David H Koch Charitable Foundation 480926946 2008 05426897

-

Upload

michael-fisher -

Category

Documents

-

view

6 -

download

0

description

Transcript of David H Koch Charitable Foundation 480926946 2008 05426897

,. .. EXTENSION GRANTED

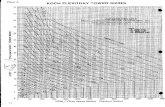

9. 90 PF Return of Private Foundation Form • or Section 4947(a)(1) Nonexempt Charitable Trust Department o1 the Treasury Treated as a Private Foundation Internal Revenue service Note: The foundation ma be able to use a co of this return to sat1s state re

OMB No 1545-0052

~@08 For ca endar vear 2008, or tax vear begmnmg , 2008, and ending , 20

G Check all that aootv I I Initial return I I Final return I I Amended return I I Address change I I Name change Name of foundation

Use the IRS

label. DAVID H. KOCH CHARITABLE FOUNDATION Otherwise,

print Number and street (or P.O box number rt ma1l 1s not delivered to street address)

or type. SeeSpecific 4111 E. 37TH ST. N. Instructions. City or town, state, and ZIP code

WICHITn KS 67220-3203

Room/suite

H Check type of organization l.xJ Section 501 (cl@} exempt private foundation

n Section 4947(a)(1) nonexempt charitable trust I I Other taxable private foundation

A Employer identification number

48-0926946 B Telephone number (see page 10 of the nstrucbons)

l 316 l 828-5552 C If exemption appllcatJon 1s

pending, check here • • • • • • D 1. Foreign orgamzatJons. check here

2. F ore1gn organozatJons meebng the 85% test, check here and attach computabon • • • • • • • •

:o E If pnvate foundabon status was terminated D

I Fair market value of all assets at end J Accounting method:LJ Cash lxJ Accrual under secbon so?(b)(1)(A). check here • ~ of year (from Part II, col (c), /me D Other (specify)---------------------- F 16) ~ $ 8 5 2 7 6. o o s. (Part I, column (d) must be on cash basis)

l:r.Tii•• Analysis of Revenue and Expenses (The total of amounts m columns (b), (c), and (d) may not necessanly equal the amounts m column (a) (see page 11 of the mstruct,ons) J

1

2

Contnbubon~s. grants. etc.. received (attach schedule) • Check ~ LJ 1f the foundation 1s not required to

attach Sch B. • • • • • • • • • 3 Interest on savings and temporary cash investments

4 Dividends and interest from securities

5 a Gross rents • • • • • • • • • • • • • • • • •

(a) Revenue and expenses per

books

100 000 000.

50.319.

(b) Net investment income

50. 319.

If the foundation IS In a 60-month term1nallon n under section 507(b)(1)(B). check here • ~

(c) AdJusted net income

(d) Disbursements for charitable

purposes ( cash basis onM

STMI' 1

b Net rental income or (loss) ________ 1----------+---------+----------+----------a, ::, c: Cl) > Cl)

er::

6 a Net gain or (loss) from sale of assets not on hne 10 b Gross sales pnce tor all

assets on hne Sa ---------- 1----------+----------+---------1----------7 Capital gain net income (from Part IV, line 2) •

8 Net short-term capital gain

9 Income mod1f1cations • • • • • • • • • 1 0 a Gross sales less returns I

and allowances • • • • • 1---------+----------+---------+----------1---------

b Less Costmgoodss~d. '~--------+----------+-----------+----------<--------c Gross profit or (loss) (attach schedule)

11 Other mcome (attach schedule) •••

12 Total. Add Imes 1 throuoh 11 ••••

1 3 Com pensat1on of officers, directors, trustees, etc

Other employee salaries and wages

Pension plans, employee benefits • • • • •

Legal fees (attach schedule) • • • • • • • •

Accounting fees (attach schedule:S.T!-fr. ~

Other professional fees (attach s-""-"'"""' ~

100. 050 319. 50 319.

NONE

6, 615. NONE NONE 5. 490.

2. 010. L 590.

lntereirr ••• IQ-EGE~VE:D ... Taxes ( ittach sc~edulel 1000 none 1 -· -·- .""" ons'j *i-------~5~0~3~. +---------+----------+----------

Depre 1atil n (attacG stgdtOU!d d1 ~ on.

26

Occup (; •• AU ......... IJ)

Travel, ~on•erences. and meetinaSc ••• ~ Prmlm! andp~$~~-, UT ..... Other e""'~-- __ I1eou1e) :::,;1·J.vrJ.· • =l Total operating and administrative expenses.

Add lines 13 through 23 • • • • • • • • • •

Contributions. gifts. grants paid .S.TMJ'. Ei. • Total exoenses and disbursements. Add Imes 24 and 25

27 Subtract hne 26 from hne 12·

a Excess of revenue over expenses and disbursements • •

b Net Investment income (1f negative, enter -0-)

c Adlusted net income (if neaat1ve enter -0-) ••

1 206.

10 334.

103. 650. 000.

103 660 334.

-3. 610 015.

1. 206.

NONE NONE 8 286.

18 650 000.

NONE NONE 18 658 286

50. 319.

-0-For Privacy Act and Paperwork Reduction Act Notice, see page 30 of the Instructions.** STMT 4 JSA

Form 990-PF (2008)

t!)J 8E1410 1 000

14352G K932 08/13/2009 11:10:25 V08-7.3 85652

--- - - -- -------------------,. Form 990-PF 12008) 48-0926946 Pa!!e2

l:F.Tilll Balance Sheets Attached schedules and amounts in the Beginning of year End of year descnpt1on column should be for end-of-year amounts only (See instructions) (a) Book Value (b) Book Value (c) Fair Market Value

1 Cash - non-interest-bearing • .. . . 4 483. 3, 697. 3, 697. 2 Savings and temporary cash investments • ... 3 879. 936. 272 255. 272. 255. 3 Accounts receivable ~ ______ ----------------- -

Less allowance for doubtful accounts ~ -------------4 Pledges receivable ~ ------------ 8~ OOQ_, 000. - - -- -

Less allowance for doubtful accounts ~ NONE 85.000 000. 85 000. 000. -------------5 Grants receivable ...... . . . . . . . . . . . 6 Receivables due from officers, directors, trustees, and other

disqualified persons (attach schedule) (see page 15 of the 1nstruct1ons)

7 Other notes and loans receivable (attach schedule) ~ _____ -Less: allowance for doubtful accounts ~ -------------

Ill 8 Inventories for sale or use . . ...... . .. ... . . . CD 9 Prepaid expenses and deferred charges • • ••• STr-:IT.. f3. 56. 53. 53. Ill Ill

10 a < Investments - U S and state government obhgat1ons (attach schedule)

b Investments - corporate stock (attach schedule) •

c Investments - corporate bonds (attach schedule). 11 Investments - land, buildings, ~ and equipment basis ------------------ - - - - -- -

Less accumulated depreciation ~ (attach schedule) - ------ - -- - --------

12 Investments - mortgage loans .. . 13 Investments - other (attach schedule) • • • • • • • • • • • • • 14 Land, buildings, and ~

equipment basis ------------------ - - - -- - --Less accumulated depreciation ~ (attach schedule) - --- - --- -- - - -- ------

15 Other assets (describe ~ ____________________ )

16 Total assets (to be completed by all filers - see the instructions Also, see page 1, item I) • 3 884. 475. 85. 276. 005. 85.276 005.

17 Accounts payable and accrued expenses . NONE 1 545. 18 Grants payable .. . . NONE 85.000 000.

: 19 Deferred revenue . . . .. ~ 20 Loans from officers, directors, trustees, and other d1squalrfied persons

~ 21 Mortgages and other notes payable (attach schedule) •• . . ::i 22 Other llab11it1es (describe ~ -------------------)

23 Total liabilities (add Imes 17 through 22) • . . . . . . . . NONE 85. 001. 545 . ~w ' Foundations that follow SFAS 117, check here 1

and complete lines 24 through 26 and lines 30 and 31. Ill

3. 884. 475. 274 4 60. 8 24 Unrestricted • . .. . ; 25 Temporarily restricted .. . . . .. . . I 26 Permanently restricted • • • . . . . . . . . ,:, Foundations that do not follow SFAS 117, c: ~o ::, check here and complete lines 27 through 31. LL

0 27 Capital stock, trust principal, or current funds • • • . .. !! 28 CD

Paid-in or capital surplus. or land, bldg , and equipment fund

= 29 Retained earnings, accumulated income, endowment. or other funds •

! 30 Total net assets or fund balances (see page 17 of the CD

instructions) • • 3, 884. 475. 274,460. z ... . . . . .. . . . . . . .. 31 Total liabilities and net assets/fund balances (see page 17

of the instructions) • . . . . . . . . . . . . . . . . . . . . . 3 IHIIIIII Analysis of Changes in Net Assets or Fund Balances

884. 475. 85. 276, 005 .

1 Total net assets or fund balances at beginning of year - Part II, column (a), hne 30 (must agree wrth end-of-year figure reported on prior year's return) • . . .. . . . . . . . 1 3,884,475.

2 Enter amount from Part I, line 27a . . . . . .. . . . 2 -3. 610. 015. . .. . .. . 3 Other increases not included in line 2 (Itemize)~ ------------------------------------ 3 4 Add Imes 1, 2, and 3 .. . . . . . . . . . . . . . . . . . . . . . . . . . ... . . . . ......... 4 274. 460. 5 Decreases not included m line 2 (rtemize) ~ --------------------------------------- 5 6 Total net assets or fund balances at end of year (line 4 minus hne 5) - Part II, column (b), hne 30 ••••• 6 274. 460. JSA Form 990-PF (2008) 8E1420 1 000

14352G K932 08/13/2009 11:10:25 V08-7.3 85652

Form 990-PF (2008) 48-og2fig4f, Page 3 ·~1.1111-.. ,- Capital Gains and Losses for Tax on Investment Income

(a) List and describe the kmd(s) of property sold (e.g., real estate, (b) How (c) Date ~d) Date sold acquired acquired

2-story bnck warehouse; or common stock, 200 shs. MLC Co) P-P\Jrmase (mo .. aay, yr.) mo., day, yr) D-Donation

1a b

c d e

(e) Gross sales pnce (f) Deprec1at1on allowed (g) Cost or other basis (h) Gain or (loss) (or allowable) plus expense of sale (e) plus (f) minus (g)

a b

c d

e Complete onlv for assets showing gain in column (h) and owned by the foundation on 12/31/69 (I) Gains (Col. (h) gain minus

(i) F.M.V. as of 12/31/69 (j) AdJusted basis (k) Excess of col. (1) col. (k), but not less than -0-) or as of 12/31/69 over col. (J). 1f any Losses (from col. (h))

a b

c d e

2 Capital gain net income or (net capital loss) { If gain, also enter in Part I, hne 7 } ..... If (loss), enter -0- in Part I, hne 7 2

3 Net short-term capital gain or (loss) as defined 1n sections 1222(5) and (6): If gain, also enter in Part I, line 8, column (c) (see pages 13 and 17 of the 1nstruct1ons). } If (loss), enter -0- 1n Part I, line 8 ...•.•.........•••.••.......... .. 3

•:.t:111••- Qualification Under Section 4940(e) for Reduced Tax on Net Investment Income (For optional use by domestic private foundations subJect to the section 4940(a) tax on net investment income)

If section 4940(d)(2) applies, leave this part blank.

Was the foundation liable for the section 4942 tax on the distributable amount of any year 1n the base period? . . • • 0 Yes [x) No If "Yes," the foundation does not qualify under section 4940(e). Do not complete this part.

1 Enter the appropriate amount in each column for each year, see page 18 of the instructions before making any entnes. (a)

(b) (c) (d) Base penod years D1stnbut1on ratio

Calendar year (or tax year beginning 1n) AdJusted qualrfymg d1stnbutlons Net value of nonchantable-use assets (col (b) divided by col (c))

2007 10, 106. 3 737,419. 0.002704 2006 4, 350, 615. 982. 416. 4.428485 2005 11. 518. 218, 181. 0. 052791 2004 8. 899. 13 600. 0.654338 2003 16. 218. 13 229. 1. 22594 3

2 Total of line 1, column (d) ..................................... 2 6.364261 3 Average d1stribut1on ratio for the 5-year base period - divide the total on line 2 by 5, or by the

number of years the foundation has been in existence 1f less than 5 years .......... 3 1. 272852

4 Enter the net value of noncharitable-use assets for 2008 from Part X, line 5 4 L 531. 990 . . . . . . . . . . . 5 Multiply line 4 by line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 1.949,997 .

6 Enter 1 % of net investment income (1% of Part I, line 27b) . . . . . . . . . . . . . . . . . . . 6 503 •

7 Add lines 5 and 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 L 950, 500 .

8 Enter qualifying distributions from Part XII, line 4 • . . . . . . . . . . . ......... 8 18, 658, 286 . If lme 8 1s equal to or greater than hne 7, check the box m Part VI, hne 1b, and complete that part using a 1% tax rate. See the Part VI instructions on page 18.

JSA BE1430 1 000 Fonn 990-PF (2008)

14352G K932 08/13/2009 11:10:25 V08-7.3 85652

Form 990-PF (2008) 4 8 -0 9 2 6 9 4 6 Page 4 11!11'!11 Excise Tax Based on Investment Income (Section 4940(a), 4940(b), 4940(e), or 4948 - see page 18 of the instructions)

Date of ruling letter _________ (attach copy of ruling letter if necessary - see instructions) •

b Domestic foundations that meet the section 4940(e) requirements m Part V, check 1 50 3.

1 a Exempt operating foundations descnbed m section 4940(d)(2), check here ~ LJ and enter "NIA" on hne 1 • }

here ~ lxJ and enter 1 % of Part I, line 27b • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • c All other domestic foundations enter 2% of hne 27b Exempt foreign organizations enter 4% of Part I, lme 12, col (b) _

2 Tax under section 511 (domestic section 4947(a)(1) trusts and taxable foundations only. Others enter-0-)

3 Add Imes 1 and 2 • • • • • • • • • • • • • • • • • • • • • . • • • • • • • • • • • • • • • • • • • • 4 Subtitle A (income) tax (domestic section 494 7(a)(1) trusts and taxable foundations only. Others enter -0-)

5

6

Tax based on investment income. Subtract lme 4 from hne 3. If zero or less, enter -O

Cred1ts/Payments

. . .

556. a 2008 estimated tax payments and 2007 overpayment credited to 2008. 1--'6:;_;a=--+-------=-='-"-''-I

b Exempt foreign organizations-tax withheld at source • • • • • • •

c Tax paid with application for extension of time to file (Form 8868).

d Backup withholding erroneously withheld ••••••••••••

6b

6c

6d

NONE

NONE

2

3

4

5

503. NON E

503.

7 Total credits and payments. Add Imes 6a through 6d • • • • • . ••••••••••••••••

8 Enter any penalty for underpayment of estimated tax. Check here D 1f Form 2220 1s attached . . t--'7~--------5~5~6.

8

9 Tax due. If the total of Imes 5 and 8 1s more than hne 7, enter amount owed ••••••

10 Overpayment If lme 7 1s more than the total of Imes 5 and 8, enter the amount overpaid • ~ 10 53. 11 Enter the amount of line 10 to be· Credited to 2009 estimated tax ~ 53. Refunded ~ 11 ·~••jll'f•• Statements Regarding Activities

Yes No 1 a During the tax year, did the foundation attempt to influence any national, state, or local leg1slat1on or did 1t

participate or intervene m any poht1cal campaign? • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • •

b Did 1t spend more than $100 during the year (either directly or indirectly) for political purposes (see page 19

of the instructions for definition)? • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • •

If the answer is "Yes• to 1a or 1b, attach a detailed descnpt1on of the activities and copies of any matenals

• • • • • • l--'1~a-+--+---'-'x'-

1b X ...... -~----~ published or d1str,buted by the foundation m connection with the activities.

c Did the foundation file Form 1120-POL for this year? •••••••••••• , ••••••••

d Enter the amount (1f any) of tax on political expenditures (section 4955) imposed during the year. • • • • • • • • • • • • • • • l--'1C-'c-+--+---'-'x'-

(1) On the foundation ~$ (2) On foundation managers.~$ __________ _

2

e Enter the reimbursement (1f any) paid by the foundation during the year for political expenditure tax imposed on

foundation managers. ~ $ ___________ _

Has the foundation engaged in any achVlties that have not previously been reported to the IRS? • • • • • • • • • •

If "Yes,· attach a detailed description of the activities.

3 Has the foundation made any changes, not previously reported to the IRS, in its governing instrument, articles of

2 X ...... ------~ incorporation, or bylaws, or other s1m1lar instruments? If "Yes,• attach a conformed copy of the changes ••••••••••••• ,__3~----~X~

4a Did the foundation have unrelated business gross income of $1,000 or more dunng the year? • • • • • • • • • • • • • • 4a X

b If "Yes," has 1t filed a tax return on Form 990-T for this year? ••••••••••••••••

s Was there a liquidation, termination, d1ssolut1on, or substantial contraction during the year? •

If "Yes,• attach the statement required by General Instruction T

6 Are the requirements of section 508(e) (relating to sections 4941 through 4945) satisfied either

7

• By language in the governing instrument, or

• By state leg1slat1on that effectively amends the governing instrument so that no mandatory directions that

conflict with the state law remain in the governing instrument? • • • • • • • • • • • • • • • • • • • • • • • • • • • • • •

Did the foundation have at least $5,000 m assets at any time during the year? If "Yes,· complete Part II, col. (c), and Part XV.

Ba Enter the states to which the foundation reports or with which 1t 1s registered (see page 19 of the

instructions) ~ KSL----------------------------------------------------------------b If the answer 1s "Yes" to line 7, has the foundation furnished a copy of Form 990-PF to the Attorney General

4b NVA 5 x

6 x 7 x

(or designate) of each state as required by General Instruction G? If "No,· attach explanation •••••••••••••••••• l--'8~b'-+ __ X---1t---

9 Is the foundation claiming status as a private operating foundation within the meaning of section 4942(J)(3)

or 4942(J)(5) for calendar year 2008 or the taxable year beginning in 2008 (see instructions for Part XIV on

page 27)? If "Yes,• complete Part XIV • • • • • • • • • • • • • • • • . • • • • • • . • • • • • • • • • • • • • • • • • • • • i--:9:...._-1----1---=-X"--

1 o Did any persons become substantial contributors during the tax year? If "Yes," attach a schedule ltstmg their

names and addresses • • • • • • . . • . • • • • • • • • • • • • • . • • . . • • . • • • • • • • • • • • • . . • • • • • . • 1 o x Form 990-PF (2008)

JSA

8E1440 1 000

14352G K932 08/13/2009 11: 10:25 V08-7.3 85652

JSA

Form 990-PF (2008) 48-0926946 Page5

l::r.11t••J1ll'r'•W Statements Reaardina Activities (continued)

11 At any time during the year, did the foundation, directly or indirectly, own a controlled entity within the

meaning of section 512(b)(3)? If "Yes,· attach schedule (see page 20 of the instructions). • •••• . . ........... 11 x 12 Did the foundation acquire a direct or indirect interest in any applicable insurance contract before

August17,2008? ....................................... . . . . . . . . . 12 x 13 Did the foundation comply with the public inspection requirements for its annual returns and exemption application? • 13 x

Website address ~ _____ NO NE __________________________________________________________________ _

14 The books are 1n care of ~ VONDA HOLLI MAN-------------------- Telephone no. ~ _____ 316-8 28-5552 _____ _

Located at ~;1111_ E._ 37TH ST._ N._ WICHITA_ KS---------------------- ZIP+4 ~ 67220-3203 ____ 11

15 Section 4947(a)(1) nonexempt charitable trusts filing Form 990-PF 1n lieu of Form 1041- Check here ••••••••• N/. A •••••• ~ [__J

and enter the amount of tax-exempt interest received or accrued during the year • • • • • • • • • • • • • • • • • • ~ I 15 I 1::r.,~•u1~=• Statements Regarding Activities for Which Form 4720 May Be Required

File Form 4720 if any item is checked in the "Yes" column, unless an exception applies.

1a During the year did the foundation (either directly or indirectly): 0Yes (1) Engage in the sale or exchange, or leasing of property with a disqualified person? •••

(2) Borrow money from. lend money to, or otherwise extend credit to (or accept 1t from) a

disqualified person? • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • •

(3) Furnish goods, services, or fac11it1es to (or accept them from) a disqualified person? •••

(4) Pay compensation to, or pay or reimburse the expenses of, a disqualified person? ••••

(5) Transfer any income or assets to a disqualified person (or make any of either available for

.. H~:: tj Yes

the benefit or use of a disqualified person)?. • • • • • • • • • • • • • • • • • • • • • •

(6) Agree to pay money or property to a government official? (Exception. Check "No" 1f

0Yes

G)No

~

No

No

No

G) No

the foundation agreed to make a grant to or to employ the official for a period after

termination of government service, 1f terminating within 90 days.). • • • • • • • • • • • • • • • D Yes GJ No

b If any answer 1s "Yes" to 1a(1)-(6), did any of the acts fail to qualify under the exceptions described 1n Regulations

section 53.4941 (d)-3 or in a current notice regarding disaster assistance (see page 20 of the mstruct1ons)?

Organizations relying on a current notice regarding disaster assistance check here • • • • • • • • • • • •

c Did the foundation engage in a prior year in any of the acts described 1n 1a, other than excepted acts, that

were not corrected before the first day of the tax year beginning 1n 2008? • • • • • • • • • • • • • • • • •

2 Taxes on failure to distribute income (section 4942) (does not apply for years the foundation was a private

operating foundation defined in section 4942(1)(3) or 4942(1)(5))

a At the end of tax year 2008, did the foundation have any undistributed income (Imes 6d and D 6e, Part XIII) for tax year(s) beginning before 2008?. • • • • • • • • • • • • • • • • • • • • • • • • Yes If "Yes," list the years ~ __________ , _________ , ________ , _______ _

b Are there any years listed in 2a for which the foundation 1s not applying the provisions of section 4942(a)(2)

(relating to incorrect valuatlon of assets) to the year's undistributed income? (If applying section 4942(a)(2)

to all years listed, answer "No" and attach statement - see page 20 of the mstruct1ons.) • • • • • • • • • •

c If the provisions of section 4942(a)(2) are being applied to any of the years listed in 2a, list the years here.

~ ---------- ·--------- ·-------- ·--------3a Did the foundation hold more than a 2% direct or indirect interest m any business

enterprise at any time during the year? • • • • • • • • • • • • • • • • • • • • • 0Yes G) No

Yes No

1b x

1c x

2b NIA

b If "Yes," did 11 have excess business holdings in 2008 as a result of (1) any purchase by the foundation or

disqualified persons after May 26, 1969, (2) the lapse of the 5-year period (or longer period approved by the

Comm1ss1oner under section 4943(c)(7)) to dispose of holdings acquired by gift or bequest, or (3) the lapse

of the 10-, 15-, or 20-year first phase holding period? (Use Schedule C, Form 4720, to determine if the

foundation had excess busmess holdings m 2008 ) • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • 3b N/IA . . . . . . . ---~ ......... ~-4a Did the foundation invest during the year any amount in a manner that would Jeopardize its charitable purposes? • • •

b Did u,e foundation make any investment 1n a prior year (but after December 31, 1969) that could jeopardize its charitable purpose that had not been removed from Jeopardy before the first dav of the tax year beginning in 2008?

4a x

4b x Fonn 990-Pf (2008)

8E1450 1 000

14352G K932 08/13/2009 11:10:25 V08-7.3 85652

JSA

Form 990-PF (2008) Page&

Statements Re arding Activities for Which Form 4720 Ma

Sa During the year did the foundation pay or incur any amount to (1) Carry on propaganda, or otherwise attempt to influence legislation (section 4945(e))?

(2) Influence the outcome of any spec1f1c public election (see section 4955); or to carry on,

directly or indirectly, any voter reg1strat1on drive? •••••••••••••••••••

(3) ProVJde a grant to an ind1V1dual for travel, study, or other similar purposes? ••••••

(4) Provide a grant to an organization other than a charitable, etc., organization described in

section 509(a)(1), (2), or (3), or section 4940(d)(2)? (see page 22 of the instructions)

..... Oves [x]No

aves Yes

tENo No

Oves [x]No

(5) ProVJde for any purpose other than religious, charitable, scaent1fic, literary, or

educational purposes, or for the prevention of cruelty to children or animals? • • • • • • • • • • D Yes Q No

b If any answer 1s "Yes· to 5a(1)-(5), did any of the transactions fail to qualify under the exceptions described in

Regulations section 53.4945 or in a current notice regarding disaster assistance (see page 22 of the instructions)? • • • • • • • f-S'--b--t-~N-'-FA~

Organizat1ons relying on a current notice regarding disaster assistance check here • • • • • • • • • • • • • • • ~ D c If the answer 1s "Yes· to question 5a(4), does the foundation claim exemption from the tax

because 1t maintained expenditure responsibility for the grant? • • • • • • • • • • • • • •

If "Yes,· attach the statement required by Regulations section 53.4945-S(d).

J-l{l:,. Oves

&a Did the foundation, during the year, receive any funds, directly or indirectly, to pay premiums

on a personal benefit contract?. • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • D Yes

b Did the foundation, during the year, pay premiums, directly or indirectly, on a personal benefit contract? •••••

0No

[x]No

If you answered "Yes• to 6b, also file Form 8870

7 a At any time during the tax year, was the foundation a party to a prohibited tax sheller transaction? • • D Yes Q No

6b x

b If yes, did the foundation receive an proceeds or have an net income attributable to the transaction? • • • • • • • • • • • • • 7 b N Information About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees, and Contractors

1 List all officers, directors, trustees, foundation managers and their compensation (see page 22 of the instructions).

(a) Name and address (b) Title, and average ti Compensation (d) Contnbubons to (e) Expense account,

hours per week not paid, enter employee benefit plans other allowances devoted to oosrt1on -0-1 and deferred comoensat,on

-------------------------------------SEE STATEMENT 10 NONE NONE NON

-------------------------------------

-------------------------------------

-------------------------------------2 Compensation of five highest-paid employees (other than those included on hne 1 - see page 23 of the instructions).

If none, enter "NONE."

(a) Name and address of each employee paid more than $50,000

NONE ________________________________ _

Total number of other employees paid over $50,000 ..

(b) ntle, and average hours per week

devoted to position (c) Compensation

(d) Contributions to employee benefit

plans and deferred comoensation

(e) Expense account, other allowances

•••• -~INONE

E

Fonn 990-PF (2008)

8E1460 1 000

14352G K932 08/13/2009 11:10:25 V08-7.3 85652

Form 990-PF (2008) 4 8 -0 9 2 6 9 4 6

1:tft@jj1 Information About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees, and Contractors (contmued)

Page7

3 Five highest-paid independent contractors for professional services (see page 23 of the instructions). If none, enter "NONE." (a) Name and address of each person paid more than $50,000 (b) Type of service (c) Compensabon

NONE-----------------------------------------------------

Total number of others receiving over $50,000 for professional services ...........•...........••.. ~ I NONE

1:tftjfft Summary of Direct Charitable Activities

List the foundation's four largest direct charitable act1vrt1es dunng the tax year Include relevant stabst1cal information such as the number of organizations and other beneficianes served, conferences convened, research papers produced, etc

1_N{A-----------------------------------------------------------------------

2

3

4

: Summarv of Proa ram-Related Investments (see paqe 23 of the instructions) Describe the two largest program-related investments made by the foundation dunng the tax year on Imes 1 and 2.

1_NONE----------------------------------------------------------------------

2

All other program-related investments See page 24 of the mstrucbons.

3_NONE _____________________________________________________________________ _

Total. Add Imes 1 throuqh 3 .•••••.....••.......•..••..........•.....•••••. ~

JSA

8E1465 1 000

14352G K932 08/13/2009 11:10:25 V08-7.3 85652

E,cpenses

Amount

Form 990-PF (2008)

Form 990-PF(2008) 48-092694 6

1iftf3i Minimum Investment Return (All domestic foundations must complete this part. Foreign foundations, see page 24 of the instructions.)

1 Fair market value of assets not used (or held for use) directly 1n carrying out charitable, etc., purposes:

a Average monthly fair market value of securities •.•••••••...•.. 1a . . . ... b Average of monthly cash balances •.•.••..............•• 1b . . . ... c Fair market value of all other assets (see page 24 of the instructions) •.. 1c ... d Total (add Imes 1a, b, and c) ...•.••.•...•.•....•..•..•. 1d . . . . . . e Reduction claimed for blockage or other factors reported on lines 1a and

1 c ( attach detailed explanation) • . . • . • . • • . . . . . • . . . . . . I 1 e I 2 Acqu1s1t1on indebtedness applicable to line 1 assets 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 Subtract line 2 from line 1d 3

Cash deemed held for charitable act1vrt1es: Ente"r 1 1 /2 o/o 0

0f line 3 (for 0

gre0

ater amount."see page 25 . .

4

of the instructions) 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 Net value of noncharitable-use assets. Subtract line 4 from line 3. Enter here and on Part V, line 4 5 6 Minimum investment return. Enter 5% of line 5 ......•..••........•........ 6

1::.-. ,---~- Distributable Amount (see page 25 of the instructions) (Section 4942(J)(3) and (J)(5) private operating foundations and certain foreign organizations check here ~ D and do not complete this part.)

1 Minimum investment return from Part X, line 6 . .. i 2~ i

. . . 1

2a Tax on investment income for 2008 from Part VI, line 5 . 503. b Income tax for 2008. (This does not include the tax from Part VI.). I 2b I c Add Imes 2a and 2b 2c . . . . . . .

3 Distributable amount before adJustments. Subtract line 2c from line 1 . . 3 4 Recoveries of amounts treated as qualifying d1stribut1ons ... . . 4 5 Add Imes 3 and 4 5 . . . . 6 Deduction from distributable amount (see page 25 of the instructions) • 6 . . . . 7 Distributable amount as adjusted. Subtract line 6 from line 5. Enter here and on Part XIII,

line 1 . . . 7

1ifii3jl Qualifying Distributions (see page 25 of the instructions)

1 Amounts paid (including admm1strat1ve expenses) to accomplish charitable, etc., purposes

a Expenses, contributions, gifts, etc. - total from Part I, column (d), line 26 ••••••.•.•. 1a b Program-related investments - total from Part LX.-8 1b ....................... .

2 Amounts paid to acquire assets used (or held for use) directly m carrying out charitable, etc.,

purposes .•••.•..•••••••••.•.....•..•.•••••••••.........•.•. 2

3 Amounts set aside for specific charitable projects that satisfy the

a Su1tab1hty test (prior IRS approval required) 3a ................................ b Cash d1stribut1on test (attach the required schedule) 3b ...........................

4 Qualifying distributions. Add lines 1 a through 3b. Enter here and on Part V, hne 8, and Part Xiii, line 4 . . . . . . 4

5 Foundations that qualify under section 4940(e) for the reduced rate of tax on net investment income.

Enter 1 % of Part I, line 27b (see page 26 of the 1nstruct1ons) . 5

6 Adjusted qualifying distributions. Subtract line 5 from line 4 ....•.••••••.•......... 6

Page8

1 555,320.

NONE 1 555. 320.

NONE 1 555. 320.

23. 330 .

1 531. 990. 76. 600.

76. 600 .

503. 76. 097 .

76, 097 .

76. 097 .

18.658 286.

NONE

NONE

NONE NONE

18.658 286 .

503 . 18.657 783.

Note: The amount on line 6 will be used in Part V, column (b), m subsequent years when calculating whether the foundation qualifies for the section 4940(e) reduction of tax m those years.

Form 990-PF (2008)

JSA

8E1470 1 000

14352G K932 08/13/2009 11:10:25 V08-7.3 85652

Form 990-PF (2008) 48-0926946 •:,c,i,1a:~m1 Undistributed Income (see page 26 of the instructions)

(a) (b) (c) 1 Distributable amount for 2008 from Part XI, Corpus Years pnor to 2007 2007

hne7 ..................... 2 Und1stnbuted mcome, 1f any, as of the end of 2007

a Enter amount for 2007 only .......... b Total for pnor years 20 __ .20 __ ,20 __

3 Excess distributions carryover, 1f any, to 2008

a From 2003 . . b From 2004 . c From 2005 . . d From 2006 4 165. 825. e From 2007 . f Total of Imes 3a through e • ..........

4 Qualifying d1stnbut1ons for 2008 from Part XII, line 4 ~ $ 18, 658, 286.

a Applied to 2007. but not more than line 2a • • •

b Applied to und1stnbuted mcome of pnor years (Election required - see page 26 of the instructions) ......

c Treated as d1stnbutions out of corpus (Election required - see page 26 of the instructions) ••

d Applied to 2008 d1stnbutable amount ..... e Remammg amount d1stnbuted out of corpus ..

5 Excess d1stnbut1ons carryover apphed to 2008 • (ff an amount appears in column (d), the same amount must be shown m column (a))

6 Enter the net total of each column as indicated below:

a Corpus. Add Imes 3f, 4c, and 4e. Subtract line 5

b Pnor years' undistributed income Subtract hne 4b from line 2b ......... . . . . .

c Enter the amount of pnor years' undistributed income for which a notice of deficiency has been issued, or on which the section 4942(a) tax has been previously assessed • • • • • • • • • • •

d Subtract line 6c from lme 6b. Taxable amount - see page 27 of the 1nstruct1ons

e Und1stnbuted income for 2007. Subtract line 4a from lme 2a. Taxable amount - see page 27 of the instructions .............

f Undistributed income for 2008. Subtract Imes 4d and 5 from lme 1. This amount must be d1stnbuted m 2009 ...............

7 Amounts treated as d1stnbut1ons out of corpus to satisfy requirements imposed by section 170(b)(1)(F) or 4942(9)(3) (see page 27 of the instructions) • • • • • • • • • • • • • • • • • •

8 Excess distributions carryover from 2003 not apphed on lme 5 or lme 7 (see page 27 of the instructions) • • • • • • • • • • • • • • ....

9 Excess distributions carryover to 2009. Subtract lines 7 and 8 from llne 6a . . . ....

10 Analysis of lme 9 a Excess from 2004 . . b Excess from 2005 . . c Excess from 2006 . . 4 165. 825. d Excess from 2007 . e Excess from 2008 18.582 189.

JSA

8E1480 1 000

4.165 825.

18 582. 189.

22.748 014.

22 748. 014.

14352G K932 08/13/2009 11:10:25 V08-7.3 85652

- - -

Page9

(d) 2008

76 097.

i I

'

76, 097.

:

I

I

' I

Form 990-PF (2008)

Form 990-PF (2008) 48-0926946 Page 10

•"-.··-···- Private QperatinQ Foundations see oaoe 27 of the instructions and Part VII-A, question 9) NOT APPLICABLE 1a If the foundation has received a ruling or determination letter that

1.t _is. ~ .p~1v~t~ .o~e:a.tin~ I foundation, and the ruling is effective for 2008, enter the date of the ruhng

b Check box to indicate whether the foundation is a private operating foundation described 1n section I I 4942(]}(3) or I I 4942(]}(5)

2a Enter the lesser of the ad-Tax year Prior 3 years

(e) Total Justed net income from Part (a) 2008 (b) 2007 (c) 2006 (d) 2005 I or the minimum investment return from Part X for each year listed .......

b 85% of line 2a ..... c Qualifying d1stnbubons from Part

XII, hne 4 for each year listed

d Amounts induded ,n hne 2c not used directly for act,w condud of exempt act1vibes • • • • •

e Quallfy1ng d1stnbubons made directly for act1w condud of exempt act1vit1es Subtract line 2d from line 2c • • • • • •

3 Complete 3a, b, or c for the alternatrve test relied upon

a • Assets" altematrve test - enter

(1) Value al all assets ... (2) Value of assets quallfy1ng

under sed.Jon

49420)(3)(8)(1). • • • • b "Endowment" alternabve test-

enter 2/3 of minimum invest·

ment return shown ,n Part X. 1"1e 6 for each year listed ..

c "Support" altematrve test - enter

(1) Total support other than gross investment income ("1terest, dMdends, rents. payments on secunbes loans (section 512(a){5)), or royalbes) • • • • • •

(2) Support from general public and 5 or more exempt orgamzations as provided in section 4942 0)(3)(8)(111) ••••••

(3) Largest amount of sup-port from an exempt organization .....

(4) Gross investment income • •:..; I .... __ ,_ ~upple~entary Information (Complete t~is part _only if the foundation had $5,000 or more in assets at any

time during the year - see page 27 of the mstruct1ons.) 1 Information Regarding Foundation Managers:

a List any managers of the foundation who have contributed more than 2% of the total contributions received by the foundation before the close of any tax year (but only 1f they have contributed more than $5,000). (See section 507(d)(2).)

DAVID H. KOCH

b List any managers of the foundation who own 10% or more of the stock of a corporation (or an equally large portion of the ownership of a partnership or other entity) of which the foundation has a 10% or greater interest.

N A 2 Information Regarding Contribution, Grant, Gift, Loan, Scholarship, etc., Programs:

Check here .... W 1f the foundation only makes contributions to preselected charitable organizations and does not accept unsolicited requests for funds. If the foundation makes gifts, grants, etc. (see page 28 of the instructions) to ind1v1duals or organizations under other conditions, complete items 2a, b, c, and d.

a The name, address, and telephone number of the person to whom applications should be addressed

b The form in which applications should be submitted and information and materials they should include.

c Any submission deadlines.

d Any restrictions or limitations on awards, such as by geographical areas, charitable fields, kmds of institutions, or other factors:

JSA 8E1490 1 000

14352G K932 08/13/2009 11:10:25 V08-7.3 Form 990-PF (2008)

85652

14ifiEJtJ Supplementary Information (continued) Form 990-PF (2008) 4 8 -0 9 2 6 9 4 6 Page 11

3 Grants and Contributions Paid During the Year or Approved for Future Payment Recrprent If rec1p1ent 1s an 1nd1111dual, Foundation Purpose of grant or show any relat1onsh1p to status of Amount

Name and address (home or business) any foundation manager rec1p1ent

contnbubon or substantial contnbutor

a Paid during the year

SEE STATEMENT 11

Total. . . . . . . . . .. ~ Ja 18. 650. 000. b Approved for future payment

SEE STATEMENT 12

Total. . . . . . .. . . . . . . . . ~ Jb 85.000.000 . Form 990-PF (2008)

JSA BE1491 1 000

14352G K932 08/13/2009 11:10:25 V08-7.3 85652

JSA

Form 990-PF (2008) . [D Analysis of Income-Producing Activities Enter gross amounts unless otherwise 1nd1cated Unrelated business income

(a)

1 Program service revenue. Busrness code

a

b

c

d

e

f

g Fees and contracts from government agencies

2 Membership dues and assessments • • • • •

3 Interest on savings and temporary cash in11eStments

4 D1v1dends and interest from securities ... 5 Net rental income or (loss) from real estate.

a Debt-financed property ••••••••

b Not debt-financed property ...... 6 Net rental income or (loss) from personal property

7 Other investment income ......... 8 Gain or (loss) from sales of assets other than inventory

9 Net income or (loss) from special events • •

1 O Gross profit or (loss) from sales of inventory.

11 Other revenue a b

c d

e

12 Subtotal. Add columns (b), (d), and (e) .... 13 Total. Add line 12, columns (b), (d), and (e) • • • • • •••••••• (See worksheet in line 13 instructions on page 28 to verify calculations )

(b) Amount

48-0926946

Excluded b section 512, 513, or514

(c) (d) Exdusron code Amount

14 50. 319.

50, 319.

.. II:• Relationship of Activities to the Accomplishment of Exempt Purposes

Page 12

(e) Related or exemgt function incom f See page 28 of he instructions )

Line No. Explain below how each activity for which income 1s reported in column (e) of Part XVI-A contributed importantly to

... the accomplishment of the foundation's exempt purposes (other than by providing funds for such purposes). (See page 28 of the instructions.)

NOT APPL! CABLE

Fonn 990-PF (2008)

8E1492 1 000

14352G K932 08/13/2009 11:10:25 V08-7.3 85652

1

48-0926946 Information Regarding Transfers To and Transactions and Relationships With Exempt Organizations

Did the organization directly or indirectly engage in any of the following with any other organization described in section

501 (c) of the Code (other than section 501 (c)(3) organizations) or in section 527, relating to political organizations?

a Transfers from the reporting foundation to a nonchantable exempt organization of

(1) Cash • . . . . . (2) Other assets . . . . . . .

b Other transactions:

(1) Sales of assets to a noncharitable exempt organization . . . . . (2) Purchases of assets from a nonchantable exempt organization . . (3) Rental of fac11it1es, equipment, or other assets . . (4) Reimbursement arrangements • . . . (5) Loans or loan guarantees . . . . . . (6) Performance of services or membership or fundra1sing solicitations .

c Sharing of fac11it1es, equipment, mailing lists, other assets, or paid employees

Page 13 Noncharitable

Yes No

, 1a(1) x 1al21 x

1b(1) x 1b(21 x 1b(3) x 1b(41 x 1b(S) x 1b(61 x

1c x d If the answer to any of the above is "Yes," complete the following schedule. Column (b) should always show the fair market value of the goods,

other assets, or ser111ces given by the reporting foundation. If the foundation received less than fair market value in any transaction or sharing

arrangement, show m column (d) the value of the goods, other assets, or ser111ces received.

(a) Line no (b) Amount involved (c) Name of nonchantable exempt organization (d) Description of transfers, transactions, and shanng arrangements

NIA NIA

2a Is the foundation directly or indirectly affiliated with, or related to, one or more tax-exempt organizations described m

section 501(c) of the Code (other than section 501(c)(3)) or in section 527?. • • • • • • • • • • • • • • • • • • • • • • • • D Yes Q No

b If "Yes," comolete the followina schedule. (a) Name of organization (b) Type of organization (c) Description of relabonsh1p

Under penalties of perJury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and behef, 1t 1s true, correct, and complete. Declarabon of preparer (other than taxpayer or fiduciary) 1s based on all mformat1on of which preparer has any knowledge.

~ ~~CJ~ I 8'-IL/-;z 001 ~ Tre9..s.. (f.,e_r Cl) Signature of officer or trustee Date Title ... Cl)

Date Preparer's 1dent1fying number :c Check if D ~~A.

(See Signature on page 30 of the c: ~..?:- Preparer's Co~ g/14/zooq self-employed~ instructions)

.!=> (/) :!:!~c5 signature P00770702

:g,: Firm's name (or yours 1f ~BKD. LLP BN ~ 44-0160260 ii: :::, self-employed), address, 1551 N WATERFRONT PKWY, STE 300

and ZIP code WICHITA. KS 67206-6601 Phone no. 316-26 5-2811 Form 990-PF (2008)

JSA

8E1493 1 000

14352G K932 08/13/2009 11:10:25 V08-7.3 85652

JSA

Schedule B (Form 990, 990-EZ, or 990-PF)

Schedule of Contributors OMB No 1545-0047

Department of the Treasury Internal Rewnue Ser111ce

Name of the organization

~ Attach to Form 990, 990-EZ, and 990-PF.

DAVID H. KOCH CHARITABLE FOUNDATION

~@08 Employer Identification number

48-0926946 Organization type {check one).

Filers of:

Form 990 or 990-EZ

Form 990-PF

Section:

D 501cc>< ) {enter number) organization

D 4947{a){1) nonexempt charitable trust not treated as a private foundation

D 527 political organization

Q 501{c){3) exempt private foundation

D 4947{a){1) nonexempt charitable trust treated as a private foundation

D 501{c){3) taxable private foundation

Check 1f your organization 1s covered by the General Rule or a Special Rule. {Note. Only a section 501 {c){7), (8), or (10) organization can check boxes for both the General Rule and a Special Rule. See instructions.)

General Rule

Q For organizations filing Form 990, 990-EZ, or 990-PF that received, during the year, $5,000 or more {in money or property) from any one contributor. Complete Parts I and II.

Special Rules

D For a section 501 {c){3) organization filing Form 990, or Form 990-EZ, that met the 33113 % support test of the regulations under sections 509{a){1 )/170{b){1 ){A){v1), and received from any one contributor, during the year, a contribution of the greater of (1) $5,000 or (2) 2% of the amount on Form 990, Part VIII, line 1 h or 2% of the amount on Form 990-EZ, line 1. Complete Parts I and II.

D For a section 501{c){7), (8), or (10) organization filing Form 990, or Form 990-EZ, that received from any one contributor, during the year, aggregate contributions or bequests of more than $1,000 for use exc/us,vely for religious, charitable, sc1ent1fic, literary, or educational purposes, or the prevention of cruelty to children or animals. Complete Parts I, II, and Ill.

D For a section 501{c){7), (8), or (10) organization filing Form 990, or Form 990-EZ, that received from any one contributor, during the year, some contributions for use exclus1vely for rel1g1ous, charitable, etc., purposes, but these contributions did not aggregate to more than $1,000. {If this box is checked, enter here the total contributions that were received dunng the year for an exc/us1vely religious, charitable, etc., purpose. Do not complete any of the parts unless the General Rule applies to this organization because 1t received nonexclus1vely religious, charitable, etc., contributions of $5,000 or more

during the year.) • . . . • • • • • • . . . . . • • . . • • • • • . • • • . . • • • . . . . . • • • . . . ~ $ ---------

Caution. Organizations that are not covered by the General Rule and/or the Special Rules do not file Schedule B {Form 990, 990-EZ, or 990-PF), but they must answer "No" on Part IV, line 2 of their Form 990, or check the box in the heading of their Form 990-EZ, or on line 2 of their Form 990-PF, to certify that they do not meet the filing requirements of Schedule B {Form 990, 990-EZ, or 990-PF).

For Privacy Act and Paperwork Reduction Act Notice, see the Instructions for Fonn 990. These Instructions will be Issued separately.

Schedule B (Fonn 990, 990-EZ, or 990~F) (2008)

8E1251 1 000

14352G K932 08/13/2009 11:10:25 V08-7.3 85652

Schedule B (Form 990, 990-EZ. or 990-PF) (2008)

Name of organization DAVID H. KOCH CHARITABLE FOUNDATION

1ifl11 Contributors (see instructions)

(a) (b) No. Name, address, and ZIP + 4

__ 1_ DAVID H. KOCH

667 MADISON AVENUE

NEW YORK, NY 10021

(a) (b) No. Name, address, and ZIP + 4

---

(a) (b) No. Name, address, and ZIP + 4

---

(a) (b) No. Name, address, and ZIP + 4

---

(a) (b) No. Name, address, and ZIP+ 4

---

(a) (b) No. Name, address, and ZIP + 4

---

JSA 8E1253 1 000

14352G K932 08/13/2009 11:10:25 V08-7.3 85652

(c) Aggregate contributions

$ 100,000,000.

(c) Aggregate contributions

$

(c) Aggregate contributions

$

(c) Aggregate contributions

$

(c) Aggregate contributions

$

(c) Aggregate contributions

$

Page __ of __ of Part I

Employer Identification number

48-0926946

(d) Type of contribution

Person § Payroll

Noncash

(Complete Part II 1f there 1s a noncash contribution.)

(d) Type of contribution

Person § Payroll Noncash

(Complete Part II 1f there 1s a noncash contribution.)

(d) Type of contribution

Person § Payroll

Noncash

(Complete Part II 1f there is a noncash contribution )

(d) Type of contribution

Person § Payroll

Noncash

(Complete Part II 1f there is a noncash contribution.)

(d) Type of contribution

Person § Payroll

Noncash

(Complete Part II if there is a noncash contribution.)

(d) Type of contribution

Person § Payroll

Noncash

(Complete Part II if there is a noncash contribution.)

Schedule B (Form 990, 990-EZ, or 99G-PF) (2008)

Fonn 8868 (Rev Apnl 2008)

Application for Extension of Time To File an Exempt Organization Return OMB No. 1545-1709

Department of the Treasury Internal Revenue Service .... File a separate apphcat1on for each return

• If you are fihng for an Automatic 3-Month Extension, complete only Part I and check this box • • • • . • . . . . . . • . . ..,.. • If you are fihng for an Additional (Not Automatic) 3-Month Extension, complete only Part II (on page 2 of this form). Do not complete Part II unless you have already been granted an automatic 3-month extension on a previously filed Form 8868.

1@11 Automatic 3-Month Extension of Time. Only submit original (no copies needed}.

:ac~~P:~;t~o~ ~e~~1r:~ ~o_fi'.e .F~~m. ~9?-.T .a~~ r.e~u.e~t1_n~ ~~ ~u~o~.a~1c. 6--~~n~h. e~~~s'.o~: ~h.e~k. t~1~ ~o~ ~n.d .c~~p!e~e ....• ..,.. D All other corporations (including 1120-C filers), partnerships, REM/Cs, and trusts must use Form 7004 to request an extension of time to file mcome tax returns.

Electronic Filing (e-file). Generally, you can electronically file Form 8868 1f you want a 3-month automatic extension of time to file one of the returns noted below (6 months for a corporation required to file Form 990-T) However, you cannot file Form 8868 electronically 1f (1) you want the additional (not automatic) 3-month extension or (2) you file Forms 990-BL, 6069, or 8870, group returns, or a composite or consolidated From 990-T. Instead, you must submit the fully completed and signed page 2 (Part II) of Form 8868. For more details on the electronic f1hng of this form, visit www 1rs.gov/efl/e and chck one-file for Chanfles & Nonprofits.

Type or Name of Exempt Organization I Employer identification number

print DAVID H. KOCH CHARITABLE FOUNDATION 4 8-092694 6

File by the due date for filing your return See mstruct,ons

Number, street, and room or suite no. If a P.O. box, see instructions.

4111 E. 37TH ST. N. City. town or post office, state, and ZIP code. For a foreign address, see instructions.

WICHITA KS 67220-3203 Check type of return to be filed (file a separate apphcat1on for each return)

~ Form 990 ~ Form 990-T (corporation) Form 990-BL Form 990- T (sec. 401 (a) or 408(a) trust)

Form 990-EZ Form 990-T (trust other than above)

Form 990-PF Form 1041-A

Form 4720

Form 5227

Form 6069

Form 8870

• The books are in the care of ..,.. _V,..;O=Nc::D:.,.A.:........eH""'O"'-L='-=L~I_,_MA~N,.,__ ______________________ _

Telephone No . ..,.. 316 8 28-5552 FM No .....

• If the organization does not have an office or place of business in the United States, check this box ....o • If this 1s for a Group Return, enter the organization's four d1g1t Group Exemption Number (GEN) . If this 1s

and attach a list with the for the whole group, check this box .... D . If It is for part of the group, check this box .... ~o~-------names and EINs of all members the extension will cover.

1 I request an automatic 3-month (6 months for a corporation required to file Form 990-T) extension of time until O 8 I 1 5 ,2 O O 9 , to file the exempt organization return for the organization named above. The extension 1s for the organization's return for:

..,.. fxl calendar year2008

..,.. D tax year beginning -----------

or

___ , and ending ----------

2 If this tax year 1s for less than 12 months, check reason: D Initial return D Final return D Change in accounting period

Ja If this application is for Form 990-BL, 990-PF, 990-T, 4720, or 6069, enter the tentative tax, less any nonrefundable credits. See instructions. Ja $

b If this apphcat1on 1s for Form 990-PF or 990-T, enter any refundable credits and estimated tax payments made. Include any prior year overpayment allowed as a credit. Jb $

c Balance Due. Subtract line 3b from line 3a. Include your payment with this form, or, 1f required, deposit

with FTD coupon or, 1f required, by using EFTPS (Electronic Federal Tax Payment System). See ~

instructions. Jc $ Caution. If you are going to make an electronic fund withdrawal with this Form 8868, see Form 8453-EO and Form 8879-EO for payment instructions.

NONE

NONE

NONE

For Privacy Act and Paperwork Reduction Act Notice, see Instructions. Fonn 8868 (Rev. 4-2008)

JSA SF 8054 2.000

14352G K932 08/13/2009 11:10:25 V08-7.3 85652

DAVID H. KOCH CHARITABLE FOUNDATION 48-0926946

FORM 990PF, PART I - DIVIDENDS AND INTEREST FROM SECURITIES

DESCRIPTION

GOLDMAN SACHS FUNDS

TOTAL

REVENUE AND

EXPENSES PER BOOKS

50,319.

50,319.

14352G K932 08/13/2009 11:10:25 V08-7.3 85652

NET INVESTMENT

INCOME

50,319.

50,319.

~

STATEMENT 1

DAVID H. KOCH CHARITABLE FOUNDATION

FORM 990PF, PART I - ACCOUNTING FEES

DESCRIPTION

ACCOUNTING

TOTALS

REVENUE AND

EXPENSES PER BOOKS

6,615.

6,615.

14352G K932 08/13/2009 11:10:25 V08-7.3 85652

48-0926946

NET INVESTMENT

INCOME

NONE

ADJUSTED NET

INCOME

NONE

CHARITABLE PURPOSES

5,490.

5, 4 90.

STATEMENT 2

,.,

DAVID H. KOCH CHARITABLE FOUNDATION

FORM 990PF, PART I - OTHER PROFESSIONAL FEES

DESCRIPTION

GRANT ADMINISTRATION FEES

TOTALS

REVENUE AND

EXPENSES PER BOOKS

2,010.

2,010.

14352G K932 08/13/2009 11:10:25 V08-7.3 85652

48-0926946

CHARITABLE PURPOSES

1,590.

1,590.

STATEMENT 3

"

• DAVID H. KOCH CHARITABLE FOUNDATION

FORM 990PF, PART I - TAXES ==----====================

DESCRIPTION

EXCISE TAX

TOTALS

REVENUE AND

EXPENSES PER BOOKS

503.

503.

14352G K932 08/13/2009 11:10:25 V08-7.3 85652

48-0926946

STATEMENT 4

DAVID H. KOCH CHARITABLE FOUNDATION

FORM 990PF, PART I - OTHER EXPENSES

DESCRIPTION

INSURANCE BANK FEES CORPORATION REGISTRATION FEES

TOTALS

REVENUE AND

EXPENSES PER BOOKS

1,028. 89. 89.

1,206.

14352G K932 08/13/2009 11:10:25 V08-7.3 85652

48-0926946

CHARITABLE PURPOSES

1,028. 89. 89.

1,206.

STATEMENT 5

DAVID H. KOCH CHARITABLE FOUNDATION

FORM 990PF, PART I - CONTRIBUTIONS, GIFTS, GRANTS PAID

RECIPIENT NAME AND ADDRESS

GRANTS PAID

AMERICANS FOR PROSPERITY FOUNDATION 1726 M STREET, NW WASHINGTON, DC 20036

CITY CENTER OF MUSIC & DRAMA, INC. 70 LINCOLN CENTER PLAZA NEW YORK, NY 10023

NEW YORK - PRESBYTERIAN HOSPITAL 525 EAST 68TH STREET B:JX 123 NEW YORK, NY 10021

PROSTATE CANCER FOUNDATION 1250 FOURTH STREET, SUITE 360 SANTA l()NICA, CA 90401

GRANTS ACCRUED

CITY CENTER OF MUSIC & DRAMA, INC. 70 LINCOLN CENTER PLAZA NEW YORK, NY 10023

RELATIONSHIP TO SUBSTANTIAL CONTRIBUTOR AND

FOUNDATION STATUS OF RECIPIENT

N/A PUBLIC

N/A PUBLIC

N/A PUBLIC

N/A PUBLIC

N/A PUBLIC

14352G K932 08/13/2009 11:10:25 V08-7.3 85652

48-0926946

•

PURPOSE OF GRANT OR CONTRIBUTION AMOUNT

GENERAL OPERATING SUPPORT 1,000,000.

RENOVATION OF NEW YORK STATE THEATER BUILDING 15,000,000.

PROSTATE CANCER RESEARCH 1,000,000.

JOINT PROSTATE CANCER RESEARCH PROJECT 1,650,000.

TOTAL CONTRIBUTIONS PAID 18,650,000.

RENOVATION OF NEW YORK STATE THEATER BUILDING 85,000,000.

STATEMENT 6

DAVID H. KOCH CHARITABLE FOUNDATION

FORM 990PF, PART I - CONTRIBUTIONS, GIFTS, GRANTS PAID

RECIPIENT NAME AND ADDRESS

RELATIONSHIP TO SUBSTANTIAL CONTRIBUTOR AND

FOUNDATION STATUS OF RECIPIENT

14352G K932 08/13/2009 11:10:25 V08-7.3 85652

48-0926946 a

•

PURPOSE OF GRANT OR CONTRIBUTION Al-OUNT

TOTAL APPROVED CONTRIBUTIONS ACCRUED 85,000,000.

TOTAL CONTRIBUTIONS PAID AND ACCRUED 103,650,000.

STATEMENT 7

DAVID H. KOCH CHARITABLE FOUNDATION 48-0926946

FORM 990PF, PART II - PREPAID EXPENSES AND DEFERRED CHARGES

DESCRIPTION

PREPAID EXPENSES

TOTALS

14352G K932 08/13/2009 11:10:25 V08-7.3 85652

ENDING BOOK VALUE

53.

53.

ENDING FMV

53.

53.

STATEMENT 8

..

IPART VII-A, Question 5

DAVID H. KOCH CHARITABLE FOUNDATION

EIN 48-0926946

ATTACHMENT TO 2008 FORM 990-PF

STATEMENT 91

During 2008, the David H. Koch Chantable Foundation distributed cash equal to approximately 480% of the fair market value of the foundation's assets as of December 31, 2007. The recipients receiving the distributions are all public charities, and are listed on Statement 11 of the attached Form 990-PF.

Although the Foundation paid out total distributions that meet the technical definition of a "substantial contraction" (more than 25% of the fair market value of assets at the beginning of the year), the Foundation is not in the process of terminating or liquidating. $15,000,000 in distributions made in 2008 were paid out of the current income received in December 2008. The remaining $3,658,286 in distributions were paid out of the income received in prior years, and was not distributed until February 2008.

As an additional indication of the continuing activity of the Foundation, the 2008 Form 990-PF reports 2008 pledges receivable in the amount of $85,000,000; and grants payable in the amount of $85,000,000.

DAVID H. KOCH CHARITABLE FOUNDATION 48-0926946 '\

FORM 990PF, PART VIII - LIST OF OFFICERS, DIRECTORS, AND TRUSTEES ----------------------------------------------------------------- ~

NAME AND ADDRESS

DAVID H. KOCH 667 MADISON AVE NEW YORK, NY 10021

RUTHE. WILLIAMS PO BOX 2256 WICHITA, KS 67201

VONDA HOLLIMAN PO BOX 2256 WICHITA, KS 67201

TITLE AND AVERAGE HOURS PER WEEK DEVOTED TO POSITION

PRESIDENT/DIRECTOR 1.

SECRETARY 1.

TREASURER 1.

GRAND TOTALS

14352G K932 08/13/2009 11:10:25 V08-7.3 85652

COMPENSATION

NONE

NONE

NONE

CONTRIBUTIONS EXPENSE ACCT TO EMPLOYEE BENEFIT PLANS

NONE

NONE

NONE

AND OTHER ALLOWANCES

NONE

NONE

NONE

-------------- ----------------------------NONE NONE NONE

-------------- -------------- --------------

STATEMENT 10

DAVID H. KOCH CHARITABLE FOUNDATION

FORM 990PF, PART '1:-J - GRANTS AND CONTRIBUTIONS PAID DURING THE YEAR

RECIPIENT NAME AND ADDRESS

AMERICANS FOR PFDSPERITY FOUNDATION 1726 M STREET, NW WASHINGTON, DC 20036

CITY CENTER OF MUSIC & DRAMA, INC. 70 LINCOLN CENTER PLAZA NEW YORK, NY 10023

NEW YORK - PRESBYTERIAN HOSPITAL 525 EAST 68TH STREET BJX 123 NEW YORK, NY 10021

PFDSTATE CANCER FOUNDATION 1250 FOURTH STREET, SUITE 360 SANTA MONICA, CA 90401

RELATIONSHIP TO SUBSTANTIAL CONTRIBUTOR AND

FOUNDATION STATUS OF RECIPIENT

N/A PUBLIC

N/A PUBLIC

N/A PUBLIC

N/A PUBLIC

14352G K932 08/13/2009 11:10:25 V08-7.3 85652

48-0926946 -1.

'

PURPOSE OF GRANT OR CONTRIBUTION AMOUNT

GENERAL OPERATING SUPPORT 1,000,000.

RENOVATION OF NEW YORK STATE THEATER BUILDING 15,000,000.

PFDSTATE CANCER RESEARCH 1,000,000.

JOINT PROSTATE CANCER RESEARCH PROJECT 1,650,000.

TOTAL CONTRIBUTIONS PAID 18,650,000.

STATEMENT 11

DAVID H. KOCH CHARITABLE FOUNDATION

FORM 990PF, PART~ - CONTRIBUTIONS APPROVED FOR FUTURE PAYMENT

RECIPIENT NAME AND ADDRESS

CITY CENTER OF MUSIC & DRAMA, INC. 70 LINCOLN CENTER PLAZA NEW YORK, NY 10023

RELATIONSHIP TO SUBSTANTIAL CONTRIBUTOR AND

FOUNDATION STATUS OF RECIPIENT

N/A PUBLIC

14352G K932 08/13/2009 11:10:25 V08-7.3 85652

48-0926946 .l

::

PURPOSE OF GRANT OR CONTRIBUTION AMOUNT

RENOVATION OF NEW YORK STATE THEATER BUILDING 85,000,000.

TOTAL CONTRIBUTIONS APPROVED 85,000,000.

STATEMENT 12

![TENTH JUDICIAL DISTRICT CIVIL DEPARTMENT CHARLES G. KOCH and ) DAVID H. KOCH ... · 2012-03-01 · Koch, David Koch, and Edward Crane] to be exercised by them in the same proportions](https://static.fdocuments.in/doc/165x107/5e9c6e5451a75529cc77beaf/tenth-judicial-district-civil-department-charles-g-koch-and-david-h-koch-.jpg)