Defining Target Markets and Promotional Strategies for ... Judging Area/Case... · Hershey’s Ice...

Transcript of Defining Target Markets and Promotional Strategies for ... Judging Area/Case... · Hershey’s Ice...

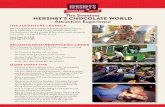

Defining Target Markets and Promotional Strategies for Hershey’s Ice Breakers Cool Blasts

2015 American Marketing Association Collegiate Case Competition

December 9, 2015

Ice Breakers Cool Blasts Case

Page 1 Table of Contents 2…..….Summary 2…..….SWOT Analysis 4…..….Primary Objectives 5…..….Target Market 6…..….Product 7…..….Distribution 9…..….Promotion 11…….Price 12…….Budget 12…….Timeline 12…….Sales Forecast 13…….Measures of Success 14…….Appendix 25…….References

Ice Breakers Cool Blasts Case

Page 2

Summary The Hershey Company is the leading manufacturer of chocolate and non-chocolate

candies in North America, with over 80 brand names in about 70 countries worldwide. The company has grown from January 2011 at a stock price of $48.70 to December 2015 at a stock price of $87.14, a 56% increase. Currently, the Hershey Company enjoys competitive strengths in having huge brand equity, Its new product that was launched in April 2015, Ice Breakers Cool Blasts, is an effective breath freshener, and is faster at delivering its effectiveness compared to other gum and mint products. However, the product faces competitive weaknesses due to the unfamiliarity of the product category, lack of knowledge on how to best market this product due to its recent launch, and lack of variety of flavors. The market, fortunately, presents opportunities for successful marketing of Cool Blasts due to plunging gum sales and rise of social media popularity. However, a lack of consumer brand awareness, product loyalty to other established products, and psychological benefits of chewing gum pose threats to the success of marketing Ice Breakers Cool Blasts.

In order to address these concerns, we conducted a situational analysis of the internal and external factors for the Ice Breakers Cool Blasts product and developed objectives for this marketing strategy. We used primary and secondary marketing research to develop a multisegment targeting strategy and created several promotional and distribution strategies. We have evaluated opportunities for promotional pricing and have evaluated a proposed budget that spans a complete year in time in order to create sales forecasts for the product. Lastly, we defined specific measures that we will use to determine the success of the marketing strategy.

SWOT Analysis

Strengths One of the competitive strengths of Ice Breakers Cool Blasts is the effectiveness of the

breath fresheners and another is the instantaneous of the breath fresheners due to the product line’s proprietary visible cooling crystals. The cooling crystals are extremely fast-acting, and long-lasting in its ability to keep fresh breath. While conducting our research study, participants who tried Ice Breakers Cool Blasts on average, rated the freshness of the product with the highest satisfaction rating in comparison to other features such as flavor of the product, duration of the product, and texture of the product. Based on the results of the study, Ice Breakers Cool Blasts ability to deliver effective breath fresheners instantly is a competitive strength. This competitive strength has great appeal to millennials who are characterized by impatience and a high need for immediate response: for instance, millennials, have grown up with smartphones, social media, broadband, and thus, they expect instant access to information; similarly, they come to expect the same type of gratification in other aspects of their lives – and the Ice Breakers Cool Blasts’ instant ability to deliver effective breath fresheners coincides with millennials’ expectation of instant effectiveness and gratification (PriceWaterhouseCoopers, 2011).

Another competitive strength Ice Breakers Cool Blasts possesses is the strong brand equity of the Hershey Company. The Hershey Company is currently North America’s leading manufacturer of chocolate and non-chocolate candies. It has net sales of more than $6.6 Billion each year, and the company’s products are in about 70 countries. In the case brief, the Hershey Company’s products, including Hershey’s Kisses Chocolate Candy, Reese’s Peanut Butter Cups Chocolate Candy, and Hershey’s Milk Chocolate Candy Bars rank first, second, and

Ice Breakers Cool Blasts Case

Page 3 fourth respectively in terms of brand equity (American Marketing Association, 2015). Based on these rankings, we can generalize that the Hershey Company has strong brand equity from the success of Hershey’s Kisses and Reese’s Peanut Butter Cups, and we can use this competitive strength to market its other products, such as Ice Breakers Cool Blasts. Using a product development strategy, we can market the new product, Ice Breakers Cool Blasts, to an existing market of millennials who have grown up and are familiar with the Hershey Company products (Nieburg, 2015).

Weaknesses Weaknesses of Ice Breakers Cool Blasts includes creating confusion in the consumers’

minds about what the product is, the texture, and duration of the product. First of all, mints have enjoyed a long history of acceptance. Ancient Greeks and Romans valued mint for helping with digestion and providing fresh breath, and mint-flavored chocolate candies were introduced to society in the latter half of the 19th century (The Food Timeline, n.d.). Mints are created from sugar or sugar substitutes, bound together by familiar binders such as corn syrup or natural gums. (Breath Mint) On the other hand, gum has been around for a long time as well. The Mayans and the Aztecs, discovered that from slicing the bark of the sapodilla tree in Central America and southern Mexico, they can extract resin and formulate a chewable material that resembles gum. From there, Thomas Adams Sr., transformed chicle into pieces of chewable gum through boiling and hand-rolling the substance, creating what we know now today, as gum (Fiegl, 2009). In comparison to the longer history of gum and mints, the creation of Ice Breakers Cool Blasts, launched in April 2015, is relatively new, and therefore does not enjoy the same familiarity with the product from consumers as gum and mints do. Consumers can grasp the concept of gum stemming from trees, and the concept of mints from mint herbs or plants. However, cool blasts do not enjoy the same history of education and acceptance as that of mints and gum, therefore creating confusion in the consumers’ minds about what the product is, constituting a weakness.

Another weakness is the texture of Cool Blasts. While conducting research studies and taste tests on Ice Breakers Cool Blasts with consumers, one of the qualities that received lower ratings based on features of the product was the texture of the product. The pastiness of the texture, was a continuous concern for lower ratings for Ice Breakers Cool Blasts. Consumers were asked to compare it to gum and mints, and in comparison to gum, Cool Blasts’ chalky taste was met with disdain, and preferred less than gum and hard mints as a result.

Another overwhelming concern brought up by consumers was the duration of the product. Cool Blasts instantly dissolved in the consumers’ mouths. However, the quick solubility of cool blasts, which on average, was a little over 40 seconds, was met with some negative feedback. Due to its quick dissolving feature, consumers viewed Cool Blasts as inferior to gum because of the lack of ability to chew on Cool Blasts for an extended period of time. Gum, which lasts longer, is correlated with benefits for consumers such as increasing focus on tasks that require long periods of monitoring from consumers, according to a study conducted from Kate Morgan and colleagues from Cardiff University (Morgan, 2013). Thus, since Cool Blasts does not last long, it is has a weaker correlation than gum in keeping attentiveness.

Opportunities Opportunities that the Hershey Company can take advantage of includes that there has

been tremendous growth in social media in the last 20 years. For instance, on Facebook, 80% of users are within the 18-24 years old range, 72% in the 25-34 years old range, and 61% in the 35-

Ice Breakers Cool Blasts Case

Page 4 44 years old range. On Instagram, 46% of users are in the 18-24 years old range, 24% in the 25-34 years old range, and 15% in the 35-44 years old range. Given that there is a significant demographic base within our target market on Facebook, we can use these segmentations to our advantage by creating targeted ads to these demographics through paid advertisements that fit our target market based on demographic information from their profile, and psychographic information from the pages they like and interests they list related to characteristics our target market possess. On Instagram, we can reach our target market by creating unique content. Posts with one or more hashtags receive on average, 12.6% more engagement than other posts. Product launches are one of the major ways brands can engage with customers on Instagram. To increase engagement, the use of hashtags, creating campaigns for products through questions such as “caption this” or asking consumers about their thoughts on new products will help generate more exposure, engagement, and ultimately allow brands to have conversations with their customers to induce further interest and trial. Through the use of social media such as Facebook and Instagram, Hershey can take advantage of the opportunity of growing social media to engage with its customers. Another opportunity for Hershey is the growing interest of our target market in creating experiences, such as hosting music concerts for these millennials and their friends. These people are seeking to create new memories and experience things they never have before, and Ice Breakers Cool Blasts can induce trial of its product by becoming part of the new experience and distributing its product with the target market who is seeking new adventures.

Threats

Threats the company faces includes consumer brand and product loyalty to established products, and psychological benefits of chewing gum. “28% of consumers are loyal (Carter, 2015). However, 28% is a low percent relative to 72% who are not, who can be induced to try other brands and products that are low in monetary risk such gum. On the other hand, the psychological benefits of chewing gum poses a larger threat to Ice Breakers Cool Blasts. According to the research we conducted with Cool Blasts, the likelihood of consumers who chew gum more frequently compared to mints to convert to Cool Blasts were hesitant due to the ability of gum to boost cognitive processes, and decreased feelings of sleepiness. In order to address these threats, we will position our product to target the relevant demographic market who would benefit most from the unique feature of our product, which is the need for instantaneous gratification of breath freshening.

Primary Objectives ● Define a new target demographic to be used alongside the current 18-34 year old target

market within a multisegment targeting strategy. ● Develop a promotional strategy for Ice Breakers Cool Blasts that increases awareness for

the product among the newly-defined target markets. ● Propose product packaging revisions and promotions that engage consumers in order to

increase interest in the Ice Breakers Cool Blasts product. ● Plan targeted consumer touch-points and events that encourage and increase trial among

specified segments.

Ice Breakers Cool Blasts Case

Page 5

Target Market We propose using a multisegment targeting strategy, targeting both 18-34 and 35-50 age

ranges. We arrived at these two segments by conducting a product sampling survey with 135 subjects (see Appendix, Exhibits 1.1-1.9). Our hypothesis was that older generations (ages 35+) may also find Ice Breakers Cool Blasts favorable after reviewing the Ice Breakers Brand Loyalty Ladder in the case provided (American Marketing Association, 2015). In our study, we provided subjects with one Ice Breakers Cool Blasts sample and then had each subject complete a short evaluation survey using Qualtrics. We surveyed 69 subjects within the ages of 18-34, 31 subjects within the ages of 35-50, 32 subjects within the ages of 51-65, and 3 subjects that are 65 or older.

When comparing age demographics to the overall rating of Ice Breakers Cool Blasts, our research found that on average 35-50 year olds ranked Ice Breakers Cool Blasts more positively than 51-65 year olds. 35-50 year olds gave an average rating of 7.3/10 compared to an average 51-65 ranking of 6.4/10. With a P value of 0.09 and a significance level of 0.10, we are 90% confident that 35-50 year olds prefer Ice Breakers Cool Blasts to 51-65 year olds. Based on our research, we also found no significant differences among age groups in determining the likelihood that they will purchase the product.

We also looked at what demographics currently have the highest amounts of gum and mint consumption. With a P value of 0.052 and a significance level of 0.10, we are 90% confident that 18-34 year olds consume more mints and gum than 35-50 year olds. In addition, with a P value of 0.054 and a significance level of 0.10, we are 90% confident that 18-34 year olds consume more gum than 51-65 year olds. With this in mind, the current target market of 18-34 year olds is valuable since Ice Breakers Cool Blasts currently targets this market, and this product is most relatable to gum and mints. Furthermore, gender was not a distinguishing demographic based on our study results, and was not used in our decision to define the target market.

Because on our results describing the overall rating, the likelihood of purchasing the product, and the average gum or mint usage rate, and the assumption that Ice Breakers brand loyalists will be interested in the Cool Blasts product, we decided to focus on targeting the 35-50 age group in addition to the already existing target age range of 18-34 year olds.

18-34 Target Market - Millennials

The Millennials segment include those that are of ages 18-34. Millennials make up about 25% of the US (Mintel, 2012). Millennials are much more socially conscious than their peers. A study found the 45% of Millennials have made the decision to drive less to reduce pollution. Millennials are constantly connected, over half of Millennials feel disconnected without their phone (Mintel, 2012). Millennials are socially conscious, educated, impatient, connected to social media, and phones. In order to best target this group, we suggest going through new forms of contact such as in-app advertisements, sponsoring charities, and making your brand known as environmentally conscious. It is said that 60% of Millennial are brand loyal, and are barely stimulated from product advertising (Mintel, 2012). Ice Breakers Cool Blasts needs to leverage its marketing strategy with social media accounts, a redesigned package, and affordable pricing with an efficient promotional strategy that will establish a reputable brand for Millennials.

Ice Breakers Cool Blasts Case

Page 6

35-50 Target Market - Generation X Generation X or “Gen X” for short, is the generation between Baby Boomers and

Millennials. They range from ages 35-50. The number of Gen Xers within the current population is smaller than Baby Boomers and Millennials at just 16% of the population. Because of this many marketers try to cross target Gen Xers with the two other generations. Findings show that 66% of Gen Xers are college educated, which causes median household income to a large maximum of $65,000 a year (Mintel, 2011). Many Gen Xers also surf the internet (63% of the population), which gives marketers the opportunity to target them using online ads and application advertising. This generation is very willing to accept diversity and is practical. They are self-reliant, individualistic, and value freedom and flexibility. For these reasons, it is important that Ice Breakers Cool Blasts identifies with Gen Xers with unique promotional strategies such as traditional television ads and Facebook targeted ads.

Product

We conducted a product sampling study followed by a survey to gauge consumer opinions and feedback towards the Ice Breakers Cool Blasts. The information collected laid the foundation for many of the decisions that we made about the product and strategy. Our initial findings showed that 76% of subjects were satisfied with the flavors tested, giving the product an average overall rating of 6.9/10. When looking into the individual features, customers enjoyed the freshness and flavor most about the product (8.6/10 and 7.9/10 rating respectively), but subjects did not think as positively about the product duration and texture (5.6/10 and 5.5/10 rating respectively).

This finding initially concerned us because duration and texture are the two features that distinguish Ice Breakers Cool Blasts from other gum and mint products. Still, we found solace in the fact that the overall response to these product features were still positive (5 being neutral) and that there were a handful of individuals who had strong positive responses to these features. With this in mind, Ice Breakers Cool Blasts has the potential to appeal to a niche market that loves these unique features, and if the benefits of this product over gum or mints can be explained, the potential for even greater population appeal. Therefore our product positioning is as follows: Ice Breakers Cool Blasts targets 18-50 year olds and delivers the benefits of having a great flavor providing fresh breath instantaneously through its unique cooling crystal formula.

We believe that the Ice Breakers Cool Blasts packaging design is innovative, yet there are still some improvements to be made. First of all, based on the product’s flagship feature, which is that it dissolves quickly in your mouth, we know that the target market for this product includes individuals who seek a fast and refreshing result without chewing gum. However, there is no description about this unique and differentiated product feature on the package design. We think the Hershey Company should make this clearer on the packaging to attract more potential customers who seek a fast and refreshing result from a gum-like product such as Ice Breakers Cool Blasts. We have proposed one example of how this may be implemented as shown in the figure located in the appendix (see Appendix, Exhibit 2.1).

Secondly, Ice Breakers Cool Blasts’ package design is not as efficient as it could be in regards to its room allocation. For example, the remaining space in each plastic container cause noise as the chews move and collide against the package. This makes it difficult for customers to carry while walking discretely, and it will potentially affect the purchase decision of student consumers who study frequently in quiet environments, or business professionals who spend

Ice Breakers Cool Blasts Case

Page 7 most of their time in the office environment. Our solution is to wrap each chew with a thin layer of recyclable paper material, or aluminum foil, to reduce the friction between chews and package and therefore reduce the noise. Another shortcoming caused by the remaining space in each slot is that customers can easily drop the chew when opening the package since the chews are not secure in the package. By using the wrapper, Ice Breakers Cool Blasts can efficiently limit the space chews are able to move and thus stabilize chews in each slot.

Distribution

Our group recommends that the distribution of Ice Breakers Cool Blasts continue as it has been with a few additions. National distribution into mass merchandisers, convenience stores, supermarkets, and others has worked well in the past for the company and Hershey’s has long-term relationships with these distribution channels. For something new to add to the distribution channels, we recommend that Ice Breakers Cool Blasts be sold in coffee shops like Starbucks. Cool Blasts make a good match with coffee and coffee shops because the chews provide a way to freshen up bad coffee breath, as many people who go to coffee shops are white collar young Millennial workers with incomes over $50,000 household income (Mintel, 2015). We also recommend using sampling in stores across the country like Walmart, Target, and grocery stores, in order to increase the amount of awareness and knowledge of our product, as it is a product that truly needs to be experienced in order to be understood.

An additional promotional and distributional tool for the 18-34 target audience could be events on college campuses. Though 16% of college students preferred to receive product information through free sampling on campus in 2014, this is a creative measure to accessing this target audience (Statista, 2015). Various brands have taken the opportunity of placing campus wide activities to boost awareness of products. For example, Target hosts “Target Takeover” for universities such as George Washington University, at the beginning of the academic year (George Washington University, 2015). “Target Takeover” is an event where Target centers are open only for college students; hence, students are encouraged to purchase a multitude products for the beginning of the semester (George Washington University, 2015). Target also utilized an innovative on-campus setting called “The Lounge” (O’Loughlin, 2014). “The Lounge” functions as an intricate interactive multi-screen structure where “each hour of each day was programmed with “socially fueled” content (such as a workout class or magic show) that kept college student viewers coming back to watch and shop” (O’Loughlin, 2014). Similar to The Lounge, Ice Breakers Cool Blasts could develop an interactive display in the shape of an igloo where people try product and receive a blast of cool air to truly feel the freshness of the Ice Breakers Cool Blasts. Through its infamous “Share a Coke” campaign, Coca Cola created a pop up event directed towards building friendships among college students (Monllos, 2014). Using plastic Coke bottles “featuring a cap that could only be opened when fit together with another bottle's cap and twisted,” Coca Cola increased its product recognition by requiring students to find a partner in order to enjoy the drink (Monllos, 2014). Ice Breakers Cool Blasts To reiterate the idea that Ice Breakers Cool Blasts are a burst of freshness, sweepstakes to win a trip to “cool” places like Sweden, a ski or snowboarding trip with a winter Olympic athlete (or athletes), or an Alaskan cruise could increase product sales. If the Hershey Company were to partner with a winter Olympic athlete (or athletes), they could be the face of this promotion. These examples of campus events offer even greater direct-to-consumer exposure of products. One of the most innovative and increasingly profitable ways to promote Ice Breakers Cool Blasts is through the sponsorship of music and entertainment events. Statista projected live

Ice Breakers Cool Blasts Case

Page 8 music sponsorship revenue in the United States to reach $2.09 billion dollars; this revenue is set to total at least $2.34 billion in 2019 (Statista, 2015). Music sponsorship has also been on the rise, totaling $1.4 billion dollars in North America in 2015 (IEG, 2015). In 2013, Billboard journalist Andrew Hampp noted in relation to music, advertising spending from brand sponsors played a “highly influential role in artist development and even track and album sales” (Hampp, 2013). Hampp furthers this by noting brand examples:

Target’s dedicated spending against exclusive album partners like P!nk, Taylor Swift, One Direction and Justin Timberlake has resulted in the retailer nabbing a significant share of first-week sales for those acts’ respective releases, while Microsoft, Fiat and Dr. Pepper are among the brands that have played a key role in breaking current hits from acts like Macklemore & Ryan Lewis, Pitbull and Icona Pop, respectively (Hampp, 2013).

Promoting and distributing through musical acts would aid Ice Breakers Cool Blast further increase brand recognition and boost product sales. Music festivals could also be a tool to reach the Millennial target audience of 18-34 year olds. Peter Rubinstein, a writer for Your EDM, a hub for the electronic dance genre, published a music festival sponsorship study performed by AEG and Momentum Worldwide (Rubinstein, 2015). AEG, the largest live event promoter in the world, and Momentum Worldwide, a branding company, found that “93% of those surveyed liked the brands that sponsor live events, 80% said they will purchase a product, and those who attended a music festival with a brand sponsorship walked away with a 37% better perception of the company” (Rubinstein, 2015). Rubinstein noted that one of the most common event tactics used by sponsoring brands was the use of elaborate booths for the products; these visually appealing booths drew strings of music fans to try the products (Rubinstein, 2015). Ice Breakers Cool Blasts can utilize on site displays, including the interactive displays used for college campuses, to attract consumers. Music festivals frequented by Millennials have proven to be remarkably lucrative. In 2014, the top five most attended music festivals in the United states were Austin City Limits with 450,000 attendees, Electric Daisy Carnival with 450,000 as well, Lollapalooza with 220,000, Coachella with 180,000, and Ultra with 160,000 (Ahmed, 2015). In 2015, Coachella experienced its most attended festival in its history with 193,000 (Waddell, 2015). As the highest grossing music festival in the world, Coachella brought in over $84 million dollars, an increase of nearly six million from the previous year (Waddell, 2015). For Ice Breakers Cool Blasts, the growing number of festival attendees creates a potential consumer base, as well as increased product visibility.

We plan on sponsoring concerts, commercials, and launch a social media campaign and increase impressions. The Hershey Company would be highly recommended to sponsor music festivals to gain exposure among Millennials. An example of a music festival that we can sponsor is Lollapalooza in Chicago, IL. Sponsoring Lollapalooza with $100,000 can help leverage Ice Breakers Cool Blasts in a position in which all 300,000 attendees have exposure to our product. The Hershey Company can develop a commercial to instill a brand recall, and air around the time that NCIS does to create awareness among Generation X. Our estimated budget for this commercial is $450,000, and can create brand awareness among roughly 16 million viewers. Another option to create awareness for the Cool Blasts is to launch a social media campaign via Instagram, in which people will be required to post a picture of them with the slogan “How do you feel fresh? #coolblasts #anewtypeoffresh,” and the picture with the most engagement which is measured by the number of favorites, comments, and most favorable

Ice Breakers Cool Blasts Case

Page 9 sentiment. The top four winners will receive a $25,000 scholarship per winner. We will accomplish this by hiring a team of social media marketing experts for $65,000 for the year. Another example of a campaign to create awareness for Ice Breakers Cool Blasts is to sponsor a national combative sport such as a volleyball tournament. Each state can enlist one team to compete, where the winning team continues to compete in the tournament until there is one winning team left standing. The event will last 5 days, the winning team will win $10,000, and receive free Ice Breakers Cool Blasts for a year.

Promotion In order to expand Ice Breakers Cool Blasts’ visibility, we recommend that the Hershey

Company expand its promotional efforts through an integrated marketing communications program. Given the target audiences, this program should include online and traditional television, online social platforms, and print magazines. As our target audiences are increasingly responsive and receptive to visual mediums, it is necessary to increase promotional efforts through them. One of the most valuable modes of communication is television. The Hershey Company can expand its televised presence by creating multiple unique advertisements. These advertisements could contain material with a signature and memorable tagline. In terms of content, the advertisements could center on situations that the target audience's face. The target audiences encounter many social situations where Ice Breakers Cool Blasts would be convenient. For example, for 18-34 year olds in undergraduate or graduate programs, many must conduct presentations, often in front of peers or professors. Freshness of breath can enhance a presenter’s confidence and professionalism. Likewise, 35-50 year olds may participate in conferences with employees, senior management, or colleagues. Bad breath and coming off as unprofessional while chewing gum should be the last of their worries. Ice Breakers Cool Blasts’ quick burst of freshness and convenient dissolvability could diminish the stigma of having foul breath during a presentation. These target audiences, especially 18-34 year olds may also experience having to go through an interview process for an internship or job. Again, Ice Breakers Cool Blasts could rescue interviewees from the nuisance of bad breath. Other situations the advertisements could cover are romantic situations such as dates, weddings, music concerts, or other places where one encounters large groups of people. For television advertisements, it is important to know how and where the target audiences consume them. For 18-34 year olds, video advertising is heavily watched through online streaming platforms such as Hulu, YouTube, or Amazon Instant Video. These services are also available on mobile devices, increasing the visibility of the video advertisements. In 2013, 85% of 18-29 year olds used these platforms to watch television programs (Statista, 2015). These streaming services place video advertisements before showing content, which would allow Ice Breakers Cool Blasts to draw more attention from Millennials. While Millennials turn to online video services to watch TV programs, the older target audiences of 35-50 year olds still watch through traditional TV. In 2014, Washington Post journalist Cecilia Kang described the trend of older TV audiences in the United States. For the 2013-2014 TV season, the median age viewer was 44.4 years (Kang, 2014). Kang also noted Fox had a median age of 47.8. Thus, traditional TV caters best for a target audience of 35-50 year olds. In terms of product placements, advertisements should be scheduled during the airtimes of NFL Sunday Night Football (NBC), The Big Bang Theory (CBS), NCIS (CBS), and NCIS: New Orleans as they were the top four the most watched shows for the 2014-15 television season (Rice, 2015).

Ice Breakers Cool Blasts Case

Page 10 Another communication channel, social media, is beneficial for reaching the target audiences. According to a report by the Pew Research Center, 90% of 18-29 year olds use social media (Perrin, 2015). Overall, 65% of American adults are active on social media (Perrin, 2015). Facebook, this most popular social networking site with over 157 million users as of 2015, is another source for social media advertising (Statista, 2015). Among the number of American adults who use the Internet, 87% of Facebook users are 18-29, 73% are 30-49, and 63% are 50-64 (Duggan et. al., 2015). Advertising on Facebook alone generated over $14 billion dollars worldwide (Statista, 2015). As of April 2015, professional social networking site, LinkedIn, has seen the highest membership from 30-49 year olds (who comprise of 32% of all users) followed by 50-64 (who are 26% of all users) (Statista, 2015). For all Twitter users (over 17 million people), 42% are exposed to products through company-affiliated accounts, providing another stream for Ice Breakers Cool Blasts brand visibility (Baer, n.d.). Advertising on social media would also be viable as revenue from desktop and mobile social media advertising in the United States is expected to exceed $21 billion dollars by 2020 (Statista, 2015). Based on revenues and usage, social media advertising would be a highly lucrative endeavor for Ice Breakers Cool Blasts. Through printed advertising revenue for newspapers in the United States has been decreasing by over two billion dollars per year, positive trends for printed advertising in magazines could be an additional option to increasing product exposure to target audiences (Statista, 2015). With the number of newspapers and advertising revenue dwindling, it would not be a sound choice for promoting Ice Breakers Cool Blasts. At these rates, it would not be in the Hershey Company’s best interest to invest in a weak promotional medium. The expenses would not match revenues or visibility that could be directed from other promotional channels. Unlike newspapers, magazines have experienced steady growth in numbers, as there were 7,289 in the United States alone in 2014 (Statista, 2015). Expenditure in printed magazine advertising has also decreased at a much lower rate than newspapers; according to Statista, spending will remain at a stagnant $15.1 billion dollars throughout 2016 and increase to $15.2 billion dollars in 2017 (Statista, 2015). In terms of product placement, magazines cater to each target audience. As of September 2015, the top four magazines with the largest audience in the United States were are ESPN with 114.5 million, People with 78.57 million, Better Homes and Gardens with 48.58, and Forbes with 44.39 million (Statista, 2015). These magazines offer product samples within their publications, providing direct-to-consumer sampling for products. A packet of Ice Breakers Cool Blasts that are relatively the same size as the samples given for research purposes in this case competition could easily be placed on a full-page advertisement within a magazine. With such a large audience and accessible product placement, printed magazine advertisements boost Ice Breakers Cool Blast visibility and brand recognition.

Through traditional and online television, social media, and printed magazines, the Hershey Company can form expansive integrated promotional network for Ice Breakers Cool Blasts. These communications channels allow the Hershey Company to promote Ice Breakers Cool Blasts to each desired target audience. Based on given data, advertising through these realms is eminently profitable for the product. The amount of viewership through each channel also initiates enormous exposure and recognition for the product. All of these promotional strategies address increasing awareness, interest, and trial for Ice Breakers Cool Blasts.

Ice Breakers Cool Blasts Case

Page 11 Price

The Hershey Company would prefer us to not propose a new price for the Ice Breakers Cool Blast product for this case, thus, we will not consider increasing or decreasing the product’s intrinsic sales price. However, the Hershey Company should take price sensitivity into consideration when they price Ice Breakers Cool Blasts to Millennials and Generation X. According to Mintel, “when eating snacks, consumers say the most important features include their favorite brand (37%), and lowest price (30%)” (Mintel, 2015). It is essential that the Hershey Company establishes a reputable brand and affordable price for Ice Breakers Cool Blasts, if they want to sell their product. In addition, Millennials are significantly more price sensitive than Generation X. A study performed by Mintel indicates that “34% [of Millennials] indicate a product that is the lowest price is important to them when eating a snack,” and are more likely to shop at discount retailers for snacks (Mintel, 2015). The Hershey Company should continue to supply discount retailers with the Ice Breakers Cool Blasts to have them readily accessible for Millennials and Generation X. Furthermore, a study conducted by Mintel with approximately 2,000 prospects identifies that 53% of consumers are more likely to indulge in seasonal non-chocolate candy, and 50% of consumers impulsively purchase non-chocolate candy (Mintel, 2014). The Hershey Company should consider a promotional pricing for the Ice Breakers Cool Blasts for a particular season, to strengthen sales for that corresponding quarter, because it appears that approximately half of the consumers are seeking newer, non-chocolate products to purchase during the season.

Additionally, another method to reach our target age range of 18-34 and 35-50 is by promotional pricing, during a particular season. The age range of 18-34 are made up of primarily Millennials who have the lowest median household income and limited spending power, which is approximately $39,190 on average (Mintel, 2012). On the contrary, Generation X has the highest median household income, and more spending power, which is approximately $62,064 on average (Mintel, 2012). In order to introduce them to Ice Breakers Cool Blasts we will do a promotional price of buy one get one free. This will increase interest in our product and can potentially establish brand loyalty among our target markets (Boundless, n.d.). This promotion strategy will enable our target market to familiarize themselves with the flavors, packaging, and the product. Although a loss may be incurred with the promotional pricing, it will be counterbalanced by the large increase in sales, due to the increase of attention of Ice Breakers Cool Blasts. The Hershey Company will be successful with this promotional pricing strategy, if a promotional allowance is utilized with an intermediary. A promotional allowance is vital for this scenario, because promotional allowance is contingent on pushing the product to the next channel member in the distribution process, if the buyer agrees to perform some promotional activity for a price reduction. A promotional activity may include an in-store display, or a co-op advertising allowance. In summary, the Hershey Company will maximize reach and sales of the Ice Breakers Cool Blasts to the two target markets by taking price sensitivity, promotional pricing, and promotional allowance into consideration.

Ice Breakers Cool Blasts Case

Page 12

Budget In order to reach and make customers aware of Ice Breakers Cool Blasts, we have put

together a budget for merchandising, promotion, and product packaging. Our goal was to increase overall awareness of Cool Blasts among our target demographics of Millennials and Generation Xers. To reach Millennials, we have set aside $3 million into event sponsorships and our campus takeover project. Generation Xers are more responsive to older methods of media such as television. We have decided to invest $2 million into a new television commercials during some of this year’s most popular shows. Our next goal was to give customers the chance to try our product. We have set aside $3 million into sampling campaigns both in stores like Target and Walmart, and also within Starbucks. Last, but not least, we are updating merchandising and product packaging. In order to update our new package, we have set aside $500,000 and to merchandise we have set aside $1,500,000. We feel that these budgets were the best way to allocate our money as we took care of what we saw as most important first, that being awareness, and then worked our way down to the actual logistics and packaging of the product.

Timeline The Hershey Company’s objectives are to create awareness, have consumers identify the

benefits provided by Ice Breakers Cool Blasts, and to have Ice Breakers Cool Blasts accessible and purchased by our target market. Throughout the course of a year (April 2016-March 2017), we will relaunch Ice Breakers Cool Blasts through three lifecycle stages: awareness, interest, and trial to accomplish the objectives. The progressive stages will last 5 months, 3 months, and 3 months respectively.

The awareness stage’s primary objective is to instill brand recall and educate consumers about the Cool Blasts. In order to accomplish this objective is by creating opportunities for consumers to be exposed to the product, which include sponsoring concerts, events, commercials and creating social media campaigns. The interest stage’s primary objective is to have customers identify the benefits sough of Ice Breakers Cool Blasts through sampling the product. The Hershey Company can accomplish this by providing incentives to create consumer testimonials, and share these consumer testimonials and distributing these testimonials as public relations material through various social media outlets such as Facebook and Instagram. Next, the trial stage’s primary objective is to have Ice Breakers Cool Blasts accessible for consumers to purchase at discount retailers. The Hershey Company can accomplish this by utilizing a promotional and seasonal discount for the Cool Blasts. If the Hershey Company were to apply a promotional allowance discount for retailers, then Cool Blasts will be easily accessible for consumers to purchase. By March 2017, we want our target market to know about Cool Blasts, be able to differentiate Cool Blasts from other substitutes, and identify the benefits sought from using the product (see Appendix, Exhibit 3.1).

Sales Forecast 1 Year Sales Forecast (see Appendix, Exhibit 4.1)

● Due to the amount of sales that Walmart will bring, we believe that Cool Blasts will see a large 10% growth over last year’s monthly average income of approximately $750,000.

Ice Breakers Cool Blasts Case

Page 13 ● We foresee steady growth of 1.5% a month, during the summer months, as this is a new

product and our intense marketing efforts will create a large amount of awareness of Cool Blasts.

● We expect to hit a slump after the summer as consumers won’t be using Cool Blasts to refresh themselves in the summer sun.

● The fall television season should be a good one for Cool Blasts as our commercials in the hottest shows like NCIS and Big Bang Theory will better introduce Cool Blasts to Generation X and Baby Boomers.

● After the 2016 winter, we expect that sales will reach the monthly growth rate of Hershey’s, around 0.5% a month, but still growing.

4 Year Predictions (see Appendix, Exhibit 4.2)

● Now that Cool Blasts have become more well known, sales for the product will still continue to grow, but at slower pace than Cool Blasts was before.

Measures of Success

The Hershey Company will gauge the success of Ice Breakers Cool Blasts through numeric measures. The numeric measure of success will be analyzed with the percentage of sales for Ice Breakers Cool Blasts, and the increase of those sales from the relaunch until March of 2017. In addition, we will gauge success through growth in social media likes, and sentiment on the Facebook page where the campaign is launched. On Facebook, we seek to hit a goal of increasing likes on Ice Breakers Cool Blasts page by 150,000 by March of 2017, and measure sentiment through free listening tools such as Hootsuite. Furthermore, our success on Instagram can be measured through the amount of favorites, comments, tags, increase in followers and shares on the profile and photos we post. Other measures of success we can measure is how well the product meets the customer’s needs. This can be gauged through feedback surveys and ratings from consumers, along with feedback from sales and service organizations.

Ice Breakers Cool Blasts Case

Page 14

Appendix Exhibit 1.1. Brief overview of data results collected from the product sample study conducted.

Descriptive Statistics

Total number of participants 132 Number of participants tasting spearmint 71 Number of participants tasting peppermint 61 Average overall rating 6.895 Average rating of flavor 7.919 Average rating of duration 5.561 Average rating of freshness 8.615 Average rating of texture 5.478 Average likelihood to purchase 5.415 Count of gum users 96 Count of mint users 39 Subjects that never use gum or mint 2 Subjects that use gum or mint less than once a month 13 Subjects that use gum or mint 1-3 times a month 12 Subjects that use gum or mint once a week 20 Subjects that use gum or mint 2-3 times a week 25 Subjects that use gum or mint daily 33 Most frequent ranking of product flavor 1 (42%) Most frequent ranking of product duration 3 (45%) Most frequent ranking of product freshness 1 (40%) Most frequent ranking of product texture 4 (65%) 18-34 year old count 69 35-50 year old count 31 18-34 year old count 32 65+ year old count 3 Male count 57 Female count 76 Caucasian count 95 African American count 6 Native American count 1 Hispanic count 8 Asian count 24 Other count 1

Ice Breakers Cool Blasts Case

Page 15 Exhibit 1.2. Screenshots of the Qualtrics survey that was dispersed to subjects after taste testing the Ice Breakers Cool Blasts.

Ice Breakers Cool Blasts Case

Page 18 Exhibit 1.3. Two sample T-test for differences in means between males and females overall rating for the Ice Breakers Cool Blasts product.

Two-Sample T-Test Assuming Unequal Variances Overall Rating Male Overall Rating Female Mean 7.04 6.84 Variance 4.33 4.4605 Observations 56 75 Hypothesized Mean Difference 0 df 120 t Stat 0.5293 P(T<=t) one-tail 0.2988 t Critical one-tail 1.2886 P(T<=t) two-tail 0.5976 t Critical two-tail 1.6577 Exhibit 1.4. T-test comparing multiple sample means across age demographics for the overall opinion of the experience while consuming Ice Breakers Cool Blasts.

Overall experience by age demographic 18-34 35-50 50-65 65+ Average 6.86 7.31 6.44 8.67 Variance 4.66 1.65 6.45 5.33 Count 69 29 32 3 P value 18-34 35-50 51-65 65+ 18-34 1 0.2002 0.4243 0.3058 35-50 1 *0.0926 0.4166 51-65 1 0.2298 65+ 1 * Values with an asterisk indicate a significant result on with an α = 0.10

Ice Breakers Cool Blasts Case

Page 19 Exhibit 1.5. T-test comparing multiple sample means across age demographics for the likeliness that the group will purchase this item

Likeliness to purchase by age demographic 18-34 35-50 50-65 65+ Average 5.15942 5.677419 5.53125 7.333333 Variance 8.87127 4.95914 9.805444 9.333333 Count 69 31 32 3 P value 18-34 35-50 51-65 65+ 18-34 1 0.41846 0.575088 0.342317 35-50 1 0.831298 0.448519 51-65 1 0.417033 65+ 1 Exhibit 1.6. T-test comparing multiple sample means across age demographics to determine differences in gum and mint consumption

Age demographic that currently consumes gum or mints 18-34 35-50 50-65 65+ Average 5.333333 4.709677 4.65625 4.666667 Variance 3.019608 2.07957 2.426411 6.333333 Count 69 31 32 3 P value 18-34 35-50 51-65 65+ 18-34 1 *0.052018 *0.054407 0.692661 35-50 1 0.888076 0.979254 51-65 1 0.99498 65+ 1

Ice Breakers Cool Blasts Case

Page 20 Exhibit 1.7. Deeper look into Ice Breakers Cool Blasts product characteristics

Ice Breakers Cool Blasts characteristic rankings Frequency chosen Flavor Duration Freshness Texture Preferred most 55 21 52 3 Preferred 2nd 46 27 41 17 Preferred 3rd 22 59 24 26 Preferred least 8 24 14 85 Total 131 131 131 131

Ice Breakers Cool Blasts characteristic rankings Percentage chosen Flavor Duration Freshness Texture Preferred most 42% 16% 40% 2% Preferred 2nd 35% 21% 31% 13% Preferred 3rd 17% 45% 18% 20% Preferred least 6% 18% 11% 65% Total 100% 100% 100% 100% Exhibit 1.8. Open-ended comments and feedback from subjects.

● The texture and shape was strange. It was confusing because it chewed like gum, but then dissolved. It is also way too strong.

● I like how it's the best of both worlds (gum and mint) ● Pros: strong flavor and feel of freshness / Cons: bad texture, hard to chew at first ● I am not a fan of the texture/consistency of the product ● I like the packet it came in. ● It was the worst parts of a gum and mint texture wise with the basic result of the mint

version of it. ● It was a strong flavor. The cold air mixed with the flavor hurt my teeth. ● The mint is a little bit too strong ● It basically immediately dissolved in my mouth and I probably wouldn't buy this product

because of that reason ● I dissolved very quickly, which is great for being on the go. The taste was slightly too

strong because whenever I'd breath, I could feel this heavy cooling sensation. Otherwise, the taste was good and lasted for a while.

● I liked how it freshened up my breath a lot. and I like how long it lasts. ● I liked how long the freshness lasted. I dislike how noisy the package is and how close

the mints are together.

Ice Breakers Cool Blasts Case

Page 21 ● Educating the consumer on its fast dissolving quality on its package. / Package is a bit

noisy / It's a bit difficult to take a single piece off the package ● I liked that it was instantly effective, and easy to chew. ● It's too fresh for me. It's almost spicy. Especially after taking a drink of water, the cooling

effect is too harsh and irritates the throat. ● The green has a much less harsh flavor, but it does not last as long. ● I did not like the taste of the spearmint. It was a mix of slightly sweet, but then it had a

strange aftertaste. This also tasted a little chalky after it dissolved. I only really liked how long the freshness lasted.

● I was surprised when it started to dissolve, but it is very fresh ● Left a little bad film on teeth not flavor at first ● Tasted more like toothpaste. Flavor was too overpowering from the beginning of chew. ● I like how powerful it is if I were looking for a keep burst of freshness, but the texture is

very gum-like and confuses me that it dissolves. ● crystals stuck in your teeth, weird unexpected feeling in your mouth, and the object didn't

last long. ● At first I thought it was gum, and was sort of surprised/disappointed when it disappeared. ● Taste was good. Texture was stale and hard to chew. ● I like it better than Altoid. It's got a nice flavor. I'm sure my breath smells better. It's

slightly strong for me. I wanted it to be gum. ● I like that it is very flavorful. The flavor might be, too strong. My mouth has been

tingling for 5 minutes now. Inhaling is cooler and my breath feels cooler. ● Flavor was good, makes mouth feel fresh, but dissolved too fast, not like chewing gum,

more like a mint, didn't last that long for chewing, freshened breath ● pro: Very refreshing, strong to clear sinuses, very good, con: doesn't last very long ● It dissolves too fast, like chewing stuff, the product is too strong ● I was pleased that the product was a mint and not gum so no unsightly chewing. The

mints last and have a just right mint taste. ● Felt weird when the product "crumbled" in my mouth. But I like the super minty flavor.

Has a lasting impact. ● The consistency can be a turnoff and presentation is not very impactful. Lack of

established categories can cause confusion. ● I disliked that after just a few seconds the mint turned into a paste texture, but I enjoyed

the freshness. ● The flavor was not good and it was too strong. The texture felt like 4 hour old gum and

made me want to spit it out. ● I liked the freshness in my mouth. But I probably won't buy i because the artificial

sweeteners cause gastral issues. ● It's sugar free so I had to check the ingredients first - dislike. Peppermint always has a

Ice Breakers Cool Blasts Case

Page 22 slightly bitter taste - dislike.

● I liked the taste and could feel a cool feeling in my throat and felt like my breath was minty (after having onions at lunch :D). Thank you for letting me try it.

Exhibit 1.9. Evaluation of Data

Overall ranking based on age: When comparing age demographics to the overall rating of Ice Breakers Cool Blasts, our

research found that on average 35-50 year olds ranked Ice Breakers Cool Blasts more positively than 51-65 year olds. 35-50 year olds gave an average rating of 7.3/10 compared to an average 51-65 ranking of 6.4/10. With a P value of 0.09, and an α of 0.10, we are 90% confident that 35-50 year olds prefer Cool Blasts to 51-65 year olds. Because of this, we decided to focus on targeting this group in addition to the already existing target age range of 18-34 year olds.

Likeliness to purchase product Based on our research, we found no significant differences among age groups in

determining the likelihood that they will purchase the product.

Gum/mint usage We looked at what demographics currently have the highest amounts of gum and mint

consumption. with a P value of 0.052 and an α of 0.01, we are 90% confident that 18-34 year olds consume more mints and gum than 35-50 year olds. In addition, with a P value of 0.054 and an α of 0.10, we are 90% confident that 18-34 year olds consume more gum than 50-64 year olds. With this in mind, the current target market of 18-34 year olds is valuable since Ice Breakers Cool Blasts currently targets this market, and this product is most relatable to gum and mints.

Ice Breakers Cool Blasts Case

Page 23 Exhibit 2.1. Proposed packaging design revisions that include a tagline providing information about the product’s main feature, “Ultra Fresh in Seconds”.

Exhibit 3.1. Proposed lifecycles timeline.

Ice Breakers Cool Blasts Case

Page 24 Exhibit 4.1. 1 Year Forecasted Sales for Ice Breakers Cool Blasts, April 2016-March 2017.

Exhibit 4.2. 4 Year Forecasted Sales for Ice Breakers Cool Blasts, April 2016-March 2021.

Ice Breakers Cool Blasts Case

Page 25

References American Marketing Association. (2015, October 9). 2015-2016 American Marketing

Association collegiate case competition: Ice Breakers Cool Blasts full case, pages 1-18. Ahmed, I. (2015, May 6). This video breaks down just how popular (and profitable) the biggest

music festivals are. Retrieved December 8, 2015, from h ttp://www.complex.com/music/2015/05/how-much-music-festival-2015-make

Baer, J. (n.d.). 7 surprising statistics about Twitter in America. Retrieved December 8, 2015, from http://www.convinceandconvert.com/social-media-strategy/7-surprising-statistics- about-twitter-in-america/

Breath Mint. (n.d.). Retrieved November 18, 2015, from http://www.madehow.com/Volume- 6/Breath-Mint.html

Carter, B. (2015, February 24). Customer Loyalty Statistics: 2015 Edition. Retrieved November 21, 2015, from http://blog.accessdevelopment.com/customer-loyalty-statistics-2015- edition

Duggan, M., Ellison, N., Lampe, C., Lenhart, A., & Madden, M. (2015, January 9). Demographics of key social networking platforms. Retrieved December 8, 2015, from http://www.pewinternet.org/2015/01/09/demographics-of-key-social-networking-platforms-2/

Fiegl, A. (2009, June 16). A Brief History of Chewing Gum. Retrieved November 18, 2015, from http://www.smithsonianmag.com/arts-culture/a-brief-history-of-chewing-gum-6102 0195/?no-ist

The Food Timeline. (n.d.). FAQs: candy. Retrieved November 17, 2015, from http://www.foodtimeline.org/foodcandy.html#mints

George Washington University. (2015). Target takeover 2015. Retrieved December 9, 2015, from http://www.gwrha.com/target-takeover-2015.html

Goldman Sachs. (2015). Millennials Coming of Age. Retrieved December 9, 2015, from http://www.goldmansachs.com/our-thinking/pages/millennials/

Hampp, A. (2013, May 10). Festival sponsorship spending projected to set record in 2013. Retrieved December 8, 2015, from http://www.billboard.com/biz/articles/news/branding/1561337/festival-sponsorship-spending-projected-to-set-record-in-2013

IEG. (2015). North American music sponsorship spending 2015. Retrieved December 8, 2015, from http://www.statista.com/statistics/476233/music-sponsorship-spending-north- america/

Kang, C. (2014, September 5). TV is increasingly for old people. Retrieved December 7, 2015, from https://www.washingtonpost.com/news/business/wp/2014/09/05/tv-is-increasingly- for-old-people/

Mintel. "Marketing to Millennials - US - August 2012." Mintel Academic. Mintel, Sept. 2011. Web. 09 Dec. 2015. <http://academic.mintel.com.proxy.xxxxx/display/634138/#atom8>.

Mintel. (2015, April). Snacking Motivations and Attitudes. Retrieved December 9, 2015, from http://academic.mintel.com.proxy.xxxxx/display/735232/?highlight#hit1

Mintel. (2014, April). Sugar Confectionery and Breathe Fresheners. Retrieved December 9, 2015, from http://academic.mintel.com.proxy.xxxxx/display/724875/?highlight

Mintel. (2012, August 1). Marketing to Millennials. Retrieved November 28, 2015, from

Ice Breakers Cool Blasts Case

Page 26 http://academic.mintel.com.proxy.xxxxx /display/634138/

"Millennials Infographic." Goldman Sachs. GOLDMAN SACHS, 2015. Web. 09 Dec. 2015. <http://www.goldmansachs.com/our-thinking/pages/millennials/>.

Monllos, K. (2014, May 28). Ad of the day: Coke designs a friendly bottle that can only be opened by another bottle. Retrieved December 9, 2015, from http://www.adweek.com/news/advertising-branding/ad-day-coke-designs-friendly-bottle- can-only-be-opened-another-bottle-157988

Morgan, K. (2013, March 10). Chewing gum can boost concentration: study. Retrieved November 18, 2015, from http://articles.economictimes.indiatimes.com/2013-03- 10/news/37598182_1_gum-task-sort-term-memory

Nieburg, O. (2015, March 31). The kings of confectionery: Mars and Hershey level pegging in 2015 Harris Poll. Retrieved November 17, 2015, from http://www.confectionerynews.com/Markets/Top-US-chocolate-and-candy-brands-201

Online video advertising spending in the U.S. 2015 | Statista. (2014). Retrieved December 9, 2015, from http://www.statista.com/statistics/190306/us-online-video-advertising-forecast-2010- to-2015/

O'Loughlin, S. (2014, May 7). How Target became the big brand on campus. Retrieved December 9, 2015, from http://www.eventmarketer.com/article/grand-ex-2014/

O'Donnell, Fiona. "Marketing to Gen X - US - April 2011." Mintel Academic. Mintel, Apr. 2014. Web. 09 Dec. 2015. <http://academic.mintel.com.proxy.xxxxx/display/542925/>.

Poggi, J. (2015, September 24). TV Ad Pricing Chart: 'Sunday Night Football,' 'Empire' Are Broadcast's Most Expensive Ad Buys. Retrieved December 9, 2015, from http://adage.com/article/media/ad-pricing-chart-sunday-night-football-empire-broadcasts- most-expensive-ad-buys/300516/

PriceWaterhouseCoopers. (2011). Millennials at work: Reshaping the workplace. Retrieved November 16, 2015, from https://www.pwc.com/gx/en/managing-tomorrows- people/future-of-work/assets/reshaping-the-workplace.pdf

Perrin, A. (2015, October 8). Social media usage: 2005-2015. Retrieved December 8, 2015, from http://www.pewinternet.org/2015/10/08/social-networking-usage-2005-2015/

Boundless. (n.d.). Promotions. Retrieved November 19, 2015, from https://www.boundless.com/business/textbooks/boundless-business-textbook/product and-pricing-strategies-15/pricing-strategies-95/promotions-447-4692/

Rice, L. (2015, May 22). The 50 most watched broadcast shows of 2014-15. Retrieved December 8, 2015, from http://www.ew.com/article/2015/05/22/50-most-watched- broadcast-shows-2014-15

Rubinstein, P. (2015, August 11). Study shows Millennials' opinion of brands that sponsor music festivals. Retrieved December 8, 2015, from http://www.youredm.com/2015/08/11/study- shows-millenials-opinion-of-brands-that-sponsor-music-festivals/

Schawbel, D. (2015, January 20). 10 New Findings About The Millennial Consumer. Retrieved December 9, 2015, from http://www.forbes.com/sites/danschawbel/2015/01/20/10-new-findings-about-the-millennial-consumer/

Statista. (2015). Facebook: global advertising revenue 2016. Retrieved December 8, 2015, from http://www.statista.com/statistics/271258/facebooks-advertising-revenue-worldwide/

Statista. (2015). Live music industry revenue in the U.S. by source 2016. Retrieved December 8, 2015, from http://www.statista.com/statistics/491896/live-music-industry-revenue-in-the-

Ice Breakers Cool Blasts Case

Page 27 us-by-source/

Statista. (2015). Magazine advertising spending in the U.S. 2011-2017. Retrieved December 8, 2015, from http://www.statista.com/statistics/272414/magazine-advertising-spending-in- the-us/

Statista. (2015). Magazines with largest audience in the U.S. 2015. Retrieved December 8, 2015, from http://www.statista.com/statistics/208807/estimated-print-audience-of-popular- magazines/

Statista. (2015). Number of magazines in the United States 2002-2014. Retrieved December 8, 2015, from http://www.statista.com/statistics/238589/number-of-magazines-in-the-united-states/

Statista. (2015). Print advertising revenue of U.S. newspapers, 2013 statistic. Retrieved December 8, 2015, from http://www.statista.com/statistics/272568/print-advertising- revenue-of-us-newspapers/

Statista. (2015). Social media advertising - United States. Retrieved December 8, 2015, from http://www.statista.com/outlook/220/109/social-media-advertising/united-states#market- revenue

Statista. (2015). U.S. student preferred product info sources 2014. Retrieved December 9, 2015, from http://www.statista.com/statistics/381191/preferred-sources-of-information-about- products-among-students-usa/

Statista. (2015). U.S. LinkedIn reach by age 2015. Retrieved December 8, 2015, from http://www.statista.com/statistics/246172/share-of-us-internet-users-who-use-linkedin- by-age-group/

Statista. (2015). Use of streaming services to watch TV in the U.S. by age 2013. Retrieved December 7, 2015, from http://www.statista.com/statistics/257214/use-of-streaming- services-to-watch-tv--in-the-us-by-age/

TV advertising revenue in the U.S. 2015 | Statistic. (2015). Retrieved December 9, 2015, from http://www.statista.com/statistics/259974/tv-advertising-revenue-in-the-us/

Waddell, R. (2015, July 15). Coachella earns over $84 million, breaks attendance records. Retrieved December 8, 2015, from http://www.billboard.com/articles/business/6633636/coachella-2015-earnings-84-million- breaks-attendance-records

Several reference URLs were blacked out and changed to “xxxx” to maintain anonymity, as they use the institution’s internal library database. If requested, we can provide the correct URL.