Earned Income Credit - cotaxaide.org Earned Income Credit.pdf · Earned Income Credit Pub 4491 ......

Transcript of Earned Income Credit - cotaxaide.org Earned Income Credit.pdf · Earned Income Credit Pub 4491 ......

Earned Income Credit

Pub 4491 – Lesson 30

Pub 4012 – Tab I

Earned Income Credit Major update needed for 2017 law

change (disaster relief)

Refundable Credit

NTTC Training – TY2017 2

● A refundable credit can generate a refund even if the taxpayer didn’t pay any money in

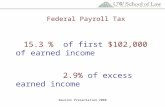

Amount of the Credit

NTTC Training – TY2017 3

Ask: Who else lived with you last year?

Don’t forget anyone who was temporarily away... at school? in the hospital? in juvenile detention?

NTTC Training – TY2017 4

Two Sets of Rules

NTTC Training – TY2017 5

● First, for taxpayers who have qualifying children (QC)

● Second, for taxpayers who don’t have qualifying children

And...

● Taxpayer must have taxable earned income (excluded income does not count, except combat pay)

Resource Guide Tab I

NTTC Training – TY2017 6

● Open to Tab I-2

Rules for Everyone

NTTC Training – TY2017 7

● Taxpayer(s) and qualified child must have SSNs that are valid for employment—not ITINs − Valid for work only with DHS authorization is ok

● Taxpayer cannot file MFS

● Must be US citizen or resident alien all year – check in personal information if not

Rules for Everyone (Cont)

NTTC Training – TY2017 8

● Cannot exclude foreign earned income – Form 2555 or 2555-EZ

● Taxpayer’s maximum investment income = $3,450

● Taxpayer cannot be a qualified child of another taxpayer

Rules if Taxpayer has a QC

NTTC Training – TY2017 9

● Child must meet tests: − Relationship − Age − Residency − Not filing MFJ

● If married, child must be a dependent

Note: Support test does not apply

Rules if Taxpayer does not have a QC

NTTC Training – TY2017 10

● Taxpayer must be at least 25 and under 65 as of December 31

● Cannot be dependent of another taxpayer

● Must have lived in US more than half the year

Quiz: Earned or Not Earned for EIC?

NTTC Training – TY2017 11

● Disability pension or annuity when taxpayer is under minimum retirements age?

● Taxable long-term disability benefits received prior to minimum retirement age

● Nontaxable combat pay

● Taxable scholarship or fellowship grants that are not reported on Form W-2

● Pay for work performed while an inmate at a penal institution or on work release

Use Resource Guide page I-1

Earned

Not Earned

Earned if it helps

Earned

Not Earned

TaxSlayer knows what is earned but…

NTTC Training – TY2017 12

● 1099-R disability pension – need to check to move to wages

TaxSlayer knows what is earned but…

NTTC Training – TY2017 13

● Prisoner income – It’s in a W-2 − Need to identify it as prisoner income in Other

Income (can click thru line 21) to take it out of earned income

This only identifies it as unearned income – it does not add it to income

Number of Children

Other Filing Status

MFJ

None $15,010 $20,600

One $39,617 $45,207

Two $45,007 $50,597

Three or more $48,340 $53,930

Maximum Income Limits

NTTC Training – TY2017 14

Credit Amount

NTTC Training – TY2017 15

● Calculated based on − Earned income -OR-

− AGI

● Credit is based on the smaller of the two

● Maximum credit for 2017: $6,318

Qualifying Child Review

NTTC Training – TY2017 16

Resource Guide Page C-3

1. Relationship

2. Age

3. Residency

4. Support does not matter

5. Cannot file MFJ

QC of more than one person

NTTC Training – TY2017 17

● If child is qualifying child for more than one taxpayer, only one can claim the credit

● Follow the tie-breaker rules

● If taxpayer has QC who is used by someone else, taxpayer can claim EIC with a different child, or – new – can claim EIC without a child (if all other rules met)

“Tie-breaker” Rules (1 of 2)

NTTC Training – TY2017 18

● If only one is a parent, goes to parent (but see Rule 4)

● If both are parents, they can choose, but if both parents claim the same child, − Goes to parent with whom child lived longest − If same amount of time, goes to parent with

highest AGI

● If neither is parent, goes to person with highest AGI

Open 4012 to Page C-4

“Tie-breaker” Rules (2 of 2)

NTTC Training – TY2017 19

● If one or more parent could claim child but no parent does… − The child is treated as the qualifying child of the

person who had the highest AGI for the year, but only if that person’s AGI is higher than the highest AGI of any of the child’s parents who can claim the child

− If parents file MFJ, this rule allows the parents to divide their combined AGI equally (between themselves) (until the regs are finalized)

Child of Divorced...Parents

NTTC Training – TY2017 20

● Must meet the residency requirement, so credit goes to the custodial parent

Qualifying Child Chart:

NTTC Training – TY2017 21

Entering Dependent / Qualifying Child Information in TaxSlayer

NTTC Training – TY2017 22

Taxpayers and qualifying children must all have SSN that is valid for employment The dependent does not have a SSN/ITIN/ATIN? Need W-7?

Check if you wish to NOT claim the dependent for EIC Purposes

Entering Dependent / Qualifying Child Information in TaxSlayer continued

NTTC Training – TY2017 23

● Read each option very carefully List a QC for EIC, but not for dependent exemption deduction

Disallowed EIC in prior year?

NTTC Training – TY2017 24

● Check Intake Sheet

● Ask the taxpayer

● Answer “no” if disallowed for math error

EIC Denied in the Past

NTTC Training – TY2017 25

● When EIC has been denied in the past, Form 8862 needs to be filed – search 8862

Check if EIC was Reduced or disallowed.

Form 8862 – Filers with a Qualifying Child

NTTC Training – TY2017 26

Enter each child one at a time.

Not Qualified for EIC?

NTTC Training – TY2017 27

● Taxpayer does not qualify for EIC because s/he is the qualifying child of another – Basic Info:

Override: Not Eligible for EIC

NTTC Training – TY2017 28

Not Eligible?

Requires Taxpayer signature

TaxSlayer will properly compute EIC and you should not need to use this page

EIC Questions

NTTC Training – TY2017 29

● Starting with 2017, no due diligence questions (as there was for 2016)

● If either Taxpayer or Spouse was nonresident during the year, indicate so in the Personal Information section

Quality Review

NTTC Training – TY2017 30

● Have all qualifying children been included? − Those temporarily away? − Those who are self-supporting? − Those with “permanent” disabilities?

● Has penal income been identified?

● Sch EIC and WKt completed correctly?

Exit Interview

NTTC Training – TY2017 31

● Remind taxpayers that this credit can disappear when child turns 19 (unless s/he is a full-time student or disabled)

● For 2017, affects taxpayers with children with birthdates in: − 1998 or − 1993 (for a full-time student)

Exit Interview

NTTC Training – TY2017 32

● Since 2016, IRS cannot process a return with EIC or Additional Child Tax Credit until February 15

● Ok to prepare and submit e-file

● Advise taxpayer that refund will be delayed

Quiz 1

NTTC Training – TY2017 33

● Tom is 32 years old. He cannot work and lives with his parents. He receives social security disability checks, which he uses to pay his folks for his room and board and for his clothes and entertainment

● Can his parents claim him as a dependent?

● Can they claim him for EIC?

Quiz 1 Answer

NTTC Training – TY2017 34

● Not as a dependent: He provides more than half of his own support

● Yes for EIC: The support test does not apply

Quiz 2

NTTC Training – TY2017 35

● John and Mary have ITINS, but their two children have social security cards

● Can John and Mary claim the children as dependents?

● Can they claim them for EIC?

Quiz 2 Answer

NTTC Training – TY2017 36

● Yes – Meet all requirements for dependency

● No – Both taxpayer and QC must have SSNs to qualify for EIC

Quiz 3

NTTC Training – TY2017 37

● Mary has always claimed her daughter Susan as a dependent and for EIC

● In November, Susan got married and plans to file MFJ with her husband

● Can Mary claim Susan as a dependent?

● Can she claim Susan for EIC?

Quiz 3 Answer

NTTC Training – TY2017 38

● No – MFJ (unless filing only to claim a refund of withholding or estimated tax) disqualifies for dependency

● No – If married, child must be a dependent

Quiz 4

NTTC Training – TY2017 39

● 70-year old worker with no children at home has earned income of $10,000

● TaxSlayer does not give him any EIC. Is this correct?

Quiz 4 Answer

NTTC Training – TY2017 40

● Yes – Without a child, taxpayer must be at least 25 but under 65 to qualify for EIC

Quiz 5

NTTC Training – TY2017 41

● Bill is 30 years old and earned $33,000; his wife, Emily, is 27 and earned $1,000

● Bill and Emily have three children under age 19 who lived with both of them until August when they divorced

● The children lived with Emily through the rest of the year

● Who is eligible to claim EIC?

Quiz 5 ANSWER

NTTC Training – TY2017 42

● Emily is the one eligible to claim all − The children lived with her the longest

(tiebreaker) − She could choose to let Bill claim them

● Bill could claim some or all of the children if Emily does not claim them (lived with Bill more than ½ the year and AGI is not an issue between parents, except as a tiebreaker)

Earned Income Credit

NTTC Training – TY2017 43

Questions?

Comments…