Ethical issue in finance

Click here to load reader

-

Upload

pankaj-chandel -

Category

Economy & Finance

-

view

652 -

download

0

Transcript of Ethical issue in finance

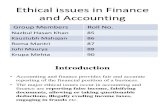

Ethical Issues in Finance

BY:- Pankaj Singh Chandel

Ethical issues in FinanceEthics in finance can be developed around three broad themes:

In financial markets

In financial services industry (including banking and insurance)

By financial people in organizations

Frauds in the financial sector

Legal authorities define fraud as a crime that “involves the use of dishonest or deceitful conduct in order to obtain some unjust advantage over someone else”.

Frauds include:• Financial services sector, i.e., credit card fraud, cheque fraud and other types of identify-related fraud;

• Insurance fraud

• Telecommunication-related fraud

• Securities-related fraud

• Computer-related fraud

• Unauthorized extension of credit facilities;

• Pledging of spurious goods;

• Hypothecating goods to more than one bank;

• Inflating the value of goods;

• Removing goods with the involvement or negligence of bank employees;

• Pledging of goods belonging to a third party;

• Accepting obsolete and inadequate stocks;

Types of bank frauds

• Frauds in deposit accounts are opening of bogus accounts, forging signatures of introducers, and collecting through such stolen accounts or forged cheques or bank drafts.

• Frauds are also committed in the area of granting overdraft facility in the current accounts of customers

• Credit card fraud• Phishing- Duplicate

Types of bank frauds (Contd.)

• Prevention of Money Laundering Act, 2002

Reporting of Cash and Suspicious Transactions

Types of Reports: Cash Transaction Reports (CTR), Suspicious Transaction Report (STR), Counterfeit Currency Report (CCR)

Reporting to RBI

Other guidelines are also given under the Act to curb the menace of money laundering

Compliance to Anti-Money Laundering Standards

• The Banking Ombudsman Scheme, 2006

Measures against bank frauds

We can identify three types of fraud in the insurance industry:

1. Internal fraud against the insurer committed by an employee;

2. Policy holder/claims fraud committed against the insurer, in the purchase and/or execution of an insurance product by obtaining wrongful coverage or payment; and

3. Intermediary fraud committed against the insurer or policy holders by intermediaries – independent broker/agent.

Frauds in insurance sector

The possibility of fraud is prevalent during any one of the three stages in the insurance process:

a. Policy Proposal stage;

b. Policy Contract stage; and

c. Claim Process stage.

Frauds are seen in the both life and non-life insurance sector

Frauds in insurance process

The following measures can be adopted to combat fraud in the insurance sector:

1.Collection of proper evidence

2.Need for regulation

3.Regulation of allied services

4.Need for judicial co-operation

5.Insurers should aim at conviction

Combating insurance fraud

6.Need for transparency and fairplay

7.Insurers’ coalition

8.Building consumers’ awareness

9.Rewards for whistle-blowers

10.Effective legislation and judicial action

Combating insurance fraud (Contd.)

• Accountant should present ‘a true and fair view’ of the financial statement of business operations.

• The picture the accountant paints can be either enlightening or misleading , depending on how accountant chooses to depict it.

• Even within law , various practices can be carried out by accountants which are often regarded as being in ethically grey areas. The most common practice of this kind is known as ‘ creative accounting’.

• It is a term which is popularly associated with ‘ cooking the books’ in a way which is legal although morally dubious.

Creative Accounting definition…

• The use of aggressive and/or questionable accounting techniques in order to produce a desired result, generally high earnings per share.

• Creative accounting may include selling assets with a low cost basis, shipping unusually large quantities of product near the end of the year, and failure to write down inventories that have declined in value

• A typical aim of creative accounting will be to inflate profit figures. • However, Some companies may also reduce reported profits in good years to

smooth results. Assets and liabilities may also be manipulated, either to remain within limits such as debt covenants, or to hide problems

• The term “window dressing” has similar meaning when applied to accounts, but is a broader term that can be applied to other areas.

• In the US it is often used to describe the manipulation of investment portfolio performance numbers. In the context of accounts, “window dressing” is more likely than “creative accounting” to imply illegal or fraudulent practices, but it need to do so.

Abusive Tax Shelters• Shifting of profits from high tax country to lower tax

country in order to take advantage of the loopholes in the tax laws of the different countries.

• The basic objective is tax evasion. • The large accounting firms form teams dedicated to

gaming the tax codes for the benefits of their clients. Major accounting firms are under the attack for tax advice that violates the spirit of the tax law by exploiting the letter of the tax laws

Insider Trading

• Insider trading refers generally to buying or selling a security , in breach of a fiduciary duty or other relationships of trust and confidence, while in possession of material, nonpublic information about the security.

Examples of insider trading cases that have been brought by the SEBI are cases against

• Corporate officers, directors, and employees who traded the corporations securities after learning of significant, confidential corporate developments;

• Friends, business associates, family members, and other tippees of such officers, directors, and employees, who traded the securities after receiving such information;

• Employees of law, banking, brokerage and printing firms who were given such information to provide services to the corporation whose securities they traded;

• Government employees who learned of such information because of their employment by the government; and

• Other persons who misappropriated, and took advantage of, confidential information from their employers.

• Because insider trading undermines investor confidence in the fairness and integrity of the securities markets, the SEBI has treated the detection and prosecution of insider trading violations as one of its enforcement priorities.

• The main argument against insider trading is that it is unfair to those who do not have the privileged information.

• There is also the argument that it is the unethical misappropriation of proprietary knowledge ( i.e. Knowledge that only those in the firm should have, knowledge owned by the firm and not to be used by abusing one’s fiduciary responsibilities to the firm. Such behaviour also undermines the trust necessary to the proper functioning of a firm.

• Most important argument against insider trading is that it leads to inefficiency in the markets.

Role of ethics

• Ethics plays an important role in finance and sources of ethical behaviour in finance and accounting can be from the following :-– Code of Conduct for Accountants and Auditors– Code of Conduct for Merchant Bankers– Code of Conduct for Insurance Agent– Code of Conduct for Bankers– Code of Conduct for Brokers and Members– Code of Conduct for CFO