Entity formation and securities law Evan Husney

-

Upload

arlen-meyers-md-mba -

Category

Business

-

view

414 -

download

0

Transcript of Entity formation and securities law Evan Husney

Entity Formation and Securities Laws

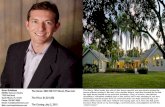

Evan HusneyFoster Graham Milstein & Calisher

LLPFebruary 17, 2016

Choice of Entity

• Major Considerations– Liability Protection– Taxes– Ease of Formation– Familiarity of Form– Ability to Access Investor Funds– Record Keeping Requirements

Subchapter “S” Corporations

• Limited Liability• Pass Through Taxation• Simple to Form (note need for shareholders

agreement)• Cannot go public (see limitations below)• Limitations on Owners

– No more than 100 shareholders– Only one class of stock– Only U.S. citizens or resident aliens– No entities except certain qualified trusts and tax exempt organizations

Subchapter “C” Corporations

• Same as “S” Corporations except:– No Pass-through Taxation (double tax

structure)– Can Go Public– No Limitations on number or type of Owners– More Than One Class of Stock Allowed

Limited Liability Companies

• Limited Liability • Pass Through Taxation – same as S Corp.• Can Be Difficult to Form• Less Familiar Than Corporations• No limitations on number or type of

members• More flexible if needed

Helpful Hints - Preparing For Investors

• Properly Complete Corporate Formalities– Organizational Documents– Employee Agreements– Securities Issues– Other Contracts

• Capitalization– Think About The Future– Don’t Sell Expensive Equity Early– Keep it Simple– Limit Number of Equity Holders if Possible

Helpful Hints - continued

• Surround yourself with the right advisors/board• Intellectual Property

– Is it Protectable?– If so, is it Protected?

• Understand Your Target– Should You be Talking to Whom You are Talking?– Don’t Waste Your Time– First Impressions are Huge– Find a Champion

Helpful Hints - continued

• Have Your Story Straight– Executive Summary (no more than 2-3 pages)– Detailed Business Plan– Use Friends and Contacts to Review– Should Take Many Iterations to Complete

• Have Patience!

Securities Laws

• Both Federal and State apply – must comply with both – “Blue Sky” filings

• State based on domicile of investor• Starting point is registration requirements• Expensive and Time Consuming• Regulation D Exempt Offerings (Federal

Rules 504-506)

Rule 504

• No more than $1,000,000 during 12 months• Unlimited number of investors• No specific disclosure requirements• Anti-fraud and material info rules still apply

Rule 505

• No more than $5,000,000 during any 12 months

• No more than 35 unaccredited investors and unlimited number of accredited investors

• No general solicitations or general advertising

• Anti-fraud and material info rules still apply

Rule 506

• No dollar limitation• No more than 35 unaccredited investors and unlimited

number of accredited investors• accredited investors still need a certain level of

sophistication• Unaccredited investors need to receive information

sufficient for full registration• General solicitation or general advertising allowed under

certain circumstances• Anti-fraud and material info rules still apply

New Rules

• Now can have up to 2,000 accredited investors (up from 500) and still be a private company

• General Solicitation allowed for Rule 506(c) offerings– Must take additional steps to verify investor

status

Verification

• Safe Harbor– Review documents showing sufficient income– Review documents showing net worth– Rely on written confirmation of a qualified

third party– Rely on certification of investor that previously

invested in a private offering as accredited

Accredited Investor Definition

• Directors, officers, partners of issuer• Net worth of $1 million (individually or jointly with

spouse but excluding residence)• Income in excess of $200,000 (or $300,000 with

spouse) in last 2 years and expectation of same in current year

• Business entity treated as a single individual unless formed for purpose of investment, in which case each individual must comply

Private Placement Memo

• Offering document provided to potential investors• Provides material disclosures required by

securities and anti-fraud rules• Basically a business plan wrapped by legal

disclaimers and more information about the company and securities being offered.

• Must contain any info that would be material to investment decision

Offering Process

• Prepare PPM• Hand out and track numbered copies• Prepare subscription agreement that

investor will sign with investor reps and warranties and amounts subcribed

• Accept payment and issue securities• File Form D and any required state filings

Case Study

• 3 individuals wish to form a new business to sell a revolutionary solar product

• Each will own 33% of the company• They will need financing of $2 million• The product is patentable technology• What next?