Dhawal Wadhwa, 23, pays have cost him 40...

Transcript of Dhawal Wadhwa, 23, pays have cost him 40...

www.outlookmoney.com

12 JUNE 2013

`

Dhawal Wadhwa, 23, pays a meagre `9,500 a month to live in a Delhi flat that would

have cost him `40 lakh

12 JUNE 2013 VOLUME 12

ISSUE 12

HEAD OFFICE AB-10, S.J. Enclave, New Delhi 110 029; Tel: (011) 33505500, Fax: (011) 26191420 OTHER OFFICES Bangalore: (080) 33236100, Fax: (080) 25582810; Kolkata: (033) 33545400, Fax: (033) 22823593; Chennai: (044) 33506300, Fax: 28582250; Hyde rabad: (040) 23371144, Fax: (040) 23375676; Mumbai: (022) 33545000, Fax: (022) 33545100. Printed and published by Vinayak Aggarwal on behalf of Outlook Publishing (India) Pvt. Ltd. Editor: Udayan Ray. Printed at IPP Limited, C4-C 11, Phase-II, Noida and published from AB-10 Safdarjung Enclave, New Delhi 110029For Subscription queries, please call: 011-33505653, or email: [email protected]

Published for the fortnight of May 30-12 June, 2013; Release date: May 29, 2013. Total no. of pages 64 + Covers

Outlook Money does not accept responsibility for any investment decision taken by readers on the basis of information provided herein. The objective is to keep readers better informed and help them decide for themselves.

Cover Design: MANOJIT DATTA; Cover Photo: VISHAL KOUL

16 NEW BONDS IN MARKET The RBI is all set to launch inflation indexed bonds on 4 June. The first tranche will be worth `1,000-2,000 crore and the maturity period will be 10 years. About 20 per cent of the issue will be kept for retail investors. So, what are their merits and demerits? Should you invest in them? Find out all this and more

VARUN VASHISHTHA

TUSHAR MANE

A home helps save on rent, appreciates in value and, in times of distress, can be sold or even mortgaged. So, buying one was a no-brainer—till interest rates and property prices shot up and went into the stratosphere. Therefore, it’s time for a fresh look at that purchase

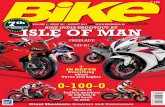

RENT OR BUY?COVER STORY pg

22

2 OUTLOOK MONEY 12 JUNE 2013 www.outlookmoney.com

NEXT ISSUE

DATED26 JUN 2013

ON STANDS12 JUNE

2013

4 OUTLOOK MONEY 12 JUNE 2013 www.outlookmoney.com

6 Internet Contents Action in our Web world7 Editor’s Note8 Letters61 Fortnight Figures64 Sunny’s Money Happiness Shortlived

UPDATE10 Newsroll EPF deposits to now earn 8.50% per annum; WPI inflation hits 41 month low; Cobrapost: RBI for capping commissions on insurance sales; Reliance

Infrastructure take a hit; Companies yet to meet Sebi deadline on shareholding norm 14 Queries Your queries on matters affecting your personal finance answered

REGULARS

START18 INTERVIEW H.S. Upendra Kamath, CMD, Vijaya Bank, on why competition from new private banks is good, and more

20 PROVIDENT FUNDThe FinMin’s plan to use EPFO corpus to buy bonds on ailing PSUs is fiscally irresponsible and adverse for workers and taxpayers, writes Mukul G. Asher

30 INSURANCE DECODERIDBI Federal Life’s Wealthsurance Dreambuilder

31 INSURANCE MADE EASY Know the insurance agents’ code of conduct to choose the right agent

32 AIRLINE STOCKSThe domestic aviation sector has been

in turbulence for some time now and it may continue. A lowdown on the sector and the investment approach

34 INTERVIEW Anand Rathi, chairman, Anand Rathi Financial Services, on the opportuni-ties for the Indian investor and the growth story for Indian equities

36 AVANT GARDELower interest rates take a long time to lead to large ticket investments. Plus, the investment is also far from healed, writes Mohit Satyanand

38 STOCK PICK Reasons why the public sector Dena Bank is a good buy for your portfolio

39 OLM 50 Q4 REVIEWAn update of OLM 50 data ending March 2013; plus analysis of the

performance of OLM 50 funds vis-a-vis their benchmarks

44 MY PLAN A roadmap for the Rajput family

46 HEAD START Planning for an early retirement

MANAGE48 ENTERPRISE How Anand Shrivastav, a Harvard alumnus, made a business out of mobile remittances

51 GOLDEN WAY Is the fall in gold prices a good thing for your investments?

SENIOR MONEY 52 TAXATIONSenior citizens get some additional breaks that can keep their outgo down

SPEND 54 INTERIORS Bring the foliage back in your home

56 TAIL LIGHT Ford EcoSport previewed

59 FOR WHAT IT’S WORTH Earning and living all by yourself in the 20s is a stepping stone towards self-evolution, writes Sumana Mukherjee

60 YOUR SPACE Readers’ own space to share personal finance thoughts and win prizes

pg

44

pg

10

BHUPINDER SINGH

22 OUTLOOK MONEY 12 JUNE 2013 www.outlookmoney.com

http://digital.outlookmoney.com 12 JUNE 2013 OUTLOOK MONEY 23x http://twitter.com/OutlookMoney; http://www.facebook.com/olmindia

BY ASHWINI KUMAR SHARMA

greed, buying a house has always been top of your list. But need you pay a king’s ransom for owning a house that you can rent for a fraction of the outgo.

Typically, everyone wants to own a home. Buying the first house is, in fact, the most aspirational investment that everyone pre-

pares for. However, skyrocketing property prices have wracked and ruined that dream for many. And, while some have put off the plan to buy a house, others have simply resigned to the idea of continuing living on rent, which is relatively within their means.

But a close look at the situation will tell you that renting isn’t exactly for the hopeless. In the backdrop of the current market situation, staying on rent could actually be the wise thing to do. And many despite having the means, have actu-ally chosen to stay in a rented house until the time is right.

When deciding to buy a house, one should factor in a lot of things besides high property prices, such as how long do you plan to stay in the city where you want to buy a house. For, if you happen to move out soon after the purchase, the house can turn out to be a bigger liability than an asset.

Alternatively, if buying a home at the moment would mean missing out on your other life goals in favour of the hefty home loan EMIs. Consider your family needs, finan-cial situation, rising inflation, increasing cost of living, the state of the real estate market (especially in your preferred area), and then the cost involved in both the options, rent-ing and buying.

On the basis of the internal and external factors, the deci-sion to buy a house or stay on rent differs for everyone. However, listed below are a few reasons why you could be

FIND OUT WHEN BUYING A HOME IS VIABLE DESPITE HIGH REALTY PRICES AND LOAN RATES AND WHEN STAYING ON RENT IS SMART

Territory Manager, Dabur India

Housewife

x `

`

x

``

` `

`

`

TUSHAR MANE

BY TEENA JAIN KAUSHAL

RANDHIR Singh Rajput, 40, is a doctor with a central government body. He stays in Delhi on rent with his parents, wife Seema, 34, and son Gurkirat, 14. He earns `1.05 lakh a month and the family spends `89,000 on household and lifestyle expenses, education and equated monthly instalments (EMIs) on a home loan. He invests `18,000 a month in equity mutual funds (MFs) through a systematic investment plan (SIP).

His investments are cash-in-hand (`4,000), savings bank (`50,000), recurring deposit (`40,000), fixed deposit (`9.50 lakh), mutual funds (`6.91 lakh) and Employees’ Provident Fund (`3 lakh). He has a home loan of `50 lakh of which `33 lakh has been disbursed. The rest will be disbursed in October 2014.

Randhir has employer-provided life and health covers and his family a group health cover by his employer. His father is a retired defence person and both his parents are cov-ered for health insurance. He wants a good education for his son and a comfortable retired life for himself and his wife. He wishes to retire early in life, at 52 years. His other goal is buying a vehicle in three years time at a present value of `10 lakh. ❒

If, like Randhir and Seema, you would like to share your story and have a financial plan made by a financial planner, write in to us with your contact number at [email protected]

44 OUTLOOK MONEY 12 JUNE 2013 www.outlookmoney.com

A FEW TWEAKS REQUIRED

THE PLANby

HARSH ROONGTA

CEO APNAPAISA.COM The planner can be

reached at [email protected]

x http://twitter.com/OutlookMoney; http://www.facebook.com/olmindiahttp://digital.outlookmoney.com 12 JUNE 2013 OUTLOOK MONEY 45

GOALSGOAO LS

2010 2020 2030 2040Figures according to future price Inflation @ 8 per cent per annum *For son

RETIREMENT

`4.03 croreYEAR 2031

EDUCATION*

`34 lakhYEAR 2017

WEDDING*

`50 lakhYEAR 2025

CONTINGENCY PLAN: FOR 3 MONTHSn Per month expenses `86,000n Allocate `94,000 (savings bank + cash-in-hand + RD) n Invest money in liquid plus fund of mutual fund n Increase fund to desired level with increase in income

LIFE INSURANCE PLANNINGLife-long group life cover Employer-providedLife-long disability, accident, illness cover Employer-providedAdditional life, disability, accident cover Not required

HEALTH INSURANCE PLANNINGLife-long group health cover for family Employer-providedLife-long group health cover for parents Provided by

father’s employerAdditional health cover Not required

CHILD’S FUTURE-EDUCATION n Allocate existing investment in equity MF and FD to this goaln Retain all equity mutual fund investment n Redeem FD and invest in two income fund of mutual fundsn Invest `18,000 a month in conservative monthly income plan n Home loan EMI to rise after disbursal of loan, but after pos-session family will save on rent and, so, can continue investing

CHILD’S FUTURE-WEDDING n Investment to start after saving for education goal n Invest `30,000 a month in equity, gold fund in 90:10 ration Surplus available will be only `10,000 per month n Increase investment to desired sum with increase in income

RETIREMENT FUNDINGThe couple will need `1.26 lakh when Randhir retires at 58 years. The corpus of `4.03 crore will suffice till Seema is 80 years of age. Their existing EPF (provided he continues to work till retirement and contribute to it) and gratuity will give him around `1.50 crore. Randhir’s pension income will partly take care of his retirement need. To meet the shortfall, he has to: n Postpone retirement age to 58 yearsn Invest `10,000 per month in 90:10 ratio in equity MF and Public Provident Fund after saving corpus for education

VEHICLE PURCHASEn Postpone till rise in income in the future.

TAX PLANNINGn Randhir’s tax planning is covered in his existing contribution to EPF

BHUPINDER SINGH

x

![Thozhilvartha 13 July 2013-Preview - magsonwink.commagsonwink.com/ECMedia/MagazineFiles/MAGAZINE-191/PREVIEW-11… · The MATHRUBHUMI THOZHILVARTHA - India's No.1 Weekly for Job Prospects]uh´IG](https://static.fdocuments.in/doc/165x107/5b2a4b257f8b9ae1288ba4a2/thozhilvartha-13-july-2013-preview-the-mathrubhumi-thozhilvartha-indias.jpg)

![l†-Œo h„Ñ« t-br«¥e - magsonwink.commagsonwink.com/ECMedia/MagazineFiles/MAGAZINE-191/PREVIEW-11… · ÀuG . indianrailways.gov.in h x†fr|uI. "¥]k ]qcr]¶rNo _ ...](https://static.fdocuments.in/doc/165x107/5aaa5c017f8b9a72188e1f0a/l-oeo-h-t-bre-ug-indianrailwaysgovin-h-xfrui-k-qcrrno-.jpg)