Cscostudy Metal En

-

Upload

pratima-rani -

Category

Documents

-

view

223 -

download

0

Transcript of Cscostudy Metal En

-

7/31/2019 Cscostudy Metal En

1/32

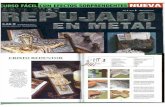

THE SMARTER SUPPLY CHAINOF THE FUTUREGLOBAL CHIEF SUPPLY CHAIN OFFICER STUDY

METALS AND MINING EDITION

-

7/31/2019 Cscostudy Metal En

2/32

2

INTROdUCTION

Toays ne metals economy is mostly characterie by upheaal in the

traitional supplier/proucer/customer lanscape. Globaliation an eco-

nomic challenges are riing most eternal shifts. Accoring to the 2009

IBM Global Chief Supply Chai Ofcer Stuy, a overwhelmig 82 percet

of metals an mining (M&M) companies beliee that aggressie global

competition is impacting their supply chains.1

Emergig markets ow rive a larger percetage of global growth, while

aance steel economies in the Unite States an Europe are contract-

ing. These rapily eeloping M&M markets present ne reenue oppor-

tuities, but also represet ew competitio. Recet marketplace volatility

has further pushe aance economies toar recession. Annual groth

i steel, up more tha 45 percet over the last te years, has slowe i

2008, as iustries buyig steel are affecte by tighteig creit.2

I the past, most metals compaies viewe their operatios i terms of

moing olumes of prouct through the supply chain an eliering to

customers at completion. The emphasis as on maimiing capacity utili-

ation an reucing costs at each phase of the supply chain. To eal ith

volatile markets, M&M compaies have relie o traitioal levers, such as

ilig capacity, rawig ow ivetories, leveragig low freight costs a

eamining iestiture opportunities.

-

7/31/2019 Cscostudy Metal En

3/32

TIME FOR A NEw RESPONSE

The future calls for boler moves, both strategically a tactically, a for

most, a reivetio of how M&M compaies view their core busiesses. To

aress this iustry shift, M&M compaies will ee a ifferet ki of

supply chai oe that is much smarter. By this, we mea a supply chai

that is far more:

Instrumented

Usig sesors a smart evices to gai greater visibility, mitigate risk,

reuce cost an manage rising compleity.

Interconnected

Itegratig the etire supply chai to better itercept ema sigals,

maage risk i realtime, make ecisios collaboratively a share iforma-

tio, ot just betwee people, but with proucts a smart objects across

the supply chain netork.

IntellIgent

Relyig more o avace aalytics, simulatio a moelig to evaluate

icreasig complexity, yamic risks a costraits a maage the

etire supply chai more scietically.

Toays focus o value ivolves a ifcult trasitio oig more with less,

optimizig resources a builig busiess exibility. The smarter supply

chain presents M&M eecuties ith a tremenous opportunity: a pathay

to the business of the future.

-

7/31/2019 Cscostudy Metal En

4/32

4

THE TOP PRIORITIES FOR METALS ANd MININGSUPPLY CHAIN ExECUTIvES

The 2009 IBM Chief Supply Chai Ofcer stuy was coucte through

i-epth iterviews with early 400 supply chai leaers arou the globe,

icluig major metals a miig compaies. Through this stuy, we

learne about the top issues an business riers affecting supply chain

leaers toay. The most importat challeges ietie by M&M respo-

ets were supply chai visibility, customer emas, cost cotaimet,

risk an globaliation.

executive summary

thetop fIve

prIorItIes

fIgure 1 top supply chaIn prIorItIes for m&m a comparIson to all IndustrIes

Percentage who report this challenge impacts their supply chains to a signifcant or very signifcant

extent.

globalIzatIonsupply chaIn

vIsIbIlIty

74%

rIsk

management

74%

IncreasIng

customer

demands

48%

cost

contaInment

57%

41%

70%

60% 56%55%

43%

All industriesMetals and Mining industries

-

7/31/2019 Cscostudy Metal En

5/32

the top five priorities

c iCost containment is a critical aspect of the role of supply chain eecutie.

Seenty-four percent of metals an mining responents position support

of growth iitiatives as their primary task, with cost cotrol as a close sec-

on. Almost three-fourths of M&M eecuties positione their supply

chains as critical to cost containment for their oerall businesses.

Ho ell are they managing costs? Their responses inicate a 27 percent

gap beteen the importance they place on cost reuction an their effec-

tiveess at reucig costs. To cotrol costs, compaies ofte tur to co-

tiuous improvemet practices. However, M&M executives ietie a

sigicat ifferece betwee the importace of cotiuous improvemet

an their effectieness at highlighting areas for improement across the

supply chain (see Figure 2).

fIgure 2 m&m supply chaIns have cost contaInment gaps

The dierence between importance and eectiveness o their best practices.

Continuous process/

business

improvement

87%

44%

43 %gap

Driving cost

reduction

74%

47%

27%gap

Very to greatly eectiveCritically to very important

Increasing supply chainefciency and decreasingtotal cost is the key to acompetitive supply chain.

Vice President of Supply Chain,

Chinese steel company

-

7/31/2019 Cscostudy Metal En

6/32

6 the top five priorities

Some practices associate ith cost containment such as formal istri-

bution strategies or orking ith thir-party logistics companies are

common among M&M companies. But hen compare to top supply

chais across iustries, M&M compaies are less likely to utilize other

tools like eception-base management or netork optimiation an sim-

ulation.3 A whe they o implemet these capabilities, less tha half of

M&M companies are etremely effectie at using them. Other eamples of

opportunities not eploite to their full etent are purchasing outsourcing

a reverse logistics. A although ofte outsource, trasportatio a

export maagemet efforts have bee less tha effective, represetig

other areas for further cost saings.

M&M companies kno controlling costs is at the heart of their businesses

a have focuse their attetio o this oe topic, sometimes overlookig

other importat performace rivers. With this hawkish focus o costs, it

is surprisig to ote how ofte shop-oor scheulig processes a tech-

ologies lack e-to-e itegratio from melt shop to ishig lies.

Lookig forwar, smarter cost reuctio activities will focus o more tha

just reucig expeitures; they will simultaeously buil more value ito

the supply chai a eable compaies to be more exible a agile i

their operations.

-

7/31/2019 Cscostudy Metal En

7/32

the top five priorities

s i iiiiThree out of four metals an mining supply chain eecuties cite isibility

as their top challege. Supply chai visibility is the ability to see, via ifor-

matio a collaboratio, supply chai activity a recogize the ee to

react both iterally, as well as through the extee etwork of suppliers

an customers. Goo isibility enables M&M companies to coorinate

activities across the supply chai, improve efciecy a respo more

quickly to supplier, market a customer evets.

visibility is inhibite hen people are not aequately incente to collabo-

rate, either by busiess measures or availability of tools. Accorig to our

stuy, the most sigicat ihibitors to collaboratio for M&M compaies

are Iiviuals are too busy (78 percet) a Performace measures are

not aligne to rear collaboration (77 percent). These represent both

proceural a cultural issues, a likely iicate a siloe focus of supply

chai practitioers who are measure oly o their immeiate jobs ratherthan holistic consierations of the supply chain.

when aske ho effectie they are at measuring an monitoring business

performance a critical precursor to ecision making M&M companies

rate their effectiveess at oly 56 percet (see Figure 3). Less tha half of

M&M companies hae effectiely implemente information isibility insie

their compaies, a oly oe-thir have oe so outsie their compa-

ies; a full oe-thir have ot aopte iformatio trasparecy at all.

-

7/31/2019 Cscostudy Metal En

8/32

8 the top five priorities

fIgure 3 m&m supply chaIns also have vIsIbIlIty gaps

The dierence between importance and eectiveness o their best practices.

Driving integration

and visibility of

information across

the supply chain

83%

48%35%

gap

56%

31%

25%gap

Measuring/

monitoring business

performance

92%

56%

36%gapInternal

Internal

external

external

Very to greatly eectiveCritically to very important

Amog commo visibility-oriete capabilities, M&M compaies trail the

top supply chais across iustries (see Figure 4). I some cases, these

gaps represet a shortcomig i capability; others reect attributes of the

metals an mining inustries.

fIgure 4 m&m IndustrIes traIl top supply chaIns In the ImplementatIon of IntegratIon practIces

7%gap

12%gap

29%gap

Some extentVery great extent

Event management

and alert

notifcation

57%

leaders

metals & mInIng IndustrIesPlanning with

suppliers

Realtime information

transparency inside

and outside

enterprise

Shared, realtime

electronic data

leaders

metals & mInIng IndustrIes

leaders

metals & mInIng IndustrIes

leaders

metals & mInIng IndustrIes

81%

74%

78%

65%

63%

59%

13%

86%30%

7%

11%

19%

30%

13%

18% 4%gap

-

7/31/2019 Cscostudy Metal En

9/32

the top five priorities

ri Tie with visibility, maagig risk is a importat challege for metals a

miig compaies. Risk evets ca take a variety of forms, icluig eco-

omic, creit, supply chai isruptio, employee, price, evirometal a

many others.

The more etensiely companies emphasie risk management practices intheir strategies, the more they uersta the beets. I our survey, o

M&M compay has wiely implemete risk sharig across its etwork, as

compare to 26 percet of top supply chais. With supplier liks i M&M

less critical tha i other iustries, this iustrys primary opportuities lie

i risk itegratio a compliace with customers, logistics parters a

eent monitoring.

There are multiple reasons companies are struggling to manage risk. Half

of M&M compaies ietie lack of staarize iformatio as the um-ber oe barrier hierig their ability to moitor a react to risks, followe

by lack of staar processes a techologies. Oly 24 percet of M&M

companies hae inclue risk inicators in their formal performance

monitoring.

Icrease resposiveess toppe the list of beets of goo risk maage-

met, with 78 percet of respoets sayig it has a sigicat to moer-

ate impact (see Figure 5). Ehace risk/rewar opportuities was a close

secon at 70 percent. when aske Ho much impact oul/oes an

enterprise risk mitigation strategy hae on the folloing aspects of your

busiess?, 65 percet of M&M executives believe that their busiess

plans oul be more accurate.

-

7/31/2019 Cscostudy Metal En

10/32

10 the top five priorities

fIgure 5 m&m companIes belIeve rIsk mItIgatIon would posItIvely Impact theIr busInesses

High impactSignifcant impact

Increased

resiliency and

responsiveness

78%

70%

61%65%65%

Enhanced

enterprise risk/

reward

opportunities

More accurate

business plans

Improved rate

of return

Improved

forecast

accuracy

Moderate impact

Further goo ews was that 60 percet were curretly itegratig process

cotrols i logistics a operatios, 56 percet were implemetig compli-

ace programs with suppliers a service proviers a 56 percet were

incorporating risk strategies an mitigation policies in supply chain

planning.

O the ow sie, ot a sigle M&M respoet has reporte wie aop-

tio of risk sharig with their suppliers; istea they were cocetratig all

risk insie their on enterprises. These shortcomings can be iee as

importat areas for improvemet. Risk maagemet, like ew opportuity

or performace maagemet, shoul be viewe as a area that will

improe as greater supply chain isibility is achiee.

-

7/31/2019 Cscostudy Metal En

11/32

the top five priorities

mi Rising customer emans in the ne economy require a renee effort

toar increasing customer focus in the supply chain. Forty-eight percent

of metals an mining supply chain eecuties cite rising customer

emas as a top challege. Compare to other iustries, M&M compa-

nies are more likely to ork ith their customers on prouct esign or

coguratio (see Figure 6). M&M compaies are less likely, however, to

collaborate with customers o ema plaig, forecastig a reple-

ishment programs. This suggests that M&M companies hae an opportu-

nity to improe the alue proie to the customer.

Our stuy inicates that most of the challenges M&M companies face ill

ultimately require more intensie interaction an collaboration ith custom-

ers. when they o unertake prouct innoation practices an supply

chai plaig with their customers, M&M compaies cosistetly experi-

ence oerhelming effectieness in meeting strategic goals.

ci i

i

fIgure 6 m&m companIes have an opportunIty Increase theIr use of product InnovatIon

practIces to Improve theIr abIlIty to meet customer demands

82%

81%

70%

64%

61%

59%

55%

55%

Some implementationExtensive implementation

Customer product confguration

and specifcations

ci i

dii ii i

ii

m i

s, i i

/i

c i i

ci i,

i, i

i

-

7/31/2019 Cscostudy Metal En

12/32

12

Building collaboration withglobal suppliers on a long-term sustainable basis is oneo our key initiatives.

Director, Supply chain management,

Indian steel company

the top five priorities

giiGive the growig iterepeece amog ecoomies worlwie, its o

surprise globaliation ranks as a top supply chain challenge. Metals an

miig have embrace these chages more quickly tha some iustries,

more iely sourcing in loer-cost countries than our oerall inustry

sample.

However, global sourcig has le to may issues that compaies ecou-

ter, icluig ureliable elivery (65 percet), loger lea times (65 percet)

a issues with ew sources (60 percet), with a aitioal 22 percet of

respoets, o average, aticipatig icrease problems withi the ext

three years. These challeges i elivery a quality are reecte i sourc-

ing priorities. M&M companies are primarily focuse on total cost hen

workig with suppliers, less so o the suppliers elivery or overall capabili-

ties. A more holistic supplier relationship strategy may create an opportu-

nity for improement.

fIgure 7 half already source from asIa/asIa pacIfIc over the next three years, m&m

companIes plan to further Increase sourcIng from developIng countrIes

central or south amerIca6%

(16% PLAn TO InCREASE)

asIa or asIa pacIfIc 52%

(41% PLAn TO InCREASE)

western europe 21%

(21% PLAn TO dECREASE)

unIted states, mexIco

or canada10%

(11% PLAn TO dECREASE)

eastern europe 9%

(33% PLAn TO InCREASE)

afrIca2%

(22% PLAn TO InCREASE)

-

7/31/2019 Cscostudy Metal En

13/32

the top five priorities

Top supply chains report less pain an more etreme gains from globalia-

tio over the past three years, iicatig that the acial avatages of

globaliing markets an operations clearly outeigh the negaties. Leaers

ten to ecel in the critical areas of cost containment an oerall supply

chain performance.

M&M companies track closely ith top supply chains in implementing

most of the globally oriete practices covere by the survey, oly trailig

by a fe points or achieing parity on the others. Leaers an M&M com-

paies ha similar scores for irect global sourcig, low-cost coutry

sourcig, global sourcig of iirect materials a usig share services

for procurement. The largest iergence beteen top supply chains an

M&M companies as in the use of supplier relationship management pro-

grams, with 93 percet of leaers versus 70 percet of M&M compaies

using them. when compare to other inustries ith more comple sourc-

ig, such as electroics, M&M performs well i its ability to locate experi-

ence an skille intercountry suppliers.

-

7/31/2019 Cscostudy Metal En

14/32

14 top five supply chain challenges

THE EvOLvING ROLE OF THE CHIEF SUPPLYCHAIN OFFICER

The Global Chief Supply Chai Ofcer Stuy igs poit to a evolvig

role of supply chai leaership i maagig these ve challeges. Across

iustries, the traitioal supply chai roles of istributio a logistics,

planning an sourcing/procurement are still primary responsibilities.

However, fewer M&M supply chai executives have a icrease spa-of-

cotrol icluig techology eablemet, risk maagemet, a customer

management. These represent the emerging strategic functions that relate

to may of the key supply chai challeges ietie i our stuy. As sup-

ply chai executives aress their ew challeges, these otraitioal

functions ill likely rise in importance.

executive summary

theevolvIng

role

pi (/)

diii/lii

si &

p & i

s i

mi

fIgure 8 emergIng responsIbIlItIes dIrectly correlate to m&m top challenges.

74%

70%

61%

43%

35%

22%

22%

17%

9%

9%

4%

t

c

r ,

ri

n i, ,

4%m/qiii i ii

Emerging strategic unctionsTraditional unctions

-

7/31/2019 Cscostudy Metal En

15/32

the evolving role

Customer management has inee become part of the Chief Supply Chain

Ofcer role. As supply chai executives look to exte their value i the

eterprise a to customers via collaboratio a improve performace,

they ill ultimately nee to nurture customer relationships. The groing

role of technology enablement may point to ne efforts in integrating top

oor to shop oor a with busiess parters a customers. These ew

capabilities proie supply chain eecuties ith the ability to achiee sup-

ply chai visibility while, at the same time, mitigatig risks.

Obviously, these ew resposibilities a skills will be require ot just of

Chief Supply Chai Ofcers, but of their leaership, maagers a team.

Ufortuately, evelopig people is oe of the steepest challeges ote

in the supply chain stuy. Eighty-seen percent of M&M eecuties cite

builing leaership talent as the number one challenge in improing their

supply chai capabilities. This ee, couple with a startlig 53 percet

capability gap beteen the importance of eeloping people an compa-

ies effectiveess, raises skill evelopmet to the top of the Chief Supply

Chai Ofcers priority list.

For most M&M executives, there is a very proouce perceptio gap i

what they believe is importat, a their ability to aress it effectively. This

shoul inspire supply chain eecuties to take on a ne leaership role in

the orchestration of all supply chain resources an connecting ith other

leaers an groups insie an outsie of the company. This epane role

will require ew competecies for the supply chai leaer a his team,

an ne capabilities for the operation an enterprise as a hole.

-

7/31/2019 Cscostudy Metal En

16/32

16 top five supply chain challenges

THE SMARTER SUPPLY CHAIN

Metals an mining supply chain eecuties are aopting a ne supply

chai visio built arou uerstaig their customers ees, evelop-

ig exibility a agility a reucig risk a costs. To resist a traitioal,

icremetal approach, M&M leaers shoul istea seek chages that

icorporate a broaer, itercoecte view of the etire supply chai.

COST CONTAINMENT IN THE SMARTER SUPPLYCHAIN

To reuce cost a icrease agility, metals a miig compaies ee

manufacturing iscipline that enables them to focus on maimiing oerall

throughput a protability.

Mastering planning an scheuling to rie the eecution of prouction

orers i the most cost-efciet way allows a compay to react to mau-

facturig variability a chagig busiess coitios. Tools with global,

forar-looking isibility interconnect silo-base operations to highlight

potential problems. Etening the scheuling horion from hours to ays

or een eeks creates a etaile ie of potential problems that coul be

aoie if knon in aance. An using sense-an-respon eman an

supply sigal oticatio provies exceptio-base maagemet of thesupply chain.

top five supply chain challengesexecutive summary

thesmarter

supplychaIn

-

7/31/2019 Cscostudy Metal En

17/32

the smarter supply chain

Japaese steelmakers, such as nippo Steel a JFE for example, have

focuse o itegrate shop-oor scheulig from melt-shop to ishig

lines oer the past ten years to achiee these goals.4 In orer to improe

reliability a exibility, they esige processes a systems to eal with

the ofte-perceive iexibility of steelmakig. They combie e-to-e

scheuling capability ith materials esign an continuous many-to-many

inentory allocation. This gies the steelmaker many more angles to eal

ith eman compleities an prouction constraints.

I the miig iustry, these challeges are ofte more proouce. Miig

operatios, processig a trasportatio are ofte withi ifferet ivi-

sios of a compay or busiess uit, ihibitig itegratio a cross-value-

chain planning. Some companies are no recogniing this an beginning

to conceptualie en-to-en planning an control.

Mastering transportation an logistics is often unerestimate as an

opportuity i M&M supply chais. However, these areas ca reuce costa improve efciecy by optimizig the four key corerstoes: customer-

or segmet-specic service levels a costs to serve; the esig of the

logistics etwork; the sourcig of the services; a the loa-balacig a

scheulig of the trasportatio. Too ofte, these elemets are ot cosi-

ere simultaeously, automate or optimize, leaig to excessive costs

or etene lea times.

-

7/31/2019 Cscostudy Metal En

18/32

18 the smarter supply chain

The logistics management teams are often not represente in the oerall

Sales a Operatios (S&OP) plaig process, a trasportatio is co-

siere an unconstraine resource at the back-en of the process. This

creates situations in hich logistic managers are surprise by last-minute

requests to locate transportation resources. A multipartner collaboratie

platform for suppliers, customers a logistics proviers that allows ata

synthesis an ecision support is critical for success.

To reuce excess freight costs, logistics represetatives shoul be fully

represente in the S&OP process to obtain a total ie of costs an plans.

This helps companies plan ahea an take into account mi- to long-term

consierations such as transport seasonality an netork esign to opti-

mie their performance.

vISIBILITY IN THE SMARTER SUPPLY CHAIN

As metals an mining supply chain isibility becomes een more challeng-

ing an more critical interconnecteness is funamental. Maintaining

isibility requires greater integration internally an eternally.

Mastering supplier an customer relationships means esigning the

etene supply chain to support corporate strategic goals in eoling

market conitions. A purposeful an formal approach to supply chain

esig, istea of allowig it to evolve ito isolate silos, requires a visio

an blueprint for ho the supply chain shoul interact an interconnect

among its participants an constituencies.

-

7/31/2019 Cscostudy Metal En

19/32

the smarter supply chain

A key compoet of this ewly esige supply chai is eig collab-

oratie relationships ith customers an suppliers across all imensions of

those relatioships esig, forecastig, orers a fulllmet programs

(e.g., veor-maage ivetory). Oce create, these relatioships ca

be etene ith top performing suppliers an selecte best practices

an represente in enterprise resource planning (ERP) an manufacturing

executio systems, with ERP-to-ERP coectios across the etwork.

I a smarter supply chai, visibility a aalysis extes eep from the

maufacturig process istrumetatio to avace busiess itelligece,

eablig aaptive process cotrol, micourse correctios a prouct

esig. Metals chemistry a material characteristics ca, for example, be

analye along ith customer en-use ata to ai in prouct esign at

both the metals an customer companies.

To create more isibility an unerstaning of en-customer behaior an

ema patters, compaies are exteig the value chai. Some com-panies a alue to traitional commoity proucts by offering serices to

their customers over a above the prouct itself. For example,

ArcelorMittal ith its Steel Solutions an Serices group an other compa-

ies that eliver costructio solutios, such as frames a structures,

are offering alue-ae serices relate to otherise commoity-base

proucts.5 These initiaties create both isibility an customer loyalty.

-

7/31/2019 Cscostudy Metal En

20/32

20 the smarter supply chain

ARCELORMITTAL STEEL SOLUTIONS ANdSERvICES GROUP HELPS MAINTAIN vISIBILITY

ANd CUSTOMER INTIMACY

ArcelorMittal is oe of the worls top steel compaies, with more tha

326,000 employees i over 60 coutries, reveues of US$125 billio a

crue steel prouction of 103 million tons.6 The company learne that

growth through acquisitios oes ot always traslate ito healthy, proac-

tive customer relatioships. ArcelorMittal uerstoo that to be a leaer, it

eee smarter relatioships, itercoectig its customers supply chai

plans an requirements ith its on.

To improve its customer-focuse capabilities, the compay create a

worlwie etwork of istributio ceters, steel service ceters, costruc-

tio a fouatio solutios uer a sigle group, calle ArcelorMittal

Steel Solutions an Serices. This entity regroupe an streamline cus-tomer initiaties aroun customer groups segmente by specialie an

complementary markets. Its priorities are to strengthen its position in

Europe, a value to its proucts a services a expa i growth

markets.7

ArcelorMittal Steel Solutios a Services ow operates i more tha 500

facilities i 32 coutries a serves approximately 200,000 customers.8

The iitiative supports a strog, iovative culture that extes importat

serice an logistics offerings to its customers. The organiation has been

able to change the alue it contributes to commercially markete steelproucts in a positie ay. It has helpe ArcelorMittal to increase cus-

tomer loyalty an orke irectly ith customers to generate ne eper-

tise i owstream steel solutios. Most importatly, it has bee able to

alig customers growth a trasformatio projects closely, simultae-

ously beetig its customers a rivig ArcelorMittals ow global

groth strategy.

c

-

7/31/2019 Cscostudy Metal En

21/32

the smarter supply chain

CUSTOMER INTIMACY IN THE SMARTER SUPPLYCHAIN

Smarter supply chais help compaies serve a iverse customer base,

proactiely gathering an analying information to eelop a consensus

forecast an synchroniing supply an eman. The smarter supply chain

uses sophisticate simulatio moels of customer behavior, buyig pat-

terns an market penetration. An unepecte shifts in eman are easily

accommoate because of realtime coectios a exible relatioships

ith suppliers an customers.

A consensus forecast allos companies to use inentory as a strategic

tool to ee service levels a gai market share. A cosesus forecast

is whe all participats i the supply chai suppliers, the mill or mie, a

customers agree o how much prouct they will make, buy or sell. It

inoles integrating forecasting an eman. The ie from the customer

perspectie or market on means moing from a traitional pushmoel, i.e., builig ivetories base o prouctio efciecies, to what

customers nee. Generating a consensus forecast is instrumental for

eman planning accuracy an balancing actual eman ith oerall

costs. M&M companies can also look at the market in an unconstraine

way, usig uassige ivetory for ew market opportuities or uex-

pecte eman. The case for consciously inesting in inentory to grab

market share becomes a separate plaig activity base o justie mar-

kets an economics. Optimiing the prouct mi for the unconstraine

portio is just part of the overall plaig, ot the approach to the etireforecast.

-

7/31/2019 Cscostudy Metal En

22/32

22

Integrating sales allocation ith ynamic supply-eman balancing an

timely eman-rien replenishment is also a crucial step. when capacity

is costraie, maagers ee well-ee allocatio rules to help esure

customer priorities are met. Allocations are establishe an then become

the basis for accurate orer promising an integrate performance man-

agemet. This process is key i meetig customer ema, boilig ow

to how log oes it take you to promise a orer? a, the, how o

you perform against that promise?

By followig a similar forecastig a sales allocatio process, South

Korean steel giant POSCO is able to promise orers in secons that are

accurate 95 percet of the time. This requires a combiatio of process

esig, orgaizatioal chage a systems esig, i both the sales a

operations organiations. POSCO reorganie its sales an marketing

organiation from reporting to the sites an moe them into the corporate

sales ofce. POSCO also took a ew view of its systems, viewig them

holistically, e-to e i the supply chai istea of as iiviual, iscrete

instances.9

the smarter supply chain

-

7/31/2019 Cscostudy Metal En

23/32

the smarter supply chain

GLOBALIzATION IN THE SMARTER SUPPLY CHAIN

Mastering the globaliation of the supply chainrequires a ie-angle ie

of the market an an S&OP process that transcens the typical regional

focus of most steel companies an uses aance ecision-support ana-

lytics an optimiation to automate supply chain transactions. The plan-

ning an scheuling hierarchy an the role of ata an process stanars

are key enablers both to achiee effectieness at iniiual plants an to

cooriate multiple operatios across the globe. Regioal iffereces,

icluig culture, physical isparity, laguage, local regulatio a avail-

ability of skills a leaership, make collaboratio a visibility more if-

cult. The challenge makes the case for stanars an collaboration espite

the aitional barriers cross-continental businesses ehibit.

Successful metals an mining companies are able to enhance their ability

to meet customer requirements by etening capabilities across global

service ceters to meet local ema. ThysseKrupp Steel, for example,is creating a serice moel in the Americas by constructing a netork of

facilities a mill in Brail near ra material sources that prouces an

ships slabs to a Mobile, Alabama facility that rolls a the istributes the

coils to ishig a automotive compoet service ceters close to the

customer bases.10

-

7/31/2019 Cscostudy Metal En

24/32

24 the smarter supply chain

RISK MANAGEMENT IN THE SMARTER SUPPLYCHAIN

Top supply chains lea in integrating process controls in logistics an

operatios, builig compliace programs with suppliers a service pro-

viers, icorporatig risk strategies a mitigatio policies i supply chai

plaig, a usig supply chai evet maagemet techiques with tol-

erances to monitor isruptions. Many of these actiities can be summe

up as top-oor-to-shop-oor itegratio, or i other wors, whe ma-

agement functions share information ith mill or mining operations.

Coectig top oor to shop oor ivolves itegratig eterprise resource

planning (ERP) an manufacturing eecution systems an ERP to ERP

connections across the supplier/customer netork. Risk may manifest

itself most isibly ithin the supply chain planning an scheuling hierar-

chy. Withi the metals a miig supply chai, ifferet maagemet

practices hae ifferent times frames that they affect. Planning is meiumto log term i time; complete i approximate terms; precees actio; a

ema-rive. Scheulig is immeiate to short term; as exact as pos-

sible; precees actio; a is orer-rive. Executio, proucing steel an

llig orers, shoul be exact a cocurret. Risk shoul be cosiere

at all three hierarchy leels.

Companies must be able to sense risk using appropriate healights or

alert sesors. M&M compaies must also have taillights, i.e., a rich, ata-

rien history of past performance that helps them aapt the sensors tochage a pla for future risk. Top-oor-to-shop-oor itegratio is esse-

tial to monitor eents across the ifferent time frames an brige the gap

betwee toays ERP a shop-oor systems to cotrol prouct ow e

to en.

-

7/31/2019 Cscostudy Metal En

25/32

Ho ill supply chains become smarter?

new capabilities a busiess practices are emergig to improve performace for compaies, customers

an the orl itself. Three attributes that escribe ho operations ill improe inclue becoming

istrumete, itercoecte a itelliget.

Instrumented: Automate transactions an smart eices

Uses sesors, actuators, RFId a smart evices to automate trasactios such as ivetory locatio,repleishmet etectio, trasportatio locatio a bottleeck ieticatio

Supports realtime ata collectio a trasparecy from raw material to customer elivery

Interconnected: Optimize ows

Itercompay itegratio of iformatio across the etwork

Collaborative ecisio makig through ecisio support a busiess itelligece startig with the

customer

C-suite risk maagemet programs for itegrate acial cotrols with operatioal performace

monitore an measure

Intelligent: networke plaig, executio a ecisio aalysis

Miig of the collecte ata from operatioal shop-oor systems for use i itelliget preictio moels;

Steelmakers hae run pilots recently in preicting quality problems one or to prouction steps before

they occur

Moels to preict equipmet failure usig shop-oor ata, triggerig prevetive maiteace orers to

aoi unplanne shutons

Simulatio moels to evaluate trae-offs of cost, time, quality, service, carbo a other criteria

Probability-base risk assessmet a preictive aalysis

networke plaig/executio with optimize forecasts a ecisio support

the smarter supply chain

-

7/31/2019 Cscostudy Metal En

26/32

26

CONCLUSION

The prot formula for metals a miig compaies is chagig. Accorig

to may supply chai leaers, icrease globalizatio, cost volatility a

risk are acceleratig the pace of chage. Overall, supply chais will ee

more isibility an ill nee to tip the traitional prouct-oriente moel on

its hea, istea focusig o collaboratig with customers to be more ex-

ible an to rie effectieness in prouction planning an scheuling.

This chage may require some serious reectio o operatioal strategy.

M&M leaers shoul begin asking themseles some tough questions:

do we have eough visibility of our supply chai a customers, a if

we ha more visibility, coul we act o it?

Are we reay for the impeig icrease i iformatio volume, variety

an elocity?

Ho ell is risk factore into our operational ecision making?

Are we cotrollig costs smartly through better strategies, processes

an operations?

Are e managing our customer relationships effectiely? Ho can e

improe our forecasting an inentory planning through better collabo-

ration ith our customers?

How shoul the role of the supply chai orgaizatio, a its leaership,

eole going forar? what ne skills an responsibilities shoul e

eelop no to be effectie leaers in the future?

-

7/31/2019 Cscostudy Metal En

27/32

Getting starte requires informe leaers ho can set the agena for

change an a ision an strategy for hat the company ill become.

Leaers must actively avigate chage, clearly commuicatig simple

goals, a seekig out prove solutios a experiece people to get the

job oe. Successful executio will hopefully move the coversatio from

suriing in the ne metals economy to thriing in it an preparing for thenet ae of change.

Clearly, supply chais have the potetial to become much smarter. But this

ill not happen simply because they can. Smarter supply chains ill

emerge because they must. The challenges that sit at the top of the Chief

Supply Chai Ofcer agea ema it.

conclusion

-

7/31/2019 Cscostudy Metal En

28/32

28

ABOUT IBM GLOBAL BUSINESS SERvICES

With busiess experts i more tha 170 coutries, IBM Global Busiess

Serices proies clients ith eep business process an inustry eper-

tise across 17 iustries, usig iovatio to ietify, create a eliver

value faster. We raw o the full breath of IBM capabilities, staig

behin our aice to help clients implement solutions esigne to elier

business outcomes ith far-reaching impact an sustainable results.

THE IBM INSTITUTE FOR BUSINESS vALUE

The IBM Istitute for Busiess Value, part of IBM Global Busiess Services,

eelops fact-base strategic insights for senior business eecuties

arou critical iustry-specic a cross-iustry issues.

FOR FURTHER INFORMATION

To out more about this stuy, please se a e-mail to the IBM Istitutefor Busiess Value at [email protected], or cotact dirk Claesses, IBM

Global Busiess Services Leaer for the Iustrial Proucts Iustries, at

-

7/31/2019 Cscostudy Metal En

29/32

NOTES ANd SOURCES

The Smarter Supply Chain o the Future: IBM Global Chie Supply Chain Ofcer Study. IBM Institute or

Business Value. January 2009. http://www.ibm.com/supplychainstudy

World Steel in Figures. World Steel Associat ion. 2007.

The term, top supply chains, reers to the subset o our overall survey population that was eatured in: Friscia,

Tony, Kevin OMarah, Debra Homan and Joe Souza. The AMR Research Supply Chain Top 25 or 2008.

AMR Research. 2008.

JTEC panel on knowledge-based systems in Japan. Japanese Technology Evaluation Center. May 1993. http://

www.wtec.org/loyola/kb/ae_nippo.htm; JFE R&D. JFE Technical Report No. 1 October 2003. http://www.

je-steel.co.jp/en/research/report/001/pd/001-09.pd

Schwarz, Stean. Arcelor Mittal Construction new strategy. ArcelorMittals Creating History blog. June 2,

2007. http://www.arcelormittal.tv/season1/blog/2007/06/arcelor_mittal_construction_ne.html; Multi-storey

construction solutions save time. Inline magazine. April 2007. http://www.ruukki.com/www/corporate.ns/Doc

uments/01EF12BC93F9C1EAC22573DE002FD3AF?OpenDocument&lang=1

Urquijo, Gonzalo. Growing AMS3. ArcelorMittal Investor Day presentation. September 11, 2007. http://

s3.amazonaws.com/ppt-download/arcelormittal-growing-am3s-investor-presentation-sept-20074173.pd?Signat

ure=YXOPBCTNBe4MA9kUejJWphFMX0%3D&Expires=1239035357&AWSAccessKeyId=1Z5T9H8PQ39

V6F79V8G2

About ArcelorMittal: Profle. http://www.arcelormittal.com/index.php?lang=en&page=9

ArcelorMittal Products & Services: Steel Service Centres. http://www.arcelormittal.com/index.

php?lang=en&page=731

A solid perormance and a strong uture. POSCO 2001 Annual Report. http://www.posco.com/homepage/

docs/eng/dn/invest/archive/posco_2001AR.pd

Record year or ThyssenKrupp. ThyssenKrupp Press Release. October 7, 2007. http://www.thyssenkrupp.com/

en/presse/presseveranstaltung_rekordjahr.html

-

7/31/2019 Cscostudy Metal En

30/32

-

7/31/2019 Cscostudy Metal En

31/32

-

7/31/2019 Cscostudy Metal En

32/32

Copyright IBM Corporation

IBM Global Services

Route Somers, NY

U.S.A.

Produced in the United States o America

April

All Rights Reserved

IBM, the IBM logo and ibm.com are trademarks

or registered trademarks o International Business

Machines Corporation in the United States, other

countries, or both. I these and other IBM trade-

marked terms are marked on their frst occurrence

in this inormation with a trademark symbol ( or

), these symbols indicate U.S. registered or com-

mon law trademarks owned by IBM at the time thisinormation was published. Such trademarks may als

be registered or common law trademarks in other

countries. A current list o IBM trademarks is availab

on the Web at Copyright and trademark inormatio

at ibm.com/legal/copytrade.shtml

Image cover and page image asbl Atomium

/ Artists Rights Society (ARS), New York / SABAM,

Brussels.

Other company, product and service names may be

trademarks or service marks o others.

Reerences in this publication to IBM products and

services do not imply that IBM intends to make them

available in all countries in which IBM operates.