Europe & Africa Subsea Market Outlook subsea uk... · High costs of development drilling in deep...

Transcript of Europe & Africa Subsea Market Outlook subsea uk... · High costs of development drilling in deep...

The Subsea Sector in Africa & Europe Overview of Current Activity and Market Forecast to 2018

Marine Richard – Associate Analyst at Infield Systems Limited

12th November 2013

I. Subsea Market Overview: Drivers and Current Award Activity

a. Oil and Gas Price Dynamics

b. Subsea Market Drivers

c. Global Subsea Tree Awards

II. European Subsea Market Forecast

a. Subsea Market by Country

b. Subsea Market by Operator

c. Subsea by Type, Build Phase and Water Depth

d. Manufacturing Capacity

III. African Subsea Market Forecast

a. Subsea Market by Country

b. Subsea Market by Operator

c. Subsea by Type, Build Phase and Water Depth

IV. Conclusions

V. Administration

a) Contacts

b) Disclaimer

Table of Contents

2

Subsea Market Overview Drivers and Current Award Activity

SECTION I

Oil and Gas Price Outlook

Brent Oil Price Forecast (Annual Average)

Gas Price in Key Regions

Brent prices will likely fall in 2014, while the divergence in gas prices will gradually narrow

Sources: Infield Systems, 2013; U.S. Energy Information Administration, Petroleum and Other Liquids Database, 2013, BP Statistical Review of World Energy, 2013; Bloomberg, 2013.

• We anticipate Brent prices to fall in 2014 from their 2013 average

Downward pressure from increasing production

Better economic outlook in major economies

• Oil prices may fall in the second half of the decade

• Major divergence in global gas prices

US gas prices have been suppressed by abundant shale supply

Asian LNG prices have increased following Fukushima

European gas prices have stayed somewhere in the middle

• By 2020 gas prices will likely continue to rise in the US and fall gradually in the rest of the world

A fully traded global gas market remains unlikely by 2020

4

0

20

40

60

80

100

120

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

$/b

bl

Brent

2

4

6

8

10

12

14

16

18

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

$/m

mB

tu

US (NYMEX) UK (NBP) Japan (LNG)

Oil production trends – onshore vs. offshore

Source: Macro Market Overview in Global Perspectives Reports to 2017 (published 2013).

0

10

20

30

40

50

60

70

80

90

1965 1970 1975 1980 1985 1990 1995 2000 2005 2010 2015

mb

pd

Onshore Offshore Shallow Offshore Deep & Ultra-Deep

Undeveloped Deepwater Reserves by Country

6

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

45,000

MM

bb

loe

Oil Reserves Condensate Reserves Gas Reserves

Source: Macro Market Overview in Global Perspectives Reports to 2017 (published 2013).

Oil fields by On-Stream Year, Reserves Size and Water Depth

7

0

500

1,000

1,500

2,000

2,500

3,000

3,500

1970 1975 1980 1985 1990 1995 2000 2005 2010 2015

Wat

er D

epth

(m)

Source: Macro Market Overview in Global Perspectives Reports to 2017 (published 2013).

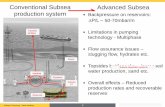

Subsea Market Drivers – Deepwater Economics

8

Field Sanction Points by Water Depth

Production cost curves

• The vast majority of developments are sanctionable at an oil price of $90/bbl

• Field economics expected to be favourable for most developments

0

40

80

120

160

200

0

400

800

1,200

1,600

2,000

Produced MENA Conventional Other Conventional CO2 EOR Other EOR Deep Water Arctic Heavy Oil Bitumen Shale Oil

Ava

ilab

le Q

uan

tity

(b

n b

bl)

Available Quantity (Left) Cost Range (Right) Low Oil Price Medium Oil Price High Oil Price

$/b

bl

0

500

1,000

1,500

2,000

2,500

3,000

3,500

0 10 20 30 40 50 60 70 80 90 100 110

Wat

er d

epth

(m

)

Sanction Price ($/bbl)

Shallow

Deep

Ultra Deep

Source: Macro Market Overview in Global Perspectives Reports to 2017 (published 2013).

Maximum Tieback Distance (km), 1970-2017 Average Tieback Distance (km), 1970-2017

Subsea Market Drivers – Going further The average tieback distance is increasing

9

• 1997: Shell’s MC Mensa in US GoM

Ultra deep subsea tieback to fixed platform – 110km

• 2007: Statoil’s Snøhvit/Albatross (Melkoya Island) in Norway

Shallow subsea tieback to shore – 156km

• 2016+: Chevron et al Gorgon area fields in Australia

Deepwater subsea tiebacks to shore – up to 188km

• The average length of tiebacks is increasing in line with the development of more remote and deeper fields

• Development of tiebacks featured across both green and brownfield work

• Subsea equipment used to target reservoirs over a wider area

• Technological developments have pushed the frontiers for deepwater E&P and use of SURF-only developments

0

5

10

15

20

25

1970 1975 1980 1985 1990 1995 2000 2005 2010 2015

Avg Tieback Distance (km)

Source: Infield Systems

Mensa

Snøhvit/Albatross

Gorgon Area

Browse Basin CCS

0

50

100

150

200

250

300

1970 1975 1980 1985 1990 1995 2000 2005 2010 2015

Max Tieback Distance (km)

Source: Infield Systems

Source: Macro Market Overview in Global Perspectives Reports to 2017 (published 2013).

Subsea Tree Awards by Quarter and by Region 2006-2013 Historically Africa, Europe and Latin America have accounted the majority of awards

Source: Subsea Match & Track Report Q2 2013 10

0

50

100

150

200

250

2006Q1

2006Q2

2006Q3

2006Q4

2007Q1

2007Q2

2007Q3

2007Q4

2008Q1

2008Q2

2008Q3

2008Q4

2009Q1

2009Q2

2009Q3

2009Q4

2010Q1

2010Q2

2010Q3

2010Q4

2011Q1

2011Q2

2011Q3

2011Q4

2012Q1

2012Q2

2012Q3

2012Q4

2013Q1

2013Q2

2013Q3

Africa Asia Australasia Europe Latin America Middle East & Caspian Sea North America

Recent Subsea Tree Award Activity in 2013

Subsea Tree Awards per Quarter 2008-2013

2013 YTD Market Share (%) by Manufacturer

The number of awards in 2013 shows that investor confidence has returned

• FMC

Call-off of frame agreement with Petrobras

Egina (Nigeria)

Awards in Gulf of Mexico

• Cameron:

Frame agreement with Petrobras

Many UK awards

Shah Deniz 2 (Azerbaijan)

• Aker Solutions

Frame agreement with Petrobras

Total’s operations in Africa

Kraken (UK)

• GE O&G

Gehem and Gendalo fields (Indonesia)

West Africa and the UK

11 Source: Subsea Match & Track Report Q2 2013

Aker Solutions

28%

Cameron 28%

FMC 37%

GE O&G 7%

0

50

100

150

200

250

FMC Cameron Aker Solutions GE O&G Dril-Quip

0

200

400

600

800

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Africa Asia Australasia Europe Latin America Middle East & Caspian Sea North America

Global Subsea Tree Awards by Region

Global Subsea Tree Awards (%) by Region 2014-2018

Africa 30%

Asia 8%

Australasia 6%

Europe 25%

Latin America 18%

Middle East & Caspian Sea

2%

North America 11%

Global Subsea Tree Installations by Region

Where do Europe and Africa fit in? Europe and Africa are expected to account for a major share of global subsea tree awards

Source: Subsea Match & Track Report Q2 2013

12

• Europe and Africa awards in 2014-2018

• Asia and Australia emerging markets for subsea

• North America: stable activity

• Latin America: 18% of future awards

Expected decrease in annual awards in 2014-2018

Europe and Africa to counterbalance decline

0

200

400

600

800

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Africa Asia Australasia Europe Latin America Middle East & Caspian Sea North America

European Subsea Market Forecast

SECTION II

European Subsea Equipment by Country

Subsea Equipment Installations by Country

Subsea Equipment Installations (%) by Country 2014-2018

A record number of trees are set to be installed in Europe in the next five years

• Subsea units expected for installation in 2009-2018

Includes trees, manifolds, templates and plems.

• Subsea units to be installed in next 5 years

24% of global installations

• Drivers

Economies coming out of recession

High oil prices

Favourable fiscal regime

Incremental drilling on producing fields

Development of marginal fields

New large developments

• Challenges

Dependent on continued financial incentives

Manufacturing Capacity

Source: Subsea Dataset Q2 2013

0

50

100

150

200

250

300

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Norway UK Netherlands Italy Others

UK 48% Norway

45%

Italy 2%

Others 5%

European Subsea Capex by Operator

Subsea Equipment Capex (US$m) by Operator

Subsea Equipment Capex (%) by Operator 2014-2018

The European subsea sector is characterised by a broad operator base led by Statoil

• Subsea Capex expected for 2014-2018. Includes all build phases:

Detailed Engineering

Procurement and Construction

Development Drilling

Installation

• Many operators

Mix of Majors, Independents and NOCs

Top 7 operators account for nearly 2/3 of subsea Capex

• Statoil’s dominant position:

Entirely in Norway

Aasta Hansteen, Gullfaks South, Oseberg, Johan Castberg, Troll, Visund

• Chevron: Rosebank

• BP: Schiehallion redevelopment, subsea tiebacks to Skarv FPSO

• Eni: Goliat

Source: Subsea Dataset Q2 2013

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Statoil BP Chevron Shell Eni Total EnQuest Others

Statoil 27%

Chevron 9%

BP 7%

Eni 6%

Shell 6%

Total 5%

EnQuest 4%

Others 36%

0

50

100

150

200

250

300

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Manifold Plem Satellite Well Subsea Compression Subsea Separation Template Templated Well

Subsea Equipment Installations by Type

Subsea Equipment Installations (%) by Type 2014-2018

Manifold 13%

Plem 2%

Satellite Well 54%

Template 8%

Templated Well 23%

Subsea Equipment Capex (%) by Water Depth 2014-2018

European Subsea Equipment by Type and Build Phase Shallow water developments are expected to account for over 75% of subsea Capex

Source: Subsea Dataset Q2 2013

Subsea Equipment Capex (%) by Build Phase 2014-2018

0-99m 13%

100-499m 64%

500-999m 7%

1000-1499m 16%

Detailed Engineering

3%

Development Drilling

52%

Procurement And

Construction 34%

Install 11%

Subsea Manufacturing Capacity in Europe Without plant expansions, utilisation rates are expected to reach 100% by 2017, eroding excess capacity

Source: Subsea Dataset Q2 2013

17

0%

20%

40%

60%

80%

100%

120%

-50

0

50

100

150

200

250

300

350

400

450

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Demand Excess Capacity Utilisation Rate (Europe)

African Subsea Market Forecast

SECTION III

African Subsea Equipment by Country

Subsea Equipment Installations by Country

Subsea Equipment Installations (%) by Country 2014-2018

A record number of subsea units expected for installation in Africa in 2014-2018, led by activity in Angola

• Subsea unit installations in 2009-2018

• Subsea units to be installed in next 5 years

20% of global installations

• Drivers

Rising demand for oil and high oil prices

Large deepwater and ultra-deepwater oil discoveries in the last decade in West Africa

Marginal fields tied back to a single FPSO

Large fields offshore Nigeria

Incremental drilling in North Africa

• Challenges

Fiscal regime in Nigeria

Upcoming laws in emerging regions

Manufacturing capacity

Source: Subsea Dataset Q2 2013

0

50

100

150

200

250

300

350

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Angola Nigeria Ghana Egypt (Mediterranean) Equatorial Guinea Congo (Brazzaville) Libya Others

Angola 47%

Nigeria 17%

Ghana 9%

Congo (Brazzaville)

6%

Equatorial Guinea 5%

Egypt (Mediterranean)

4%

Libya 3%

Others 9%

African Subsea Capex by Operator

Subsea Equipment Capex (US$m) by Operator

Subsea Equipment Capex (%) by Operator 2014-2018

The top 6 operators will represent most of the subsea Capex anticipated for Africa in 2014-2018

• Subsea Capex expected for 2014-2018

High costs of development drilling in deep waters

• Many operators

Primarily majors in established basins

Independents in North Africa

Independents in emerging countries in West Africa

• Top 6 companies

• Much more concentrated than Europe

• Total

Egina, Kaombo 1 and 2, CLOV, Moho Nord Marine

Pazflor, Ukot

• BP: PSVM, PCC

• Eni: Cabaca, Sankofa, N’Goma

• Chevron: Lucapa, Ekoli

Source: Subsea Dataset Q2 2013

0

2,000

4,000

6,000

8,000

10,000

12,000

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Total BP Tullow ExxonMobil Chevron Eni Noble Others

Total 35%

BP 12%

Eni 10%

Chevron 10%

ExxonMobil 9%

Tullow 8%

Others 16%

0

50

100

150

200

250

300

350

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Booster Pump Manifold Plem Satellite Well Subsea Separation Templated Well

Subsea Equipment Installations by Type

Subsea Equipment Installations (%) by Type 2014-2018

Manifold 19% Plem

3%

Satellite Well 78%

Subsea Equipment Capex (%) by Water Depth 2014-2018

African Subsea Equipment by Type Majority of Africa subsea Capex will be geared towards deepwater developments in 2014-2018

Source: Subsea Dataset Q2 2013

Subsea Equipment Capex (%) by Build Phase 2014-2018

0-99 1%

100-499 6%

500-999 19%

1000-1499 38%

>1499 36%

Detailed Engineering

2%

Development Drilling

67%

Procurement And

Construction 18%

Install 13%

Conclusions

SECTION IV

Europe & Africa Comparison Table 2014-2018

Europe Africa

Subsea Equipment Installations x x

Global Market Share (subsea installations) x x

Subsea Capex x x

Global Market Share (subsea Capex) x x

Main Countries UK, Norway Angola, Nigeria

Ghana, Equatorial Guinea, Congo (Brazzaville) Libya, Egypt

Subsea Drivers Shallow-water marginal fields, EOR

Some standalone developments Cluster developments

Large deepwater discoveries

Equipment Type Subsea trees

Templates and compression in Norway Subsea trees

Operator Base Very diversified

IOCs, Independents, NOCs Primarily Majors in established basins Independents in underexplored areas

Challenges Field economics

Fiscal policy PIB in Nigeria

Fiscal policy and local content in emerging areas

Administration

SECTION V

Contact Points A globally recognised oil & gas consultancy with a dedicated international team of cross-sector specialists

25

Contact Points

33 energy professionals – global footprint

Office Locations

London

Aberdeen

Houston

Head Office

Regional Office Gregory Brown (Consultant)

London [email protected] +44 207 423 5032

Marine Richard (Associate Analyst) London

[email protected] +44 207 423 5046

Quentin Whitfield (Director) London

[email protected] +44 207 423 5001

Ioanna Karra (Associate Consultant) London

[email protected] +44 207 423 5026

James Hall (Director of Operations) London

[email protected] +44 207 423 5024

Steve Adams (International Sales Manager) Aberdeen

[email protected] +44 122 425 8150

Disclaimer

26

The information contained in this document is believed to be accurate, but no representation or warranty, express or implied, is made by Infield Systems Limited as to the completeness, accuracy or fairness of any information contained in it, and we do not accept any responsibility in relation to such information whether fact, opinion or conclusion that the reader may draw. The views expressed are those of the individual contributors and do not represent those of the publishers.

Some of the statements contained in this document are forward-looking statements. Forward looking statements include, but are not limited to, statements concerning estimates of recoverable hydrocarbons, expected hydrocarbon prices, expected costs, numbers of development units, statements relating to the continued advancement of the industry’s projects and other statements which are not historical facts. When used in this document, and in other published information of the Company, the words such as "could," "forecast”, “estimate," "expect," "intend," "may," "potential," "should," and similar expressions are forward-looking statements.

Although the Company believes that its expectations reflected in the forward-looking statements are reasonable, such statements involve risk and uncertainties and no assurance can be given that actual results will be consistent with these forward-looking statements. Various factors could cause actual results to differ from these forward-looking statements, including the potential for the industry’s projects to experience technical or mechanical problems or changes in financial decisions, geological conditions in the reservoir may not result in a commercial level of oil and gas production, changes in product prices and other risks not anticipated by the Company. Since forward-looking statements address future events and conditions, by their very nature, they involve inherent risks and uncertainties.

© Infield Systems Limited 2013