Debt Management. Budgeting 101 The first step is to know how much money is coming in so you know how...

-

Upload

osborn-young -

Category

Documents

-

view

214 -

download

0

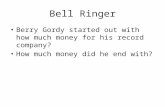

Transcript of Debt Management. Budgeting 101 The first step is to know how much money is coming in so you know how...

Debt Management

Budgeting 101

• The first step is to know how much money is coming in so you know how much money you can spend.

BRING HOME PAY $772.75

Budgeting Basics:

• Determine wants vs needs

• Determine your short term and long term goals

• Do the math

• Are you tough enough to make the decisions that will get you where you want to be?

Needs vs Wants

Needs are things you must have to survive:

Clothes Food Housing Medicine

Wants are things you would like to have:

Car Jewelry Music TV

ATM Fees Computerware Home PartiesCosmetics

Online Services Clothes Over the limit feesCDs

Pagers Dating Insurance Parking Fees Shoes

Gifts Overage Fees Bottled Water Tanning Bounced Checks Greeting Cards Haircuts Videos

Cable TV Late Payment Fees Dinners OutGames

Books Fast Food Dry Cleaning Car Wash

Electronics Magazines Movie Rentals Sports

Lunches Out Film Development Prescriptions

Household Items Pet Costs Licenses Speeding Tickets

Cash Advance Fees Snacks Vending MachinesSouvenirs

Debt vs Income

• Debt – something you have to pay

• Income – money you earn

• Debts are subtracted from your income.

Good Vs Bad Debt

• Good debt is debt that returns something of long term value such as a college education or home.

• Bad debt is “feel good” debt and may be unwise purchases that you can’t afford and don’t really need like an expensive television or a fancy watch

Budget

A budget is a list of expenses (debts) that you pay each month.

Budgets help you pay for your needs and decide what wants you can afford.

Sample Budget• Bring Home Pay: $772.75

Rent $400

Food $100

Insurance $ 75

Utilities $100

Savings $ 25

Medicine $ 20

Clothes $ 20

Amount Left

$32.75

Other types of money…

• Your income is your biggest source of money to spend.

• People can also use other sources of money:

Credit/Loans, Debit, Charge Cards and Credit Cards

What is Credit?

Credit is a loan, allowing you to receive goods and services now and pay for them later

It is an agreement that the money borrowed will be paid back

It is a debt, it is NOT income

It comes with fees - interest and other charges

Why use Credit?• Credit could be used to pay for:

Furniture Clothes Electronics Jewelry

• Places that offer financing (credit):

Furniture stores (Rooms to Go, Ashley, etc)

Clothing stores (Martin’s, Wakefield’s, etc)

Jewelry stores (Griffin’s, Friedman’s, etc)

Electronic stores (Bust Buy, Circuit City, etc)

Paying for credit• Credit purchases must be paid back over a

set length of time.• They include fees. • The fees can change if the payment is not

made on time or if the company decides to change them.

• All your credit purchases go on your credit report / credit record.

Build your Credit Record• Information about your credit stays

on your credit report for seven years.

Employers, insurers, creditors, and leasing agents check your credit report. It can affect jobs, ability to get loans at lower interest rates, ability to buy a house or other large items, ability to rent an apartment and cost for insurance!

Debit Cards: The BasicsDebit cards allow access to checking

account through ATMs and point of sale (POS) terminals (Wal-Mart, K Mart, etc)

Amount is deducted from checking account

Not a charge card, must have the funds available

Pre-Paid Cards: The Basics

Pre-paid cards may be “loaded” with a certain dollar value that can then be spent at POS terminals.

Not a charge card, must have money available.

Charge Cards: The BasicsMust be paid in full every month

(AMEX)

Provides convenience of not having to pay for purchases with cash, but balance may not be carried over month-to-month

Credit Cards: The Basics

Credit cards operate on a credit limit and revolving basis

If not paid-in-full within set length of time, interest is charged on the remaining balance

Credit Cards: Fees, fees, fees Interest rate fees--what you pay for

using the $$ usually 17% - 21% for students (after intro rate)

Annual fee for just having the credit card

Over the limit fees, charged whenever you exceed your credit limit

Late payment fees

Transaction fees

Other fees….Read the fine print!!!

Sample Budget with Credit• Bring Home Pay: $772.75

Rent $400

Food $100

Insurance $ 75

Utilities $100

Savings $ 25

Medicine $ 20

Clothes $ 20

Credit $ 30

Amount Left $2.75