Davao del Sur

Transcript of Davao del Sur

i

PROVINCE OF DAVAO DEL SUR

PROVINCIAL COMMODITY INVESTMENT PLAN (PCIP)

Davao del Sur CY 2014-2020

i

TABLE OF CONTENTS

Title Page

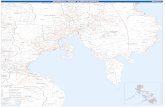

Message 1 Foreword 2 Executive Summary 3 Introduction 5 Chapter I – Development Background 6 Chapter II – Development Vision and Framework of the Province 7 Chapter III – Priority Commodity Chains Development 13 I-A. Commodity Profile: Cacao 13 I-B. Investment Plan 18 II-A. Commodity Profile: Banana (Cardaba/Saba) 20 II-B. Investment Plan 25 III-A. Commodity Profile: Rubber 26 III-B. Investment Plan 31 IV-A. Commodity Profile: Abaca 32 IV-B. Investment Plan 39 V-A. Commodity Profile: Cassava 41 V-B. Investment Plan 46 VI-A. Commodity Profile: Seaweeds 47 VI-B. Investment Plan 50 Chapter IV – Institutional Arrangements for PRDP-Funding 52 Map of Davao del Sur showing newly created Davao Occidental 53

ii

LIST OF TABLES

Title (Table) Page

1 Land Area planted with Cacao, Region XI, CY 2013 14 2 EVSA Result for Cacao, Davao del Sur 15 3 EVSA Result for Cacao, Davao Occidental 16 4 Municipal / City Data for Cacao, Davao del Sur and Davao Occidental, CY 2013 17 4a Existing Processors, Nurseries, Facilities and Business Enterprises for Cacao, Davao del Sur and Davao Occidental, CY 2013 17 5 RP Cardaba Banana Production Volume, 2013 20 6 Banana Production Volume, Davao Region, 2013 20 7 Municipal / City Data for Banana (Cardaba/Saba) Davao del Sur and Davao Occidental, CY 2013 21 7a Existing Processors, Nurseries, Facilities and Business Enterprises for Banana 21 8 EVSA Result for Cardaba, Davao del Sur 23 9 EVSA Result for Cardaba, Davao Occidental 24 10 Key Products Produced and Traded in Mindanao Regions 26 11 Cup Lump Production: Mindanao Producing Regions, 2013 27 12 Cup Lump Production Volume and Area Planted with Rubber Davao Region, 2013 27 13 Rubber Production Volume, Davao Region, 2013 27 14 Municipal / City Data for Rubber, Davao del Sur and Davao Occidental, CY 2013 28 14a Existing Facilities, Nurseries, Facilities and Business Enterprises for Rubber, Davao del Sur and Davao Occidental, CY 2013 28 15 EVSA Result for Rubber, Davao del Sur 29 16 EVSA Result for Rubber, Davao Occidental 30 17 Mindanao’s Percentage Share to RP Production 32 18 Production Volume, Davao Region, 2013 33

iii

LIST OF TABLES

Title (Table) Page

19 EVSA Result for Abaca, Davao del Sur 34 20 EVSA Result for Abaca, Davao Occidental 35 21 Municipal / City Data for Abaca, Davao del Sur and Davao Occidental, CY 2013 36 21a Existing Processors, Nurseries, Facilities and Business Enterprises for Abaca, Davao del Sur and Davao Occidental, CY 2013 37 21b Provincial / Municipal / City Data for Abaca 38 22 Cassaba Producing Regions 41 23 Cassava Production Volume, Davao Region, 2013 41 24 Municipal / City Data for Cassava, Davao del Sur and Davao Occidental, CY 2013 42 24a Existing Processors, Nurseries, Facilities and Business Enterprises for Cassava, Davao del Sur and Davao Occidental, CY 2013 42 24b Provincial / Municipal / City Data for Cassava 43 25 EVSA Result for Cassava, Davao del Sur 44 26 EVSA Result for Cassava, Davao Occidental 45 27 Seaweeds Production in Mindanao, 2013 47 28 Fresh Seaweeds Production Volume in Davao Region, 2013 47 29 Municipal / City Data for Seaweeds, Davao del Sur and Davao Occidental, CY 2013 48 29a Existing Associations, Facilities, Traders in Seaweeds, Davao del Sur, CY 2013 48 30 EVSA Result for Seaweeds, Davao del Sur 49

iv

LIST OF FIGURES

Title (Figure) Page

1 Soil / Land Suitability Map 9

2 Land Cover Map, Davao del Sur 10

3 Hazard Maps 11

4 Philippines and Region XI Situation 13

5 Regional Contribution to National Production Average, 2008-2012 14

6 Davao del Sur’s Cacao Production Profile in Region XI 14

7 Expanded Vulnerability and Suitability Analysis Map for Cacao, Davao del Sur 15

8 Expanded Vulnerability and Suitability Analysis Map for Cacao, Davao Occidental 16

9 Expanded Vulnerability and Suitability Analysis Map for Cardaba, Davao del Sur 23

10 Expanded Vulnerability and Suitability Analysis Map for Cardaba, Davao Occidental 24

11 Expanded Vulnerability and Suitability Analysis Map for Rubber, Davao del Sur 29

12 Expanded Vulnerability and Suitability Analysis Map for Rubber, Davao Occidental 30

13 Percentage Share of Philippines to Global Production, 2012 32

14 Expanded Vulnerability and Suitability Analysis Map for Abaca, Davao del Sur 34

15 Expanded Vulnerability and Suitability Analysis Map for Abaca Davao Occidental 35

16 Expanded Vulnerability and Suitability Analysis Map for Cassava, Davao del Sur 44

17 Expanded Vulnerability and Suitability Analysis Map for Cassava, Davao Occidental 45 18 Expanded Vulnerability and Suitability Analysis Map for Seaweeds, Davao del Sur 49

v

LIST OF ANNEXES

Title (Annex)

Annex 1 - Consolidated Value Chain Matrix – CACAO

Annex 2 - Consolidated Value Chain Matrix – BANANA (CARDABA/SABA)

Annex 3 - Consolidated Value Chain Matrix – RUBBER

Annex 4 - Consolidated Value Chain Matrix – ABACA

Annex 5 - Consolidated Value Chain Matrix – CASSAVA

Annex 6 - Consolidated Value Chain Matrix – SEAWEEDS

PDC EXECOM RESOLUTION NO. 1 – SERIES OF 2015

1

Republic of the Philippines PROVINCE OF DAVAO DEL SUR

Matti, Digos City

PROVINCIAL GOVERNOR’S OFFICE

MESSAGE

The Provincial Commodity Investment Plan (PCIP) is a requirement for the Provincial

Government to avail the Philippine Rural Development Program (PRDP).

Now that this plan has come out, we can now attain the programs and projects that

would help developed our agri-fishery sector.

I do hope that what is contained in the PCIP would be materialized.

My profound gratitude to those who have contributed in conceiving this workable

commodity investment plan.

CLAUDE P. BAUTISTA Governor

2

FOREWORD

The 2014 – 2020 Provincial Commodity Investment Plan (PCIP) contains the programs

and projects proposed for funding through the Philippine Rural Development Project (PRDP).

The coming up of this plan followed a tedious and repetitious process from value chain

analysis of the different key players of the seven (7) priority crops of Region XI, to identification

of the programs and projects by the local government units.

The plan shall serve as the Provincial Government’s direction and guide in proposing

programs and projects not only for PRDP funding but also for other funding agencies.

It is the desire of the Provincial Leadership the realization of this plan as this would

respond to the needs of the constituents of Davao del Sur.

I – PLAN Team PPMIU

3

EXECUTIVE SUMMARY

The Provincial Commodity Investment Plan (PCIP) reflects the programs and projects

that would enhance the development of the priority commodity crops of Region XI.

As presented in the PCIP, the projects are specifically lined-up in the Intervention Matrix

per crop which are identified by the Municipal Planning and Development Coordinators,

Municipal Engineers and Municipal Agriculturists. Assisting the consultation workshops are the

Provincial Planning and Development Office (PPDO), Office of the Provincial Agriculturist

(OPAg). Provincial Engineer’s Office (PEO), Provincial Environment and Natural Resources

Office (PENRO) and the Philippine Fiber and Development Authority (PhilFIDA).

The seven (7) priority commodities which undergo Value Chain Analysis are the

following:

1. Cacao

2. Banana (Cardaba/Saba)

3. Abaca

4. Rubber

5. Cassava

6. Seaweed

7. Palm Oil

In the identification of programs and projects per crop, some LGUs opted to choose

either two (2) or the six (6) crops based on the area planted and considering that most of the

crops are planted intercropped with other major agriculture crops like coconuts, rubber and

others. For Palm Oil, the province is not included in the priority list for this commodity

considering that there was no report on data for areas planted with palm oil.

The six (6) commodities are also prioritized in this order, to wit:

1. Cacao comes first considering that this is the priority crop in Davao Region.

2. Banana ranks second as this could be intercropped with cacao and the province

being the lead in this industry in Davao Region.

3. Rubber

4. Abaca

5. Cassava

6. Seaweeds

Most of the programs and projects listed in the Intervention Matrix considered the

following priority concerns, to wit:

1. Establishment of nurseries to ensure good quality and disease-free planting

materials/seedlings.

2. Upgrading of farm-to-market roads in the key commodity producing areas.

4

3. Improve farmer’s access to skills and resources that would enable them to adopt

good agronomic practices.

4. Establishment of tissue-cultured laboratories for abaca and banana.

5. Provision of post-harvest facilities and common service facilities for chipping,

granulation, drying and others.

6. Strengthen local supply chains of organic fertilizer.

7. Provision of other infra-support facilities like fish ports, warehouse and others.

8. Establishment of demo farms to showcase benefits of the different priority crops.

9. Establishment of a pool of skilled farmers, and other key players.

10. Upgrading of value chain products of the priority commodities that can sustain

market demands both local and foreign markets.

Prioritization of the projects shall be based on the results of the Expanded Vulnerability

and Suitability Analysis (E-VSA) as to the top three (3) producing municipalities per province.

The presentation by province shall facilitate the implementation of the projects in Davao

Occidental in 2016, which is year 2 of the PRDP project. The Department of Agriculture has

already included Davao Occidental as one of the PRDP-covered provinces. But in this PCIP, it

is still included and presentation is by province: Davao del Sur and Davao Occidental.

5

INTRODUCTION

The funding support provided by the World Bank in the implementation of the Mindanao

Rural Development Program (MRDP) has supported the Local Government Units vision to boost

economic development. The program not only developed the capacities of the project

implementors through its Focal Persons/Project Coordinators, it also resulted to the

enhancement of the management skills of project beneficiaries as they are to sustain the

project. Success of MRDP are always shown on the existence and expansion of the different

projects especially on the livelihood component. It has provided additional means of income to

the project beneficiaries. While for the infrastructure components, it increased access to good

roads, potable water supply and better post harvest facilities. All these services makes MRDP a

successful program.

The replication of MRDP as PRDP or the Philippine Rural Development Project

extending the program to a national scope covering all provinces of the Philippines would be the

best strategy of the national government’s platform for agriculture. PRDP will be implemented

with the following four (4) program components, to wit:

A.) I-PLAN or Investment in Agriculture and Fishery Modernization Planning (AFMP) at

the Local and National Level;

B.) I-BUILD or Intensified Building Up of Infrastructure and Logistics for Development;

C.) I-REAP or Investment in Rural Enterprise and Agriculture and Fishery Development;

and

D.) I-SUPPORT or the Implementation support of the program.

The process of planning for PRDP is anchored on the I-PLAN component who shall

complement the National and Regional Agriculture and Fishery Modernization Plans (AFMPs)

with the Provincial Community Investment Plans (PCIPs). The PCIP shall be the principal basis

for all interventions of the I-REAP and I-BUILD components that are proposed for DA-MRDP

funding. In the formulation of the PCIP, the following shall serve as its guiding principles, to wit:

a.) The AFMP as basis for prioritizing public agriculture and fishery investments;

b.) DA-LGU partnership in the formulation of the plan to ensure smooth implementation

of all agriculture and fishery projects;

c.) Use of science based tools for resilient and sustainable agriculture and fisheries

sectors;

d.) Value chain development context for sub-project designs;

e.) Geo-tagging as an important tool in plan formulation and monitoring and evaluation

phases;

f.) Integrated service delivery through synergistic partnership; and

g.) Natural Resource Management in globally significant biodiversity areas, seascapes

and landscapes and priority degraded coastal areas.

The interplay of the PRDP components in the national and regional levels of the

Department of Agriculture shall also be adopted in the provincial level through the Provincial

Project Management Implementing Unit (PPMIU). Such scheme of implementation shall prove

the success of the program, like MRDP.

6

Chapter I

DEVELOPMENT BACKGROUND

The Provincial Development and Physical Framework Plan (PDPFP) 2007-2013 is a six-

year medium term development plan intended to coincide with the two (2) three year political

terms of the Governor and the full term of the national leadership. The planning environment of

the PDPFP includes all major sectors relevant to the development of the province which are

grouped to correspond to the five (5) core elements: population, economic activity, physical

resources, income/ access to services and land use. Analysis of the planning environment

showed four (4) major development concerns with its corresponding general development

goals, to wit:

Concerns Goals

1. High poverty incidence To reduce poverty incidence

2. Forest degradation To conserve and rehabilitate the forest lands and natural resources

3. Inadequacy of access to basic services

To improve access to basic social services and infrastructure facilities and utilities

4. Inadequacy of basic infrastructure facilities and utilities

To enhance access and mobility for economic productivity, food security and commodity trade

The plan period of the PDPFP has ended in 2013. The creation of Davao Occidental

from Davao del Sur has held in abeyance its updating until 2016 Local Election when Davao

Occidental will officially function as a province. At present, Davao del Sur’s thrusts were also

redirected with the assumption of the new leadership in June 30, 2013. The issues and

concerns become a challenge to identify programs and projects which would respond to the

magnitude of the existing socio-economic situation of poverty and inadequacy.

Davao del Sur is an agricultural province bestowed with rich resources and one of the

Region XI’s top contributors as exporter of some agricultural products. Its major products

include rice, corn, coconut, cacao, banana (cardaba and cavendish), mango and a variety of

fruits and root crops substantially contribute to the income of the agriculture sector. About 68%

of the area of the province is devoted to agricultural production. Despite all efforts and funding

support collectively and collaboratively participated both by private and public entities, still the

desire to make the agriculture sector prosper was not yet fully realized especially among the

small farmers in the province. Their gainful participation are focussed on improving their

capabilities to increase productivity; access more lucrative markets; and obtain shares in

marketing and processing activities.

For the agribusiness/enterprise industry, this is usually a group endeavour either by a

cooperative or by People’s Organizations (POs). Usually, their products are sold only in the

local markets. Assisting them in the processing, financing and marketing as well as

improvement of the quality of their products are the Department of Trade and Industry (DTI),

Department of Labor and Employment (DOLE), Department of Science and Technology (DOST)

and the Local Government Units (LGUs). However, it is always observed that still they could not

qualify nor meet global demand/market. Thus, the need for them to enhance their skills and

capabilities as well as provide with adequate capital to be able to compete with the global

market.

7

Chapter II

DEVELOPMENT VISION AND FRAMEWORK OF THE PROVINCE

In the PDPFP 2007-2013, the following is its vision and mission, to wit:

VISION:

“An agri-industrialized, commercial and eco-tourism province that is socially and

economically progressive in the fields of agriculture, fishery, forestry and tourism

with a well-developed land and sea transport network; home to healthy, God-

loving empowered people rich in cultural heritage and strong commitment to the

principles of social justice, democracy and good governance, all within the

framework of sustainable development.”

MISSION:

For all stakeholders “to vigorously pursue for the social and economic upliftment

of the standard of living of its constituents through effective collaboration with all

stakeholders and sectors towards the attainment of the vision.”

Development concerns of the Provincial Government under the new leadership is

anchored on the 8 - POINT AGENDA known as DAVAO SUR (Development-Oriented

Governance, Agricultural Competitiveness, Village Empowerment, Adequate

Infrastructure, Outstanding Education, Subsidized Health Care, Upliftment of Culture

through Tourism and Rural Industrialization). Under the Agricultural Sector; Programs

and Projects are focused and redirected on the following vision, mission and other

indicators to wit:

Vision:

“An economically viable and competitive province driven by Strong Public-Private

Partnership (PPP) and corporate-oriented governance for all its constituents”

Mission:

“Reduction of Poverty by ensuring food security creating sufficient and fair job

opportunities and adopting technologies mindful of the protection of the

environment and mitigating the effects of climate change”

Objectives

General:

To boost the economy of the province from a vantage point of its

strengths:

a. The intensification of agriculture and aquatic resources

b. Pursuit of rural agri-industrialization

c. Creation of livelihood opportunities and fair employment by forging

strong and meaningful PPP agreements

d. Convergence mechanisms to execute and realize the overall

mission

Specific:

1. Improve food security and reduce, if not totally curtail, poverty incidence in the countryside;

2. Increase the income of marginalized farmers and fisher folks;

8

3. Intensify and diversify food production in suitable areas and encourage expansion of commercial and high value crops production that have potential in domestic as well as international markets;

4. Strengthen efforts on agri-industrialization to level-up agriculture

and marine products to International Standard Organization (ISO) standards and globally competitive rank;

5. Forge sustainable Public Private Partnership (PPP) projects with

local and foreign investors on product development;

6. Continuously enhance the capacity and capabilities of the farmers and fisherfolks to sustain their chosen livelihoods;

7. Enhance value formation among the people for them to develop a

sense of responsibility to the efforts being made by their chosen leaders to alleviate their plight;

8. Provide coping mechanisms and promote self-reliance to enhance

the resilience of the farmers, fisherfolks and Small and Medium Enterprises (SMEs) to the possible risks and damages that might be brought by climate change and other unforeseen events, and

9. Augment and strictly implement policies related to sustainable

agriculture, environment thru responsive corporate governance.

Strategies: 1. Capability enhancement of stakeholders in the agriculture

production 2. Provision of infrastructure and support facilities

3. Provision of production and post harvest facilities

4. Intensity/enhance access to credit and marketing facilities

5. Intensity/ investment promotions

6. Strengthen trading agreement with local supermarkets and foreign

buyers

7. Establish strong PPP arrangements in boosting and modernizing the agriculture and fishery sectors.

Potentials:

Davao del Sur’s topography has contributed much to agricultural production. Of

its total land area, about 65% is rolling and mountainous with ranges running southward. It has wide fertile valleys which are found between the mountain ranges and lowland areas. It has also narrow coastal plains rich with marine resources as the province has ten (10) coastal municipalities namely, Sta. Cruz, Digos City, Hagonoy, Padada, Sulop, Malalag, Sta. Maria, Malita, Don Marcelino, Jose Abad Santos and one (1) island municipality, Sarangani. The presence of Mount Apo, known as the highest and longest mountain range of the country also contributed to the richness of the soils of Bansalan, Digos City and Sta. Cruz that gives bountiful harvest of fruits, vegetables and other crops. More so, the province is predominantly lowland as about 40% of its total land area falls within 0 – 200 meters elevation. Other are scattered within 200 meters-1500 meters elevation. Crop productions in these areas are varied based on its suitability in elevation.

9

Figure 1. Soil / Land Suitability Map

10

The province’s land resources are basically suitable for agricultural production. Its existing major crops include coconut, mango, banana, rice, corn, sugarcane, vegetables, rubber, coffee and abaca. The existing land use for agricultural production would show that the province still has great potential areas for expansion, intensification and diversification for food production. Figure 2. Land Cover Map, Davao del Sur

11

There are minimal risks to the economic activities of the province. Most of these are natural-made calamities. However, man-made calamities brought about by climate change is unavoidable. Figure 3. Hazard Map

12

The Philippine Rural Development Project (PRDP) through the implementation of

the interventions that will be outlined in the Provincial Commodity Investment Plan

(PCIP) will be a great contribution to the achievement of the goals that address to the

issues and constraints confronting the agriculture sector. Vice-versa, it will also help

realize PRDP’s goal of increasing farm production and income of the farmers.

13

Chapter III

PRIORITY COMMODITY CHAINS DEVELOPMENT

I - A.) COMMODITY PROFILE: CACAO

Cacao is an important crop around the world: a cash crop for growing countries

and a key input for processing and consuming countries. Philippines grows cacao as

well as produces and consumes chocolate-based products. Cocoa travels along a global

supply chain and its demand in the global market are high. However, cacao producing

countries are unable to meet the growing demand for cocoa products worldwide. The

Philippines itself is a net importer of cocoa products, and the value chain study for cacao

showed that the trade deficit is increasing at about 15% per annum. The National Cacao

Industry Plan of the Department of Trade and Industry suggests that for the country to

belong to the group leading in the production of cacao, it has to produce 100,000 metric

tons of dried beans by 2020. By that year, the worldwide demand for cacao would reach

up to 5 million metric tons or an increase of area planted to cacao by 15,000 hectares to

17,000 hectares.

Figure 4. Philippines and Region XI Situation

* The country is a net importer of cacao with a strong domestic demand.

* Philippine merchandise exports and imports of cacao (in US Million Dollars)

The top five (5) confectionery companies that dominate the cocoa and chocolate

supply chain in the country are the following:

1. Mars Inc. of USA;

2. Modele’z International Inc. of USA;

3. Barcel SA, Division of Group Bimbo of Mexico;

4. Nestle SA of Switzerland; and

5. Meiji Co. LTD of Japan

Mars Incorporated through its agent the Kennemer Foods, Inc. is also an active

player of the cacao producing municipalities of Davao del Sur.

The entry of the above-cited large volume buyers of cocoa bean provides the

platform for market-driven upgrading of the cocoa sub-sector.

3.54 3.57 3.24 5.24 5.4

39.8446.03

55.49

88.37

102.67

0

20

40

60

80

100

120

2007 2008 2009 2010 2011

Imports

Exports

14

Eastern Visayas2%

Northern Mindanao

9%

Davao Region72%

Zamboanga Peninsula

3%

ARMM2%

Others12%

Eastern Visayas

NorthernMindanao

Davao Region

ZamboangaPeninsula

ARMM

Others

In the commodity prioritization study conducted by the Department of Agriculture XI,

cacao ranked first considering that Davao Region was identified as the number one (1)

cacao producing region based on area planted and production. The four (4) provinces

and one (1) city of Davao Region also showed as the top first five of the top 10 Cacao

producing provinces in Mindanao, contributing 72%.

Figure 5: Regional Contribution to National Production Average 2008-2012

In Davao Region,

Davao del Sur had the

largest area planted but this

has shrunked to a negligible

level due to low prices and

high cost of production that

entice farmers to switch to

other high value crops where

they could expect to get

better returns/income. Davao

City ranks second with

Davao Oriental having the

lowest area planted with

cacao.

Figure 6: Davao del Sur’s Cacao Production Profile in

Region XI

Table 1: Land Area planted with Cacao

Region XI, CY 2013

Province Area Planted (in hectares)

Davao del Norte 1,045

Davao del Sur 1,355

Davao Oriental 892

Compostela Valley 549

Davao City 1,352 Source: BAS

For the whole province of Davao del Sur, Sta. Maria has the largest area planted with

cacao, followed by Magsaysay and Malita. But in the Expanded Vulnerability and Suitability

Analysis (E-VSA), the presentation is already divided into two (2) province: Davao del Sur and

Davao Occidental with the considerations that the latter will officially take off as a province in the

midst of the PRDP implementation. For Davao del Sur, the top three (3) cacao producing

municipalities are Magsaysay, Bansalan and Sta. Cruz, while for Davao Occidental, Sta. Maria

still leads with Malita and Don Marcelino as the top three (3) cacao producing municipalities.

As for suitability analysis, in Davao del Sur, Kiblawan ranks first. Although its area devoted to cacao is only 38 hectares, followed by Magsaysay and Sulop. While for Davao Occidental, Sta. Maria, Malita and

Davao City 4,441.25

Davao del Norte

4,372.48

Davao Oriental 670.24

COMVAL 1,839.20

Davao del Sur 1,829.56

15

Sarangani are the three (3) ranking municipalities suited for cacao production.

Figure 7.

16

Figure 8.

17

Table 4. Municipal/City Data for Cacao, Davao del Sur and Davao Occidental, CY 2013

Province/

Municipality/ City/Province

Area

Planted

Production

Volume (Metric Tons)

No. of

Farmers

No. of Farmer Groups

% No.

of Farmers that are member of Farmer

groups

Area

Expansion

No. of

Processors

Davao del Sur

Bansalan 103 10.90 313 25 288 92% 126 2

Digos City 15 - 50 - - - 515 -

Hagonoy 1 - 2 - - - - -

Kiblawan 38 29.00 75 - - - 750 -

Magsaysay 199 122.56 544 22 400 73.5% 650 -

Malalag 25 12.60 175 - - - 100 -

Matanao 12 - 20 - - - 500 -

Padada 7 - 30 - - - 85 -

Sta. Cruz 61 17.64 429 - - - 205 1

Sulop - 0.90 9 72 - - 53 -

Davao Occidental

Don Marcelino

46 - 120 - - - 20 -

Jose Abad Santos

- - 25 - - - 50 -

Malita 173 172.75 264 3 100 37.9% 1,320 -

Sarangani 1 - 1 - - - 1,200 -

Sta. Maria 545 514.80 416 5 300 72.1% 655 2

Total: 1,226 881.15 2,473 127 1,088 275.5% 6,229 5 Source: MAO/OPAG

Table 4a: Existing Processors, Nurseries, Facilities and Business Enterprises for Cacao

Davao del Sur and Davao Occidental, CY 2013

Province Municipality

/ City

Processors Existing Plant Nursery/ Location Facilities

Business Enterprise/ Name of Traders No. Location

Davao del Sur

Bansalan 2

ND Foods, Pob. Bansalan

Pob. 1&2, Sitio Banikanhon Tablea Processing Facilities

Digos City OPAg cmpd, Digos

Hagonoy

Magsaysay San Isidro, Magsaysay

Matanao MAO office, Matanao

Padada 1 MAO office, Padada

Sta. Cruz

Zone II, Sta. Cruz Zone II – 2 units all weather cacao drier

Kiblawan Poblacion, Kiblawan

Sulop Poblacion, Sulop

Don Marcelino

MAO office, Don Marcelino

Malalag MAO office, Malalag

Davao Occidental

Jose Abad Santos

MAO office, JAS

Malita

-Ticulon & Near Mun. Gym, Malita MARWABEMPCO-fermentation boxes, cacao solar boxes

Buy & sell of fresh cacao beans

-Kilalag Upland Farmers Ass’n (KUFA)

-Mr. Lumain, Kidalapong, Lacaron & Pangian

-Silangan Farmers Ass’n. (SFA) -Alex Camahalan, Felis, Malita

-Romeo Casanjuan -Boy Pardo, Lacaron, Malita

-Alex Camajalan -MARWABEMPCO

-Gilberto Amarillo -Saturnino C. Parcasio Jr.

-Richard Magalig

Saranggani -MAO office, Saranggani

Sta. Maria 2 UNICARBAI

Back of Mun. Hall, Sta. Maria UNICARBAI MPC – 1 unit cacao shredder

Buy & sell fresh cacao beans

Tablea Processing 24 units fermentation boxes Tie-up with KENNIMER

Basiawan, Sta. Maria

1 unit cacao solar dryer Food International, D/C

SDMC-1 unit cacao shredder

Tablea processing facility

PKEARBAI MPC, tablea processing, Basiawan

Total

18

I - B.) INVESTMENT PLAN:

Cacao production in Davao del Sur’s decreasing trends is still the recent

situation of the industry. The main cause for this decrease is the low price and

the high cost of production which resulted to a chain most farmers adopt i.e. to

convert cacao areas to other high value crops. Old cacao trees were also cut and

converted to other crops.

However, with the entry of large confectionary companies in the province,

farmers are starting to plant cacao as intercrop to coconut, banana and others.

Most of the 68% agriculture land of the province is suitable to cacao considering

the environmental conditions and the richness of the land resources. It has about

6,229 targeted for expansion.

The Value Chain Analysis and Competitiveness Strategy Studies conducted by DA XI showed that the main areas of convergence of interest among the cocoa value chain players and focal objectives to be achieved in order to foster competitiveness and sustainability are the following:

1. Improved access to and availability of affordable and good quality

planting materials.

2. Improved access to and availability of fertilizers and inputs appropriate for cacao smallholders.

3. Increased areas planted to cacao

4. Improved flow and quality of extension services for cacao farming and adoption of good practices.

5. Increased capacity and improve ability to produce cocoa beans of consistent quality as per market standards.

6. Improved cooperation and organizational capacity of farmers.

7. Improved physical linkages to inputs and support markets.

8. Improved/Rehabilitated farm-to-market roads in key cacao production

areas.

The achievement of the above-cited objectives requires a collaborative

undertaking among all players and stakeholders in the cocoa bean industry in

Davao del Sur. Value chain development shall be focussed on helping these

players link with and competes in the global markets. This would also link the

smallholders to more viable economic opportunities and increase their benefits

from market participation.

The interventions identified by the different Local Government Units

(LGUs) of the province are expected to assist the cacao players and

stakeholders to access to a wider range of services and inputs.

The proposed programs and projects are expected to eliminate or lessen

the constraints in the value chain development from provision of technical skills

and services to accredited nurseries as sources of good planting materials

capacitation of farmers and other stakeholders through trainings, establishment

of organic inputs production facilities; provision of infra support facilities and post

harvest facilities and establishment of demo farms.

19

The collaborative efforts of all stakeholders of cacao industry which is

supported by all local government units will surely boost Davao del Sur’s cocoa

bean industry.

I - C.) CONSOLIDATED VALUE CHAIN MATRIX: CACAO (refer to Annex 1)

20

II - A.) COMMODITY PROFILE: BANANA (Cardaba/Saba)

Banana is a crop that can substitute rice as main staple food. There

are numerous cultivars under our cooking bananas such as cardaba, abutan,

inabaniko, sabang, puti, mundo, gubno, saba sa hapon and bigihan.

However, the most common cultivar with both social and economic

importance is the cardaba or saba. Its flesh is white, starchy and fine

textured, which make it ideal for cooking and processing.

Banana Cardaba is grown in backyards of rural households and in

small farms as it grows in nearly all kinds of soil although there are other

considerations needed like deepness, drainage, aeration and others. It is also

less labor-intensive than many other crops. Among its by-products are

banana chips, banana snack food, deserts, flour and other value adding

products of banana.

Banana is the 8th most important food crop in the world and the 4th

most important in the least developed countries. It is produced in 135

countries and territories. Majority of its producers are small holder farmers

who grow the crop either for home consumption or for local markets.

The Philippines is the only producer of cardaba banana. Other

countries have their own local cooking banana varieties. In 2013, Philippine

cardaba banana production was 2,556.986.05 MT with Mindanao’s share to

national production placed at 60%.

Table 5. RP Cardaba Banana Production Volume, 2013

Source: BAS

In Mindanao, the top 3 producing provinces in 2013 are North

Cotabato, Davao del Sur and Lanao del Norte. Davao del Sur caters to

banana chips exporters while North Cotabato and Lanao del Norte penetrate

the fresh retail markets. Davao Region has the largest area planted to

cardaba banana among the other banana producing provinces in Mindanao.

In Davao Region, Davao del Sur has the biggest production volume,

followed by Compostela Valley, Davao Oriental, Davao del Norte and Davao

City.

Table 6: Banana Production Volume, Davao Region, 2013

Province

Production Volume (in MT)

Davao del Norte 47,720.46

Davao del Sur 271,165.41

Davao Oriental 72,826.01

Compostela Valley 74,201.17

Davao City 21,520.08

Total 487,433.13

Source: BAS

Island Production Volume (in MT)

% Share to RP Production

Luzon 535,180.73 21%

Visayas 496,472.67 19%

Mindanao 1,525,332.65 60%

Total 2,556,986.05

21

In Davao del Sur, the top 3 producing municipalities in 2013 are

Magsaysay, Malita and Malalag. Its total area planted with banana is 7,787

hectares with 57,915.82 MT production volume. It has potential area of 3,605

hectares as targetted by the different agriculture offices in the province.

Table 7. Municipal/City Data for Banana (Cardaba/Saba), Davao del Sur and Davao

Occidental, CY 2013

Provincial/

Municipality/ City

Area

Planted (Has.)

Production

Volume (Metric Tons)

No. of

Farmers

No. of Farmer Groups

% No.

of Farmers that are member of Farmer

groups

Area

Expansion

No. of

Processors

Davao del Sur

Bansalan 296 3557.30 647 25 574 88.7% 100 -

Digos City 300 2998.00 318 2 130 40.9% 305 1

Hagonoy 76 446.69 133 1 25 19% 55 -

Magsaysay 1499 7998.69 2812 22 1968 70% 300 -

Matanao 612 5542.52 1555 2 60 4% 500 -

Padada 245 1173.60 250 1 31 12% 50 1

Sta. Cruz 547 1982.40 672 3 90 13% 430 2

Kiblawan 535 3780.36 563 1 35 6% 75 1

Malalag 711 4977.00 2306 - - - 535 -

Sulop 652 2434.76 1067 1 40 4% 25 -

Davao Occidental

Don Marcelino

235 2200.00 691 1 60 13% 44 -

Jose Abad Santos

190 396.70 214 1 30 14% 31 -

Malita 1270 15240.00 1324 20 600 45% 1055 -

Sarangani 177 353.00 458 - - - 50 -

Sta. Maria 442 4844.80 552 1 30 5% 50 3

Total: 7787 57,915.82 13,562 81 3,673 334.6% 3, 605 8 Source: MAO/OPAG

Table 7a. Existing Processors, Nurseries, Facilities and Business Enterprises for Banana

(Cardaba)

Province Municipality /

City

Processors Existing Plant Nursery/ Location

Facilities Business Enterprise / Name

of Buyer / Trader No. Location

DA

VA

O D

EL S

UR

Bansalan 1

Lao Integrated Farm, Eman, Bansalan

Pob. 1 & 2 (Sitio Banikanhon)

Digos City 1

Double “S” Banana Chips, Tres de Mayo, Digos

OPAg compound, Digos Mini Banana Chipper & Banana processing facilities

Hagonoy 1

Banana chips, Lanuro, Hagonoy (BFT)

Magsaysay San Isidro, Magsaysay

Matanao MAO Office, Matanao

Padada 1

KF Nutri Foods, Lower Limonzo, Padada

MAO Office, Padada Banana Chipper & Banana processing facilities

Sta. Cruz

3

Prime Banana Plant, Zone IV, Sta. Cruz GSL Enterprise, Zone IV, Sta. Cruz Ninestar Banana Chips Processing, Coronon

Zone 2, Sta. Cruz

Banana Processing Plant Banana Processing Plant Banana Processing Plant

Buy & Sell Fresh Banana Loreta Huerbana & Albert Panilla

Kiblawan 1 PAFBUF MPC, Passig, Kiblawan Poblacion, Kiblawan

Banana Chipping Machine, Stainless blade, Chimney

Sulop Poblacion, Sulop

Malalag 1 Banana Chips, Malalag RIC MAO Office, Malalag Banana Processing Facilities

DA

VA

O

OC

CID

EN

TA

L

Don Marcelino MAO Office, Don Mar

Jose Abad Santos

MAO Office, JAS

Malita

1 Banana Chips, Malita RIC

Ticulon, Malita Banana Processing Facilities Buy & Sell Fresh Banana -Arcelo Balasila, Esther Florentino -MARWABEMCO

Saranggani MAO Office, Saranggani

Sta. Maria Back of Mun. Hall, Sta. Maria

Total 10

22

In the E-VSA result, presentation of data is divided into two (2) provinces.

For Davao del Sur, Magsaysay, Malalag and Matanao are the top three (3)

banana cardaba producing municipalities and for Davao Occidental, Malita,

Sta. Maria and Jose Abad Santos. As to suitability analysis, Magsaysay,

Kiblawan and Malalag are the top three (3) municipalities suitable for banana

cardaba. While for Davao Occidental, Malita, Sta. Maria and Saranggani.

23

Figure 9. EXPANDED VULNERABILITY & SUITABILITY ANALYSIS MAP

for CARDABA

24

Figure 10. EXPANDED VULNERABILITY & SUITABILITY ANALYSIS MAP

for CARDABA

25

II - B.) INVESTMENT PLAN:

The Focus Group Discussion (FGD) conducted by DA XI showed that

transactions within the various marketing channels of cardaba banana occur

through negotiations between the farmers and the buyers and payment is

usually done through cash. It is on this direction that interventions to support

the banana industry should be considered by all stakeholders.

Prioritization and ranking of intervention strategies was set by the

stakeholders as guide in the identification of programs and projects in the

following order of priority, to wit:

1. Improve farmers access to skills and resources that could enable

them to adopt good agronomic practices parallel to ensuring that there

are sufficient market-based incentives to facilitate chain wide

upgrading.

2. Strengthen supply and demand for certified/accredited organic

fertilizer parallel to ensuring that there are sufficient market-based

incentives to facilitate chain wide upgrading.

3. Strengthen local capacity to commercially produce and distribute high

yielding and disease resistant planting materials.

4. Upgrading of existing processed products and development of related

products that Mindanao can sustain as a marketing proposal in the

domestic market with a view of laying the ground work for export

sales.

5. Construction and/or upgrading of farm to market roads.

6. Improve capacity of enterprises to comply with GMP/HACCP and

sustainable production practices.

7. Development and/or upgrading of marketing infrastructure to enhance

collective marketing and bulk storage.

The possibility of expanding the areas planted by banana is very feasible

if given the appropriate support using PPP as a strategy. More so, because

Davao del Sur has vast agricultural land and cardaba banana could be

intercropped by all other existing crops. With all these efforts, Davao del Sur

could aimed to become the number one cardaba banana producing province in

Mindanao.

As to prioritization of the province, this crop is ranked second to Cacao,

considering that these crops could be intercropped. Thus, projects identified in

the PCIP could support both the Cacao and Banana Industry.

II - C.) CONSOLIDATED VALUE CHAIN MATRIX: BANANA CARDABA (refer to Annex 2)

26

III – A.) COMMODITY PROFILE: RUBBER

Rubber is a tropical crop that produces “white milky fluid” from its

trunk called latex. This latex are processed by manufacturers who converted

the raw rubber into the following value added products, to wit:

a.) Automotive products (tire, fanbelt, radiator, hose and others) b.) Industrial products (conveyor belt, rubber roller and others)

c.) Consumer products (footwear, mattresses, gloves, toys,

Hygienic products and others)

The tire industry is the largest consumer of natural rubber accounting

to about 80% of the global consumption of natural rubber. It is considered

eco-friendly and superior in quality as compared with synthetic rubber

whereby it displays a phenomenal increase. Key products produced and

traded by Mindanao rubber industry are cup lumps, crumb rubber, crepe

rubber and rubber sheets. At present, there is only one company in Mindanao

who produces finished products: boots/footwear, which are exclusively sold

for export markets.

The total world natural rubber production in 2012 was 11,445 MT

coming from the Top 10 Natural Rubber Producing Countries where

Philippines ranked 9th contributing only 1% of the world production.

Table 10: Key Products Produced and Traded in Mindanao Regions

Region Cup Lump

Crumb Rubber

Crepe Rubber

Rubber Sheet

Latex Rubber

Finished Product

Zamboanga Peninsula

Northern Mindanao

Davao Region

Soccksargen

Caraga

ARMM

Legend

Established product Start-up/For establishment

Source: KII/FGD/Past Studies

In Mindanao, Zamboanga Peninsula had the biggest production in

2013 among the five (5) rubber producing regions with Davao Region and

Caraga contributing 2% of the Mindanao Production. Among the regions in

Mindanao, only Davao Region produces cup lump.

27

Table 11: Cup Lump Production: Mindanao Producing Regions, 2013

Source: BAS

In Davao Region, Compostela Valley has the highest production

volume, followed by Davao del Sur, Davao City, Davao del Norte and Davao

Oriental. In terms of area planted with rubber, Davao del Sur tops.

Table 12: Cup Lump Production Volume and Area Planted with Rubber, Davao

Region, 2013

Source: BAS

Davao del Sur is the number 10 of the Top 10 Provinces in

Mindanao in terms of Average Yield per Hectare with Lanao del Sur at the

top.

Table 13: Rubber Production Volume, Davao Region, 2013

Province Average Yield

1.Lanao del Sur 5.18

2.Davao City 4.72

3.North Cotabato 4.65

4.Zamboanga del Sur 4.47

5.Misamis Occidental 3.25

6.Compostela Valley 2.56

7.Zamboanga City 2.47

8.Zamboanga del Norte 2.25

9.Zamboanga Sibugay 2.08

10.Davao del Sur 1.97

Source: BAS

In Davao del Sur, Bansalan has the largest area planted with

rubber with Hagonoy and Kiblawan having the least number of hectares

planted with rubber. In total, the province has identified a total of 4,720

hectares as potential areas for rubber.

Region Production Volume (in MT)

% to Regional Production

Zamboanga Peninsula 195,357.03 44%

Northern Mindanao 11,261.00 3%

Davao Region 8,240.00 2%

SOCKSARGEN 172,953.92 39%

Caraga 10,030.83 2%

Total Mindanao 444,676.92 99.97%

Province/City Production Volume (in MT)

Area Planted (in hectares)

Davao del Norte 1,111.79 581

Davao Oriental 41.10 155

Davao del Sur 2,560.92 1,300

Compostela Valley 2,997.41 1,173

Davao City 1,529.58 324

Total 8,240.80 3,533.00

28

Table 14: Municipal/City Data for Rubber Davao del Sur and Davao Occidental CY 2013

Provincial/ Municipality/

City

Area

Planted (Has.)

Production

Volume (Metric Tons)

No. of

Farmers

No. of Farmer Groups

% No.

of Farmers that are member

of Farmer groups

Area

Expansion

No. of

Processors

Davao del Sur

Bansalan 1,341 11,748.90 895 21 679 75.9% 550 -

Digos City 450 34.79 430 1 100 23.3% 410 -

Hagonoy 5 - 1 - - - - -

Magsaysay 947 3,621.70 882 15 529 60.0% 600 -

Matanao 115 9.50 230 2 100 43.5% 50 -

Padada 9 - 6 - - - - -

Sta. Cruz 123 5.57 291 2 60 21% 365 -

Kiblawan 5 Newly Planted 5 - - - - -

Malalag 46 - 508 1 100 19.7% 650 For verification

Sulop 38 Newly Planted 98 - - - 30 -

Davao Occidental

Don Marcelino 133 Newly Planted 176 6 - 92% 300 -

Jose Abad Santos

10 Newly Planted 15 - - - 20 -

Malita 420 - 338 1 -200 59.2% 1,445 -

Sarangani 12 0.80 5 - - - 300 -

Sta. Maria 64 0.50 55 - - - - -

Total: 3,718 15,421.76 3,935 49 1,768 394.6% 4,720 -

Source: MAO/OPAG

Table 14a. Existing Facilities, Nurseries, Facilities and Business Enterprises for Rubber

Davao del Sur and Davao Occidental, CY 2013

Province Municipality /

City

Processors Existing Plant Nursery/ Location Farmers’ Association List of Traders, Buyers, Assemblers

No. Location

DA

VA

O D

EL S

UR

Bansalan

N/A -Marber, Bansalan -Ms. Mabandos, Mabunga, Bansalan

SAFACO, Darapuay, Bansalan ARMCO, Alegre, Bansalan KMPC, Kinuskusan, Bansalan DLSA Coop, Anonang, Bansalan

SAFACO, Darapuay, Bansalan ARMCO, Alegre, Bansalan KMPC, Kinuskusan, Bansalan DLSA Coop, Anonang, Bansalan Rosalino Lao, Eman, Bansalan Mr. Gerona, Kinuskusan, Bansalan

Digos City

Hagonoy

Magsaysay

Municipal Nursery, San Isidro, Magsaysay

Lomer Abordo, Tacul, Magsaysay Marlyn Saraum, Tacul, Magsaysay Silverio Torate, Tacul, Magsaysay Genghiz Ganad, Tacul, Magsaysay Alegre Catigan, Upper Bala, Magsaysay Dennis Eulogio, Upper Bala, Magsaysay Urbano Daugdaug, Upper Bala, Magsaysay Virgie Aradillos, Bala, Magsaysay Bonifacio Colata, Upper Bala, Magsaysay

Matanao

AIFA, Asinan, Matanao SALIFA, Saub, Matanao CUIFA, Colonsabac, Matanao DOFAWA, Dongan Pekong, Matanao SUFA, Savoy, Matanao MALCARA, Towak, Matanao IPAMCO, Asbang, Matanao

CUIFA, Colonsabac, Matanao

Padada

Sta. Cruz JOFIRA Nursery, Jose Rizal, S/C

Kiblawan

Sulop

Malalag

DA

VA

O

OC

CID

EN

T

AL

Don Marcelino

Jose Abad Santos

Malita Mr. Tobias Gorit, Poblacion, Malita Mr. Tobias Gorit, Poblacion, Malita

Saranggani

Sta. Maria

Total

E-VSA result conducted by DA XI presents the data by province. For

Davao del Sur, Bansalan, Magsaysay and Digos City are the top three (3)

producing municipalities of rubber. While for Davao Occidental, Malita, Don

Marcelino and Sta. Maria. As to suitability analysis, in Davao del Sur,

Bansalan, Magsaysay and Kiblawan are the top three (3) municipalities

suitable for rubber production. And for Davao Occidental, Malita, Sta. Maria

and Saranggani.

29

Figure 11. EXPANDED VULNERABILITY &

SUITABILITY ANALYSIS MAP for RUBBER

30

Figure 12.

31

III - B.) INVESTMENT PLAN:

Rubber is usually marked as cup lumps, crumb rubber and crepe rubber

and this is usually sold by farmers to local agents, municipal and provincial

traders. Big owners of rubber plantations sold directly their product to rubber

processing plants. In the barangays, farmers sell their cup lumps to

cooperatives who are consolidators of the product, who in turn, sold this to

processing plants.

The chain of market affects the price of the commodity and this is

where focus is needed to look into identification of programs and projects

needed to develop rubber industry. Interventions identified during the

Value Chain Analysis workshop conducted by DA XI should be

considered by rubber producing LGUs.

In the ranking and prioritization of Intervention Strategy, Davao del

Sur rubber stakeholders have prioritized in this order:

1. Improvement of flow of extension services and adoption of

good agricultural practices/sustainable farming practices.

2. Improvement of tapping quality and productivity.

3. Promotion of cost-effective fertilizer management and

application and the complimentary use of organic fertilizer.

4. Upgrading of farm-to-market roads.

5. Development of capacity of collective groups to provide milling

and trading services.

6. Development of local capacity to commercially produce and

distribute certified budded planting materials of high yielding

rubber clones.

7. Promotion of ethical and responsible trading relationship and

development of traceability system.

8. Development of capacity of farmers to incrementally associate,

collaborate and coordinate to achieve economies of scale in

their transactions and to become attractive to large buyers.

The prioritization of the interventions by the stakeholders of rubber

should be considered by planners in order to identify clearly the projects

that would respond to their needs. The support that would be given by the

government entities are expected to improve and enhance rubber

industry.

III - C.) CONSOLIDATED VALUE CHAIN MATRIX: RUBBER

(refer to Annex 3)

32

IV – A.) COMMODITY PROFILE: ABACA

Abaca is a species of banana which is a native commercial crop to the

Philippines. The plant has a great economic importance, being harvested for its

fiber, known worldwide as the “Manila Hemp”, which is extracted from the leaf-

stems. The abaca fiber is superior over all other natural fibers because of its

great strength and its resistance to the action of water.

Figure 13: % Share Of Philippines to Global Production, 2012

Philippines is

the world’s top

producer and

exporter of abaca. In

2012, it contributes

about 85% of the

world production.

Source: BAS

In the Philippines, abaca is widely grown in 56 provinces and in 2013 its

production volume reached 64, 951.60 MT of abaca fiber. Of this production,

34% was supplied by Mindanao cluster, 37% by Luzon and 29% by Visayas.

Table 17: Mindanao’s Percentage Share to RP Production

Region Production Volume (in MT)

% Share to RP Production

Luzon 24,340.29 37%

Visayas 18,753.28 29%

Mindanao 21,858.03 34%

Zamboanga Peninsula 589.54 1%

Northern Mindanao 2,243.88 3%

Davao Region 7,268.63 11%

Soccksargen 953.65 1%

Caraga 5,827.89 9%

ARMM 4,974.44 8%

Philippines 64,951.60 100%

Source: BAS

In Davao Region, Davao del Sur ranks second with Davao Oriental in

terms of Production Volume in 2013 with the following data, to wit:

33

Table 18: Production Volume, Davao Region, 2013

In Davao del Sur, Malita has the largest area planted with abaca with

7,273.30 hectares. The second largest area, Don Marcelino, is way behind with

only 803.30 hectares. The rest of the municipalities have devoted 10 hectares to

700 hectares only for abaca. However, the Agriculture Offices of the different

LGUs have identified potential areas that can be grown with this commodity and

it has reached to 19,000 hectares. The bulk of the expansion area still comes

from Malita. Assisting the farmers as to technology is Philippine Fiber

Development Authority (PhilFIDA). However, the Department of Labor and

Employment (DOLE) has also provided facilities like stripping machines and

others to abaca cooperatives and associations in the province.

In the Expanded Vulnerability and Suitability Analysis (E-VSA),

presentation of data is already segregated by province. For Davao del Sur, it

showed that the top three (3) abaca producing municipalities are Sta. Cruz,

Bansalan and Digos City. While for Davao Occidental, Malita, Don Marcelino and

Jose Abad Santos are the top three (3) abaca producing municipalities. As to

suitability analysis for abaca, in Davao del Sur, Kiblawan, Bansalan and Sulop

are the top 3 municipalities suited for abaca. And for Davao Occidental, Malita,

Sta. Maria and Saranggani.

Province Area Planted (in hectares)

Davao del Norte 233. 40

Davao del Sur 3,067.33

Davao Oriental 3,484.41

Compostela Valley 459.62

Davao City 23.87

Source: BAS

Total: 7,268.63

34

Figure 14. EXPANDED VULNERABILITY & SUITABILITY ANALYSIS MAP

for ABACA

35

Figure 15. EXPANDED VULNERABILITY & SUITABILITY ANALYSIS MAP

for ABACA

36

Table 21: Municipal/City Data for Abaca, Davao del Sur and Davao Occidental, CY 2013

Municipality/

City

Area

Planted (Has.)

Production

Volume (Metric Tons)

No. of

Farmers

No. of Farmer Groups

% No.

of Farmers that are member of Farmer

groups

Area

Expansion

No. of

Processors

Davao del Sur

Bansalan 486 264.25 1,025 4 174 17% 1,500 1

Digos City 75 40.53 117 1 72 62% 1,500 -

Hagonoy - - - - - - - -

Kiblawan 46 25.24 131 3 97 74.0% 700 1

Magsaysay 14 7.82 31 - - - 500 -

Malalag 14 7.74 29 - - - 300 -

Matanao - - - - - - - -

Padada - - - - - - - -

Sta. Cruz 574 312.13 947 3 129 13.6% 1,500 -

Sulop - - - - - - - -

Davao Occidental

Don Marcelino

803 437.01 1,284 - - - 3,500 -

Jose Abad Santos

694 377.52 1,229 - - - 3,500 -

Malita 7,273 3,956.65 4,467 1 30 0.67% 5,000 -

Sarangani 11 5.79 35 - - - 500 -

Sta. Maria 613 333.49 1,307 - - - 1,500 -

Total: 10,603 5,768.17 10,602 12 502 4.73% 20,000 2 Source: FIDA * Include all varieties of abaca (Tangongon, Bungolanan, Maguindanao, Liboton, Daratex, etc.)

Marketing abaca fibers are usually coursed through the cooperatives as consolidators

who also sold these fibers to local traders/outlets.

37

Table 21a: Existing Processors, Nurseries, Facilities and Business Enterprises for Abaca, Davao del Sur and Davao Occidental, CY 2013

Province Municipality/City Processors Existing Plant Nursery

/Location Facilities Farmers Association List of Traders Class

No. Location

DA

VA

O D

EL S

UR

Bansalan 1 Tribal Women’s Weaver’s Association, Bitaug, Bansalan

Mobile stripping machine – MAFAMCO, Malupo, Anonang, Bansalan

-Altavista People’s Association (ALPEA), Altavista -Tribal Women Veavers’ Ass’n. (TWWA), Bitaug -Bitaug Agricultural Workers Ass’n., Bitaug

-MAFAMCO, Malupo, Anonang, Bansalan -MELBA NUYAD, Villa Doneza, Bansalan -Ruel Mahiling, Curvada, Bansalan -Pederson Agri-Trading, Bansalan -Nelson Andao, Poblacion, Bansalan -ALPEA, Altavista, Bansalan

D C D C D D

Digos City Mobile Stripping Machine – B-Man Community Coop., Binaton, Digos

-B-Man Cooperative, Binaton, Digos -Royelo Lezada, Kapatagan, Digos -Bernadette Aquino, Kapatagan -B-Man Cooperative, Binaton, Digos -Ronald Angga, Kapatagan, Digos -Marites Montez, Kapatagan, Digos

-Analyn Rocacorba, Luna St., Digos -Joseph Panes, Kapatagan, Digos -Fatima Sultan Esmail, Crumb St., Digos -Marilyn Hidalgo, Kapatagan, Digos

D D D A D

D D D D

Hagonoy

Magsaysay

Matanao

Padada

Sta. Cruz Tudaya Falls Farmers Ass’n, Tudaya, Brgy. Sibulan, Sta. Cruz Cooperator Mr. Dennis Amad

Mobile Stripping Machine, Tudaya Falls Farmers’ Ass’n., Sibulan

-Tudaya Falls Farmers’ Ass’n. Tudaya, Sibulan -Tibolo Abaca Farmers’ Ass’n (TAFAS), Tibolo -Mt. Apo Ancestral Domain Community Farmers Ass’n. (MADCOFA), Tudaya, Sibulan

-Ben Gomia, Astorga, Sta. Cruz -Pepito Ado, Tudaya, Sibulan, Sta. Cruz -Dennis Amad, Tudaya, Sibulan -Jocelyn Pili, Tudaya, Sibulan, Sta. Cruz

D D D D

Kiblawan 1 Tribal Handicraft Makers’ Ass’n., Kiblawan, Davao del Sur

-Kimlawis Farmers’ Ass’n. (KFA), Kimlawis -Bololsalo Abaca Farmers’ Ass’n. (BAFA), Bololsalo -Tacub Tribal Women’s Ass’n. (TIWA), Tacub -Balasiao Integrated Social Forestry Ass’n., (Balasiao)

Sulop

Malalag

DA

VA

O O

CC

IDE

NT

AL

Don Marcelino

-Baning Ismail, Dalupan, Don Marcelino -Renato S. Bautista, Dalupan, Don Marcelino -Loreto I. Aradani, Dalupan, Don Marcelino -Noe Arcilla Jr., Poblacion, Don Marcelino

D D D D

Jose Abad Santos

Malita

-Alberto Mante, Lagumit, Malita -Raul Barrios, Lagumit, Malita -LRM Fiber Marketing/Larry Matalandang, Poblacion, Malita -Emelie Bajenting, Poblacion, Malita -Roy Paquera, Little Bagiuo, Malita

A A

A D D

Saranggani

Sta. Maria -Ramilo Tiwo, Sta. Maria D

Total

Source: FIDA, Digos City

Table 21b: PROVINCIAL / MUNICIPAL / CITY DATA FOR ABACA

38

Province Municipality

/ City

Area Planted (Has.)

Production

Volume (mt)

Number of

Farmers

No. of Farmer Groups

% no. of Farmers that

are members of farmer groups

Area for expansion

(has.)

Processors Existing Plant nursery

location Facilities Farmers Association List of Traders

Class No. Location

DA

VA

O D

EL S

UR

Bansalan 485.80 264.25 1025 4 174 17% 1500 1

Tribal Women’s Weavers Ass’n. Bitaug, Bansalan

Mobile Stripping Machine-MAFAMCO, Malupo, Anonang, Bansalan

Altavista’s People’s Ass’n. (ALPEA), Altavista – Tribal Women Weavers Ass’n. (TWWA), Bitaug – Bitaug Agricultural Workers’ Ass’n., Bitaug

-Malupo Abaca Farmers Coop, Bansalan -Melba Nuyad, Villa Doneza, Bansalan -Ruel Makiling, Curvada -Pederson Agri-Trading, Bansalan -Nelson Andao, Poblacion, Bansalan -Altavista People’s Ass’n. Bansalan

D C D C D D

Digos City 74.50 40.53 117 1 72 62% 1500

Mobile Stripping Machine – B-Man Community Cooperative, Binaton, Digos City

-B-Man Cooperative, Binaton, Digos City

-Royelo Lezada, Kapatagan, Digos City -Bernadette Aquino, Kapatagan, Digos -B-Man’s Community Coop., Binaton, Digos -Ronald Angga, Kapatagan, Digos -Marites Montez, Kapatagan, Digos -Analyn Rocacorba, Luna St., Digos -Joseph Panes, Kapatagan, Digos City -Fatima Esmail, Crumb St., Digos City -Marilyn Hidalgo, Kapatagan, Digos

D D D A D D D D D

Hagonoy

Magsaysay 14.40 7.82 31 500

Matanao

Padada

Sta. Cruz 573.80 312.13 947 3 129 13.6% 1500

Tudaya Falls, Farmers Ass’n., Tudaya, Brgy. Sibulan

Mobile Stripping Machine, Tudaya Falls Farmers Ass’n., Sibulan

-Tudaya Alls Farmers Ass’n., Tudaya, Sibulan -Tibolo Abaca Farmers Ass’n. (TAFAS), Tibolo -Mt. Apo Ancestral Domain Community Farmers Ass’n. (MADCOFA), Tudaya, Sibulan

-Ben Gomia, Astorga, Sta. Cruz -Letty Puroc, Sta. Cruz -Dennis Amad, Tudaya, Sibulan -Jocelyn Pili, Tudaya, Sibulan, Sta. Cruz -Gaspar Diazon, Tudaya, Sta. Cruz

D D D D D

Sta. Cruz Cooperator: Mr. Dennis Amad

Kiblawan 46.40 25.24 131 3 97 74% 700 1

Tribal Handicraft Makers’ Ass’n., Kiblawan, Davao del Sur

-Kimlawis Farmers’ Ass’n., (KFA), Kimlawis -Bulolsalo Abaca Farmers’ Ass’n. (BAFA), Bololsalo -Tacub Tribal Women’s Ass’n., (TTWA), Tacub -Balasiao Integrated Social Forestry Ass’n., (Balasiao)

Malalag 14.20 7.74 29 300

Sulop

DA

VA

O O

CC

IDE

NT

AL

Don Marcelino

803.30 437.01 1284 3500

-Baning Ismail, Dalupan, Don Marcelino -Renato S. Bautista, Dalupan, Don Marcelino -Loreto I. Aradani, Dalupan, Don Marcelino -Noe Arcilla Jr., Poblacion, Don Marcelino

D D D D

Jose Abad Santos

694.00 377.52 1229 3500

Malita 7273.30 3956.65 4467 1 30 60% 5000

-Emelie Bajenting, Poblacion, Malita -Marilou Baguio, Little Baguio, Malita -Noling Suganay, Little Baguio, Malita -Esther Albios, Little Baguio, Malita -Elcana Calinawan, Little Baguio, Malita -Pamela Angos, Little Baguio, Malita -Arnold Villahermosa, Little Baguio, Malita -Espaldon San, Little Baguio, Malita -Ben Manicsic Jr., Little Baguio, Malita -Eunice Pepugal, Little Baguio, Malita -Olivo Trading, Poblacion, Malita -ASM Fiber Trader, Lagumit, Malita -LRM Fiber Marketing, Poblacion, Malita -Raul Barrios, Lagumit, Malita

C D D D D D D D D D D A A A

Saranggani 10.60 5.79 35 500

Sta. Maria 613.00 333.49 1307 1500

Total 10,603.30 5,768.17 10,602 12 502 4.73% 20,000 2

39

IV - B.) INVESTMENT PLAN:

The target area for expansion which is beyond the existing area planted

with abaca showed the interest of the LGUs to include abaca among its priority

crops. The programs and projects they have identified and specified in the PCIP

are interventions that would increase its production and shall focus on the

different priority areas identified during the Value Chain Analysis (VCA)

workshops by the different abaca stakeholders. Among these priority areas are

the following:

a. Use of good quality tissue cultured planting materials of high yielding

varieties

b. Access to mechanical stripping machine, dryer, and storage

c. Improve farm productivity

d. Good roads in order to reduce cost of transaction and post harvest

losses

e. Improve flow of benefits to farmers to increase share in market

price/profits

f. Achievement of Rainforest Alliance Certificate

In the prioritization and ranking of intervention strategy, Davao del Sur’s

stakeholders had this ranking in sequence to wit:

1. Strengthening of local commercial production and distribution of high

yielding and disease resistant planting materials.

2. Development and/or strengthening of local extension advices and

assistance to achieve Rainforest Alliance Certification.

3. Construction and/or repair of farm to market roads in key abaca

production areas.

4. Establishment and/or strengthening of collective enterprises

specializing in post harvest operations and abaca consolidation.

5. Harmonization of interpretation of standards and corresponding price

differentials including development of enforcement mechanism.

6. Promotion of direct/modular relationships between lead firms and

abaca communities.

7. Development of capacity of farmers to incrementally associate,

collaborate, and coordinate to achieve economies of scale and to

become attractive partners to Class A traders and processors.

In the consultative workshops conducted by the Provincial Government, it

was identified that construction of a tissue-cultured laboratory is needed in order

to provide planting materials of high yielding varieties and disease resistant

planting materials.

40

The support of the Local Government Units to abaca industry shall be a

major input as they provide technical and financial assistance directly to abaca

farmers through the Municipal Agriculture Office. However, additional funding

from PRDP and the adoption of PPP as a strategy are opportunities that would

respond to the needs of the industry effectively.

IV - C.) CONSOLIDATED VALUE CHAIN MATRIX: ABACA (refer to Annex 4)

41

V - A.) COMMODITY PROFILE: CASSAVA

Cassava is an important food source which is excellent in carbohydrates but an inferior source of protein, fat and vitamins. This crop is a staple food in 105 countries. In the Philippines, it only contributes 4% to the gross value added in agriculture. According to the Food and Agriculture Organization (FAO) report published in May, 2013: Cassava has a huge potential and could turn from “a poor people’s food into a 21st century crop” if grown according to a new environment-friendly farming model.

Cassava is used as a raw material for many industrial applications. Its

most important industrial uses are as source of energy in animal diets in the feed industry, for the starch industry and more recently for the production of ethanol.

On the global standing of cassava, for 103 countries in 2012, 57% comes

from Africa, Asia contributed about 37% of the world production with Thailand and Indonesia as the top producers. Philippines ranks 25th in terms of production volume.

In the Philippines, 77% of cassava production comes from Mindanao

wherein ARMM and Northern Mindanao accounted for 90% of the total Mindanao production.

Table 22: Top 5 Cassava Producing Regions

Source: BAS

In Davao Region, Davao del Sur has the biggest cassava production

volume, followed by Compostela Valley, Davao del Norte, Davao Oriental and

Davao City.

Table 23: Cassava Production Volume, Davao Region, 2013

Source: BAS

For Davao del Sur, the top three (3) cassava producing municipalities are:

Malita, Don Marcelino and Magsaysay. In 2013, it has a total land area of

1,091.50 planted with cassava with 613 hectares as possible area for expansion.

Region Volume (in MT) % to RP

ARMM 1,035,107.18 44%

Northern Mindanao 601,288.53 25%

Bicol Region 113,789.70 5%

Central Visayas 90,697.63 4%

Eastern Visayas 90,331.26 4%

Province Area Planted (in MT)

Davao del Norte 3,116.42

Davao del Sur 4,637.71

Davao Oriental 2,296.57

Compostela Valley 3,656.53

Davao City 2,261.38

42

Table 24: Municipal/City Data for Cassava, Davao del Sur and Davao Occidental, CY 2013

Province/ Municipality/

City

Area

Planted (Has.)

Production

Volume (Metric Tons)

No. of

Farmers

No. of Farmer Groups

% No.

of Farmers that are member

of Farmer groups

Area

Expansion

No. of

Processors

Davao del Sur

Bansalan 84 67.00 221 25 205 92.8% 60 1

Digos City 5 50.00 7 - - - 15 1

Hagonoy 0 0.12 5 - - - 5 -

Kiblawan 8 80.00 10 - - - 50 -

Magsaysay 119 1,219.59 326 - - - 20 -

Malalag 50 410.84 919 - - - 20 -

Matanao 12 166.00 47 - - - 20 -

Padada 9 9.25 139 - - - 85 -

Sta. Cruz 51 277.40 82 1 53 65% 70 -

Sulop 1 3.09 344 - - - 8 -

Davao Occidental

Don Marcelino 234 1,886.00 430 - - 12.40% 20 -

Jose Abad Santos

2 12.50 122 - - - 20 -

Malita 500 5,000.00 606 - - - 200 -

Sarangani 4 20.50 20 - - - 10 -

Sta. Maria 13 10.00 39 - - - 10 -

Total: 1,092 9,212.29 3,317 26 258 170.02% 613 2

Source: MAO/OPAG

Table 24a: Existing Processors, Nurseries, Facilities and Business Enterprises for Cassava

Davao del Sur and Davao Occidental, CY 2013

Province Municipality /

City

Processors Existing Plant

Nursery/ Location

Farmers’ Association Facilities Business Enterprise/

Name of Traders No.

Location

DA

VA

O D

EL S

UR

Bansalan 1

Marcelo Fuentespina, Lower Mabuhay

n/a Bansalan Planters Ass’n., Bansalan

Bansalan Planters Ass’n. – 2 units Cassava Chipper / Granulator

Marcelo Fuentespina, L. Mabuhay, Bansalan

Digos City 1

Emily Escaño, Tres de Mayo, Digos

Emily Escaño, Tres de Mayo, Digos City

Hagonoy

Magsaysay

MLGU – 1 unit Cassava Chipper/Granulator

Matanao

Padada

Sta. Cruz

Brgy. Zone 1 Farmers’ Ass’n. Sta. Cruz

Kiblawan

Sulop

Malalag

DA

VA

O

OC

CID

EN

TA

L

Don Marcelino

Jose Abad Santos

Malita

Agri-Aqua Multi-Purpose Cooperative, Kidalapong, Malita

2 units Cassava Chipper/ Granulator

Jun Rey Albiso, Kidalapong, Malita

Saranggani

Sta. Maria

Total 2

In the E-VSA result, the analysis of data is presented by province. For

Davao del Sur, the top three (3) cassava producing municipalities are

Magsaysay, Bansalan, and Sta. Cruz. And for Davao Occidental, Malita, Don

Marcelino and Jose Abad Santos. As to suitability analysis, in Davao del Sur,

Malalag, Magsaysay and Sulop are the top 3 ranking municipalities suitable for

cassava production. And for Davao Occidental, Malita, Sta. Maria and

Saranggani.

43

Table 24b: PROVINCIAL / MUNICIPAL / CITY DATA FOR CASSAVA

Province Municipality

/ City

Area Planted (Has.)

Production

Volume (mt)

Number of

Farmers

No. of Farmer Groups

% no. of Farmers that

are members of farmer groups

Area for expansion

(has.)

Processors Existing Plant

nursery location

Farmers Association Existing Facilities List of Traders, Buyers, Assemblers No. Location

DA

VA

O D

EL S

UR

Bansalan 83.96 68.00 221 25 205 92.8% 60 1 Marcelo Fuentespina, Lower Mabuhay N/A Bansalan Planter’s Ass’n., Bansalan Bansalan Planters Ass’n., - 2 units Cassava Chipper / Granulator

Marcelo Fuenterspina, L. Mabuhay, Bansalan

Digos City 5.00 50.00 7 15 1 Emily Escaño, Tres de Mayo, Digos Emily Escaño, Tres de Mayo, Digos

Hagonoy 0.03 0.12 5 5

Magsaysay 118.79 1219.59 326 20 MLGU – 1 unit Cassava Chipper/Granulator

Matanao 12.25 166.00 47 20

Padada 9.26 9.25 139 85

Sta. Cruz 51.00 277.40 82 1 53 65.0% 70

Brgy. Zone 1 Farmers Ass’n., Sta. Cruz

Kiblawan 8.00 80.00 10 50

Malalag 49.50 410.84 919 20

Sulop

DA

VA

O

OC

CID

EN

TA

L Don

Marcelino 234.00 1886.00 430 20

Jose Abad Santos

2.19 12.50 122 20

Malita 500.00 5000.00 606 200 Agri-Aqua Multi-Purpose Cooperative, Kidalapong, Malita

2 units Cassava Chipper / Granulator Jun Rey Albios, Kidalapong, Malita

Saranggani 4.00 20.50 20 10

Sta. Maria 12.50 10.00 39 8

Total 1,091.50 9,213.29 3,317 26 258 45.0% 613 2

44

Figure 16. EXPANDED VULNERABILITY & SUITABILITY ANALYSIS MAP

for CASSAVA

45

Figure 17. EXPANDED VULNERABILITY & SUITABILITY ANALYSIS MAP

for CASSAVA

46

V - B.) INVESTMENT PLAN:

The programs and projects identified by the different Local Government Units in support to cassava industry of the province shall be jointly and collaboratively undertaken by its stakeholders in partnership with the government sector.

Generally, the interventions shall focus on the following priority areas which

were identified by the stakeholders during the workshop called by DA XI, to wit: a.) Sustainable intensification of cassava production through improvement

of farm productivity and set-up of cassava agri-business clusters in identified expansion areas.

b.) Chain wide improvement in net income/profitability without compromising price competitiveness through production of chips and granules at the most effective and efficient way with the least ecological impact.

c.) Year-round production of chips and granules that are consistently in

accordance with market standards and requirements.

In the ranking and prioritization of the intervention strategies, the following

are identified in sequence, to wit:

1. Development of local capacity for production of foundation seeds and

its multiplication and the commercial distribution of planting materials.

2. Strengthening of existing providers of embedded services and/or

development of embedded models to transfer the needed skills, know-

how and information to enable farmers to adopt sustainable production

practices and improve productivity.

3. Strengthening of local supply chains of organic fertilizer and

development of effective demand.

4. Establishment of GMP compliant common service fertilizer for chipping,

drying, granulation and processors.

5. Upgrading of farm-to-market roads.

6. Improvement of coordination and production planning between cassava

farmers and processors.

7. Development of mobile peeling, chipping and drying system around

clusters of farms (in remote areas)

The interplay of the players of the cassava industry as identified in the

value chain shall facilitate the elimination of the barriers and constraints. The

financial support of PRDP shall be a major input in the economic growth of the

cassava industry of the province. The coming in of San Miguel Corporation as a

feed processing plant shall also provide bigger opportunities of cassava farmers.

V - C.) CONSOLIDATED VALUE CHAIN MATRIX: CASSAVA (refer to Annex 5)

47

VI - A.) COMMODITY PROFILE: SEAWEEDS

Seaweeds are plants in the sea that have no true roots, stems and leaves

and are classified into four (4) groups: red algae, brown algae, green algae and

blue algae. Among these varieties, red seaweeds are the most economically

important in the Philippines. It accounted 98% of the total Philippine production.

These red seaweeds is the source of carrageenan, which is one of the world’s

foremost food and industrial additive within the Philippine seaweed value chain.

Seaweeds farmers usually sell it as fresh or dried.

Philippines contributed 35% of seaweed production, next to Indonesian

which is 48%. Zamboanga and Tawi-tawi in Mindanao dominate the export of dried

seaweeds, while Cebu dominates the processing and exporting of carageenan as

majority of the processing factories are based in Cebu. Davao Region’s production

is only 3,686.48 MT way behind ARMM which is 609,164.54 MT.

Table 27: Seaweeds Production in Mindanao, 2013

Source: BAS

In Davao Region, Davao del Sur is accounted to have the biggest seaweed

production in 2013 followed by Davao City and Davao del Norte. The provinces of

Davao Oriental and Compostela Valley posted no seaweed production in 2013.

Table 28: Fresh Seaweeds Production Volume in Davao Region, 2013

Source: BAS

In Davao del Sur, only two (2) LGUs are engaged in seaweed production: Sta. Cruz and

Digos City. Although data from the Office of the Provincial Agriculturist (OPAg) is limited, the total

area planted for seaweed is only 49 hectares with Digos leading the seaweeds industry.

However, there are municipalities which started planting seaweeds with minimal hectare and

considered as “trial” planting. These are located in the municipalities of Malita and Sta. Maria of

Davao Occidental. Target area for expansion is 110 hectares which include Malita targeting

around 20 hectares.

Region Production Volume (in MT)

Zamboanga Peninsula 218,789.07

Northern Mindanao 42,261.32

Davao Region 3,686.46

SOCKSARGEN 20.58

Caraga 19,876.72

ARMM 609,164.54

Total 893,799.32

Province Production Volume (in MT)

Davao del Norte 8.93

Davao del Sur 3,341.27

Davao City 336.25

Davao Oriental 0

Compostela Valley 0

Total 3,686.46

48