Thailand Car Sales Statistics Subcompact SUV Segment July 2015

Covering First Quarter 2018 Volume 26, Number 2 … Covering 1Q 18.pdf · Subcompact SUV 4.1 5.5...

-

Upload

hoangthuan -

Category

Documents

-

view

214 -

download

0

Transcript of Covering First Quarter 2018 Volume 26, Number 2 … Covering 1Q 18.pdf · Subcompact SUV 4.1 5.5...

Covering First Quarter 2018 Volume 26, Number 2

Greater Cleveland Auto OutlookSponsored by: Greater Cleveland Automobile Dealers Association

Market Summary

Source: IHS Markit.

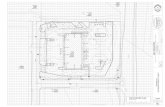

Annual Trend in Area Market

Historical Data Source: IHS Markit.

223713247344

265369 270994 267185 268713 264000

50,000

100,000

150,000

200,000

250,000

300,000

2012 2013 2014 2015 2016 2017 2018Forecast

New

ligh

t veh

icle

regi

stra

tions

YTD '17 YTD '18 % Chg. Mkt. Share

thru Mar. thru Mar. '17 to '18 YTD '18

TOTAL 64,955 65,137 0.3%

Car 22,205 18,538 -16.5% 28.5%

Light Truck 42,750 46,599 9.0% 71.5%

Domestic 36,102 36,027 -0.2% 55.3%

European 3,608 3,844 6.5% 5.9%

Japanese 19,382 19,514 0.7% 30.0%

Korean 5,863 5,752 -1.9% 8.8%

FORECAST

Area New Vehicle Registrations Predicted to Exceed 260K Units in ‘18

Economic growth is solid. The economy has been growing at a re-spectable, albeit less than robust, pace for several years. Most econo-mists expect this trend to continue in 2018. Positives are lower taxes and rising employment. Negatives are increasing interest rates and potential harmful fallout resulting from restrictive trade policies. These negatives should not be enough to derail the economy, however.

Consumer confidence is high. The improving economy, rising in-comes, and ascending net worth have led many consumers to feel upbeat about current and future economic conditions. The volatile stock market and higher borrowing costs are potential concerns for 2018, but baseline consumer sentiment should remain positive.

New vehicles have a lot to offer. From zero emission electric vehicles to every conceivable iteration of SUVs and trucks, manufacturers are serving up an impressive array of new vehicles. And these new models are packed with driver assistance and infotainment technologies that make the average 10 year old vehicle on the road seem obsolete.

Key factors providing a boostto new vehicle sales

Consumer affordability is weakening. Low interest rates, steady (if not spectacular) household income growth and high incentives com-bined to keep new vehicle affordability strong for many years. But this scenario is changing. Higher loan rates are boosting monthly finance and lease payments, which will keep some new vehicle shoppers on the sidelines.

Used vehicle values are softening. Improving supplies of used cars and trucks and increasing off-lease volumes are likely to put a mild damper on new vehicle sales in two ways. First, trade in values will soften, increasing net transaction prices. And second, lower used ve-hicle prices will entice some consumers to purchase used vehicles instead of new.

Pent up demand is waning. The area new vehicle market posted steady and significant gains between 2009 and 2015, but there is a ceiling on high how sales can go. As shown on the graph to the left, the market has plateaued during the past two years and is likely to drift lower in 2018.

Key factors holding backnew vehicle sales

Domestics consist of vehicles sold by GM, Ford, FCA (excluding Alfa and FIAT), and Tesla. Historical figures were revised by IHS Markit and will differ slightly from those shown in previous releases. *Figures for March ‘18 were estimated by Auto Outlook.

The graph above shows annual new retail light vehicle registrations in the area from 2012 thru 2017 and Auto Outlook’s projection for 2018.

Page 2 Greater Cleveland Auto Outlook

61,154

65,137

0 10,000 20,000 30,000 40,000 50,000 60,000 70,000

1Q avg.('13 to '17)

1Q '18

Quarterly new retail light vehicle registrations

Q2 '17 Q3 '17 Q4 '17 Q1 '18*

Area 0.8% -0.6% -0.8% 0.3%

U.S. -1.0% -2.8% 0.6% 0.7%

-10.0%

-7.5%

-5.0%

-2.5%

0.0%

2.5%

5.0%

7.5%

10.0%

% c

hang

e ve

rsus

yea

r ear

lier

Greater ClevelandAuto Outlook

First Quarter 2018

Published by:Auto Outlook, Inc.

PO Box 390Exton, PA 19341

Phone: 800-206-0102EMail: [email protected]

Editor: Jeffrey A. Foltz

Reproduction, including photocopying of this publication in whole or in part, is prohibited without the express per-mission of Auto Outlook, Inc. Any material quoted must be attributed to Greater Cleveland Auto Outlook, published by Auto Outlook, Inc. on behalf of the Greater Cleveland Au-tomobile Dealers Association, and must also include the statement: “Data Source: IHS Markit.” Unforeseen events may affect the forecast projections. Consequently, Auto Outlook is not responsible for management decisions based on the content of Greater Cleveland Auto Outlook.

Area Market U.S. Market

Percent change in registrations

YTD '18 thru Mar.* vs. YTD '170.3% 0.7%

Passenger car market share

YTD '18 thru Mar.*28.5% 31.5%

Domestic brand market share

YTD '18 thru Mar.*55.3% 42.5%

Top 10 brands and market share

YTD '18 thru Mar.*

First Chevrolet 15.3% Toyota 13.0%

Second Ford 14.4% Ford 11.8%

Third Jeep 8.7% Chevrolet 11.6%

Fourth Honda 8.1% Honda 9.7%

Fifth Toyota 7.6% Nissan 6.8%

Sixth Nissan 4.9% Jeep 6.3%

Seventh Kia 4.9% Subaru 4.4%

Eighth Subaru 4.5% Kia 3.5%

Ninth GMC 4.4% GMC 3.5%

Tenth Hyundai 3.9% Hyundai 3.3%

*March 2018 figures estimated by Auto Outlook Source: IHS Markit

QUARTERLY TREND

Percent Change in Area and U.S. New Vehicle Market

MARKET TRACKER: QUARTERLY RESULTS

Area Registrations Remained Strong in 1Q ‘18

QUARTERLY PERSPECTIVE

1Q 2018 Registrations Versus Average for Previous Five Years

* Figures for the First Quarter of 2018 were estimated by Auto Outlook based on data for January and February. Source: IHS Markit.

MARKET TRACKER: AREA MARKET VERSUS U.S.

Area Car Market Share Falls to 28.5%

* Figures for 1Q 2018 were estimated by Auto Outlook based on data for January and February. Source: IHS Markit.

Area registrations exceeded the average for the previous five years in the First Quarter of this year.

The area and U.S. markets increased slightly in 1Q ‘18.

Covering First Quarter 2018 Page 3

0.0%

0.2%

0.4%

0.6%

0.8%

1.0%

1.2%

1.4%

Q215

Q315

Q415

Q116

Q216

Q316

Q416

Q117

Q217

Q317

Q417

Q118*

Mar

ket S

hare

Hybrid Plug In Hybrid Electric

New Retail Hybrid and Electric Vehicle Registrations

Top 10 Selling Models in Area - YTD '18 thru February

Rank Model Regs.

1 Toyota Prius 98

2 Toyota RAV4 70

3 Kia Niro 61

4 Ford Fusion 49

5 Toyota Camry 38

6 Ford C-Max 26

7 Hyundai Ioniq 24

8 Toyota Highlander 21

9 Tesla Model S 20

10 Honda Accord 20

MARKET TRACKER - SEGMENTS

Compact and Mid Size SUV Segments Rank First and Second

The table above shows Cleveland area market share for 20 vehicle segments during the first two months of 2017 and 2018, and the change in market share over the period. The best selling model in each segment is also shown. Segments are ranked from top to bottom based on 2018 share. Data Source: IHS Markit.

The graph above shows hybrid powertrain and electric vehicle quarterly market share in the area. *First Quarter 2018 includes January and February. Source: IHS Markit.

MARKET TRACKER: HYBRID AND ELECTRIC VEHICLES

Prius and RAV4 are Top Sellers in Hybrid/Electric Market

Hybrid/electric vehicle market share in Q1 ‘18:

1.6%

Quarterly Alternative Powertrain Market Share(includes hybrid and electric vehicles)

Greater Cleveland Area Segment Market Share Review

SegmentMarket Share

YTD ‘17 thru FebruaryMarket Share

YTD ‘18 thru FebruaryChange in shareYTD ‘17 to ‘18

Best selling modelin segment

Compact SUV 26.9 28.2 1.3 Chevrolet Equinox

Mid Size SUV 13.7 14.6 0.9 Jeep Grand Cherokee

Full Size Pickup 11.2 12.6 1.4 Ford F Series

Compact Car 15.0 11.5 -3.5 Honda Civic

Mid Size Car 10.3 7.8 -2.5 Ford Fusion

Subcompact SUV 4.1 5.5 1.4 Chevrolet Trax

Mini Van 2.6 2.6 0.0 Chrysler Pacifica

Subcompact Car 2.3 2.3 0.0 Kia Soul

Luxury Mid Size SUV 2.2 2.1 -0.1 Cadillac XT5/SRX

Near Luxury Car 1.8 1.9 0.1 BMW 3-Series

Compact/Mid-Size Pickup 1.5 1.8 0.3 Toyota Tacoma

Large Car 1.9 1.8 -0.1 Dodge Charger

Luxury Compact SUV 1.4 1.8 0.4 Lincoln MKC

Large Van 1.1 1.4 0.3 Ford Transit Connect Van

Luxury and High-end Sports Cars 1.3 1.3 0.0 BMW 5-Series

Large SUV 1.1 1.1 0.0 Chevrolet Tahoe

Sports/Pony cars 0.8 0.7 -0.1 Dodge Challenger

Luxury Large SUV 0.4 0.5 0.1 Land Rover Range Rover

Entry Luxury Car 0.2 0.2 0.0 Mercedes CLA-Class

Luxury Subcompact SUV 0.3 0.2 -0.1 BMW X1

Page 4 Greater Cleveland Auto Outlook

The table above shows new retail light vehicle (car and light truck) registrations in the Greater Cleveland area market. Figures are shown for the First Quarters of 2017 and 2018, and annual totals for 2016 and 2017. The top ten ranked brands in each category are shaded yellow.

Brand Registrations ReportGreater Cleveland Area New Retail Car and Light Truck Registrations

First Quarter* Anuual Totals

Registrations Market Share (%) Registrations Market Share (%)

1Q '17 1Q '18 % change 1Q '17 1Q '18 Change 2016 2017 % change 2016 2017 Change

TOTAL 64,955 65,137 0.3 267,185 268,713 0.6

Cars 22,205 18,538 -16.5 34.2 28.5 -5.7 101,769 90,239 -11.3 38.1 33.6 -4.5

Light Trucks 42,750 46,599 9.0 65.8 71.5 5.7 165,416 178,474 7.9 61.9 66.4 4.5

Domestic Brands 36,102 36,027 -0.2 55.6 55.3 -0.3 143,358 144,567 0.8 53.7 53.8 0.1

European Brands 3,608 3,844 6.5 5.6 5.9 0.3 16,218 16,221 0.0 6.1 6.0 -0.1

Japanese Brands 19,382 19,514 0.7 29.8 30.0 0.2 83,499 83,733 0.3 31.3 31.2 -0.1

Korean Brands 5,863 5,752 -1.9 9.0 8.8 -0.2 24,110 24,192 0.3 9.0 9.0 0.0

Acura 330 378 14.5 0.5 0.6 0.1 1,734 1,742 0.5 0.6 0.6 0.0

Alfa Romeo 7 61 771.4 0.0 0.1 0.1 3 155 5066.7 0.0 0.1 0.1

Audi 374 358 -4.3 0.6 0.5 -0.1 1,800 1,846 2.6 0.7 0.7 0.0

BMW 571 650 13.8 0.9 1.0 0.1 2,926 2,571 -12.1 1.1 1.0 -0.1

Buick 2,017 2,062 2.2 3.1 3.2 0.1 7,183 8,323 15.9 2.7 3.1 0.4

Cadillac 682 748 9.7 1.0 1.1 0.1 3,336 3,278 -1.7 1.2 1.2 0.0

Chevrolet 10,353 9,974 -3.7 15.9 15.3 -0.6 39,542 40,738 3.0 14.8 15.2 0.4

Chrysler 932 972 4.3 1.4 1.5 0.1 5,205 3,750 -28.0 1.9 1.4 -0.5

Dodge 1,789 1,645 -8.0 2.8 2.5 -0.3 6,157 6,371 3.5 2.3 2.4 0.1

FIAT 60 29 -51.7 0.1 0.0 -0.1 361 255 -29.4 0.1 0.1 0.0

Ford 10,213 9,401 -8.0 15.7 14.4 -1.3 41,216 40,638 -1.4 15.4 15.1 -0.3

Genesis 56 57 1.8 0.1 0.1 0.0 50 244 388.0 0.0 0.1 0.1

GMC 2,688 2,877 7.0 4.1 4.4 0.3 9,905 10,467 5.7 3.7 3.9 0.2

Honda 5,559 5,277 -5.1 8.6 8.1 -0.5 24,655 24,872 0.9 9.2 9.3 0.1

Hyundai 2,667 2,526 -5.3 4.1 3.9 -0.2 9,968 10,629 6.6 3.7 4.0 0.3

Infiniti 382 323 -15.4 0.6 0.5 -0.1 1,682 1,585 -5.8 0.6 0.6 0.0

Jaguar 97 65 -33.0 0.1 0.1 0.0 261 318 21.8 0.1 0.1 0.0

Jeep 4,678 5,687 21.6 7.2 8.7 1.5 20,041 19,688 -1.8 7.5 7.3 -0.2

Kia 3,140 3,169 0.9 4.8 4.9 0.1 14,092 13,319 -5.5 5.3 5.0 -0.3

Land Rover 130 186 43.1 0.2 0.3 0.1 552 534 -3.3 0.2 0.2 0.0

Lexus 520 565 8.7 0.8 0.9 0.1 2,709 2,635 -2.7 1.0 1.0 0.0

Lincoln 719 573 -20.3 1.1 0.9 -0.2 2,989 2,959 -1.0 1.1 1.1 0.0

Maserati 20 14 -30.0 0.0 0.0 0.0 64 105 64.1 0.0 0.0 0.0

Mazda 1,248 1,471 17.9 1.9 2.3 0.4 4,803 5,183 7.9 1.8 1.9 0.1

Mercedes 784 738 -5.9 1.2 1.1 -0.1 3,724 3,412 -8.4 1.4 1.3 -0.1

MINI 92 87 -5.4 0.1 0.1 0.0 467 489 4.7 0.2 0.2 0.0

Mitsubishi 327 409 25.1 0.5 0.6 0.1 1,464 1,377 -5.9 0.5 0.5 0.0

Nissan 3,471 3,215 -7.4 5.3 4.9 -0.4 13,627 13,877 1.8 5.1 5.2 0.1

Other 21 15 -28.6 0.0 0.0 0.0 108 91 -15.7 0.0 0.0 0.0

Porsche 107 118 10.3 0.2 0.2 0.0 494 529 7.1 0.2 0.2 0.0

Ram 1,989 2,031 2.1 3.1 3.1 0.0 7,580 8,121 7.1 2.8 3.0 0.2

Subaru 2,772 2,914 5.1 4.3 4.5 0.2 10,742 11,254 4.8 4.0 4.2 0.2

Tesla 38 55 44.7 0.1 0.1 0.0 193 222 15.0 0.1 0.1 0.0

Toyota 4,770 4,959 4.0 7.3 7.6 0.3 22,070 21,191 -4.0 8.3 7.9 -0.4

Volkswagen 1,148 1,281 11.6 1.8 2.0 0.2 4,726 5,126 8.5 1.8 1.9 0.1

Volvo 204 247 21.1 0.3 0.4 0.1 756 819 8.3 0.3 0.3 0.0

*March 2018 figures were estimated by Auto Outlook.Source: IHS Markit

Covering First Quarter 2018 Page 5

-15.4%

-7.4%

-5.3%

-5.1%

0.9%

1.8%

4.0%

5.1%

8.7%

14.5%

17.9%

25.1%

-51.7%

-33.0%

-30.0%

-5.9%

-5.4%

-4.3%

10.3%

11.6%

13.8%

21.1%

43.1%

-20.3%

-8.0%

-8.0%

-3.7%

2.1%

2.2%

4.3%

7.0%

9.7%

21.6%

-60.0% -40.0% -20.0% 0.0% 20.0% 40.0% 60.0%

Infiniti

Nissan

Hyundai

Honda

Kia

Genesis

Toyota

Subaru

Lexus

Acura

Mazda

Mitsubishi

FIAT

Jaguar

Maserati

Mercedes

MINI

Audi

Porsche

Volkswagen

BMW

Volvo

Land Rover

Lincoln

Dodge

Ford

Chevrolet

Ram

Buick

Chrysler

GMC

Cadillac

Jeep

BRAND SCOREBOARD - PART ONE

Land Rover Has Largest Percentage Gain in First Quarter 2018

*Figures for March, 2018 were estimated by Auto Outlook. Source: IHS Markit.

Percent Change in Area New Retail Light Vehicle RegistrationsYTD 2018 thru March* vs. YTD 2017

The graph below provides a comparative evaluation of brand sales performance in the area market. It shows the year-to-date percent change in reg-istrations for each brand, organized by category (i.e., Detroit Three, European, and Asian).

Detroit Three BrandsLargest % increases in 2018:

Jeep and Cadillac

European BrandsLargest % increases in 2018:

Land Rover and Volvo

Asian BrandsLargest % increases in 2018:

Mitsubishi and Mazda

Page 6 Greater Cleveland Auto Outlook

4.6

4.7

5.7

7.3

8.3

9.6

11.6

12.9

13.6

16.4

0.0 5.0 10.0 15.0 20.0

Volvo

Land Rover

Infiniti

Audi

Acura

BMW

Mercedes

Lincoln

Lexus

Cadillac

Share of luxury light truck market (%)

2.9

3.7

5.7

5.8

8.4

9.4

10.3

11.2

17.0

17.2

0.0 5.0 10.0 15.0 20.0

Genesis

Volvo

Infiniti

Acura

Lexus

Audi

Lincoln

Cadillac

BMW

Mercedes

Share of luxury car market (%)

3.6

4.8

5.2

5.5

6.7

6.9

7.1

12.3

17.4

17.5

0.0 5.0 10.0 15.0 20.0

Buick

Subaru

Ram

Nissan

GMC

Toyota

Honda

Jeep

Ford

Chevrolet

Share of non luxury light truck market (%)

2.5

4.8

4.8

5.5

8.1

11.3

12.2

14.2

14.6

15.6

0.0 5.0 10.0 15.0 20.0

Dodge

Subaru

Volkswagen

Nissan

Hyundai

Toyota

Kia

Ford

Chevrolet

Honda

Share of non luxury car market (%)

BRAND SCOREBOARD - PART TWO

Brand Market Share Leaders in Primary Segments

Top 10 Non Luxury Car Brands in Area MarketOctober 2017 thru March 2018*

Top 10 Luxury Car Brands in Area MarketOctober 2017 thru March 2018*

Top 10 Non Luxury Light Truck Brands in Area MarketOctober 2017 thru March 2018*

Top 10 Luxury Light Truck Brands in Area MarketOctober 2017 thru March 2018*

Leading Car Brands

Non Luxury: Honda, Chevrolet, and FordLuxury: Mercedes, BMW, and Cadillac

Leading Light Truck Brands

Non Luxury: Chevrolet, Ford, and JeepLuxury: Cadillac, Lexus, and Lincoln

Source: IHS Markit. *Figures for March, 2018 were estimated.

Source: IHS Markit. *Figures for March, 2018 were estimated.

Covering First Quarter 2018 Page 7

0.6%

1.9%

2.1%

0.9%

0.9%

2.3%

2.1%

2.0%

2.8%

1.6%

3.3%

3.5%

4.4%

3.5%

6.8%

13.0%

9.7%

6.3%

11.8%

11.6%

0.9%

1.0%

1.1%

1.1%

1.5%

2.0%

2.3%

2.5%

3.1%

3.2%

3.9%

4.4%

4.5%

4.9%

4.9%

7.6%

8.1%

8.7%

14.4%

15.3%

0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0%

Lincoln

BMW

Mercedes

Cadillac

Chrysler

Volkswagen

Mazda

Dodge

Ram

Buick

Hyundai

GMC

Subaru

Kia

Nissan

Toyota

Honda

Jeep

Ford

Chevrolet

Market Share

Area

U.S.

The graph below provides a comparison of Cleveland Area and U.S. new retail market share during the first three months of this year for the top 20 selling brands in the area. Brands are positioned on the graph from top to bottom based on area market share. Chevrolet was the area leader, ac-counting for 15.3% of the market, well above its 11.6% share in the Nation.

BRAND SCOREBOARD - PART THREE

Chevrolet, Ford, and Jeep Area Shares are Well Above U.S.

Area and U.S. Market Share - YTD 2018 thru March*

*Figures for March, 2018 were estimated. Source: IHS Markit.

Chevrolet, Ford, and Jeep area market shares were well above U.S. levels.

Page 8 Greater Cleveland Auto Outlook

-60%

0%

60%

120%

180%

-5000

0

5000

10000

15000

Perc

ent c

hang

e in

regi

stra

tions

-20

12 to

201

7 (b

lue

bars

)

Unit

chan

ge in

regi

stra

tions

-20

12 to

201

7 (o

rang

e ba

rs)

BRAND SCOREBOARD - PART FOUR

Chevrolet, Jeep, Subaru, & Ram Have Big Gains In Past 5 Years

The graph below provides a balanced ap-praisal of brand sales performance in the Cleveland area market during the past five years. It shows both the unit change in reg-istrations between 2012 and 2017 (orange bars) and the percent change (blue bars) for the top 20 selling brands in 2017. Viewing both indicators on the same graph makes it easier to identify brands that have posted sig-nificant and consistent gains during the past five years. Only six brands had a decline in registrations during the five year period.

30 percentEight brands had increases of greater than 30%: Ram, Jeep, Subaru, Buick, Lincoln, GMC, Chevrolet, and Nissan.

3,000 unitsEight brands had increases of greater than 3,000 units: Chev-rolet, Jeep, Subaru, Ram, GMC, Honda, Buick, and Nissan.

Five Year Unit and Percent Change in Area New Retail Light Vehicle Registrations (Top 20 Brands)2017 vs. 2012

Source: IHS Markit.

Blue bars show percent change in registrations

Orange bars show unit change in registrations

Covering First Quarter 2018 Page 9

Chevrolet Cruze

Ford Fusion

Buick Encore

Ford Escape

Honda CR-V

Honda Civic

Jeep Grand Cherokee

Jeep Cherokee

Chevrolet Equinox

Toyota Camry

GMC Terrain

Subaru Forester

Ford F Series

Chevrolet Silverado

Nissan Rogue

Ram Pickup

Kia Forte

Toyota RAV4

Ford Explorer

Chevrolet Trax

Hyundai Elantra

Jeep Wrangler

Chevrolet Traverse

Jeep Compass

Chrysler Pacifica

-25 -20 -15 -10 -5 0 5 10 15 20 25

MODEL RANKINGS

Pacifica, Compass, and Traverse Move Up in Rankings

The graph below shows the change in rankings during the first two months of 2017 to the same period this year for the top 25 selling models in the Greater Cleveland Area market. Models are positioned on the graph from top to bottom based on the change in rankings. The biggest gainer was the Chrysler Pacifica. Other big winners were Jeep Compass, Chevrolet Traverse, and Jeep Wrangler

Source: IHS Markit.

Change in rankings from YTD ‘17 to YTD ‘18

Models on this side moved down in the rankings Models on this side of the graph moved up in the rankings

Chrysler Pacifica moved up 14 positions. It was the 39th best seller during the first two months of ‘17, and moved up to 25th this year.

Change in Rankings for Top 25 Selling Models - YTD ‘17 thru February to YTD ‘18

Page 10 Greater Cleveland Auto Outlook

0

20

40

60

80

100

120

'09 '10 '11 '12 '13 '14 '15 '16 '17 1Q '18

Cons

umer

sen

timen

t

Years

Three Key Factors Impacting New Vehicle Sales

Factor The numbers...Primary

conclusion...

What it means for new vehicle

sales...

Consumer Sentiment

Consumer sentiment in-dex increased to 98.9 thru

March of 2018, up from 91.8 in 2016 and 63.8 in

2008.

Strong consumer sentiment will pro-vide a boost to the new vehicle market

Household Net Worth Household net

worth was a record $96.3

trillion in 2017, up more than 87% from

2009.

Rising household net worth will pro-vide a boost to the new vehicle market

Labor Market Area unem-

ployment rate declined vs.

year ear-lier in each of the past six

months

Total employment has increased, but

further gains will be harder to come by.

Bottom line: new vehicle market should remain strong despite mild softening

Univ. of Michigan Consumer Sentiment Index

U.S. Household Net Worth

Change in area unemployment rate vs. Same month year earlier

0.0

20.0

40.0

60.0

80.0

100.0

'08 '09 '10 '11 '12 '13 '14 '15 '16 '17

Hous

ehol

d ne

t wor

th (t

rillio

ns o

f $'s

)

Years

-1.0

-0.5

0.0

0.5

1.0

Mar

-17

Apr-1

7

May

-17

Jun-

17

Jul-1

7

Aug-

17

Sep-

17

Oct-1

7

Nov-

17

Dec-

17

Jan-

18

Feb-

18

Chan

ge in

une

mpl

oym

ent r

ate

Months

Covering First Quarter 2018 Page 11

COUNTY SCOREBOARD

Huron County Had Largest Percentage Gain in Early 2018

The tables above show new retail light vehicle registrations. Top five ranked counties in each category are shaded. Data Source: IHS Markit.

COUNTY MARKETS SUMMARY - PART 1

YTD registrations thru February Percent Change Unit Change Light Truck Market Share (%)

YTD

2017

YTD

2018

YTD '17 to

YTD '18

YTD '17 to

YTD '18

YTD

2017

YTD

2018

YTD '17 to

YTD '18Allen 521 525 0.8% 4 61.8 67.2 5.4Ashland 326 319 -2.1% -7 71.2 76.8 5.6Ashtabula 484 484 0.0% 0 75.8 78.5 2.7Carroll 136 128 -5.9% -8 83.1 85.2 2.1Coshocton 151 122 -19.2% -29 78.8 84.4 5.6Cuyahoga 9,807 9,235 -5.8% -572 60.0 66.4 6.4Erie 710 631 -11.1% -79 67.5 74.5 7.0Geauga 886 900 1.6% 14 76.2 81.8 5.6Hancock 476 477 0.2% 1 67.9 74.0 6.1Holmes 147 134 -8.8% -13 84.4 88.8 4.4Huron 389 430 10.5% 41 68.9 75.1 6.2Lake 2,088 2,203 5.5% 115 68.4 72.1 3.7Lorain 2,689 2,482 -7.7% -207 66.8 72.2 5.4Lucas 3,056 3,006 -1.6% -50 70.9 75.7 4.8Mahoning 2,476 2,167 -12.5% -309 65.0 74.3 9.3Medina 1,945 1,886 -3.0% -59 67.5 75.2 7.7Portage 1,301 1,258 -3.3% -43 69.6 74.6 5.0Richland 711 640 -10.0% -71 70.6 76.7 6.1Stark 2,337 2,369 1.4% 32 69.1 74.3 5.2Summit 4,178 4,282 2.5% 104 64.1 70.3 6.2Trumbull 2,134 1,727 -19.1% -407 69.0 76.3 7.3Tuscarawas 489 420 -14.1% -69 73.8 80.7 6.9Wayne 589 636 8.0% 47 74.4 78.1 3.7Wood 994 926 -6.8% -68 72.3 76.8 4.5

COUNTY MARKETS SUMMARY - PART 2

Market Share Summary - YTD thru February

Domestic Brands Top Ten Selling Brands in Area

YTD

2017

YTD

2018

Change

'17 to '18 Chevrolet Ford Jeep Honda Toyota Kia Nissan Subaru GMC HyundaiAllen 56.6 57.9 1.3 7.2 35.6 3.8 12.2 10.3 7.2 3.2 1.9 2.7 2.5Ashland 65.6 72.7 7.1 18.5 24.1 8.5 5.3 4.4 3.8 5.0 3.1 5.3 1.6Ashtabula 59.3 54.3 -5.0 16.5 10.1 7.6 10.7 9.7 4.3 3.1 5.0 6.0 6.4Carroll 72.1 64.1 -8.0 18.8 24.2 9.4 6.3 5.5 1.6 2.3 14.1 4.7 0.0Coshocton 58.9 63.9 5.0 13.1 26.2 6.6 11.5 7.4 2.5 4.9 2.5 3.3 2.5Cuyahoga 44.2 42.8 -1.4 9.2 11.1 8.1 8.4 9.8 6.2 6.6 6.5 3.8 4.4Erie 74.9 67.2 -7.7 22.8 24.2 7.1 11.4 5.5 6.3 1.3 2.1 2.5 1.7Geauga 51.9 53.8 1.9 11.9 13.6 11.6 9.4 7.3 4.3 3.9 6.7 5.6 2.0Hancock 61.8 54.3 -7.5 13.4 18.2 6.5 11.1 3.8 6.7 7.1 3.8 6.1 3.8Holmes 79.6 76.9 -2.7 14.2 34.3 10.4 6.7 6.0 2.2 1.5 0.0 5.2 1.5Huron 72.2 75.6 3.4 30.2 17.7 9.3 7.4 2.8 5.1 0.7 0.7 2.6 5.6Lake 45.7 47.7 2.0 11.4 10.3 9.7 9.5 8.7 5.8 4.5 7.4 5.0 3.9Lorain 63.9 61.4 -2.5 14.6 23.6 6.8 5.9 7.1 5.2 6.0 3.4 5.4 2.5Lucas 66.7 67.4 0.7 10.1 13.9 15.1 8.6 4.9 4.5 3.3 2.0 4.0 2.4Mahoning 72.7 65.1 -7.6 30.3 11.1 4.4 4.2 6.1 3.9 4.6 5.8 9.2 2.4Medina 55.7 55.9 0.2 13.7 13.0 9.9 5.9 9.1 5.0 4.1 5.4 5.5 2.8Portage 59.6 59.5 -0.1 17.5 17.4 9.8 6.3 7.4 6.2 3.4 4.2 2.1 5.3Richland 64.6 66.4 1.8 25.3 13.8 9.5 7.0 9.1 4.1 4.2 1.4 6.3 3.4Stark 58.5 53.9 -4.6 14.6 17.0 8.8 9.2 6.1 4.8 5.1 5.0 3.5 4.7Summit 48.8 47.8 -1.0 12.0 12.5 8.7 8.7 8.3 4.4 5.5 5.1 3.5 6.5Trumbull 77.7 72.0 -5.7 36.9 11.6 5.1 5.3 6.4 3.6 3.4 3.0 8.6 1.5Tuscarawas 54.2 53.6 -0.6 13.3 18.6 6.9 11.4 7.1 4.0 9.5 3.1 4.8 2.9Wayne 65.5 61.5 -4.0 22.2 15.4 9.1 10.1 8.0 4.1 2.4 4.1 2.8 1.4Wood 65.5 65.1 -0.4 12.6 14.6 11.7 9.5 5.6 3.7 3.3 2.4 5.5 3.0

Page 12 Greater Cleveland Auto Outlook

7.9%

2.6%

2.8%

3.0%

4.1%

4.3%

4.4%

4.6%

5.5%

5.8%

6.7%

7.5%

7.6%

9.1%

11.6%

12.5%

0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0%

Others

Dodge Durango

Toyota 4 Runner

Buick Envision

Dodge Journey

Buick Enclave

Hyundai Santa Fe Sport

Kia Sorento

Honda Pilot

Toyota Highlander

GMC Acadia

Ford Edge

Subaru Outback

Chevrolet Traverse

Ford Explorer

Jeep Grand Cherokee

Share of Mid Size SUV Segment

Greater Cleveland Auto Outlook

Greater Cleveland Auto Outlook is distributed free of charge to all members of the Greater Cleveland Automobile Deal-ers Association. The publication is sponsored and supported by GCADA.

Greater Cleveland Auto Outlook is published and edited by Auto Outlook, Inc., an independent automotive market research firm. Opinions expressed in Greater Cleveland Auto Outlook are solely those of Auto Outlook, Inc., and are not necessarily shared by GCADA.

Greater Cleveland Automobile Dealers Association

10100 Brecksville RoadBrecksville, OH 44141

440-746-1500www.gcada.org

Copyright Auto Outlook, Inc. April 2018

MID SIZE SUV SEGMENT

Grand Cherokee is Best-Selling Mid Size SUV in Area Market

Source: IHS Markit.

Share of Greater Cleveland Area Mid Size Suv SegmentPrevious Six Months (Sept. 2017 thru Feb. 2018)

TOP SELLING MID SIZE SUVSJeep Grand Cherokee

Ford Explorer

Chevrolet Traverse