Dream Yuga, entry of HMSI in entry level segment of bikes in India

-

Upload

benu-singhal -

Category

Automotive

-

view

1.827 -

download

0

description

Transcript of Dream Yuga, entry of HMSI in entry level segment of bikes in India

|

project study of distribution channel for honda’s upcoming low cost bike in india

ABSTRACT:

Successful value creation needs successful value delivery. Honda Motorcycle & Scooter India (HMSI) has planned to open 200 outlets a year for at least next 10 year. These plans are not ambitious; in fact, it’s a need of the hour to support India’s burgeoning demand for 2-Wheelers (2-W). Some highlights of market leaders of various industries:

1. 2 Wheeler Industry: Hero MotoCorp has more 5000+ touch points, covering sales, services and spares.

2. Passenger Car Industry: Maruti Suzuki India Ltd. is leading the market with its 1000+ sales outlets and 2946 service stations.

3. Banking Industry: One of the oldest banks of India, SBI is serving millions of Indians with its 13000 outlets.

4. Insurance Industry: With the network of its 1337064 agents, LIC is having near monopoly status in India.

5. Retail in Groceries: Your nearest Kiryana Store, serving you since ages. Its arm’s stretch distance from you, makes it indispensable for you.

Superior distribution channels can take the company to the market leadership position. Failure to coordinates the value network properly can have dire consequences.

2 | P a g e

INDEX

S.no. Content Page no1. Introduction 41A. Distribution channels 51B. The most anticipated product from HMSI 72 Factors determining the Distribution Channel 82A Indian 2-wheeler industry 102B Why the Hero MotoCorp is consistent market leader 122C Rural market 132D Objective of HMSI 162E Different segment of motorcycle 173 Current & Future expansion of Channels by

HMSI18

3A Current distribution channel 193B Proposed channel expansion by company 194. Team Inputs 204A Proposed channel for low cost bike by the team 214B State wise analysis of outlet per person 225 Bibliography 23

3 | P a g e

4 | P a g e

1. INTRODUCTION

1A. DISTRIBUTION CHANNELS:

Most producers do not sell their goods directly to the final users; between them stands a set of intermediaries performing variety of functions. These intermediaries constitute a distribution channel (also called marketing channels).

The channel chosen affect all other marketing decisions. The company’s pricing depends on whether it uses mass merchandisers or high-quality boutiques. The firm’s sales force and advertising decisions depend on how much training and motivation dealers need. In addition, channel decisions involve relatively long-term commitments to other firm as well as set of policies and procedures. When an automaker signs up independent dealers to sell it automobiles, the automaker cannot buy them out the next day and replace them with company-owned outlets.

1. In managing its intermediaries, the firm must decide how much effort to devote to push versus pull marketing.

Push Strategy: involves the manufacturer using its sales force and trade promotion money to induce intermediaries to carry, promote, and sell the product to end users. Push strategy is appropriate where there is low brand loyalty in a category, brand choice is made in the store, the product is an impulse item, and product benefits are well understood.

Pull Strategy: involves the manufacturer using advertising and promotion to persuade consumers to ask intermediaries for the product, thus inducing the intermediaries to order it. Pull strategy is appropriate when there is high brand loyalty and high involvement in the category, when people perceive differences between brands, and when people choose the brand before they go to the store. Top marketing companies such as Nike, Intel and Coca-cola skillfully employ both push and pull strategies.

2. Channel Levels:The producer and the final customer are part of every channel. There are broadly three types of channel.

0-level: Manufacturer-Consumer 1-level: Manufacturer-Retailer-Consumer 2-level: Manufacturer-Wholesaler-Retailer-Consumer

3. Number of Intermediaries: Exclusive Distribution: means severely limiting the number of intermediaries. It

is used when the producer wants to maintain control over the service level and output offered by the resellers. By granting exclusive distribution, the producer hopes to maintain more dedicated and knowledgeable selling. Used in distribution of new automobiles, some major appliances, some women’s apparel brands, etc.

5 | P a g e

Selective Distribution: involves the use of more than a few but less than all the intermediaries who are willing to carry a particular product. It is used by established companies and by new companies seeking distributors.

Intensive Distribution: consists of the manufacturer placing the goods or services in as many outlets as possible. This strategy is generally used for tobacco products, soap, snack foods, etc.

Manufacturers are constantly tempted to move from exclusive or selective distribution to more intensive distribution to increase coverage and sales. This strategy may help in the short term, but often hurts long term performance. Intensive distribution increases product and service availability but may also result in retailers competing aggressively. If price war ensues, retailer profitability may also decline, potentially dampening retailer’s interest in supporting the product. It may also harm brand equity.

6 | P a g e

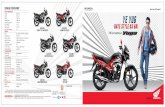

1B. THE MOST ANTICIPATED PRODUCT FROM HMSI:

Hero MotoCorp, the new avatar of Hero Honda, which accounts for 46% of all bikes sold in India, dominates the market with models like the 100cc CD Dawn, Splendor, Passion and the 125cc Super Splendor. Honda Motorcycle & Scooter India Pvt. Ltd. (HMSI) was restricted to enter this segment, as per their agreement with the previous partners- Hero Honda India Ltd. Now, after their part, HMSI is free to enter this segment. According to the ‘The Economic Times’, the company hopes to introduce a low-cost bike, possibly the cheapest, in India — currently being manufactured in China. Tatsuhiro Oyama, senior managing officer & director motorcycle operations at the Japanese giant, told ET: "We are working out plans to gain leadership in the Indian two-wheeler market." The Japanese giant’s Indian subsidiary hopes to sell these 125 cc made-in-China bikes — currently sold in some African markets — at around Rs 30,000 (ex-showroom Delhi), almost Rs 4,000 lower than market leader Hero’s CD Dawn and about Rs 18,000 cheaper than the Super Splendor, The Economic Times said. "Going forward we are conducting a feasibility study for our low-cost bike that is currently made in China and could be manufactured in India," added Oyama.

To add to its armor, on 5th January’12, HMSI unveiled the ‘Dream Yuga’, its first bike aimed at the highly lucrative mass market at the Auto Expo in Delhi. HMSI will be launching “Dream Yuga”, the mass segment bike, in mid 2012.

Honda Dream Yuga is a mass production commuter bike which will hit the market by 2012 May. This bike has a 110cc engine which produces 9 BHP @ 7500 RPM. 72 KMPL mileage is something which is worth noticing. Expected price of the bike is between Rs. 40000 & Rs. 45000/-.

7 | P a g e

8 | P a g e

2. FACTORS DETERMINING THE DISTRIBUTION CHANNEL

FACTORS DETERMINING THE DISTRIBUTION CHANNEL OF HMSI’s

LOW COST MOTORCYCLE:

1. Indian 2 Wheeler Industry2. Learning from Market Leader 3. Rural Market4. HMSI Objective5. Segment of the Motorcycle

9 | P a g e

2A. INDIAN TWO-WHEELER (2W) INDUSTRY

The 2W consists of:1. Motorcycle2. Scooters3. Mopeds

19961997

19981999

20002001

20022003

20042005

20062007

20082009

20100%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

MopedsScooterMotorcycle

The distribution of the chart shows how the preference of an Indian customer has changed over the period of time. There was a time when 70% of the 2W sales come from mopeds and scooter. Today, motorcycle segment alone has 82% market share in 2W segment. One cannot guess what is there in future; the market dynamics keep on changing. Once exited from scooter market, Rahul Bajaj, chairman of Bajaj Auto, has expressed intentions to re-enter in it. In 2008, Kinetic Motor, which was pre-dominantly present in scooter market, was sold out to Mahindra 2wheelers. In December 2010, Hero Honda filed for divorced, ending its 27 year long relationship with Honda. In November 2011, HMSI overtook TVS on monthly sales basis, and brought more fire in the playground for Bajaj Auto. This is the state of Indian 2W industry, ever changing, ever challenging.

The Indian two-wheeler industry has shown a robust volume growth over the last two-years, having grown by 25% in 2009-10 and 27% in 2010-111 to reach 1,33,29,895 units. The 2W industry growth over the last two years has been supported strongly by various underlying factors including India’s rising per capita GDP, increasing rural demand, growing urbanization, swelling replacement demand, increasing proportion of cash sales and the less measurable metric of improved consumer sentiment.

10 | P a g e

Segmental Market Share

Company wise breakup of sales (1,33,29,895 units) for the wear 2010-11:

These 4 companies held 93% combine market share of 2-wheeler industry in India.

ICRA expects the 2W industry to report a volume CAGR of 10-12% over the next five years to reach a size of 21-23 million units by 2015-16 as it views the fundamental growth drivers - comprising of expected steady GDP growth, moderate 2W penetration levels, favorable demographic profile, under developed public transport system and utility quotient of a 2W - to be intact. Additionally, the entry of new players in the industry, multitude of new model/ variant launches, growing distribution reach, cheaper ownership costs on a relative basis are expected to be some of the other prime movers for industry growth over the medium term. In ICRA’s view, while the trend in rising commodity prices, hardening interest rates and increasing fuel costs may lead to some moderation in industry growth over the short term, the growth over the medium to long term is expected to remain in double digits. Hence all 2W majors are busy in ramping up their capacity.After so many Joint-Ventures, Mergers & Acquisitions and then Divorces, one thing is clear- making motorcycle is not a rocket science. Ashok Taneja, Managing Director, Shriram Rings and Pistons, a long-time vendor to Hero, says "Technology is not that much of a factor in motorcycle sales any longer”. Hero, after their divorce with Honda, is not taking chances and is in advanced stages of talks for technology with a "group of Japanese companies”. If you have the money, you can buy it off the shelf in Japan, South Korea, and elsewhere. Kinetic, after splitting with Honda, tied up with Hyosung of South Korea and rolled out motorcycles, including a high-end cruiser, the Aquila, priced at Rs 1.5 lakh. The same experts would also tell you that success in 2W is not about technology alone, sales and distribution are vital.

11 | P a g e

Hero Moto Corp41%

Bajaj Auto25%

TVS Motor Company

15%

HMSI12%

REST7%

2B. WHY THE HERO MOTOCORP IS CONSISTENTMARKET LEADER:

Hero sold over 5 million units in fiscal 2010-11. This was the first time when they crossed 5 million mark in single year. It was its superior customer reach which contributed the most in achieving this mammoth sales. Currently it has more than 800 dealers and 5000 touch points, which includes sales, service & spares. 50% of the total sale had come from Rural Market. In Rural Markets, Hero is far more stronger than its any of its competitor.

Hero’s strategy: Every village, every household"Small towns, villages… we are everywhere," says Anil Dua, Senior Vice President, Marketing and Sales, Hero Moto Corp.In villages where Hero does not have direct presence, it has authorised representatives of dealers - Dua calls them opinion makers - who travel from place to place extolling the virtues of its motorcycles. "Our aim is Har Gaon, Har Aangan (every village, every household)," he says.Hero dealers even send mechanics every month to repair and service motorcycles in far-flung villages. Vivek Goyal, owner of Autoneeds, a Hero dealer for 22 years with outlets in Delhi's middle-class borough of Patparganj and in Gurgaon, says word of mouth is always positive for Hero. "If we can sell a bike to one major household in a village, we can crack the village," he says.

12 | P a g e

2C. RURAL MARKET:

The future of growth in 2W lies in rural market. Currently half of the total sales of Hero are rural. Motorcycle sales in the world’s second-most populous nation will grow about three times to about 30 million in 2020 according to Ernst & Young LLP. Rural sales will increase to 45 percent of the total in that period from the current 40 percent, as distribution expands and incomes rise in those areas.“As per capita incomes rise in villages, the first aspiration is to buy a personal mobility solution,” said Rakesh Batra, who leads the automobile practice at Ernst & Young in New Delhi. “In villages, there is no public transportation and the alternative is to walk, ride on the back of a tractor or a bicycle.”

Literature Review of the E&Y report on “Competing for Market Share in Rural India”:A key contributor to India’s strength has been the significant growth in consumption from its rural market. Estimates put the Indian rural market close to 45% of the total Indian GDP.

1. In demographic terms, rural India is more advantageously placed, with the number of working population there outnumbering the total urban population.

Age group Population (rural) mn

Greater than 70 22

61 to 70 33

51 to 60 56

41 to 50 77

31 to 40 107

21 to 30 127

Less than 20 311

2. A clear demonstration of the importance of rural India is shown by looking at the number of organizations which derive a significant proportion of their overall sales from outside of the country’s largest towns and cities :

Company Category % sales from rural marketsHindustan Unilever Household Products 45%Hero Honda Two wheelers 50%Dabur Personal Products 40%Dish TV Media 33%TVS Two wheelers 50%

3. 72% of the total population lives in 6,00,000 villages. Yet more than half of the population and approximately 60% of the total rural wealth is concentrated in just 17% of these same villages. Given these characteristics, deploying an optimal distribution structure for such a market becomes a challenge for any company, especially those which have been geared toward managing a distribution chain predominantly in urban markets. For instance, decisions on distribution networks have to take into account both the size of the potential market as well as the cost required to service the dispersed demand that rural India represents.

4. How companies can improve their performance in Rural Markets:

13 | P a g e

i. Network Strategy:In order to improve strategic deployment, a detailed review is required of the existing network. So that high performing dealers could be allocated attractive markets.

ii. Channel management, working on the answers of the following: What indicators of the channel partner’s funding system should the

organization team be actively tracking? How should dealer’s fund in market/stock be tracked? Should the network be self-funded, funded by distributor/stockist or

provided channel funding/CC? What should be liability borne by company in each case? What rate of

interest should channel partner be charged? How should dealer’s funds be distributed among sales/service/spares?

iii. Sales force effectiveness :Analysis of customer buying behavior revealed that customer conversion dramatically drops when the salesman has not met the customer during the sales process. For example, conversion ratio was 36% when a company salesman met the customer, irrespective of whether the customer visited the dealership or not. Conversion ratios went up to 48% when the customer visited the dealership and was visited by the salesman. However, when the salesman did not contact the customer during the sales process, the conversion was only 5%, irrespective of the customer having visited the dealership.

Conclusion:While organizations spend significant amounts of time and effort in developing their brand equity, in rural India, given the nature of the market, it is critical for organizations to focus equally, if not more so, on their distribution equity. We believe this will yield greater returns to organizations planning to succeed in rural markets in India.

2D. HONDA MOTORCYCLE & SCOOTER INDIA PVT LTD. :

14 | P a g e

The Company which was founded in 1999, today is the 4th largest manufacture of 2W in India. In November 2011, HMSI overtook TVS motor company in 2-wheeler segment on monthly basis, while former sold 1,99,154 units later could sold only 1,72,829 units. Still on 10 months cumulative basis, TVS is ahead of HMSI, where former had sold 18,09,105 units and later had sold only 16,80,405.

HMSI owns 10 brands of Motorcycle and 3 brands of Scooters. It has 45%

market share in Scooters segment.

2001-02

2002-03

2003-04

2004-05

2005-06

2006-07

2007-08

2008-09

2009-10

2010-11

2011-12 (10 months

)

0

2

4

6

8

10

12

14

16

18

0.551.6

3.414

5.512 6.0067.15299999999998

9.911

12.713

16.56 16.8Growth Trajectory

Sales (in lac units)

OBJECTIVE OF HMSI:

15 | P a g e

In 10 years down the line HMSI wants to become market leader in 2W segment. Honda aims sell 10 million 2 wheeler by 2020 and have 30% market share, which will make it No.1 in India.

Meeting the Objective:

Along with cost-competitive models, Honda is also busy ramping up capacity to match that of the Munjals-owned Hero MotoCorp. Oyama told ET the company plans to set up a fourth plant in India with an initial capacity of 1.2 million units, entailing an investment of Rs 1,000 crore. The fourth plant will take its cumulative capacity to 5.2 million, not far behind the Munjals, whose current capacity stands at 6.15 million per year.

"We are aiming to sell 10 million two-wheelers in India by 2020 and target a 30% market share to achieve leadership in India. We are market leader in scooters and now the focus is to replicate the same in bikes," said Oyama.

First plant Second plant Third plantTotal capacity

LocationIMT* Manesar,

HaryanaTapukara Industrial Area, Rajasthan

Narsapuram Area, Karnataka

As of May 2011 1.6M units - - 1.6M unitsJul-11 1.6M units 0.6M units - 2.2M unitsMar-12 1.6M units 1.2M units - 2.8M units

1st half of 2013 1.6M units 1.2M units 1.2M units 4.0M units

Starting from 2013, HMSI wants to build 1 plant a year till 2017, meaning 5 plants in next 5 years.

2E. DIFFERENT SEGMENT OF MOTORCYCLE

16 | P a g e

HMSI wants to replicate the same story of scooters in motorcycle segment.

The motorcycle segment can be further divided into 3 categories:

1. Entry level; with a price (ex-showroom) tag less than Rs.40000/- 2. Executive; with a price (ex-showroom) range Rs.40000/- to Rs.50000/-3. Premium; with a price (ex-showroom) over Rs.50000/-

The Executive segment’s share in the domestic motorcycles segment has risen from 48% in 2005-06 to 65% in 2010-11. Being the largest volume generator, the Executive segment has also seen the largest number of new model launches and portfolio refurbishments by all players and involves the highest product and brand clutter. Although the Executive segment has high competitive intensity reflected in the presence of a large number of brands, Hero Honda remains the clear market leader on the strength of its Splendor and Passion series of bikes that have maintained a dominant position over the years.

Sales of 100-cc motorcycles account for about 50 percent of total motorbike sales of 10.9 million in India, according to Mr. Rattan, VP at HMSI. About 91 percent of the 5.5 million motorcycles that Hero, the maker of over half the motorcycles in India, sold last year were below 125-cc models, according to data from the Society of Indian Automobile Manufacturers.

17 | P a g e

18 | P a g e

3. CURRENT & FUTURE EXPANSION OF CHANNELS BY HMSI

3A. CURRENT DISTRIBUTION CHANNEL:

Currently HMSI is managing 1577 touch points across India. It has an army of 452 dealers, where urban-rural breakup is 254 & 198 respectively.

No. of Sales Outlets are = 761

No. of Service Outlets are = 816

Competition Mapping:

Company Capacity Touch Points Dealers1. Hero Moto Corp 6.1 million 5000+ 800+2. Bajaj Auto 5 million 3600+ 5893. HMSI 2.8 million 1577 450

3B. PROPOSED CHANNEL EXPANSION BY COMPANY:

HMSI aims to have at least one sales outlet for every Hero Moto Corp sales outlet. To live the dream of market leader, it will be adding 200 outlets every year for next 10 year.

19 | P a g e

20 | P a g e

4. TEAM INPUTS

4A. PROPOSED CHANNEL FOR LOW COST BIKE BY THE TEAM:

1. HMSI should use its own distribution channels to make available this low-cost bike.2. Due to high weightage of Rural Market in total sales, special emphasis need to be given

for rural channels. SBI has 13000 outlets and PNB has 6249 outlets (CBS branches) across the India. The company should tie-up with these banks to make these outlets the point of sale for low-cost bike.Eg: UP has 1288 CBS branches of PNB. These touch points can be used to sale low-cost bikes.

21 | P a g e

4B. STATE WISE ANALYSIS OF OUTLET PER PERSON

Rank State/UT Population%age of Total

Sales Outlets

Ratio(Avg=858)

Index(Base =TN)

Deficiency

1 Uttar Pradesh 199,581,477 16.49170% 73 443 55 60

2 Maharashtra 112,372,972 9.28554% 80 862 107

3 Bihar 103,804,637 8.57752% 17 198 25 52

4 West Bengal 91,347,736 7.54819% 22 291 36 39

5 Andhra Pradesh 84,665,533 6.99603% 62 886 110

6 Madhya Pradesh 72,597,565 5.99884% 43 717 89 5

7 Tamil Nadu 72,138,958 5.96094% 48 805 100

8 Rajasthan 68,621,012 5.67025% 40 705 88 6

9 Karnataka 61,130,704 5.05132% 47 930 116

10 Gujarat 60,383,628 4.98958% 80 1603 199

11 Orissa 41,947,358 3.46617% 23 664 82 5

12 Kerala 33,387,677 2.75887% 49 1776 221

13 Jharkhand 32,966,238 2.72405% 11 404 50 11

14 Assam 31,169,272 2.57556% 11 427 53 10

15 Punjab 27,704,236 2.28924% 49 2140 266

16 Haryana 25,753,081 2.12801% 30 1410 175

17 Chhattisgarh 25,540,196 2.11042% 17 806 100

18 Jammu and Kashmir 12,548,926 1.03694% 4 386 48 4

19 Uttarakhand 10,116,752 0.83596% 11 1316 163

20 Himachal Pradesh 6,856,509 0.56656% 2 353 44 3

21 Tripura 3,671,032 0.30334% 1 330 41 1

22 Meghalaya 2,964,007 0.24492% 0 0 2

23 Manipur 2,721,756 0.22490% 0 0 2

24 Nagaland 1,980,602 0.16366% 0 0 1

25 Goa 1,457,723 0.12045% 7 5811 722

26 Arunachal Pradesh 1,382,611 0.11425% 1 875 109

27 Mizoram 1,091,014 0.09015% 1 1109 138

28 Sikkim 607,688 0.05021% 0 0 1

NCT Delhi 16,753,235 1.38434% 21 1517 188

UT1 Pondicherry 1,244,464 0.10283% 1 972 121

UT2 Chandigarh 1,054,686 0.08715% 2 2295 285

UT3Andaman and Nicobar Islands 379,944 0.03140% 0 0 1

UT4 Dadra and Nagar Haveli 342,853 0.02833% 0 0 1

UT5 Daman and Diu 242,911 0.02007% 0 0 1

UT6 Lakshadweep 64,429 0.00532% 0 0 1

Total India 1,210,193,422 100%

Taking Tamil Nadu as a base, red colored states are the states which should be given preference for consideration for channel enhancement and development.

22 | P a g e

BIBLIOGRAPHY

1. ‘Part 6: Delivering Value’, Marketing Management by Philip Kotler & Kevin Lane Keller.

2. Size, Growth Rate & Distribution of Population by Census India.Link:http://censusindia.gov.in/2011-prov-results/data_files/india/Final%20PPT%202011_chapter3.pdf

3. Two-Wheeler Industry: Growth Drivers Intact by ICRA Rating Services, June 2011.Link: http://www.icra.in/Files/ticker/Two-Wheeler%20Industry%20Note,%20June%202011.pdf

4. Doing Business in India, E&Y Report 2011Link:http://www.ey.com/Publication/vwLUAssets/Doing_business_in_India_2011/$FILE/Doing_business_in_India_2011.pdf

5. Case Study on Competing for Market Share in Rural India by E&Y.Link:http://performance.ey.com/wp-content/uploads/2011/05/Competing-for-market-share-in-rural-India.pdf

6. HMSI website: http://www.honda2wheelersindia.com/

7. Hero MotoCorp’s Annual ReportsLink: http://heromotocorp.com/investors/financials

8. Bajaj Auto’s Annual ReportsLink: http://www.bajajauto.com/bajaj_investor_annual_report.asp

9. The Economic TimesLink: http://economictimes.indiatimes.com/

10. The Financial ExpressLink: http://www.financialexpress.com/

23 | P a g e