ES category of the portfolio approved by year

Source: self-elaboration on the basis of SNSC data10.

8 This ESAP should not be confused with the other commonly used acronym for Environmental and Social Action Plan 9 These figures were estimated for the SNSC retreat in 2017. The analysis could not use a total of 339 for which the environmental categorization was not included in SAP. It is likely that lots of them are category 4 projects, since the analysis only reported 1 ongoing category 4 projects out of the 116 analyzed. 10 Data reconstructed from the ES categorization conducted by ORQR/SNSC and reported in their Annual Reports (2015 and 2017 does not cover the whole year according to those reports).

23%

20%

18%

31%

31%

32%

32%

27%

28%

34%

23%

16%

17%

14%

15%

22%

12%

5%

2010

2015

2016

2017

cat 1 cat 2 cat 3 cat 4 missing

Annex 2 - ISS in the context of the Bank’s Project Cycle The Bank´s project cycle comprises key stages before Board approval (project identification, preparation and appraisal) and during implementation/completion. The project cycle fits into a country programming one. Across this cycle, different ES outputs are developed by the borrower and validated by the Bank, depending on the type and E&S risk of the intervention. The operationalization of the ISS at the project level entails various due diligence, review and supervision activities that the Bank undertakes to ensure that the borrower comply with the ISS requirements. (See figure below).

Figure 5. ISS across the Project Cycle

Source: 2017 AfDB Safeguards & Compliance Unit presentation

Management of Environmental and Social Risks at Project Identification For public sector projects, the borrower is first expected to provide baseline data and internal screening/scoping documents in accordance with the national system of environmental and social screening during the project identification phase. On the basis of these data, sector departments conduct initial environmental, social and climate change scoping to determine the appropriate Environmental and Social category. Sector Departments submit a Request for Categorization Memorandum to the Bank’s Safeguards and Compliance team (Safeguard’s team). The Safeguards team reviews the categorization and suggests revisions as necessary. If approved, the Safeguards team provides a Validation of Categorization Memorandum. For private sector projects, the Bank will normally enter later in the process, once project identification has been completed.

Management of Environmental and Social Risks at Project Preparation For public sector projects, subsequent to the validation of the proposed categorization, the

Bank notifies the borrower of the project categorization and specifies the various studies

required under Bank policy. The borrower prepares the Terms of Reference for the required

studies, for which the Bank may provide technical assistance funds. It is expected that affected

communities, vulnerable groups and other local stakeholders are consulted on the Terms of

Reference. The Terms of Reference are reviewed by the Sector Team before being reviewed

by the Safeguards team. The Terms of Reference are revised as required and relevant

information is included in the Project Concept Note (PCN). The Safeguards team conducts a

compliance check of the PCN and Terms of Reference as part of the Readiness Review.

For private sector projects, an initial assessment of environmental and social issues is

conducted by the Safeguards team during the Project Concept Review stage. This initial

review is intended to identify potential issues that require examination through more detailed

studies and identify a preliminary Environmental and Social categorization for the project.

Issues identified during this initial review help inform the Terms of Reference for more in-depth

Environmental and Social impact assessments, as required.

Management of Environmental and Social Risks at Project Appraisal At the Project Appraisal Stage, all public sector projects identified as category 1 or 2 must

prepare an Environmental and Social Impact Assessment (ESIA) and Environmental and

Social Management Plan (ESMP), as applicable. During appraisal, a site visit should be

conducted to ensure compliance with national legislation and determine the adequacy of the

assessment, revising the operational safeguards applicable (see below) and the project

categorization as appropriate.

The borrower finalizes the required studies based on comments received, at which point the

Safeguards team reviews the reports for compliance and provides feedback as necessary.

Once cleared by the Safeguards team, the studies are posted publicly before being cleared.

In providing clearance of these assessments, the Safeguards team specifies conditions for

the loan agreement. The information from the studies is then incorporated into the Project

Appraisal Report and Results-Based Logical Framework. The Safeguards team provides a

final clearance through the Readiness Review of the Appraisal Report.

Private sector projects similarly undergo in-depth Environmental and Social Impact

Assessment during the appraisal phase led by the Safeguards team. The Safeguards team is

then responsible for conducting a due diligence review of the studies, verifying: (i) compliance

with Bank policy and national legislation; (ii) that public disclosure requirements have been

met; and (iii) that sufficient financial provisions have been made in the PAR for implementation

of the ESMP. If these requirements are met, the Safeguards team issues an Environmental

and Social Compliance Note, which is sent to the Country Team for review alongside the

Project Appraisal Report.

Management of Environmental and Social Risks during Supervision and at

Completion Both public and private sector projects require close supervision during implementation from

Board approval through completion. According to IESIA Guidelines (Vol.1, p.54), supervision

of ES issues by environmental and social specialists should be done regularly especially for

high-risk Category 1 projects.

Supervision is focused on ensuring effective implementation of the measures set out in the

ESMP. However, to be effective, it may also include ensuring that any specific loan conditions

are fulfilled prior to commencing disbursement, and also, for example, ensuring that issues

from the loan conditions and the ESMP are reflected in the Invitation to Tender for any

contractors, who are usually in charge of the implementation of the ESMP and control of

potential environmental and social impacts.

For Public Sector projects, the Implementation Progress and Results Report (IPRR) is

designed to capture results through indicators tracking the provisions of the Bank’s

Environmental and Social Safeguards requirements. The types of indicators most commonly

used are focused not on the quality of implementation, but on the timeliness of implementation

of the environmental and social management plan (ESMP) and/or the Resettlement Action

Plan (RAP). A specific annex in the ESAP 2015 details the ES information that shall be

incorporated into Section C.1 of the IPRs (compliance with covenants), see table below.

Table 3. ESS information to be included in the IPR.

13

Annex 3. Reconstructed Theory of change of the Integrated Safeguards System

14

15

Annex 4. Desk validation tool used to assess the projects in relation to

ESS requirements. INTEGRATED SAFEGUARDS SYSTEM DESK-BASED EVALUATION AND SCORING TOOL The environmental and social Desk-Based Evaluation and Scoring Exercise (ISS desk validation) will be based on a document review of the sampled Public Sector and Private Sector Operations, including both qualitative and quantitative analyses for specific project characteristics.

Project approved before ISS entry into force (before June 2014), more flexibility on the scoring is applied.

Project approved after ISS entry into force (after July 2014) The objectives of the Exercise are:

1. Determine the extent of compliance with the Bank’s Safeguards requirements; 2. Identify the types of quality challenges during identification, monitoring and mitigation of

environmental and social impacts of Bank projects; 3. Identify challenges to the operationalization of Safeguards requirements at Entry and during

Supervision; 4. Examine trends in environmental-social categorisation over time; and 5. Examine differences between existing ratings for environmental and social dimensions in

supervision and completion reports and the external experts’ assessment.

Bank’s safeguards-related documents/sections of documents reviewed (Please leave only the documents effectively used in the desk validation including their date; delete those that do not apply).

Documents considered in the current Desk-Based Evaluation of ISS

Public Sector Private Sector

Request for categorization and/ or memo of Validation of Categorization

ESIA/ESMP

RAP (Resettlement Action Plan), if applicable

ESCON Memo (Env-Social compliance note, if available)

Readiness Review – PAR – sections about safeguards

Project Appraisal Report – sections about safeguards

General supervision reports (BTOR, aide memoire/IPR)11

Safeguards supervision reports, if any

Project Completion Report, PCR

Request for categorization and/ or memo of Validation of Categorization

ESIA or ESMS for category 4 (env-social management system)

ESCON Memo (Env-Social compliance note, if available)

Project Appraisal Report– sections about safeguards

General supervision reports (BTOR, aide memoire/PSR)1

Safeguards supervision reports, if any

Project Completion Report, XSR

11 The Lattanzio’s sector specialists in charge of the desk validation of the project will flag to the Lattanzio’s safeguards specialists any general supervision report where safeguards issues are mentioned.

16

QUALITY AT ENTRY

Judgement Criteria

Highly Satisfactory Satisfactory Unsatisfactory Highly Unsatisfactory

All elements of the Bank QA processes are integrating social and environmental issues with full compliance with ISS, at Quality at Entry

Most elements of the Bank’s QA processes are integrating social and environmental issues with full compliance with ISS, at Quality at Entry

At least one of the Bank QA processes is not integrating social and environmental issues with full compliance with ISS, at Quality at Entry

Several elements of the Bank’s QA processes are not integrating social and environmental issues with full compliance with ISS, at Quality at Entry

EVALUATION QUESTIONS (use Bank documents only) INDICATORS EXPERT COMMENT

Operational Safeguard 1: Environmental and Social Assessment

1.1 Has the Project’s E & S category been correctly assigned?

Was an ESIA required? (if NO go to Question 1.2) If YES,

Was the Scope appropriate?

Was the Direct Area of Influence appropriate?

Were all potential significant impacts identified?

Were all significant impacts to be mitigated included in ESMP?

1.2 Was an SESA required? (if NO go to Question 1.3) If YES,

Was the Scope appropriate?

Were all potential significant impacts identified?

Were all significant impacts to be mitigated included in the ESMP?

1.3 Was the project screened and categorised following the Bank’s Climate Screening Manual12? (if NO go to Question

1.5) If YES,

1.4 Was an Adaptation Review and Evaluation Procedures (AREP) included in parallel to the ESMP?

1.5 Is the Bank Summary of the ESMP adequate?

Was the full ESMP validation finished before approval or some additional studies were included as conditions in the loan

agreement or any other arrangement?

Is the Summary uniquely referenced?

Is the Summary finalised and signed off?

Does the Summary describe the impacts to be mitigated?

1.6 Is there a fully documented stakeholder and community consultation?

Were community impacts identified and addressed appropriately?

Were vulnerable groups identified and addressed appropriately?

1.7 Has a grievance mechanism been described?

12 The Climate Safeguards System, which is part of the ISS, has been piloted since 2014, and includes climate risk

screening and adaptation review for project categorization, so that potential measures may be identified to protect the investment against climate risks and to promote opportunities for adaptation. Information about the application of the CSS is stored in a different Bank online database from that of the other ISS applications, the Climate change tracking system.

17

Operational Safeguard 2: Involuntary Resettlement

2.1 Was a Resettlement Action Plan needed? (if NO go to Question 3) If YES,

Is the Bank Summary of the RAP adequate?

Is the Summary uniquely referenced?

Is the Summary finalised and signed off?

Does the Summary describe the impacts to be mitigated?

2.2 Has compensation at full replacement cost been applied?

2.3 Is there a likely prospect that the outcome will:

Improve standard of living?

Improve income-earning capacity?

Improve overall means of livelihood?

Address gender adequately?

Address age adequately?

Not disenfranchise Project-Affected People?

Operational Safeguard 3: Biodiversity and Ecosystem Services

3.1 Has the ESIA/ESMP identified any specific impacts on biodiversity and ecosystem services and propose adequate mitigation measures?

3.2 Has the sustainable use of natural resources been taken into account by the Project?

Operational Safeguard 4: Pollution Prevention and Control, Greenhouse Gases, Hazardous Materials and Resource Efficiency

4.1 Does the ESIA/SMP validated by the Bank include a full inventory of impacts arising from pollution, waste or hazardous materials?

4.2 Is there vulnerability analysis and monitoring of GHGs?

4.3 Is there an appropriate monitoring and compensatory framework?

Operational Safeguard 5: Labour Conditions, Health and Safety

5.1 Does the ESIA/SMP validated by the Bank include adequate information about protection for workers’ conditions, rights and protection from abuse and exploitation?

5.2 Does there appear to be adequate health and safety practices?

5.3 Does there appear to be adequate measures taken for avoiding child or forced labour?

DISCLOSURE

18

Were the requirements for disclosure of the ESIA and ESMP summaries on the Bank’s website respected according to the safeguards category of the project?13

QUALITY OF SUPERVISION Judgement Criteria

Highly Satisfactory Satisfactory Unsatisfactory Highly Unsatisfactory

All elements of Bank QA processes are integrating social and environmental issues with full compliance with ISS, at Quality of Supervision

Most elements of the Bank’s QA processes are integrating social and environmental issues with full compliance with ISS, at Quality of Supervision

At least one of the Bank QA processes is not integrating social and environmental issues with full compliance with ISS, at Quality of Supervision

Several elements of the Bank’s QA processes are not integrating social and environmental issues with full compliance with ISS, at Quality of Supervision

EVALUATION QUESTIONS (use Bank documents only) INDICATORS EXPERT COMMENT

Operational Safeguard 1: Environmental and Social Assessment

1.1 Is progress on the implementation of the ESMP satisfactory?

1.2 Is progress on the outcomes of stakeholder and community consultation satisfactory?

1.3 Are community impacts identified and addressed, being followed up satisfactorily?

1.4 Are actions concerning vulnerable groups being followed up satisfactorily?

Operational Safeguard 2: Involuntary Resettlement

2.1 Is progress on implementation of the RAP satisfactory?

2.2 Is progress on the compensation at full replacement cost satisfactory?

2.3 Is improvement of the standard of living satisfactory?

2.4 Is the improvement of income-earning capacity satisfactory?

2.5 Is improvement of the means of livelihood satisfactory?

2.6 Is improvement of the standard of living satisfactory?

2.7 Improve overall means of livelihood?

2.8 Does gender continue to be addressed adequately?

2.9 Does age continue to be addressed adequately?

Operational Safeguard 3: Biodiversity and Ecosystem Services

3.1 Is the project mitigating adequately its impacts on biodiversity?

3.2 Does the sustainable use of natural resources continue to be promoted by the Project?

Operational Safeguard 4: Pollution Prevention and Control, Greenhouse Gases, Hazardous Materials and Resource Efficiency

4.1 Is the inventory of impacts arising from pollution, waste or hazardous materials being maintained?

4.2 Is there ongoing monitoring of GHGs?

4.3 Is there ongoing monitoring of the compensatory framework?

Operational Safeguard 5:

13 For Category 1 projects, these shall be disclosed for 120 days for public sector projects and at least for 60 days for

private sector operations. All category 2 operations shall be disclosed for 30 days before Board deliberations (page 3 of ESAP, 2015).

19

Labour Conditions, Health and Safety

5.1 Is there ongoing adequate protection for workers’ conditions, rights and protection from abuse and exploitation?

5.2 Are there ongoing adequate health and safety practices?

5.3 Are there ongoing adequate measures taken for avoiding child or forced labour?

Annex 5. OS2 assessment proposal (compensation/resettlement of

affected population) By mid-January 2019, IDEV managed to identify a sample of 41 projects which were approved since ISS

became effective (July 2014) and which triggered OS2. Among those, 19 were included in the review of

the first stage of the evaluation14.

The assessment of OS2 compliance in the framework of this evaluation will involve a three-stage

evaluation process:

1) Rapid assessment of the projects which have triggered OS2 which have been approved by the Board after July 2014 to the end of 2017.

2) Deep Dives on selected themes 3) Interviews with key stakeholders

1. Rapid Assessment A rapid assessment will be carried out on the universe of Projects having been approved between July 2014 and the end of 2017. It was agreed not to include projects approved in 2018 to maximize the chances to get projects with a significant advance of the resettlement/compensation of the population. The ideal set of documentation reviewed at this stage is summarized in the table below. Table 4 Typology of Documents to be collected as part of this assessment

Bank Generated Borrower Generated Others (for instance, external party report, other donor,

national authorities…)

Pre-Bank’s approval

- Project Appraisal Report (PAR)

- RAP Summary

- Environmental and Social Impact Assessment (including ESMP)

- Resettlement Action Plan (RAP)

- External Due Diligence reports

Implementation - Implementation Progress Report (IPR)15

- Aide Memoire (AM) - Back to Office Reports (BTOR)

- Advance reports (quarterly/annual) of the implementation of the RAP

- Lenders Technical Advisors reports

- Lenders E&S Monitoring Consultants reports

14 There are 18 review fiches since one project entailed two loans but the same RAP and ESIA (Mauritania and Senegal Rosso multinational bridge). 15 Or Project Supervision Reports (PSR) for private sector projects.

20

Completion - Environmental and Social Completion Report (ESCR)

- Project Completion Report (PCR)

- RAP Completion Report - Lenders Technical Advisors reports

- Lenders E&S Monitoring Consultants reports

The list of projects and the state of documentation found is available in a separate Excel.

This rapid assessment tool has been largely crafted on the basis of the AfDB ISS Guidance material (2015)

and will assess:

1) Project Preparation and Appraisal a. Assessment of Borrower’s RAP b. Assessment of Bank summaries (RAP Summary and PAR sections about the RAP) c. Assessment of Loan Agreements

2) Project Implementation a. Assessment of IPR, as well as Aide Memoires/BTOR (or PSR for private sector projects)

when available 3) Project Completion

a. Assessment of ESCR and PCR (or XSR for private sector projects), The Rapid Assessment Tool template is included at the end of this Annex.

2. Deep Dives

For a subset of key thematic issues, detailed Deep Dives will be carried out. The selection of deep dive key

themes was carried out during the inception phase of this assignment and drawn from a combination of

(i) identification of key issues based on IRM documentation, (ii) key issues identified in the AfDB

Involuntary Resettlement Policy: Review of Implementation (2015), (iii) the results of this assignment’s

Rapid Assessment. The final selection of Deep Dive key themes was consulted with the Evaluation

Reference Group Members.

Theme #1: Stakeholder Engagement

OS 1 and 2 and the Volume 2: guidance on safeguards issues (2015) provide detailed accounts of the

requirements for, and associated guidance related to, participation, consultation and Broad Community

Support (BCS) as well as the management of grievances in the context of Bank financed operations

involving involuntary resettlement in particular, and also in the context of Bank-financed projects more

generally. RAPs should describe how the participation requirements of OS 2 have been fulfilled, and

specifically how the requirement for BCS has been accomplished in the project context.

IRM reports have highlighted this theme as a key area related to complaints received. Comparators also

report this theme as a recurrent source of complaints. Therefore, IDEV ISS Evaluation included this issue

in Question 4.4 of the Evaluation Matrix. Consistent with OS 2, the Stakeholder Engagement theme will

primarily focus on stakeholder engagement with Project Affected Persons (PAPs) rather than broader CSO

consultations aspects which is a broader and higher level point than OS 2 that should be done at the

Project level (as part of OS 1).

21

Early findings from BDEV’s OS 2 Rapid Assessment show significant discrepancies between Bank policy and guidance and Project documentation on public participation, including demonstrating broad community support, consultation and participation during implementation and specific approaches taken for consultation with vulnerable groups. The objective of this deep dive will be focused on assessing to what extent the project design documents reported on adequate stakeholder engagement activities performed before project approval and what is described to ensure stakeholder engagement throughout project implementation. Therefore, the Deep Dive will explore how this requirement is met by a subset of projects, highlighting ‘good practices’, what are comparator organizations policies and practices with regards to consultation (e.g. Free, Prior and Informed Consent – FPIC). This will inform recommendations on how the AfDB could reinforce this area. Theme #2: Vulnerable Groups OS 2 states that member countries and other borrowers/clients are responsible for protecting the physical, social and economic integrity of vulnerable groups. There is a specific section on “vulnerable groups’ identification and inclusion in development’ in Volume 2: guidance on safeguards issues (2015). The Resettlement Policy Review of Implementation (2015) noted that “all PAPs are generally treated equally, without special attention to vulnerable groups”. The preliminary findings of BDEV’s OS 2 Rapid Assessment has identified that resettlement planning and implementation provide very limited attention to vulnerable groups, despite the policy and guidelines of the AfDB. Vulnerable groups are not systematically identified in baseline assessments, are not provided with specific consultation opportunities and seldom provided with specific compensation or resettlement assistance. This Deep Dive will explore how this requirement is met, what are comparator organizations policies and practices with regards to vulnerable groups. This will inform evaluation recommendations on this area. Theme #3: Supervising OS 2 implementation & implementation challenges

The effective implementation of OS2-related requirements present significant challenges on the ground, which may hinder the realization of all the mitigation measures included in Resettlement Action Plans.

BDEV’s rapid assessment has identified significant deficiencies in the reporting of supervisions exerted by the Bank regarding OS 2. RAP implementation advance is very cursory in IPRs and BTOR/Aide Memoires, for projects triggering OS 2. Despite being included systematically in Loan Agreements of projects triggering OS 2, very few borrower RAP implementation reports could be assessed16.

The deep dive will explore in more detail implementation supervision processes for OS 2, including the participation of E&S officers in supervision missions and, to the extent possible, the skills set of the officer supporting Task Managers. The deep dive will also try to capture any available data about RAP implementation challenges, although preliminary findings suggest that this information is very few and spares in Borrower and Bank supervision reports. Finally, it will also describe how comparator organizations are supervising resettlement issues (including the World Bank’s newly introduced Tracking Social Performance system). This will inform recommendations on how the AfDB could reinforce this area.

16 Despite having started data collection in December 2018, the BDEV received only four (4) individual Borrower’s

RAP progress reports out of a total of 36 projects. All Bank staff involved in those interventions (E&S officers and

Task/Portfolio Managers) has been contacted. The lack of an integrated archiving system hampered data collection.

22

3. Interviews Interviews with Bank’s Safeguards Specialists will be held to inform the Rapid Assessment and the Deep Dives (Project Task Managers and Borrowers for the deep dives, E&S department staff, staff from the Bank’s Independent Review Mechanism, comparator institutions. Interview protocols will be developed later. [Note: the protocols will be developed after desk review of documents to develop initial desk based rapid assessment and deep dives] A focus group with task managers whose projects triggered OS2 and social safeguards will be handled to discuss the preliminary findings from the desk review of the 36 projects.

23

Rapid Assessment Tool (template) for projects which triggered OS2

IDEV’s OS2 compliance Rapid Assessment Tool for the ISS Evaluation (2019)

This document presents a rapid assessment tool to assess the quality and comprehensiveness of the Bank’s and Borrower’s documentation related to OS2 at

key stages of the Project Cycle against the policy and ISS guidance materials.

Project Stage Documents solicited by IDEV for the Rapid Assessments

Documents received and used by IDEV for the Rapid Assessment

(specify document title and date) Project Preparation & Appraisal Borrower’s RAP

Bank’s RAP summary

Bank’s PAR sections covering OS2

Loan agreement related to OS2

Project Implementation Bank’s IPRs or PSRs/BTOR/aide memoires

Project Completion Bank’s completion reports (ESCR end PCR/XSR) covering OS2

24

1.Project Preparation & Appraisal

Assessment of the quality of the Borrower’s RAP: The borrower is responsible for preparing Resettlement Actions Plan, when applicable, during Project Preparation/Appraisal

Dimension /

linkage to Evaluation

Matrix (EM)

Criteria17 Outcome [ Yes,

Partially or No18 ]

Rationale 19

1. Project Description

Adequate general description of the project and its area of influence, including a map

2. Potential Impacts

Adequate description of the project components or activities that would give rise to involuntary resettlement, the zone of impact of such activities, and the alternatives considered to avoid or minimize involuntary resettlement20.

3. Organizational / Institutional

arrangement to ensure RAP

implementation

Adequate description of the institutional arrangements to ensure adequate and timely implementation of the RAP (responsibility of the executing agency, third party stakeholder or, interagency coordination if necessary).

Adequate description of the RAP implementation process, including a detailed timetable21 and an estimation of costs and overall budget22.

17 The criteria are largely based on ISS Guidance Materials, 2015 18 The assessor will use professional opinion to assign each criterion as having been met (Yes), partially met (Partially) or Not Met (No). This will be justified in the rationale column. The assessment outcome is defined as follows – Yes: requirement has been largely met, no gaping holes are identified; Partially: requirement has been addressed but has one or two gaping holes; No: requirement has not been met, having 3 or more gaping holes. [OPTION: In some instances, these criteria can be applied differently and will be justified in the rationale column]. 19 Specify RAP page where this is addressed and add any other justification for the assessment, including examples/narrative when possible which could be used in the evaluation reports (examples of good or not-so-good practices). 20 The “avoid or minimize” process should be clearly and comprehensively demonstrated in the RAP document. 21 The RAP should provide an implementation schedule covering all resettlement activities, from preparation through implementation, including target dates for achievement of expected benefits to displaced people and host communities, and target dates for terminating the various forms of assistance. 22 The RAP should provide detailed tables indicating the breakdown of cost estimates for all resettlement activities, including allowances for inflation and other contingencies, a timetable for expenditures, sources of funds, and arrangements for the timely flow of funds.

25

(to inform EQ

4.2 of the evaluation

matrix)

Adequate the monitoring and evaluation system for the RAP. This should comprise monitoring23 during implementation as well as ex-post evaluation24.

Adequate description of the capacity of the executing agency to implement the RAP (capacity of staff and necessary financial resource), including capacity building measures (with an associated timetable and budget) when needed

4. Community participation and

meaningful consultation

[related to EQ4.4 of the EM]

Adequate written proof of meaningful consultation25

Adequate description of how community participation and consultation will happen during implementation.

Adequate information about the specific approach taken to consultation with vulnerable groups26

5. Project-level grievance requirements - [Related to EQ4.5 of the EM]

Adequate detailed description of the grievance redress mechanism that has been developed

23 The RAP should include arrangements for monitoring of resettlement activities by the implementing agency, supplemented by independent third party monitors as appropriate. The section should lay out the timing of monitoring activities (including quarterly reviews, in-depth reviews of mid-term progress etc.) and should be consistent with overall project scheduling. This section should also describe how sufficient monitoring information will be obtained, what the performance monitoring indicators will be, and how the monitoring outcomes will be recorded and documented. 24 The RAP should explain that an independent ex-post evaluation – in the form of a RAP completion audit or RAP implementation completion report – will be carried out by the borrower or client and the Bank - and include relevant information in the Project Completion Report (PCR). It should be clarified that this PCR will be followed by the Bank’s own PCR, and a commitment should be made in the FRAP that, if either of these assessments reveals that any key objectives of the FRAP were not achieved, follow-up measures shall be developed to remedy the situation. 25 An explicitly written statement should be provided in the RAP that embodies the agreements reached from the negotiations with affected people (including displaced persons, host communities, government representatives, NGOs and other stakeholders), as a guarantee that consultations were conducted in a meaningful way and that BCS was obtained for the involuntary resettlement process being carried out. In addition, meeting minutes, focus group minutes, interview minutes and attendance records should be kept and appended to the RAP. A summary of what was discussed in each consultation, and how the outcomes of the consultations were fed into the resettlement planning process. 26 Vulnerable status can be determined by identifying a group’s likelihood of facing harder conditions as a result of the project, owing to such factors as gender, economic status, ethnicity, religion, cultural behaviour, sexual orientation, language or health condition. Depending on the specific context of the project, vulnerable groups may thus include female-headed households, those below the poverty line; the landless, some categories of children (orphans, homeless), marginalised social groups and indigenous peoples, those without legal title to assets; ethnic, religious and linguistic minorities; and those who are physically handicapped. Guidance on the identification of vulnerable groups and vulnerability assessments is found in the Integrated Environmental and Social Impact Assessment (IESIA) Guidance Notes (ISS Policy Statement and OS, page 26. AfDB, 2013). The RAP should spell out the specific approach taken to consultation with vulnerable groups, including Indigenous Peoples and those affected by gender vulnerabilities.

26

6. Integration with host communities

Adequate written proof that a meaningful host community capacity assessment has been carried out, and that potentially negative impacts on host communities have been addressed by the project27, including the development of conflict resolution mechanisms to resolve integration issues, if deemed necessary.

7. Baseline data about the PAPs

Adequate level of detail of the socioeconomic baseline conditions in existence prior to the implementation of the involuntary resettlement process28.

8. Legal framework

applicable to the RAP

Adequate description of the applicable legal and administrative procedures related to resettlement in the domestic context29

Adequate description of the international standards to which the resettlement operation is seeking to adhere, how these align with / differ from domestic legislative requirements, and how the gaps between the two are to be addressed in the project context.

9. Description of eligibility criteria

of PAPs

Adequate detailed eligibility criteria used in the project context; namely eligibility criteria that define all affected people for compensation and other resettlement assistance, including vulnerable groups.

10. Valuation of, and

RAP should describe the proposed types and levels of compensation under local laws and the supplementary measures required to achieve full replacement cost for lost assets30.

27 The RAP should also provide details of the measures being taken to augment public services (e.g. education, water, heath and production) in host communities, in order to make them comparable to the services provided to those subject to displacement. 28 A baseline survey should include a population census that covers 100% of those facing displacement impacts (including seasonal resource users that may not be present in

the project area of influence during the time of the survey), and that gathers information on: a) existing public infrastructure and services;

b) production and land tenure systems (including common property and non-title based land ownership or other local allocation systems); c) household organization, d) livelihoods

(including natural assets upon which the affected people may depend for a portion of their livelihoods); e) standards of living; and

––gender and age disaggregated information pertaining to the economic, social and cultural conditions of the affected population, as well as a asset inventory that covers 100%

of those facing displacement impacts, and that seeks to assess the magnitude of the expected losses, both in terms of total and partial losses to individual as well as group

assets. The baseline survey should identify and provide detailed information on disadvantaged or vulnerable individual and groups, for whom special provisions may need to be

made.

29 This should include a description of the remedies available to displaced persons in the judicial process, the normal time frame for such procedures, and available alternative dispute resolution mechanisms that may be relevant to the project. 30 The RAP should detail the methodology to be used in valuing losses to determine their full replacement cost. It is crucial that a certified professional valuator is detailed local market evaluation study that is written up and justified appropriately in the RAP. The RAP should describe in detail the packages of compensation and other resettlement measures which will be provided to ensure that standards of living, income-earning capacity, production levels and overall means of livelihood for all categories of eligible group

27

compensation for losses

11. Management of influx

The RAP should detail any measures being implemented to prevent influx of ineligible persons at the selected sites, together with the legal arrangements being put in place for regularizing tenure and transferring titles to the displaced persons.

12. Env. management of the resettlement site

Adequate assessment of the environmental impacts of the proposed resettlement site and measures to mitigate and manage these impacts.

Assessment of the quality of the Bank’s summary of the RAP

The Bank prepares RAP summaries of the borrower’s RAP documentation and provides a synopsis of the RAP in the Project Appraisal Report. The RAP summaries are disclosed before presentation of the Projects to the Board. Assessment of the Bank’s RAP summaries

The RAP summary should include key aspects to confirm the compliance of the Borrower’s RAP with the requirements of OS2. While the contents of the ESIA summary is included in the ESAP, 2015 (annexe 8), the ESAP does not provide specific guidance on the RAP summaries, only the FRAP/ARAP outlines are provided (Annex 13: Format of Report: Full Resettlement Action Plan /Abbreviated Resettlement Action Plan). IDEV will confirm with SNSC if there is any other internal guidance for ESS specialists about the minimum content and the types of analyses to be included in the summaries.

Dimension Criteria Outcome [Yes, Partially, No]

Rationale

1. Project Description Same as (borrower )RAP assessment (section 2.1)

2. Potential Impacts Same as RAP assessment (section 2.1)

3. Organizational / Institutional arrangement to ensure RAP implementation

Same as RAP assessment (section 2.1)

4. Community participation and meaningful consultation Same as RAP assessment (section 2.1)

are improved beyond pre-project levels. The RAP should summarize the compensation packages developed, in the form of an entitlements matrix that identifies: a) all categories of affected people; b) all types of loss associated with each category; and c) all options for the types of compensation and resettlement assistance to which each category is entitled.

28

5. Project-level grievance requirements Same as RAP assessment (section 2.1)

6. Integration with host communities Same as RAP assessment (section 2.1)

7. Baseline data about the PAPs Same as RAP assessment (section 2.1)

8. Legal framework applicable to the RAP Same as RAP assessment (section 2.1)

9. Description of eligibility criteria of PAPs Same as RAP assessment (section 2.1)

10. Valuation of, and compensation for, losses Same as RAP assessment (section 2.1)

11. Management of influx Same as RAP assessment (section 2.1)

12. Environmental management of the resettlement site Same as RAP assessment (section 2.1)

13. Compliance with the disclosure requirements deadlines according to the ES category31

The RAP summaries should be disclosed through the Bank’s website and field offices32

Assessment of Bank’s PAR sections related to OS2

According to the ESAP, 2015, section 4.6 of the PAR, covering environmental and social impacts should cover the resettlement aspects. The ESAP, 2015, provides guidance on inclusion RAP related information which informs the assessment table below (see ESAP, 2015, annex 23 Environmental and Social Content in Project Appraisal Report). It is also expected that the PAR includes components related to environmental and social aspects in the Project logframe and costing (ESAP, 2015, Step 4.6a).

Criteria Outcome [Yes/Partially/No]

Rationale

Does the PAR mention that a FRAP / ARAP has been prepared / reviewed / disclosed33?

Is the completion date of the RAP indicated in the PAR?

Is the review date of the RAP indicated in the PAR?

Is the disclosure date of the RAP indicated in the PAR?

Are the key resettlement issues that need to be addressed described in the PAR?

Are the main measures proposed to address these resettlement issues described in the PAR?

31 Information to add includes PAR date, date of the RAP summary (if specified) and date of website publication. 32 At least 120 days before presentation to the Board for Category 1 projects (for public sector projects) and 30 days for Category 2 projects (unspecififed public/private). [Note: guidance unclear on public and private sector differentiation] see ESAP 2015, step 4.6a. This assessment is based on the website disclosure only – the field office disclosure could not be assessed. 33 The PAR should describe the disclosure done by the client on the RAP documentation. [NOTE: the guidance is slightly ambiguous if it refers to Borrower’s RAP or the Bank’s summaries. For this assignment, this section is understood to mean the disclosure of the Borrower’s documentation by the Borrower]

29

Are resettlement aspects included in the log frame?

Are resettlement costs included in the Project costing?

Assessment of the inclusion of RAP measures in the Bank’s loan agreement

Loan agreements should include conditions and covenants to cover any outstanding environmental and social concerns that need to be satisfied prior to or after project approval34.

Type Measure35 Applied [Yes/No]

Condition precedent Detailed resettlement action plan

Detailed compensation plan

Acquisition of land right

Submission of a works and compensation schedule and of satisfactory evidence that all Project affected persons in respect of [civil works in a given lot] have been compensated36

Submission of satisfactory evidence indicating that the resources allocated for the compensation and/or resettlement of PAPs have been deposited in a dedicated account in a bank37

Other Conditions Acquisition of Land completed

Evidence of compensation

Proof of environmental acceptability

Undertakings/Commitments Implementation of RAP

Compensation

Periodic Report (ESMP/ESIA/RAP)

Completion Report (ESMP/ESIA/RAP)

34 It should be noted that according to ESAP (Step 5.1), environmental and social loan conditions and covenants should be kept to a minimum. The majority of environmental and social issues should have been resolved prior to this Project Cycle phase. 35 The list of measures will be adjusted to reflect the universe of measures related to OS2 used in loan agreements. 36 Standard RAP clauses prepared by the legal dept. (send to IDEV by SNSC) 37 Standard RAP clauses prepared by the legal dept. (send to IDEV by SNSC)

30

2. Project Implementation

Assessment of the Quality of information to justify the ES rating in the IPR or other Bank’ s supervision report.

As part of the Implementation Progress and Results Report, the Bank should report on environmental and social safeguards in section C.1 on legal covenants. Under this section, a compliance rating should be included and an assessment of the ESMP/RAP implementation should be provided. [Note: the guidance includes only ESMP but it is assumed here that this also includes the RAP when applicable].

Criteria Outcome [Yes/Partially/No]

Rationale

Does the IPR provide a rating on compliance with environmental and social safeguards?38

Is the ES rating in the IPR properly justified?

Does the IPR provide information about the level of compliance of the RAP-related loan conditions?

Is the rating supported by an assessment of implementation of the RAP39

Does the IPR reported the RAP implementation as a source of delay of the overall project implementation? Explain the reasons in the comments column

Does the IPR provide any information about the results of the RAP in terms of livelihood restoration or enhancement?

38 The IPR template includes a row for E&S safeguards overall – it does not specifically address OS2/resettlement issues. 39 The guidance form the ESAP, 2015 annex 23 suggests an assessment should be detailed on E&S issues in section C.1b to describe implementation progress of the ESMP/RAP and outstanding issues. The rating options include the following: (4) Highly Satisfactory: All safeguards measures – as specified in the ESMP – are expected to be met at the time of reporting ; (3) Satisfactory: At least 75% of safeguards measures – as specified in the ESMP – are expected to be met at the time of reporting. Minor delays in compliance (usually 6 – 12 months) are being experienced for conditions not yet met. Actions to address the issues related to unmet conditions are under implementation ; (2) Unsatisfactory: Between 50% and 70% of safeguards measures – as specified in the ESMP – are expected to be met at the same time of reporting. Substantial delays in compliance (usually 6 – 12 months) are being experienced for conditions not yet met. Corrective actions have to be implemented and closely monitored and (1) Highly Unsatisfactory: Less than 50% of safeguard measures – as specified in the ESMP – are expected to be met at the time of reporting. Major delays in compliance (over 12 months) are being experienced for conditions not yet met. Immediate management attention is required and sanctions are envisaged. The IPR template suggests a full report on compliance with covenants should be included in Annex 3 of the IPR.

31

Assessment of the Quality of information in the Aide Memoire/BTOR

Criteria Outcome [Yes/Partially/No]

Rationale

Do the Aide Memoire/BTOR provide an adequate assessment of the RAP implementation?

Is the RAP information included in the aide-memoire and BTOR aligned with the one included in IPRs?

3. Project Completion

Upon completion of a Project, the Bank safeguards specialist should prepare an Environmental and Social Completion Report (ESCR) (ESAP, 2015, Step 7.1). The Project Completion Report (PCR) includes a summary of the ESCR. Private sector projects usually develop an Expanded Supervision Report (XSR) as a completion report40. Assessment of the ESCR and PCR

The format for this content is provided in the ESAP, 2015 (annex 25: environmental and social content in Project Completion Report) and forms the basis for the assessment table below.

Criteria Outcome [Yes/Partially/No] Rationale

Adequacy of description of the RAP41

Adequacy of the assessment of RAP implementation42

Adequacy of the evaluation of results of RAP implementation43

Adequacy of description of other impacts not foreseen in the RAP44

40 As this evaluation purposefully samples projects approved after July 2014 (when ISS became effective), not many completed projects are expected. 41 This section shall outline a brief overview of the Resettlement Action Plan. Particular reference shall be given to mitigation measures that were proposed in order to ensure that the operation is in line with the Bank’s safeguard policies. 42 This section shall provide a thorough analysis of the environmental and social performance rating of the project. The assessment shall be based on the RAP prepared at the project appraisal stage. The assessment shall include: the number of mitigation measures implemented, the extent of implementation, the timeliness and the extent of compliance with the Bank’s E&S safeguard policies and procedures. 43 This section of the report shall evaluate the results of the RAP implementation by clearly indicating the performance of all parties involved (Borrower, Bank, Contractors, Consultants, etc.) in implementing the RAP, whilst giving reasons for successful implementation or failure thereof. 44 Impacts not foreseen at the time of compiling the RAP shall be outlined in this section. Information shall also be provided on the nature and scale of these impacts, as well as how they were mitigated or minimized.

32

Adequacy of description of lessons learned45

45 Lessons drawn from managing the environmental and social issues of this project shall be described in this section.

33

Annex 6. Financial intermediaries operations assessment proposal

The portfolio of the Bank of category 4 projects

As detailed in Annex 1, category 4 are projects involving investment of Bank Group’s funds through Financial Intermediaries (FI) in subprojects that may result in adverse Environmental and Social (ES) impacts. FIs include banks, insurance, reinsurance, and leasing companies, microfinance providers, private equity funds and investment funds that use the Bank’s funds to lend or provide equity finance to their clients. FIs also include private or public sector companies that receive corporate loans or loans for investment plans. FIs operations have many sub-projects for which the resources provided by the AfDB may be used for. In these situations, the FI has the full responsibility to ensure compliance of the subprojects with AfDB’s ISS. For that, the individual subproject need to be screened and appropriate due diligence, monitoring and overall ES management performed in relation to the potential ES risk associated to the subprojects. The Bank’s FI portfolio is channeled through three main types of instruments: lines of credit, equity (funds) and guarantees. The FI portfolio of the Bank Group has been significant for the past decade. As presented in the figure below, lines of credit (LOC) represent an important part of the FI operations of the Bank, ranging from a maximum of 93% in 2011 to 29% in 2018. From 2013, the Bank started increasing the use of guarantee and this resulted in the decrease of LOC and equity funds. The figure below presents the composition of the FI portfolio, which was reconstructed according to the approvals by the Board of Directors. This includes investments which may have been cancelled later for different reasons. Figure 6.Amount allocated to Financial Intermediary operations, in UA million46 (2008-2018).

Source: IDEV’s calculations based on data from Board’s approvals

46 Using the list of Board approvals in the intranet, the evaluation team reconstructed the list of Financial Intermediary operations filtering by type of instrument (line of credit, equity and guaranty), assuming they are the majority of category 4 projects according to ISS. Corporate loans, which sometimes are classified as 4, were not included in this calculation.

298

557

314

698

402 394 412622

1159

585

291

141

142

190

51

134 157 133

73

154

70

76

25

12

743

108

777

239

333

626

0

200

400

600

800

1000

1200

1400

1600

1800

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Line of Credit Equity Guarantee

34

Lines of Credit (LOC) at the AfDB

LOC are long-term loans, either in local or foreign currency, provided by an International Financial Institution

(IFI) to a Financial Intermediary (FI) for on-lending to their customers, also referred to as sub-borrowers.

They aim to improve access to finance for the private sector and to foster the development of financial

markets by enhancing the financial and technical capacity of FIs. LOC is one of the instruments used to

finance private sector47. LOCs provide liquidity and contribute to institutional development and capacity

building. The long-term tenure of the LOCs allow the borrowing institutions to extend the maturity of their

lending operations. LOCs also allowed the Bank to indirectly and efficiently reach a larger number of

enterprises than would otherwise be possible, particularly the SMEs.

Different channels are used to disburse the LOC: commercial banks, microfinance institutions, Development Financial Institutions - DFIs (national and regional development banks), and SMEs. According to IDEV’s calculation based board approvals data, over the period 2011- June 2014, the Bank has approved 28 LOC for UA 1,582 Million. The amount approved almost remains the same (UA 1,487 Million) between July 2014 and October 2018 for 24 operations. Multinational LOCs received the highest amount followed by West Africa, Southern Africa and East Africa. According to a recent IDEV evaluation synthesis48 of LOC, there are several reasons for this geographical distribution, including the strategic choices of AfDB, the high risks for some countries, the size of markets, the quality of counterparts, the competitiveness of Bank pricing, etc.

Equity

Equity is an instrument used by the Bank to promote both private and financial sector development through

cooperation with DFIs and other private institutions.49 Equity is also used by the Bank as an instrument to

promote efficient use of resources and play a catalytic role in attracting investors and lenders to financially

viable projects. The Bank uses this status to hold equity in any public or private enterprises without any

managerial function. By doing so, the Bank can bring in other investors with capital, managerial skills and

technical know-how contributing to the development of capital market in the member countries. The Bank

can also choose to invest through quasi-equity instruments. Equity is usually extended in the Bank's lending

currencies. The final figures of the ongoing equity portfolio will be confirmed for the evaluation report.

Guarantees

Guarantee is an instrument used by the Bank to facilitate the access of the enterprise to local or foreign

currency funding on attractive terms and maturities not otherwise easily available (AfDB, 2003). For the

Bank, guarantees carry risks similar to those for the loans to enterprises and therefore, the projects for

which the guarantees are issued by the Bank, are appraised, processed and supervised in the same way

as projects loans. The Bank’s guarantees are classified into two categories: Partial Credit Guarantees

(PCGs) and Partial Risk Guarantees (PRGs). The PCGs cover a portion of scheduled repayments of private

sector loans or bonds against the risk of default. It can be used to support mobilization of private funds for

project finance, financial intermediation and policy-based finance. PRGs cover private lenders against the