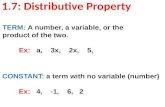

Distributive Ledger and the Credit Union Industry · Distributive Ledger and the Credit Union ......

Transcript of Distributive Ledger and the Credit Union Industry · Distributive Ledger and the Credit Union ......

Distributive Ledger and the Credit Union Industry PRESENTED BY JOHN BEST OF BEST INNOVATION GROUP

AND KIRK KORDELESKI CEO OF THE EDGE CONSULTING GROUP

5 Key Points about Distributed Ledger technology • 1. It is more than bitcoin.

• 2. A shared distributed ledger is a linked set of transaction records.

• 3. All transactions are independently verified by others and held on a distributed ledger.

• 4. Its value is in increased efficiency and safety.

• 5. “Smart contracts” concept will bring efficiencies and speed to lending and trading.

R3CEV LLC - http://r3cev.com/ • R3 (R3CEV LLC) is a distributed ledger technology company. It leads a consortium of 42 financial

companies in research and development of blockchain usage in the financial system.

• Barclays, BBVA, Commonwealth Bank of Australia, Credit Suisse, Goldman Sachs, J.P. Morgan,[7] Royal Bank of Scotland, State Street, UBS, Bank of America, BNY Mellon, Citi, Commerzbank, Deutsche Bank, HSBC, Mitsubishi UFJ Financial Group, Morgan Stanley, National Australia Bank, Royal Bank of Canada, Skandinaviska Enskilda Banken,[9] Société Générale, Toronto-Dominion Bank,] Mizuho Bank, Nordea, UniCredit. BNP Paribas, Wells Fargo, ING, Macquarie Group ,Canadian Imperial Bank of Commerce, BMO Financial Group, Danske Bank, Intesa Sanpaolo, Natixis, Nomura, Northern Trust, OP Financial Group, Banco Santander, Scotiabank, Sumitomo Mitsui Banking Corporation, U.S. Bancorp and Westpac Banking Corporation

• On March 3, 2016, R3 announced that it had completed a trial involving 40 banks held in the last two weeks of February, testing the use of blockchain solutions offered by Eris Industries, IBM, Intel and Chain to facilitate the trading of debt instruments. This was a follow-on to an 11-bank trial conducted earlier in January which used Ethereum hosted on Microsoft Azure.

Hyperledger - https://www.hyperledger.org/ • Seeking to emulate major, successful open-source projects outside the distributed ledger

space, the Hyperledger Project is an ambitious attempt to unite key stakeholders seeking to leverage the emerging technology.

• Announced in December, the project is being led by the Linux Foundation, the trade

association that oversees the development of the open-source Linux operating system. Initially called Open Ledger Project and later renamed, the effort includes the support of some 30 firms, including Cisco, Intel, JP Morgan, the London Stock Exchange and Wells Fargo.

Distributed Ledger Is NOT Bitcoin It’s the elegant underlying technology that enables BITCOIN.

It is also known as ◦ Shared Ledger

◦ Distributed Ledger

CU A

CU B

1. Credit Union A sends money to Credit Union B

2. Transaction is converted to a encrypted block

3. The Ledger is broadcast to every part of the network

Validator Nodes

Validator Nodes

4. Each Node approves the transaction – Consensus is achieved

5. The ledger is then added to the chain which provides a indelible record of the event

6. Credit Union B receives the transaction

How the Ledgers are chained up • Each Ledger is tied to the previous Ledger via a hash (a unique ID)

• The next Ledger references the previous Ledger hash (unique id)

• Each Ledger could contain 1 or 1000’s of transactions , or any other kind of data

• Entities that need the transaction information are identified through cryptography o Public Key’s and Private Key’s for entities

Permissioned versus Permissionless 5 questions to help you determine which is which

5 QUESTIONS

1. Who maintains it?

PERMISSIONED

Anyone that wants to

PERMISSIONLESS

A group of permissioned

2. How are they incentivized to do it right

3. Who produces the underlying data or can send transactions ?

4. Who has access to that data?

5. Where is it stored?

Reputational Risk

Permissioned and vetted entities Credit unions and third party providers

Small group of trusted entities and data owners

Servers on a known network

Rewards, carrot and stick, cash

Anyone that wants to

Anyone , transparency

Massively distributed

Bitcoin

Ethereum

Permissionless Permissioned

Public

Private

Validation A

cce

ss

N/A

Sovrin

Corda (R3)

Algorithmic

(code)

Permissionless Permissioned

Public

Private

Validation A

cce

ss

N/A

Algorithmic +

Human

Human

(agreements)

Example: Bitcoin/Ethereum Example: Sovrin

Example: Corda

Ethereum/DAO hack • Hacker exploited open source code

• Network is the Alt-coin network also known as Ethereum

• PUBLIC PERMISSIONED NETWORK

• 27 day wait to get the money

• Money hasn’t changed hands yet.

Why are Distributed Ledgers Valuable? • Stored data is guaranteed availability

• You can run applications on them and be guaranteed an extremely high uptime

• You can run applications on them, and be guaranteed an extremely high uptime going very far into the future

• You can run applications on them, and convince your users that the application’s logic is honest and is doing what you are advertising that it does

• You can run applications on them, and those applications can talk to each other with 100% reliability – even if the underlying platform has only 99.999% reliability

• You can build applications that very easily and efficiently take advantage of the data produced by other applications (eg. combining payments and reputation systems is perhaps the largest gain here)

Security key points • Data encrypted by the most current encryption standards

• Data is broken up and spread across many nodes also encrypted

• Actual transaction data is encrypted by sender for reciever

Things NOT to use a Distributed Ledger for • Storing Pictures or any kind of large data

• Internal workflow projects such as collections

• Running a home banking system

• Analytics or Machine learning

Distributed ledger’s Potential – Financial • Smart Contracts o Indirect Lending

• Smart Asset o Titles

• Clearing and Settlement o Instant reconciliation o Its possible to have no more

holds

• Payments oME2B

• Digital Identities

• Member

• Contract

Signed

Member App

•Crypto Key

BC Client • Contract

• Key Match

Blockchain

• Contract Sense

• Response

Credit Union

• Member

• Contract

Update

Member App

• Smart Contract

Key Match

Ledger • Contract

Attributes

• Crypto Key

BC Client

• Contract Sense

• New Attributes

Credit Union

Blockchain’s Potential – Non Financial • Filament

o Internet of Things

• IBREA o Real Estate

• Genecoin o Genealogy

• Warranteer o Product Warranties

• UProov o Legal

• Ascribe o Art

• Tierion o Healthcare

• Provenance o Global Supply Chain

Introduction To The CU Ledger Initiative A CONCEPT TO CREATE A DISTRIBUTED LEDGER NETWORK FOR CREDIT UNIONS

The CULedger Industry Research Project Concept • Explore creating a specialized Credit Union

Ledger

• Goals

o Remove barriers for entry for all Credit Unions

o Normalize platform before we start using

o Create interoperability among all Credit unions regardless of

Cores

Third Party products

Platforms

o Reach adoption and implementation sooner rather than later

CU1 CU2

CU3

CU4

CU5

CU6

CU7

CU8 CU9

CU10

CU11

CU12

CU13

CU14

CU15

CU16

Private permissioned credit union Distributed Ledger network industry governance

CREDIT UNIONS CUSO’s LEAGUES TRUSTED PARTNERS

EVERYONE PARTICIPATES The more nodes we have the more secure and reliable the network will be.

CUSO1 CUSO2

CUSO3

CUSO4

www.CULedger.com Concept CU Ledger Website

Products ◦ HYPERLEDGER ◦ RIPPLE ◦ SOVRIN ◦ CORDA

CU/CUSO Participation ◦ Programmers ◦ Designers ◦ Product management ◦ Researchers ◦ Funding

CU portal for signing up and getting involved

Christopher Allen Christopher Allen is a veteran of the Crypto Wars with a wealth of knowledge about the history of internet cryptography, including both successes and paths not taken.

Co-authored the IETF TLS 1.0 standard and produced the first commercial SSL and TLS toolkits.

After Consensus merged with elliptic-curve pioneer Certicom, Christopher worked on early smart contract technology as the company’s CTO

Recently, Christopher was VP of Developer Relations for the secure smartphone company Silent Circle.

He has also taught at Blockchain University, advised multiple organizations on privacy and security, and produced a design workshop on the Web of Trust.

Now at Blockstream, he is Principal Architect, working especially on distributed ledger standards, decentralized identity and new engines of trust.

Distributed Ledger Gateway technology •Create new integration points for the Credit Union

•An entry and exit point for the ledger that is secure.

•Uses CUFX as a its standard

•Connects to various systems at the Credit Union to achieve integration

•Plug and play model

CU A

CU B

1. Credit Union A sends money to Credit Union B

2. Credit Union goes through CUFX Gateway to Distributed Ledger network

Gateway Node

3. Transaction is converted to a encrypted block

4. The ledger is broadcast to every part of the network

Validator Nodes

Validator Nodes

5. Each Node approves the transaction – Consensus is achieved

6. The ledger is then added to the chain which provides a indelible record of the event

7. The gateway is notified of a transaction for Credit Union B 8. Credit Union B receives the transaction

Turn your Credit Union into a Test “Node” • Installation is simple

• Step by step instructions provided

• No connectivity to your network or your host (at this time)

• Test node only

• Research on transactions will be conducted and shared with the initiative

• Node will be supported by initiative (No extra work after setup for the IT department)

• Can be Cloud based

Types of distributed network applications to review • Identity o Federated or universal Identity is rapidly emerging as one of the most important use cases for the

Distributed ledger networks. The initiative will review identity as a possible application of the Culedger network.

• Lending o The term, smart contract, refers to any contract capable of automatically enforcing itself, without a

third party between individual participants. Smart contracts are written as computer programs rather than in legal language on a printed document. This technology was largely unrealized due to the infrastructure needed to support it. Now that Blockchain and Crypto technology has evolved there has been great movement in this area. The initiative will review lending options and look into other contract based transactions

• Money Movement o Many of the initiatives such as ripple are designed to move funds between individuals and institutions.

The intitiative will explore options in this area as well.

Identity Key Points • There is a growing password crisis , this will get resolved somehow someday.

• Identity as a platform is a disruptor and it’s a hot topic in every industry

• All other identity plays have failed so far o Google, Microsoft, Facebook, LinkedIn and many more

• Banks have explored this but failed because they wouldn’t work together

• This opportunity is wide open – No one has solved this

• Even if we fail to grow this beyond the Credit Union industry it is still a win.

Pieces of your identity everywhere

Too many usernames, passwords

ID theft, fraud

New address? Expired/lost card? Manually update everywhere

“Honeypots” of valuable data

We’re tracked, our data harvested and sold without our consent

Billions of people “unbanked”

“Sovrin” identity is now possible

A presence you own and control

Other people/entities link to you

You become the source for: Proof of identity

Your correct info, data

Your preferences for anything

Your consent

Your rules

An “inversion of control”

Private, super-secure

Irrevocable

Credit Union’s as the “Authenticators” We checked your license

We checked OFAC

We checked your credit

We performed KYC

We looked in to your eyes in person most of the time

We can attest to each of these things on your behalf

How can we leverage this? WE ALREADY KNOW AND LOVE YOU ! YOU ARE OUR PRECIOUS MEMBER!

Digital Identity isn’t just for the members The Credit Union will have a digital identity It will pave the way for B2B payments

Create efficiencies with smart contracts and identity

Use it to login to your corporate network

Communicate between Credit Unions

Re-invent shared branching

Digital Universe

People

Assets

IoT

Entities

Assets

Why is this worth considering? • Normalizing our authentication methods will o Reduce integration cost for digital platforms

o Reduce call center calls regarding passwords

o Improve speed to market for all products

o Improve security drastically

o Increase interoperability between organizations

• If other industries like health care or the government adopt the platform Credit Unions will become the sponsors of this technology and leaders of the privacy movement o Credit Unions can sponsor members on to the network

o As a sponsor the Credit Union logo will remain as the top position of the member forever

• It has the potential to bring non-interest income to the industry o “Ledgerchange” could offset interchange compression