Dep

-

Upload

savoir-pen -

Category

Documents

-

view

212 -

download

0

description

Transcript of Dep

Illustration

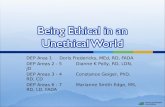

A B C D E= B-D F = B*5% G H I = E-F

*2002-03 10000 11 6963 3037 500 10 0 2537

*2003-04 10000 10 6330 3670 500 10 0 3170

**2004-05 10000 9 5697 4303 500 10 1

**2005-06 10000 8 5064 4936 500 10 2

Year of Acquisition of

asset

Original Cost / Historical

Value

No of yrs used as on

31/03/2014

Deprn 31/03/201

4 @ 6.33% (

Sch-XIV CA-1956)

Net Carrying Amount

as on 31/03/2

014

Residual Value 5% of

cost

Useful life as

per Companie

s Act 2013

Remaining Useful

life as on 31/03/201

4

Amount to be

charged from

Opening retain

earnings on

01/04/2014

0

0

3803

2218

Depreciation to be provided for 2014-

15

J = (E-F) /H

0

0