DAILY REPORT - Banca Intesa BeogradDate Currency Source: Public Debt Management Agency Moody's S&P...

Transcript of DAILY REPORT - Banca Intesa BeogradDate Currency Source: Public Debt Management Agency Moody's S&P...

Source: Daily FX

Value Previous Change YTD Value Previous Change YTD

118.5623 118.6632 -0.09% 0.08% 1.1491 1.1491 0.00% -4.28%

103.0349 103.2123 -0.17% 3.95% 1.1402 1.1404 -0.01% -2.54%

103.9109 103.9902 -0.08% 2.59% 0.8743 0.8779 -0.41% -2.79%

135.5927 135.2595 0.25% 1.62% 1.3144 1.3093 0.39% 0.24%Source: NBS 112.9600 113.2300 -0.24% -1.51%

Source: Bloomberg

Source: Bloomberg Source: Bloomberg

Value Next decision Value

3.00% 08.11.2018. 0.00%

Deposit facility 1.75% 2.25%

Lending facility 4.25% 0.75%

Repo operations (one week) 2.35% -0.75%

Source: NBS Source: Bloomberg

9.10.2018 8.10.2018 Change (bps) 9.10.2018 8.10.2018 Change(bps)

1.98% 1.97% 0.01 -0.365% -0.365% 0.000

2.60% 2.63% -0.03 -0.371% -0.371% 0.000

2.90% 2.94% -0.04 -0.318% -0.318% 0.000

3.07% 3.10% -0.03 -0.268% -0.267% -0.001

Source: Reuters Source: Bloomberg, EBF

Note: Values are with 1 day delay Note: Values are with 1 day delay

Value Previous Change (bps) Value Previous Change(bps)

2.287% 2.284% 0.003 0.100% 0.093% 0.007

2.420% 2.414% 0.006 0.451% 0.439% 0.012

2.629% 2.626% 0.003 1.062% 1.055% 0.007

-0.784% -0.783% -0.001 3.147% 3.127% 0.020

-0.742% -0.743% 0.000 0.000% 3.187% -3.187

-0.661% -0.659% -0.002 0.000% 3.262% -3.262

Sources: ICE, Bloomberg Sources: IBA, Bloomberg

Libor 3M (CHF) USD ISDA 5Y FIXING

Libor 6M (CHF) USD ISDA 10Y FIXING

Libor 3M (USD) EURIBOR ISDA 5Y FIXING

Libor 6M (USD) EURIBOR ISDA 10Y FIXING

Libor 1M (CHF) USD ISDA 3Y FIXING

BELIBOR 6M EURIBOR6M

Libor interest rates Interest rate Swap

Libor 1M (USD) EURIBOR ISDA 3Y FIXING

BEONIA EONIA

BELIBOR1M EURIBOR1M

BELIBOR3M EURIBOR3M

United Kingdom (BOE) 1.11.2018

Switzerland (SNB) 13.12.2018

Serbia - Interbank interest rates Serbia Europe - Interbank interest rates - Europe

Next decision

Key policy rate Eurozone (ECB) 25.10.2018

US (FED) 8.11.2018

GBP/RSD GBP/USD

USD/JPY

National Bank of Serbia Interest rates Major interest rates

EUR/RSD EUR/USD

USD/RSD EUR/CHF

CHF/RSD EUR/GBP

FX rates and money market

FX rates on domestic market International markets

Currency Currency

Key events

TimeCountry/

RegionEvent Period Previous Forecast

Overall trading at the Belgrade Stock Exchange RSD747,04mn (€6,30mn). Bonds trading RSD734,06mn (€6,19mn).

Euro slightly changed against dollar. Trading at $1.150.

European stocks up. Stoxx 600 up 0.2%, DAX up 0.3%, FTSE 100 up 0.1%.

U.S. equities down. Dow Jones down 0.2%, S&P500 down 0.1%.

Oil steady (WTI $74.65, Brent $84.79)

Gold up ($1.190,68).

Financial Market Analysis

Treausury and ALM department

DAILY REPORT

Flash

Dinar adds against euro 0.1% (118,5623).

Bank of the Group

October 10, 2018

1.13

1.14

1.15

1.16

1.17

1.18

1.19

1.2EUR/USD

0

5

10

15

20

25

30

35

40

45

117

118

119

120

121

122EUR mio EUR/RSD

Turnover on FX market (right axis)

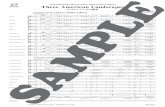

Date Currency

Source: Public Debt Management Agency

Moody's S&P Fitch

Ba3 BB BB

Outlook Stable Stable Stable

Date 17.3.2017 15.12.2017 15.12.2017 Sources: Bloomberg, JPMorgan

Source: Bloomberg

Date Value Previous Date Value Previous

04.02.2016 2.75% 2.79% 21.05.2018 0.45% 0.47%

02.03.2017 2.64% 2.65% 13.06.2018 0.65% 0.96%

07.02.2017 3.48% 3.49% 20.04.2018 1.20% 1.24%

24.10.2017 4.05% 4.65% 16.04.2018 1.78% 1.88%

28.02.2018 3.80% 3.88% 11.06.2018 2.50%

11.09.2018 3.74% 3.75% 26.03.2018 3.50% 4.00%

23.10.2017 5.00% 5.60% 06.09.2017 4.20% 4.20%

07.08.2018 4.80% 4.85% Source: Public Debt Management Agency

23.06.2016NBS key rate +

0.25%

NBS key rate +

0.25%

Source: Public Debt Management Agency

Source: Public Debt Management Agency Source: Public debt Management Agency

Sources: Ministry of finance, Banca Intesa Sources: Ministry of finance, Banca Intesa

Vrednost Prethodna UST spred

Serbia 5y 2018 2.705% 2.689% 0.525%

Serbia 7y 2020 3.817% 3.852% 1.010%

Serbia 10y 2021 4.080% 4.067% 4.080%Source: Bloomberg

Izvor: Bloomberg

Source: Bloomberg

7 years

10 years

24 month amortizing

Serbian Eurobonds yields (USD)

15 years

2 years 5 years

3 years 7 years

5 years 10 years

Maturity

3 months 53 weeks

6 months 2 years

53 weeks 3 years

Maturity

RSD Government securities EUR Government securities

Instrument Value

No scheduled auctions for today

Serbia Credit rating

Fixed income

Scheduled auctions

80

130

180

230

280

330

bps JP Morgan EMBI Srbija

2.2

2.7

3.2

3.7

4.2

4.7

105

107

109

111

113

115

117

Serbian 10y Eurobond 2021

Price Yield (right axis)

1.52.53.54.55.56.57.58.59.5

10.511.512.513.514.5

Yields on RSD government securities primary auctions

3m 6m 53w 2y 3y NBS key rate 5y 7y 10y

0.00.51.01.52.02.53.03.54.04.55.05.56.06.57.0

Yields on EUR government securities primary auctions

53w 2y 3y 5y 7y 10y 15y

2

Source: Belgrade Stock Exchange

Source: Belgrade Stock Exchange Source: Belgrade Stock Exchange

Sourc: Bloomberg

KMBN 1,960 9,800,000 2.08% 2.08% 0.47 7.91 6.61

FITO 2,800 1,120,000 0.00% 0.00% 1.61 9.73 17.60

NIIS 682 632,896 0.15% 0.29% #N/A N/A #N/A N/A #N/A N/A

MTLC 1,976 474,240 -1.69% -2.18% 1.34 16.73 7.98

THHM 235 222,545 0.00% 0.00% 0.16 #N/A N/A -8.32

PDCL 10,310 175,270 0.00% 0.00% 1.73 51.20 3.44

AERO 1,669 168,569 0.54% 0.60% 2.29 16.74 14.52

ZLTP 2,800 126,000 0.00% 0.00% 0.42 10.31 4.14

LSTA 375 18,750 0.00% -6.02% 0.36 #N/A N/A -18.27

RUDO 149 0 0.00% 0.00% 0.41 #N/A N/A -5.68

Sources: Belgrade Stock Exchange; Bloombeg

0.48%

-0.21%

-0.23%

0.28%

-0.16%

Source: Bloomberg

crobex sbi20

Source: Bloomberg Source: Bloomberg

sofix bet-c

Izvor: Bloomberg Izvor: Bloomberg

Source: Bloomberg Source: Bloomberg

dj balkan

Source: Bloomberg

DJ Stoxx Balkan 50 Balkan 399.85 400.48 -15.08%

SOFIX Bugarska 617.13 618.55 -8.90%

BET Rumunija 8,545.34 8,521.11 10.21%

Crobex Hrvatska 1,775.19 1,766.69 -3.67%

SBITOP Slovenija 836.94 838.68 3.77%

Regional stock exchanges

Index Country/Region ValueValue from the previous

dayChange YTD

RUDO AD BEOGRAD 99,241,599 Din.

AERODROM NIKOLA TESLA AD BEO 58,458,609,301 Din.

ZLATARPLAST AD NOVA VAROS 177,839,200 Din.

LASTA AD BEOGRAD 700,291,125 Din.

METALAC AD GORNJI MILANOVAC 4,031,040,000 Din.

TEHNOHEMIJA AD BEOGRAD 240,767,840 Din.

PODUNAVLJE AD CELAREVO 1,999,160,550 Din.

KOMERCIJALNA BANKA AD BEOGRA 32,963,193,760 Din.

GALENIKA FITOFARMACIJA AD 7,392,000,000 Din.

NIS AD NOVI SAD 111,207,192,800 Din.

P/BV P/E ROE Market capitalization

The most traded stocks on Belgrade Stock Exchange from the previous day

Company Ticker Price RSDTurnovor

RSD

Daily

change

Weekly

change

Ratios P / B P / EBelex15 0,73 6,49

Turnover 747,042,985 RSD 451,509,543 RSD 65.45%Source: Belgrade Stock Exchange

6,259,490 € 3,805,278 € 64.49%

Belex 15 730.75 727.94 0.39% -4.19%

Belex line 1,537.08 1,535.40 0.11% -7.65%

Belgrade Stock Exchange

Value Previous value Change YTD

1,500

1,600

1,700

1,800

1,900

2,000

2,100

2,200

2,300

CROBEX

350

400

450

500

550

600

650

700

750

SOFIX

5,500

6,000

6,500

7,000

7,500

8,000

8,500

9,000

9,500

BET

300

400

500

600DJ Stoxx Balkan 50

500

550

600

650

700

750

800 Belex 15

-1.69%

0.00% 0.00% 0.00% 0.00% 0.00% 0.15% 0.54%

2.08%

MTLC ENHL TGAS FITO JESV ALFA NIIS AERO KMBN

Daily change of Belex 15 members

1,000

1,200

1,400

1,600

1,800Belex line

600

650

700

750

800

850

900

950

SBITOP

3

Source: Bloomberg

dow jones s&p

Izvor: Bloomberg Izvor: Bloomberg

Source: Bloomberg Source: Bloomberg

nasdaq dax

Izvor: Bloomberg Izvor: Bloomberg

Source: Bloomberg Source: Bloomberg

nikkei dj stoxx

Izvor: Bloomberg Izvor: Bloomberg

Source: Bloomberg Source: Bloomberg

Izvor: Bloomberg Izvor: Bloomberg

Source: Bloomberg Source: Bloomberg

Source: Bloomberg

Snežana Topalović 201-1400 Snežana Spasojević 201-3621Vladimir Gavović 201-1263 Dragomir Milin [email protected] Biljana Radosavljević 201-3610

Darko Karanović 201-3624

Boban Todorović 201-3627Dragan Ignja 201-3626

ContactFinancial Market analysis Customer execution office (fixed income)

Dealing

Disclaimer

This overview is written to inform and does not represent a call for making business decisions and buying or selling mentioned financial instruments. Banca Intesa ad Beograd does not guarantee exactness of summoned data.

Information, opinions and commentaries in this overview are given with the best intention according to available data provided from relevant sources and as a result of professional attitudes and orientations of analytical team working in

Banca Intesa ad Beograd. Banca Intesa ad Beograd does not assume responsibility for possible loss and damage caused by business activities according to any element and contents of the overview. This document may only be

reproduced in whole or in part together with the name of Banca Intesa Beograd.

Nikkei 225 Japan 23,469.39 23,783.72 -1.32% 3.09%

Dow Jones Stoxx 600 EU 372.93 372.21 0.19% -4.18%

FTSE UK 7,237.59 7,233.33 0.06% -5.86%

DAX Germany 11,977.22 11,947.16 0.25% -7.28%

NASDAQ US 7,738.02 7,735.95 0.03% 12.09%

S&P 500 US 2,880.34 2,884.43 -0.14% 7.73%

Dow Jones Industrial US 26,430.57 26,486.78 -0.21% 6.92%

Index Country/Region Value Previous value Change YTD

World stock exchanges

14,00015,00016,00017,00018,00019,00020,00021,00022,00023,00024,00025,00026,00027,00028,000

Dow Jones Industrial

1,700

1,800

1,900

2,000

2,100

2,200

2,300

2,400

2,500

2,600

2,700

2,800

2,900

3,000

S&P 500

4,0004,2004,4004,6004,8005,0005,2005,4005,6005,8006,0006,2006,4006,6006,8007,0007,2007,4007,6007,8008,0008,2008,400

NASDAQ Composite

260

280

300

320

340

360

380

400

420DJ Stoxx 600

9,000

11,000

13,000

15,000

17,000

19,000

21,000

23,000

25,000

27,000

Nikkei 225

\

8,000

9,000

10,000

11,000

12,000

13,000

14,000DAX

35

45

55

65

75

85

95Oil Brent (USD/bbl)

1,050

1,100

1,150

1,200

1,250

1,300

1,350

1,400Gold

\

5

10

15

20

25

30

35

40 Vix Index

4