e-Newsletter - LAWINRC › sites › inrc.law.uiowa.edu › files › FallNews2008.pdfIowa...

Transcript of e-Newsletter - LAWINRC › sites › inrc.law.uiowa.edu › files › FallNews2008.pdfIowa...

-

e-Newsletter

In This Issue:

Fall, 2008Volume 4, Issue 4

FOCUS ON: Nonprofit News

• Disaster Relief as a 501(c)(3) Tax Exempt Activity

• Qwest Foundation. Helps Fund Nonprofit Conference

• New Economic Bill Includes Charitable Provisionst

• Continuing Legal Education Class Success

• From Veteran Organization to Nonprofit

• Computer Security on a Nonprofit Budget

• Book Review: Ethical Fundrasing

• Iowa’s Nonprofit Respond to Iowa’s Needs

• Jude West Wins Benjamin Franklin Award

Qwest Foundation has generously made a $10,000 gift to the Larned A. Waterman Iowa Nonprofit Resource Center through the University of Iowa Foundation to fund a statewide nonprofit conference to be held on October 28 and 29, 2008. The conference name is “Iowa Conference on Volunteer Service and Nonprofit Management,” and its theme is Together: Building Iowa’s Future. The

conference is a joint effort between the University of Iowa’s Larned A. Waterman Iowa Nonprofit Resource Center and the Iowa Commission on Volunteer Service. The conference will be held at a central Iowa location, the Scheman Center in Ames, Iowa, and it is projected that 450 attendees will come. As with the previous funding to the Larned A. Waterman Iowa Nonprofit Resource Center by Qwest Foundation in 2006 and 2007, a cornerstone will be six hours of training on the Iowa Principles and Practices for Charitable Nonprofit Excellence. Conference sessions will revolve around

disaster relief settings. A nonprofit set up to provide “emergency rescue services to stranded, injured, or lost persons,… suffering because of fire, flood, accident, or other disaster” (Rev. Rul. 69-174) is exempt under 501(c)(3). But “a nonprofit organization that provides rental housing and related services at cost to a city for its use as free temporary housing for families whose homes have been destroyed by fire” (Rev. Rul. 77-3) is not exempt under 501(c)(3). One of the most well-known problems with tax exemption and disaster response arose during the 9/11 disaster recovery effort. The Treasury regulations state that to be charitable the nonprofit’s efforts have to be assistance to the “poor and distressed,” but does that really mean that a nonprofit cannot give relief to

When a disaster strikes, such as Iowa’s 2008 natural disasters of the Parkersburg tornado and the flooding all over Iowa, nonprofits are essential responders. The Red Cross responded across Iowa to meet immediate needs of shelter, food and other basic assistance. Many Iowa nonprofits respond to those natural disasters that continue to create needs all over the state, but will activity done in the name of disaster response always fit within the purpose the nonprofit has for federal tax exemption?. Nonprof its can get federa l ta x exemption under I.R.C. 501(c)(3) as “charitable” if they provide assistance to the “poor and distressed.” See Treas. Reg. 1.501(c)(3)-1(d)(2). It is not always easy to determine how this Treasury regulation provision will be applied by the I.R.S. to

Disaster Relief as a 501(c)(3) Tax Exempt Activity

Qwest Foundation Helps Fund Nonprofit Conference (Disaster Relief continued on page 4)

Richard Koontz, Director of the Larned A. Waterman INRC

(Qwest continued on page 6)

-

INRC Newsletter page 2 of 8

For more information go to http://www.independentsector.org/programs/gr/EconomicStabilization.htm

On Friday September 5, 2008, the University of Iowa College of Law and the Larned A. Waterman Iowan Nonprofit Resource Center hosted a two-day Con-tinuing Legal Education Class (CLE), bringing together experts in a variety of areas of the law to provide guidance and insight on important issues pertaining to nonprofit law. Among the distinguished panel of faculty and experts was former University of Iowa President Willard Boyd, who discussed nonprofit governance as well as recent legal developments in nonprofit law. Iowa Law professor Sheldon Kurtz also discussed the Uniform Prudent Management of Institutional Funds Act (UPMIFA), highlighting the duties and obligations of charitable institutions in managing, appropriating for expenditure, and investing institutional funds as well as explaining the rules regarding the accumulation of endowment funds. In addition, a panel made up of local attorneys and the president and CEO of the Greater Cedar Rapids Community Foundation provided a timely discussion

Last week’s major economic legislation contains several items of importance to charitable organizations

Restores and extends through 1. 2009 the IRA rollover and food inventory giving incentives.Temporarily lifts the limits on 2. individual (50%) and corporate (10%) for cash contributions to Midwestern flood relief.Mileage provision for volunteers 3. assisting in disaster recovery: increases the deductible mileage

rate for charitable use of vehicles from 14 cents to 41 cents (70 % of the business rate) and permits volunteers to exclude from income mileage reimbursement for relief efforts.

This legislation does not address increasing the mileage rate for all volunteers which is the subject of pending legislation in the Congress. For more information on the Economic Stabilization Act go to the website of Independent Sector.

New Economic Bill Includes Charitable Provisions

Continuing Legal Education Class Success

Willard L. Boyd Chair, Larned A Waterman INRC

on post-flood legal issues. Richard Koontz, Director of the Larned A. Waterman Iowa Nonprofit Resource Center, pointed out how the revised I.R.S. guidelines will impact non-profit organizations. Specifically, Koontz addressed the new form 990 policies, de-tailing how the changes will affect differ-ent agencies. Also, Theresa Pattara, Tax Counsel for the U.S. Senate Committee on Finance, discussed a wide range of relevant tax issues. Pattara’s presentation provided valuable information about the tax treatment of nonprofit organizations including tips on avoiding the pitfalls of maintaining a nonprofit corporation’s tax exempt status. Other topics included I.R.S. Circular 230, strategic nonprofit gover-nance, and a report on nonprofits form the Iowa Attorney General’s Office. For more information about this CLE or to pick-up a copy of the training materi-als, contact Richard Koontz at [email protected], or visit our website at http://nonprofit.law.uiowa.edu/.

Justin Maritin, Research Assistant, Larned A Waterman INRC

-

INRC Newsletter page 3 of 8

More information about the flood relief fund can be found at http://www.gcrcf.org.

Iowa’s Nonprofits Respond to Iowa’s Needs

Created in 1992, The Greater Cedar Rapids Community Foundation is a well established nonprofit in the corridor area, having made just in calendar year 2007 grants to 246 Iowa nonprofits. With the flood of 2008 hitting their community hard, The Greater Cedar Rapids Community Foundation (“GCRCF”) has stepped up to the plate to be of significant assistance. A “Flood 2008 Fund” was established by GCRCF to assist Linn County nonprofits in their recovery efforts. In a truly generous fashion, every penny of the fund goes to the recovery effort, no administrative expenses of GCRCF being taken from the fund. In addition to the Flood 2008 Fund, GCRCF administers a number of other flood relief funds, such as the Berthel Fisher 2008 Flood Relief Fund and the Rockwell Collins Flood Recovery Fund. Another important flood fund at GCRGF is the Job and Small Business Business Recovery Fund, a fund set up by the Cedar Rapids Area Chamber of Commerce which provides grants and 0% interest forgivable loans to a small for-profit business. This fund helps decrease economic loses to the Cedar Rapids community resulting from

the flood by getting s m a l l businesses back on their feet, and keeping r e v e n u e s and jobs in the area. Donations to the flood relief efforts of The Greater Cedar Rapids Community Foundation can be made at www.gcrcf.org. Other community foundations in Iowa are making similar rapid and extensive natural disaster relief efforts in 2008. The Iowa Council of Foundations has put together a list of funds various funding entities in Iowa have established in response to this year’s natural disasters, available online at http://www.iowacounciloffoundations.org/disasters/iowa-response.htm. Iowa recognizes how praiseworthy and essential nonprofit efforts like The Greater Cedar Rapids Community Foundation and its Flood 2008 Fund are, an example of how Iowa nonprofits quickly respond to community needs.

Jude West Wins Benjamin Franklin AwardRichard Koontz, Director of the Larned A. Waterman INRC

Jude West, Co-director of the Larned A. Waterman Iowa Nonprofit Resource

Center, has been given the Benjamin Franklin Award by the Association of Fundraising Professionals of Eastern Iowa. The Benjamin Franklin Award is “presented to a fundraising

professional who has

attained significant achievements in a long career and is looked to by the profession as a role model. This is generally a person with ten or more years experience in fundraising that has contributed to the field as a professional, trainer/mentor, and/or volunteer.” Jude was nominated for the work he did with the Iowa City Catholic Foundation and the Iowa City Catholic Community. The award will be presented to Jude at an event held at noon at the Holiday Inn in Coralville on Nov 13th.

Richard Koontz, Director of the Larned A. Waterman INRC

-

INRC Newsletter page 4 of 8

See I.R.S. FAQs at http://www.irs.gov/charities/charitable/

article/0,,id=149908,00.html

(Distaster Relief continued from page 1)

those distressed by the disaster but not poor? Some families in New York City were clearly victims of 9/11, with housing needs, emotional counseling needs, etc., but they had annual incomes of $500,000. Must an Iowa nonprofit ask those it responds to in disasters their annual income before it provides assistance? The initial response of the I.R.S. in 9/11 was that, if the person was not “poor,” even if “distressed,” the charity could not as a tax exempt entity give them assistance. And this meant, if the nonprofit continued to respond to the genuine need of those distressed by the disaster, whether poor or not, exempt status could be revoked and those contributing to the nonprofit for disaster relief might not get deductions. The well-known and respected expert on tax exemption, Bruce Hopkins, has always held that the I.R.S. position with respect to 9/11 recovery efforts was incorrect. His position is that the correct interpretation of the Treasury regulation is to provide relief to those who are “poor and/or distressed.” Relief can be distributed in a disaster setting regardless of the recipient’s income as long as there are “objective criteria in place” to determine the needs of recipients. (Hopkins, The Law of Tax-Exempt Organizations, p. 141) The I.R.S. articulation of assistance to individuals in disasters that reflects what Hopkins refers to as “needs based assessment,” which helps bridge this gap when responding to genuine need. Knoming that finances are not always relevant: “In the chaotic and disorienting aftermath of a disaster, a charity can attend to a victim’s immediate needs without regard to financial means.” When the immediate disaster has passed, things change. “Danger recedes, and people are able to call upon their individual resources, it becomes increasingly appropriate for charities to conduct

individual financial needs assessments.” The I.R.S. also requires that a charity providing disaster relief must document its assistance, including records of the following:

A complete description of the •assistanceCost of the assistance•The purpose for which the assistance •was givenThe charity’s objective criteria for •disbursing assistance under each programHow the recipients were selected•The name, address, and amount •distributed to each recipient Any relationship between the •recipient and officers, directors, or key employees of or substantial contributors to the organizationThe composition of the selection •committee approving assistance

It is important to remember also that some nonprofits that undertake activities in relation to disaster have exemptions for purposes other than 501(c)(3)’s “charitable.” For instance, a nonprofit hospital treats victims of disasters. A nonprofit hospital also provides medical treatment to those with various illnesses not arising from disasters. A hospital’s exemption is not jeopardized by serving disaster victims who are wealthy. Why? Because it is not exempt as “charitable,” but as a medical facility, and so the “poor and distressed” issue is not relevant. In the same way, a church provides spiritual counseling to those who are suffering after a disaster. The church need not be concerned with the “poor and distressed” issue. There are some helpful guidelines on tax issues arising from disaster response settings in the I.R.S. publication 3833, “Disaster Relief” available online at http://www.irs.gov/pub/irs-pdf/p3833.

For a more in depth legal analysis, see Janet Gitterman and Marvin Friedlander, “Disaster

Relief - Current Developments” available

online at http://www.irs.gov/pub/irs-tege/

eotopicm03.pdf.

-

INRC Newsletter page 5 of 8

CERT offers technical tips in numerous areas;

please see website for more information. (http://www.cert.org/tech_tips/).

Matthew Hoffman , Research Assistant, Larned A Waterman INRC

Computer Security on a Nonprofit Budget

There are now over one million known computer viruses, worms, and Trojan horses on the Internet threatening computers. Nonprofit organizations are, of course, not immune. For organizations with just a few standalone computers; the costs of Internet security software and updates may seem prohibitively expensive. Although many companies offer free versions of their Internet security products, most circumscribe the accompanying licenses to home users not nonprofits. In this article, we review the well-accepted minimum requirements for security software and encourage you to take advantage of companies who support the nonprofit community.

Tip #1: Essential Software for Nonprofit Organizations At a minimum, all nonprofit organizations should equip each of their computers with (1) antivirus software, (2) antispyware software, and (3) a firewall. Many companies offer free or discounted antivirus software for personal or nonprofit use. Please see full article on the INRC website for a list of companies our

research found gave discounted software to nonprofits.

Tip #2: Regularly Update Your Software Regardless of your choice of software, regular updates help ensure your computers are protected against attacks. Most viruses and spyware take advantage of software flaws to gain control of computers or steal information. There are three software categories you should focus on first: (1) operating systems, (2) security software, (3) Internet browsers. These are the most common targets of attack, and when lacking critical updates, leave your system the most vulnerable.

Tip #3: Properly Configure Your Browser For this tip, we simply recommend going to the website for the Computer Emergency Response Team (CERT) at Carnegie Mellon University. They are a government-funded organization that “promotes the use of appropriate technology and systems management practices to resist attacks ...to ensure continuity of critical services.” They offer a guide for securing their Internet browsers (http://www.cert.org/tech_tips/securing_browser/).

With the Iraq war continuing, many Iowans are returning from military service, and some may be wondering what kind of nonprofits exist for veterans. The United States Tax Code embraces veteran organizations. Veteran organizations are somewhat unique in that they may not only achieve tax exemption, but also tax-deductible donations and the ability to set aside insurance funds for payment to their members. However, choosing the right tax code provision for achieving nonprofit status can feel a little like maneuvering through the Minotaur’s labyrinth.

From Veteran Organization to NonprofitNathan Roberts, University of Iowa College of Law Alumni

Veteran organizations can theoretically file for nonprofit status under many different subsections of Internal Revenue Code Section 501. Organizations can become, among other things, 501(c)(3) nonprofit organizations, 501(c)(4) social welfare organizations, 501(c)(7) social clubs, 501(c)(8) & (10) fraternal organizations, or 501(c)(19) veteran’s organizations. Each of these sections was created for a different purposes, and each offers its own combination of benefits and restrictions. The right choice for your

(Veteran continued on page 7)

-

INRC Newsletter page 6 of 8(Qwest continued from page 1)

Enrollment for the conference can be done on the Iowa Volunteer Commission website at www.volunteeriowa.org.

five main themes: youth development, volunteer management, capacity building, Principles and Practices, and professional development. In total, there will be 48 sessions. One half of the grant ($5,000) will be used to assist lower income nonprofits send people to the conference. Nonprofits applied for $145 contributions from the grant to cover the registration fee, the amount based on a showing of need. Recipients of the scholarships will write one page statements of what they learned to increase the efficiency of their nonprofit’s operation after the conference. Scholarships have gone to nonprofits in a wide geographic area: Algona, Ames, Carroll, Coralville, Des Moines, Decorah, Elkhorn, Fairfield, Homestead, Iowa City, Keota, Lansing, Maquoketa, Marshalltown, Mason City, Moline (IL), Pella, Sioux City, Storm Lake, Waterloo.

The other half of the grant ($5,000) will be used for speaker honoraria. Most of the speakers at the conference will not be paid. Two well known, prominent speakers, Cynthia Wakeman and Kris Meyer, who will address the entire conference rather than the smaller breakout sessions, will be paid an honorarium. Cynthia Wakeman’s keynote address is titled “Thriving in Changing Times – Leading into the Future” “If you always do what you’ve always done, you’ll get what you’ve always gotten,” Ms. Wakeman says. “Learn simple strategies to transform your organization and your community into a change-seeking machine.” The University of Iowa acknowledges the UI Foundation as the preferred channel for private contributions that benefit all areas of the university. For more information about the UI Foundation, visit its web site at www.uifoundation.org.

Jerome Coenic-Taylor, Research Assistant, Larned A Waterman INRC Book Review: Ethical Fundraising

Ethical Fundraising by Janice Gow Pettey is an excellent book that promotes the idea of organizations fundraising with the proper intent. The book explains the importance of the public trusting that their donations to organizations are being spent appropriately and that the organization is allocating their resources effectively. In order for people to continue to donate, they need to know that their money is not being used in vain and this book addresses the ethical principles necessary to fundraise properly. Within the text, Pettey discusses in depth the Association of Fundraising Professionals’ Donor Bill of Rights which provides a list of ten things that the donor is entitled to know. For example, the first Bill states that a donor has right to be “informed of the organization’s mission, of the way the organization

intends to use its donated resources and of its capacity to use donations effectively for their intended purposes.” The book also provides within the chapter titled “Honesty and Full Disclosure”, the five “C”s as some criteria for fund raising ethics. The five “C”s are consistency, coherence, continuity, communication and convictions. Creativity and Consequences of ethical fundraising are also discussed. The book also provides in appendices copies of the primary fundraising ethics codes, as well as a list of websites for international fundraising codes of ethics and standards. This book is a great and much needed resource for many nonprofit organizations that plan to improve their fundraising standards.

-

INRC Newsletter page 7 of 8

For an overview of the kinds of tax exemption for veterans organizations, see I.R.S. Publication 3386 available online at http://www.irs.gov/pub/irs-pdf/p3386.pdf

(Veteran continued from page 5)

organization depends on several factors including your organization’s membership and the activities you have chosen. Perhaps an obvious choice judging by its title, a 501(c)(19) veteran’s organization status offers a remarkable set of benefits to many veteran organizations if they can qualify. Qualification depends a great deal on membership, which must consist of at least 75% past or present members of the US Armed Forces (herein “veterans”) and at least 97.5% of either veterans, cadets, or their spouses. These requirements ensure a fairly exclusive membership, but auxiliary organizations can also attach to 501(c)(19) nonprofits allowing additional spouses and other family members to join in the ranks. Activities for (c)(19) organizations are probably the least restricted, including activities that would be normally be off limits to other nonprofits. These include setting money aside to insure its members, helping veterans receive needed benefits, sponsoring patriotic activities, all kinds of social activities for its members and their guests, activities that further the social welfare (similar to (c)(3) organizations), and even lobbying and political activities. Many organizations fail to fit within the (c)(19) umbrella, which admittedly allows a attractively broad range of activities. A brief comparison of (c)(19) and other subsections follows:Under 501(c)(4), no membership requirements exist – only the organization’s activities are restricted. This makes the subsection perfect for organizations that fail the (c)(19) membership requirements but want to “promote the social welfare of the community.” However, contributions are no longer deductible, strict activity limitations apply, and social, recreational, and political activities are no longer acceptable. In stark contrast to (c)(4),

organizations that file as a nonprofit social club under 501(c)(7) must do so for primarily pleasure, recreation and similar activities and is taxed on some forms of income and dues. Similar to (c)(4), this subsection applies specific activity limitations and avoids the strict membership requirements of (c)(19). Lobbying and political activities are acceptable. Some organizations opt for simply filing for exemption as a charitable nonprofit under 501(c)(3). As mentioned above, this path does not allow for activities such as political activities, substantial lobbying, and social activities. The (c)(3) organization’s purposes and charitable activities are more regulated. Donations to the organization can be deductible to the extent that nothing is given in return. Organizations filed under 501(c)(8) and (10) must be “fraternal” in nature, operate under the “lodge” system, and have members who share strong common ties and goals. These types of organizations provide a broader umbrella of acceptable activities, including social welfare activities, social activities for members, veterans, and current members of the Armed Forces, and providing insurance benefits to members under (c)(8). Donations are deductible if used for religious, charitable, scientific, literary, or educational purposes or for the prevention of cruelty to children or animals. One final note: these organizations can sometimes be effectively used in tandem. For example, you may want to form a (c)(19) organization with a (c)(4) subordinate post for an associated membership that does not fit within the (c)(19) standards. This is appropriate, and may be an effective means for keeping the (c)(19) benefits to whatever extent is possible.

-

The Larned A. Waterman Iowa Non-profit Resource Center is a University of Iowa interdisciplinary collaboration created to make more accessible educa-tional and service programs focused on strengthening the operational capacity of Iowa nonprofit organizations. The Center works collaboratively with government agencies, nonprofit organizations and educational institutions to impart new knowledge through activities and provide information and training resources to help

About Our Organizationnonprofit organizations and interested persons throughout Iowa. We seek to build the capacity and develop the effectiveness of community-based organizations and enhance the overall effectiveness of local organizations in building communities. The Center also introduces students to the nonprofit sector and develops their sense of public and community service.

Visit the center’s website at:ooooooo http://inrc.continuetolearn.uiowa.edu.

The Larned A. Waterman Iowa Nonprofit Resource Center

130 Grand Avenue CourtIowa City, Iowa 52242

Toll free: 1.866.500.8980

INRC Newsletter page 8 of 8

............................................................................

Training Opportunities

Be sure to visit: http://inrc.continuetolearn.uiowa.edu/

for additional information on each event listed.

Certificate in Volunteer Management, Kirkwood Continuing EducationThe Certificate in Volunteer Management requires completion of six core courses and elective credit. Courses may be taken at any time and will run until May 2009.

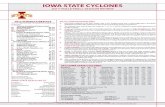

Information: www.kirkwood.edu; follow the Continuing Education Program linkDate / 9:00 am-4:00 pm Topic / All courses offered at KCC Cedar Rapids campusOctober 16, 2008 Orientation and training volunteersNovember 6, 2008 Leadership and supervision of volunteersNovember 20, 2008 Volunteer appreciation, retention and recognitionDecember 4, 2008 Evaluating your volunteer program & individual volunteer performance

Nonprofit Management Academies, Iowa State UniversityInformation: www.extension.iastate.edu/communities/npma.html and www.extension.iastate.edu/communities/npmacatalog.html Several courses will be ofered in Scott and Johnson Counties over the next few months. Follow the links above for a complete course list and for additional registration information.

Start an Iowa Charitable Nonprofit: A day-long workshop in Iowa City. The next date has been set for Satur-day, No-vember 22, 2008. This session is a “hands on” workshop to review and complete all the legal forms needed to start a non-profit with 501(c) (3) status in the State of Iowa. Contact the INRC or visit our web-site for registration information.

Iowa Conference on Volunteer Service and Nonprofit ManagementMark your calendars and plan to attend this new conference in Ames on October 28-29, 2008. Enrollment in selected courses will make your organization eligible for inclusion in Iowa’s Register of Account-ability. For more information, go to http:// inrc.continuetolearn.uiowa.edu/updates/ registerHowto.pdf

LEGAL DISCLAIMER: All newsletter content is pro-vided for informational purposes only and does not constitute legal counsel. Although we have made every attempt to ensure accuracy, the INRC is not responsible for any errors or omissions or for the results obtained from the use of this information. All information is provided with no warranty of any kind.

............................................................................

In the Works Issues First Newsletter: In the Works is a publication of the Iowa Commission on Volunteer Service (ICVS). The ICVS mission is to empower Iowans to improve communities and lives through volunteer service.Please visit the website for more information. http://volunteeriowa.org/intheworks/

![Iowa Department of Public Health Iowa Health Focus ...publications.iowa.gov/6429/1/july_aug2008[1].pdfIowa Department of Public Health Iowa Health Focus July/Aug 2008 3 Smokefree Air](https://static.fdocuments.in/doc/165x107/5b1ebe697f8b9a8a3a8bedd9/iowa-department-of-public-health-iowa-health-focus-1pdfiowa-department-of.jpg)