eFM2e, Ch 02 (Fin Stmts), Chapter Model

-

Upload

harriz-jati -

Category

Documents

-

view

214 -

download

0

Transcript of eFM2e, Ch 02 (Fin Stmts), Chapter Model

-

7/30/2019 eFM2e, Ch 02 (Fin Stmts), Chapter Model

1/8

02 Chapter model 12/10/08

THE ANNUAL REPORT

INPUT DATA SECTION: Historical Data Used in the Analysis2008 2007

Year-end stock price $23.06 $26.00Shares outstanding (in millions) 50 50Tax rate 40% 40%

BALANCE SHEET (Section 2-2)

BALANCE SHEETS - Allied Food Products - December 31(in millions of dollars)

2008 2007

Assets

Cash and equivalents 10$ 80$Accounts receivable 375 315Inventories 615 415

Total current assets 1,000$ 810$

Net plant and equipment 1,000 870Total assets 2,000$ 1,680$

Liabilities and Equity

Accounts payable 60$ 30$Accruals 140 130

Notes payable 110 60

Total current liabilities 310$ 220$

Long-term bonds 750 580

Total debt 1,060$ 800$

Common stock (50,000,000 shares) 130 130

The balance sheet can be thought of as a snapshot in time of a firm's financial position. You can

observe the firm's level of assets and the manner in which they have used debt and equity to fund

those assets.

Chapter 2. Financial Statements, Cash Flows, and Taxes

The annual report contains a verbal section plus four key statements: the balance sheet, income

statement, statement of stockholders' equity, and statement of cash flows. These statements contain a

wealth of information that is used by bankers, stock and bond analysts, and managers. Hence, they

are quite important. Spreadsheets are used both to create and to analyze these statements, as we

demonstrate in this model.

In this model, we start with the same balance sheet and income statement that was used in the

chapter, but in an Excel format, and then we show how spreadsheets can be used to analyze the data.

The analysis continues to cover the statement of stockholders' equity, statement of cash flows, and

shows how accounting data may be modified to evaluate managerial performance.

This model is STRICTLY OPTIONAL. Neither students nor instructors need to go through it. However,

if someone wants to practice with Excel, then the model can be useful. Also, on the tabs we showsolutions for the within-chapter self-test questions.

-

7/30/2019 eFM2e, Ch 02 (Fin Stmts), Chapter Model

2/8

Retained earnings 810 750

Total common equity 940$ 880$Total liabilities and equity 2,000$ 1,680$

-

7/30/2019 eFM2e, Ch 02 (Fin Stmts), Chapter Model

3/8

INCOME STATEMENT (Section 2-3)

INCOME STATEMENTS - Allied Food Products - Years Ending December 31(in millions of dollars)

2008 2007

Net sales 3,000.0$ 2,850.0$Operating costs except depreciation 2,616.2 2,497.0Depreciation 100.0 90.0Earnings before interest and taxes (EBIT) 283.8$ 263.0$Less interest 88.0 60.0

Earnings before taxes (EBT) 195.8$ 203.0$Taxes 78.3 81.2

Net income 117.5$ 121.8$

Common dividends 57.5$ 53.0$Addition to retained earnings 60.0$ 68.8$

PER-SHARE DATA

2008 2007

Common stock price 23.06$ 26.00$Earnings per share (EPS) 2.35$ 2.44$

Dividends per share (DPS) 1.15$ 1.06$Book value per share (BVPS) 18.80$ 17.60$

The income statement summarizes a firm's revenues and expenses over an accounting period, usually

a year. The "bottom line" of an income statement is the firm's net income. Collectively, the income

statement gives an indication of a firm's operating ability.

We can now use the above information to calculate three specific per-share data measures: earnings

per share (EPS), dividends per share (DPS), and book value per share (BVPS). Simply divide the totals

by the appropriate number of shares outstanding. Note that BVPS is calculated by dividing total

common equity (common stock plus retained earnings) by shares outstanding.

The per-share data give managers and investors a quick look at some items that affect the price of the

stock.

-

7/30/2019 eFM2e, Ch 02 (Fin Stmts), Chapter Model

4/8

STATEMENT OF CASH FLOWS (Section 2-4)

STATEMENT OF CASH FLOWS - Allied Food Products (2008)Parentheses indicate net cash outflows, no parentheses indicates net cash inflows.

I. Operating Activities 2008

Net Income before dividends 117.5$Depreciation and amortization 100.0Increase in inventories (200.0)

Increase in accounts receivable (60.0)Increase in accounts payable 30.0Increase in accruals 10.0

Net cash provided by (used in) operating activities (2.5)$

II. Long-Term Investing ActivitiesAdditions to property, plant, and equipment (230.0)$

Net cash used in investing activities (230.0)$

III. Financing ActivitiesIncrease in notes payable 50.0$Increase in bonds outstanding 170.0Payment of dividends to stockholders (57.5)

Net cash provided by financing activities 162.5$

IV. SummaryNet decrease in cash and equivalents: (Net sum of I (70.0)$

Cash and equivalents at beginning of the year 80.0Cash and Equivalents at end of the Year 10.0$

STATEMENT OF STOCKHOLDERS' EQUITY (Section 2-5)

STATEMENT OF STOCKHOLDERS' EQUITY - Allied Food Products (2008)

Total

Retained ockholders'Shares Amount Earnings Equity

Balances, Dec. 31, 2007 50,000 $130.0 $750.0 $880.02008 Net Income $117.5Cash dividends ($57.5)Addition to Retained Earnings $60.0Balance of Retained Earnings, Dec. 31, 2008 $810.0

Information from the balance sheet and income statement can be used to construct the Statement of

Cash Flows, which is shown below for Allied, in millions of dollars.

The statement of stockholders' equity takes the previous year's balance of retained earnings, adds the

current year's net income, and then subtracts dividends paid to common stockholders. The end result

is the new balance of retained earnings. Allied's statement is shown below, in millions:

Common Stock (000)

-

7/30/2019 eFM2e, Ch 02 (Fin Stmts), Chapter Model

5/8

FREE CASH FLOW (Section 2-6)

FCF = EBIT(1 T) + Depr'n (Capital expenditures + Net Working Capital)

FCF = $170.3 + $100.0 ( $230.0 + $150.0 )

FCF = -$109.7

-

7/30/2019 eFM2e, Ch 02 (Fin Stmts), Chapter Model

6/8

CORPORATE TAXES (Section 2-7) 12/10/08

It pays this Plus this % on Sales $315,000

amount on the excess Costs $250,000the base over the base Taxable $65,000

(1) (2) (3) (4) Taxes$0 $50,000 $0 15.0% Net income

$50,000 $75,000 $7,500 25.0%

$75,000 $100,000 $13,750 34.0% Tax on base

$100,000 $335,000 $22,250 39.0% Income over base

$335,000 $10,000,000 $113,900 34.0% Tax rate

$10,000,000 $15,000,000 $3,400,000 35.0% Tax on income over base

$15,000,000 $18,333,333 $5,150,000 38.0% Total taxes

$18,333,333 and up $6,416,667 35.0% Average tax rate

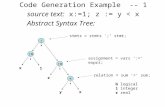

1. You are to fill in the 8 yellow cells. They should end Sales $315,000up looking like the green cells. Costs $250,000

2. Put pointer on H11. Then click fx. Find and select Taxable $65,000category Lookup & Reference, and then click VLOOKUP and Taxes $11,250OK to get the dialog box shown to the right. Fill it in as Net income $53,750

indicated. H7 is the number you are looking up, thetaxable income. Highlight A9:D16 and select it to define the Tax on base $7,500area of the lookup table. You want to look up a number Income over base $15,000in the 3rd column. Tax rate 25.0%4. Excel looks down Column 1 until it finds the value that's Tax: income over base $3,750

just argerthan the number in H7, then it backs up one, Total taxes $11,250then it goes to the 3rd column, finds the right number, and Average tax rate 17.3%

inserts it in H11. You now have the tax on the base income.5. To find the income over the base, use VLOOKUP again. Put pointer on H12.Get a new dialog box and fill it in just like the first one, except the third entry is 1 ratherthan 3. You now subtract this amount from the firm's taxable income. Do this by editing and enteringentering H7 followed by a minus sign right after the equal sign in H12. The income over base is $15,000.6. Now look up the marginal tax rate, i.e., the rate on the income over the base. Again, get adialog box and fill it out as before, but with a 4 for the index. See the third box to the right.7. Now just complete the arithmetic and finish the income statement. Note that the marginaltax rate is 25%, but the average tax rate is only 17.3%.

With the income statement completed, you can change sales and/or costs to see the new results.For example, change sales (H5) from $315,000 to $400,000 to see the average rate rise from 17.3%

to 27.8%.

Use the Excel function VLOOKUP to find the taxes due on a given amount of corporate income. The

corporate tax table is shown below, with an income statement that's missing the tax liability and net income

to the right. We use VLOOKUP to find the taxes due, after which we find net income.

If a corporation's

is between:taxable income

-

7/30/2019 eFM2e, Ch 02 (Fin Stmts), Chapter Model

7/8

SECTION 2-2 12/10/08SOLUTIONS TO SELF-TEST QUESTIONS

3. What was Allieds net working capital on December 31, 2007? ($650 million)

Cash and equivalents $80Inventories $415Accounts receivable $315Accounts payable -$30Accruals -$130

Notes payable -$60 Not included

Net working capital $650

-

7/30/2019 eFM2e, Ch 02 (Fin Stmts), Chapter Model

8/8

SECTION 2-6 12/10/08SOLUTIONS TO SELF-TEST QUESTIONS

FCF = EBIT(1 T) + Depreciation - (Cap. Expenditures + Increase in Net WC)

FCF = $30(1 0.4) + $5 [10 + (15-2-3)]FCF = $18 + $5 [ 10 + 10 ]FCF = $23 20FCF = $3

3. A company has EBIT of $30 million, depreciation of $5 million, and a 40% tax rate. It needs

to spend $10 million on new fixed assets and $15 million to increase its current assets, and it

expects its payables to increase by $2 million and its accruals to increase by $3 million. What isits free cash flow? ($3 million)