Dec-13 - jsil.com · Adamjee Insurance Co. Ltd. 2.48 Packages Ltd. 2.12 Asset quality (%age of...

Transcript of Dec-13 - jsil.com · Adamjee Insurance Co. Ltd. 2.48 Packages Ltd. 2.12 Asset quality (%age of...

Dec-13

ECONOMY The Current Account continued to post a dismal picture with a deficit of USD1,885 mn for the period July-Nov 2013, as compared to a deficit of USD684 mn in the same period last year. Workers’ remittances for Nov. 2013 were USD1.13 bn compared to USD1.35 bn in Oct. 2013. Trade deficit reduced by USD192 mn MoM during November however services deficit increased by USD273 mn. Foreign Reserves improved by USD275 mn up until Dec. 27, 2013 to USD8.52 bn from USD8.25 bn in Nov. 2013. Pakistan received the second installment of USD553 mn from the IMF during the month of December. Pakistan was also able to secure a credit line of USD225 mn for the Blaance of Payments from a consortium which includes the Credit Suisse. The PKR recorded strong performance during the month of December increasing by 3.0% MoM as Forex reserves improved. With the IMF payments continuing to loom in the near future we expect further PKR depreciation.

MONEY MARKET REVIEW In December 2013 the State Bank of Pakistan borrowed funds worth PKR913 bn through two T-bill auctions. With weighted average yields for 3M and 6M T-bills averaging in at 9.89% and 9.98% respectively, no bids were received for 12M T-bills during the period. In December of 2013, Pakistan annual inflation rate declined sharply to 9.18 percent, from 10.90 percent in November. On a monthly basis, prices decelerated by 1.3 percent. Core inflation measured by non-food non-energy CPI increased by 8.2 percent in December, compared to 8.5 percent in November. Owing to the deceleration in inflation rate the SBP might keep the monetary tightening on hold, at least in the short term.

EQUITY MARKET REVIEW The equity market continued its bullish run in December, with the KSE-100 index reaching its highest levels ever at 25,579. The KSE-100 index realized an increment of 3.9%, whereas the KSE30 Index and KMI-30 index gained 3.1% and 4.3% respectively. Average daily volume also improved MoM reaching 141.92 mn as compared to 115.51 mn during November for KSE100 index. This is the second consecutive year the equity market has given a strong performance of 49.4% for CY 2013, after increasing 49% in CY2012. Foreign investor’s portfolio investment remained positive at USD398 mn during CY2013 as compared to USD126 mn in CY2012. Politics was the dominant investment theme for Pakistan's equity market in 2013. Smooth transition of power in the May 2013 elections exciting domestic and foreign investors. Major positives were the first time in Pakistan's sixty-five year history that a democratically elected government completed its term and handed over power to another. Additionally the PML-N government won a simple majority in the National Assembly; imperative for the much needed reform process. With the upcoming result season we expect companies to post growth oriented results and higher dividends. However with the equity market at an all time high and macro challenges still apparent we would remain cautiously optimistic only.

Monthly YoY Inflation

0.0%

4.0%

8.0%

12.0%

16.0%

Apr‐12

Jun‐12

Aug

‐12

Oct‐12

Dec‐12

Feb‐13

Apr‐13

Jun‐13

Aug

‐13

Oct‐13

Dec‐13

Source: Pakistan Bureau of Statistics

Interbank rates KIBOR (Average) Dec ’13 vs. Nov ‘13

10.2

10.1

10.1 10.4

10.5

11.5

12.4

9.4 9.7 9.8 10

.1

10.2

11.5

12.1

8.50

9.50

10.50

11.50

12.50

13.50

1M 3M 6M 9M 1Y 2Y 3Y

Dec '13 Nov '13

Source: State Bank of Pakistan

Market activity Daily volume vs. KSE-30 movement

‐

25

50

75

100

125

150

175

2‐Dec 9‐Dec 16‐Dec 23‐Dec 31‐Dec

Shrs in mn

18,250

18,500

18,750

19,000

19,250

Volume (L.H.S) KSE‐30 (R.H.S)

Source: Karachi Stock Exchange

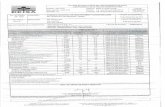

Performance data and analytics MUFAP Recommended Format Dec-13

Investment philosophy UTP is a balanced fund that aims to preserve and grow investor’s capital in the long term while providing a regular stream of current income on an annual basis. The fund operates a diverse portfolio of equity and fixed income investments whereby the equity component is meant to provide the growth in capital while dividends on the equity component along with the fixed income investments help generate the current income.

Key information Fund type Open endCategory Balanced SchemeFund launch date 27 October, 1997Net Assets (PKR mn) 1,419.64NAV (PKR) 138.60Benchmark1 50% 6M KIBOR & 50% KSE 30 IndexManagement fee 2.00% (Exclusive of Sindh Sales Tax)Front-end Load 3.00%Back-end Load NILPricing mechanism Forward Trustee Central Depository Company of Pakistan Ltd.Dealing Days & Cut-off time (Monday to Friday) 3:00 p.m.Auditor KPMG Taseer Hadi & Co.Risk profile MediumRating (PACRA) 5 Star (Short term) & 3 Star (Long term)Listing LSELeverage NILAMC Rating AM2- (By JCR-VIS)

Performance (%) Cumulative return2 1M 1Y 3Y 7Y Launch Avg. Ann.*

Fund 4.53 36.63 84.81 115.05 1171.26 17.01Benchmark 1.98 22.98 52.37 71.23 699.04 13.70Difference 2.55 13.65 32.44 43.82 472.22 3.31* Average Annualized Return since inception as per Morning Star formula

Monthly performance (%) FY14 FY13 FY12 FY11 FY10

Jul 5.47 3.57 -0.15 4.22 5.69Aug -5.57 5.07 -1.21 -3.10 9.51Sep -0.66 -0.06 4.13 0.40 8.26Oct 2.44 1.64 0.39 3.57 -1.36Nov 6.40 4.01 -2.44 4.13 0.95Dec 4.53 1.89 -2.45 4.58 1.23Jan 2.37 7.38 2.08 0.52Feb 4.73 5.16 -4.30 -1.39Mar 1.70 4.88 7.85 0.20Apr 1.64 2.08 -0.45 0.25May 9.46 -0.67 -3.29 -7.73Jun -0.08 -1.05 -2.40 -1.72YTD 12.72 42.01 16.60 13.23 14.05Benchmark 10.53 22.77 8.37 18.08 25.07Difference 2.19 19.24 8.23 -4.85 -11.02

Non Compliant Investments under Circular 07/2009

Agritech Ltd. Sukuks 117,601,483 (117,601,483) - 0.00 0.00

Azgard Nine Ltd.a PPTFC 31,980,766 (31,980,766) - 0.00 0.00

Agritech Ltd.b PPTFC - - - 0.00 0.00

Azgard Nine Ltd.c PPTFC - - - 0.00 0.00

Name of Investment

% of Net

Assets

% of GrossAssets

TypeValue before

provision

Provision held

(if any)

Valueafter

provision

(a) The commercial paper amounting to Rs. 75 mn of Azgard Nine Ltd has been settled through Issuance of 15,000 PPTFC's of an equivalent amount in the name of the fund. The said PPTFCs were restructured and ANL provided 772,253 shares of Agritech Limited at the rate of Rs. 35 each which reduced our provision accordingly. During the month of January 2013 5000 PPTFC'S have been disposed off. (b) Fund has received Agritech PPTFC's against interest receivable of Agritech Sukuk which is valued at zero but cost is carried at 18,665,000. (c) The Fund has received 3,853 Zero Coupon PPTFC against interest receivable of unlisted TFC's. Since these PPTFC's are received against already defaulted securities and even MUFAP started its revaluation, the management as a matter of prudence is not revaluing said PPTFC's. These PPTFC's are valued at zero but cost is carried at 19,265,000.

Fund manager's review UTP returned 4.53 percent during December 2013 outperforming its benchmark by 2.55 percent. On YTD basis, the fund returned 12.72 percent against its benchmark’s return of 10.53 percent.

Asset allocation (%) Dec-13 Nov-13

Cash 25.87 3.56 Placement with Banks and DFIs 3.44 3.56 Equity 44.64 65.72 TFCs / Sukkuks - - PIBs - - T Bills 25.54 26.25 Other including receivables 0.51 0.92 Total 100.00 100.00

Equity sector breakdown (%) Dec-13 Nov-13

Oil & Gas 18.53 22.89 Banks 10.32 9.38 Personal Goods 3.24 9.24 Electricity 3.10 3.89 Automobile & Parts 2.54 2.33 Others 6.91 17.99 Total 44.64 65.72

Top holding (%age of total assets) Bank Alfalah Ltd. 6.55 Pakistan State Oil Co. Ltd. 5.99 Oil & Gas Development Co. Ltd. 5.39 MCB Bank Ltd. 3.77 Nishat Power Ltd. 3.10 Attock Petroleum Ltd. 2.87 Pak Suzuki Motor Co. Ltd. 2.54 Pakistan Oilfields Ltd. 2.52 Adamjee Insurance Co. Ltd. 2.48 Packages Ltd. 2.12

Asset quality (%age of total assets) AAA, 25.59%

AA+, 3.44%AA, 25.82%

Statistical analysis Fund Benchmark

Beta 0.5 1.0Standard Deviation 15.0% 22.7%Largest Month Gain 14.0% 19.3%Largest Month Loss -24.0% -33.8%% Positive Months 72.8% 64.1%

Investment Committee Members Mr. Rashid Mansur - Chief Executive Officer Mr. Khawar Iqbal - Chief Financial Officer Dr. Ali Akhtar Ali - CIO / Fund Manager Mr. Assad H. Khan - Country Head Business Development

Contact us JS Investments Limited Toll Free: 0800 - 00887 E-mail: [email protected] Website: www.jsil.com 1. From the month of Jan 2010 onwards, the benchmark for the UTP fund has switched

from 70% 6M KIBOR & 30% KSE 30 Index to 50% 6M KIBOR & 50 % KSE 30 Index. 2. Cumulative return is based as per MUFAP stated methodology.

Disclosure for WWF Liability under Circular 17 of 2012 The Scheme has maintained provisions against Worker's Welfare Fund’s liability to the tune of Rs. 27,207,985, if the same were not made the NAV per unit/return of the Scheme would be higher by Rs. 2.66 / 1.9%. For details investors are advised to read the Note 10 of the latest Financial Statements of the Scheme.

Performance data and analytics MUFAP Recommended Format Dec-13

Investment philosophy The main objective of JSGF is to enable the Certificate Holders to participate in a diversified portfolio of high quality equity securities listed on the stock exchanges and to maximize the investment return, by prudent investment management. Key information Fund type Open endCategory Equity SchemeFund launch date 06 June, 2006Net Assets (PKR mn) 4,501.51NAV (PKR) 157.80Benchmark KSE30 IndexManagement fee 2.00% (Exclusive of Sindh Sales Tax)Front-end Load 3% of NAV (Applicable to Class "A")Back-end Load 20% of NAV (Applicable to Class "B")Pricing mechanism Forward Trustee MCB Financial Services LtdDealing Days & Cut-off time (Monday to Friday) 3:00 p.m.Auditor Ernst & Young Ford Rhodes Sidat Hyder & Co.Risk profile HighRating (PACRA) 3 Star (Short term) & 3 Star (Long term)Listing LSELeverage NILAMC Rating AM2- (By JCR-VIS) Performance (%) Cumulative return1

1M 1Y 2Y 3Y LaunchFund 4.63 64.15 161.19 135.28 98.55Benchmark 3.08 36.65 84.78 62.31 54.43Difference 1.55 27.50 76.41 72.97 44.12 Monthly performance (%)

FY14 FY13 FY12 FY11 FY10Jul 11.41 3.80 -1.13 6.80 7.80Aug -8.85 5.36 -5.05 -7.98 9.99Sep 0.45 -0.71 5.12 2.96 7.41Oct 1.83 2.34 -3.31 2.45 -0.95Nov 15.14 6.32 -3.28 6.24 -1.48Dec 4.63 1.24 -3.95 9.50 0.44Jan 2.12 8.93 1.43 -0.62Feb 7.11 9.60 -6.08 -2.13Mar 2.25 6.89 8.54 1.15Apr 3.00 2.49 -0.09 -0.19May 14.87 2.07 1.98 -12.65Jun -0.87 -0.35 -3.54 -0.54YTD 25.14 56.91 17.92 22.56 6.51Benchmark 16.05 35.95 2.90 21.24 26.22Difference 9.09 20.96 15.02 1.32 -19.71 Fund manager's review During the month of December 2013, JS Growth Fund delivered a return of 4.63% as compared to its benchmark’s return of 3.08%, thereby outperforming it by 1.55%.

Asset allocation (%) Dec-13 Nov-13

Cash 38.06 15.19 Equity 61.13 81.54 Other including receivables 0.81 3.27

Total 100.00 100.00

Equity sector breakdown (%)

Dec-13 Nov-13Oil & Gas 17.06 21.87 Banks 13.47 12.51 Food Producers 9.11 8.44 Non Life Insurance 7.57 8.92 Automobile & Parts 5.42 4.87 Others 8.51 24.92 Total 61.13 81.54

Top holding (%age of total assets) Rafhan Maize Products Ltd. 7.14 Bank Alfalah Ltd. 6.76 MCB Bank Ltd. 6.71 Oil & Gas Development Co. Ltd. 6.68 Pakistan State Oil Co. Ltd. 6.31 Adamjee Insurance Co. Ltd. 6.14 Pak Suzuki Motor Co. Ltd. 5.42 Packages Ltd. 3.36 D. G. Khan Cement Co. Ltd. 2.68 Nishat Mills Ltd. 2.30

Statistical analysis Fund Benchmark

Beta 0.8 1.0Standard Deviation 25.6% 29.4%Largest Month Gain 18.9% 25.2%Largest Month Loss -35.2% -45.1%% Positive Months 60.4% 58.2%

Investment Committee Members Mr. Rashid Mansur - Chief Executive Officer Mr. Khawar Iqbal - Chief Financial Officer Dr. Ali Akhtar Ali - CIO / Fund Manager Mr. Assad H. Khan - Country Head Business Development Contact us JS Investments Limited Toll Free: 0800 - 00887 E-mail: [email protected] Website: www.jsil.com Disclosure for WWF Liability under Circular 17 of 2012 The Scheme has maintained provisions against Worker's Welfare Fund’s liability to the tune of Rs. 74,881,939, if the same were not made the NAV per unit/return of the Scheme would be higher by Rs. 2.62 / 1.7%. For details investors are advised to read the Note 8 of the latest Financial Statements of the Scheme.

1 Cumulative return is based as per MUFAP stated methodology.

Performance data and analytics MUFAP Recommended Format Dec-13

Investment philosophy The fund maintains a portfolio of high yielding equity securities aiming at earnings derived from capital appreciation and dividend income. The portfolio seeks capital growth through investments in marketable securities with better-than-average appreciation potential and liberal dividend policies. To benefit from changing interest rate environment and some portion of the portfolio is also kept in debt instruments and bank deposits. Key information Fund type Open endCategory Equity SchemeFund launch date 14 January, 1996Net Assets (PKR mn) 2,078.30NAV (PKR) 176.82Benchmark KSE30 IndexManagement fee 2.00% (Exclusive of Sindh Sales Tax)Front-end Load 3% of NAV (Applicable to Class "A")Back-end Load 20% of NAV (Applicable to Class "B")Pricing mechanism Forward Trustee MCB Financial Services LtdDealing Days & Cut-off time (Monday to Friday) 3:00 p.m.Auditor KPMG Taseer Hadi & Co.Risk profile HighRating (PACRA) 4 Star (Short term) & 4 Star (Long term)Listing LSELeverage NILAMC Rating AM2- (By JCR-VIS) Performance (%) Cumulative return1

1M 1Y 2Y 3Y 5YFund 4.30 60.61 148.97 131.21 118.93Benchmark 3.08 36.65 84.78 62.31 242.89Difference 1.22 23.96 64.19 68.90 -123.96 Monthly performance (%)

FY14 FY13 FY12 FY11 FY10Jul 8.16 3.57 -0.10 7.08 7.85Aug -7.20 5.88 -3.25 -6.28 0.80Sep -0.82 1.11 4.09 0.47 6.61Oct 3.02 4.23 -0.60 8.20 -0.33Nov 12.94 4.98 -5.32 7.58 -2.57Dec 4.30 1.86 -2.97 6.14 -0.19Jan 1.37 7.42 1.14 -1.21Feb 7.90 5.08 -4.31 -2.45Mar 2.58 5.61 6.27 -2.22Apr 3.74 0.00 1.66 0.99May 14.40 5.13 -0.57 -14.59Jun -0.16 0.09 -2.77 -2.87YTD 20.80 64.30 15.25 25.89 -11.32Benchmark 16.05 35.95 2.90 21.24 26.22Difference 4.75 28.35 12.35 4.65 -37.55 Fund manager's review During the month of December 2013, JS Value Fund delivered a return of 4.30% as compared to its benchmark’s return of 3.08%, thereby outperforming by 1.22%. On YTD basis, the fund outperformed the benchmark by 4.75%.

Asset allocation (%) Dec-13 Nov-13

Cash 20.90 14.55 Equity 78.59 84.43 Other including receivables 0.51 1.01

Total 100.00 100.00

Equity sector breakdown (%)

Dec-13 Nov-13Oil & Gas 25.76 24.80 Food Producers 12.07 12.01 Banks 11.66 9.35 Personal Goods 9.82 12.11 Electricity 5.66 5.87 Others 13.62 20.29 Total 78.59 84.43

Top holding (%age of total assets) Rafhan Maize Products Ltd. 10.79 Pakistan State Oil Co. Ltd. 8.20 Bank Alfalah Ltd. 6.24 Oil & Gas Development Co. Ltd. 6.12 Nishat Power Ltd. 5.66 Pakistan Oilfields Ltd. 5.52 MCB Bank Ltd. 5.43 Nishat Mills Ltd. 5.10 Nishat (Chunian) Ltd. 4.72 Attock Petroleum Ltd. 4.44

Statistical analysis Fund Benchmark

Beta 0.6 1.0Standard Deviation 22.0% 29.3%Largest Month Gain 21.4% 25.2%Largest Month Loss -24.4% -45.1%% Positive Months 65.4% 60.6%

Investment Committee Members Mr. Rashid Mansur - Chief Executive Officer Mr. Khawar Iqbal - Chief Financial Officer Dr. Ali Akhtar Ali - Chief Investment Officer Mr. Zohaib Pervez, CFA - Fund Manager Mr. Assad H. Khan - Country Head Business Development Contact us JS Investments Limited Toll Free: 0800 - 00887 E-mail: [email protected] Website: www.jsil.com Disclosure for WWF Liability under Circular 17 of 2012 The Scheme has maintained provisions against Worker's Welfare Fund’s liability to the tune of Rs. 32,254,063 if the same were not made the NAV per unit/return of the Scheme would be higher by Rs. 2.74 / 1.6%. For details investors are advised to read the Note 8 of the latest Financial Statements of the Scheme.

1 Cumulative return is based as per MUFAP stated methodology.

Performance data and analytics MUFAP Recommended Format Dec-13

Investment philosophy JS LCF is an open-end Equity Scheme that aims to benefit from an attractive Capital Market in an economy with growth potential, to maximize the total investment return consisting of a combination of capital appreciation and dividend income. Consistent with its Investment Objective, the Fund shall invest primarily in equity securities of listed Large-Cap companies with market capitalization of over Rupees one billion. The remaining Funds shall be invested in Authorized Investments including cash and/or near cash instruments which include cash in bank accounts, and Government securities not exceeding ninety (90) days maturity.

Key information Fund type Open endCategory Equity SchemeFund launch date 14 May, 2004Net Assets (PKR mn) 702.42NAV (PKR) of Unit "A" 91.88Benchmark KSE30 IndexManagement fee 2.00% (Exclusive of Sindh Sales Tax)Front-end Load 3.00%Pricing mechanism Forward Trustee Central Depository Company of Pakistan Ltd.Dealing Days & Cut-off time (Monday to Friday) 3:00 p.m.Auditor KPMG Taseer Hadi & Co.Risk profile HighRating (PACRA) 4 Star (Short term) & 4 Star (Long term)Listing LSELeverage NILAMC Rating AM2- (By JCR-VIS)

Performance (%) Cumulative return1 1M 1Y 2Y 3Y Launch Avg. Ann.*

Fund 5.55 64.60 149.74 139.61 280.67 14.88Benchmark 3.08 36.65 84.78 62.31 154.87 10.19Difference 2.47 27.95 64.96 77.30 125.80 4.68* Average Annualized Return since inception as per Morning Star formula

Monthly performance (%) FY14 FY13 FY12 FY11 FY10

Jul 12.94 4.07 -1.09 5.36 8.33Aug -8.41 4.39 -6.17 -4.36 6.80Sep -1.23 -1.16 6.94 0.48 7.34Oct 3.16 1.89 -2.67 11.10 -1.81Nov 12.98 6.40 -3.43 8.58 -0.53Dec 5.55 1.40 -4.21 5.52 0.66Jan 2.87 9.03 2.06 -0.26Feb 7.98 9.81 -6.34 -1.97Mar 3.96 4.94 12.22 -1.34Apr 0.66 0.44 -0.39 -0.14May 12.08 3.08 0.62 -9.13Jun 0.52 -1.16 -0.14 -2.10YTD 25.69 54.57 14.87 38.38 4.65Benchmark 16.05 35.95 2.90 21.24 26.22Difference 9.64 18.62 11.97 17.14 -21.58

Non Compliant Investments under Circular 07/2009 & Circular No. 16 of 2010

Agritech Ltd.1 PPTFC - - - - - Agritech Ltd.2 Sukuk 4,991,429 (4,991,429) - - - Azgard Nine3

PPTFC - - - - -

Valueafter

% of Net Assets

% GrossAssets

Name of Investment

TypeValue before

Provisionheld

(1) These PPTFCs were issued on 11 January 2012 against outstanding mark-up due on Sukuk certificates of Agritech Limited The Fund has recognized the above TFCs at nil value. The principal outstanding against these TFCs is to be redeemed in six equal semi-annual installments starting from 01 July 2012 and will mature on 01 January 2015. These TFCs have been classified as Non Performing Asset by MUFAP on 17 January 2012.Cost of these PPTFCs are carried at Rs. 3.485 million. (2) The above investment was made by the Fund prior to its conversion from closed end fund to an open end fund. However, under the circular 7 of 2009 of SECP, the open end equity fund cannot invest in the debt securities. Management is of the view that investment was made prior to the above mentioned conversion. Nevertheless, the carrying value of investments at 31 March 2013 was Nil. (3) These convertible privately placed term finance certificates (PPTFCs) were issued against the cumulative preference shares of Azgard Nine Limited on 22 October 2012 under the "Settlement Agreement" dated 22 October 2012 between the Management Company of the Fund and Azgard Nine Limited. Since these PPTFCs are received against non-performing security, therefore the management, as a matter of prudence has recognized above PPTFCs at nil value. These convertible PPTFCs carry mark-up rate of 11% per annum with a tenor of 8 years (inclusive of a 2 year grace period for principal redemption) as per the terms and conditions. In case of Default, the PPTFC Holders shall have the right to exercise the option to convert the PPTFCs into ordinary voting shares of Azgard Nine Limited as per the terms and conditions. Cost of these PPTFCs are carried at Rs. 83.16 million. However, the fund received two interest coupon payments so far against the said PPTFCs.

Asset allocation (%) Dec-13 Nov-13

Cash 13.27 18.54 Equity 82.16 80.08 Other including receivables 4.57 1.38

Total 100.00 100.00

Equity sector breakdown (%)

Dec-13 Nov-13Oil & Gas 24.32 18.84 Banks 15.64 8.37 Personal Goods 10.32 15.74 Automobile & Parts 8.96 7.31 Electricity 8.17 8.99 Others 14.74 20.82 Total 82.16 80.08

Top holding (%age of total assets) Oil & Gas Development Co. Ltd. 10.98 Pak Suzuki Motor Co. Ltd. 8.96 Pakistan State Oil Co. Ltd. 8.37 Nishat Power Ltd. 8.17 Bank Alfalah Ltd. 8.07 IGI Insurance Ltd. 7.63 Meezan Bank Ltd. 7.57 D. G. Khan Cement Co. Ltd. 7.11 Nishat Mills Ltd. 6.33 Attock Petroleum Ltd. 4.97

Statistical analysis

Fund BenchmarkBeta 0.7 1.0Standard Deviation 22.8% 29.4%Largest Month Gain 14.7% 25.2%Largest Month Loss -30.8% -45.1%% Positive Months 61.2% 59.5%

Investment Committee Members Mr. Rashid Mansur - Chief Executive Officer Mr. Khawar Iqbal - Chief Financial Officer Dr. Ali Akhtar Ali - Chief Investment Officer Mr. Arslan Asif Soomro - Fund Manager Mr. Assad H. Khan - Country Head Business Development Fund manager's review In the month of December 2013, JS Large Cap Fund delivered returns of 5.55% as compared to the benchmark's return of 3.08%, thereby outperforming by 2.47%. The YTD return of JS Large Cap Fund stands at 25.69%, as compared to the benchmark's return of 16.05%, thereby outperforming by 9.64%. Contact us JS Investments Limited Toll Free: 0800 - 00887 E-mail: [email protected] Website: www.jsil.com 1 Cumulative return is based as per MUFAP stated methodology. Disclosure for WWF Liability under Circular 17 of 2012 The Scheme has maintained provisions against Worker's Welfare Fund’s liability to the tune of Rs. 39,240,282, if the same were not made the NAV per unit/return of the Scheme would be higher by Rs. 5.13 / 5.6%. For details investors are advised to read the Note 8 of the latest Financial Statements of the Scheme.

Performance data and analytics MUFAP Recommended Format Dec-13

Investment philosophy JS Islamic Fund [JS ISF] aims to grow investor’s capital in the long term in adherence with principles of Shariah compliance as advised by the Shariah Advisory Council (SAC) of this fund. The fund investments are limited to asset classes approved by the Shariah Advisory Council (SAC) and all companies under investment consideration are semiannually screened for Shariah compliance. Key information Fund type Open endCategory Shariah Compliant Islamic - Equity SchemeFund launch date 27 December, 2002Net Assets (PKR mn) 366.29NAV (PKR) 72.99Benchmark1 KMI-30 IndexManagement fee 2.00% (Exclusive of Sindh Sales Tax)Front-end Load 3.00%Back-end Load NILPricing mechanism Forward Trustee Central Depository Company of Pakistan Ltd.Dealing Days & Cut-off time (Monday to Friday) 3:00 p.m.Auditor KPMG Taseer Hadi & Co.Risk profile HighRating (PACRA) 3 Star (Short term) & 2 Star (Long term)Listing LSELeverage NILAMC Rating AM2- (By JCR-VIS)

Performance (%) Cumulative return2

1M 1Y 2Y 3Y Launch Avg. Ann.*Fund 4.84 54.11 137.45 148.03 369.20 15.06Benchmark 4.33 45.68 110.70 122.48 374.75 15.18Difference 0.51 8.43 26.75 25.55 -5.55 -0.12* Average Annualized Return since inception as per Morning Star formula

Monthly performance (%) FY14 FY13 FY12 FY11 FY10

Jul 15.35 3.24 2.57 7.66 7.45Aug -11.98 6.71 -4.25 -4.86 10.19Sep 1.59 0.11 7.38 2.14 6.86Oct 1.02 -0.36 1.10 3.67 -0.94Nov 10.07 1.40 -6.35 7.66 1.75Dec 4.84 1.89 -7.14 6.59 0.71Jan 3.05 11.00 6.00 0.37Feb 7.08 6.68 -6.44 -0.33Mar 2.83 12.78 10.77 4.13Apr 2.07 -3.64 2.67 0.06May 11.39 5.59 0.31 -12.64Jun -0.64 -0.12 -0.43 -0.55YTD 20.24 45.51 25.84 40.23 16.31Benchmark 15.57 54.41 13.57 43.66 41.98Difference 4.67 -8.90 12.27 -3.43 -25.67

Fund manager's review In the month of December 2013, the JS Islamic Fund returned 4.84% as compared to the benchmark’s return of 4.33%, outperforming the benchmark by 0.51%. The cumulative Fiscal Year 2014's YTD return stands at 20.24%.

Asset allocation (%) Dec-13 Nov-13

Cash 8.68 6.10 Equity 88.77 91.70 Other including receivables 2.55 2.20

Total 100.00 100.00

Equity sector breakdown (%)

Dec-13 Nov-13Oil & Gas 32.60 31.17 Automobile & Parts 16.71 17.13 Banks 9.92 - Personal Goods 9.27 13.92 General Industrials 8.94 9.08 Others 11.33 20.40 Total 88.77 91.70

Top holding (%age of total assets) Pakistan State Oil Co. Ltd. 13.20 Oil & Gas Development Co. Ltd. 12.81 Meezan Bank Ltd. 9.92 Nishat Mills Ltd. 9.27 Pak Suzuki Motor Co. Ltd. 9.21 Packages Ltd. 8.94 Indus Motor Co. Ltd. 7.50 D. G. Khan Cement Co. Ltd. 6.81 Pakistan Oilfields Ltd. 6.59 Pakistan Telecommunication Co. Ltd. 4.52

Statistical analysis Fund Benchmark

Beta 0.8 1.0Standard Deviation 22.3% 25.2%Largest Month Gain 15.4% 20.2%Largest Month Loss -28.7% -37.1%% Positive Months 68.4% 65.2%

Investment Committee Members Mr. Rashid Mansur - Chief Executive Officer Mr. Khawar Iqbal - Chief Financial Officer Dr. Ali Akhtar Ali - Chief Investment Officer Mr. Arslan Asif Soomro - Fund Manager Mr. Assad H. Khan - Country Head Business Development Contact us JS Investments Limited Toll Free: 0800 - 00887 E-mail: [email protected] Website: www.jsil.com Disclosure for WWF Liability under Circular 17 of 2012 The Scheme has maintained provisions against Worker's Welfare Fund’s liability to the tune of Rs. 8,583,124, if the same were not made the NAV per unit/return of the Scheme would be higher by Rs. 1.71 / 2.3%. For details investors are advised to read the Note 9 of the latest Financial Statements of the Scheme. 1 From January 2010, benchmark switched from DJIMPK to KMI-30 index.

2 Cumulative returns are based as per MUFAP stated methodology.

Performance data and analytics MUFAP Recommended Format Dec-13

Investment philosophy JS FoF is a fund of funds that aims to grow investor’s capital in the long term while diversifying the asset manager risk bundled together with the benefits of an asset allocation fund. The fund operates a diverse portfolio of equity, balanced, fixed income and money market funds (both open and closed ended) with the option to adjust the asset mix as equity markets rise or fall and the economy strengthens or weakens. Key information Fund type Open endCategory Fund of Fund SchemeFund launch date 31 October, 2005Net Assets (PKR mn) 107.08NAV (PKR) 47.64Benchmark BM FoF1

Management fee 1.00% (Exclusive of Sindh Sales Tax)Front-end Load 3.00%Back-end Load NILPricing mechanism Forward Trustee Central Depository Company of Pakistan Ltd.Dealing Days & Cut-off time (Monday to Friday) 3:00 p.m.Auditor KPMG Taseer Hadi & Co.Risk profile MediumListing LSELeverage NILAMC Rating AM2- (By JCR-VIS) Performance (%) Cumulative return2

1M 1Y 2Y 3Y Launch Avg. Ann.*Fund 4.63 38.60 78.75 92.53 178.30 13.34Benchmark 3.60 25.38 58.71 57.73 89.26 8.12Difference 1.03 13.22 20.04 34.80 89.04 5.22* Average Annualized Return since inception as per Morning Star formula Monthly performance (%)

FY14 FY13 FY12 FY11 FY10Jul 13.60 0.36 0.03 3.52 5.74Aug -8.62 3.11 -3.49 -1.08 8.60Sep 6.78 -0.38 6.18 1.41 12.84Oct -0.05 1.52 0.88 1.88 -0.36Nov 7.87 3.20 0.10 10.27 0.57Dec 4.63 1.07 -1.88 6.45 -0.83Jan 2.31 4.34 2.53 0.45Feb 4.35 4.21 -4.80 -2.38Mar 1.20 5.66 6.70 0.34Apr 2.59 -1.28 3.55 -1.96May 11.12 2.98 0.01 -10.60Jun -10.01 1.15 -1.68 2.65YTD 25.04 21.01 20.00 31.70 13.99Benchmark 9.25 26.91 9.88 18.27 21.18Difference 15.79 -5.90 10.12 13.43 -7.19 Fund manager's review JS FoF depicted a monthly performance of 4.63 percent in December 2013 as compared to its benchmark return of 3.60 percent, thereby outperforming it by 1.03 percent.

Asset allocation (%) Dec-13 Nov-13

Open-end 26.56 43.85 Close-end 40.81 41.59 T Bills - - Cash 32.42 14.26 Other including receivables 0.21 0.30 Total 100.00 100.00

Statistical analysis

Fund BenchmarkBeta 0.8 1.0Standard Deviation 16.7% 16.7%Largest Month Gain 13.6% 11.0%Largest Month Loss -13.7% -25.1%% Positive Months 69.7% 68.7%

Investment Committee Members Mr. Rashid Mansur - Chief Executive Officer Mr. Khawar Iqbal - Chief Financial Officer Dr. Ali Akhtar Ali - Chief Investment Officer Mr. Arslan Asif Soomro - Fund Manager Mr. Assad H. Khan - Country Head Business Development Contact us JS Investments Limited Toll Free: 0800 - 00887 E-mail: [email protected] Website: www.jsil.com Disclosure for WWF Liability under Circular 17 of 2012 The Scheme has maintained provisions against Worker's Welfare Fund’s liability to the tune of Rs. 10,496,785, if the same were not made the NAV per unit/return of the Scheme would be higher by Rs. 4.67 / 9.8%. For details investors are advised to read the Note 6 of the latest Financial Statements of the Scheme.

1 Average of asset allocation funds returns. 2 Cumulative return is based as per MUFAP stated methodology.

Performance data and analytics MUFAP Recommended Format Dec-13

Investment philosophy JS AAA Fund is a dynamic asset allocation fund that aims to achieve superior risk adjusted growth in investor’s capital over the long term. The fund operates a diverse portfolio of equity, fixed income and money market investments and it may constantly adjust the asset mix as equity markets rise or fall and the economy strengthens or weakens. The fund is allowed to invest up to 100% of net assets in any one type of asset class. Key information Fund type Open endCategory Asset Allocation SchemeFund launch date 28 June, 2005Net Assets (PKR mn) 134.02NAV (PKR) 15.96Benchmark 50% KSE30 Index + 50% Avg. 6M KIBORManagement fee 2.00% (Exclusive of Sindh Sales Tax)Front-end Load 3.00%Back-end Load NILPricing mechanism Forward Trustee Central Depository Company of Pakistan Ltd.Dealing Days & Cut-off time (Monday to Friday) 3:00 p.m.Auditor Ernst & Young Ford Rhodes Sidat Hyder & Co.Risk profile HighListing LSELeverage NILAMC Rating AM2- (By JCR-VIS) Performance (%) Cumulative return1

1M 1Y 2Y 3Y Launch Avg. Ann.*Fund 5.63 31.15 77.03 59.03 59.94 5.67Benchmark 1.97 22.90 62.03 42.32 64.92 6.05Difference 3.66 8.25 15.00 16.71 -4.98 -0.38* Average Annualized Return since inception as per Morning Star formula Monthly performance (%)

FY14 FY13 FY12 FY11 FY10Jul 10.10 3.41 -0.27 7.66 6.89Aug -12.69 4.16 -3.56 -5.10 9.38Sep 0.68 -1.75 4.89 1.01 8.26Oct 1.28 -0.34 -0.88 4.42 -3.41Nov 12.76 3.66 -4.44 4.13 0.19Dec 5.63 -0.25 -5.58 4.38 2.92Jan 0.49 9.40 2.12 0.04Feb 5.40 5.04 -7.32 -1.92Mar -0.70 6.94 8.59 3.74Apr 3.13 0.20 0.34 -1.25May 5.84 0.92 0.09 -11.60Jun -2.15 -0.40 -3.55 0.16YTD 16.75 22.51 11.68 16.62 12.20Benchmark 10.49 22.69 5.00 21.24 26.22Difference 6.26 -0.18 6.68 -4.62 -14.02 Fund manager's review JS AAA depicted a monthly performance of 5.63 percent in December 2013 as compared to its benchmark return of 1.97 percent. On YTD basis the fund outperformed its benchmark by 6.26 percent.

Asset allocation (%) Dec-13 Nov-13

Cash 46.51 14.21 Equity 32.75 82.48 PIBs - - T Bills - - Other including receivables 20.74 3.31 Total 100.00 100.00

Equity sector breakdown (%)

Dec-13 Nov-13Non Life Insurance 13.13 3.06 Automobile & Parts 8.54 - Oil & Gas 5.97 24.97 General Industrials 5.11 7.19

- - Others 0.00 47.26 Total 32.75 82.48

Top holding (%age of total assets) IGI Insurance Ltd. 8.62 Pak Suzuki Motor Co. Ltd. 8.54 Oil & Gas Development Co. Ltd. 5.97 Siemens (Pakistan) Engineering Co. Ltd. 5.11 Adamjee Insurance Co. Ltd. 4.51

Statistical analysis Fund Benchmark

Beta 0.8 1.0Standard Deviation 26.1% 28.6%Largest Month Gain 21.0% 25.2%Largest Month Loss -36.8% -45.1%% Positive Months 64.1% 61.2%

Investment Committee Members Mr. Rashid Mansur - Chief Executive Officer Mr. Khawar Iqbal - Chief Financial Officer Dr. Ali Akhtar Ali - CIO / Fund Manager Mr. Assad H. Khan - Country Head Business Development Contact us JS Investments Limited Toll Free: 0800 - 00887 E-mail: [email protected] Website: www.jsil.com Disclosure for WWF Liability under Circular 17 of 2012 The Scheme has maintained provisions against Worker's Welfare Fund’s liability to the tune of Rs. 11,574,293, if the same were not made the NAV per unit/return of the Scheme would be higher by Rs. 1.38 / 8.6%. For details investors are advised to read the Note 6 of the latest Financial Statements of the Scheme.

1 Cumulative return is based as per MUFAP stated methodology.

Performance data and analytics MUFAP Recommended Format Dec-13

Investment philosophy JS KSE-30 Index Fund is an index fund that aims to track the performance of the KSE-30 Index by investing in constituent companies of the index in proportion to their weighting. The fund targets sophisticated investors who can time their entry and exit from the fund in accordance with the expected performance of the equity market or for investors who seek long term exposure to the equity market. Key information Fund type Open endCategory Index Tracker SchemeFund launch date 29 May, 2006Net Assets (PKR mn) 44.33NAV (PKR) 27.70Benchmark KSE30 IndexManagement fee 1.50% (Exclusive of Sindh Sales Tax)Front-end Load 2.00%Back-end Load NILPricing mechanism Forward Trustee MCB Financial Services LtdDealing Days & Cut-off time (Monday to Friday) 3:00 p.m.Auditor KPMG Taseer Hadi & Co.Risk profile HighListing LSELeverage NILAMC Rating AM2- (By JCR-VIS) Performance (%) Cumulative return1

1M 1Y 2Y 3Y Launch Avg. Ann.*Fund 2.99 33.05 81.81 67.96 79.36 7.99Benchmark 3.08 36.65 84.78 62.31 56.69 6.09Difference -0.09 -3.60 -2.97 5.65 22.67 1.90* Average Annualized Return since inception as per Morning Star formula Monthly performance (%)

FY14 FY13 FY12 FY11 FY10Jul 11.40 5.23 -0.53 9.14 7.88Aug -5.17 5.28 -8.19 -5.76 13.68Sep -2.55 -1.03 6.71 0.77 8.23Oct 4.90 0.75 1.32 5.22 -3.26Nov 4.77 1.39 -3.51 6.46 0.50Dec 2.99 2.26 -5.22 7.04 1.75Jan 2.02 9.05 3.24 1.78Feb 5.46 6.86 -8.72 0.20Mar -2.46 4.48 7.52 5.69Apr 2.70 0.72 1.13 0.68May 10.16 -2.38 0.46 -12.86Jun -3.84 -0.34 -0.62 3.50YTD 16.53 30.76 7.75 27.12 28.52Benchmark 16.05 35.95 2.90 21.24 26.22Difference 0.48 -5.19 4.85 5.88 2.29 JS KSE-30 Index Fund vs. KSE 30

-20%

-10%

0%

10%

20%

Dec/11 Mar/12 Jun/12 Sep/12 Dec/12 Mar/13 Jun/13 Sep/13 Dec/13

JS KSE-30 Index Fund KSE-30 Index

Asset allocation (%) Dec-13 Nov-13

Cash 3.61 3.25 Equity 96.00 95.68 Other including receivables 0.38 1.07

Total 100.00 100.00

Equity sector breakdown (%)

Dec-13 Nov-13Oil & Gas 35.75 35.55 Banks 24.57 25.15 Chemicals 14.46 14.26 Construction & Materials 7.59 7.10 Electricity 5.92 6.14 Others 7.70 7.48 Total 96.00 95.68

Top holding (%age of total assets) Oil & Gas Development Co. Ltd. 17.02 MCB Bank Ltd. 11.12 Pakistan Petroleum Ltd. 8.58 Fauji Fertilizer Co. Ltd. 7.63 Pakistan Oilfields Ltd. 5.24 The Hub Power Co. Ltd. 4.82 United Bank Ltd. 3.95 Lucky Cement Ltd. 3.84 Pakistan State Oil Co. Ltd. 3.75 Engro Corporation Ltd. 3.60

Statistical analysis Fund Benchmark

Beta 1.0 1.0Standard Deviation 29.0% 29.3%Largest Month Gain 25.5% 25.2%Largest Month Loss -43.9% -45.0%% Positive Months 63.0% 58.7%

Investment Committee Members Mr. Rashid Mansur - Chief Executive Officer Mr. Khawar Iqbal - Chief Financial Officer Dr. Ali Akhtar Ali - Chief Investment Officer Mr. Zohaib Pervez, CFA - Fund Manager Mr. Assad H. Khan - Country Head Business Development Contact us JS Investments Limited Toll Free: 0800 - 00887 E-mail: [email protected] Website: www.jsil.com Disclosure for WWF Liability under Circular 17 of 2012 The Scheme has maintained provisions against Worker's Welfare Fund’s liability to the tune of Rs. 2,126,142, if the same were not made the NAV per unit/return of the Scheme would be higher by Rs. 1.33 / 4.8%. For details investors are advised to read the Note 7 of the latest Financial Statements of the Scheme.

1 Cumulative return is based as per MUFAP stated methodology.

Performance data and analytics MUFAP Recommended Format Dec-13

Investment philosophy JS Cash Fund (JS CF) is an open-end 'Money Market Scheme' that mainly invests in low risk short-term fixed income instruments including money market instruments to provide a regular and reasonable return to investors while ensuring high liquidity. The Fund shall invest primarily in short duration instruments and may even hold some or all of its assets in cash for the purpose maintaining liquidity. Key information Fund type Open endCategory Money Market SchemeFund launch date 29 March, 2010Net Assets (PKR mn) 1,647.55NAV (PKR) 102.35Benchmark BM CF1

Management fee 1.00% (Exclusive of Sindh Sales Tax)Front-end Load 1.00%Back-end Load NILPricing mechanism BackwardTrustee MCB Financial Services Ltd Dealing Days & Cut-off time (Monday to Friday) 3:00 p.m.Auditor Ernst & Young Ford Rhodes Sidat Hyder & Co.Risk profile Extremely LowListing LSEFund stability rating AA+(f) - (By JCR-VIS)Leverage NILAMC Rating AM2- (By JCR-VIS) Performance (%) Annualised performance 2

1M 6M 1Y LaunchFund 8.04 7.34 7.78 11.96Benchmark 8.65 8.27 8.40 11.09Difference -0.60 -0.94 -0.62 0.88 Monthly performance (%) Annualised performance 2

FY14 FY13 FY12 FY11 FY10Jul 7.28 10.42 11.66 11.00 n/aAug 7.24 13.78 13.06 10.88 n/aSep 5.83 8.35 11.85 10.89 n/aOct 7.27 9.77 13.81 12.32 n/aNov 7.65 7.65 10.43 11.43 n/aDec 8.04 7.97 9.64 13.16 n/aJan 7.72 11.03 10.76 n/aFeb 7.10 9.72 12.31 n/aMar 7.79 10.31 12.32 n/aApr 8.29 10.79 12.61 10.74May 8.17 10.00 11.28 8.99Jun 7.70 10.13 11.80 10.40YTD 7.34 9.11 11.62 12.01 9.90Benchmark 8.27 8.98 10.09 10.65 9.85Difference -0.94 0.13 1.53 1.36 0.05 Fund manager's review JS Cash Fund reported an annualized return of 8.04% for the month of December 2013 as compared to the annualized benchmark return of 8.65%, underperforming the benchmark by 0.60%.

Asset allocation (%) Dec-13 Nov-13

Cash 7.70 0.86 Placement with Banks and DFIs 23.01 19.91 T Bills 69.08 79.03 Other including receivables 0.22 0.20 Total 100.00 100.00

Asset quality (%age of total assets)

AAA, 72.22

AA, 4.22

AA+, 16.954

A+, 0.07

AA‐, 6.326

Statistical analysis

Fund BenchmarkStandard Deviation 0.7% 0.5%Largest Month Gain 1.2% 0.9%Largest Month Loss 0.0% 0.0%% Positive Months 100.0% 100.0%Duration (Days) 25Weighted Avg. Maturity (Days) 25

Investment Committee Members Mr. Rashid Mansur - Chief Executive Officer Mr. Khawar Iqbal - Chief Financial Officer Dr. Ali Akhtar Ali - CIO / Fund Manager Mr. Assad H. Khan - Country Head Business Development Contact us JS Investments Limited Toll Free: 0800 - 00887 E-mail: [email protected] Website: www.jsil.com 1. 50% Average return of 3-months deposit rates of AA and above rated scheduled

commercial Bank(s), and 50% average 3-months T-Bill rate. 2. Annualised return is based as per MUFAP stated methodology. Disclosure for WWF Liability under Circular 17 of 2012 The Fund/Scheme has not made provisions amounting to Rs. 10,884,138 against Worker’s Welfare Fund (WWF) liability upto June 30, 2013, if the same were made the NAV per unit/return of the Scheme would be lower by Re. 0.75 / 0.7%. Moreover, prospective provisioning against WWF has commenced in the Fund with effect from July 1, 2013. For details investors are advised to read the Note 8 of the latest Financial Statements of the Scheme.

Performance data and analytics MUFAP Recommended Format Dec-13

Investment philosophy JS IF is an income fund that aims to preserve investor’s capital while providing a regular stream of current income on an annual basis which is higher than that offered by commercial banks on deposits of a similar liquidity profile as this fund. The fund operates a diverse portfolio of investment-grade debt securities, government securities and money market instruments. The fund may maintains liquidity in the form of spread transactions and bank deposits. Key information Fund type Open endCategory Income Fund SchemeFund launch date 26 August, 2002Net Assets (PKR mn) 709.34NAV (PKR) 87.75Benchmark BM IF1

Management fee 1.50% (Exclusive of Sindh Sales Tax)Front-end Load 1.00%Back-end Load NILPricing mechanism Forward Trustee MCB Financial Services LtdDealing Days & Cut-off time (Monday to Friday) 3:00 p.m.Auditor Ernst & Young Ford Rhodes Sidat Hyder & Co.Risk profile Low To MediumListing LSEFund stability rating A+(F) PACRA RatingLeverage NILAMC Rating AM2- (By JCR-VIS) Performance (%) Annualised performance 2

1M 6M 1Y 3Y LaunchFund 7.77 6.30 6.28 8.26 12.33Benchmark 10.16 9.76 9.95 13.12 14.24Difference -2.39 -3.46 -3.67 -4.86 -1.91 Monthly performance (%) Annualised performance 2

FY14 FY13 FY12 FY11 FY10Jul 4.86 11.24 11.58 9.22 9.32Aug 6.71 20.78 22.81 18.44 10.48Sep -0.15 11.71 12.05 12.32 13.41Oct 5.81 11.72 21.02 14.29 37.73Nov 12.33 5.78 10.81 23.38 -0.12Dec 7.77 23.72 6.45 15.66 0.57Jan 6.49 13.54 1.70 4.78Feb -0.85 11.42 15.43 11.66Mar 7.00 11.29 17.44 -23.36Apr 8.69 3.67 11.52 17.69May 7.67 12.94 -79.51 -72.06Jun 6.40 10.16 -1.28 -36.52YTD 6.30 10.60 13.07 3.95 -8.47Benchmark 9.76 10.38 13.01 10.02 9.94Difference -3.46 0.22 0.05 -6.07 -18.41 Non Compliant Investments under Circular 07/2009

Azgard Nine a TFC 6,661,110 (6,661,110) - - - Azgard Nine b PPTFCs 38,376,919 (38,376,919) - - - Agritech Ltd.c Sukuk 59,572,782 (59,572,782) - - - Agritech Ltd.d PPTFC - - - - - Dewan Cement e TFC 50,000,000 (49,990,000) 10,000 0.00 0.00 Azgard Nine f PPTFC - - - - -

Value after provision

% ofNet

Assets

% of GrossAssets

Name of Investment

TypeValue before

provision

Provision held

(if any)

a) The fund has made a full provision against the principal amount in accordance with the requirements of regulatory body & the provisioning policy of the Fund. (b) The CP of ANL has been settled through issuance of 15,000 PPTFCs in the name of the Fund. These PPTFCs have been restructured however, the mgt. as a matter of prudence has maintained the provision against the said PPTFCs. In lieu of restructuring of Azgard Nine existing debt securities, Agritech pledge shares has been credited in Faysal Bank (Trustee of the Issuer) CDS account. These shares are booked and marked to market accordingly. (c) The fund has made a full provision against the principal amount in accordance with the requirements of Circular 1 & the provisioning policy of the Fund. (d) The Fund has made a full provision against the principal amount of Agritech Limited’s Sukuk in accordance with the requirements of Circular 1 of 2009 issued by the SECP and the provisioning policy of the Fund. The Fund has received Agritech Limited’s PPTFC of face value of Rs. 11.245 million against interest due on Agritech Limited’s Sukuk which is not recognized as income by the Fund and these PPTFCs are valued at zero. (e) Non rated securities. (f) The fund received 4,827 zero coupon PPTFCs against interest receivable of listed and unlisted TFCs. Since these PPTFCs are received against already defaulted securities and have non-performing status in MUFAP, therefore the management as a matter of prudence maintained the provision against the said PPTFCs. These PPTFCs are valued at zero but cost is carried at 24,135,000.

Asset allocation (%)

Dec-13 Nov-13Cash 0.64 3.56Placement with Banks and DFIs 21.78 19.57Equity* 1.86 1.97T Bills 73.05 72.38PIBs 0.00 0.00TFCs / Sukkuks 2.20 2.19Other including receivables 0.47 0.33Total 100.00 100.00

* Under debt-swap arrangement with Azgard Nine Limited (ANL), the fund has received shares of Agritech Limited (AGL), against the investments of ANL-PPTFC and listed TFCs, these listed TFCs and PPTFCs had been fully provided.

TFCs/Sukuks allocation - Top Ten Holding

2.20%

0.001%

0.0% 0.5% 1.0% 1.5% 2.0% 2.5%

Bank Alfalah Ltd.

Dewan Cement

Asset quality (%age of total assets)

A21.78%

AAA73.05%

AA-2.20% A+

0.49%

"<BBB"0.00%

AA0.16%

Statistical analysis Fund Benchmark

Standard Deviation 4.8% 1.1%Largest Month Gain 3.7% 1.2%Largest Month Loss -10.3% 0.0%% Positive Months 91.2% 100.0%Duration (Yr) 0.10Weighted Avg. Maturity (Yr) 0.26

Investment Committee Members Mr. Rashid Mansur - Chief Executive Officer Mr. Khawar Iqbal - Chief Financial Officer Dr. Ali Akhtar Ali - CIO / Fund Manager Mr. Assad H. Khan - Country Head Business Development

Fund manager's review For the month of December 2013, JSIF yielded an annualized return of 7.77% as compared to the benchmark of 10.16%; underperforming it by 2.39%. Contact us JS Investments Limited Toll Free: 0800 - 00887 E-mail: [email protected] Website: www.jsil.com 1. From Mar '12, the benchmark was changed from 60% 1Year PKRV Rate + 40% 6M

KIBOR Rate to 40% 1Year PKRV Rate + 60% 6M KIBOR 2. Annualized performance return is based as per MUFAP stated methodology.

Disclosure for WWF Liability under Circular 17 of 2012 The Fund/Scheme has not made provisions amounting to Rs. 20,426,315 against Worker’s Welfare Fund (WWF) liability upto June 30, 2013, if the same were made the NAV per unit/return of the Scheme would be lower by Rs. 2.2 / 3.0%. Moreover, prospective provisioning against WWF has commenced in the Fund with effect from July 1, 2013. For details investors are advised to read the Note 9 of the latest Financial Statements of the Scheme.

Performance data and analytics MUFAP Recommended Format Dec-13

Investment philosophy JS Islamic Government Securities Fund (JS IGSF) is an open end 'Shariah Compliant Sovereign Income Scheme' which aims at generating a stable stream of current HALAL income while ensuring low risk (volatility) and capital preservation in the medium to long term by investing primarily in Shariah Compliant Government Securities. The Scheme maintains 70 - 75% of its assets in Shariah Compliant Sovereign debt securities at all times, while the remaining assets are invested in bank deposits with Islamic banks/Islamic windows of commercial banks in order to generate higher risk adjusted returns. The scheme carries a minimal level of overall interest rate risk by maintaining a relatively higher level of liquidity through weighted average portfolio duration (WAD) not exceeding 180 days. Key information Fund type Open endCategory Shariah Compliant Income Scheme Fund launch date 5 June, 2013Net Assets (PKR mn) 467.64NAV (PKR) 100.75Benchmark BM IGSF1

Management fee 0.75% (Exclusive of Sindh Sales Tax)Front-end Load 1.00%Back-end Load NILPricing mechanism Forward Trustee MCB Financial Services Ltd Dealing Days & Cut-off time (Monday to Friday) 3:00 p.m.Auditor KPMG Taseer Hadi & Co.Risk profile Low to MediumListing LSEFund stability rating AA- (By PACRA)Leverage NILAMC Rating AM2- (By JCR-VIS)

Performance (%) Annualised performance 2

1M 6M 1Y 2Y LaunchFund 9.47 8.53 n/a n/a 8.21Benchmark 6.78 6.91 n/a n/a 7.12Difference 2.69 1.62 n/a n/a 1.09 Monthly performance (%) Annualised performance 2

FY14 FY13Jul 6.83 n/aAug 6.91 n/aSep 7.88 n/aOct 6.81 n/aNov 12.54 n/aDec 9.47 n/aJan n/aFeb n/aMar n/aApr n/aMay n/aJun 6.03YTD 8.53 6.03Benchmark 6.91 6.70Difference 1.62 -0.67 Fund manager's review JS IGSF returned an annualized 9.47 percent during the month of December 2013 outperforming its benchmark by 2.69 percent. On YTD basis, the fund also returned 8.53 percent.

Asset allocation (%) Dec-13 Nov-13

Cash 18.51 28.16 Placement with Banks and DFIs 7.46 - TFCs / Sukkuks 71.15 69.57 Other including receivables 2.88 2.27

Total 100.00 100.00

Asset quality (%age of total assets)

AAA, 71.2

A+, 0.2

AA‐, 18.3

AA, 0.1

A, 7.5

Statistical analysis

Fund BenchmarkStandard Deviation 1.0% 0.7%Largest Month Gain 1.0% 0.6%Largest Month Loss 0.0% 0.0%% Positive Months 100.0% 100.0%Weighted Avg. Maturity (Yr) 1.03

Investment Committee Members Mr. Rashid Mansur - Chief Executive Officer Mr. Khawar Iqbal - Chief Financial Officer Dr. Ali Akhtar Ali - Chief Investment Officer Mr. Zohaib Pervez, CFA - Fund Manager Mr. Assad H. Khan - Country Head Business Development

Contact us JS Investments Limited Toll Free: 0800 - 00887 E-mail: [email protected] Website: www.jsil.com 1 The benchmark of the scheme shall be the average 6 month Placement (Deposit) rate

of 3 Islamic Banks (including Islamic windows of Commercial Banks) 2 Annualized performance return is based as per MUFAP stated methodology. Disclosure for WWF Liability under Circular 17 of 2012 The Scheme has maintained provisions against Worker's Welfare Fund’s liability to the tune of Rs. 459,212, if the same were not made the NAV per unit/return of the Scheme would be higher by Re. 0.10 / 0.1%. For details investors are advised to read the Note 7 of the latest Financial Statements of the Scheme.

Performance data and analytics MUFAP Recommended Format Dec-13

Investment philosophy JS Pension Savings Fund (JS PSF) is designed to provide a secure source of savings and retirement income to individuals. JS PSF is a portable pension scheme allowing individuals the flexibility of contributions and portfolio customization through allocation of such contributions among equity and fixed income investment avenues suited to their specific needs and risk profile. Key information Fund type Open endCategory Pension Savings FundFund launch date 26 June, 2007Benchmark n/aManagement fee 1.50% (Exclusive of Sindh Sales Tax)Front-end Load 3.00%Back-end Load NILPricing mechanism Forward Trustee Central Depository Company of Pakistan Ltd.Dealing Days & Cut-off time (Monday to Friday) 3:00 p.m.Auditor A. F. Ferguson & Co.Risk profile Investor dependent Leverage NILAMC Rating AM2- (By JCR-VIS) Net Assets (PKR mn) JS - PSF-Equity Sub Fund 94.54JS - PSF-Debt Sub Fund 136.30JS - PSF-MM Sub Fund 106.37 NAV (PKR) JS - PSF-Equity Sub Fund 254.44JS - PSF-Debt Sub Fund 179.52JS - PSF-MM Sub Fund 153.97 Performance (%)

1M 1Y 2Y 3Y LaunchJS - PSF-Equity Sub Fund 6.01 82.58 196.86 182.52 154.46JS - PSF-Debt Sub Fund 1 6.93 1.95 16.88 30.77 79.53JS - PSF-MM Fund 1 5.92 8.41 20.79 34.75 53.98 Monthly performance (%) Annualised performance1

FY14 FY13 FY14 FY13 FY14 FY13Jul 11.10 7.67 -20.78 14.90 4.98 9.77Aug -6.02 6.54 -0.53 44.00 5.67 11.35Sep -1.50 -0.47 1.93 13.37 7.77 8.13Oct 1.66 2.94 7.07 17.75 7.55 8.33Nov 16.06 5.14 5.48 7.14 7.67 7.14Dec 6.01 1.62 6.93 8.76 5.92 26.53Jan 1.08 12.50 30.01Feb 7.25 -5.05 8.32Mar 3.56 11.29 5.46Apr 8.88 5.51 8.26May 15.31 6.94 6.91Jun 0.69 -8.41 -1.31YTD 28.63 78.21 -0.07 11.42 6.67 11.34

Equity Debt 1 Money market 1

Fund manager's review During the month of December 2013, JS Pension Savings Equity Sub Fund, Debt Sub Fund and Money Market Sub Fund delivered returns of 6.01%, 6.93% p.a and 5.92% p.a respectively.

Asset allocation (%) Equity Dec-13 Nov-13Cash 4.56 3.28 Equity 95.03 95.42 Other including receivables 0.41 1.30

Total 100.00 100.00

Debt Dec-13 Nov-13Cash 5.32 6.39 Equity* 0.24 0.25 TFCs / Sukkuks - - T Bills 94.32 93.22 Other including receivables 0.12 0.14 Total 100.00 100.00

Money Market Dec-13 Nov-13Cash 3.71 5.49 Equity* 1.52 1.60 T Bills 94.65 92.79 Other including receivables 0.12 0.12

Total 100.00 100.00

* Under debt-swap arrangement with Azgard Nine Limited (ANL), debt and money market sub funds have received shares of Agritech Limited (AGL), against the investments of ANL-PPTFC, these PPTFCs in sub funds had been fully provided.

Equity sector breakdown (%) Dec-13 Nov-13

Oil & Gas 16.57 16.67 Automobile & Parts 15.03 15.10 Banks 11.06 7.86 General Industrials 11.03 6.75 Non Life Insurance 10.74 9.06 Others 30.59 39.98 Total 95.03 95.42

Top holding (%age of total assets) Murree Brewery Co. Ltd. 9.27 Rafhan Maize Products Ltd. 9.16 Bank Alfalah Ltd. 8.69 Pakistan State Oil Co. Ltd. 7.93 Adamjee Insurance Co. Ltd. 6.98 Packages Ltd. 6.72 Baluchistan Wheels Ltd. 5.98 Pakistan Telecommunication Co. Ltd. 5.83 Oil & Gas Development Co. Ltd. 5.52 Pak Suzuki Motor Co. Ltd. 5.20

Investment Committee Members Mr. Rashid Mansur - Chief Executive Officer Mr. Khawar Iqbal - Chief Financial Officer Dr. Ali Akhtar Ali - CIO / Fund Manager Mr. Assad H. Khan - Country Head Business Development

Contact us JS Investments Limited Toll Free: 0800 - 00887 E-mail: [email protected] Website: www.jsil.com Disclosure for WWF Liability under Circular 17 of 2012 The Scheme has maintained provisions against Worker's Welfare Fund’s liability to the tune of Rs. 3,320,623, if the same were not made the NAV per unit/return of the Scheme would be higher by Rs. 3.80 (ESF), Rs. 1.57 (DSF), Rs. 1.04 (MMF) / 1.5% (ESF), 0.9% (DSF), 0.7% (MMF). For details investors are advised to read the Note 6 of the latest Financial Statements of the Scheme.

1 Annualized performance return is based as per MUFAP stated methodology.

Performance data and analytics MUFAP Recommended Format Dec-13

Investment philosophy JS Islamic Pension Savings Fund (JS IPSF) is designed to provide a Halal and secure source of savings and retirement income to individuals according to the principles of Islamic Shariah. JS IPSF is a portable pension scheme allowing individuals the flexibility of contributions and portfolio customization through allocation of such contributions among equity, fixed income and other Halal investment avenues suited to their specific needs and risk profile. Key information Fund type Open endCategory Shariah Compliant Voluntary Pension SchemeFund launch date 16 June, 2008Benchmark n/aManagement fee 1.50% (Exclusive of Sindh Sales Tax)Front-end Load 3.00%Back-end Load NILPricing mechanism Forward Trustee Central Depository Company of Pakistan Ltd.Dealing Days & Cut-off time (Monday to Friday) 3:00 p.m.Auditor A. F. Ferguson & Co.Risk profile Investor dependent Leverage NILAMC Rating AM2- (By JCR-VIS) Net Assets (PKR mn) JS - IPSF-Equity Sub Fund 83.96JS - IPSF-Debt Sub Fund 54.12JS - IPSF-MM Sub Fund 50.01 NAV (PKR) JS - IPSF-Equity Sub Fund 331.94JS - IPSF-Debt Sub Fund 168.33JS - IPSF-MM Sub Fund 146.41 Performance (%)

1M 1Y 2Y 3Y LaunchJS - IPSF-Equity Sub Fund 5.01 56.01 129.24 146.30 230.57JS - IPSF-Debt Sub Fund 1 7.18 7.40 14.50 30.39 67.63JS - IPSF-MM Sub Fund 1 5.25 6.19 14.04 25.02 45.80 Monthly performance (%) Annualised performance1

FY14 FY13 FY14 FY13 FY14 FY13Jul 11.92 4.86 7.04 10.34 7.05 9.37Aug -13.00 7.29 6.42 34.70 6.10 18.15Sep 0.42 -0.90 6.82 14.10 4.58 11.33Oct 2.58 0.88 6.42 17.59 6.21 14.21Nov 12.33 1.95 10.64 -31.11 7.90 -10.48Dec 5.01 3.00 7.18 3.84 5.25 -1.54Jan 1.63 11.64 8.37Feb 6.37 -0.16 2.44Mar 2.22 7.66 6.18Apr 5.34 10.54 8.44May 11.75 5.64 3.26Jun 1.35 5.58 6.29YTD 18.33 55.71 7.52 7.86 6.26 6.56

Money market 1Equity Debt 1

Fund manager's review In the month of December 2013, JS Islamic Pension Savings Equity Sub Fund, Debt Sub Fund and Money Market Sub Fund delivered returns of 5.01%, 7.18% p.a and 5.25% p.a. The Fund's composition is tilted towards investments avenues that offer higher risk-adjusted returns to the valuable pension clients.

Asset allocation (%) Equity Dec-13 Nov-13Cash 12.52 6.03 Equity 87.15 92.06 Other including receivables 0.32 1.91

Total 100.00 100.00

Debt Dec-13 Nov-13Cash 6.32 6.30 IJARA Sukuk Bond 92.09 92.52 Other including receivables 1.59 1.18

Total 100.00 100.00

Money Market Dec-13 Nov-13Cash 61.86 61.46 IJARA Sukuk Bond 37.07 37.13 TDR - - Other including receivables 1.08 1.41

Total 100.00 100.00

Equity sector breakdown (%)

Dec-13 Nov-13Oil & Gas 29.81 33.69 Construction & Materials 14.34 12.99 Food Producers 10.13 11.50 Personal Goods 8.97 10.66 General Industrials 5.64 6.90 Others 18.26 16.31 Total 87.15 92.06

Top holding (%age of total assets) Rafhan Maize Products Ltd. 10.13 Nishat Mills Ltd. 8.77 Pakistan State Oil Co. Ltd. 8.40 Oil & Gas Development Co. Ltd. 7.94 D. G. Khan Cement Co. Ltd. 7.69 Attock Petroleum Ltd. 7.18 Lucky Cement Ltd. 6.65 Pakistan Oilfields Ltd. 6.29 Packages Ltd. 5.64 Pak Suzuki Motor Co. Ltd. 5.13

Investment Committee Members Mr. Rashid Mansur - Chief Executive Officer Mr. Khawar Iqbal - Chief Financial Officer Dr. Ali Akhtar Ali - Chief Investment Officer Mr. Zohaib Pervez, CFA - Fund Manager Mr. Assad H. Khan - Country Head Business Development Contact us JS Investments Limited Toll Free: 0800 - 00887 E-mail: [email protected] Website: www.jsil.com Disclosure for WWF Liability under Circular 17 of 2012 The Scheme has maintained provisions against Worker's Welfare Fund’s liability to the tune of Rs. 1,989,275, if the same were not made the NAV per unit/return of the Scheme would be higher by Rs. 4.92 (ESF), Rs. 1.34 (DSF), Re. 0.92 (MMF) / 1.5% (ESF), 0.8% (DSF), 0.6% (MMF). For details investors are advised to read the Note 6 of the latest Financial Statements of the Scheme.

1 Annualized performance return is based as per MUFAP stated methodology.