David Mayes Capri 24/5 RESPONSIBILITY WITHOUT POWER NORDIC AND ANTIPODEAN SOLUTIONS TO THE PROBLEM...

-

Upload

ophelia-maxwell -

Category

Documents

-

view

215 -

download

2

Transcript of David Mayes Capri 24/5 RESPONSIBILITY WITHOUT POWER NORDIC AND ANTIPODEAN SOLUTIONS TO THE PROBLEM...

David Mayes Capri 24/5

RESPONSIBILITY WITHOUT POWER

NORDIC AND ANTIPODEAN SOLUTIONS TO THE PROBLEM OF FOREIGN-OWNED

SYSTEMIC BANK BRANCHESThe Architecture of Financial System Stability

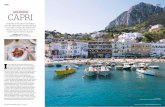

Form Market Micro Structure to Monetary Policy24-5 May, 2006, Capri

David G Mayes Bank of Finland

David Mayes Capri 24/5

MOTIVATION• Within two years the primary

supervisory responsibility for half of Finland’s banking system will lie outside the country

• Responsibility for financial stability remains with the Bank of Finland

• The impact of a systemic event does not move with supervisory responsibility

• We have to be convinced that the system will work well – we don’t have to run it

David Mayes Capri 24/5

WHERE BANKS ARE CROSS BORDER

• Banks have an element of choice over structure and location – want to maximise potential benefit from guarantees

– want to make themselves systemic

– potential guarantees are a guess - ‘constructive’ ambiguity

– largely driven by benefits while in business not hypothetical failure

• Public cost of the safety net – cost of avoiding failure vs. costs if it occurs – implicit guarantees, including any support for private deposit insurance funds

– cost depends on certainty

– not the result of some grand study

David Mayes Capri 24/5

A SPECIFIC CASE - NORDEA

• Leading example in EU/EEA – Most cross-border of the major banks

• Proposes to take advantage of the European company statute and operate as a bank headquartered in Sweden with branches in Denmark, Estonia, Finland, Norway, Poland, (New York)

• Currently New York and Estonia are branches of Nordea Finland – so issue already exists as from 1 May 2004 (agency agreement)

David Mayes Capri 24/5

NORDEA PROBLEMS POSED BY AN EEA

BRANCH STRUCTURE

Market Share 2004Banking Insurance

Denmark 25 20Estonia 11 2Finland 40 35Norway 15 9Sweden 20 6

David Mayes Capri 24/5

A SPECIFIC CASE - NORDEA• Supervision a soluble problem

– US pointers of what to do (and not to do)– Need local presence– Improvement over current arrangements – poor information

• Wrinkle over deposit insurance– Matches supervisory responsibility in EU/EEA (top-up ability)– Existing funds are not portable

• Lender of Last Resort sorted out already • Problem is systemic responsibility and problem and

failure provision – EU agreement beforehand unlikely – still a national problem when taxpayer money involved

• Have to be ready in advance not possible at the time– Must be technical not political problem

• Will match legal structure more closely with actual– Current reflects law – illusion that can break off subsidiaries

David Mayes Capri 24/5

AUTHORITIES FACE MISMATCH• ability to decide on corporate structure, market

structure, regulatory regime (arbitrage, EU/EEA structures)

• systemic responsibility– within national jurisdiction (wider international

responsibilities) – different organisations CB

• power over resolution– Home country control – host cannot avoid systemic crisis

• distribution of benefit from intervention (losses from failure to intervene)– owners, employees, depositors, insured depositors, creditors,

borrowers, taxpayers, borrowers

David Mayes Capri 24/5

PROBLEMS FOR JOINT ACTION• Insolvency legislation different, differences in

supervisory procedures, past preferences for intervention timing and methods different

• Common pool and equal treatment will help – but not just a bank

• Need to intervene early, preferably before failure – to minimise potential loss transparency of supervisory procedures not agreed - predictability

• Disclosure regime – market discipline Not agreed

Best if the market solves problems when bank merely a poor performer

David Mayes Capri 24/5

A HOME AND A HOST PROBLEM• Host country problem – bank is systemic, when it

is not so in the home country – Interests not aligned – the Finnish and New Zealand

problem (Branches vs Subsidiaries)

• Home country problem – bank is large relative to GDP– Too big too save – the Swiss problem – Difficult to organise burden sharing

• Many countries– Too difficult to organise – the Swedish problem

• Case where branch is systemic to bank but not to host country

David Mayes Capri 24/5

4 REGIMES• Supervisors and market satisfied with

performance– Normal times no need for action

• Supervisorily compliant, poor market performance– Market should be acting

• Supervisors concerned (poor market performance?)– Supervisors and market should be acting

• Thought insolvent– Authorities have to act

• For satisfactory resolution all regimes must work

David Mayes Capri 24/5

A SECOND DIMENSION:INSTITUTIONS

• Supervisors, central banks, deposit insurers, governments, courts

• EU/EEA limitations on solutions– A major contrast with the US, the role of the deposit

insurer

• National/Supranational/Co-operative bodies

David Mayes Capri 24/5

SUPERVISORS AND MARKET SATISFIED WITH PERFORMANCE• How do we handle – supervision; Lender of last

resort; deposit insurance? – main focus of discussion but not the most intractable problems

David Mayes Capri 24/5

SUPERVISORS AND MARKET SATISFIED WITH PERFORMANCE• How do we handle – supervision; Lender of last resort;

deposit insurance? • Supervision – main debate is over the difference between home

country as lead/consolidating supervisor and college of supervisors – Europe not yet ready for a ‘federal level’ player– Basel 2 forces a team approach for supervisors – Pillar 2 committee

– Key issue is ‘systemic’ branches – host must be involved

– Need equal access to database on the group not exchange of information on home choice under an MoU

– Already in operation with Baltic States since May 1 2004

– Strong degree of harmonisation of regulations and supervisory practice helped by CEBS

– Large element of mutual trust required

David Mayes Capri 24/5

SUPERVISORS AND MARKET SATISFIED WITH PERFORMANCE• How do we handle – supervision; Lender of last resort;

deposit insurance? • Supervision • Lender of last resort – traditional definition (short-term,

collateralised to believed solvent at above market rates)

(collateralised market lending preferred to individual institution), central banks already working together even though only one in the Eurosystem. Different currency lending supplied by the relevant NCB, ex ante discretionary limits. MoU in June 2003.

David Mayes Capri 24/5SUPERVISORS AND MARKET SATISFIED WITH PERFORMANCE• How do we handle – supervision; Lender of last resort;

deposit insurance? • Supervision • Lender of last resort• Deposit insurance – still a problem

– Not ‘transferable’– More expensive in Sweden than Finland – competitive

disadvantage to operate as a branch from Sweden – this and the common approach under Basel 2 may destroy European company idea

– Needs new EU directive to resolve it (grandfathering not possible) currently under discussion.

Moral hazard from legacy and perceived willingness to bail out

David Mayes Capri 24/5

SUPERVISORILY COMPLIANT, POOR MARKET PERFORMANCE

• Market discipline– Basel 2 disclosure insufficient – not even up to New

Zealand 1996 levels of relevance, timeliness, frequency or auditing

– Need plausible route for action – takeover – but by whom when market share already high?

– Market signal from sub-debt? Must really be at risk. Action needs to follow – commitment by supervisor?

Not really under discussion – pushes burden on supervisor – market should solve most problems

David Mayes Capri 24/5

SUPERVISORS CONCERNED

• Prompt corrective action– Much better to avoid a serious problem by early action

when no public money at risk– Mayes, Halme and Liuksila (2001) – compulsory

resolution at zero net worth (or earlier)– Is there a co-ordination problem?– Is there an incentive problem?– Incidence of losses not same as location of business

• Where are the shareholders? Where are the unsecured creditors? Where are the knock on risks (contagion)? Where is the insured deposit liability? Employees?

David Mayes Capri 24/5

THOUGHT INSOLVENT

• Need universal solution, prior legal agreement to support it – home supervisory country?– Territoriality possible outside EU but subsidiaries have to be

individually viable• Territoriality essential if home has domestic depositor preference• In many respects distinction between subsidiary and branch very

limited – functions, source of strength

– Legal basis for intervention varies considerably over the EU – public vs. private law

– Can we distinguish systemically important from other operations (Hüpkes, 2004)?

• Specialised institutions• Not all claims have to be dealt with immediately (NZ approach)• Reputation – (contagion within the organisation)• Rating driven close-outs

David Mayes Capri 24/5

THOUGHT INSOLVENT

• Need universal solution, prior legal agreement to support it – home supervisory country?

• Do we need a resolution agency? Mayes and Liuksila (2003) Mayes (2004) Could exist for a group of countries, could exist for each systemic bank– Avoid some conflicts of interest – needs to act early to

minimise losses, no loss of reputation from supervisory ‘failure’

– Could be a shell to be staffed on demand from the participant supervisors

– Judicial and executive functions

David Mayes Capri 24/5

THOUGHT INSOLVENT• Need universal solution, prior legal agreement to

support it – home supervisory country?• Do we need a resolution agency? Mayes and

Liuksila (2003) Mayes (2004) Could exist for a group of countries, could exist for each systemic bank

• There is no European equivalent to the FDIC– Most deposit insurers are asset managers with very small staffs

– Not usually depositor preference

– No least cost resolution requirements

– Least cost for whom in systemic case – wider than depositors – taxpayers?

– ‘EDIC’ route for non-systemic cases?

David Mayes Capri 24/5

PROBLEMS FOR JOINT ACTION• Need failure regime in parallel with supervisory

regime– Start when bank gets into difficulty. Major problem

of valuation - capital adequacy wrong basis – hypothetical liquidation value – not mark to market

• Do we need a resolution agency? – Just lead countries case by case, European? – Adjudication and resolution departments. – Deposit insurance agency not best choice in EU/EEA? – CB has systemic responsibility.

David Mayes Capri 24/5

WHEN SHOULD RESOLUTION AGENCY STEP IN?

• At PCA stage? As soon as a problem is identified preparations should start for the worst – sharpens incentive to make voluntary solution work

– Need to value claims in a hurryNZ solution of compulsory bank systems to make this easier

• Is it possible to step in before shareholder value thought zero as with 2% rule in US?– ECJ ruling suggests no, shares must be thought worthless– Condition for a banking licence?

• Guarantee is key part of Mayes, Halme and Liuksila (2003) – can this be offered by an agency on behalf of governments?

David Mayes Capri 24/5

WILLINGNESS TO PRE-COMMIT RESOURCES UNDER INSOLVENCY

ENTAILS CONFIDENCE IN PRE-INSOLVENCY PROCEDURES

• Whose fault was the insolvency? An event in another country? An action by another country’s authorities? Need joint prior responsibility

• Not possible to argue about who should pay at the time? Could CEBS act as an immediate adjudicator?

• Need to be convinced that all possible was done in regimes 1,2 and 3 to commit to regime 4. This is not currently the case

David Mayes Capri 24/5

DESIRABLE PRINCIPLES• Banks have strong self-interest in prudence• Market offers effective correction mechanisms for weak

performance• Plausible solution method without bail out

– Assign losses up front

• Can keep systemic operations going– Ex post guarantee

• Can act fast enough in a crisis– PCA early and unavoidable, information available

• Previously agreed loss-sharing among countries and procedures for resolution, with clear leader

• Clear and full macroeconomic accounting

David Mayes Capri 24/5

ISSUES FOR EU RETHINK

• Pure home country control – collegial

• Deposit insurance - transferability

• A resolution agency

• Insolvency law

David Mayes Capri 24/5

OTHERS FACE THE SAME PROBLEM

• New Zealand’s banks are mainly foreign owned – largely Australian

• Australia has domestic depositor preference• Option 1

– ensure systemic banks are locally incorporated not branches– Make sure they can be viable units on their own – do not

outsource vital functions – avoid dependence on parent– Structure information system so they can be viably taken into

administration in 48 hours – MoUs on information and crisis management

• Option 2– Joint supervision under Australian leadership– NZ depositors treated same as Australian

David Mayes Capri 24/5

CURRENT POSITION

• Joint committees on options in 2004-5

• Following Option 1 but discussing greater harmonisation and co-operation through Trans-Tasman Council on Banking Supervision

• Key difference is ‘outsourcing’ policy

David Mayes Capri 24/5

OUTSOURCING REQUIREMENTSOCTOBER 2005

• The bank’s clearing and settlement obligations due on a day can be met on that day

• The bank’s financial risk positions on a day can be identified on that day

• The bank’s financial risk positions can be monitored and managed on the day following any failure and on subsequent days

• The bank’s existing customers can be given access to payments facilities on the day following any failure and on subsequent days.

David Mayes Capri 24/5

MUTUAL LESSONS• Available functions matter rather than branch vs.

subsidiary status for territorial solutions– (Nordea subsidiaries already not individually viable?)

• Effective supervision and ability to act in the event of a problem requires close co-operation and information beyond current EU/EEA and Australia/NZ levels. Need a resolution agency?

• Cannot operate a universal common pool solution without equal treatment and tackling host country systemic issues

• Need to have agreed PCA, early intervention, use public law?, minimise demands on public funds, act within the value day

• Cannot marry very different regimes