US Dollar Index (DXY): Modeling against Domestic and Global Macro-Economic Factors

DailyFX - US Dollar Index October 14- 2014 (1)

-

Upload

helen-brown -

Category

Documents

-

view

2 -

download

0

description

Transcript of DailyFX - US Dollar Index October 14- 2014 (1)

US Dollar index may consolidate gains Alejandro Zambrano | FX Analyst E-mail: [email protected] www.DailyFX.com | @AlexFX00

14h of October, 2014

The US Dollar index (DXY) gained 7.2% year over year by the end of September on the back of strong US

short term rates. Yet with the new month the US dollar has been giving back parts if its gains on a dovish

tone set by the Federal Reserve. The consolidation might continue in the near term as the DXY moved

ahead of the Swap rates and the Swap rate differential itself has turned less favourable.

Looking beyond the short term, the swap spread should start to widen again as the FED is expected to

raise rates before the ECB and BoJ. This should support long term DXY gains. The major risk to this short

term scenario is a further deterioration in risk appetite causing safe haven flows to support the Dollar.

The latest FOMC minutes caused short term US rates to decline in relation to its major trading peers, as the FED voiced concerns about a strong US Dollar and concerns about global growth. The Federal reserve sees a stronger US Dollar as a reason for a slowdown in US ex-ports and dampening of inflation, these comments sur-prised the markets.

Looking at the relationship between US Core Inflation and annual returns of the DXY the relationship has been weak over the last 10 years. Only 4% of the variation in core inflation is explained by the US Dollar index (DXY). The negative relationship implies that US CPI may have declined to 1.62% yoy in September from 1.72% in Au-gust. This is on the back of the 7.2% yearly return of the US Dollar index. However given the overall weak con-nection between DXY year over year changes and the inflation rate the US dollar must gain near 20% yoy be-fore we can draw strong conclusions about inflation.

More importantly for the US Dollar, the FOMC minutes have dampened the US 2 year Swap rate versus its ma-jor peers of the US Dollar index (DXY).

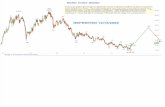

The DXY and the 2yr Swap spread can be seen in figure 1, the daily correlation between these variable is 0.75 over the last 10 years. When the spread widens the US Dollar Index tends to gain and vice versa.

The US 2 year swap started to outperform its peers of the DXY index in March 2014 but it took until May 2014

Fig.1 The 2 year Swap Spread has been supporting a

strong dollar but has now started to contract.

Fig.2 Model of DXY using the 2yr Swap Spread as an

explanatory variable shows that the DXY has reached

the upper limit given the Swap Spread. With the Swap

spread contracting, the upper limit should decline,

generating a lower DXY.

US Dollar index may consolidate gains | DailyFX

2

before the DXY started to trend higher. As seen the spread has started to narrow after reaching a spread of 40 bps.

The spread is expected to narrow further in the near term while it should expand in the longer run given that US economy remains on track, which is prompting rate hikes by the FED and the ECB keeps their dovish stance.

DXY Fair value

Isolating the effect of the 2 year swap spread on the DXY beyond the simple correlation study shown in fig-ure 1, we have developed a simple fair value model with the swap spread as the sole explanatory variable. Using a sample from 2011, the DXY turned overbought starting from the last week of September as DXY con-tinued to rally without a sufficient increase of the swap spread.

With the DXY reaching the upper limit, of what can be explained by the swap spread, the DXY may decline with 3% before the dollar strengthens. This should be on the back of DXY turning less overbought given the swap spread and on the back of the swap spread nar-rowing.

It’s important to note that the model does not take any aggressive stock market declines into consideration.

Why the Swap Spread is expected to keep narrowing

There is no doubt that the US economy is doing well right now. Figure 3 shows the PMI composite for the major markets and showing the US being on top. US PMI at current levels usually translates into a GDP growth of 3% yoy. At the same time EU PMI has de-clined to 52 and the latest Eurozone industrial produc-tion numbers to show a decline of -1.9% yoy. This sup-ports the longer term view that the US Dollar may gain as US economic growth outperforms the rest of the world.

Yet this idea seems to be well priced in. Figure 4 shows the US Economic Surprise index showing that US data has been outperforming and may now turn softer going forward. This should keep US rates in check and support a narrowing of the DXY Swap spread, hence a short term weaker US Dollar.

Fig.3 PMI Composites show that the UK and US are

leading while the Eurozone is approaching 50, which

implies lower economic growth. Japan has just

emerged from a reading below 50, showing that the

economy is weak and more quantitative easing might

be needed.

Fig.4 US Economic Surprise index looks to have peak

and if it follows it’s common pattern, should keep on

drifting lower, meaning that US data reports are

missing expectations.

US Dollar index may consolidate gains | DailyFX

3

Summary

The US dollar index may correct to 84/83 before investors may decide to add to long positions.

The reason for the correction would be the DXY moving ahead of rate differentials and the subse-

quent narrowing of the US 2 year swap rate vs. its major peers in the DXY index.

The trigger for a narrowing of the swap spread was the Federal Reserve’s concerns about a strong

US dollar and its effect on inflation and on US export orders.

The narrowing of the spread might continue as the near term expectations about the US economy

are slightly elevated according to the US economic surprise index.

Our short term estimate of the US dollar index does not take the risk aversion into consideration,

something that might trigger Dollar buying on safe haven flows.

Disclaimer: FXCM Inc. is headquartered at 55 Water Street, 50th Floor, New York, NY 10041 USA. Trading forex/CFD's on margin carries a high level of risk, and may not be suitable as you could sustain a total loss of your deposit. Leverage can work against you. Do not speculate with capital that you cannot afford to lose. Be aware and fully understand all risks associated with the market and trading. Prior to trading any products offered by Forex Capital Markets, LLC, FXCM Securities Limited, Forex Capital Markets Limited, inclusive of all EU branches, FXCM Asia Limited, carefully consider your financial situation and experience level. FXCM may provide general commentary which is not intended as investment advice and must not be construed as such. Seek advice from a separate financial advisor. FXCM assumes no liability for errors, inaccuracies or omissions; does not warrant the accuracy, completeness of information, text, graphics, links or other items contained within these materials. Read and understand the Terms and Conditions on FXCM's website prior to taking further action.