Corporate Wrap, Employee Wealth and Workplace Saving – The

Transcript of Corporate Wrap, Employee Wealth and Workplace Saving – The

Corporate Wrap, Employee Wealth and Workplace Saving – The Future?

15th September 2011

1

Saving via the workplace :

© 2011 GfK NOP 5

g pa consumer perspective

Nick Watkins and Frank Fletcher

TISA corporate wrap seminar Nick Watkins GfK Financial

[email protected]: +44-20-7890 9190

Today’s agenda

• Introduction

• Why do consumers save?• Why do consumers save?

• The workplace market

• Attitudes towards wraps

• The role of employers

• Conclusions

© 2011 GfK NOP 6

Corporate Wrap, Employee Wealth and Workplace Saving – The Future?

15th September 2011

2

Data sources

FRS

• Continuous survey of personal

Ad Hoc survey

• One-off survey of employees, financial holdings, acquisitions, usage, awareness and behaviour

• Broad product coverage : banking, general insurance, savings, investments and protection

• 60,000 adults interviewed pa. using an innovative methodology : face-to-face and online

• Range of metrics : products, brands, channels and customers. Measuring both volume and value

conducted for this presentation• 500 interviews with full-time

workers, aged 25-64• Controls on size of company and

value of savings• GfK NOP Online Panel used to

provide sample

© 2011 GfK NOP 7

both volume and value

Why do consumers save?

© 2011 GfK NOP 8

Corporate Wrap, Employee Wealth and Workplace Saving – The Future?

15th September 2011

3

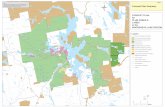

Potential workplace market

Total of 16.4 million F/T workers aged 25-64

4.8 million

© 2011 GfK NOP 9

All adults = 48.8 million

Higher holdings than rest of population

Number of target group holding savings and investments

49%

30%

24%

© 2011 GfK NOP 10

Source: FRS: Base: All 25-64 AND working AND £10K+ in S&I

Time period: 12 months ending

8% 7%

2% 1%

*Proportion of target group that hold investments

Corporate Wrap, Employee Wealth and Workplace Saving – The Future?

15th September 2011

4

All aged 25-64 who are currently working and with £10k+ in savings

More focus on paying down debt

Revolving Credit Card Outstanding balance on Credit Overdraft usage in the last Revolving Credit Card gCard

gmonth

7% decrease 11% decrease 5% decrease

© 2011 GfK NOP 11

Source: FRS: Base: All 25-64 AND working AND £10K+ in S&I

Time period: 12 months ending

Trend to paying off mortgage balance

Likelihood to take out savings/investments – £10k+ savers

Increasing intention to take out investments

S&I intentions by value in assets

25%7

Bank rate Likely to open savings Likely to open investment

5%

10%

15%

20%

1

2

3

4

5

6

© 2011 GfK NOP 12Data source: Bank of England/FRS Source: GfK FRSTime Period: monthly data/6 months rolling Base: All likely to open an investment/a savings account in the next 12 months

*Questionnaire change in Jan 07 led to increase levels of consideration

*Methodology change Aggregated value

0%0

Jul 2

005

Oct

200

5Ja

n 20

06A p

r 20

06Ju

l 200

6O

ct 2

006

Jan

2007

Apr

2007

Jul 2

007

Oct

200

7Ja

n 20

08A p

r 20

08Ju

l 200

8O

ct 2

008

Jan

2009

A pr

2009

Jul 2

009

Oct

200

9Ja

n 20

10Ap

r 20

10Ju

l 201

0O

ct 2

010

Jan

2011

A pr

2011

Jul 2

011

Corporate Wrap, Employee Wealth and Workplace Saving – The Future?

15th September 2011

5

Majority of investments still arrangedface-to-face

24%24%

Channel of arrangement of target group

24%24%

62%62%

Online –method of

arrangementCompany

Direct 66%

Bank 6%

Face-to-face –method of

arrangementCompany

Direct 51%

Bank 13%

© 2011 GfK NOP 13

Intermediary 19% Intermedi

ary 35%

Data source: FRS: Base: Investments opened in the last 5 years

All 25-64 AND working AND £10K+ in S&I

Time period: 12 months ending

Technology

Greater choice of interaction methods, giving

RDR

Higher fees for advice expected

IFA changes

IFAs reacting to RDR by changing their business

Pension funding

NEST designed to encourage more long term saving and

Several drivers of wrap adoption

methods, giving more control and convenience

their business models towards a more centralised proposition

term saving and investing, to address under‐provision for retirement

© 2011 GfK NOP 14

Corporate Wrap, Employee Wealth and Workplace Saving – The Future?

15th September 2011

6

Likely implications of RDR

A wider ‘advice gap’

Fewer advisors

Advisors will focus on

Some consumers will go self direct

Likely growth of fund supermarkets

Potential for a workplace solution

Reinforced by auto-enrolment and associated responsibilities

© 2011 GfK NOP 15

‘wealthier’ customers supermarkets

• Banks may also benefit

and associated responsibilities for education

Constraints on bank sales growth

Direct

Banks reduce branch staff

Bank/BsocEmployer

Banks are

© 2011 GfK NOP 16Base: All with New PPP/Stakeholder/SIPP (excl. other/DK)Time Period: 12me data

Channel of arrangement – New PPP/Personal Stakeholder/SIPP

IFAfined

Corporate Wrap, Employee Wealth and Workplace Saving – The Future?

15th September 2011

7

The role of employers

© 2011 GfK NOP 17

Role of employers could increase

New investments arranged via employer

91% increase in the number of investments arranged via an

employer in the last year (FRS)

All, alongside Hargreaves Lansdown’s Corporate Vantage, currently offering workplace savings

schemes, with many others including Zurich and Friends also entering the market

© 2011 GfK NOP 18

Data source: GfK FRS: Base: All new investments in the last 12 months

Time Period:12 months ending June 2011

Collectiveness of workplace allows employees access to A-rated funds previously only

available to institutional retailers

Corporate Wrap, Employee Wealth and Workplace Saving – The Future?

15th September 2011

8

Awareness of platforms

Age IncomeAssets

• Younger age groups higher awareness of corporate platforms

• Older groups higher

• Higher income correlates with higher awareness

• 37% of people earning £62,000+ are aware of

• £10k+ in savings have higher awareness of platforms

• 21% aware of individual platforms

© 2011 GfK NOP 19

• Older groups higher awareness of individual platforms

,individual or corporate platforms

p

• 9% aware of corporate platforms

Source: GfK Online Investment platform study

Awareness of providers

<£10k in savings and

£10k+ insavings and sa gs a d

investmentssa gs a dinvestments

Barclays Wealth 12% 17%

Skandia 10% 15%

TD Waterhouse 7% 12%

Fidelity Funds Network 5% 14%

Hargreaves LansdownVantage 4% 16%

Elevate 2% 1%

Co‐funds 2% 6%

Higher awareness amongst those with £10k+ in savings

© 2011 GfK NOP 20

Co‐funds 2% 6%

Transact 1% 1%

Much lower awareness of specialist IFA brands

Source: GfK Online Investment platform study

Corporate Wrap, Employee Wealth and Workplace Saving – The Future?

15th September 2011

9

More wealthy use platforms more

22% any platform

78% of £10k+ earners do not use platforms

Of which 20% would consider using them(8% IFA, 14% Direct, 7% Corporate)

© 2011 GfK NOP 21

Platform users

35% reject platforms outrightVS

44% don’t know

Source: GfK Online Investment platform study

Convenience the primary driver for all wraps

Reasons why people would use platforms (of those considering using)

© 2011 GfK NOP 22Source: GfK Online Investment platform studyBase: All those who that would consider using

Corporate Wrap, Employee Wealth and Workplace Saving – The Future?

15th September 2011

10

Employers add more convenience and trust (?)

Reasons for choice – those aware and interested in corporate wrap services

Reasons for choice – those interested in corporate wrap services and £10k+ in savings

© 2011 GfK NOP 23Source: GfK Online Investment platform study

Caution: Low base size n=28 Caution: Low base

size n=67

Barriers : knowledge or concerns about employer

Reasons for rejection – those NOT interested in corporate wrap services and £10k+ in savings

If your employer has or were to offer a corporate wrap service, would this be of interest to you?

© 2011 GfK NOP 24Source: GfK Online Investment platform study

Caution: Low base size n=55

Corporate Wrap, Employee Wealth and Workplace Saving – The Future?

15th September 2011

11

Conclusions

Increasing receptiveness to wraps generally

Awareness and uptake higher for individual wraps than corporate

Currently wealthier more self-directedy

Challenge to IFA business post-RDR

Post-RDR, wraps might also become key enablers for the middle market

Corporate platforms have role to play for both higher earners and younger employees

Communications will be key

Persuade the receptive; satisfy the sceptics

Adoption will differ by employer type and size

© 2011 GfK NOP 25

Adoption will differ by employer type and size