Economy 360 Dec 2009

Transcript of Economy 360 Dec 2009

-

8/14/2019 Economy 360 Dec 2009

1/14

MAIA FINANCIAL SERVICES PVT LTD

1

MAIA

FINANCIAL

SERVICES

PVT LTD

ECONOMY360DEGREES

INDIA:DECEMBER 2009

-

8/14/2019 Economy 360 Dec 2009

2/14

MAIA FINANCIAL SERVICES PVT LTD

2

Index:

1) Market View .32) Economic Indicators

a. GDP growth ..4b. Credit growth.4c. Money supply..5d. Inflation6 e. Yield curve6f. Corporate Bond spreads.... ..7g. 10 year government bond yield..8h. Interest rates.9i. Dollar.9 j. IIP9 k. Core Infrastructure Industry11

3) Economy Pulse Analysis.11

-

8/14/2019 Economy 360 Dec 2009

3/14

MAIA FINANCIAL SERVICES PVT LTD

3

Market View:

Currently the markets are at 17169 and 5123 as we write this report(As on 3rd

dec 2009).

Indian markets have not been able to break their October highs while the global marketsare making new highs. The long term trend remains intact with a bias on upper side.

However the shorter term looks to be uncertain.

Global recovery, domestic growth story, Weakness in the dollar are the key points to drive

the markets to these level.

We feel that on a longer term, gold can still touch newer highs on account of weakening

dollar.

We expect the markets to show resistance this month in clearing the previous top made in

October. A dip of 5% or so can be expected from these levels. However one should notethat it would again act as entry points for long term investors.

A look on various economic indicators supports our view of markets for shorter term remainingvolatile, uncertain with a bias on negative side-Credit off take growth for the week ended 6

thNov

2009 slowed down to as low as 9.8%. However it showed an improvement and the latest figuresindicate the readings to be at 10.8% for the week ended 23

rdNov. This reading is well below

RBIs target growth of 18% and well below that of the previous year growth which was at 23%.

Direct tax collections in the first eight months of the current financialyear increased merely by 3.7% to Rs 1,83,822 crore, against Rs 1,77,251 crore in the

April-November period of 2008-09.

India's exports fell 6.6 per cent in October extending the decline for the 13th month in a row. Asper the foreign trade data, oil imports in October 2009 were valued at $6.6 billion, down 9.3 percent from $7.2 billion in the same month last year.

Oil imports during April-October of the current fiscal were valued at $42.8 billion, 39.3 per centless than $70.5 billion in April-October 2008.

The November PMI index reading was the weakest since March. The drop was driven largely byslower growth in both new orders and output. Also The HSBC Purchasing Managers' Index

(PMI), based on a survey of 500 companies, fell to 53 in November from 54.5 in October. Areading above 50 means activity expanded during the month.

All these readings and indications have to be weighed with the positive data which is released(say for example GDP numbers this time were quite strong). Weighing the positives andnegatives and using the weight of evidence approach we feel that a correction to the tune of 5-6% cannot be ruled out.

-

8/14/2019 Economy 360 Dec 2009

4/14

-

8/14/2019 Economy 360 Dec 2009

5/14

MAIA FINANCIAL SERVICES PVT LTD

5

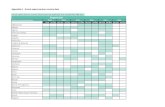

Mar. 31# Nov. 20# Amount % Amount % Amount % Amount % Amount %

(i) Net Bank Credit to Government (a+b) 12,77,199 14,87,583 16,396 1.1 1,49,819 16.7 2,10,385 16.5 1,88,356 21.9 4,38,247 41.8

(a) Reserve Bank 61,580 72,328 21,120 51,703 10,749 80,616 1,33,834

(b) Other Banks 12,15,619 14,15,255 -4,724 -0.3 98,116 9.7 1,99,636 16.4 1,07,740 10.7 3,04,413 27.4

(ii) Bank Credit to Commercial Sector (a+b) 30,13,337 31,37,509 2,678 0.1 2,68,821 10.4 1,24,172 4.1 5,64,408 24.7 2,89,698 10.2

(a) Reserve Bank 13,820 5,396 356 -274 -8,424 -190 3,882

(b) Other Banks 29,99,517 31,32,112 2,322 0.1 2,69,095 10.4 1,32,596 4.4 5,64,598 24.7 2,85,816 10.0

Year-on-year

2008-2009 2009-2010 2008 2009

Outstanding as on Variation over

2009 Fortnight Financial year so far

Source: RBI

The credit offtake has shown a marginal uptick for the second consecutive fortnight endingNovember 20. However it still remains way below the target level of 18%. The latest readingwas at 10.8%.

Bank loans have risen by Rs 7,056 crore, for the fortnight ending November 20.

However, deposits grew by 19.04%, or Rs 6,69,427 crore, during the same period. Theoutstanding deposits at the end of November 20 stood at Rs 41,85,923 crore as against Rs35,16,496 crore in the corresponding fortnight in the previous fiscal.

Money Supply:

Mar. 31# Nov. 20# Amount % Amount % Amount % Amount % Amount %2 3 4 5 6 7 8 9 10 11 12 13

47,64,019 51,95,285 22,133 0.4 3,70,988 9.2 4,31,266 9.1 7,08,500 19.3 8,06,414 18.4

(i) Currency with the Public 6,66,364 7,23,575 8,603 1.2 50,576 8.9 57,212 8.6 93,881 17.9 1,04,589 16.9

(ii) Demand Deposits with Banks 5,81,247 5,76,971 -7,751 -1.3 -84,038 -14.5 -4,276 -0.7 11,629 2.4 82,636 16.7

(iii) Time Deposits with Banks 35,10,835 38,90,003 21,360 0.6 4,08,565 14.3 3,79,167 10.8 6,02,834 22.6 6,19,392 18.9

(iv) "Other" Depos its with Reserve Bank 5,573 4,736 -78 -1.6 -4,115 -45.5 -837 -15.0 155 3.2 -203 -4.1

2008 2009

1

M3

Outstanding as on Variation over

2009 Fortnight

Components (i+ii+iii+iv)

(Rs. crore)

Financial year so far Year-on-year

2008-2009 2009-2010

Source: RBI

As can be seen from the above table the Money Supply M3 has grown at a rate of 18.4% year onyear. This is mainly due to rise in currency with the public and time deposits with the bank.Higher money supply and supply side constraints have contributed to high inflation in CPI terms.

-

8/14/2019 Economy 360 Dec 2009

6/14

MAIA FINANCIAL SERVICES PVT LTD

6

Inflation:

Source: RBI

It is a matter of worry that the food inflation is around 16%. WPI has stopped its downtrend. Webelieve that slowly WPI is also going to rise to a level of 5-6% by next year. If this happens RBIwill surely take action on liquidity front. The first tool would obviously be on monetary front.This would not augur well for equity markets.

Yield curve

-

8/14/2019 Economy 360 Dec 2009

7/14

MAIA FINANCIAL SERVICES PVT LTD

7

The yield curve remains normal and is not a cause of worry.

Corporate bond spreads

-

8/14/2019 Economy 360 Dec 2009

8/14

MAIA FINANCIAL SERVICES PVT LTD

8

.

As can be seen from the above figure there is substantial decrese in bond spreads compared to

that of March 2009 situation. However there was recently an increment of 10-15 basis points incorporate bond spreads due to fears of Dubai World.However markets had reacted to this newsbut it was only temporary and the fears had slowly subsided.

10 year Government Bond yield

-

8/14/2019 Economy 360 Dec 2009

9/14

MAIA FINANCIAL SERVICES PVT LTD

9

Year Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

2009 4.62 5.35 5.78 5.83 5.95 6.9 6.78 7.09 7.06 7.18 7.06

2008 6.57 6.78 7.05 7.4 7.32 8.17 9.32 8.81 7.94 6.68 5.8 4.77

2007 7.48 7.75 7.9 7.99 7.84 7.93 7.49 7.53 7.21 7.3 7.29 7.17

2006 6.63 6.95 7 6.9 6.95 7.15 7.51 7.4 7.17 7.23 7.21 7.25

2005 6.6 6.63 6.7 6.88 6.95 6.62 6.54 6.55 6.64 6.72 6.65 6.67

There is a possibility of yields increasing on account of high inflation and probablity that RBIwill take monetary action to control the high inflation.

Interest rates:

With food inflation going to 15-16% it is for sure that some monetary action on liquidity woulddefinitely be required. Increasing the interest rates would not be that good a news to the equitymarkets. However we feel that RBI will start increasing the rates by early next year.

Dollar:

Weakness in the dollar is one of the point driving the markets. We are of the view that may be ona shorter term dollar will rebound but going down the line dollar will remain weak.

This is because-Within the next 12 months, the U.S. Treasury will have to refinance $2 trillion inshort-term debt. The additional deficit spending is estimated to be around $1.5 trillion. Thisamount is equal to nearly 30% of entire GDP.

Now the question to ask is -Where will the money come from? The U.S. holds gold, oil, andforeign currency in reserve. It has 8,133.5 metric tonnes of gold (it is the world's largest holder).

At current dollar values, it's worth around $300 billion. The U.S. strategic petroleum reserveshows a current total position of 725 million barrels. At current dollar prices, that's roughly $58billion worth of oil and according to the IMF, the U.S. has $136 billion in foreign currencyreserves. So altogether $500 billion of reserves. Even the short-term foreign debts are far biggerthan this $500 billion.

-

8/14/2019 Economy 360 Dec 2009

10/14

MAIA FINANCIAL SERVICES PVT LTD

10

So where will the money come from? The printing press. The Federal Reserve has alreadymonetized nearly $2 trillion worth of Treasury debt and mortgage debt. This weakens the valueof the dollar and devalues Treasury bonds.

All of this is going to lead to a severe devaluation of the U.S. dollar.

IIP:

Index of Industrial Production (IIP) increased by 9.1 percent in September 2009 vis--vis 11.0percent in August 2009. The reported IIP figure for the month of September was better thanBloomberg consensus estimate of 7.0 percent. IIP growth rate was 6.0 percent during the samemonth last year. On m-o-m basis, IIP increased by 2.6 percent in September 2009, after anincrease of 1.0 percent previous month. IIP for the month of August 2009 was revised to 11.0percent from 10.4 percent reported earlier. The general IIP index for September 2009 stood at301.4 against 293.7 for the month of August 2009. The overall growth for the period April-September FY2009-10 was 6.5 percent compared with 5.0 percent for the corresponding period

of last year.

Manufacturing Sector:

Manufacturing Sector, which accounts for 79.4 percent of IIP, grew by 9.3 percent in September2009 against 11.0 percent in the month of August 2009. Manufacturing sector grew by 6.2percent in September last year. On m-o-m basis, manufacturing increased by 3.5 percent inSeptember 2009, after growing by 0.6 percent in previous month. The overall growth ofManufacturing Sector for the period of April-September FY2009-10 was 6.3 percent comparedwith 5.3 percent for the corresponding period of last year.

India's manufacturing activity expanded for the seventh consecutive month in October 2009 butat a slightly slower pace as growth in new orders and output slowed.

Mining Sector

Mining Sector, which accounts for 10.4 percent of IIP, grew by 8.6 percent for the month ofSeptember 2009 against 11.0 percent in August 2009. Mining sector grew by 5.8 percent inSeptember 2008. The overall growth of Mining Sector for period of April-September FY2009-10was 8.2 percent compared with 3.8 percent for the corresponding period of last year.

Consumer Goods Sector

Consumer Goods Sector grew by 8.2 percent in September 2009 vis--vis 10.5 percent in August2009. For the period of April-September FY2009-10, Consumer Goods Sector registered agrowth of 4.3 percent against 7.6 percent for the corresponding period of last year. ConsumerDurables Sector remained the best performer in September 2009, which grew by 22.2 percent.On m-o-m basis, the sector increased by 12.9 percent in September 2009 vis--vis a decline of0.6 percent in previous month.

-

8/14/2019 Economy 360 Dec 2009

11/14

MAIA FINANCIAL SERVICES PVT LTD

11

Consumer Durables and Non Durables Sector:

Consumer Durables registered a 14.7 percent growth in production in September 2008.Consumer Non-Durables Sector grew by 2.6 percent in September 2009 against 6.4 percent inthe month of August 2009. Consumer Non-Durables Sector registered a growth of 4.8 percent in

September 2008.

Capital Goods Sector

Capital Goods Sector registered a 12.8 percent growth in September 2009 vis--vis 8.7 percentin the month of August 2009. On m-o-m basis, Capital Goods Sector grew by a massive 31.3percent in September 2009 against an increase of 6.1 percent in previous month. IIP growth forCapital Goods Sector was 20.8 percent a year ago. For the period of April-September FY2009-10, Capital Goods Sector registered a growth of 5.3 percent against 10.7 percent for April-September FY2008-09.

Basic Goods Sector

Basic Goods Sector grew by 6.7 percent for the month of September 2009 compared with 9.6percent in August 2009. Basic Goods Sector registered a growth of 5.0 percent in September lastyear. The overall growth of Basic Goods Sector for period of April-September FY2009-10 was6.7 percent compared with 3.9 percent for the corresponding period of last year.

Intermediate Goods SectorIntermediate Goods Sector grew by 10.8 percent in September 2009 against 14.2 percent inAugust 2009. Intermediate Goods Sector registered a decline of 2.5 percent in September2008. The overall growth of Intermediate Goods Sector for the period of April-September

FY2009-10 was 9.5 percent compared with 0.4 percent for the same period of last year.

Core Infrastructure Industry:

Indias six core infrastructure industries, which have 26.7 percent weight in the IIP, grew 4.0percent for the month ended September 2009 vis--vis 7.8 percent in August 2009. Infrastructuregrowth was 4.0 percent in September last year. The index for the six key industries stood at thelevel of 246.7 for the month of September 2009 compared with 256.9 in August 2009. Electricitywas the best performer among the six industries, which grew by 7.5 percent in September 2009.

Coal and Cement grew at the rate of 6.5 percent each in September 2009. Refinery Productsgrew by 3.4 percent. However, the production of Crude Petroleum and Finished Steel declinedby 0.5 and 0.4 percent respectively. During April- September of FY2009-10, six core industriesregistered a growth of 5.0 percent against 3.4 percent during the corresponding period of theprevious year.

-

8/14/2019 Economy 360 Dec 2009

12/14

MAIA FINANCIAL SERVICES PVT LTD

12

Economy Pulse Analysis:

Economic Indicator Type Comment

Yield Curve Leading Normal.

Corporate Bond Spreads Leading Have recently risen by 10-15

basis points on account of

Dubai crisis.

Inflation Coincident WPI has stopped its down

move, CPI rising to 16%

year on year. Going down the

line, would be bad for equity

markets

Interest rates Coincident Currently stable, however

indicators are signaling that

RBI would sooner or later

start raising the rates

10 year government bond

yield

Leading Rising. With the huge

government borrowing

programme, jittery effects of

Dubai Crisis and inflationfears the yields have started

rising. This would be bad for

equity markets

Credit growth Leading Lower at 10.8% vs target of

18%. It is bad for the equity

markets

CCIL Bond Index Leading Falling. As the yields are

rising, bond prices are falling.

This would be bad for the

equity markets going down the

line

GDP Coincident Growth of 7.9% for the 2nd

quarter of the FY10. Better

-

8/14/2019 Economy 360 Dec 2009

13/14

MAIA FINANCIAL SERVICES PVT LTD

13

than the same quarter of the

previous year and it is a

positive surprise.

IIP Lagging Good. However the

manufacturing segment isshowing signs of weakness.

Core Infrastructure Industries Lagging During April- September ofFY2009-10, six core industriesregistered a growth of 5.0percent against 3.4 percentduring the correspondingperiod of the previous year.

.

Money Supply Leading Higher than the target

growth rate. This is however

due to increased government

spending and the borrowing

programme.

Analyst Name: Avani Mehta Company Name: MAIA Finacial Services Pvt Ltd

Email Id:[email protected] Address: C wing, Bsel Tech Park, Opposite

Vashi Station, Vashi, Navi Mumbai.

Contact No: 022 27810674/75/76

Disclaimer: This report is purely for information purpose only. It contains information from sources which we

believe are reliable but we do not guarantee. It also includes analysis and views expressed by our analysts. Thisreport should not be construed to be investment recommendation/advice. Investors should not solely rely on the

information contained in this report and must make investment decisions based on their own independent inquiry,

investigation and analysis and shall not have any claim on Maia Financial Services Pvt Ltd. Efforts are made to

ensure accuracy and to avoid errors and omissions, but errors and omissions may creep in. It is notified that neither

Maia Financial Services Pvt Ltd nor its employees will be responsible for any damages or loss of action to any

one, of any kind, in any manner, therefrom. Moreover this report is the property of Maia Financial Services Pvt

mailto:[email protected]:[email protected]:[email protected]:[email protected] -

8/14/2019 Economy 360 Dec 2009

14/14

MAIA FINANCIAL SERVICES PVT LTD

14

Ltd. No content can be copied, reproduced, republished, uploaded, and/or distributed for any use without obtaining

prior written permission of Maia Financial Services Pvt Ltd. All legal disputes are subject to Mumbai jurisdiction

only.