Absorption costing, Activity Based Costing & Standard Costing

Costing Sagar Patil Final

-

Upload

sagar-patil -

Category

Documents

-

view

224 -

download

3

description

Transcript of Costing Sagar Patil Final

“Process Costing With Special Reference To

Interprocess Profits & Equivalent Production”

A PROJECT REPORT SUBMITTED TO UNIVERSITY OF MUMBAI IN

PARTIAL FULFILLMENT OF THE REQUIREMENT FOR M.COM

SEMESTER 1

IN SUBJECT OF ADVANCE COST ACCOUNTING

BY

NAME OF THE STUDENT: SAGAR MADAN PATIL

ROLL NO: 15-9533

COLLEGE NAME: K.V.PENDHARKAR COLLEGE

BATCH : 2015-2016

DECLARATION BY STUDENT

I SAGAR MADAN PATIL, ROLL NO.15-9533, The student of M.Com

(Accountancy) Semester1(2015), K.V.PNDHARKAR COLLEGE,

Affiliated to University of Mumbai, hereby declare that the project

for the

Subject of ADVANCE COST ACCOUNTING

“Process Costing With Special Reference To

Interprocess Profits & Equivalent Production”

Submitted by me to University of Mumbai, for Semester - I

examination is based on actual work carried by me.

I further state that this work is original and not submitted anywhere

else for any examination.

Place : Dombivli Signature Of The Student

Date :

Roll No : 15-9533

Name: Sagar Madan Patil

ACKNOWLEDEMENT

AT BEGINNING I WOULD LIKE TO THANK GOD FOR HIS

BLESSING. I AM VERY MUCH THANKFUL TO MY PROF. Mr.

PRASHANT NAIK, PROF. DR. JANARDAN HOTKAR MY

PRINCIPAL DR. A. K. RANADE & CO-ORDINATOR CA.

PRASAD LIMAYE FOR THEIR GUIDANCE, SUPPORT &

ENCOURAGEMENT.

I ALSO LIKE TO THANK MY FAMILY MEMBERS AND

FRIENDS FOR THEIR CO-OPERATION & HELP AND ALSO

WOULD EXPRESS MY GRAITUDE TO ALL THOSE WHO

HELPED ME DIRECTLY OR INDIRECTLY TO COMPLETE

MY PROJECT.

I ALSO TAKE THE OPPORTUNITY TO SHOW MY SINCERE

GRATITUDE TO MY PARENTS.

SAGAR MADAN PATIL

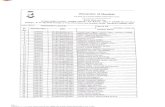

INDEX

SR NO. TITLE

1. CHAPTER- I

INTRODUCTION.

OBJECTIVE OF STUDY.

REASEARCH METHDOLOGY.

LIMITATIONS.

SIGNIFICANCE.

2. CHAPTER- II

TYPES OF PROCESS COSTING.

COSTING PROCEDURE.

INTER-PROCESS PROFIT.

EQUVALENT PRODUCTION.

3. CHAPTER- III

REVIEW OF LITERATURE.

OBSERVATION.

4. CHAPTER- IV

FINDINGS & SUGGESTIONS.

CONCLUSION.

WEBLIOGRAPHY & BIBLIPGRAPHY.

CHAPTER : I - INTRODUCTION

MEANING OF

COST ACCOUNTING

Cost accounting is a process of collecting, analyzing, summarizing and evaluating various alternative courses of action. Its goal is to advise the management on the most appropriate course of action based on the cost efficiency and capability. Cost accounting provides the detailed cost information that management needs to control current operations and plan for the future.Since managers are making decisions only for their own organization, there is no need for the information to be comparable to similar information from other organizations. Instead, information must be relevant for a particular environment. Cost accounting information is commonly used in financial accounting information, but its primary function is for use by managers to facilitate making decisions.Unlike the accounting systems that help in the preparation of financial reports periodically, the cost accounting systems and reports are not subject to rules and standards like the Generally Accepted Accounting Principles. As a result, there is wide variety in the cost accounting systems of the different companies and sometimes even in different parts of the same company or organization.

Origins

All types of businesses, whether service, manufacturing or trading, require cost accounting to track their activities.[1] Cost accounting has long been used to help managers understand the costs of running a business. Modern cost accounting originated during the industrial revolution, when the complexities of running a large scale business led to the development of systems for recording and tracking costs to help business owners and managers make decisions. In the early industrial age, most of the costs incurred by a business were what modern accountants call "variable costs" because they varied directly with the amount of production. Money was spent on labor, raw materials, power to run a factory, etc. in direct proportion to production. Managers could simply total the variable costs for a product and use this as a rough guide for decision-making processes.Some costs tend to remain the same even during busy periods, unlike variable costs, which rise and fall with volume of work. Over time, these "fixed costs" have become more important to managers. Examples of fixed costs include the depreciation of plant and equipment, and the cost of departments such as maintenance, tooling, production control, purchasing, quality control, storage and handling, plant supervision and engineering. In the early nineteenth century, these costs were of little importance to most businesses. However, with the growth of railroads, steel and large scale manufacturing, by the late nineteenth century these costs were often more important than the variable cost of a product, and allocating them to a broad range of products lead to bad decision making. Managers must understand fixed costs in order to make decisions about products and pricing.

For example: A company produced railway coaches and had only one product. To make each coach, the company needed to purchase $60 of raw materials and components, and pay 6 laborers $40 each. Therefore, total variable cost for each coach was $300. Knowing that making a coach required spending $300, managers knew they couldn't sell below that price without losing money on each coach. Any price above $300 became a contribution to the fixed costs of the company. If the fixed costs were, say, $1000 per month for rent, insurance and owner's salary, the company could therefore sell 5 coaches per month for a total of $3000 (priced at $600 each), or 10 coaches for a total of $4500 (priced at $450 each), and make a profit of $500 in both cases.

Cost Accounting vs Financial Accounting

Financial accounting aims at finding out results of accounting year in the form of Profit and Loss Account and Balance Sheet.

Cost Accounting aims at computing cost of production/service in a scientific manner and facilitate cost control and cost reduction.

Financial accounting reports the results and position of business to government, creditors, investors, and external parties.

Cost Accounting is an internal reporting system for an organization’s own management for decision making.

In financial accounting, cost classification based on type of transactions, e.g. salaries, repairs, insurance, stores etc.

In cost accounting, classification is basically on the basis of functions, activities, products, process and on internal planning and control and information needs of the organization.

Financial accounting aims at presenting ‘true and fair’ view of transactions, profit and loss for a period and Statement of financial position (Balance Sheet) on a given date. It aims at computing ‘true and fair’ view of the cost of production/services offered by the firm.

INTRODUCTION TO PROCESS COSTING

Process costing is a form of operations costing which is usedwhere standardized homogeneous goods are produced. Thiscosting method is used in industries like chemicals, textiles, steel,rubber, sugar, shoes, petrol etc. Process costing is also used in theassembly type of industries also. It is assumed in process costingthat the average cost presents the cost per unit. Cost of productionduring a particular period is divided by the number of unitsproduced during that period to arrive at the cost per unit.

Process costing is a method of costing under which all costsare accumulated for each stage of production or process, and thecost per unit of product is ascertained at each stage of productionby dividing the cost of each process by the normal output of thatprocess.

Definition : CIMA London defines process costing as “that form ofoperation costing which applies where standardize goods areproduced”

Features of Process Costing :

(a) The production is continuous(b) The product is homogeneous(c) The process is standardized(d) Output of one process become raw material of another process(e) The output of the last process is transferred to finished stock(f) Costs are collected process-wise

(g) Both direct and indirect costs are accumulated in each process(h) If there is a stock of semi-finished goods, it is expressed interms of equalent units(i) The total cost of each process is divided by the normal output ofthat process to find out cost per unit of that process.

Advantages of process costing:

1. Costs are be computed periodically at the end of a particularperiod2. It is simple and involves less clerical work that job costing3. It is easy to allocate the expenses to processes in order to haveaccurate costs.4. Use of standard costing systems in very effective in processcosting situations.5. Process costing helps in preparation of tender, quotations6. Since cost data is available for each process, operation anddepartment, good managerial control is possible

Reasons for use:

Companies need to allocate total product costs to units of product for the following reasons:

A company may manufacture thousands or millions of units of product in a given period of time.

Products are manufactured in large quantities, but products may be sold in small quantities, sometimes one at a time (automobiles, loaves of bread), a dozen or two at a time (eggs, cookies), etc.

Product costs must be transferred from Finished Goods to Cost of Goods Sold as sales are made. This requires a correct and accurate accounting of product costs per unit, to have a proper matching of product costs against related sales revenue.

Managers need to maintain cost control over the manufacturing process. Process costing provides managers with feedback that can be used to compare similar product costs from one month to the next, keeping costs in line with projected manufacturing budgets.

A fraction-of-a-cent cost change can represent a large dollar change in overall profitability, when selling millions of units of product a month. Managers must carefully watch per unit costs on a daily basis through the production process, while at the same time dealing with materials and output in huge quantities.

OBJECTIVES:

To study the meaning of Process Costing and its importance.

To study the Types of Process Costing.

To study the accounting procedure of process costing including

Normal Loss, Abnormal Loss or Gain.

To study the treatment of Normal Loss, Abnormal Loss or

Gain with the help of formulas.

To study What is Inter Process profits and Equivalent

Production?

Understand how Process costing operates.

REASEARCH & METHDOLOGY:

THE PROJECT DATA IS COLLECTED AND BASED

ON SECONDARY DATA I.E. IT IS COLLECTED

THROUGH PUBLISH DATA VARIOUS REFERENCE

BOOKS, JOURNALS, MAGAZINES, BULLETIN,

WEEKLINGS, PAPERS, ARTICLES AND INTERNET ARE

REFERRED.

LIMITATION:

I HAVE COLLECTED DATA THROUGH SECONDARY

SOURCES DUE TO LACK OF TIME FACTOR AND

SUGGESTIONS WHICH I HAVE MADE IS BEST OF MY

KNOWLEDGE AS I AM STUDENT AND NOT ANY EXPERT IN

THIS PARTICULAR FIELD.

SIGNIFICANCE:

The project is based and prepared on subject namely

Process Costing with Special Reference to Interprocess

profits & Equivalent Production. This project is simple and

easy to understand.

I followed a proper structure i.e. Introduction, Defination,

Step, Types etc. with the help of that we can easily come to

know the concept of project.

Project is useful to study and improve theoretical

knowledge regarding the topic or subject.

Data and information of the project is collected from

internet and books, periodicals so that we will get

appropriate and correct information about the project.

CHAPTER- II

TYPES OF PROCESS COSTING:

There are three types of process costing, which are:

1. Weighted average costs . This version assumes that all costs,

whether from a preceding period or the current one, are lumped

together and assigned to produce units. It is the simplest version to

calculate.

2. Standard costs . This version is based on standard costs. Its

calculation is similar to weighted average costing, but standard

costs are assigned to production units, rather than actual costs;

after total costs are accumulated based on standard costs, these

totals are compared to actual accumulated costs, and the difference

is charged to a variance account.

3. First-in first-out costing (FIFO) . FIFO is a more complex

calculation that creates layers of costs, one for any units of

production that were started in the previous production period but

not completed, and another layer for any production that is started

in the current period.

There is no last in, first out (LIFO) costing method used in process

costing, since the underlying assumption of process costing is that the

first unit produced is, in fact, the first unit used, which is the FIFO

concept.

Why have three different cost calculation methods for process costing,

and why use one version instead of another? The different calculations

are required for different cost accounting needs. The weighted average

method is used in situations where there is no standard costing system,

or where the fluctuations in costs from period to period are so slight that

the management team has no need for the slight improvement in costing

accuracy that can be obtained with the FIFO costing method.

Alternatively, process costing that is based on standard costs is required

for costing systems that use standard costs. It is also useful in situations

where companies manufacture such a broad mix of products that they

have difficulty accurately assigning actual costs to each type of product;

under the other process costing methodologies, which both use actual

costs, there is a strong chance that costs for different products will

become mixed together. Finally, FIFO costing is used when there are

ongoing and significant changes in product costs from period to period –

to such an extent that the management team needs to know the new

costing levels so that it can re-price products appropriately, determine if

there are internal costing problems requiring resolution, or perhaps to

change manager performance-based compensation. In general, the

simplest costing approach is the weighted average method, with FIFO

costing being the most difficult.

COSTING PROCEDURE:

For each process an individual process account is prepared.Each process of production is treated as a distinct cost centre.

Items on the Debit side of Process A/c. Each process account is debited with –a) Cost of materials used in that process.b) Cost of labour incurred in that process.c) Direct expenses incurred in that process.d) Overheads charged to that process on some pre determined.e) Cost of ratification of normal defectives.f) Cost of abnormal gain (if any arises in that process)

Items on the Credit side:Each process account is credited witha) Scrap value of Normal Loss (if any) occurs in that process.b) Cost of Abnormal Loss (if any occurs in that process)

Cost of Process:The cost of the output of the process (Total Cost less Sales valueof scrap) is transferred to the next process. The cost of eachprocess is thus made up to cost brought forward from the previousprocess and net cost of material, labour and overhead added in thatprocess after reducing the sales value of scrap. The net cost of thefinished process is transferred to the finished goods account. Thenet cost is divided by the number of units produced to determinethe average cost per unit in that process. Specimen of ProcessAccount when there are normal loss and abnormal losses.

Dr. Process I A/c Cr.

Particulars Units Amount Particulars Units Amount

To Basic Material

xx Xxx By Normal Loss Xx xx

To Direct Material xx Xx By Abnormal Loss

Xx xx

To Direct Wages xx Xx By Process II A/c Xx xx

To Production overhead

xx Xx (Output trf to next process

To Cost of Rectification of Normal Defect

xx Xx

To Abnormal Gains

Xx By Process I stock A/c

Xx xx

Xxx Xxx Xxx xxx

Process Losses:

In many process, some loss is inevitable. Certain productiontechniques are of such a nature that some loss is inherent to theproduction. Wastages of material, evaporation of material is unavoidable in some process. But sometimes the Losses are alsooccurring due to negligence of Labourer, poor quality raw material,poor technology etc. These are normally called as avoidablelosses. Basically process losses are classified into two categories

(a) Normal Loss (b) Abnormal Loss.

Treatment of Normal Loss in Process Accounts :

Normal losses are those which we can not stop. These are natural wastage. Normal loss is an unavoidable loss which occurs due to theinherent nature of the materials and production process undernormal conditions. It is normally estimated on the basis of pastexperience of the industry. It may be in the form of normal wastage,normal scrap, normal spoilage, and normal defectiveness. It mayoccur at any time of the process.No of units of normal loss: Input x Expected percentage ofNormal Loss.The cost of normal loss is a process. If the normal loss unitscan be sold as a crap then the sale value is credited with processaccount. If some rectification is required before the sale of thenormal loss, then debit that cost in the process account. Afteradjusting the normal loss the cost per unit is calculates with thehelp of the following formula:

cost of goods unit : Total cost increased - Sale value of Scrap

Input - Normal loss Units

For example, if you doing the business of timber on the basis of their weight. It is sure that after cutting of tree, weight of wood will decrease. So, this loss is normal loss. In process account’s credit side, we just show the normal loss’s units. Now, our total produced units will decrease. This will decrease our cost of production in any process. For example: If total cost of process A is Rs. 10,000. When we produce 100 units in A process, we have checked that due to natural reasons, we have just 90 units. Now, in A Process Account, we will show 100 units in debit side and 10 units of normal loss in credit side without writing its amount. Due to this our total cost of Rs. 10,000 will of 90 units. It means, cost per unit has increased from Rs. 100 per unit to Rs. 111 per unit.

Treatment of Abnormal Loss in Process Accounts:

All those losses which happen due to abnormal reasons are called abnormal losses. Following are its main example.

1. If you use bad quality raw material in the production, there is big risk of wastage in production. So, use of bad quality raw material is the reason of abnormal loss.

2. Careless is also reason of abnormal loss. For example, due to the careless of worker, 5 units waste the products during production. So, loss of 5 units is the abnormal loss.

3. All those losses which are not normal will be the abnormal loss. For treating the abnormal loss in the process account, we need to calculate the value of abnormal loss.

Dr. Abnormal Loss A/c Cr.

Particulars Units Amt Particulars Units Amt

To process A/c Xx xx By bank A/c Xx Xx

By Costing P&L A/c

Xx Xx

Xxx xxx Xxx Xxx

a) When there is not any normal loss: Abnormal loss = Normal cost at normal production / normal output X units of abnormal loss

b) When there is normal loss: Abnormal loss = {Normal cost at normal production / (Total output – normal loss units)} X Units of abnormal loss.

Example : In process A 100 units of raw materials were introduced at a cost of Rs. 1000. The other expenditure incurred by the process was Rs. 602 of the units introduced 10% are normally lost in the course of manufacture and they possess a scrap value of Rs. 3 each. The output of process A was only 75 units. Prepare process A account.

Process A Account

Debit Side Units Amount in Rs.

Credit Side Units Amount in Rs.

Raw material 100 1000 Normal Loss 10 -

Other Expenses - 602Sale of Scrap of normal wastage 10 units X Rs. 3 each

- 30

*Abnormal Loss 15 262

Process B ( Output ) - balancing figure

75 1310

100 1602 100 1602

* Calculation of Abnormal loss in units and in value:

Total input========== 100 units Less normal loss in units== 10 units --------------------------------------Normal Output ======== 90 units actual output of A process = 75 units--------------------------------------Abnormal loss in units ==== 15 units ========================== Value of Abnormal Loss = Cost of Total Output - scrap sale of normal loss/ Normal Output X Units of Abnormal loss = 1602 - 30 / 90 X 15 = Rs. 262

Treatment of Abnormal Gains in Process Accounts :

The margin allowed for normal loss is an estimate (i.e. on

the basis of expectation in process industries in normal conditions)

and slight differences are bound to occur between the actual output

of a process and that anticipates. This difference may be positive or

negative. If it is negative it is called ad abnormal Loss and if it is

positive it is Abnormal gain i.e. if the actual loss is less than the

normal loss then it is called as abnormal gain. The value of the

abnormal gain calculated in the similar manner of abnormal loss.

The formula used for abnormal gain is:

Abnormal Gain:

Total Cost incurred – Scrap Value of Normal Loss x Abnormal gain

units

Input units – Normal Loss Units

The sales values of abnormal gain units are transferred to

Normal Loss Account since it arrive out of the savings of Normal

Loss. The difference is transferred to Costing P & L A/c. as a Real

Gain.

Dr. Abnormal Gain A/C Cr.

Particulars Units Rs. Particulars Units Rs.

To Normal loss A/c

To Costing P/L A/c

XXX

XXX

XXX

XXX

By Process A/c XXX XXX

XXX XXX XXX XXX

INTERPROCESS PROFITS:

Normally the output of one process is transferred to another

process at cost but sometimes at a price showing a profit to the

transfer process. The transfer price may be made at a price

corresponding to current wholesale market price or at cost plus an

agreed percentage. The advantage of the method is to find out

whether the particular process is making profit (or) loss. This will

help the management whether to process the product or to buy the

product from the market. If the transfer price is higher than the cost

price then the process account will show a profit. The complexity

brought into the accounting arises from the fact that the inter

process profits introduced remain a part of the prices of process

stocks, finished stocks and work-in-progress. The balance cannot

show the stock with profit. To avoid the complication a provision

must be created to reduce the stock at actual cost prices. This

problem arises only in respect of stock on hand at the end of the

period because goods sold must have realized the internal profits.

The unrealized profit in the closing stock is eliminated by creating a

stock reserve. The amount of stock reserve is calculated by the

following formula.

Stock Reserve = Transfer Value of stock x Profit included in transfer

Price

Transfer Price

WHAT ARE EQUIVALENT UNITS

OF PRODUCTION?

Equivalent units of production are a term applied to the work-in-

process inventory at the end of an accounting period. It is the number of

completed units of an item that a company could theoretically have

produced, given the amount of direct materials, direct labor, and

manufacturing costs incurred during that period for the items not yet

completed. In short, if 100 units are in process but you have only

expended 40% of the processing costs on them, then you are considered

to have 40 equivalent units of production.

Equivalent units are a cost accounting concept that is used in process

costing for cost calculations. It has no relevance from an operational

perspective, nor is it useful for any other type of cost derivation other

than process costing.

Equivalent units of production are usually stated separately for direct

materials and all other manufacturing expenses, because direct materials

are typically added at the beginning of the production process; while all

other costs are incurred as the materials gradually work their way

through the production process. Thus, the equivalent units for direct

materials are generally higher than for other manufacturing expenses.

When you assign a cost to equivalent units of production, you typically

assign either the weighted of the beginning inventory plus new

purchases to the direct materials, or the cost of the oldest inventory in

stock (known as the first in, first out, or FIFO, method). The simpler of

the two methods is the weighted average method. The FIFO method is

more accurate, but the additional calculations do not represent a good

cost-benefit trade off. Only consider using the FIFO method when costs

vary substantially from period to period, so that management can see the

trends in costs.

Equivalent Units of Production

After materials, labor, and overhead costs have been accumulated in a

department, the department’s output must be determined so that unit

product costs can be computed. The difficulty is that a department

usually has some partially completed units in its ending inventory. It

does not seem reasonable to count these partially completed units as

equivalent to fully completed units when counting the department’s

output. Therefore, these partially completed units are translated into

an equivalent number of fully completed units. In process costing, this

translation is done using the following formula:

As the formula states, equivalent units are the product of the number of

partially completed units and the percentage completion of those units

with respect to the processing in the department. Roughly speaking, the

equivalent units are the number of complete units that could have been

obtained from the materials and effort that went into the partially

complete units.

Weighted-Average Method

Under the weighted-average method, a department’s equivalent units are

computed as follows:

Note that the computation of the equivalent units of production involves

adding the number of units transferred out of the department to the

equivalent units in the department’s ending inventory. There is no need

to compute the equivalent units for the units transferred out of the

department—they are 100% complete with respect to the work done in

that department or they would not be transferred out. In other words,

each unit transferred out of the department is counted as one equivalent

unit.

Computation of Equivalent Production & Cost per equivalent

unit and evaluate the output.

particular input

units

Particulars Output

units

%

Work

Done

Equivalent

units

Op. WIP

Units intro

1000

10000

Op. WIP

Completed

Normal loss

Cl. WIP

Abnormal loss(bal. fig)

1000

8000

1100

800

100

40

100

-

75

100

400

8000

-

600

100

1100 11000 9100

CHAPTER- III

REVIEW OF LITERATURE:

Process costing is a form of operations costing which is

used where standardized homogeneous goods are produced.

This costing method is used in industries like chemicals,

textiles, steel, rubber, sugar, shoes, petrol etc. Process costing

is also used in the assembly type of industries also. It is

assumed in process costing that the average cost presents the

cost per unit. Cost of production during a particular period is

divided by the number of units produced during that period to

arrive at the cost per unit.

Process costing is a method of costing under which all

costs are accumulated for each stage of production or process,

and the cost per unit of product is ascertained at each stage of

production by dividing the cost of each process by the normal

output of that process.

OBSERVATION:

I have studied and analyzed the project namely, “Process

Costing with Special Reference to Inter-process Profits &

Equivalent Production.” In that project I followed a proper

structure of project i.e. introduction, meaning, definition,

significance, objectives, limitations, etc. so with the help of that data

we can easily understand the project.

I observed that the cost accounting is a process of collecting,

analyzing, summarizing and evaluating various alternatives courses

of actions. Process costing is a form of operations costing which is

used where standardized homogeneous goods are produced. In

process costing we have to calculate or determine the cost which is

incurred to manufactured a particular product.

Process Costing is beneficial to the manufacturing companies as

well as assembling type of industries. It is very useful. It has its

advantages, and significance but it also has its own limitations and

disadvantages that I have mentioned in the project. There should be

a need to made some changes or upgrade this topic according to

changing market and technology.

CHAPTER- IV

FINDINGS & SUGGESTION:

Production is contentious.

Product is homogeneous and standardized.

Suitable where goods are made for stock

Cost is calculated at the end of the period.

The output of one process transferred to another process as

input.

Suggestion: The computation of average cost is more difficult

in those cases where more than one type of products is

manufactured so, it is suggested that there should be need to

change or upgrade process costing to overcome and solved that

kind of limitations.

CONCLUSION:

I have studied and analyzed the Process Costing in regarding of

their Objectives, Use, Importance, Features, Types, etc. “Process

Costing with Special Reference to Interprocess Profit & Equivalent

Production”. The Cost is very much important in the Cost making

of any product and hence it should be accurate. The process costing

undergoes through various processes and finally gets converted into

finished goods. In Between this the company earns profit internally

through bulk purchases and equivalent production helps to achieve

a good profit and earning.

WEBILIOGRAPHY & BIBLIOGRAPHY:

WWW.GOOGLE.COM

WWW.WIKIPEDIA.COM

BOOK: MUMBAI UNIVERSITY MODULE.