CSI Conference 2009

-

date post

20-Oct-2014 -

Category

Education

-

view

1.698 -

download

1

description

Transcript of CSI Conference 2009

CSI WORLD HEADQUARTERSANNUAL INVESTIGATION, FRAUD, SYSTEMIC RISK MANAGEMENTCONFERENCE 2009

CSI World HeadquatersTraining Professionals Globally

2

0

0

9

2 6 - 2 7 MAY 2009

GOING BEYOND FINANCIAL RISK MANAGEMENT

K u a l a L u m p u r , M a l a y s i a

Main Marketing Agent :

CFE International Consultancy Group Pte Ltd

Dear Friends,

I hope to see you in Malaysia!Sincerely,Tommy Seah, Chairperson. CSI World Headquarters

Once again, auditors, compliance officers, anti-fraud professionals from the private and publicsectors will exchange ideas on evolving fraud issues.Join them as they explore the techniques andstrategies being employed to combat these newtwists to financial risk. The 2009 Annual CSISystemic Risk Conference will be in Kuala LumpurMalaysia on 26th May 2009.

2

0

0

9

As the Program Chair for the 3rd CSI World Headquarters Regional Confer-ence in Kuala Lumpur, I'd like to welcome you to this conference that brings together a variety of professional finance teams from government, commercial, and academic organizations worldwide to foster coopera-tion and coordination in financial risk prevention, to prompt rapid reaction to financial crisis and incidents, and to promote information sharing among members and the financial community at large. As always, we also extend a warm welcome to all our colleagues in other industry who share our interest in improving financial information protection.

If you or your organization are interested in creating a sound financial management team or are responsible for the coordination of financial risk management whether as a system administrator, network administrator, management, law enforcement, or vendor, you should attend this confer-ence.

I also have some excellent news to share with you. In this conference, we will introduce the CSI-BLACK BELT in Credit Risk Management, Financial Analysis Masterclass which is a mandatory requirement for all new CSIs.

This conference program is an exciting combination of technology as well as management sessions. Our key note speakers include Mr. Tony Reyes, the HTCIA Chairperson from New York and Mr. Phill Russo, the Australian, CIA solution provider on Digital Forensics. Both of them have indicated that they will be conducting their respective Masterclass immediately after the Confer-ence.

You are encouraged to sign up for any of the Masterclass and enjoy all the benefits as a Confer-ence delegate.

MAKE PLANS TODAY TO ATTEND THIS “CAN’T MISS”CONFERENCE. THE CSI WORLD HEADQUARTERSANNUAL INVESTIGATION, FRAUD, SYSTEMICRISK MANAGEMENT CONFERENCE WAS SPE-CIALLY DEVELOPED FOR THE CSI BY RECOGNIZEDCERTIFIED FRAUD EXAMINERS, INTERNAL AUDIT AND ITPROFESSIONALS.

With “ everyone a CSI” approach, this conference will provide you with tools and techniques toassist you in understanding your organization’s systemic risk challenges whether you are delvinginto audit, IT or Fraud examination for the first time or are already savvy in Fraud Examination andsystem appraisal.

The CSI World Headquarters Annual Investigation, Fraud, Systemic Risk Management Conferencewill feature four unique tracks that cater to all experience levels so you get the most out of yourlearning experience. Stay ahead of the technology curve and register today!

THIS TWO-DAY CONFERENCE WILL FEATURE ACOMBINATION OF HIGH-LEVEL PLENARY SESSIONS ANDEXTENDED CASE-STUDY SESSIONS LED BY SENIOR-LEVELFRAUD PRACTITIONERS & RISK MANAGEMENT SPECIALIST

The Number 1 FraudBuster in Asia Pacific

Only Regent Emeritus from this part of the world

latest secrets, tactics and developments on Risk Assessment, Fraud Prevention,

leading international and domestic practitionersTake advantage of a programme that has researched and developed with the

CSI World Headquarters 2009 Conference Objectives

BE A CSI and STOP the ROT2

0

0

9

In order for Financial Institutions to hide as much in liabilities as they wanted, all these firms had to do was to create various types of special purpose entities (SPEs) in which they did not have a controlling interest. In other words, if Bradley-Bingly and Lehman Brothers create a company in which they each take a 50% interest, neither company, technically, has a controlling interest.

Since the mortgage-backed securities that these companies created or bought were sold to investors, in many instances these SPEs were extremely lax in their underwriting standards. Subprime, Alt-A, interest-only and adjustable mortgages with very low teaser rates were given to unqualified home buyers, then packaged and sold to unwary investors. Let the buyer beware. Meanwhile, these SPEs were sending profits up to their joint owners, and executives at these companies were making big bonuses based on spectacular reported earnings.

But as the orgy of lending got so out of hand that buyers of securitized mortgages began to balk, the plans went awry. The execs in big banks couldn't stand to let the orgy end; so, they started guaranteeing the securities in order to get them sold. These guarantees eliminated their protection from the blowback of securities gone bad. Now the liabilities could end up on their balance sheets. Not surprisingly, many did.

That's how we got here. That's why investors will take hits in the hundreds of billions of dollars, and why taxpayers will pay in higher taxes or higher inflation or both. A few top executives will get fired, but they’re not giving back their bonus money, even though all the profits the bonuses were based on have evaporated along with billions of dollars of market capitalization.

YOU can stop this from happening again. Be a CSI.

The Financial Crisis towards the end of 2008 is a plain and simple case poor regulatory supervisison, failure in compliance and internal audit and mis-management of the banks.

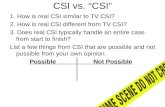

> Why Become a CSI ?

> What is CSI (Certified System Investigator)?In most cases, a CSI is someone who has completed a programme of study and practicaltrainings in the CSI, passed the Uniform CSI Examinations and obtained high standard ofprofessional work experience in the field. Due to the high standard of this certifying programme,it is becoming a much sought after benchmark in the financial market. This is an industrialrecognition that CPAs, CFEs, CFAs, etc. seek to be certified.

Enthusiastic internal and external auditors - and IT auditors - are using the knowledge from thiscertification programme to bring value-added services to their clients and corporations.Financialand IT institutions operate within global markets, where change and competitive pressures areconstant. One key corporate strategy is to build up internal business competencies. Havingpeople with the right competencies (the right knowledge, skills and attitude to perform specificjob functions) who understand the markets and the operations, and can navigate through theintricacies of the market place is fundamental for financial institutions to ensure their long-termgrowth and success.

Our objective is to increase the existing pool of competent industrial practitioners who canperform to international standards through a series of structured software trainingprogrammes.

three critical body ok knowledge.Namely,

Black Belt in Financial AnalysisBlack Belt in SEATABlack Belt in Data Analytics and Digital Forensics

CSI World Headquarters 2009 Annual Conference Agenda

Who Should Attend

PROGRAMME FOR 26 MAY 2009 (Day 1)0800 – Complimentary Breakfast (For first day only) 0900 – Registration 0930 – Conference starts

0930-1000 - Welcome note and opening speech By Tommy Seah, Chairperson Emeritus, CSI World Headquarters An introduction CSI World HQ • Seeing risk as an opportunity

• What is a Certified System Investigator?

- How is it different from other risk guides?

• How the standard fits with other management

systems/standards

• International developments

• Opportunities and benefits of being a CS I

1000 – 1030 – Morning Break

1030 – 1100 – Second SessionTopic: Managing your client base: Controlling reputational risk while driving your business

By Rolf van der Pol Head, Regional Due Diligence Royal Bank of Scotland

- How to bring KYC for all your clients up to a complete and accurate level o ‘clean the house’

- How to build an organisation to maintain KYC up to the required level o ‘keep the house clean’

- How to drive your business while doing this o ‘drive your business’

Describing

- Experiences from ABN AMRO Bank - Lessons learned - Key success factors

1100 – 1130 – Third Session Fraud Risk Assessment By Tommy Seah, Chairperson Emeritus, CSI World Headquarters CFE, CSI, FCPA, FAIA, ACIB, MSID, CSOXP

Building a Fraud Audit Framework

discusses the fraud risk audit program

as it pertains to fraud risk at the mega

- risk level.

1130 – 1200 – Fourth Session Topic: Risk Management for Internal Auditors By Partner, Consultancy Firm (To be announced)

-

1200 – 1230 – Fifth Session Topic: Investigative Profiling for Fraud Risk Management By Stanley Chia, Vice Chairperson, CSI World Headquarters CFE, CSI, CAMS, BEcons, MCom (Business Law)

- How is fraud risk affecting corporations

- What is investigative profiling

- How can we use profiling to mitigate fraud risk

- Prevention is better than cause.

1230-0200 – Lunch Break and Exhibition

0200–0230 –Sixth Session

Topic: Forensic Techniques for Risk Management

By Director of Forensic Services of one of the Big 4 Accounting Firms (To be announced)

0230 – 0300 – Seventh Session

Topic: Business Continuity Planning

By Josephine Low, Head, Internal Audit, Tan Cheong Motor; Vice- President, IIA Malaysia

0300 – 0330 – Afternoon Break

0330 – 0400 – Eighth Session

Topic: IT Security and Risk Management

By Anthony Rayes, Chairperson, HT CIA

IT security awareness is at an all-time high, And organizations are spending and hiring in record numbers.

Legislation and regulations are proliferating. Yet, for all this e_ort, nearly every statistical measure of IT security performance — from the number of incidents and vulnerabilities to the cost and impact of a security breach —is bad news.

In what other endeavor would so much investment be permitted with such poor results?

The potential for disruption from malicious or accidental threats is growing, yet our ability to manage risk has never been more uncertain. Throwing more money at IT security will not close the gap.

0400-0430 –Ninth Session

Topic: Using Digital Forensic for Risk Management

By Phil Russo, CIA Forensics

ACE AccessData Certi_ed Examiner ACI AccessData Certi_ed Instructor CFE Certi_ed Fraud Examiner CPDE Certi_ed ProDiscover Examiner Grad Cert Computer Security CompTIA A+,CCNA, GIAC GSec Gold Cert IV IT IM, Cert IV IT Support, Cert IV Training Cert III Investigative Services

Computer forensics the basic ingredients -Either you are or your not – no half way -Its all about times and dates -We do it so we don’t need to go to court •Write Blockers

-What are they -Why are they needed -Hardware Write blockers -Software Write blockers -Manual Windows Registry changes -Hardware Vs Software Pros and Cons -Validation Process •Images - What’s in an image anyway? -What is an image -Raw mirror or embed -Logical or Physical acquisition -Imaging Location

0430 – 0500 – Closing Session

By Tommy Seah, Chairperson Emeritus, CSI World Headquarters

- Master Class Briefing - Token of Appreciation Presentation to Speakers - Photo Session

PROGRAMME FOR 27 MAY 2009 (Day 2)0900 – Administration for Master Classes 0930 – Master Classes Start 1030 – 1100 – Morning Break

1230 – 0200 – Lunch Break & Exhibition

0200 – Master Classes resume

0330 – 0400 – Afternoon Break

0500 – Master Class ends

0500 – 0530 – Certificates Presentation & Photo Session

www.amanet.org

DEVELOPMENT SUPPORT SOLUTIONS

Chart acourseto better businessresults.

www.csi-worldhq.org

CSI 2009 Conference

3 TRACK EVENTS 27th May 2009

YOU get to Choose the one that suit you most

• Improve your company’s picture • Help boost shareholder value • Increase your own value to your organization

Learn the practical techniques you need to succeed in today’s fast-paced, we-need-

a-decision-now business environment. Find out how to more accurately determine

if an investment is going to pay (or if your company might take a bath),

evaluate acquisitions to gain a competitive edge, between cash and

true , forecast cash w, keep top management up to speed and much more.

I wish I had taken this course years ago!”—Private Banker

Exceeded my expectations in terms ofcontent and leader quality.”

—Risk Manager

CSI’s Black Belt Masterclass

Financial tools to help you do your job better.

TRACK A

Financial Instruments Fraud

CS i CORE SKILLS

Fundamentals of Financial Instruments FRAUD

CSI World Conference Masterclass TRACK A www.csi-worldhq.org

In today’s uncertain economy, when every manager is being held accountable for the bottom line, you have to be y.” You’ve got to know how tojustify a request…quantify your contributions to thecompany…spot pr drains immediately. Because nomatter how e ective your management style or howinnovative your ideas, your performance will bemeasured in dollars and cents.

This seminar o ers exactly what you need to further your career and build your future. From SWAPS to OPTIONS to receivablesand payables, this course shows you the concepts, tools and techniques that can help you make each decision pay o on thejob and on the bottom line.

How You Will t•• Gain gr

• Lear

• Cultivate proactive working rprofessionals and enhance your value to your organization

• Understand the business dynamics of dollars and cents—and take initiatives that meet short- and long-term goals

• Take the guesswork out of your decision making and deliver a better bottom line

• Expand your professional expertise—and your career opportunities

CAN YOU SPEAK THE LANGUAGE? Assets. Futures. Capitalization. Debt andequity Arbitrage. Present value index. When you hear these wordstossed about by coworkers, do you cringe and feel totally out of their league?

DO YOUR EYES GLAZE OVER? Your boss shares the P&L and balance sheet withyou. Do you understand what the numbers are saying? Do you know what to lookfor to evaluate the hedging strategy of your operations? Can you use the data todevelop future strategies? Or, are the instruments all but meaningless to you?

DO YOU FEEL CONFIDENT ASKING FOR MONEY? You need more money foryour department and you’re meeting with the people. Do you feel secureenough to deal with the “professionals”? Can you give them a well-thought-outbudget...or quantify your team’s contributions to the company to justify the increase?

Give us eighthours—we’ll help

you conquer yourfear of ialinstruments.

A CSI BLENDED LEARNING

ADVENTURE

FACULTY SPOTLIGHT

Don’t let fear of you back.

Who Should AttendThis program is designed for managers inevery functional area of responsibility, in all industries.

NOTE: Please bring a calculator and a copy of yourannual report (if available).

He is the elected Vice Chairman 2006/07 of the Association of

of Regents based in Texas, USA. CFE is a post graduate

recognized by the FBI and USACentral Intelligence Agency in it’s recruitment of auditors for combating fraud.

His services in providing technical training is much sought after by numerous banks in the region, includingGermany, Singapore, Malaysia, China, Indonesia, Philippines and Taiwan. Tommy's previous work experience includes systems based auditing in an American International Bank, where he was the Senior Regional

A

I wish I had learn this from Mr. Stanley CHIA years ago ! — CSI Chief Examiner

Exceeded my expectations in terms ofcontent and leader quality.”

— Chief Bottling Plant Inspector

CSI’s Black Belt Masterclass

tools to help you do your job better.

TRACK B

PROFILING

Fraud Risk Management

CS i CORE SKILLS

and Fraud Risk Management

CSI World Conference Masterclass TRACK B www.csi-worldhq.org

Give us eighthours—we’ll help

you conquer yourfear in conducting

A CSI BLENDED LEARNING

ADVENTURE

FACULTY SPOTLIGHT

techniques and has handled numerous cases for both

Stanley is also the current Honorary Director, Research & Publication of CSI World Headquarters, an international accreditation body for Computer Digital Forensics.

Stanley is both the Director & Principal Consultant of CFE Strategic Alliances, the training arm of CFE-In-Practice group of companies and also the Managing Director of CFE International Consulting Group Pte Ltd, a think tank company that provide multi-consultancy solutions to companies worldwide.

Do Not Let Fear of Embarassment Prevent YOU from getting to the TRUTH

interviews

Effective profiling

-Knowing the different types of profiling General, Fraud Management, Investigative-General Dos and Don’ts for profiling-Deciding on the need to do profiling-The “OBSERVER” Method - Opening Case –Subject/Background Analysis - Brain Storming - Information Gathering - Summary and Preliminary Profiling - Evaluation -Meeting with the “subject” Dos and Don’ts Questions and Observations - Review Preliminary Profiling - Verify the findings - Encapsulation of findings - Report Writing the Profiling Report.

Come and learn from the Master

He is well versed in financial products knowledge, fraud examination techniques and compliance methodologies. Stanley is often invited to speak at conferences and seminars in Singapore, Malaysia, Hong Kong and Shanghai where he taught fraud investigation, investigative interviewing techniques, profiling techniques and internal control. He has also co-authored a series of pocket size guide book for auditors published by CSI World Headquarters. He is currently writing a book on Interviewing & profiling techniques – ISBN 978-981-08-0599-9.

Stanley has the following professional credentials:

Certified Fraud Examiner (CFE) with the Association of Certified Fraud Examiners(ACFE) – www.acfe.comCertified Member (CAMS) with Association of Certified Anti-Money LaunderingSpecialists (ACAMS) – www.acams.orgCertified System Investigator (CSI) with the CSI World Headquarters – www.csi-worldhq.orgMember of Australasian Compliance Institute (ACI) – www.compliance.org.auMember of GRC Group New York – www.grcg.comMember of International Compliance Association – www.int-comp.org

He also holds a Master of Commerce, specializing in Business Law from TheUniversity of New South Wales. He obtained his Bachelor of Economics, majoring inMoney & Banking and Accounting in 2001 from The University of Western Australia.

B

CSI’s Black Belt Masterclass

TRACK CBattle Fraud - The Black Arts of IT Security and Digital Forensics for IT Managers and Professionals By the Number One Digital Forensic Expert from Australia Mr. Phill Russo

Start with IT Security Basics - The common threats – Malware (viruses, worms, Trojans and rootkits) - External threats - The internal threat – fact or fiction - Your Privacy act - Monitoring Network Traffic – The good the bad and the useless - Policies Procedures – where to get them from - Wireless Networks Security - Phising and Pharming scams same game different media - Take down a Phising site Who’s in control - IT Governance does it help you control your business or does it control your business - A fresh approach - Welcome to the zoo Keeping your company secrets ……. secret - Formatting Vs Forensic data Wiping - Unwanted recovery of data - Recovery of passwords, banking and internet details and history - Encryption …. What is and what is not protection - Laptops cameras and other security worries - Mobile phone forensics - Intellectual Property Leakage - Identity theft - A look at Email analysis

to be a with the latest tools and strategies.

Map the journey

Driving Organic Growth: How to Maximize All of Your Company’s Assets

Get cutting-edge tactics and strategies to successfully drive Organic Growth—an approach many companies have found to be the most reliable avenue to ongoing,

long-term success. (Visit www.cfe-in-practice.com for detailed course outline)

Real World Financial Decision Making: Applying the Tools of Corporate Finance

Apply targeted nancial tools that drive smarter business decisions. (Visit www.cfe-in-practice.org for detailed course description.)

CFE’s Financial Statement WorkshopDrill down—and discover what the numbers on those statements really mean.

(Visit www.cfe-in-practice.net for detailed course description.)

Minimizing Financial Risks When Growing Internationally

Acquire essential insights and strategies for handling the complexities of cross-border operations.

CFE’s Insurance and Risk Management WorkshopEnhance the well-being of your organization—stay in control of its insurance

program and risk management strategies. (Visit www.csi-worldhq.org for detailed course description.)

To register call +65 9106 9872 or visit www.cfe-in-practice.org

SATI SFACTION GUARANTEED

At CFE we guarantee the quality of our seminars.It’s that simple. More than 96% of our participantssay they would recommend the course they havetaken to their colleagues. If for any reason you arenot with a seminar for which you havepaid, CFE will give you credit toward another ofcomparable price or will refund your fee. That’s it.No hassles. No loopholes. Just excellent service.That’s what CFE is all about.

Please register me for:

TRACK A # DATE LOCATION

TRACK B # DATE LOCATION

TRACK C # DATE LOCATION

NAME (Please print)

TITLE

ORGANIZATION (Please use full name)

DEPARTMENT

STREET ADDRESS

+PIZETATSYTIC) () (

BUSINESS TELEPHONE NUMBER FAX NUMBER E-MAIL ADDRESS

PAYMENT OPTIONS for Singapore Dollars SGP 1200/- per pax

EMAN TNIRPERUTANGIS (as shown on card)

Please check here if you are paying by MRY cheque

CHECK (MAKE PAYABLE TO CFE-IN-PRACTICE

BILL ME

PO # _____ _____

PLEASE SEND ME: CSI Membership information.

CFE’s Catalog of Seminars.

(FOR ADDITIONAL REGISTRATIONS, PLEASE COPY THIS FORM.)

Registration fees. The full fee is payable at the time of registration. If payment is notissued at that time, you will be sent an invoice that is immediately payable uponreceipt, unless other arrangements are made with CFE. All fees include the cost ofseminar materials. Remember, this fee is tax-deductible.Please note: Registration fees and seminar schedules are subject to change withoutnotice.

Special hotel and car rental discounts. Visit www.cfe-in-practice.org or call+ 90074179 for the latest information.

CFE does not discriminate in employment, admission to membership, or admis-sion of speakers or registrants to its programs or activities on the basis of race, color,religion, gender, age, sexual orientation, disability, national or ethnic origin, veteranstatus or any other basis prohibited by state or local law.

Transfer, cancellation and refund policy. You may transfer to a future session, sendsomeone to take your place or cancel without penalty at any time up to three weeksprior to your seminar. If you provide CFE with less than three weeks’ notice, or failto attend, you will be liable for the entire seminar fee. We appreciate that this is animportant investment for you and your company and would like to accommodateyour needs the best we can. Therefore, please call us at +65 9007 4179

REGISTRATION FORM “Early Bird”

Conference Fee MYR 2800** per paxWEB: www.cfe-in-practice.org

PHONE: +65 9007 4179 —8 am–7 pm, eastern time, Monday–Friday

E-MAIL:

FAX: + 65 6827 9601

MAIL: Return this registration form to address on the

5 EASY WAYS TO REGISTER

Chart a Course for the CSI Professional Recognition

Financial Instruments FRAUDCSI’s Black Belt Cer in

For full information about qualifying seminars and discount pricing, visit cfe-in-practice.org or call +65 9007 4179 .

Discounts may not be combined with other promotions.

Special Discounts Available

TRACK A

TRACK B PROFILING Techniques

Digital Forensics TRACK C

** includes Masterclass but excludes airfare and or hotel accomodation and any other expenses

next page

CPEs for CPAs Most seminars in this catalog meet CSIrequirementsand qualify for CSI’s CPE credits

Many seminars in this catalog are approved for CSI and AIA credits by the respective Association

*This is applicable to all 1- to 3-day Asia region seminars with a member price of US$1,100 or less, or nonmember price of $1, 400. May not be combined with other Attendance at the seminars must be completed within 6 months of purchase date. Prices are subject to change. Call + 65 9106 9872 to register.

Call +65 9106 9872 to register now (mention code CSI 2009 CFinKL)

Save up to33% regular prices*

You and/or anyone in your company can attend

up to three seminars for only $4,800.

CFE’s Seminar Savings Pass

Contact : CFE International Consulting Group Private Limited The Premier Event Organiser

Training Professionals Globally

CSI World Headquarters

HOW TO REGISTER :

Please contact the Event Organizer

CFE Interna onal Consultancy Group Pte Ltd

Address: 6 Eu Tong Sen Street, 05-13, The Central, Singapore 059817

Contact: +65 6222 9862/863 (look for Cheryl or Joanne) fax: +65 6222 9865

Email: registra [email protected]

Account number is 147-619399-001

Account name: CFE Interna onal Consultancy Group Pte Ltd

For TTs, the swi instruc on is as follow:

Bank Name: The Hongkong and Shanghai Banking Corpora on Limited

Bank Address: 21 Collyer Quay, HSBC Building, #01-01, Singapore 049320

Bank Code: 7232

HSBC Swi Code: HSBCSGSG

Malaysian Delegates may pay to :T/T Payment to:

Public Bank, Kuala Lumpur Branch, Malaysia

Account Number: 3145502629Bank : Public Bank Berhad