Telecoms Regulatory Developments in Asia, Australasia and the Middle East

Developments in East Asia

-

Upload

jorden-kent -

Category

Documents

-

view

29 -

download

0

description

Transcript of Developments in East Asia

ECONOMIC INTEGRATION; ECONOMIC INTEGRATION; CHALLENGES TO MALAYSIACHALLENGES TO MALAYSIA

Steven C.M. WongAssistant Director-GeneralInstitute of Strategic and International Studies (ISIS) [email protected]

26/4/2010 @ NCCIM Forum on “A Strong China: Implications and Challenges” Crowne Plaza Mutiara, Kuala Lumpur

Stabilisation, recovery & reform: Crisis management (2008) demand management (2008-present) institutional/ regulatory reform (?)•Liberalisation globalisation financialisation•Inflated asset & commodity prices (bubbles & speculation)•Resource misallocation – capital hoarding, risk/reward tradeoffs impact on “real activity”•Shape of recovery remains open question significant residual risks (see, IMF, World Economic Outlook, April 2010)•Significant shifting of liabilities to next generation

Off-shoring, outsourcing & ownership concentration: Fragmentation of value chain to continue but business concentration to increase•Dominance of financial capital (M&A, private equity, etc.)•Ownership & control of key technologies and IP•Ownership & control of natural resources•Trade in goods flattened/competitive/”normal” profits•Trade in service industries contoured/imperfect/ “excess” profits•New frontiers – knowledge, services, investment rules, etc.

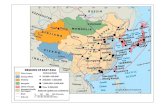

Managing the differential & eastward shift in economic gravity: Divergence, unease, tensions and low-level conflicts (so far). Key question is how to avoid missteps and escalation • Economic growth between East & West: high unemployment + low/no job recovery economic stagnation/political consequences • Bilateral currency (esp. RMB) & trade (e.g. tires, steel, chickens, etc) pressure• Decoupling of business cycles/economic growth – more myth than reality at present sustainability @ risk• Conflation of economic, political & security interests regional architecture & institutions essential

USNominal GDPUS$14.25t$14.25t (PPP)

Share of World GDP (PPP)20.5%

Nominal GDP/capitaUS$46,380$46,380 (PPP)

EU ChinaNominal GDPUS$16.45t$14.79t (PPP)

Share of World GDP (PPP)21.2%

Nominal GDP/capitaUS$38,457$29,729 (PPP)

Nominal GDPUS$4.91$8.76t (PPP)

Share of World GDP (PPP)12.5%

Nominal GDP/capitaUS$3,678$6,567 (PPP)

Impact of final demand on China’s V-A

2000 2006

Domestic demand 79.4 69.7

Intra-regional 1.8 2.8

US 6.6 7.1

EU 3.8 6.4

Japan 3.6 3.0

Rest of world 6.5 13.2

Impact of final demand on East Asia’s V-A

Domestic demand 68.9 64.3

Intra-regional 5.8 6.8

US 7.3 6.6

EU 4.7 5.8

Japan 4.1 3.2

Business Cycle Correlations with China

Pre-Crisis Post-Crisis

Asia* -0.379 0.549

G7 -0.304 0.580

US 0.490 0.517

Japan -0.633 0.477

Inter-regional Business Cycle Correlations

Asia-G7 0.084 0.611

Asia-US 0.233 0.715

Asia-Japan -0.618 0.647

Asia*-G7 0.619 0.537

Asia*-US -0.345 0.724

Asia*-Japan -0.633 0.477

V-A: Value-AddedSource: G.Pula & T. Peltonen (January 2009)

*Excluding ChinaSource: S.Y. Kim, J.W . Lee & C.Y. Park (June 2009)

“BI-DIRECTIONALITY”

RATE OF RELATIVE CONTRACTION

“BALANCING FACTOR”Eg. BRI, etc.

RATE OF RELATIVE EXPANSION

“STEADY-STATE??”

• It is essential for Malaysian policymakers to adopt systems thinking and not formulate piecemeal policiesSystems thinking recognises that the component parts of a system can best be understood in the context of relationships with each other and with other systems, rather than in isolation

• There must be clear objectives based on strategic national interests, realistic priorities and logical decision-makingMalaysia cannot afford to engage in the global politics of alignment, balancing or exclusion. By paying attention to its economy & development, it can still wield considerable middle power influence

• Economic integration may be a necessary (i.e. non-optional) condition for economic growth but is not sufficientMalaysia requires economic integration; non-participation equals peripheralization. But without vibrant investment and innovation, economic integration merely leads to a hollowing-out

• Formal economic integration must go beyond the superficial and symbolic if it is to truly encourage economic dynamism

Economic arrangements that have neither depth nor speed are not substantive and will be of little interest to the private sector

• China is a complex country with extraordinary strengths & weaknesses and represents both threats and opportunities It is not very helpful to regard China in mono-dimensional terms. Like all countries it is a composite of many qualities, some which are to Malaysia’s advantage and others not.

• One of Malaysia’s most important challenges will be to locate itself in a global/regional economic sweet spot.China is a growing part of the global economy. For Malaysia to distance itself from it owing to competitive pressures is negative and ultimately debilitating.

Steven C.M. WongAssistant Director-GeneralInstitute of Strategic and International Studies (ISIS) [email protected]