E:G;DGB6C8: G:EDGI - ii-uploads.s3.amazonaws.com Perf... · Such situations have been rare over the...

Transcript of E:G;DGB6C8: G:EDGI - ii-uploads.s3.amazonaws.com Perf... · Such situations have been rare over the...

PERFORMANCE REPORTTheIntelligentInvestorisanindependentlyownedcompanybasedinBondiJunction,NewSouthWales.EstablishedinApril1998,

thecompanyistodayAustralia’sleadingvalueinvestingpublicationandahighlyregardedsourceofindependentstockmarketinformation.

www.intelligentinvestor.com.au

TheIntelligentInvestorTheIntelligentInvestorTheIntelligentInvestorisanindependentlyownedcompanybasedisanindependentlyownedcompanybasedisanindependentlyownedcompanybasedTheIntelligentInvestorTheIntelligentInvestorTheIntelligentInvestorisanindependentlyownedcompanybasedTheIntelligentInvestorTheIntelligentInvestorTheIntelligentInvestorinBondiJunction,NewSouthWales.EstablishedinApril1998,inBondiJunction,NewSouthWales.EstablishedinApril1998,inBondiJunction,NewSouthWales.EstablishedinApril1998,

thecompanyistodayAustralia’sleadingvalueinvestingpublicationthecompanyistodayAustralia’sleadingvalueinvestingpublicationthecompanyistodayAustralia’sleadingvalueinvestingpublicationandahighlyregardedsourceofindependentstockmarketinformation.andahighlyregardedsourceofindependentstockmarketinformation.andahighlyregardedsourceofindependentstockmarketinformation.

www.intelligentinvestor.com.auwww.intelligentinvestor.com.auwww.intelligentinvestor.com.au

The Intelligent Investor Performance Report 2007 1

Contents

Introduction

Methodology

Summary and Discussion

Strong Buy and Buy recommendations

Long Term Buy and Buy for Yield recommendations

Speculative Buy, Subscribe and Accumulate recommendations

Independent Audit Report

Notes to the Schedule of Performance Statistics

Directors’ Declaration

Schedule of Performance Statistics as at 31 December 2007Strong Buy—14 Buy—14 Long Term Buy—16

Buy for Yield—21 Speculative Buy—22 Subscribe—24 Accumulate—25

Important Information

2

4

5

7

8

9

10

12

13

14

25

353 recommendations deliver 17.2% average annualised return (weighted average)

The Intelligent Investor’s research team has comfortably passed under my stewardship (I’m going on seven years in the job, now).

a n a LY S E t H E B U S I n E S S

the framework used by our team of analysts is well documented on our website. there are no ‘black boxes’ here. we always analyse the business of each company we review. If possible, we then form a view of the stock’s underlying—or ‘intrinsic’—value. If the current market price is substantially below that level, offering us an all-important margin of safety, then we’ll recommend the stock.

In a sense, you get to watch a value investing virtual reality show through the 350,000-odd words our analysts publish

You and I face a challenge. as investors, we know that the disclaimers are right: past performance is not a reliable indicator of future returns. But if we shouldn’t use past performance as a benchmark, then what should we use?

My personal solution is twofold. firstly, I want to know the intellectual framework being used by the person whose record I’m examining. what are the principles by which they are making their calls? Do they make sense to me?

Secondly, I want an extended track record. time moves on and situations change. Last year’s hot investment strategy may prove a disaster in different market conditions—a lesson learned the hard way by owners of Centro Properties Group recently.

other things being equal, the more years the better, but five years isn’t a bad milestone. It also happens to be one

The Intelligent Investor Performance Report 2007Introduction2

IntroductionThe Intelligent Investor Performance Report 2007 3

Cochlear, Macquarie Group, ARB Corporation and Harvey Norman.

H I G H Q U a L I t Y S t o C K S

It’s remarkable that each of those high-quality businesses has been available at a knock-down price at some point over the past few years. they are the type of opportunity we relish at The Intelligent Investor.

Such situations have been rare over the past three years or so, but we’re hopeful that 2008 will see a return to more sober market conditions and allow us to shop for bargains (it’s certainly started off the right way).

Value investing does not suit everyone’s personality. It needs you to be strong in your own convictions and able to move against the crowd. It also needs you to accept the sometimes unnerving reality that you will get investment decisions wrong from time to time. If these sound like unrealistic requirements, then I urge you to reconsider The Intelligent Investor’s suitability to your needs.

Before you dive into the figures, I’d like to take this opportunity to thank our team of talented analysts. not everybody looks forward to going to work each day but I’m lucky enough to do exactly that. Sitting among fine investing minds that have more than their fair share of humour and integrity is an honour and a delight.

each year. You see us respond to events as they unfold and can go back and look at past articles on our website—there’s nowhere for us to hide.

happily, the current team’s growing record has been very pleasing. the average annual return from our 353 positive recommendations (excluding 10 Subscribe recommendations, which provided a high average annual return of 34.2%) has been 17.2%.

SuMMary oF average annuaLiSed return

recommenDatIon numBer average

annual.return

StrongBuy 6 11.1%Buy 68 23.1%LongTermBuy 176 21.7%Accumulate 3 32.9%BuyforYield 39 11.7%SpeculativeBuy 61 1.1%Subscribe 10 34.2%total 363Weightedaverageannualisedreturn(excludingsubscribe) 17.2%Calculationdate:31December2007

our aim is to deliver value many times greater than our annual subscription fee and, with such figures, we trust long-term members are satisfied with our efforts.

we have comfortably outperformed the 15.0% average annual return provided by the benchmark all ordinaries accumulation Index over the same period. and, as you’ll see in the following pages, members who have followed our advice continue to hold quality stocks such as Commonwealth Bank,

GregHoffmanisResearchDirectorandhasbeenwith

TheIntelligentInvestorformorethansevenandahalfyears.

Many happy returns,Greg Hoffman

consistency scepticism conservatism

m E t H o D o L o G Y

this is our third audited performance report and, as foreshadowed last year, the first year where a change of methodology has been required. with recommendations now released online, sometimes throughout the trading day, we take the price as at the time of publication (rather than the day’s closing price).

as always, we’ve aimed for consistency and have adopted a healthy degree of scepticism in our methodology. firstly, the performance report covers all positive recommendations made from issue 80 (when Greg started) through to 31 December 2007. each and every change to a positive recommendation is included in the figures. this encompasses first-time recommendations on stocks as well as changes to existing recommendations.

to illustrate this, let’s take the example of a stock which is first recommended as a Long term Buy at $1.50, subsequently upgraded to an outright Buy at $1.10 and then downgraded once again to Long term Buy at $1.40. the stock will be included in the Long term Buy table at both prices

($1.50 from the first recommendation and $1.40 from the second) as well as in the Buy table at $1.10.

when considering amounts received from dividends, special dividends, distributions and capital returns, we have taken no account of any potential taxation issues (such as franking credits received). we have simply included the amount that would have been delivered to a stockholder’s bank account. for the sake of simplicity (and conservatism) the timing of payments has not been taken into account, which detracts slightly from the performance figures.

on ‘closed’ recommendations, the first negative recommendation has been taken. In cases of a take part profits recommendation where the stock price subsequently moved higher, this has detracted from the performance returns and vice versa. overall, the impact roughly cancels out and, for the sake of brevity in the tables, we’ve simply elected to take the first negative recommendation as the closing-off point.

for ‘open’ recommendations (those not yet sold), the closing price on 31 December 2007 has been used to calculate the performance result. finally, no account has been taken of any recommended portfolio weightings.

Methodology The Intelligent Investor Performance Report 20074

The Intelligent Investor Performance Report 2007 5

S U m m a r Y a n D D I S C U S S I o n

In our previous two performance reports we promised a future of lower returns. that has now transpired but not because we adopted the Chaser’s motto: Striving for mediocrity in a world of excellence. Instead, the reason is that our past returns were higher than what we could reasonably expect to maintain over a long period. our overall annualised return has dropped to 17.2% from an unsustainable 21.3% in last year’s report. we’re still well ahead of the 15.0% produced by the all ordinaries accumulation Index over the period, though. Incidentally, we expect the index’s return to moderate over coming years (probably to somewhere in the 8%—12% range).

neat theoretical ideas are often confounded by the stockmarket. and so it is with our Strong Buy recommendations. theoretically this category should provide members with the highest returns, yet the average annualised return sank to 11.1% this year, well below both our Buy and Long term Buy categories.

In 2007 we added maligned agricultural company Timbercorp to the Strong Buy list (our first addition in three years). But, as is often the case when buying out-of-favour stocks, the price fell further after we bought in (it also appears twice as it swung between Buy and Strong Buy territory). we expect this category will assume its rightful mantle as our best performer as the timbercorp story matures over the coming years and we add other stocks to the list (Platinum Asset Management became the fifth stock to grace the list in January 2008, after this performance report was closed off).

our Buy recommendations have an annualised return of 23.1%. we still argue that this is too high. It suggests that

we’ve been too selective with our recommendations. we’d be satisfied with a return closer to 15%.

ten companies were added to this category during the year. that’s quite a few given that the maturing bull market made value harder to find (we only added two last year). perhaps it was a function of our expanded research team, which provided more analytical firepower to seek out opportunities.

the Long term Buy category has once again proved a happy hunting ground. Its annualised return of 21.7% sits in appropriate order underneath the 23.1% from our outright Buy recommendations. But, like the Buy recommendations, we think this return is too high. that said, we don’t want to relax our standards too much. new additions to this category included Goodman Fielder, Platinum Asset Management, Souls Private Equity, Servcorp and Select Harvests.

Buy for Yield opportunities are the staple diet for our income-focused members. this year’s annualised return of 11.7% is well below last year’s return of 15.0% but much closer to what we’d expect from this category over the long term. for most of 2007 we treated most income stocks with extreme caution, perceiving that the risks outweighed the potential returns. that’s a key point given that preserving capital is our priority when choosing stocks for this category.

Summary and Discussion

[ c ontinued on page 6 ]

things started changing toward the end of the year, however. and 2008 has opened up with even more selections for the formerly opportunity-starved conservative income investor.

our Speculative Buy experience so far has been extremely disappointing. we still believe this category has a role to play in a well-diversified portfolio for many investors and hope to prove that point over the years. But 2007 was another disappointing one with the average annualised return falling to an anaemic 1.1% from an already low 5.1%.

as we’ve said in past reports, our three accumulate recommendations are only included for completeness (the category was abolished more than five years ago). only Santos remains a live recommendation, which explains the annualised return improving to 32.9% from 31.5%. the company’s fortunes improved markedly after a forgettable 2006.

only platinum asset Management was added to our Subscribe list. this category’s annualised return fell to 34.2% but we’re not particularly proud of this impressive-looking figure. In fact, it is excluded altogether from our overall returns, the reason for which we’ll explain shortly.

our aim is to achieve performance significantly higher than the market average. while this report shows what we’ve achieved so far, it’s not a blueprint for future returns. Some categories we expect to produce lower returns (Buy and Long term Buy), while other categories we hope to improve substantially as value returns to the stock market after years of a rampaging bull market (Strong Buy and Speculative Buy).

with the prospect of lower stock prices in the offing, The Intelligent Investor team is as keen as ever to find bargains. and we’re committed to improving the way our findings are communicated to you. through podcasts, face-to-face seminars and our ongoing online forum we aim to bring you closer to the research process. In turn we remain committed to delivering many times your subscription fee in value.

[ c ontinued FroM page 5 ]

Summary and Discussion The Intelligent Investor Performance Report 20076

The Intelligent Investor Performance Report 2007 7

S t r o n G B U Y r E C o m m E n D at I o n S

Last year’s biggest improver is this year’s biggest loser, demonstrating the often tumultuous nature of stockmarket investing. It’s delivered an average annual return of 11.1%, down from 26.8% in last year’s performance report. Timbercorp was the main culprit, appearing twice after oscillating between Strong Buy and Buy recommendations.

overall, our six Strong Buys have now slipped beneath the index’s result but we’re not unduly concerned. Strong Buys don’t crop up on a regular basis (at least they haven’t in recent years). we define a Strong Buy as a stock we believe to be at least 40% underpriced and it generally takes very unpalatable news to create such extreme undervaluation.

timbercorp is currently out of favour for several reasons. Its industry has received an adverse tax ruling for horticultural products, drought is scaring many investors away from the agricultural sector (though recent rainfall has been quite encouraging) and now its debt level is causing concern with the current credit crisis a particular focus for investors. while no guarantee of great returns, we believe today’s price more than compensates for these risks.

B U Y r E C o m m E n D at I o n S

our Buy list has grown with seven new names being added to this category during the past 12 months. Timbercorp, Sigma Pharmaceuticals, Souls Private Equity, Platinum Asset Management, Select Harvests, raMS home Loans Group (now RHG Group) and Servcorp have all been added. only Select harvests and Souls private equity increased in price after being recommended and so the average annual return from our Buy recommendations fell to 23.1% from 29.8% as at 31 December 2006.

Meanwhile Flight Centre matured in extraordinary fashion. Investors spurned two takeover attempts for the travel retailer and reaped the benefits with its stock price up 91.6%. It was a typical value play with the stock initially languishing over concerns that online travel providers were taking over. Its quick turnaround illustrates how the huge gains of buying out-of-favour stocks can make up for the odd loss and why not every stock you pick has to be a winner.

we currently have some exciting situations in this category. hopefully there’s another flight Centre or two among our current list of outright Buys.

strongBuy Thestockisgrosslyundervaluedinour

view,typicallyby40%ormore.Italsogenerallyofferssomeformofdownsideprotectionsuchasahighdividendyield.Thisisourstrongestformof

recommendation.

Buy Thestockisundervaluedinourview,typicallyby30%ormore.Thisisastronger

formofrecommendationthanLongTermBuy.

Strong Buy and Buy recommendations

L o n G t E r m B U Y r E C o m m E n D at I o n S

The Intelligent Investor endured something of a bear market in 2007. Many of our recommended stocks retreated while the market rewarded those chasing higher-risk situations in sectors like resources and financial stocks. It’s therefore pleasing that our staple diet of Long term Buys has produced an average annual return of 21.7%, well above the 15.0% average annual return of the all ordinaries accumulation Index.

In a bull market Long term Buys can provide some succour for value investors. Small mispricings have typically been corrected quickly in recent times but we’ve been able to add some real class to the list including Platinum Asset Management, Cochlear and Macquarie Group (the re-named Macquarie Bank).

today’s worry list includes the credit crisis, a potential US recession and higher interest rates at home. If these transpire, we’re hoping they’ll translate into lower prices for stocks and shake loose some real bargains among australia’s finest companies.

B U Y f o r Y I E L D r E C o m m E n D at I o n S

with respect to this category’s index-beating performance in last year’s report we wrote, ‘we expect [our current average annual return of 15.0%] to continue to fall over coming years. there’s no reason this category of recommendation should be achieving such high returns. that it has is largely testament to the low interest rate environment we’ve experienced over the time these recommendations were made’.

Considering that view, we’re not disappointed to see the average annual return slip to 11.7%. Indeed, there’s reason for some excitement.

the out-of-favour agricultural sector offered some juicy yields backed by significant land holdings. During 2007 we were able to recommend an old favourite in Great Southern TREES2. Timbercorp Bonds, Preference Shares and Convertible Notes also made the list, as did Willmott PINES.

we’re also hopeful that sectors like listed property will once again offer attractive yields. the credit crisis is forcing down the prices of property securities with high debt and aggressive strategies. with any luck they’ll over-correct and provide some spectacular opportunities for income investors.

longtermBuy Thisistherecommendationappliedtoaboveaveragecompaniesthatmaynevertradeatbargainpricesbutshoulddelivergoodresultstogenuinelong-terminvestorsovertime.Itcanalsobeappliedtoaveragecompaniesthataremildlyunderpriced.

BuyforYield Whereastockoffersanattractive,stableincomeinrelationtoitscurrentprice.Capitalsafetyisalsoaprimaryconsiderationforthistypeofstock.

Long Term Buy and Buy for Yield recommendations The Intelligent Investor Performance Report 20078

The Intelligent Investor Performance Report 2007 9

S p E C U L at I V E B U Y r E C o m m E n D at I o n S

Last year we stated that ‘this has been by far and away our worst category’. Unfortunately our annual average return has sunk even lower, to 1.1%. During the year we upgraded both raMS home Loans Group (now RHG Group) and Globe International twice. past recommendations such as Challenger Wine Trust, AVJennings and Charter Pacific were also re-introduced to the list.

Speculative Buy is the category that suffers most from our conservative performance methodology. the losses are often large and, like Croesus Mining, sometimes fatal. the performance report takes no account of portfolio weighting. with poor results so far, our average returns from this category have suffered much more than what a well-diversified portfolio would have if it adhered to our allocation advice.

for example, we recommended three listed investment company options in issue 150/Apr 04 for no more than 1% of members’ portfolios. they’re all included in the performance report with the same weighting as every other recommendation. the average annualised return without them is 6.0% for Speculative Buys but we remain content with our conservative methodology.

Speculative Buys have a role to play in the portfolio of many investors and can add a worthwhile element of diversification. we’ll be aiming to prove that’s the case over the coming years.

S U B S C r I B E r E C o m m E n D at I o n S

we exclude Subscribe recommendations from our overall record because they don’t reflect reality. recommend new floats is easy. Getting an allocation is not. It’s like knowing the location of the hottest nightclub in town but not knowing the bouncers—pretty much pointless and very frustrating.

any analyst worth their salt should be able to identify most decent float opportunities. at the least, a quick scan of the financial papers in the press will usually give an indication of the level of demand for a float, and therefore its prospect for initial performance upon listing.

this year’s sole entry was Platinum Asset Management. Many investors struggled to get the amount of stock they wanted at the $5 issue price and initially sent the share price up over $9. By year’s end it was back where it started (and value investors were quietly topping up their unfulfilled float allocations).

past recommendations still open that didn’t perform very well include Great Southern TREES2, Great Southern TREES3 and Wilson Investment Fund.

the average annualised return of 34.2% is down from 44.1% at the time of our previous performance report. Still, that’s more than double the index return of 15.0%. the bull market saw a lot of poor quality companies list on the exchange and we hope that the future provides more quality than quantity.

a C C U m U L at E r E C o m m E n D at I o n S

this category was the only one to improve its average annualised return. It rose to 32.9% from 31.5% as Santos’s share price improved after a difficult year in 2006. this category was abolished in 2001 after Greg thought it was too ambiguous (its closest living relative is our Long term Buy recommendation). Santos is this category’s only open recommendation and, while it looks pretty on paper, it offers little insight into either the process or performance of The Intelligent Investor.

Speculative Buy, Subscribe and Accumulate recommendations

speculativeBuy Anumberoffactorscouldearnastockthistagbut,ultimately,itreferstoamoreriskyinvestment.We’dsuggestthatyoudon’tputtoomuchofyourportfolioatrisk

followingsuchrecommendations.

subscribe Apositiverecommendationfornewissues

whereyou’llgenerallyneedtosubscribetotheoffervia

itsprospectus.

accumulate Adiscontinuedrecommendationthat

ismostcloselyakintoourLongTermBuy.

ScopeThe schedule of investment performance statistics

the schedule of investment performance statistics, which has been stamped for identification purposes, comprises the investment performance statistics, accompanying notes to the investment performance statistics, and the directors’ declaration for the Intelligent Investor publishing pty Limited (the company), for the period from 1 January to 31 December 2007.

The responsibility of the directors for the schedule of investment performance statistics

the directors of the company are responsible for the preparation and presentation of the schedule of investment performance statistics. this responsibility includes establishing and maintaining internal controls relevant to the preparation and presentation of the statement that is free from material misstatement, whether due to fraud or error; selecting and applying appropriate accounting policies; and making accounting estimates that are reasonable in the circumstances.

Auditor’s Responsibility

our responsibility is to express an opinion on the schedule of investment performance statistics based on our audit. we conducted our audit in accordance with australian auditing Standards. these auditing Standards require that we comply with ethical requirements relating to audit

engagements and plan and perform the audit to obtain reasonable assurance whether the statement is free from material misstatement.

an audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the schedule of investment performance statistics. the procedures selected depend on the auditor’s judgement, including the assessment of the risks of material misstatement of the statement, whether due to fraud or error.

In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and presentation of the schedule of investment performance statistics in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control.

an audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the financial statement.

the schedule of investment performance statistics has been prepared in accordance with the basis of preparation

Chartered AccountantsBusiness Advisers and Consultants

Level 17, 383 Kent StreetSydney NSW 2000PO Locked Bag Q800QVB Post OfficeSydney NSW 1230T +61 2 8297 2400F +61 2 9299 4445E [email protected] www.grantthornton.com.au

Grant Thornton Services (NSW) Pty LtdABN 80 798 869 203

Liability limited by the Accountants Scheme, approved under the Professional Standards Act 1994 (NSW)

Member of Grant Thornton Association IncMember of Grant Thornton International

I n D E p E n D E n t a U D I t r E p o r t t o t H E D I r E C t o r S o f t H E I n t E L L I G E n t I n V E S t o r p U B L I S H I n G p t Y L I m I t E D

[ c ontinued opp oSite ]

Independent Audit Report10 The Intelligent Investor Performance Report 2007

The Intelligent Investor Performance Report 2007 11

described in the notes to the schedule of investment performance statistics, the investment performance of the company’s recommendations, as made in its newsletters published during the period from 1 January to 31 December 2007.

the statement may not be suitable for another purpose. our report is intended solely for the company and should not be distributed to or used by parties other than the company.

we believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Independence

In conducting our audit, we followed applicable independence requirements of australian professional ethical pronouncements.

Audit opinion

In our opinion, the schedule of investment performance statistics of the Intelligent Investor publishing pty Limited from 1 January to 31 December 2007, presents fairly, in all material respects, the investment performance of the company’s investment recommendations in accordance with the basis of preparation set out in the notes to the schedule of investment performance statistics.

Grant Thornton Services (NSW) Pty LtdChartered accountants

G S LaylandDirector

Sydney, 25 January 2008

Independent Audit Report

Basis of preparation

the following items set out the assumptions on which the Schedule of performance Statistics (‘the Schedule’) is based:1. the Schedule includes recommendations contained in

issues 80 to 238 of The Intelligent Investor publication.2. each positive recommendation is included as a

new recommendation, whether for a previously recommended stock or a newly recommended stock. hence recommendations for the same company are included multiple times where there have been changes in positive recommendations made.

3. returns from dividends, special dividends, distributions and capital returns take no account of taxation implications of franking credits.

4. Capital returns have been included as a dividend received rather than as an adjustment to the price of the share where capital returns fall within the holding period. where capital returns fall outside the holding period no adjustment has been made.

5. for ease of presentation and consistency take part profit (‘tpp’) recommendations have been treated as a full sale with the performance return calculated from the positive recommendation to the tpp recommendation. while the performance of individual shares changes if performance is calculated to a full Sell recommendation, or the cut-off date of 31 December 2007 (if not sold), in aggregate the affect on returns of the portfolio is not material.

6. Due to a change in the publishing regime, recommendations are now taken from the time they are posted to The Intelligent Investor website.

7. prices for open (not sold) recommendations are as at 31 December 2007.

8. purchase prices used in calculations are the actual price when the recommendations were posted to The Intelligent Investor website.

n o t E S t o t H E S C H E D U L E o f p E r f o r m a n C E S tat I S t I C S

[ c ontinued opp oSite ]

Notes to the Schedule of Performance Statistics12 The Intelligent Investor Performance Report 2007

The Intelligent Investor Performance Report 2007 13Directors’ Declaration

9. Calculations are based on prices and dividends for one (1) share in each company for each recommendation.

10. no account of different levels of risk associated with different investments/companies has been taken.

11. no consideration has been given to portfolio weightings for each recommendation.

12. the Schedule has been prepared with reference to and where applicable, compliance with aSIC Guidance Statement on the Use of past performance in promotional Material and IfSa Standard no 6.00 on the Calculation and presentation of returns.

D I r E C t o r S ’ D E C L a r at I o n

the Directors of the Intelligent Investor publishing pty Limited (the Company) declare that the attached Schedule of performance Statistics:1. has been prepared in accordance with the assumptions

as detailed in the notes to the Schedule of performance Statistics; and

2. Complies with the requirements of the aSIC guide on the Use of past performance in promotional Material of July 2003; and

3. presents fairly the performance of the Company’s recommendations of issues 80 to 238.this declaration is made in accordance with a resolution

of the Board of Directors.

Greg HoffmanDirector

Bondi Junction, 21 february 2008

The Intelligent Investor Performance Report 2007Schedule of Performance Statistics as at 31 December 200714

[ c ontinued on page 15 ]

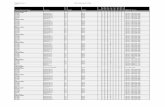

Strong Buy

Issue Date stockasX orIgInal BuY sale

Date recommenDatIon

PrIce DIvIDenDs Fr’kIng Years

return annual. PerForm.

coDe recommenDatIon PrIce Issue atsale HelD return return

84 24/7/01 Forresterkurts(FkP) FKP StrongBuy $0.81 120 4/2/03 TakePartProfits $1.48 $0.15 100% 1.5 101% 58% 58%112 17/9/02 miller’sretail MRL StrongBuy $2.05 196 28/3/06 Sell $1.70 $0.23 100% 3.5 –6% –2% –2%114 15/10/02 macquariegroup MQG StrongBuy $20.39 – NotSold – $76.20 $9.96 95% 5.2 323% 32% 32%151 11/5/04 miller’sretail MRL StrongBuy $1.46 196 28/3/06 Sell $1.70 $0.04 100% 1.9 19% 10% 10%221 10/4/07 timbercorp TIM StrongBuy $1.85 – NotSold – $1.52 $0.07 100% 0.7 –14% N/A –14%225 31/5/07 timbercorp TIM StrongBuy $1.91 – NotSold – $1.52 $0.07 100% 0.6 –17% N/A –17%numberofstrongBuyrecommendations 6 averageannualisedreturn 11.14%

Buy

Issue Date stockasX orIgInal BuY sale

Date recommenDatIon

PrIce DIvIDenDs Fr’kIng Years

return annual. PerForm.

coDe recommenDatIon PrIce Issue atsale HelD return return

80 29/5/01 JustJeans JJS Buy $1.10 87 4/9/01 AcceptOffer $1.38 $0.00 N/A 0.3 25% N/A 25%80 29/5/01 macquariegroup MQG Buy $32.00 – NotSold – $76.20 $11.41 92% 6.6 174% 17% 17%80 29/5/01 temposervices TEM Buy $2.13 150 27/4/04 Sell $1.14 $0.26 100% 2.9 –34% –13% –13%80 29/5/01 Brazin BRZ Hold/Buy $1.43 122 4/3/03 Sell/Switch $1.20 $0.275 100% 1.8 3% 2% 2%81 12/6/01 coloradogroup CDO Buy $1.66 103 14/5/02 Sell/Switch $3.05 $0.09 100% 0.9 89% N/A 89%83 24/7/01 BankWest BWA Buy $4.33 109 6/8/02 Sell $4.15 $0.175 100% 1.0 0% 0% 0%84 24/7/01 taBQld(unitaB) TQL(UTB) Buy $2.76 158 17/8/04 TakePartProfits $9.31 $0.70 100% 3.1 263% 52% 52%85 7/8/01 Forresterkurts(FkP) FKP Buy $0.98 120 4/2/03 TakePartProfits $1.48 $0.15 100% 1.5 66% 41% 41%85 7/8/01 sonsofgwalia SGW Buy $7.75 128 27/5/03 SellDown/Hold $2.14 $0.325 0% 1.8 –68% –47% –47%86 21/8/01 tab TAB Buy $2.67 149 13/4/04 Sell $4.69 $0.43 100% 2.6 92% 28% 28%88 18/9/01 australianInfrastructure AIX Buy $1.267 167 18/1/05 Sell $2.56 $0.395 39% 3.3 134% 29% 29%93 27/11/01 cmI CMI Buy $1.10 145 17/2/04 Sell $2.21 $0.20 100% 2.2 119% 42% 42%93 27/11/01 Futuris FCL Buy $1.78 – NotSold – $2.15 $0.52 88% 6.1 50% 7% 7%95 22/1/02 suncorpmetway SUN Buy $14.50 168 1/2/05 TakePartProfits $18.55 $1.80 100% 3.0 40% 12% 12%102 30/4/02 securenet SNX Buy $0.86 133 5/8/03 Hold $1.57 $0.00 N/A 1.3 83% 61% 61%102 30/4/02 telstra TLS Buy $5.09 – NotSold – $4.69 $1.66 100% 5.7 25% 4% 4%103 14/5/02 miller’sretail MRL Buy $2.33 196 28/3/06 Sell $1.70 $0.23 100% 3.9 –17% –5% –5%107 9/7/02 computershare CPU Buy $2.08 – NotSold – $9.88 $0.565 28% 5.5 402% 34% 34%107 9/7/02 stWcommunications SGN Buy $3.95 – NotSold – $2.35 $1.005 73% 5.5 –15% –3% -3%108 23/7/02 securenet SNX Buy $0.81 133 5/8/03 Hold $1.57 $0.00 N/A 1.0 94% 90% 90%108 23/7/02 strathfield SRA Buy $0.34 133 5/8/03 Sell $0.14 $0.00 N/A 1.0 –59% –58% –58%112 17/9/02 cmI CMI Buy $1.25 145 17/2/04 Sell $2.21 $0.15 100% 1.4 89% 57% 57%116 12/11/02 commonwealthBank CBA Buy $27.39 – NotSold – $59.10 $10.14 100% 5.1 153% 20% 20%116 12/11/02 macquarieairports MAP Buy $0.87 171 15/3/05 Sell $3.26 $0.245 0% 2.3 303% 81% 81%

Schedule of Performance Statistics as at 31 December 2007The Intelligent Investor Performance Report 2007 15

Buy [ c ontinued FroM page 14 ]

Issue Date stockasX orIgInal BuY sale

Date recommenDatIon

PrIce DIvIDenDs Fr’kIng Years

return annual. PerForm.

coDe recommenDatIon PrIce Issue atsale HelD return return

116 12/11/02 nationalaustraliaBank NAB Buy $32.40 – NotSold – $37.79 $9.19 92% 5.1 45% 8% 8%117 26/11/02 macquariegroup MQG Buy $22.28 – NotSold – $76.20 $9.55 95% 5.1 285% 30% 30%118 10/12/02 tabcorp TAH Buy $10.40 136 16/9/03 TakePartProfits $11.39 $0.67 100% 0.8 16% N/A 16%119 21/1/03 WestpacBankingcorp WBC Buy $14.35 – NotSold – $27.92 $5.11 100% 4.9 130% 18% 18%121 18/2/03 greatsouthernPlant. GTP Buy $0.64 147 16/3/04 TakePartProfits $2.55 $0.10 100% 1.1 314% 274% 274%122 4/3/03 anZBank ANZ Buy $16.087 – NotSold – $27.46 $5.67 100% 4.8 106% 16% 16%122 4/3/03 Harveynorman HVN Buy $2.28 – NotSold – $6.80 $0.38 100% 4.8 215% 27% 27%127 13/5/03 gowingBros GOW Buy $1.90 – NotSold – $3.80 $0.44 100% 4.6 123% 19% 19%127 13/5/03 macquarieairports MAP Buy $1.17 171 15/3/05 Sell $3.26 $0.20 0% 1.8 196% 80% 80%129 10/6/03 aristocratleisure ALL Buy $1.15 146 2/3/04 TakePartProfits $2.73 $0.03 100% 0.7 140% N/A 140%130 24/6/03 rocoil ROC Buy $1.13 – NotSold – $3.03 $0.00 N/A 4.5 209% 28% 28%130 24/6/03 santos STO Buy $5.76 – NotSold – $14.12 $1.61 100% 4.5 173% 25% 25%135 2/9/03 Futuris FCL Buy $1.44 – NotSold – $2.15 $0.40 94% 4.3 77% 14% 14%139 28/10/03 miller’sretail MRL Buy $1.86 196 28/3/06 Sell $1.70 $0.095 100% 2.4 –3% -1% –1%140 11/11/03 anZBank ANZ Buy $16.28 – NotSold – $27.46 $4.72 100% 4.1 98% 18% 18%140 11/11/03 WestpacBankingcorp WBC Buy $15.77 – NotSold – $27.92 $4.73 100% 4.1 107% 19% 19%143 20/1/04 mmccontrarian MMA Buy $0.91 – NotSold – $0.90 $0.185 100% 3.9 19% 5% 5%144 3/2/04 templetonglobalgrowth TGG Buy $1.10 – NotSold – $1.29 $0.19 100% 3.9 41% 9% 9%147 16/3/04 cochlear COH Buy $19.04 – NotSold – $74.90 $3.49 100% 3.8 312% 45% 45%151 11/5/04 leightonHoldings LEI Buy $7.83 195 14/3/06 Sell $17.70 $1.02 64% 1.8 139% 61% 61%152 25/5/04 macquariegroup MQG Buy $32.75 – NotSold – $76.20 $7.31 96% 3.6 155% 30% 30%152 25/5/04 templetonglobalgrowth TGG Buy $1.13 – NotSold – $1.29 $0.19 100% 3.6 37% 9% 9%157 3/8/04 miller’sretail MRL Buy $1.52 196 28/3/06 Sell $1.70 $0.04 100% 1.7 14% 9% 9%159 31/8/04 Infomedia IFM Buy $0.63 – NotSold – $0.54 $0.203 100% 3.3 18% 5% 5%166 7/12/04 Infomedia IFM Buy $0.74 – NotSold – $0.54 $0.184 100% 3.1 –2% –1% –1%170 1/3/05 mmccontrarian MMA Buy $1.05 – NotSold – $0.90 $0.175 100% 2.8 2% 1% 1%177 7/6/05 Flightcentre FLT Buy $14.50 – NotSold – $32.30 $1.46 100% 2.6 133% 39% 39%178 21/6/05 WilsonInvestmentFund WIL Buy $0.905 – NotSold – $1.03 $0.125 100% 2.5 28% 10% 10%179 5/7/05 arBcorp ARP Buy $3.05 – NotSold – $4.15 $0.31 100% 2.5 46% 16% 16%184 13/9/05 miller’sretail MRL Buy $0.86 196 28/3/06 Sell $1.70 $0.00 100% 0.5 98% N/A 98%187 25/10/05 carterHoltHarvey CHY Buy $2.34 196 4/4/06 AcceptOffer $2.33 $0.00 0% 0.4 0% N/A 0%190 6/12/05 stWcommunications SGN Buy $3.08 – NotSold – $2.35 $0.294 100% 2.1 –14% –7% –7%200 23/5/06 rocoil ROC Buy $3.64 – NotSold – $3.03 $0.00 N/A 1.6 –12% –8% –8%207 29/8/06 arBcorp ARP Buy $3.14 – NotSold – $4.15 $0.20 100% 1.3 39% 28% 28%222 18/4/07 timbercorp TIM Buy $2.17 – NotSold – $1.52 $0.07 100% 0.7 –27% N/A –27%

[ c ontinued on page 16 ]

The Intelligent Investor Performance Report 2007Schedule of Performance Statistics as at 31 December 200716

[ c ontinued on page 17 ]

Buy [ c ontinued FroM page 15 ]

Issue Date stockasX orIgInal BuY sale

Date recommenDatIon

PrIce DIvIDenDs Fr’kIng Years

return annual. PerForm.

coDe recommenDatIon PrIce Issue atsale HelD return return

223 27/4/07 soulsPrivateequity SOE Buy $0.22 – NotSold – $0.23 $0.01 100% 0.7 12% N/A 12%227 3/7/07 sigmaPharmaceuticals SIP Buy $1.75 – NotSold – $1.60 $0.03 100% 0.5 –7% N/A –7%229 30/7/07 timbercorp TIM Buy $1.95 – NotSold – $1.52 $0.07 100% 0.4 –19% N/A –19%231 20/8/07 Platinumassetmgmt PTM Buy $6.25 – NotSold – $5.03 $0.00 100% 0.4 –20% N/A –20%234 26/9/07 selectHarvests SHV Buy $6.70 – NotSold – $7.49 $0.00 100% 0.3 12% N/A 12%235 12/10/07 Platinumassetmgmt PTM Buy $6.17 – NotSold – $5.03 $0.00 100% 0.2 –18% N/A –18%235 15/10/07 ramsHomeloansgroup RHG Buy $0.30 – NotSold – $0.30 $0.00 100% 0.2 –2% N/A –2%237 12/11/07 servcorp SRV Buy $5.20 – NotSold – $4.90 $0.05 100% 0.1 –5% N/A –5%238 3/12/07 sigmaPharmaceuticals SIP Buy $1.64 – NotSold – $1.60 $0.00 100% 0.1 –2% N/A –2%numberofBuyrecommendations 68 averageannualisedreturn 23.1%

Long terM Buy

Issue Date stockasX orIgInal BuY sale

Date recommenDatIon

PrIce DIvIDenDs Fr’kIng Years

return annual. PerForm.

coDe recommenDatIon PrIce Issue atsale HelD return return

80 29/5/01 abigroup ABG LongTermBuy $2.12 139 22/1/04 Hold $3.90 $0.31 100% 2.6 99% 30% 30%80 29/5/01 adsteam ADZ LongTermBuy $2.17 132 22/7/03 SellDown $1.50 $0.23 100% 2.1 –20% –10% –10%80 12/6/01 aristocratleisure ALL LongTermBuy $6.70 146 2/3/04 TakePartProfits $2.73 $0.27 100% 2.7 –55% –26% –26%80 12/6/01 csr CSR LongTermBuy $6.73 157 3/8/04 Sell $8.36 $0.65 68% 3.1 34% 10% 10%81 12/6/01 greatsouthernPlant. GTP LongTermBuy $0.65 147 16/3/04 TakePartProfits $2.55 $0.46 100% 2.8 363% 74% 74%82 26/6/01 amcor AMC LongTermBuy $6.73 123 18/3/03 TakeProfits/Hold $8.11 $0.57 50% 1.7 29% 16% 16%82 26/6/01 miller’sretail MRL LongTermBuy $3.475 196 28/3/06 Sell $1.70 $0.323 100% 4.8 –42% –11% –11%82 26/6/01 simsmetal(simsgroup) SMS LongTermBuy $5.72 136 16/9/03 TakePartProfits $10.60 $0.76 94% 2.2 99% 36% 36%82 26/6/01 suncorpmetway SME(SUN) LongTermBuy $14.76 168 1/2/05 TakePartProfits $18.55 $2.08 100% 3.6 40% 10% 10%82 26/6/01 WestfieldHoldings WSF LongTermBuy $13.44 – NotSold – $21.00 $4.027 15% 6.5 87% 10% 10%83 10/7/01 taBQld(unitaB) TQL(UTB) LongTermBuy $2.62 158 17/8/04 TakePartProfits $9.31 $0.70 100% 3.1 282% 54% 54%84 24/7/01 tabcorp TAH LongTermBuy $9.08 136 16/9/03 TakePartProfits $11.39 $1.56 100% 2.1 43% 18% 18%85 7/8/01 Hillsmotorway HLY LongTermBuy $5.21 174 26/4/05 Sell $10.94 $0.91 0% 3.7 127% 25% 25%85 7/8/01 Pacifica PBB LongTermBuy $3.84 164 9/11/04 Sell $3.74 $0.605 91% 3.3 13% 4% 4%86 21/8/01 australianInfrastructure AIX LongTermBuy $1.625 167 18/1/05 Sell $2.56 $0.395 39% 3.4 82% 19% 19%86 21/8/01 Brazin BRZ LongTermBuy $1.34 122 4/3/03 SellandSwitch $1.20 $0.175 100% 1.5 3% 2% 2%86 21/8/01 WoodsidePetroleum WPL LongTermBuy $13.69 – NotSold – $50.39 $5.05 100% 6.4 305% 25% 25%87 4/9/01 BHPBilliton BHP LongTermBuy $8.815 167 18/1/05 TakePartProfits $15.68 $0.851 100% 3.4 88% 20% 20%87 4/9/01 langcorp(Patrickcorp) LAC(PRK) LongTermBuy $11.19 108 23/7/02 SellandSwitch $15.36 $0.18 100% 0.9 39% N/A 39%87 4/9/01 maynenick.(maynegrp) MAY LongTermBuy $6.24 90 16/10/01 TakePartProfits $7.38 $0.00 N/A 0.1 18% N/A 18%87 4/9/01 singletongrp(stWcomms) SGN LongTermBuy $3.82 – NotSold – $2.35 $1.078 75% 6.3 –10% –2% –2%

Schedule of Performance Statistics as at 31 December 2007The Intelligent Investor Performance Report 2007 17

[ c ontinued on page 18 ]

Long terM Buy [ c ontinued FroM page 16 ]

Issue Date stockasX orIgInal BuY sale

Date recommenDatIon

PrIce DIvIDenDs Fr’kIng Years

return annual. PerForm.

coDe recommenDatIon PrIce Issue atsale HelD return return

88 18/9/01 BramblesIndustries BIL LongTermBuy $9.92 153 8/6/04 Sell $6.04 $0.50 100% 2.7 –34% –14% –14%88 18/9/01 Foster’sgroup FGL LongTermBuy $4.58 186 11/10/05 TakePartProfits $5.49 $0.75 100% 4.1 36% 8% 8%88 18/9/01 HarveyWorldtravel HWT LongTermBuy $0.50 146 2/3/04 TakePartProfits $1.40 $0.055 100% 2.5 191% 54% 54%88 18/9/01 southcorp SRP LongTermBuy $7.20 102 30/4/02 SellandSwitch $5.81 $0.00 N/A 0.6 –19% N/A –19%88 18/9/01 tollHoldings TOL LongTermBuy $5.67 91 30/10/01 TakePartProfits $6.81 $0.00 N/A 0.1 20% N/A 20%89 2/10/01 amalgamatedHoldings AHD LongTermBuy $1.64 97 19/2/02 TakeProfits $2.76 $0.00 N/A 0.4 68% N/A 68%89 2/10/01 commonwealthBank CBA LongTermBuy $27.85 – NotSold – $59.10 $11.64 100% 6.2 154% 16% 16%90 16/10/01 australianInfrastructure AIX LongTermBuy $1.548 167 18/1/05 Sell $2.56 $0.395 39% 3.3 91% 22% 22%90 16/10/01 coloradogroup CDO LongTermBuy $1.81 103 14/5/02 SellandSwitch $3.05 $0.07 100% 0.6 72% N/A 72%90 16/10/01 Hill50 HFY LongTermBuy $0.91 99 19/3/02 Sell/AcceptOffer $1.40 $0.045 0% 0.4 59% N/A 59%90 16/10/01 riotinto RIO LongTermBuy $33.70 – NotSold – $133.95 $8.222 100% 6.2 322% 26% 26%90 16/10/01 sonicHealthcare SHL LongTermBuy $8.10 99 19/3/02 Sell $6.00 $0.00 N/A 0.4 –26% N/A –26%92 13/11/01 aPnnews&media APN LongTermBuy $3.452 218 22/2/07 Sell $5.98 $0.99 52% 5.3 102% 14% 14%92 13/11/01 Perpetualtrustees PPT LongTermBuy $38.10 159 31/8/04 TakePartProfits$46.00 $7.40 100% 2.8 40% 13% 13%93 27/11/01 telstra TLS LongTermBuy $5.41 – NotSold – $4.69 $1.77 100% 6.1 19% 3% 3%94 11/12/01 JamesHardie JHX LongTermBuy $4.85 156 20/7/04 Sell $6.07 $0.871 0% 2.6 43% 15% 15%95 22/1/02 Publishing&Broadcasting PBL LongTermBuy $9.72 159 31/8/04 TakePartProfits $13.64 $0.61 100% 2.6 47% 16% 16%96 5/2/02 DownereDI DOW LongTermBuy $0.80 130 24/6/03 TakeProfits $0.74 $0.029 0% 1.4 –4% –3% –3%96 5/2/02 unitedenergy UEL LongTermBuy $2.42 130 24/6/03 AcceptOffer $3.15 $0.273 80% 1.4 41% 28% 28%97 19/2/02 auriongold AOR LongTermBuy $2.85 112 17/9/02 SellandSwitch $3.55 $0.00 N/A 0.6 25% N/A 25%98 5/3/02 FantasticHoldings FAN LongTermBuy $1.55 207 29/8/06 Sell $2.85 $0.367 100% 4.5 176% 25% 25%98 5/3/02 leightonHoldings LEI LongTermBuy $10.50 195 14/3/06 Sell $17.70 $2.06 75% 4.0 88% 17% 17%98 5/3/02 maynenick.(maynegrp) MAY LongTermBuy $5.72 154 22/6/04 Sell $3.18 $0.225 14% 2.3 –40% –20% –20%99 19/3/02 transurban TCL LongTermBuy $3.90 131 8/7/03 TakeProfits $4.66 $0.06 0% 1.3 21% 16% 16%100 2/4/02 BankofQueensland BOQ LongTermBuy $7.05 125 15/4/03 SellandSwitch $7.70 $0.46 100% 1.0 16% 15% 15%100 2/4/02 oPsm OPS LongTermBuy $3.50 137 15/2/05 Hold $4.20 $0.40 100% 2.9 31% 10% 10%100 2/4/02 simsmetal(simsgroup) SMS LongTermBuy $6.52 136 16/9/03 TakePartProfits $10.60 $0.42 89% 1.5 69% 43% 43%101 16/4/02 computershare CPU LongTermBuy $2.56 – NotSold – $9.88 $0.565 28% 5.7 308% 28% 28%102 30/4/02 WoodsidePetroleum WPL LongTermBuy $13.53 – NotSold – $50.39 $4.35 100% 5.7 305% 28% 28%103 14/5/02 colesmyer CML LongTermBuy $6.49 129 10/6/03 Sell $6.94 $0.255 100% 1.1 11% 10% 10%104 28/5/02 Harveynorman HVN LongTermBuy $3.00 – NotSold – $6.80 $0.41 100% 5.6 140% 17% 17%104 28/5/02 tab TAB LongTermBuy $3.04 149 13/4/04 Sell $4.69 $0.31 100% 1.9 64% 30% 30%105 11/6/02 nationalaustraliaBank NAB LongTermBuy $36.42 – NotSold – $37.79 $9.19 92% 5.6 29% 5% 5%105 11/6/02 strathfield SRA LongTermBuy $0.49 133 5/8/03 Sell $0.14 $0.00 N/A 1.2 –71% –66% –66%107 9/7/02 gowingBros GOW LongTermBuy $1.75 – NotSold – $3.80 $0.54 100% 5.5 148% 18% 18%

The Intelligent Investor Performance Report 2007Schedule of Performance Statistics as at 31 December 200718

[ c ontinued on page 19 ]

Long terM Buy [ c ontinued FroM page 17 ]

Issue Date stockasX orIgInal BuY sale

Date recommenDatIon

PrIce DIvIDenDs Fr’kIng Years

return annual. PerForm.

coDe recommenDatIon PrIce Issue atsale HelD return return

107 9/7/02 greatsouthernPlant. GTP LongTermBuy $0.58 147 16/3/04 TakePartProfits $2.55 $0.10 100% 1.7 357% 146% 146%110 20/8/02 taBQld(unitaB) TQL(UTB) LongTermBuy $4.00 158 17/8/04 TakePartProfits $9.31 $0.58 100% 2.0 147% 58% 58%111 3/9/02 computershare CPU LongTermBuy $2.31 – NotSold – $9.88 $0.565 28% 5.3 352% 33% 33%112 17/9/02 macquarieairports MAP LongTermBuy $1.27 171 15/3/05 Sell $3.26 $0.245 0% 2.5 176% 50% 50%112 17/9/02 Perpetualtrustees PPT LongTermBuy $37.00 159 31/8/04 TakePartProfits$46.00 $7.40 100% 2.0 44% 21% 21%112 17/9/02 strathfield SRA LongTermBuy $0.40 133 5/8/03 Sell $0.14 $0.00 N/A 0.9 –65% N/A –65%113 1/10/02 temposervices TEM LongTermBuy $1.93 150 27/4/04 Sell $1.14 $0.15 100% 1.6 –33% –23% –23%115 29/10/02 sonsofgwalia SGW LongTermBuy $2.66 128 27/5/03 SellDown/Hold $2.14 $0.00 0% 0.6 –20% N/A –20%116 12/11/02 anZBank ANZ LongTermBuy $17.627 – NotSold – $27.46 $5.67 100% 5.1 88% 13% 13%116 12/11/02 WestpacBankingcorp WBC LongTermBuy $14.09 – NotSold – $27.92 $5.47 100% 5.1 137% 18% 18%117 26/11/02 cmI CMI LongTermBuy $1.61 145 17/2/04 Sell $2.21 $0.10 100% 1.2 43% 34% 34%119 21/1/03 macquarieairports MAP LongTermBuy $1.16 171 15/3/05 Sell $3.26 $0.20 0% 2.2 198% 66% 66%119 21/1/03 sydneyaquarium SAQ LongTermBuy $4.42 178 21/6/05 TakePartProfits $5.64 $0.68 100% 2.4 43% 16% 16%120 4/2/03 australianInfrastructure AIX LongTermBuy $1.287 167 18/1/05 Sell $2.56 $0.23 35% 2.0 117% 49% 49%121 18/2/03 tennetworkHoldings TEN LongTermBuy $2.11 160 14/9/04 TakePartProfits $3.50 $0.285 100% 1.6 79% 45% 45%122 4/3/03 aristocratleisure ALL LongTermBuy $1.76 146 2/3/04 TakePartProfits $2.73 $0.03 100% 1.0 57% N/A 57%123 18/3/03 templetonglobalgrowth TGG LongTermBuy $0.97 – NotSold – $1.29 $0.19 100% 4.8 60% 10% 10%124 1/4/03 sevennetwork SEV LongTermBuy $3.73 136 16/9/03 TakeProfits $5.50 $0.00 N/A 0.5 47% N/A 47%124 1/4/03 spotlessgroup SPT LongTermBuy $3.97 218 19/2/07 Sell $5.05 $0.825 94% 3.9 48% 11% 11%125 14/4/03 anZBank ANZ LongTermBuy $16.966 – NotSold – $27.46 $5.67 100% 4.7 95% 15% 15%125 14/4/03 Futuris FCL LongTermBuy $1.57 – NotSold – $2.15 $0.40 94% 4.7 62% 11% 11%126 29/4/03 Harveynorman HVN LongTermBuy $2.25 – NotSold – $6.80 $0.36 100% 4.7 218% 28% 28%128 27/5/03 cabcharge CAB LongTermBuy $2.90 – NotSold – $10.61 $0.908 100% 4.6 297% 35% 35%128 27/5/03 greatsouthernPlant. GTP LongTermBuy $0.83 147 16/3/04 TakePartProfits $2.55 $0.08 100% 0.8 217% N/A 217%129 10/6/03 commonwealthBank CBA LongTermBuy $29.50 – NotSold – $59.10 $9.45 100% 4.6 132% 20% 20%129 10/6/03 tollHoldings TOL LongTermBuy $7.00 197 11/4/06 TakePartProfits $13.44 $0.69 100% 2.8 102% 28% 28%130 24/6/03 aristocratleisure ALL LongTermBuy $1.42 146 2/3/04 TakePartProfits $2.73 $0.03 100% 0.7 94% N/A 94%130 24/6/03 FletcherBuilding FBU LongTermBuy $3.30 225 25/5/07 TakePartProfits $11.70 $1.375 * 3.9 296% 42% 42%130 24/6/03 macquarieairports MAP LongTermBuy $1.40 171 15/3/05 Sell $3.26 $0.15 0% 1.7 144% 68% 68%130 24/6/03 WestpacBankingcorp WBC LongTermBuy $16.62 – NotSold – $27.92 $4.73 100% 4.5 96% 16% 16%131 8/7/03 gowingBros GOW LongTermBuy $2.16 – NotSold – $3.80 $0.44 100% 4.5 96% 16% 16%131 8/7/03 suncorpmetway SUN LongTermBuy $12.28 168 1/2/05 TakePartProfits $18.55 $1.00 100% 1.6 59% 35% 35%133 5/8/03 macquariegroup MQG LongTermBuy $30.63 – NotSold – $76.20 $8.53 95% 4.4 177% 26% 26%135 2/9/03 mIagroup MIA LongTermBuy $0.65 157 3/8/04 Sell $1.03 $0.032 100% 0.9 63% N/A 63%

* Tax advantaged distributions (credits)

Schedule of Performance Statistics as at 31 December 2007The Intelligent Investor Performance Report 2007 19

[ c ontinued on page 20 ]

Long terM Buy [ c ontinued FroM page 18 ]

Issue Date stockasX orIgInal BuY sale

Date recommenDatIon

PrIce DIvIDenDs Fr’kIng Years

return annual. PerForm.

coDe recommenDatIon PrIce Issue atsale HelD return return

135 2/9/03 telstra TLS LongTermBuy $5.15 – NotSold – $4.69 $1.40 100% 4.3 18% 4% 4%137 30/9/03 Futuris FCL LongTermBuy $1.58 – NotSold – $2.15 $0.40 94% 4.3 61% 12% 12%140 11/11/03 WilsonInvestmentFund WIL LongTermBuy $0.99 – NotSold – $1.03 $0.17 100% 4.1 21% 5% 5%141 25/11/03 aust.leisure&Hospitality ALH LongTermBuy $2.27 163 26/10/04 AcceptOffer $3.76 $0.083 100% 0.9 69% N/A 69%142 9/12/03 santos STO LongTermBuy $6.40 – NotSold – $14.12 $1.46 100% 4.1 143% 24% 24%143 20/1/04 cochlear COH LongTermBuy $22.00 – NotSold – $74.90 $3.84 100% 3.9 258% 38% 38%144 3/2/04 WestpacBankingcorp WBC LongTermBuy $16.39 – NotSold – $27.92 $4.33 100% 3.9 97% 19% 19%145 17/2/04 Harveynorman HVN LongTermBuy $2.84 – NotSold – $6.80 $0.33 100% 3.9 151% 27% 27%145 17/2/04 rocoil ROC LongTermBuy $1.67 – NotSold – $3.03 $0.00 N/A 3.9 109% 21% 21%145 17/2/04 templetonglobalgrowth TGG LongTermBuy $1.18 – NotSold – $1.29 $0.19 100% 3.9 32% 7% 7%147 16/3/04 anZBank ANZ LongTermBuy $19.11 – NotSold – $27.46 $4.72 100% 3.8 68% 15% 15%147 16/3/04 macquariegroup MQG LongTermBuy $34.17 – NotSold – $76.20 $8.01 95% 3.8 146% 27% 27%150 27/4/04 nationalaustraliaBank NAB LongTermBuy $29.47 – NotSold – $37.79 $6.81 91% 3.7 51% 12% 12%151 11/5/04 WestpacBankingcorp WBC LongTermBuy $16.89 – NotSold – $27.92 $4.33 100% 3.6 91% 19% 19%155 6/7/04 aBBgrain ABB LongTermBuy $7.00 – NotSold – $8.45 $0.85 100% 3.5 33% 8% 8%155 6/7/04 Westfieldgroup WDC LongTermBuy $15.38 – NotSold – $21.00 $3.184 6% 3.5 58% 14% 14%157 3/8/04 tapoil TAP LongTermBuy $1.66 182 16/8/05 TakePartProfits $3.18 $0.00 N/A 1.0 92% 87% 87%158 17/8/04 arBcorp ARP LongTermBuy $3.53 – NotSold – $4.15 $0.61 100% 3.4 35% 9% 9%159 31/8/04 leightonHoldings LEI LongTermBuy $9.80 195 14/3/06 Sell $17.70 $1.02 64% 1.5 91% 52% 52%159 31/8/04 santos STO LongTermBuy $6.60 – NotSold – $14.12 $1.16 100% 3.3 132% 29% 29%161 28/9/04 cochlear COH LongTermBuy $24.00 – NotSold – $74.90 $3.05 100% 3.3 225% 44% 44%161 28/9/04 templetonglobalgrowth TGG LongTermBuy $1.18 – NotSold – $1.29 $0.19 100% 3.3 32% 9% 9%163 26/10/04 aBBgrain ABB LongTermBuy $7.05 – NotSold – $8.45 $0.57 100% 3.2 28% 8% 8%163 26/10/04 macquariegroup MQG LongTermBuy $39.00 – NotSold – $76.20 $7.31 96% 3.2 114% 27% 27%163 26/10/04 stWcommunications SGN LongTermBuy $3.20 – NotSold – $2.35 $0.703 53% 3.2 –5% –1% –1%165 23/11/04 Infomedia IFM LongTermBuy $0.81 – NotSold – $0.54 $0.184 100% 3.1 –11% –4% –4%166 7/12/04 mmccontrarian MMA LongTermBuy $1.07 – NotSold – $0.900 $0.175 100% 3.1 0% 0% 0%167 18/1/05 rocoil ROC LongTermBuy $1.85 – NotSold – $3.03 $0.00 N/A 3.0 73% 20% 20%168 1/2/05 Flightcentre FLT LongTermBuy $15.92 – NotSold – $32.30 $1.685 100% 2.9 113% 30% 30%168 1/2/05 HPal HPX LongTermBuy $1.75 216 30/1/07 Sell $2.280 $0.28 100% 2.0 46% 21% 21%169 15/2/05 centuryaustralia CYA LongTermBuy $1.05 – NotSold – $1.35 $0.21 100% 2.9 49% 15% 15%170 1/3/05 arBcorp ARP LongTermBuy $3.78 – NotSold – $4.15 $0.35 100% 2.8 19% 6% 6%171 15/3/05 templetonglobalgrowth TGG LongTermBuy $1.20 – NotSold – $1.29 $0.16 100% 2.8 27% 9% 9%172 29/3/05 rebelsport REB LongTermBuy $2.71 218 23/2/07 Sell $4.570 $0.25 100% 1.9 78% 35% 35%172 29/3/05 WilsonInvestmentFund WIL LongTermBuy $0.95 – NotSold – $1.03 $0.145 100% 2.8 24% 8% 8%

The Intelligent Investor Performance Report 2007Schedule of Performance Statistics as at 31 December 200720

[ c ontinued on page 21 ]

Long terM Buy [ c ontinued FroM page 19 ]

Issue Date stockasX orIgInal BuY sale

Date recommenDatIon

PrIce DIvIDenDs Fr’kIng Years

return annual. PerForm.

coDe recommenDatIon PrIce Issue atsale HelD return return

173 12/4/05 mortgagechoice MOC LongTermBuy $1.00 197 11/4/06 TakePartProfits $2.48 $0.13 100% 1.0 161% N/A 161%174 26/4/05 Hgl HNG LongTermBuy $1.75 – NotSold – $2.13 $0.362 100% 2.7 42% 14% 14%175 10/5/05 Futuris FCL LongTermBuy $1.81 – NotSold – $2.15 $0.24 100% 2.6 32% 11% 11%176 24/5/05 aust.Wealthmanagement AUW LongTermBuy $0.975 – NotSold – $2.52 $0.19 100% 2.6 177% 48% 48%176 24/5/05 JBHi-Fi JBH LongTermBuy $3.43 196 28/3/06 TakePartProfits $4.90 $0.07 100% 0.8 45% N/A 45%177 7/6/05 servcorp SRV LongTermBuy $2.60 – NotSold – $4.90 $0.43 100% 2.6 105% 32% 32%178 21/6/05 coloradogroup CDO LongTermBuy $4.74 209 3/10/06 AcceptOffer $4.18 $1.16 100% 1.3 13% 10% 10%179 5/7/05 FantasticHoldings FAN LongTermBuy $3.50 207 29/8/06 Sell $2.85 $0.11 100% 1.2 –7% –6% –6%181 2/8/05 arBcorp ARP LongTermBuy $3.35 – NotSold – $4.15 $0.31 100% 2.4 33% 13% 13%185 27/9/05 tattersall’s TTS LongTermBuy $3.27 – NotSold – $3.99 $0.38 100% 2.3 34% 14% 14%186 11/10/05 oFmgroup OFG LongTermBuy $1.95 – NotSold – $2.38 $0.31 100% 2.2 38% 16% 16%187 25/10/05 cochlear COH LongTermBuy $36.39 – NotSold – $74.90 $2.25 100% 2.2 112% 41% 41%187 25/10/05 telstra TLS LongTermBuy $4.22 – NotSold – $4.69 $0.62 100% 2.2 26% 11% 11%188 8/11/05 Futuris FCL LongTermBuy $1.91 – NotSold – $2.15 $0.185 100% 2.1 22% 10% 10%189 22/11/05 Fleetwood FWD LongTermBuy $7.41 – NotSold – $10.60 $1.235 100% 2.1 60% 25% 25%189 22/11/05 volante VGL LongTermBuy $0.96 196 4/4/06 AcceptOffer $1.05 $0.10 100% 0.4 20% N/A 20%190 6/12/05 Wattyl WYL LongTermBuy $2.50 193 15/2/06 Sell $3.57 $0.00 100% 0.2 43% N/A 43%191 17/1/06 stWcommunications SGN LongTermBuy $3.03 – NotSold – $2.35 $0.294 100% 2.0 –13% –7% –7%192 31/1/06 tennetworkHoldings TEN LongTermBuy $2.97 – NotSold – $2.74 $0.21 100% 1.9 –1% 0% 0%

193 14/2/06 Publishing&Broadcasting

PBL LongTermBuy $16.20 – NotSold – $17.65 $4.14 100% 1.9 35% 17% 17% (nowcWn&cmJ)195 14/3/06 aPnnews&media APN LongTermBuy $4.88 218 22/2/07 Sell $5.98 $0.251 30% 0.9 28% N/A 28%197 11/4/06 PremiumInvestors PRV LongTermBuy $1.02 – NotSold – $1.16 $0.125 100% 1.7 25% 14% 14%199 9/5/06 BurnsPhilp BPC LongTermBuy $0.97 211 31/10/06 AcceptOffer $1.10 $0.00 0% 0.5 14% N/A 14%200 23/5/06 salmat SLM LongTermBuy $2.80 – NotSold – $4.04 $0.375 100% 1.6 58% 33% 33%201 6/6/06 tapoil TAP LongTermBuy $1.87 237 7/11/07 Sell $2.47 $0.00 N/A 1.4 32% 22% 22%203 4/7/06 sPtelemedia SOT LongTermBuy $0.77 233 25/9/07 Sell $0.45 $0.139 100% 1.2 –24% –20% –20%205 1/8/06 corporateexpress CXP LongTermBuy $5.75 – NotSold – $6.30 $0.35 100% 1.4 16% 11% 11%206 15/8/06 cabcharge CAB LongTermBuy $6.43 – NotSold – $10.61 $0.43 100% 1.4 72% 48% 48%206 15/8/06 WilsonInvestmentFund WIL LongTermBuy $0.98 – NotSold – $1.03 $0.08 100% 1.4 13% 9% 9%209 26/9/06 gowingBros GOW LongTermBuy $3.10 – NotSold – $3.80 $0.20 100% 1.3 29% 22% 22%209 26/9/06 graincorp GNC LongTermBuy $7.68 – NotSold – $9.80 $0.10 100% 1.3 29% 22% 22%209 26/9/06 treasurygroup TRG LongTermBuy $10.90 – NotSold – $15.80 $0.60 100% 1.3 50% 38% 38%210 10/10/06 arBcorp ARP LongTermBuy $3.70 – NotSold – $4.15 $0.13 100% 1.2 16% 13% 13%210 10/10/06 Qmtechnologies QMT LongTermBuy $2.61 – NotSold – $2.70 $0.215 100% 1.2 12% 9% 9%

Schedule of Performance Statistics as at 31 December 2007The Intelligent Investor Performance Report 2007 21

Long terM Buy [ c ontinued FroM page 20]

Issue Date stockasX orIgInal BuY sale

Date recommenDatIon

PrIce DIvIDenDs Fr’kIng Years

return annual. PerForm.

coDe recommenDatIon PrIce Issue atsale HelD return return

215 16/1/07 WHsoulPattinson SOL LongTermBuy $8.80 – NotSold – $9.16 $0.285 100% 1.0 7% N/A 7%215 16/1/07 sPtelemedia SOT LongTermBuy $0.82 233 25/9/07 Sell $0.45 $0.127 100% 0.7 –30% N/A –30%216 30/1/07 Brickworks BKW LongTermBuy $12.45 – NotSold – $13.10 $0.38 100% 0.9 8% N/A 8%216 30/1/07 goodmanFielder GFF LongTermBuy $2.39 – NotSold – $1.90 $0.135 54% 0.9 –15% N/A –15%218 15/2/07 cochlear COH LongTermBuy $59.33 – NotSold – $74.90 $1.25 100% 0.9 28% N/A 28%219 1/3/07 Flightcentre FLT LongTermBuy $15.00 – NotSold – $32.30 $0.46 100% 0.8 118% N/A 118%223 4/5/07 Fisher&Paykelappliances FPA LongTermBuy $3.21 – NotSold – $3.15 $0.15 0% 0.7 3% N/A 3%224 17/5/07 sigmaPharmaceuticals SIP LongTermBuy $2.42 – NotSold – $1.60 $0.03 100% 0.6 –33% N/A –33%225 4/6/07 Platinumassetmgmt PTM LongTermBuy $7.90 – NotSold – $5.03 $0.00 100% 0.6 –36% N/A –36%225 4/6/07 soulsPrivateequity SOE LongTermBuy $0.24 – NotSold – $0.23 $0.01 100% 0.6 0% N/A 0%229 31/7/07 Flightcentre FLT LongTermBuy $17.55 – NotSold – $32.30 $0.46 100% 0.4 87% N/A 87%229 30/7/07 selectHarvests SHV LongTermBuy $10.40 – NotSold – $7.49 $0.35 100% 0.4 –25% N/A –25%230 10/8/07 servcorp SRV LongTermBuy $4.80 – NotSold – $4.90 $0.12 100% 0.4 5% N/A 5%230 7/8/07 corporateexpress CXP LongTermBuy $6.35 – NotSold – $6.30 $0.135 100% 0.4 1% N/A 1%231 16/8/07 stWcommunications SGN LongTermBuy $2.22 – NotSold – $2.35 $0.048 100% 0.4 8% N/A 8%234 8/10/07 Platinumassetmgmt PTM LongTermBuy $6.93 – NotSold – $5.03 $0.00 100% 0.2 –27% N/A –27%237 16/11/07 macquariegroup MQG LongTermBuy $80.55 – NotSold – $76.20 $0.00 100% 0.1 –5% N/A –5%numberoflongtermBuyrecommendations 176 averageannualisedreturn 21.7%

Buy For yieLd

Issue Date stockasX orIgInal BuY sale

Date recommenDatIon

PrIce DIvIDenDs Fr’kIng Years

return annual. PerForm.

coDe recommenDatIon PrIce Issue atsale HelD return return

83 10/7/01 centralequity CEQ BuyForYield $2.035 136 16/9/03 Sell $2.04 $0.24 100% 2.2 12% 5% 5%83 10/7/01 envestra ENV BuyForYield $0.80 108 23/7/02 Sell $0.84 $0.095 0% 1.0 17% 16% 16%83 24/7/01 australand ALZ BuyForYield $1.60 136 16/9/03 Sell $1.75 $0.27 89% 2.1 26% 11% 11%87 4/9/01 sydneyaquarium SAQ BuyForYield $3.60 178 21/6/05 TakePartProfits $5.64 $1.03 100% 3.8 85% 18% 18%89 2/10/01 unitedenergy UEL BuyForYield $2.79 130 24/6/03 AcceptOffer $3.15 $0.273 80% 1.7 23% 13% 13%91 30/10/01 Westfieldtrust WFT BuyForYield $3.44 – NotSold – $5.88 $1.615 3% 6.2 119% 14% 14%93 27/11/01 australianPipelinetrust APA BuyForYield $2.66 172 29/3/05 Sell $3.85 $0.636 11% 3.3 69% 17% 17%93 27/11/01 generalPropertytrust GPT BuyForYield $2.76 158 17/8/04 Sell $3.52 $0.575 0% 2.7 48% 16% 16%94 11/12/01 stocklandgroup SGP BuyForYield $4.38 164 9/11/04 Sell $5.96 $0.988 13% 2.9 59% 17% 17%95 22/1/02 PaperlinX PPX BuyForYield $5.05 157 3/8/04 Sell $5.32 $0.68 59% 2.5 19% 7% 7%95 22/1/02 Westfieldamericatrust WFA BuyForYield $1.91 – NotSold – $3.15 $0.95 3% 5.9 115% 14% 14%96 5/2/02 IngofficeFund IOF BuyForYield $1.18 160 14/9/04 Sell $1.29 $0.26 0% 2.6 31% 11% 11%96 5/2/02 Portmanmining PMM BuyForYield $1.76 133 5/8/03 Sell $1.35 $0.14 100% 1.5 –15% –11% –11%

[ c ontinued on page 21 ]

The Intelligent Investor Performance Report 2007Schedule of Performance Statistics as at 31 December 200722

[ c ontinued on page 23 ]

Buy For yieLd [ c ontinued FroM page 21 ]

Issue Date stockasX orIgInal BuY sale

Date recommenDatIon

PrIce DIvIDenDs Fr’kIng Years

return annual. PerForm.

coDe recommenDatIon PrIce Issue atsale HelD return return

99 19/3/02 simsmetal(simsgroup) SMS BuyForYield $6.93 136 16/9/03 TakePartProfits $10.60 $0.59 92% 1.5 61% 38% 38%100 2/4/02 macquariegoodmanInd. MGI BuyForYield $1.43 163 26/10/04 Sell $1.95 $0.355 0% 2.6 61% 20% 20%102 30/4/02 gandelretailtrust(cFsgandel) GAN BuyForYield $1.15 192 31/1/06 TakePartProfits $1.91 $0.403 0% 3.8 101% 20% 20%102 30/4/02 gasnet GAS BuyForYield $1.94 – 17/10/06 AcceptOffer $2.99 $0.95 0% 4.5 103% 17% 17%104 28/5/02 macquariecountrywide MCW BuyForYield $1.68 177 7/6/05 Sell $2.00 $0.42 0% 3.0 44% 13% 13%110 20/8/02 computershareresetPrefs CPUPA BuyForYield $86.50 151 1/5/04 TakePartProfits$105.30 $8.258 100% 1.7 31% 17% 17%111 3/9/02 FkP FKP BuyForYield $1.25 120 4/2/03 TakePartProfits $1.48 $0.05 100% 0.4 22% N/A 22%124 1/4/03 DeutscheDiviersifiedFund DDF BuyForYield $1.18 158 17/8/04 Sell $1.25 $0.117 0% 1.4 16% 11% 11%137 30/9/03 generalPropertytrust GPT BuyForYield $2.75 158 17/8/04 Sell $3.52 $0.22 0% 0.9 36% N/A 36%140 11/11/03 gasnet GAS BuyForYield $2.06 – 17/10/06 AcceptOffer $2.99 $0.62 0% 2.9 75% 21% 21%142 9/12/03 australianPipelinetrust APA BuyForYield $2.55 172 29/3/05 Sell $3.85 $0.261 27% 1.3 61% 44% 44%171 15/3/05 Publishing&Broad.Pars CMJHA BuyForYield $101.95 226 29/6/07 Redeemed $100.00 $17.842 0% 2.3 16% 7% 7%171 15/3/05 WoolworthsWIns WOWHA BuyForYield $103.49 201 5/6/06 Redeemed $100.00 $9.410 0% 1.2 6% 5% 5%173 12/4/05 commonwealthBankPerls CBAPA BuyForYield $203.85 197 6/4/06 Redeemed $200.00 $11.36 100% 1.0 4% N/A 4%186 11/10/05 gtPtrees2 GTPGA BuyForYield $103.70 – NotSold – $90.50 $16.039 100% 2.2 3% 1% 1%18725/10/05 tennetworkHoldings TEN BuyForYield $3.41 – NotSold – $2.74 $0.33 100% 2.2 –10% –5% –5%190 6/12/05 Publishing&Broad.Pars CMJHA BuyForYield $103.20 226 29/6/07 Redeemed $100.00 $12.006 0% 1.6 9% 5% 5%206 15/8/06 gtPtrees2 GTPGA BuyForYield $99.25 – NotSold – $90.50 $9.609 100% 1.4 1% 1% 1%95 22/1/02 nationalFoods NFD BuyForYield/Hold $2.97 176 24/5/05 AcceptOffer $6.40 $0.73 100% 3.3 140% 30% 30%216 30/1/07 gtPtrees2 GTPGA BuyForYield $101.50 – NotSold – $90.50 $6.400 100% 0.9 –5% N/A –5%230 9/8/07 tennetworkHoldings TEN BuyForYield $2.55 – NotSold – $2.74 $0.00 100% 0.4 7% N/A 7%232 10/9/07 gtPtrees2 GTPGA BuyForYield $100.05 – NotSold – $90.50 $3.200 100% 0.3 –6% N/A –6%232 10/9/07 timbercorpBonds TIMHB BuyForYield $92.85 – NotSold – $92.50 $4.465 0% 0.3 4% N/A 4%232 10/9/07 timbercorpPref.shares TIMPB BuyForYield $2.05 – NotSold – $1.83 $0.068 100% 0.3 –7% N/A –7%232 10/9/07 timbercorpconv.notes TIMG BuyForYield $94.00 – NotSold – $92.99 $4.610 0% 0.3 4% N/A 4%232 10/9/07 WillmottPInes WFLPA BuyForYield $96.00 – NotSold – $93.50 $3.510 100% 0.3 1% N/A 1%

numberofBuyforYieldrecommendations 39 averageannualisedreturn 11.7%

SpecuLative Buy

Issue Date stockasX orIgInal BuY sale

Date recommenDatIon

PrIce DIvIDenDs Fr’kIng Years

return annual. PerForm.

coDe recommenDatIon PrIce Issue atsale HelD return return

81 12/6/01 PacificDunlop(ansell) PDP SpeculativeBuy $4.45 107 9/7/02 Sell/TakePartProfits$6.75 $0.00 N/A 1.1 52% 47% 47%82 26/6/01 australianmagnesium ANM SpeculativeBuy $2.20 85 7/8/01 Sell $1.49 $0.00 N/A 0.1 –32% N/A –32%83 10/7/01 axonInstruments AXN SpeculativeBuy $1.05 97 19/2/02 Sell $0.70 $0.00 N/A 0.6 –33% N/A –33%83 10/7/01 novusPetroleum NVS SpeculativeBuy $2.24 143 20/1/04 Sell $1.88 $0.00 N/A 2.5 –16% –7% –7%

SpecuLative Buy [ c ontinued FroM page 22 ]

Issue Date stockasX orIgInal BuY sale

Date recommenDatIon

PrIce DIvIDenDs Fr’kIng Years

return annual. PerForm.

coDe recommenDatIon PrIce Issue atsale HelD return return

84 24/7/01 securenet SNX SpeculativeBuy/Hold $1.27 133 5/8/03 Hold $1.57 $0.00 N/A 2.0 24% 11% 11%85 7/8/01 smsmgmt&tech. SAS(SMX) SpeculativeBuy $2.70 157 3/8/04 Sell $2.10 $0.51 12% 3.0 –3% –1% –1%91 30/10/01 tapoil TAP SpeculativeBuy $1.29 182 16/8/05 TakePartProfits $3.18 $0.00 N/A 3.8 147% 27% 27%92 13/11/01 mYoB MYO SpeculativeBuy $0.70 148 30/3/04 Sell $1.23 $0.033 100% 2.4 80% 28% 28%98 5/3/02 Forestenterprises FEA SpeculativeBuy $0.12 150 27/4/04 Sell $0.35 $0.00 N/A 2.1 192% 65% 65%98 5/3/02 mYoB MYO SpeculativeBuy $0.65 148 30/3/04 Sell $1.23 $0.033 100% 2.1 94% 38% 38%99 19/3/02 ticor TOR SpeculativeBuy $1.31 – 22/11/05 AcceptOffer $1.88 $0.15 12% 3.7 55% 13% 13%100 2/4/02 Brandrill BDL SpeculativeBuy $0.31 121 18/2/03 Sell/Switch $0.04 $0.00 N/A 0.9 –86% N/A –86%103 14/5/02 austarunitedcomms AUN SpeculativeBuy $0.215 105 11/6/02 Sell $0.24 $0.00 N/A 0.1 9% N/A 9%103 14/5/02 lihirgold LHG SpeculativeBuy $1.42 123 18/3/03 Sell $1.37 $0.00 N/A 0.8 –4% N/A –4%

104 28/5/02 auriongold AORHoldfortheUpside/

$4.60 112 17/9/02 Sell/Switch $3.55 $0.07 100% 0.3 –21% N/A –21% SpeculativeBuy104 28/5/02 Biota BTA SpeculativeBuy $0.47 146 2/3/04 Sell $0.71 $0.00 N/A 1.8 51% 26% 26%105 11/6/02 nationalFoods NFD SpeculativeBuy $3.28 176 24/5/05 AcceptOffer $6.40 $0.66 100% 3.0 115% 30% 30%105 11/6/02 securenet SNX SpeculativeBuy $0.81 133 5/8/03 Hold $1.57 $0.00 N/A 1.2 94% 78% 78%106 25/6/02 oilsearch OSH SpeculativeBuy $0.81 153 8/6/04 Sell $1.21 $0.041 0% 2.0 54% 25% 25%108 23/7/02 ainsworthgametech. AGI SpeculativeBuy $0.940 212 7/11/06 Sell $0.35 $0.00 N/A 4.3 –59% –19% –19%108 23/7/02 amcIl AMH SpeculativeBuy $1.61 142 9/12/03 Sell $0.03 $1.85 N/A 1.4 17% 12% 12%113 1/10/02 mYoB MYO SpeculativeBuy $0.67 148 30/3/04 Sell $1.23 $0.028 100% 1.5 88% 52% 52%

114 15/10/02 australianmagnesium ANMCA

SpeculativeBuy $0.465 – NotSold – $0.115 $0.16 0% 5.2 –97% –49% –49%

partlypaid (nowANM)114 15/10/02 Peppercornmgmtgroup PMG SpeculativeBuy $1.00 116 12/11/02 Sell $1.78 $0.00 N/A 0.1 78% N/A 78%

117 26/11/02 mIm MIM HoldfortheUpside/

$1.47 129 10/6/03 Hold $1.72 $0.013 25% 0.5 18% N/A 18%

SpeculativeBuy119 21/1/03 securenet SNX SpeculativeBuy/Hold $1.03 133 5/8/03 Hold $1.57 $0.00 N/A 0.5 52% N/A 52%121 18/2/03 consolidatedminerals CSM SpeculativeBuy $0.62 140 11/11/03 Sell $1.05 $0.05 100% 0.7 77% N/A 77%125 14/4/03 solution6 SOH SpeculativeBuy $0.425 141 25/11/03 Sell $0.64 $0.00 N/A 0.6 51% N/A 51%132 22/7/03 grandHotelgroup GHG SpeculativeBuy $0.495 161 28/9/04 Sell $0.73 $0.025 0% 1.2 53% 43% 43%137 30/9/03 centennialcoal CEY SpeculativeBuy $2.47 162 12/10/04 TakePartProfits $4.38 $0.13 0% 1.0 83% 79% 79%141 25/11/03 tapoil TAP SpeculativeBuy $1.49 182 16/8/05 TakePartProfits $3.18 $0.00 N/A 1.7 113% 55% 55%142 9/12/03 ainsworthgametech. AGI SpeculativeBuy $0.49 212 7/11/06 Sell $0.35 $0.00 N/A 2.9 –25% –9% –9%142 9/12/03 kaZgroup KAZ SpeculativeBuy $0.24 154 22/6/04 Sell $0.395 $0.003 100% 0.5 66% N/A 66%147 16/3/04 grandHotelgroup GHG SpeculativeBuy $0.54 161 28/9/04 Sell $0.73 $0.025 0% 0.5 40% N/A 40%150 27/4/04 mmccontrarianoptions MMAO SpeculativeBuy $0.032 174 26/4/05 Sell $0.004 $0.00 N/A 1.0 –88% N/A –88%150 27/4/04 PremiumInvestorsoptions PRVO SpeculativeBuy $0.011 166 7/12/04 Sell $0.001 $0.00 N/A 0.6 –91% N/A –91%150 27/4/04 WilsonInvest.Fundoptions WILO SpeculativeBuy $0.022 165 23/11/04 Hold 0 $0.00 N/A 0.6 –100% N/A –100%

[ c ontinued on page 2 4 ]

The Intelligent Investor Performance Report 2007 Schedule of Performance Statistics as at 31 December 2007 23

The Intelligent Investor Performance Report 2007Schedule of Performance Statistics as at 31 December 200724

SpecuLative Buy [ c ontinued FroM page 23 ]

Issue Date stockasX orIgInal BuY sale

Date recommenDatIon

PrIce DIvIDenDs Fr’kIng Years

return annual. PerForm.

coDe recommenDatIon PrIce Issue atsale HelD return return

153 8/6/04 sonnetcorporation SNN SpeculativeBuy $0.25 161 28/9/04 Sell $0.35 $0.015 0% 0.3 46% N/A 46%165 23/11/04 calliden CIX SpeculativeBuy $0.53 – NotSold – $0.58 $0.00 N/A 3.1 8% 3% 3%172 29/3/05 croesusmining CRS SpeculativeBuy $0.46 – NotSold – ?? ?? N/A 2.8 –100% –100% –100%173 12/4/05 calliden CIX SpeculativeBuy $0.51 – NotSold – $0.58 0.00 N/A 2.7 13% 5% 5%176 24/5/05 ainsworthgametech.conv AGIG SpeculativeBuy $1.05 212 7/11/06 Sell $0.86 $0.159 0% 1.5 –3% –2% –2%176 24/5/05 miller’sretail MRL SpeculativeBuy $0.685196 28/3/06 Sell $1.70 $0.00 100% 0.8 148% N/A 148%181 2/8/05 cPIgroup CPI SpeculativeBuy $0.50 215 16/1/07 Sell $0.45 $0.00 N/A 1.5 –10% –7% –7%186 11/10/05 Betcorp BCL SpeculativeBuy $0.31 211 24/10/06 Sell/CeasingCoverage $0.37 $0.00 N/A 1.0 –88% –87% –87%188 8/11/05 Betcorp BCL SpeculativeBuy $0.34 211 24/10/06 Sell/CeasingCoverage $0.37 $0.00 N/A 1.0 –89% N/A –89%189 22/11/05 charterPacific CHF SpeculativeBuy $0.44 – NotSold – $0.25 $0.05 0% 2.1 –32% –17% –17%189 22/11/05 globaltelevision GTV SpeculativeBuy $0.04 215 13/12/06 AcceptOffer $1.03 $0.00 N/A 1.1 6% 5% 5%190 6/12/05 mcPherson’s MCP SpeculativeBuy $2.34 – NotSold – $3.17 $0.33 100% 2.1 50% 21% 21%196 28/3/06 avJennings AVJ SpeculativeBuy $1.31 – NotSold – $1.13 $0.08 100% 1.8 –8% –4% –4%197 11/4/06 challengerWinetrust CWT SpeculativeBuy $0.78 – NotSold – $0.74 $0.07 0% 1.7 4% 3% 3%198 25/4/06 keycorp KYC SpeculativeBuy $0.94 216 30/1/07 Sell $0.755$0.00 N/A 0.8 –20% N/A –20%201 6/6/06 Betcorp BCL SpeculativeBuy $3.79 211 24/10/06 Sell/CeasingCoverage $0.37 $0.00 N/A 0.4 –90% N/A –90%201 6/6/06 globeInternational GLB SpeculativeBuy $0.23 – NotSold – $1.26 $0.077 N/A 1.6 –41% –28% –28%215 16/1/07 globeInternational GLB SpeculativeBuy $0.24 – NotSold – $1.26 $0.077 N/A 1.0 –44% N/A –44%228 10/7/07 charterPacific CHF SpeculativeBuy $0.35 – NotSold – $0.25 $0.00 0% 0.5 –28% N/A –28%231 17/8/07 ramsHomeloansgroup RHG SpeculativeBuy $0.95 – NotSold – $0.30 $0.00 100% 0.4 –69% N/A –69%231 22/8/07 avJennings AVJ SpeculativeBuy $1.25 – NotSold – $1.13 $0.03 100% 0.4 –7% N/A –7%232 10/9/07 challengerWinetrust CWT SpeculativeBuy $0.77 – NotSold – $0.74 $0.023 0% 0.3 –1% N/A –1%233 20/9/07 ramsHomeloansgroup RHG SpeculativeBuy $0.80 – NotSold – $0.30 $0.00 100% 0.3 –63% N/A –63%235 16/10/07 globeInternational GLB SpeculativeBuy $1.10 – NotSold – $1.26 $0.00 N/A 0.2 14% N/A 14%numberofspeculativeBuyrecommendations 61 averageannualisedreturn 1.11%

SuBScriBe

Issue Date stockasX orIgInal BuY sale

Date recommenDatIon

PrIce DIvIDenDs Fr’kIng Years

return annual. PerForm.

coDe recommenDatIon PrIce Issue atsale HelD return return

132 22/7/03 WilsonInvestmentFund WIL SUB $1.00 – NotSold – $1.03 $0.17 100% 4.4 20% 4% 4%136 16/9/03 greatsouthernPlant.trees GTPG SUB $100.00 155 6/7/04 TakePartProfits $158.00 $3.349 100% 0.8 61% N/A 61%160 14/9/04 Babcock&Brown BNB SUB $5.00 162 12/10/04 Sell/Switch $7.85 $0.00 N/A 0.1 57% N/A 57%160 14/9/04 gtPtrees2 GTPGA SUB $100.00 – NotSold – $90.50 $19.24 100% 3.3 10% 3% 3%185 27/9/05 gtPtrees3 GTPGB SUB $100.00 – NotSold – $86.60 $15.511 0% 2.3 2% 1% 1%137 30/9/03 aust.leisure&Hospitality ALH SUB/LTB $2.40 163 26/10/04 AcceptOffer $3.76 $0.083 100% 1.1 60% 55% 55%

[ c ontinued on page 25 ]

Rep

ort

desi

gn b

y S

urve

illan

ce.n

et.a

u

The Intelligent Investor Performance Report 2007 Schedule of Performance Statistics as at 31 December 2007 25

SuBScriBe [ c ontinued FroM page 2 4 ]

Issue Date stockasX orIgInal BuY sale

Date recommenDatIon

PrIce DIvIDenDs Fr’kIng Years

return annual. PerForm.

coDe recommenDatIon PrIce Issue atsale HelD return return

177 7/6/05 tattersall’s TTS SUB/LTB $2.90 – NotSold _ $3.99 $0.38 100% 2.6 51% 17% 17%199 9/5/06 Wotif WTF SUB/LTB $2.00 – NotSold – $5.33 $0.14 100% 1.6 174% 84% 84%211 24/10/06 telstra3 TLSCA SUB/LTB $2.00 – NotSold – $3.17 $0.28 100% 1.2 73% 58% 58%222 20/4/07 Platinumassetmanagement PTM SUB/LTB $5.00 – NotSold – $5.03 $0.00 100% 0.7 1% N/A 1%numberofsubscriberecommendations 10 averageannualisedreturn 34.2%

accuMuLate

Issue Date stockasX orIgInal BuY sale

Date recommenDatIon

PrIce DIvIDenDs Fr’kIng Years

return annual. PerForm.

coDe recommenDatIon PrIce Issue atsale HelD return return

80 29/5/01 santos STO Accumulate $6.55 – NotSold – $14.12 $2.21 100% 6.6 149% 15% 15%80 29/5/01 tapoil TAP Accumulate $1.24 182 16/8/05 TakePartProfits $3.18 $0.00 N/A 4.2 156% 25% 25%80 29/5/01 tollHoldings TOL Accumulate $4.32 91 30/10/01 TakePartProfits $6.81 $0.045 100% 0.4 59% N/A 59%numberofaccumulaterecommendations 3 averageannualisedreturn 32.9%

I m p o r ta n t I n f o r m at I o n

Disclaimer please note that past performance is not a reliable indicator of future results, so we can’t promise we’ll do as well in the future. Stocks can rise and fall and returns may be negative, as you can see from the tables. these performance figures are hypothetical and have been based on recommendations from The Intelligent Investor newsletter, using the prices as at date of publication. Brokerage will also be incurred on buying and selling, but these transaction costs have not been included. we believe investment is a long-term pursuit, as you can see from the holding periods, and we encourage you to think likewise.

Warning this publication is general information only, which means it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether a particular recommendation is appropriate for your needs before acting on it, seeking advice from a financial adviser or stockbroker if necessary.

The Intelligent Investor and associated websites are published by the Intelligent Investor publishing pty Ltd (australian financial Services Licence number 282288).

Copyright the Intelligent Investor publishing pty Ltd 2008. no part of this publication, or its content, may be reproduced in any form without our prior written consent.Disclosure In-house staff hold the following securities or managed investment schemes as at 4/2/08: aea, ahC, anZ, arp, CBa, CDX, Chf, Coh, CoS, CrS, CXp, DBS, fLt, Gff, GLB, GnC, Gtp, hhV, hVn, IaS, IBt, IfL, IfM, IVC, JSt, krS, LMC, LwB, MBL, Mff, MLB, MMa, naBha, nhf, oeQ, ptM, QMt, rhG, roC, SfC, Sfh, SGB, SGn, ShV, SIp, SLM, Soe, Sof, SoL, SrV, Sto, ten, tGr, tIM, tLS, tLSCa, trS, ttS, wan, wBC and wDC. this is not a recommendation.

POBox1158BondiJunctionNSW1355Phone: (02)83056000Fax: (02)93878674info@intelligentinvestor.com.auwww.intelligentinvestor.com.au

POBox1158POBox1158BondiJunctionNSW1355BondiJunctionNSW1355Phone: (02)83056000Phone: (02)83056000Fax: (02)93878674Fax: (02)[email protected]@intelligentinvestor.com.auwww.intelligentinvestor.com.auwww.intelligentinvestor.com.au