Vol. 11: #4 • Tidbits Serves Up Some Eskimo Pie • (1/18/15) Tidbits of Coachella Valley

eskimo pie

description

Transcript of eskimo pie

Eskimo Pie Corp.Harvard Business School Case #293-084Case Software #XLS079

Copyright © 2010 President and Fellows of Harvard College. No part of this product may be reproduced, stored in a retrieval system or transmitted in any form or by any means—electronic, mechanical, photocopying, recording or otherwise—without the permission of Harvard Business School.

Copyright © 2010 President and Fellows of Harvard College. No part of this product may be reproduced, stored in a retrieval system or transmitted in any form or by any means—electronic, mechanical, photocopying, recording or otherwise—without the permission of

Year Ended December 31,Business 1989 1990 1991

Licensing 58% 59% 56%Welch’s and Heatha 14 14 24Flavors, packaging and other 28 27 20

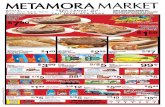

Table A Sales by Business Line

aHeath products included only in 1991.

Brand Company Unit Share

Popsicle Unilever 7.6%Klondike Empire of Carolina 5.4Eskimo Pie Eskimo Pie 5.3Snickers Mars 4.8Weight Watchers H.J. Heinz 4.3

Table B 1991 Leading Frozen Novelty Brands

Year Ended December 31,1987 1988 1989 1990

Income Statement Data (in thousands):

$30,769 $36,695 $46,709 $47,198Cost of goods sold 21,650 25,635 31,957 31,780

9,119 11,060 14,752 15,418Advertising and sales promotions 4,742 4,241 5,030 5,130General and administrative 6,068 5,403 6,394 7,063

Operating income (loss) (1,691) 1,416 3,328 3,225Interest income 308 550 801 1,004Interest expense (88) (107) (88) (67)

1,738 (77) (108) (20)Income taxes 96 729 1,511 1,616

Net income $171 $1,053 $2,422 $2,526

Balance Sheet Data (in thousands):Cash $5,550 $8,109 $10,723 $13,191Working capital 9,342 11,107 10,830 $11,735Total assets 20,857 23,006 26,159 29,518Long-term debt 1,269 1,094 919 744Stockholders’ equity 16,162 17,215 18,215 19,496Per Share Data:

3,316 3,316 3,316 3,316Net income per share $0.05 $0.32 $0.73 $0.76Cash dividend per share - - $0.40 $0.40

Source: Eskimo Pie Prospectus, p. 10.

Exhibit 1 Historical Financial Information

Net salesa

Gross profita

Other income (expense)-netb

Weighted average number of common shares outstanding

aBeginning in 1991 the Company increased prices for products and assumed responsibility for advertising and sales promotion costs previously shared with licensees. This change in business practice accounts for approximately one-half of the increase in net sales for 1991 with a similar impact on 1991 gross profit.

bIncludes the gain on sale of building of approximately $1,700,000 in 1987.

Year Ended December 31,1989 1990

Operating activities:Net income $2,422 $2,526

Depreciation 1,006 1,352Amortization 175 118Deferred income taxes 250 (58)Pension liability and other (154) (156)Decrease (increase) in receivables 1,212 (734)Decrease (increase) in inventories and prepaid expenses (524) (51)Increase (decrease) in payables to parent 2,054 (621)Increase (decrease) in accounts payable and accrued expenses 143 3,006

Net cash provided by operating activities 6,595 5,382

Investing activities

(2,358) (1,311)Other (121) (101Net cash used in investing activities (2,479) (1,412)

Financing activitiesCash dividends (1,327) (1,327)Principal payments on long-term debt (175) (175)Net cash used in financing activities (1,502) (1,502)

Increase (decrease) in cash and cash equivalents 2,614 2,468Cash and cash equivalents at beginning of year 8,109 10,723Cash and cash equivalents at end of year $10,723 $13,191

Source: Eskimo Pie Prospectus, p. F-4.

Exhibit 2 Cash Flow Summary

Capital expendituresa

aCapital expenditures in 1989 are principally related to equipment acquired for use by licensees and, in 1990, an expansion of an ingredients manufacturing facility.

1987 1988 1989 1990 1991

76.3% 78.1% 91.2% 95.6% 97.9%Unit Market Share of Eskimo products 3.3 3.9 5.7 6.8 7.5

Source: Eskimo Pie Prospectus

Exhibit 3 Distribution and Market Share of Eskimo Pie, Heath, and Welch’s Frozen Novelties

Distribution of at least one Eskimo product at U.S. Grocery Stores

Year

1980 $590 N/A N/A N/A $21981 680 N/A 15.3% N/A 41982 770 457 13.2 $1.69 171983 940 525 22.1 1.79 231984 1,100 577 17.0 1.90 321985 1,300 643 18.2 2.02 441986 1,400 681 7.7 2.06 771987 1,500 717 7.1 2.09 381988 1,355 637 -9.7 2.13 261989 1,332 623 -1.7 2.19 401990 1,321 590 -0.8 2.24 21

Source: 1980-87 Nieldsen; 1988-90 IRI

Exhibit 4 Industry Information for Frozen Novelties

Industry Revenues (millions)

Units Sold (millions)

% Change in Sales

Average Price

Advertising Spending (millions)

Year Ended December 31,1991 1992 1993

Net Sales $56,655 $59,228 $59,961Operating expenses 52,610 54,755 55,337 92.5%Operating income 4,045 4,473 4,624Interest income 828 890 1,058Interest expense 52.5 38.5 24.5Pretax income 4,821 5,324 5,657Income taxes 1,928 2,130 2,263Tax rate 40.00% 40.00% 40.00%Net income $2,893 $3,195 $3,394Margin 5.10% 5.40% 5.70%Earning per share $0.87 $0.96 $1.02Average shares outstanding 3316 3316 3316

Source: Goldman Sachs

Exhibit 6 Goldman Sachs Projected Income Statementsa

aAdjusted for 2.5 to 1.0 stock split in March 1992.

PE= 22.80 Market Value $0

Total for firm:Offer Price 14.00 16.00Special dividend 4.52 4.52Total per share 18.52 20.52

Shares outstanding 3,316 3,316Total 61,421 68,054

1991 Net Income 3,749 3,749Implied P/E Multiple 12.38 14.15

Reynolds’ Proceeds:Shares owned 2,789 2,789Per share proceeds:Stock price 14.00 16.00Special dividend 4.52 4.52Total per share 18.52 20.52Total for holdings 51,645 57,222

Source: Casewriter estimates

Exhibit 7 Hypothetical Proceeds from an Initial Public Offering

Company Sales Beta PE

Ben & Jerry' 97.0 6.7 10.2 3.7 26.3 110.1 2.8 1.2 29.8 Dreyer's Gra 354.9 24.1 37.0 15.9 113.1 534.0 44.3 1.4 33.6 Empire of Car 243.1 16.8 37.4 8.8 45.1 51.4 89.8 0.3 5.8 Steve's Hom 35.1 2.7 3.9 1.8 11.1 37.4 3.1 2.5 20.8 Hershey Foo 2899.2 292.3 463.0 219.5 1335.3 4002.5 282.9 1.0 18.2 Tootsie Roll 207.9 32.5 47.2 25.5 152.8 728.8 0.0 1.0 28.6

AVG PE 22.8 Source: Standard & Poor's, Compustat, and casewriter estimates.

Exhibit 8 Information about Comparable Companies

Cash Flow

Operating Incomea

Net Income

Book Value of Equity

Market Value of Equity

Total Debt

aBefore extraordinary items.

I. Treasury Yields90 day 4.56%Six months 4.61One year 4.64Five years 6.62Ten years 7.42Thirty years 7.92II. Corporate Borrowing RatesLong-term Bond Yields

AA 8.74%A 9.27BBB 9.56BB 11.44B 14.68

Floating RatesPrime rate 7.50%Prime commercial paper (6 months) 4.76

Source: Federal Reserve Bulletin, S&P Bond Guide.

Exhibit 9 Selected Financial Market Data, November 1991

Exhibit 8 Information about Comparable Companies

Shareholders'

Company Equity Total Debt Sales Cash Flow

Ben & Jerry's 110.1 2.8 97.0 6.7Dreyer's Grand Ice Cream 534.0 44.3 354.9 24.1Empire of Carolina, Inc. 51.4 89.8 243.1 16.8Steve's Homemade Ice Cream 37.4 3.1 35.1 2.7Hershey Foods Corp. 4002.5 282.9 2899.2 292.3Tootsie Roll Inds. 728.8 0.0 207.9 32.5

Source: Standard & Poor's, Compustat, and casewriter estimates.

Company MV/BVBen & Jerry's 4.19Dreyer's Grand Ice Cream 4.72Empire of Carolina, Inc. 1.14Steve's Homemade Ice Cream 3.37Hershey Foods Corp. 3.00Tootsie Roll Inds. 4.77

Average 3.53

Estimate for Eskimo Pie 1991 23.50

Valuation Using Comparables $ 83.0 Eskimo Pie 1991 Cash $ 13.0 Total Estimated Value $ 96.0

Exhibit 1 Historical Financial Information

1987Income Statement Data (in thousands):

$ 30,769 Cost of goods sold 21,650

9,119

Advertising and sales promotion 4,742 General and administrative 6,068 Operating income (loss) (1,691)

Interest income 308 Interest expense (88)

1,738

Income taxes 96 Net income $ 171

Balance Sheet Data (in thousands):

a Before extraordinary items.

Net salesa

Gross profita

Other income (expense) - netb

Cash $ 5,550 Working capital 9,342 Total assets 20,857 Total debt 1,269 Stockholders' equity 16,162

Per Share Data:

Weighted average number of common shares outstandin 3,316

Net income per share $ 0.05

Cash dividend per share -

Source: Eskimo Pie Prospectus, p. 10.

advertising and sales promotion costs previously shared with licensees. This change inbusiness practice accounts for approximately one-half of the increase in net sales for 1991with a similar impact on 1991 gross profit.

a Beginning in 1991 the Company increased prices for products and assumed responsability for

b Includes the gain on sale of building of approximately $1,700,000 in 1987.

Operating

Net Income Book Value Beta

10.2 3.7 26.3 1.237.0 15.9 113.1 1.437.4 8.8 45.1 0.3

3.9 1.8 11.1 2.5463.0 219.5 1335.3 1.0

47.2 25.5 152.8 1.0

PE MV/S TV/CF Company Equity Total Debt E/TMV29.76 1.16 16.85 Ben & Jerry's 110.1 2.8 0.9833.58 1.63 24.00 Dreyer's Grand Ice Cream 534.0 44.3 0.92

5.84 0.58 8.40 Empire of Carolina, Inc. 51.4 89.8 0.3620.78 1.15 15.00 Steve's Homemade Ice Cream 37.4 3.1 0.9218.23 1.48 14.66 Hershey Foods Corp. 4002.5 282.9 0.9328.58 3.51 22.42 Tootsie Roll Inds. 728.8 0.0 1.0022.80 1.59 16.89 Average 0.85

4 61 3.6

$ 91.2 $ 96.7 $ 60.8 $ 13.0 $ 13.0 $ 13.0 $ 104.2 $ 109.7 $ 73.8

Historical Financial Information Exhibit 6 Goldman Sachs Projected Income Statements

Year Ended December 31, Year Ended December 31,1988 1989 1990 1991 1992 1993

$ 36,695 $ 46,709 $ 47,198 Net Sales $ 56,655 $ 59,228 $ 59,961 25,635 31,957 31,780 Operating expenses 52,610 54,755 55,337

11,060 14,752 15,418 JKD Est Op Exp using ave. 38,978

4,241 5,030 5,130 14636 5,403 6,394 7,063 JKD Operating Income $ 3,041 1,416 3,328 3,225 Operating income 4,045 4,473 4,624

Margin 550 801 1,004 Interest income 828 890 1058 (107) (88) (67) Interest expense 53 39 25

(77) (108) (20)Pretax income 4,821 5,325 5,658

729 1,511 2,362 Income taxes 1,928 2,130 2,263 $ 1,053 $ 2,422 $ 1,780 Net income $ 2,892 $ 3,195 $ 3,395

Earning per share $ 2.18 $ 2.41 $ 2.58

Incomea

$ 8,109 $ 10,723 $ 13,191 Tax rate 40.00% 40.00% 40.00% 11,107 10,830 11,735 Margin 5.1% 5.4% 5.7% 23,006 26,159 29,518 1,094 919 744 17,215 18,215 19,496 Average shares outstanding 1326.6 1326.6 1326.6

Source: Goldman Sachs

3,316 3,316 3,316 DCF Value Using Perpetuity FormulaInitial Cash Free Cash Flow $2.7

$ 0.32 $ 0.73 $ 0.76 Growth Rate 29.2%WACC 15.5%

- $ 0.40 $ 0.40 Valuation $ (25.4)

advertising and sales promotion costs previously shared with licensees. This change inbusiness practice accounts for approximately one-half of the increase in net sales for 1991

Valuation Matrix

Growth = 10% 12% 14%Discount Rate

14% $ 101.7 $ 207.2 --15% $ 81.4 $ 138.1 421.816% $ 67.8 $ 103.6 210.917% $ 58.1 $ 82.9 140.6

Beginning in 1991 the Company increased prices for products and assumed responsability for

Includes the gain on sale of building of approximately $1,700,000 in 1987.

Equity Beta Asset Beta1.2 1.171.4 1.290.3 0.112.5 2.311.0 0.931.0 1.00

1.23 1.14

Goldman Sachs Projected Income Statements

Eskimo Pie Profit/Cashflow '91 92 93Sales $61.0 $ 63.8 $ 64.6 Operating Expenses 41.4 43.9 44.4 SG&A 15.8 16.5 16.7 Op. Profit $3.8 $3.4 $3.5 Free Cash Flow $2.7 $2.5 $2.5 Net Income $2.3 $2.1 $ 2.1

Growth '90-91 29.2% 4.5% 1.2%FCF + TV $2.7 $2.5 $49.87

PV @ 15.5% $36.5 Cash $13.0

Total Value $49.5

Company Sales Cash Flow Net Income

Ben & Jerry's 97.0 6.7 10.2 3.7Dreyer's Grand Ice Cream 354.9 24.1 37.0 15.9Empire of Carolina, Inc. 243.1 16.8 37.4 8.8Steve's Homemade Ice Cream 35.1 2.7 3.9 1.8Hershey Foods Corp. 2899.2 292.3 463.0 219.5Tootsie Roll Inds. 207.9 32.5 47.2 25.5

Source: Standard & Poor's, Compustat, and casewriter estimates.

Company P/B P/E P/S CompanyBen & Jerry's 4.19 29.76 1.16 Ben & Jerry'sDreyer's Grand Ice Cream 4.72 33.58 1.63 Dreyer's Grand Ice CreamEmpire of Carolina, Inc. 1.14 5.84 0.58 Empire of Carolina, Inc.Steve's Homemade Ice Cream 3.37 20.78 1.15 Steve's Homemade Ice CreamHershey Foods Corp. 3.00 18.23 1.48 Hershey Foods Corp.Tootsie Roll Inds. 4.77 28.58 3.51 Tootsie Roll Inds.

Average 3.53 22.80 1.59Median 3.78 24.68 1.32

Estimate for Eskimo Pie 1991 21.80 2.30 61

Valuation Using Comparables $ 77.0 $ 52.5 $ 96.7 Eskimo Pie 1991 Cash $ 13.0 $ 13.0 $ 13.0 Total Estimated Value $ 90.0 $ 65.5 $ 109.7

$76.97 $ 52.51 $ 96.70 $13.00 $ 13.00 $ 13.00

Applying average $89.97 $ 65.51 $ 109.70 Applying Median $95.40 $ 69.85 $ 93.52

Exhibit 8 Information about Comparable Companies

Operating Incomea

aBefore extraordinary items.

Book Value of Equity Total Debt Beta

26.3 110.1 2.8 1.2113.1 534.0 44.3 1.4

45.1 51.4 89.8 0.311.1 37.4 3.1 2.5

1335.3 4002.5 282.9 1.0152.8 728.8 0.0 1.0

Source: Standard & Poor's, Compustat, and casewriter estimates.

Equity Total Debt E/TMV Equity Asset Beta110.1 2.8 0.98 1.2 1.17534.0 44.3 0.92 1.4 1.29

51.4 89.8 0.36 0.3 0.1137.4 3.1 0.92 2.5 2.31

4002.5 282.9 0.93 1.0 0.93728.8 0.0 1.00 1.0 1.00

Average 1.14

Market Value of Equity

Market Return 13.76%Beta 1.14

Risk free rate 7.42%Required rate of return 14.62% 1986 18.50%

Growth rate 29.24% 1987 5.20%

1988 16.80%Market Value 1989 31.50%

1990 -3.20%13.76%

Year Ended December 31, Estimate1987 1988 1989 1990 1991E

Income Statement Data (in thousands):

$30,769 $36,695 $46,709 $47,198 $61,000Cost of goods sold 21,650 25,635 31,957 31,780 $42,086

9,119 11,060 14,752 15,418 $18,914Advertising and sales promotions 4,742 4,241 5,030 5,130 7,413General and administrative 6,068 5,403 6,394 7,063 9,623

Operating income (loss) (1,691) 1,416 3,328 3,225 $1,879Interest income 308 550 801 1,004Interest expense (88) (107) (88) (67)

1,738 (77) (108) (20)Income taxes 96 729 1,511 1,616

Net income $171 $1,053 $2,422 $2,526 $1,127-55.37%

Balance Sheet Data (in thousands): NPV $22,249.68 Cash $5,550 $8,109 $10,723 $13,191Working capital 9,342 11,107 10,830 $11,735Total assets 20,857 23,006 26,159 29,518Long-term debt 1,269 1,094 919 744Stockholders’ equity 16,162 17,215 18,215 19,496Per Share Data:

3,316 3,316 3,316 3,316Net income per share $0.05 $0.32 $0.73 $0.76Cash dividend per share - - $0.40 $0.40

Net salesa

Gross profita

Other income (expense)-netb

Weighted average number of common shares outstanding

Estimate1992E 1993E 1994E 1995E 1996E 1997E 1998E 1999E 2000E

$63,770 $64,560 $65,359 $66,167 $66,986 $67,815 $68,655 $69,504 $70,364$43,779 $44,126 $44,661 $45,378 $45,871 $46,409 $46,998 $47,602 $48,174

$19,991 $20,434 $20,698 $20,789 $21,115 $21,406 $21,656 $21,902 $22,1907,229 7,283 7,457 7,639 7,632 7,736 7,853 7,956 8,0379,430 9,557 9,858 10,000 10,012 10,163 10,320 10,439 10,552

$3,332 $3,593 $3,383 $3,151 $3,471 $3,507 $3,483 $3,508 $3,601

$1,999 $2,156 $2,030 $1,890 $2,083 $2,104 $2,090 $2,105 $51,41777.31% 7.85% -5.85% -6.87% 10.17% 1.03% -0.69% 0.72% 2343.08%

$35,249.68

Year Ended December 31,1991 1992 1993

Net Sales $56,655 $59,228 $59,961Operating ex 52,610 54,755 55,337Operating in 4,045 4,473 4,624Interest inco 828 890 1,058Interest exp 52.5 38.5 24.5Pretax incom 4,821 5,324 5,657Income taxes 1,928 2,130 2,263Tax rate 40.00% 40.00% 40.00%Net income $2,893 $3,195 $3,394Margin 5.10% 5.40% 5.70%Earning per $0.87 $0.96 $1.02

Average shar 3316 3316 3316

Exhibit 8 Information about Comparable Companies

Shareholders'

Company Equity Total Debt Sales Cash Flow

Ben & Jerry's 110.1 2.8 97.0 6.7Dreyer's Grand Ice Cream 534.0 44.3 354.9 24.1Empire of Carolina, Inc. 51.4 89.8 243.1 16.8Steve's Homemade Ice Cream 37.4 3.1 35.1 2.7Hershey Foods Corp. 4002.5 282.9 2899.2 292.3Tootsie Roll Inds. 728.8 0.0 207.9 32.5

Source: Standard & Poor's, Compustat, and casewriter estimates.

Company MV/BVBen & Jerry's 4.19Dreyer's Grand Ice Cream 4.72Empire of Carolina, Inc. 1.14Steve's Homemade Ice Cream 3.37Hershey Foods Corp. 3.00Tootsie Roll Inds. 4.77

Average 3.53

Estimate for Eskimo Pie 1991 23.50

Valuation Using Comparables $ 83.0 Eskimo Pie 1991 Cash $ 13.0 Total Estimated Value $ 96.0

Exhibit 1 Historical Financial Information

1987Income Statement Data (in thousands):

$ 30,769 Cost of goods sold 21,650

9,119

Advertising and sales promotion 4,742 General and administrative 6,068 Operating income (loss) (1,691)

Interest income 308 Interest expense (88)

1,738

Income taxes 96 Net income $ 171

Balance Sheet Data (in thousands):

a Before extraordinary items.

Net salesa

Gross profita

Other income (expense) - netb

Cash $ 5,550 Working capital 9,342 Total assets 20,857 Total debt 1,269 Stockholders' equity 16,162

Per Share Data:

Weighted average number of common shares outstandin 3,316

Net income per share $ 0.05

Cash dividend per share -

Source: Eskimo Pie Prospectus, p. 10.

advertising and sales promotion costs previously shared with licensees. This change inbusiness practice accounts for approximately one-half of the increase in net sales for 1991with a similar impact on 1991 gross profit.

a Beginning in 1991 the Company increased prices for products and assumed responsability for

b Includes the gain on sale of building of approximately $1,700,000 in 1987.

Operating

Net Income Book Value Beta

10.2 3.7 26.3 1.237.0 15.9 113.1 1.437.4 8.8 45.1 0.3

3.9 1.8 11.1 2.5463.0 219.5 1335.3 1.0

47.2 25.5 152.8 1.0

PE MV/S TV/CF Company Equity Total Debt E/TMV29.76 1.16 16.85 Ben & Jerry's 110.1 2.8 0.9833.58 1.63 24.00 Dreyer's Grand Ice Cream 534.0 44.3 0.92

5.84 0.58 8.40 Empire of Carolina, Inc. 51.4 89.8 0.3620.78 1.15 15.00 Steve's Homemade Ice Cream 37.4 3.1 0.9218.23 1.48 14.66 Hershey Foods Corp. 4002.5 282.9 0.9328.58 3.51 22.42 Tootsie Roll Inds. 728.8 0.0 1.0022.80 1.59 16.89 Average 0.85

4 61 3.6

$ 91.2 $ 96.7 $ 60.8 $ 13.0 $ 13.0 $ 13.0 $ 104.2 $ 109.7 $ 73.8

Historical Financial Information Exhibit 6 Goldman Sachs Projected Income Statements

Year Ended December 31, Year Ended December 31,1988 1989 1990 1991 1992 1993

$ 36,695 $ 46,709 $ 47,198 Net Sales $ 55,655 $ 59,228 $ 59,961 25,635 31,957 31,780 Operating expenses 52,610 54,755 55,337

11,060 14,752 15,418 JKD Est Op Exp using ave. 38,290

4,241 5,030 5,130 14378 5,403 6,394 7,063 JKD Operating Income $ 2,987 1,416 3,328 3,225 Operating income 3,045 4,473 4,624

Margin 550 801 1,004 Interest income 828 890 1058 (107) (88) (67) Interest expense 53 39 25

(77) (108) (20)Pretax income 3,821 5,325 5,658

729 1,511 2,362 Income taxes 1,528 2,130 2,263 $ 1,053 $ 2,422 $ 1,780 Net income $ 2,292 $ 3,195 $ 3,395

Earning per share $ 2.18 $ 2.41 $ 2.58

Incomea

$ 8,109 $ 10,723 $ 13,191 Tax rate 40.00% 40.00% 40.00% 11,107 10,830 11,735 Margin 5.1% 5.4% 5.7% 23,006 26,159 29,518 1,094 919 744 17,215 18,215 19,496 Average shares outstanding 1326.6 1326.6 1326.6

Source: Goldman Sachs

3,316 3,316 3,316 DCF Value Using Perpetuity FormulaInitial Cash Free Cash Flow $2.7

$ 0.32 $ 0.73 $ 0.76 Growth Rate 29.2%WACC 15.5%

- $ 0.40 $ 0.40 Valuation $ (25.4)

advertising and sales promotion costs previously shared with licensees. This change inbusiness practice accounts for approximately one-half of the increase in net sales for 1991

Valuation Matrix

Growth = 10% 12% 14%Discount Rate

14% $ 101.7 $ 207.2 --15% $ 81.4 $ 138.1 421.816% $ 67.8 $ 103.6 210.917% $ 58.1 $ 82.9 140.6

Beginning in 1991 the Company increased prices for products and assumed responsability for

Includes the gain on sale of building of approximately $1,700,000 in 1987.

Equity Beta Asset Beta1.2 1.171.4 1.290.3 0.112.5 2.311.0 0.931.0 1.00

1.23 1.14

Goldman Sachs Projected Income Statements

Eskimo Pie Profit/Cashflow '91 92 93Sales $61.0 $ 64.9 $ 65.7 Operating Expenses 41.4 44.7 45.2 SG&A 15.8 16.8 17.0 Op. Profit $3.8 $3.5 $3.5 Free Cash Flow $2.7 $2.5 $2.5 Net Income $2.3 $2.1 $ 2.1

Growth '90-91 29.2% 6.4% 1.2%FCF + TV $2.7 $2.5 $50.76

PV @ 15.5% $37.2 Cash $13.0

Total Value $50.2

Eskimo Pie Profit/Cashflow '91 92 93Sales $61.0 $ 64.9 $ 65.7 Operating Expenses 34.3 36.4 36.9 SG&A 19.0 20.2 20.5 Op. Profit $7.8 $8.2 $8.3 Free Cash Flow $5.1 $5.3 $5.4 Net Income $4.6 $4.9 $ 5.0 Growth '90-91 29.2% 6.4% 1.2%

FCF + TV $5.1 $5.3 $119.61 PV @ 15.5% $86.0

Cash $13.0 Total Value $99.0