Dynamic Stochastic General Equilibrium Model Economy€¦ · Dynamic Stochastic General Equilibrium...

Transcript of Dynamic Stochastic General Equilibrium Model Economy€¦ · Dynamic Stochastic General Equilibrium...

Dynamic Stochastic General Equilibrium Model Dynamic Stochastic General Equilibrium Model for the Philippine Economyfor the Philippine Economy

Center for Monetary and Financial Policy Center for Monetary and Financial Policy ‐‐ Bangko Sentral ng PilipinasBangko Sentral ng Pilipinas2010 Central Bank Macroeconomic Modeling Workshop2010 Central Bank Macroeconomic Modeling Workshop

The Peninsula Manila, 19The Peninsula Manila, 19‐‐20 October 201020 October 2010

Authors: Prof. Paul McNelis (Fordham University), Dr. Francisco G. Dakila , Jr., Eloisa T. Glindro and Ferdinand S. Co. The views expressed herein do not represent the views and opinions of the Bangko Sentral ng Pilipinas (BSP) nor the Fordham University.

2

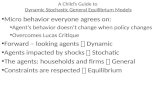

Outline of PresentationOutline of Presentation

I. Structure of the BSP‐DSGE model for the Philippine economy

II. Policy simulation results

2.1 100 bps reduction in policy rate

2.2 Increase in fiscal expenditures equivalent to 1% of GDP

III. Further areas of improvement

3

I. Structure of the BSPI. Structure of the BSP‐‐DSGE Model for the DSGE Model for the Philippine EconomyPhilippine Economy

Schematic Diagram of the BSPSchematic Diagram of the BSP‐‐DSGEDSGEModel for the Philippine EconomyModel for the Philippine Economy

Banks

National Government

Households

Firms:• Local producers• Importers• Exporters

Central Bank

International Financial Centers Foreigners:

Firms and Consumers

Supply labor to firms and consume goods produced by firms

Pay taxes

Make deposits and receive interest incomeSupply home goods to NG

Make import and

export transactions with foreign firms and

consumers

Lend to NG

Lend working capital to firms

Providespublic goods

Sets policy rate and provides

liquidity to banks

Send reserves to

CB

Service debts to IFCs

Buys home goods from

firms

International Financial Centers

Lend to banks with risk premium

Supply consumption and investment goods 4

Risks confronting each sectorRisks confronting each sector

Banks

National Government

Households

Firms:• Local producers• Importers• Exporters

Central Bank

International Financial Centers Foreigners:

Firms and Consumers

Supply labor to firms and consume goods produced by firms

Supply consumption and investment goods (both home goods and imports) 5

Pay taxes

Make deposits and receive interest incomeSupply home goods to NG

Make import and

export transactions with foreign firms and

consumers

Lend to NG

Lend working capital to firms

Providespublic goods

Sets policy rate and provides

liquidity to banks

Send reserves to

CB

Service debts to IFCs

Lend to banks with risk premium

Buys home goods from

firms

Surprise policy change

World demand

Fiscal slippage

Increase consumption over savings

• Waves of optimism and pessimism

• Foreign interest rate changes

• Productivity shock• Terms of trade shock• Monopolistic markup

pricing in home goods

• Risk averse lending• High costs of

intermediation

6

BackgroundBackground

• Quarterly data for 16 observable variables for the inflation targeting period. – the choice of 2002 as the beginning period has an added benefit to the calibration exercise because it marks the change in monetary policy framework

• Estimation procedure:– Calibration : steady state parameters were kept at their calibrated values.

– Bayesian method : applied on parameters that do not affect the steady state such as the autoregressive and exogenous shock parameters.

7

Optimization Problem for HouseholdsOptimization Problem for Households

;11

)/~(),/~(

11

ϖγ

σβ

ϖσ

+−

−=

+−ttt

ttttLHC

LHCUMaximize

habit stock

[ ]ηηη µµ1

1)1(~ −−−

− −+= ttt GCC

ρ1

~−

=t

CHt

Government consumption is included

Subject to two constraints,

xt

xt

xt IKK +−= −11 )1( δ

(1) =+Π+++ −−− 111)1( tktttdttt KRMRLW Sources of income 2

2(

)1( ⎟⎟⎠

⎞⎜⎜⎝

⎛ −+++++

t

ssf

tft

xt

fttttctt K

KIPIPLWMCP

δφττ

equal

Uses of income

Adjustment cost in investment

(2)

Optimization Problem for HouseholdsOptimization Problem for Households

Consumption at time t is a CES bundle of both domestically‐produced and imported consumption goods

11/1

1

1/1

1

1

1

1

1

11

1

1 )()()()1(−−−

⎥⎥⎦

⎤

⎢⎢⎣

⎡−=

θθ

θθ

θθθ

θ λλ ft

dtt CCC

λ1 = share of imports in the consumption basket (1‐λ1) = share of domestically‐produced goods in the consumption basketθ = price elasticity of demand for each consumption component

dtC

ftC

111

2

11

2

2

2

2

2

22

2

2 )()()1(−−−

⎥⎥⎦

⎤

⎢⎢⎣

⎡+−=

θθ

θθ

θθ

θθ λλ x

tht

d CCCt

Domestically‐produced goods consist of goods for home consumption and exports

htC

xtC

8

9

Optimization Problem for FirmsOptimization Problem for Firms

Three types of firms: ft

ht

xtt YYYY ++=

• Export firms: [ ] 111

1

11 )())(1( κκκ αα−−− +−= x

txt

xxt

xt KLAZY

• Home goods firms: 21)( α−= ht

ht

ht LZY

xfft ICY +=• Importing firms:

10

Optimization Problem for FirmsOptimization Problem for Firms

Firms face liquidity constraint and borrow a fraction of the wage bill from banks at prevailing loan rate l

tR

xtt

xt LWN 1φ=• Export firms:

xt

kt

xtt

lt

xt

xt

xt YPLWRYP −+−=Π )1( 1φ

Revenues Costs

htt

ht LWN 2φ=• Home goods firms:

xtt

lt

ht

ht

ht LWRYP )1( 2φ+−=Π

Revenues Costs

)*( *3

ft

ftt

ft YPSN φ=• Importing firms:

[ ][ ] f

ttlt

f

ftt

lt

f

PSRP

PSRP*

3

*33

1

))(1()1(

φ

φφ

+=

−++= Importers do not produce any good but incur cost of bringing imported goods into the domestic market

11

PricingPricing

**

2*12

* )1(tp

xt

xt

xt PPP ερρ +−+= −World export price:World export price:

*xtt

x PSP ∗=Export price in domestic currency:Export price in domestic currency:

*3 ]1[ f

ttlt

ft PSRP φ+=Import price in domestic currency:Import price in domestic currency:

Price of domestically produced goods:Price of domestically produced goods:

[ ] 221

2 11

21

2 )())(1( θθ θ

λλ −− −

+−= xt

ht

d PPPt

Price of export goods

Price of home‐produced goods

12

CalvoCalvo Pricing for Home GoodsPricing for Home Goods

• Sticky monopolistically competitive firms in the home‐goods market. The firms consist of backward‐looking price setters

and forward‐looking price setters

bhtP ,

otP

[ ] ζζζ ξξ −−− −+= 11

11, ))(1()( ot

bht

ht PPP

• Overall price index is a CES function of the price indices of domestic consumption goods and foreign goods.

[ ] 111

11

11

11 )())(1( θθθ λλ −−− +−= ft

dtt PPP

13

Optimization Problem for BanksOptimization Problem for Banks

• Banks earn by lending to government and firms, realizing FX gains from foreign bond holdings and taking in deposits from households.

• Banks incur costs by paying out interest to deposits, holding reservesagainst deposit, investing in government bonds, taking out new loans,setting aside capital against losses from private lending and realizingvaluation losses from foreign bond holdings.

tf

ttttlgttb

B MBSNRBRt

+++++=Π −−−− 11,11, )1()1(

tf

ttt

ttltgtttdttd

SBR

NRNBMRMR

11*

1

11,511,411,

)1(

)1(

−−−

−−−−−−

Φ++−

−−−−+− φφ

Earnings

Costs

14

Fiscal PolicyFiscal Policy

Government spending is considered procyclical, exhibits smoothing and has stochastic component.

TGTGYGtGGt YYGGG ,11 )()1()1( ερρρρ +−−++−= −−

Tax revenues are sourced from labor and consumption.

ttCttt CPLWTAX ττ +=

Fiscal balance determines the fiscal borrowing requirement.

tth

tgtt

gt TAXGPBRB −++= −− 11)1(

15

Monetary PolicyMonetary Policy

The monetary policy rule is a function of lagged policy rate, steady state policy rate, inflation gap and output gap:

ptRt

tpp

t

tpppsspptppt

YY

PP

RRR

ερρ

πρρρρ

+⎟⎟⎠

⎞⎜⎜⎝

⎛−−+

⎟⎟⎠

⎞⎜⎜⎝

⎛−−−+−+=

+

+−

1)1(

1)1()1(

131

*121111

The policy rate then feeds into bond rate, lending rate, and deposit rate

16

Monetary PolicyMonetary Policy

Once the policy rate adjustment by the central bank gets transmitted to the market interest rates, the CB provides liquidity support to the banking system.

tf

tttbt

ttltltf

ttf

t

ttdtdttt

SBBRM

NRRSBR

MRRBNLIQ

−+−−

−+−Φ+++

−+++=

−−

−−−−−−−

−−−

11,

11,51,1111

11,41,

)1(

)1()1(

)1(

φ

φ

Reserves against deposit (φ4) and capital‐asset ratio (φ5)

17

Risk Premium and Foreign Debt AccumulationRisk Premium and Foreign Debt Accumulation

The accumulation of foreign debt is determined by the difference between existing foreign debt stock and net exports.

xt

xt

xt

ft

ft

tf

ttf

tf

tt

CPICP

SBRBS

−++

Φ++= −−−−

)(

)1( 1111 Foreign debt stock

Net Exports

Foreign interest rate follows an autoregressive process.

ftr

ff

ftf

ft RRR ,1 )1( ερρ +−+= −

The model is closed by the risk premium (Φ) embedded in accumulation of foreign debt.

18

Solution of Steady StateSolution of Steady State

• The system is highly non‐linear and non‐recursive; Hence, there is no analytical solution for the steady state.

• Used computational algorithms to solve for steady state values based on calibration of structural parameters of the model.

– Hybrid approach to mitigate the problem of “local minimum” trap

• Local gradient‐based algorithm, simulated annealing, and genetic algorithm.

CE Conditions: CE Conditions: CE CE Conditions.pdfConditions.pdf

19

Convergence and Relative Stability of Parameter MomentsConvergence and Relative Stability of Parameter Moments‘‘Multivariate DiagnosticMultivariate Diagnostic’’

Convergence and Relative Stability of Parameter MomentsConvergence and Relative Stability of Parameter Moments‘‘UnivariateUnivariate DiagnosticDiagnostic’’

20

21

II. Policy SimulationsII. Policy Simulations

(the usual disclaimer applies)(the usual disclaimer applies)

Monetary Stimulus Equivalent to 100 bpsMonetary Stimulus Equivalent to 100 bps

All results are expressed in terms of percentage deviation from All results are expressed in terms of percentage deviation from steady state values. steady state values.

22

23

Comparative simulation results Comparative simulation results 1/1/

from various Philippine models from various Philippine models

Model Impact on Inflation Impact on Domestic Demand

BSP‐DSGE 0.17 0.12

BSP‐MEM 2/ 0.06 0.01

NEDA‐QMM 3/ 0.05 0.01

1/ Impact on the first year of 100 bps reduction in policy rate.2/ BSP‐MEM sensitivity table, as of 31 August 2010.3/ The NEDA Quarterly Macroeconometric Model of the Philippines: Final Report, May 2004.

Fiscal Stimulus Equivalent to 1% of GDPFiscal Stimulus Equivalent to 1% of GDP

All results are expressed in terms of percentage deviation from steady state values .

24

25

Future DirectionsFuture Directions

• Further parameter re‐calibrations to test the robustness of the model.

• Introduce matching frictions and nominal wage rigidities would enhance our study of the transmission mechanism and the implications of wage dynamics on inflation.

• Include more market‐based financial stress indicator in the model.

• Finetune inflation forecasts generated by the model.

Dynamic Stochastic General Equilibrium Model Dynamic Stochastic General Equilibrium Model for the Philippine Economyfor the Philippine Economy

Center for Monetary and Financial Policy Center for Monetary and Financial Policy ‐‐ Bangko Sentral ng PilipinasBangko Sentral ng Pilipinas2010 Central Bank Macroeconomic Modeling Workshop2010 Central Bank Macroeconomic Modeling Workshop

The Peninsula Manila, 19The Peninsula Manila, 19‐‐20 October 201020 October 2010

Authors: Prof. Paul McNelis (Fordham University), Dr. Francisco G. Dakila , Jr., Eloisa T. Glindro and Ferdinand S. Co. The views expressed herein do not represent the views and opinions of the Bangko Sentral ng Pilipinas (BSP) nor the Fordham University.