Discussion Session 2. Marginal Benefit The following table shows Abby’s willingness to pay for...

-

Upload

suzan-moody -

Category

Documents

-

view

213 -

download

0

Transcript of Discussion Session 2. Marginal Benefit The following table shows Abby’s willingness to pay for...

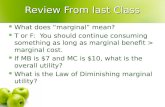

Discussion Session 2

Marginal Benefit

• The following table shows Abby’s willingness to pay for apples• Calculate her marginal benefit from apples.

Quantity of apples (pounds)

Willingness to pay Marginal Benefit

0 $01 $72 $133 $184 $225 $25

Marginal Benefit

• The following table shows Abby’s willingness to pay for apples• Calculate her marginal benefit from apples.

Quantity of apples (pounds)

Willingness to pay Marginal Benefit

0 $0 -1 $7 72 $13 63 $18 54 $22 45 $25 3

Marginal Benefit

• Let’s draw Abby’s individual demand curve for apples.• If the market price of apples is $5/lb, how many pounds of

apples will Abby buy?• Abby will buy if P<MB, until P = MB, so she will buy 3 lbs

of apples.•What is her consumer surplus?• It is TB – P x Q = 18 – 5 x 3 = 18 – 15 = 3

Cost Curves

1) Fill out the entries in the table.2) Suppose that the firm is a price taker, and market price is $9. What

quantity will the firm produce?

Quantity Total Cost (TC)

Fixed Cost (FC)

Variable Cost (VC)

Average TC(ATC)

Average VC(AVC)

Marginal Cost(MC)

0 81 122 153 214 305 50

Cost Curves

1) Fill out the entries in the table.2) Suppose that the firm is a price taker, and market price is $9. What

quantity will the firm produce?

Quantity Total Cost (TC)

Fixed Cost (FC)

Variable Cost (VC)

Average TC(ATC)

Average VC(AVC)

Marginal Cost(MC)

0 8 81 12 82 15 83 21 84 30 85 50 8

Cost Curves

1) Fill out the entries in the table.2) Suppose that the firm is a price taker, and market price is $9. What

quantity will the firm produce?

Quantity Total Cost (TC)

Fixed Cost (FC)

Variable Cost (VC)

Average TC(ATC)

Average VC(AVC)

Marginal Cost(MC)

0 8 8 -1 12 8 42 15 8 33 21 8 64 30 8 95 50 8 20

Cost Curves

1) Fill out the entries in the table.2) Suppose that the firm is a price taker, and market price is $9. What

quantity will the firm produce?

Quantity Total Cost (TC)

Fixed Cost (FC)

Variable Cost (VC)

Average TC(ATC)

Average VC(AVC)

Marginal Cost(MC)

0 8 8 - -1 12 8 4 42 15 8 7 33 21 8 13 64 30 8 22 95 50 8 42 20

Cost Curves

1) Fill out the entries in the table.2) Suppose that the firm is a price taker, and market price is $9. What

quantity will the firm produce?

Quantity Total Cost (TC)

Fixed Cost (FC)

Variable Cost (VC)

Average TC(ATC)

Average VC(AVC)

Marginal Cost(MC)

0 8 8 - -1 12 8 4 12 42 15 8 7 7.5 33 21 8 13 7 64 30 8 22 7.5 95 50 8 42 10 20

Cost Curves

2) Suppose that the firm is a price taker, and market price is $9. What quantity will the firm produce?

Quantity Total Cost (TC)

Fixed Cost (FC)

Variable Cost (VC)

Average TC(ATC)

Average VC(AVC)

Marginal Cost(MC)

0 8 8 - - - -1 12 8 4 12 4 42 15 8 7 7.5 3.5 33 21 8 13 7 4.33 64 30 8 22 7.5 5.5 95 50 8 42 10 8.4 20

Cost Curves

2) Suppose that the firm is a price taker, and market price is $9. What quantity will the firm produce?The firm produces quantity where P = MC. When MC = $9, Q = 4

Quantity Total Cost (TC)

Fixed Cost (FC)

Variable Cost (VC)

Average TC(ATC)

Average VC(AVC)

Marginal Cost(MC)

0 8 8 - -1 12 8 4 12 4 42 15 8 7 7.5 3.5 33 21 8 13 7 4.33 64 30 8 22 7.5 5.5 95 50 8 42 10 8.4 20

Cost Curves

3) What is the profit/loss?

Quantity Total Cost (TC)

Fixed Cost (FC)

Variable Cost (VC)

Average TC(ATC)

Average VC(AVC)

Marginal Cost(MC)

0 8 8 - -1 12 8 4 12 4 42 15 8 7 7.5 3.5 33 21 8 13 7 4.33 64 30 8 22 7.5 5.5 95 50 8 42 10 8.4 20

Cost Curves

3) What is the firm’s profit/loss?Profit = Total Revenue – Total Cost = P x Q – ATC x Q = 9 x 4 - 7.5 x 4 = 6

Quantity Total Cost (TC)

Fixed Cost (FC)

Variable Cost (VC)

Average TC(ATC)

Average VC(AVC)

Marginal Cost(MC)

0 8 8 - -1 12 8 4 12 4 42 15 8 7 7.5 3.5 33 21 8 13 7 4.33 64 30 8 22 7.5 5.5 95 50 8 42 10 8.4 20

Cost Curves

4) What is the break-even price?

Quantity Total Cost (TC)

Fixed Cost (FC)

Variable Cost (VC)

Average TC(ATC)

Average VC(AVC)

Marginal Cost(MC)

0 8 8 - -1 12 8 4 12 4 42 15 8 7 7.5 3.5 33 21 8 13 7 4.33 64 30 8 22 7.5 5.5 95 50 8 42 10 8.4 20

Cost Curves

4) What is the break-even price?The break-even price equals to the minimum of ATC = $7

Quantity Total Cost (TC)

Fixed Cost (FC)

Variable Cost (VC)

Average TC(ATC)

Average VC(AVC)

Marginal Cost(MC)

0 8 8 - -1 12 8 4 12 4 42 15 8 7 7.5 3.5 33 21 8 13 7 4.33 64 30 8 22 7.5 5.5 95 50 8 42 10 8.4 20

Cost Curves

5) What is the shut-down price?

Quantity Total Cost (TC)

Fixed Cost (FC)

Variable Cost (VC)

Average TC(ATC)

Average VC(AVC)

Marginal Cost(MC)

0 8 8 - -1 12 8 4 12 4 42 15 8 7 7.5 3.5 33 21 8 13 7 4.33 64 30 8 22 7.5 5.5 95 50 8 42 10 8.4 20

Cost Curves

5) What is the shut-down price?The shut-down price equals to the minimum of AVC = $3.5

Quantity Total Cost (TC)

Fixed Cost (FC)

Variable Cost (VC)

Average TC(ATC)

Average VC(AVC)

Marginal Cost(MC)

0 8 8 - -1 12 8 4 12 4 42 15 8 7 7.5 3.5 33 21 8 13 7 4.33 64 30 8 22 7.5 5.5 95 50 8 42 10 8.4 20

Deriving the Market Supply Curve

Derive the market supply curve

Quantity Firm AMC

Firm BMC

01 10 152 20 253 35 454 55 655 80 100

The Rise and Fall of Industries

Suppose that apple farming in the United States can be represented by a competitive industry. Currently the industry is in long run equilibrium.Consider the case of cost-reducing technologies. For examples, scientists develop new high-yield seeds that produce more apples at a lower cost.1) Explain how the industry would adjust to a decrease in cost of production of apples.2) Analyze what happens in the short run as well as in the long run.