Cpi Proposal

description

Transcript of Cpi Proposal

1

2

Executive Summary The malt liquor market in Singapore has hit a plateau. In fact in recent years the overall market share has seen a slight but steady decline. This is attributable to many factors. Health conscious consumers, availability of alternative beverages, and a saturated beer market are just to name a few. Another main reason is that beer is not essential to the lives drinkers. It is more of a luxury item used for relaxation and socialization purposes. Most beer drinkers will continue to drink at a similar pace at his or and non-beer-drinkers will continue to abstain from drinking beer. There are not many tangible reasons for consumers to start or stop. With this in mind, particular attention is paid to keeping the current beer consumers happy. The marketing of similar products in different ways attracts different types of consumers for different types of brand images. Asian Pacific Breweries has a large portfolio of brands and brand variants to attract these different consumer bases, helping them to lead the market in Singapore. Within this currently saturated market new product innovations will be crucial in creating and developing new market bases for APB. However, creating new malt liquor products runs the risk of competing with current APB labels. In other words, the market presence of a new beer brand will most likely detract from an existing label and the two will balance each other out for little or no profit. One way to extend the brand name and avoid this competition amongst APB brands is to create a malt liquor label that appeals to a new market, such as females, non-beer drinkers, or the elderly. Another possibility is to extend an APB brand into a completely new product platform, meaning that APB ventures away from malt liquor into another market such as hard liquor, food products, etc. The latter approach will be the basis for this design proposal. The initiative will be to use the strong brand equity of the Tiger label to launch into the snack food market. Since beer drinking is often associated with snacking and socialization, the snack food market will be a stretch for APB but it will still fall in line with the ideals and image of Tiger beer and Tiger drinkers.

3

Table of Contents

I. Current Market Situation

II. SWOT Analysis

III. Business Mission for APB in Singapore

IV. Objectives

V. Strategic Plan

VI. Operational Plan

VII. Final Conclusion

VIII. Appendix

4

I. Current Market Situation Market Situation Alcoholic Beverage Market Malt liquor continues to be the favorite alcoholic beverage of Singapore. However, as the overall sales of alcoholic drinks have remained steady, the malt liquor market, consisting of the beer and stout, has seen a 3.3% decline over the past few years, while wines and spirit sales both increased in the year 2000. The malt liquor total consumption in the country was 750,000 hectoliters in 2000. Within the market, beer sales controlled an 85.9% of sales at the end of 2000, while stout made up the rest at 14.1%. Similar sales figures are predicted for the next few years as well, as intense marketing and promotional strategies will help the market to maintain. With a stagnant population growth rate and just a few major competitors, only slight fluctuations will occur, as the malt liquor market is not particularly susceptible to drastic changes barring any major economic, political, geographical or societal catastrophes. Packaged Food Market The packaged food market in Singapore is quite mature and sophisticated in nature. Product and brand launches are common in order to spur on novelty and ensure market survival. One effect of this is the lack of brand loyalty, as consumers make decisions on value and convenience above all else. An important aspect that is spurring the packaged food market forward in Singapore is the change in consumer lifestyles. People are constantly on the move and don’t always have the time to prepare a meal or even sit down at a restaurant, making packaged food a popular choice that can be eaten just about anywhere and at any time. Product Situation Brand Image APB’s product line is based completely in alcoholic beverages. Furthermore, all of the brands are malt liquor based. The tangible differences between the labels are elements such as flavor, alcohol content, and packaging. However, these elements along with advertising, distribution, and marketing, are essential to create a variety of brand images and thus a variety of target markets for each brand. Tiger, for example, is marketed toward the “modern male”. It is seen as a drink for every man, celebrating the confidence and drive for him to succeed on his own terms. Heineken, on the other hand, is highly regarded as an international brand, available in 170 countries. It is seen with an image of being worldly, cool, intelligent, confident, and at ease. These labels also support different types of events such as music and sports to further distinguish their brand images and market bases,

5

Brands in Singapore Aside from Tiger and Heineken, APB has 38 brands and brand variants in its portfolio. It should be noted that only a few are marketed and distributed in Singapore due to the country’s relatively small market volume. These brands suited to meet consumer needs include Tiger, Heineken, Anchor, Barons, Guinness, Corona, Hooch and Kilkenny, Strongbow, and Monteiths. Competitive Situation Market Shares With its flagship brand Tiger and the world-renowned Heineken, Asian Pacific Breweries dominates the malt liquor market in Singapore, as it controlled 63.3% of the total market share in the year 2000. Competitors, Carlsberg Marketing and United Stout Marketing recorded shares of 18.8% and 14.0%, respectively. Other companies, mostly foreign imports such as Fosters of Australia, had only a 4.0% share. The strongest single brand in Singapore was Tiger, bringing in a 53.3% market share in the year, which tripled the sales of the next closest brand, Carlsberg, at 16.9%. Trends The malt liquor market is seeing more intense competition from various other markets such as imports lagers, wines and spirits. Although imports create nominal competition at this point, their market share continues to increase largely due to the rising popularity amongst working professionals. Also, the younger generation has taken to the trendy image of drinking alcoholic mixers rather than beer. Distribution Situation Distribution Channels APB distributes malt liquor in three distribution channels in Singapore. The Take-Home-Trade (THT) is the name for distribution in supermarkets, provisions, minimarts, and convenience stores. Hotels, pubs, discos, KTVs and restaurants make up what is known as the HORECA channel, and the Traditional-On-Premise segment (TOP) consists of hawker centers, food stalls, and coffee shops. Sales vs. Consumption APB derives significant sales volumes from each of these distribution channels making each one important to their success. The percentage of each channel’s total sales volume is as follows: THT-25% HORECA-30% TOP-45% Although the total sales volume of on premise distribution channels is 75%, the total consumption volume of on premise is 65%. This difference is a result of the higher price that the consumer pays to drink at most on premise locations as opposed to off premise.

6

Macro environment Population Singapore’s population is getting older. Fewer young people getting married and having children. A major cause is the country’s high level of education. Young people are career oriented and don’t usually start families at an early age, which is especially true of women, who are more educated than women from most other Asian countries. The total population of Singapore including non-residents living in the country for more than one year was estimated at 4,163,700 for the year 2002. The resident population was estimated at 3,378,300, a 1.8% increase from 2001. Of the resident population approximately two million are between the ages of 18 and 59. Roughly half of this segment is male, so approximately one million males between 18 and 59 reside in the country. Ethnicity Singapore’s ethnic background is 77.2% Chinese, 14.1% Malay, 7.4% Indian, and 1.3% other. Religiously, the Muslims, who are mostly Malay, make up 14.9% of the population, about 500,000 total residents. This population is important when considering the target market for APB, because Muslims do not drink alcohol. Thus the one million males in the target market age range for APB is reduced to about 850,000. Economy Singapore is a unique market among it Southeast Asian neighbors. Although very small in population, the average consumer has a high degree of spending power. In 2002, the average household income was USD$27,400 per year, which is by far the highest in the region (See Chart A) Many factors contribute to the wealth of this tiny nation. One major factor is its central location within Southeast Asia, making Singapore a hub for transportation, distribution, and communication in the region. The government also plays a strong role. The meritocracy is one which talented students move ahead based on their achievements, helping to push their education levels and their competitiveness in the job market. These factors coupled with the availability of well paying, high-skill employment are what make Singapore uniquely prosperous. Based on income Singapore like most countries has a wide range of population segments, varying from poor, unskilled laborers to self-made multimillionaires. However, most are relatively well off. The wealthy, such as executives and managers of large companies, make up a substantial portion, but Singapore’s largest segment is the middle class. They characterized by a high level of education working in a wide range of employment such as advanced manufacturing, trading and commerce, retailing and office based jobs. Consumer spending Overall, Singaporeans spend most of their money on housing and food, with about S$8 billion being spent on housing and over $7 billion on food in 1997. In order from high expense to low, the list includes restaurants, hotels, leisure, education, transportation, household goods and services, household fuels, health and medical, clothing, communications and alcoholic drinks. Singapore spends over S$1 billion annually on alcohol.

7

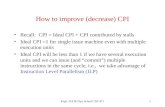

The amount that consumers spend can then be broken down into specific segments such as occupation. The main segments in Singapore include PMEB (professionals, managers, executives, and businessmen), white collar, blue collar, students, NS (National Service), and retired. The highest incidence of drinking is the PMEB, followed by NS, students, blue collar, and white collar. All of these segments are increasing in drinking incidence; except blue collar is staying the same, and white collar is decreasing. Among individual age groups, 25-29 year old account for the highest incidence of drinking and the trend is increasing. 21-24 is the next highest but is stagnant. Those between age 40-49 rank the third highest and are increasing, and those between 30-39 rank fourth and are holding steady. 18-20 year olds while still below the national average have increased their drinking incidence in recent years. Chart A

GDP per capita at PPP (USD), 2002F

27,400

8,1307,590

5,1703,850

3,080 3,4002,190 1,940 2,260

Singapore Malaysia Thailand China Philippines Sri Lanka Indonesia India Pakistan Vietnam

8

II. SWOT Analysis Strengths Powerful Brand Equity The APB brand enjoys a great amount of brand awareness, perceived quality and positive brand association in the International and Singapore market. Tiger, APB’s flagship brand has won 30 international gold medals and awards, the most prominent being the Brewing Industry International Award, UK in 1998. Tiger is also recognized as one of the top five most recognizable Asian brands according to international marketing research in the year 2000. In Singapore APB is a tremendously powerful company, where it is among the top ten value creators in the country. In 2002, APB received the Singapore Brand Award from the International Enterprise Singapore, and finished second to Singapore Airlines in Brand Strength. Strong Portfolio With 40 beer brands and brand variants APB has an impressive and well- balanced portfolio. Two of these brands, Tiger and Heineken are considered world-class brands, and Tiger is recognized as a Singapore icon. Furthermore, APB has done an excellent job in avoiding competition among its own brands by utilizing specific markets and applying unique brand images for the different labels. One example of APB creating a specific market is Anchor beer. It has been reformulated, appealing to a younger generation. It is now smoother and more refreshing, trendy and contemporary. It carries the slogan “Life needs an Anchor.” Large Budget In 2002 APB recorded a net profit of $84.4 million. This was an all time high for the company and a 13.4% increase from the previous year amidst a slumping economy. This large financial resource base allows APB to more freely develop existing markets and venture into new ones. Money is available for innovative strategies and product design that will push APB to a new level. Overall, APB’s resources give them an edge over competitors who are more restricted with spending. Diversified Distribution Channels APB brands can be found just about anywhere in Singapore. Consumers can find these brands in bottles and cans at supermarkets, minimarts and convenience stores. Bottles and draft beers are the most common in hotels, pubs, discos, KTVs and restaurants. Traditional-on-premise (TOP) locations like hawker centers and coffee shops offer bottles as well. Importantly, each of these distribution channels makes up a significant percentage of the overall sales volume for APB, so no single channel is too heavily relied on.

9

Weaknesses Limited Consumer Base The consumer base for APB is limited to Non Muslims, as the Muslim population abstains from drinking alcoholic beverages. Also, APB focuses primarily on the male population. Therefore by excluding non-alcohol drinkers and females, APB significantly reduces their market base. Lack of Innovation Although APB enjoys success from many brands, the company has lacked innovation in their product line. They have worked hard to differentiate their different beer labels but have not extended their powerful brand equity to any new product platforms. Lack of Drinking Culture APBs mission is “to become the leading brewer in the Asia-Pacific region.” The mission is quite limited, in that the focus is strictly on brewing and the malt liquor market. The weakness behind this in relation to the Singapore market is the lack of its true beer drinking culture. Beer is not central to the lives of the APB customer. In fact, 60% of the total market volume is contributed by only 20% of the drinking population, which creates an over dependence on the heavy drinker. “Too many eggs in one basket” As the research figures show, APB relies heavily on its flagship brand, Tiger beer. Although at the present time this is not a problem, as Tiger is well ahead of the competition and has strong brand equity among Singaporean consumers. However, any major threats to the Tiger brand will also create a serious threat to APB, as over 50% of the company’s total sales are generated by this single brand. If Tiger were to take on a rapid decline in sales, APB would have serious financial trouble. Opportunities Exploration and Development of New Markets The tremendous brand equity that APB holds with internationally recognizable brands such as Tiger and Heineken, creates a powerful awareness among a great number of consumers in Singapore. This awareness and perceived quality of APB products gives the company a tremendous opportunity in launching into new product platforms. Since APBs products are presently available in many distribution channels, they already have the locations necessary to sell a new product as well. Innovative products and strategies Having a large amount of investment capital and the desire to push their own boundaries, APB has opportunities that few other companies have in regards to innovation. Such innovations could involve product innovations like new brands, packaging and types of products. Strategies could include new marketing and advertising strategies in order to appeal to completely new market segments.

10

Online Sales In the dawn of the information age the Internet is creating immeasurable possibilities for virtually all companies. An obvious opportunity also lies here for APB. Unique Market in Singapore Like no other Southeast Asian country, Singapore enjoys a great deal of wealth and spending power. This makes the market in Singapore very valuable and profitable for APB. Marketing strategies must be much different here than anywhere else in the region, which allows innovative products and strategies to be developed within this flourishing economy. Threats Increasing Market share among Competitors Although APB holds a strong advantage over their nearest competitor, Carlsberg, brands such as Barons and other Stout variety beers have been increasing in market share as APB has taken a slightly downward turn. Also, a trend in drinking more stylish imports has become apparent in Singapore. Health Conscious Consumers Consumers are now more than ever concerned with health and beauty. The image that beer portrays definitely does not fall in line with this current trend. Beer is often associated with middle-aged men and balding. Alternative Beverages With such health conscious consumers in the marketplace, the trend toward alternative beverages other than beer has increased in recent years. As malt liquor continues to lose market share, wine sales are up. This is in part due to its health appeal and partly because others choose to abstain drinking alcoholic beverages altogether and in favor of beverages such as coffees, sodas, teas, juices, and energy drinks. Saturated Market With the Singapore malt liquor market presently saturated, the opportunity for growth in this market is minimal. At best, APB can expect to hold on to its current market share and hopefully see slight increases over the next several years. However, if APB wishes to see substantial gains in sales in Singapore, innovations outside of this market may be necessary.

11

SWOT Analysis Table

Strengths • Powerful Brand Equity • Strong Portfolio • Large Budget • Diversified Distribution Channels

Weaknesses • Limited Consumer Base • Lack of Innovation • Lack of Drinking Culture • Over dependence on Tiger

beer

Opportunities • Exploration and Development of

New Markets • Innovative Products and

Strategies • Online Sales • Unique Market in Singapore

Threats • Increasing Market Share for

Competitors • Health Conscious Consumers • Alternative Beverages • Saturated Market in

Singapore

Confrontation Matrix

Strengths Weaknesses Powerful

Brand Equity

Strong Portfolio

Large Budget

Diversified Distribution Channels

Limited Consumer

Base

Lack of Innovation

Lack of drinking culture

Over dependence

on Tiger

Opp

ortu

nitie

s

Development of New Markets

Good Good Bad

Innovative Products and

Strategies Good Good Bad

Online Sales Unique

Market in Singapore

Thre

ats

Competitors Market Share

Bad

Health Conscious Consumers

Bad

Alternative Beverages Bad Saturated Market in Singapore

Good Good

12

III Business Mission for APB

“To Become the leading brewer in the Asia Pacific region”

13

IV Objectives This design proposal has two main objectives. One is a short goal and the other is long term The first goal, which is more short term, is to promote Tiger beer by introducing a product that enhances the drinking experience. This promotion will not only encourage the customer to buy the new product, but it will encourage them to drink more Tiger beer as well. If each beer drinker in Singapore were to purchase just two more pitchers of beer in a year, sales would increase by roughly S$15 million. The long-term objective is to innovate a new product platform for Asian Pacific Breweries. This new product platform will explore and develop a new market in Singapore for APB, by extending the strong brand equity of the Tiger label into the snack food market The development of a new product platform is crucial in this stage of business for APB, as the Singapore beer market is presently saturated and no major increases or decreases in overall market share can be foreseen at this time. Therefore, any new additions to the present beer market will only result in detracting from the market share of other APB brands. Thus, the new product platform will explore and develop a new market for APB. The distinction making this new product innovative is the image that it will portray. By allowing the highly successful brand equity of Tiger beer to provide credibility to this new snack product, the consumer will be able to associate it with the drinking experience such as spending time with friends, socialization and enjoyment.

14

V Strategic Plan Target Market The target market is the same as Tiger beer, which is all Non Muslim males in Singapore from age 18 to 59. This target market population is approximately 850,000. Of which approximately one third drink beer so the target market is close to 300,000, about 10% of Singapore’s population Positioning/ Segmentation The new snack products will be positioned as a supplement to beer drinking and therefore targeted mainly to the current APB customer, especially, but not limited to the Tiger beer drinker. As beer consumers often enjoy snacking on foods such as nuts, pretzels and popcorn, this will be a natural extension of the “Tiger” brand name. Product Line/ Consumer wants and needs The product line will be called Tiger Nuts. The brand will be a seasoned assortment of nuts that compliments the flavor and the drinking of beer. Rather than a generic snack for all purposes, this product keeps the wants and needs of the beer drinker as the foremost concern. Brand variants such as Tiger Stix or Tiger Crisps could then be developed based on Tiger Nuts’ success. Pricing Strategy/Cost There will be no cost for the bulk product. The only “cost” would be to fill out an optional survey concerning the product. The individual packages will cost $___ which is in relation to the leading nut brand which sells the same size package for $____. Distribution Strategy/Convenience Distribution will begin with a bulk version available at HORECA on-premise locations that serve draft Tiger beer, mainly in pubs, hotels, and restaurants. Individual packages will be available at selected TOP and THT locations. As the awareness of Tiger Nuts increases, the number of distribution locations will increase as well. Communication Plan The communication of this new snack product will be a simple promotion as not to overwhelm the customer. The importance will be twofold in the beginning. The first will be to inform the Tiger drinker of its existence of Tiger Nuts and allow them the opportunity to try it at little or no cost. Secondly, it will allow the customer to give APB feedback on their approval or disapproval of the product, and any suggestions that they may have.

15

VI Operational Plan In order to bring this proposal to the marketplace, it would first require APB to acquire the means of manufacturing the snack food and packaging. There are several ways that this could be accomplished. Extensive research would be necessary in order to fully realize the best possible means. Some possibilities include:

Purchasing the facilities, machinery, materials, and personnel necessary to manufacture the product. Purchasing a small snack food manufacturer. Hiring a well-known snack food manufacturer to produce the product. Hiring a small snack food manufacturer to produce the product.

All of these possibilities have their strengths and weaknesses, but for this design proposal the most practical means of producing Tiger Nuts would be to hire a small snack food manufacturer. It would not require such great investments as purchasing the necessary production assets or buying another company. Although teaming with a well-known snack food manufacturer is tempting, the snack food company brand will likely not compliment that of Tiger. Even worse the association could damage one or both of the brand images. Therefore to simply hire a smaller manufacturer would be less risky, more cost efficient and capitalize on the Tiger brand as well. The packaging will begin mainly in bulk form, but single serving packages will be test marketed in the introduction phase as well. This packaging must not look identical to Tiger beer packaging, so that the consumer is not confused about what the product is. However it must be reminiscent of Tiger as the brand equity is paramount to this new brand’s success. The display will also be crucial to catching the customer’s eye and will therefore be reminiscent of Tiger beer as well. When introducing Tiger Nuts, there will be two separate means of promoting and test marketing. The two strategies will be promoted simultaneously in order to more quickly find out if one method is more effective than the other. One method will be to give customers free samples in bowls when they purchase a pitcher of Tiger beer at HORECA locations such as hotels, pubs, and minibars. Since Tiger Nuts will have a unique blend of seasonings to compliment the Tiger beer, (and make them more thirsty) the product will actually act as a catalyst to drink more beer. The other method will be to sell the product along side the competition of other snack food brands in selected locations. The price will be the same as the leading competitor. Both methods will provide a simple survey that the customer can voluntarily fill out. The packaged product survey can be sent to the company for a coupon for a free package. Based on sales and the feedback of the customer, APB can then make an informed decision on future plans for Tiger Nuts.

16

VII Final Conclusion In conclusion, a brand extension for APB seems to be a logical move at this point. With profits still increasing in Singapore’s saturated market, it shows that APB customers are willing to stick with their products. It is now time to invest in extending the market to new areas. Snack products present a unique market that correlates with beer drinking and therefore is a natural extension possibility. Not only will this be profitable for APB, but it will also provide a stepping-stone to expand into further markets in the future as well.

17

VIII Appendix Year 2002 APB annual report http://apb.com.sg/report/report02.html Statistics Singapore www.singstat.gov.sg Euromonitor: Global Market Information Database AC Nielson Presentation Asian Pacific Breweries SINAPORE review Questions from the NUS students regarding the “new business development project” Aaker, David A., Managing Brand Equity, (1991). New York, NY: The Free Press NP Group Website www.npsin.com

![Illuminating OpenMP + MPI Performance€¦ · cpi-mpi.c:48 cpi-mpi.c:84 cpi-mpi.c:109 cpi-mpi.c:97 1.0% cpi-mpi [program] main main [OpenMP region O] MPI Finalize MPI Reduce Showing](https://static.fdocuments.in/doc/165x107/6022cc2b9a65990f6b41506f/illuminating-openmp-mpi-performance-cpi-mpic48-cpi-mpic84-cpi-mpic109-cpi-mpic97.jpg)