Delta Airlines, Inc. Financial Analysis

description

Transcript of Delta Airlines, Inc. Financial Analysis

Delta Airlines, Inc.Financial Analysis

Presented By:

Karen Brown

Chintan Patel

Pina Patel

2003 DELTA SNAPSHOT

PASSENGERS – 104 MILLION FLIGHTS – 2002 (DAILY) DESTINATIONS – 497 / 84 EMPLOYEES – 75,000 REVENUES – $13.3 BILLION NET INCOME – (-$773 MILLION)

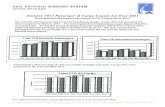

Operating Revenues

0

2000000000

4000000000

6000000000

8000000000

10000000000

12000000000

14000000000

16000000000

18000000000

1998 1999 2000 2001 2002

Total Operating Revenue

DELTA AIR LINES INC /DE/

Sales Growth

-0.2

-0.15

-0.1

-0.05

0

0.05

0.1

0.15

1998 1999 2000 2001 2002

Sales Growth

DELTA AIR LINES INC /DE/

Net Income

($1,500,000,000)

($1,000,000,000)

($500,000,000)

$0

$500,000,000

$1,000,000,000

$1,500,000,000

1998 1999 2000 2001 2002

Net Income

DELTA AIR LINES INC /DE/

Long Term Debt

$0

$2,000,000,000

$4,000,000,000

$6,000,000,000

$8,000,000,000

$10,000,000,000

$12,000,000,000

Year

Deb

t $ Series1

Series1 $1,533,000,000 $4,144,000,000 $5,797,000,000 $8,279,000,000 $10,074,000,000

1998 1999 2000 2001 2002

Ratio AnalysisDelta's 5 - Year Ratio Analysis

1998 1999 2000 2001

Liquidity Ratios

Current Ratio: 0.50 0.61 0.56 0.60

Quick Ratio: 0.33 0.38 0.40 0.35

Debt/Equity 0.57 1.08 2.34 9.39

Asset Management Ratios

Asset Turnover: 0.94 0.87 0.61 0.55

Cash Conversion: 30.90 34.40 30.20 28.30

Profitability Ratios

Profit Margin on Sales: 7.41% 4.87% -8.86% 9.67%

Return on Total Assets: 7.00% 4.24% -5.14% -5.33%

Return on Equity: 27.55% 17.44% -29.33% -117.39%

Profitability Ratio Analysis

PROFITABILITY ANALYSIS

-150.00%

-100.00%

-50.00%

0.00%

50.00%

1998 1999 2000 2001

YEAR

RA

TIO

(%

)

Profit Margin onSales:

Return on TotalAssets:

Return on Equity:

Delta vs. Industry Ratios

Delta's vs. Industry Ratios

Delta Industry

Liquidity Ratios

Current Ratio: 0.75 1.42

Quick Ratio: 0.53 1.19

Debt/Equity 16.33 2.1

Asset Management Ratios

Inventory Turnover 65.85 42.5

Asset Turnover: 0.53 0.83

Efficiency Ratios

Rev/ Emp 177,737.00 188,899.00

Profitability Ratios

Profit Margin: -5.81% 4.94%

Return on Equity: -121.90% 12.04%

Return on Equity: Deltas vs. Industry

-150.00%

-100.00%

-50.00%

0.00%

50.00%

0 0.5 1 1.5 2 2.5Return on Equity:

DELTA

INDUSTRY

Stock Prices

RECOMMENDATIONS

REDUCE SALARY EXPENSES / EMPLOYEES

SELL OFF PLANES

INCREASE FUNDING AND RESOURCES TO SONG

INCREASE INTERNET SALES

SIMPLIFY PRICE STRUCTURE

IMPROVE CUSTOMER SERVICE

QUESTIONS

???