Savings Accounts - Personal Banking, NRI Banking, Personal ...

CORPORATE PRESENTATION - Personal, NRI & Premium Banking Presentation.pdf · Formation of...

Transcript of CORPORATE PRESENTATION - Personal, NRI & Premium Banking Presentation.pdf · Formation of...

CORPORATE PRESENTATION JULY 2017

2

Disclaimer

NOT FOR PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES This presentation has been prepared by The Lakshmi Vilas Bank Limited (the “Bank”) solely for information purposes without regard to any specific objectives, financial situations or informational needs of any particular person. By attending the meeting where this presentation is being made or by reading the presentation materials, you agree to be bound by following limitations: The information in this presentation has been prepared for use in presentations by the Bank for information purposes only and does not constitute, or should be regarded as, or form part of, any offer, invitation, inducement or advertisement to sell or issue, or any solicitation or initiation of any offer to purchase or subscribe for, any securities of the Bank in any jurisdiction, including the United States and India; nor shall it, or the fact of its distribution form the basis of, or be relied on, in connection with, any investment decision or any contract or commitment to purchase or subscribe for any securities of the Bank in any jurisdiction, including the United States and India. This presentation does not constitute a recommendation by the Bank or any other party to sell or buy any securities of the Bank. This presentation and its contents are not and should not be construed as a “prospectus” or “offer document” (as defined or referred to, as the case may be, under the Companies Act, 2013, as amended) or an “offer document” under the Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2009, as amended. This presentation should not be construed as legal, tax, investment or other advice. This presentation may not be copied, distributed or disseminated, directly or indirectly, in any manner. Furthermore, no person is authorized to give any information or make any representation which is not contained in, or is inconsistent with, this presentation. Any such extraneous or inconsistent information or representation, if given or made, should not be relied upon as having been authorized by or on behalf of the Bank. This presentation contains statements that constitute forward-looking statements. These statements include descriptions regarding the intent, belief or current expectations of the Bank or its directors and officers with respect to the results of operations and financial condition of the Bank. These statements can be recognized by the use of words such as “expects,” “plans,” “will,” “estimates,” “projects,” or other words of similar meaning. Such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may differ from those specified in such forward-looking statements as a result of various factors and assumptions. The risks and uncertainties relating to these statements include, but are not limited to, (i) fluctuations in earnings, (ii) the Bank’s ability to manage growth, (iii) competition, (iv) government policies and regulations, and (v) political, economic, legal and social conditions in India. The Bank does not undertake any obligation to revise or update any forward-looking statement that may be made from time to time by or on behalf of the Bank. Given these risks, uncertainties and other factors, viewers of this presentation are cautioned not to place undue reliance on these forward-looking statements. The information contained in this presentation is only current as of its date and has not been independently verified. The Bank may alter, modify or otherwise change in any manner the contents of this presentation, without obligation to notify any person of such revision or changes. No representation, warranty, guarantee or undertaking, express or implied, is or will be made as to, and no reliance should be placed on, the accuracy, completeness, correctness or fairness of the information, estimates, projections and opinions contained in this presentation. None of the Bank or any of its affiliates, advisers or representatives accept any liability whatsoever for any loss howsoever arising from any information presented or contained in this presentation. Please note that the past performance of the Bank is not, and should not be considered as, indicative of future results. Certain data in this presentation was obtained from various external data sources, and the Bank has not verified such data with independent sources. Accordingly, the Bank makes no representations as to the accuracy or completeness of that data, and such data involves risks and uncertainties and is subject to change based on various factors. This presentation also contain certain tables and other statistical analyses. Numerous assumptions were used in preparing the statistical information, which may or may not be reflected herein. The Bank has not verified such statistical information with independent sources. As such, no assurance can be given as to the statistical information’s accuracy, appropriateness or completeness in any particular context nor as to whether the statistical information and/or the assumptions upon which they are based reflect present market conditions or future market performance. The statistical information should not be construed as either projections or predictions or as legal, tax, financial or accounting advice This presentation is not an offer of securities for sale in the United States. Securities may not be offered or sold in the United States absent registration or an exemption from registration under the United States Securities Act of 1933, as amended (the “Securities Act”). Any offering in the United States may be made only by means of the relevant offering document that may be obtained from the Bank and that will contain detailed information about the Bank and management, as well as financial statements. By receiving this document, you are deemed to have represented and agreed that you and any of your customers that you represent (i) are sophisticated investors to whom it is lawful to communicate and (ii) are located outside of the United States. This document is not financial, legal, tax or other product advice. THIS PRESENTATION IS NOT AN OFFER FOR SALE OF SECURITIES IN INDIA, THE UNITED STATES OR ELSEWHERE.

3

Table of Contents

Evolution into a new age financial platform 1

Strategy to drive growth 2

Stabilization of asset quality 3

Appendix 4

4

1. EVOLUTION INTO A NEW AGE FINANCIAL PLATFORM

5

Demand 6%

Savings 13%

Term 81%

Retail 9%

SME/MSME 17%

Rural 17% Mid-

Commercial 6%

Wholesale 51%

Evolution into a new age financial platform

Customers Branches2 ATMs States Employees1

2.96 Mn 481 958 16 4,0431

Branches

Product diversification New age financial

platform

Launched multiple new savings bank products

Launched digital initiatives - SMS alert, mobile banking services

Launched LVB Crown suite of products in 2015

Mr. P. Mukherjee joins as CEO

New retail liabilities strategy

Revamp of risk management framework

Reduced dependence on Tamil Nadu*

63 103 130 198 240 91

141 186

254

306

154

244

316

452

545

2010 2012 2014 2016 2017

Deposits (INR Bn)Gross Advances (INR Bn)

50% 49%

271 290 361 460 481

42%

Key Milestones

Large diversified platform with significant potential to be leveraged

265

8 4

2

12

19 31

48

12

4

2

2

4

4

3

5

56

Branch Count

As of March 2017

1) Figure excludes sales executives 2) Includes one satellite branch *Dependency is as % of Total Business (Deposits+ Gross Advances)

Deposits Mix Advances Mix

Legacy spanning 9 decades with good track record

6

Senior management team

Past: Axis Bank

Qualification: Bachelors in Science

P. Mukherjee Managing Director and CEO

Past: IDBI Bank

Qualification: B.Sc., CA, Diploma in Financial Services, CAIIB

N.S. Venkatesh Executive Director & CFO

Meenakshi Sundaram R.M President, Wholesale Banking

Akkidas Jacob Vidya Sagar President, Retail Banking

R.V.S. Sridhar President and Chief Risk Officer

Team strengthened with experienced lateral hires to support the strategic growth plans of the bank

7

Execution delivering results

1) Business defined as summation of Net Advances and Deposits

220 254

306

164 196

237

FY15 FY16 FY17

Deposits (INR Bn) Net Advances (INR Bn)

Healthy Growth in Business1 Stable NIMs and strong growth in NII

5,267 6,453

7,827

2.73% 2.78% 2.85%

FY15 FY16 FY17NII (INR Mn) NIM

Improvement in operating expense ratio & growth in profitability

3,577 4,071

6,341

1,323 1,802 2,561

54.6%

57.1%

50.7%

FY15 FY16 FY17

Operating profit (INR Mn) Net Profit (INR Mn) Cost to Income Ratio

Increase in return ratios

10.78% 11.74%

14.39%

0.61%

0.70%

0.83%

FY15 FY16 FY17

ROE ROA

CAGR FY15-17 18% 20% CAGR FY15-17 22%

Source: Annual reports

CAGR FY15-17 33% 39%

8

Key strategic initiatives

1) Branch Productivity = (Gross Advances+ Deposits)/ # of Branches; # of branches includes satellite branches

Key Strategic Initiatives in FY17

Revamp of Risk Management Framework

Induction of new CRO

Formation of new Recovery vertical

Centralisation of Loan Processing

SME/ MSME loan processing at MSME Recap centres and Corporate Loans at Central office

Implementation of Loan Automation Project (LAMP)

Reduce the TAT and improve quality of processing

Creation of Corporate Relationship Management Group

360 Degree coverage of the Corporate Customers

Formation of Commercial Banking Operations (CBO) Department underway

Improve the documentation and monitoring standard of Corporate and MSME accounts

Source: Annual reports

Improvement in Branch productivity 1

400 460 481

962 984

1,133

FY15 FY16 FY17

# of Branches Branch Productivity (INR Mn)

37 44

58

16.67% 17.36% 19.11%

FY15 FY16 FY17CASA (INR Bn) % CASA

Increase in CASA

CAGR FY15-17 26%

9

Stable GDP growth outlook Services driving growth; Industries growth moderated

Decreasing interest rates Re-monetisation – Cash is coming back Credit growth has been muted in FY17

Inflation expected to remain moderate

India growth fundamentals remain robust amidst recent policy changes

-0.2%

5.9%

10.3%

1.2%

7.4% 8.9%

4.1% 5.2%

8.8%

Agriculture Industries Services

(YoY GVA growth%)

2015 2016 2017

India projected to continue its growth trajectory GST likely to impact GDP growth positively

Source: IMF, Real GDP Growth

8.5

10.3

6.6 5.5

6.5 7.2

7.9 6.8 7.2 7.7 7.8 7.9 8.1 8.2

FY1

0

FY1

1

FY1

2

FY1

3

FY1

4

FY1

5

FY1

6

FY1

7

FY1

8

FY1

9

FY2

0

FY2

1

FY2

2

FY2

3

Source: Economic Survey of India FY2016-17, GVA growth by sector Source: IMF, Consumer Prices

10.6 9.5 9.5 9.9 9.4

5.9 4.9 4.9 4.8 5.1 5.0 4.9 4.9 5.0

FY1

0

FY1

1

FY1

2

FY1

3

FY1

4

FY1

5

FY1

6

FY1

7

FY1

8

FY1

9

FY2

0

FY2

1

FY2

2

FY2

3

(YoY %) Consumer Price Inflation

14.1% 13.9%

9.0% 10.9%

4.6%

14.2% 14.1%

10.7% 9.3% 11.3%

FY13 FY14 FY15 FY16 FY17

Credit Growth (YoY) Deposit Growth (YoY)

774 870 994

1,460 1,356 951 1,104 1,047

16.6 17.0

9.1 7.8

9.1 10.6

12.6 13.5

Sep-16 Oct-16 Nov-16 Dec-16 Jan-17 Feb-17 Mar-17 Apr-17

Digital Transactions* (Mn) Currency with public (INR Tn)

Demonetization

7.50%

8.00%

6.75% 6.75%

6.25%

FY13 FY14 FY15 FY16 FY17

Agri growth positively impacted due to good monsoon Industries growth : Execution of policy initiatives is key to

catalyse growth

Aggressive inflation focus by RBI Outlook for inflation within RBI target of 4% (+/-2%)

Policy Repo Rate (End of year)

Declining interest rates coupled with recent strengthening of rupee against USD from 68.02 in January 2017 to 64.73 in July 20171

Demonetisation and delay in capex led growth Asset quality pressure continues – Revamp of lending policies

and risk management a key focus for banking sector

Cash inflow into economy to spur growth Growth in digital transactions – Banking services to adapt to

changing customer behaviour

Source: RBI Source: RBI Source: RBI

(YoY %)

1) USD/INR exchange rate at 68.02 as on 02/01/2017 & 64.73 as on 07/07/2017 *Digital transactions comprises of RTGS, CTS, NEFT, IMPS, NACH, Credit Card (POS), Debit Card (POS), PPI & Mobile Banking Transactions

10

2. STRATEGY TO DRIVE GROWTH

11

Key strategies to drive growth

LOAN BOOK:

RETAIL & MSME

FOCUS

LIABILITY:

INCREASING

CASA

FEE INCOME

TECHNOLOGY

Given recent branch expansion, there is potential for increase in CASA as new vintage branches turn profitable

Redefining branches as sales outlets with defined CASA targets with a specific focus on HNI & NRI customers

Product innovation and extension of existing products (eg: expansion of “Crown” franchise to include NRE, NRO accounts)

Attractive interest rates for savings account & flexi current account facilities to drive CASA growth in the future

Aggressive advertising on both digital & offline platforms along with the launch of plethora of new initiatives (Eg: FISDOM, FINFIT,

LVB UDAAY, Rupay Card etc.)

Launch of the Transaction Banking vertical to significantly boost fee income – Focus on trade finance, bill discounting, guarantees,

LCs, cash management, government banking etc.

Tie-up with third parties for related services such as insurance, mutual funds, credit cards, money transfer, forex travel cards etc. to

provide fillip to fee based income

Formation of a separate retail lending group to be led by the newly hired Head of Consumer Lending

Focus on profitable gold loans, business credit and home loans

Project TRANSME: Working with a top tier global management consulting firm on the transformation of the MSME business model

Relationship management team to function as a one-stop shop for the fulfillment of all financial needs of loyal customers

Focus on high-rated clients

Conscious de-focusing on the wholesale business segment

ASSET QUALITY:

REVAMPED RISK

MANAGEMENT

FRAMEWORK

Overhaul of risk management framework to enhance credit risk management systems & processes in line with growth of business

Introduction of separate Recovery Vertical & empanelment of recovery agencies to reduce TAT of recovery

Key modifications in the lending policy to demarcate operations between business setups & improve asset quality in the future

Conduct of high value credit portfolio under constant monitoring guided by technology

Initiatives across the transaction lifecycle - CRM tool, automated loan origination

Multifunction mobile app with intuitive functioning for a state-of-the-art customer interface

Implementation of large-scale technological reforms - upgrade core banking suite, develop business intelligence unit, enhance

digital banking & omni-channel presence, multi function e-lounge, Oracle Financial product suite

12

Portfolio diversification with focus on retail & MSME segment

Customer Characteristics

Gross Advances (INR Bn)

Retail MSME/Rural/Mid Commercial Wholesale

Individuals, HUF, and trusts; with special focus on NRIs

and HNIs

Trading, business and small manufacturing entities as designated by RBI, sole proprietorship & partnership

firms

All business entities

Separate retail lending group and product expansion with a focus on

innovation

Conversion of existing Recap centres to specialized MSME centres for faster loan processing and reduced Turn

Around Time

Emphasis on being a multiple banking partner and channeling high-rated**

relationships towards cross-selling opportunities

Strategic Initiatives

19.8

26.4 22.0

FY15 FY16 FY17

34.4 41.7 41.7

24.1 30.7

40.7 13.0

14.2 13.4

71.5

86.5 95.9

FY15 FY16 FY17

SME/MSME Rural Mid-Commercial

73.9 85.3

121.8

FY15 FY16 FY17

*

*FY17 retail advances is not comparable with historical fiscal years given re-classification of certain loans out of retail and into MSME in FY17

**Rating of customers is done internally

13

Focused customer segmentation asset strategy

Retail

MSME/

Rural/

Agri

Wholesale

Relationship Management Group

Formation of a specialised core relationship management team to become a one-stop shop

Branch-wise strategies drawn up and performance of sales executives monitored

Development of Retail Asset Centre

Ensure specialised underwriting norms to improve customer turnaround times and quality of assets

Product expansion with a focus on innovation

Product reengineering by launching bundled products

Focus on value added services

Focus on moving up the value chain by offering competitive and neighbourhood-oriented products

Relationship Management Group

Corporate Relationship Management Group aiming for a 360 Degree coverage of Corporate Customers

Focus on high-rated Clients* leading to reduction in credit costs

Development of sales channels for proactive origination of quality loan proposals through DST and DSA strategy

Competitiveness | Matching price to market

Rationalizing pricing across the product portfolio and improving lending to Micro Enterprises

Customer Deliverance

Loan processing automation under implementation to provide technology in the delivery of products

Specialized MSME centres

Conversion of existing Recap centres to specialized MSME centres for faster loan processing and reduced Turn Around Time

Focus on loan syndication and becoming a co-lender to reputable corporates and minimizing restructured portfolio

Multiple banking partner channeling high-rated* relationships towards cross-selling opportunities

Corporate Relationship Management Group aiming for a 360 Degree coverage of corporate customers

Well diversified retail advances book with a strong focus on profitable gold loans and home loans

Transformation of MSME business model underway with top tier management consulting firm

Conscious de-focusing on wholesale business segment

*Rating of customers is done internally

14

Centralization of the wholesale credit process to the Corporate Office

Development of Retail Asset Centre to ensure specialised underwriting norms to improve customer TAT and quality of assets

Development of sales channels for proactive origination of quality loan proposals through DST* and DSA* strategy

21.6%

Diversified loan book

Key industries exposure (based on fund-based exposure in FY17)

Exposure to borrowers (based on fund-based exposure in FY17)

16.4%

Top 10 borrowers

Top 20 borrowers

Top 50 borrowers

32.1%

7.55%

4.83% 4.72%

1.70% 1.10% 0.99% 0.98% 0.93% 0.90% 0.74% 0.56% 0.38% 0.34% 0.25% 0.11%

1.42%

Infr

astr

uct

ure

Text

iles

Bas

ic m

etal

&m

etal

pro

du

cts

Bev

erag

es &

Tob

occ

o

Ru

bb

er,

pla

stic

& t

hei

rp

rod

uct

s

Ch

em

ical

s &

chem

ical

pro

du

cts

All

engi

nee

rin

g

Min

ing

&Q

uar

ryin

g

Foo

dP

roce

ssin

g

Cem

en

t &

cem

ent

pro

du

cts

Ge

ms

&je

wel

lery

Wo

od

&w

oo

dp

rod

uct

s

Pap

er &

pap

erp

rod

uct

s

Veh

icle

s,ve

hic

le p

arts

& t

ran

spo

rteq

uip

men

ts

Gla

ss &

glas

swar

e

Oth

er

Ind

ust

ries

Key initiatives

*DST: Direct Sales Team; DSA: Direct Service Associates

Note: The remaining share in fund based exposure is residual advances which comprises of educational loans, housing loans, gold loans, loan against deposits, personal loan, staff loan, consumer loan, vehicle loan etc.

15

Strategic initiatives to drive CASA growth

Offline Marketing Digital Marketing

Promotion in print, outdoor media, FM radio, television, and mobile van campaigns

Official Facebook page created to have a presence on the social networking platform

Staff Motivation

Online tests implemented to improve staff’s product knowledge and the implementation of incentives including ESOP for all staff

ADVERTISING AND PROMOTION

Flexi Current Account Debit Card for Entities Flexible current account with add-on services like cash pick-up, cash management, and door step banking etc.

One of the first banks to offer debit cards for partnerships and private entities

Robust Sales Force Doubling of the sales force on the streets; along with providing additional training for the sales force to offer trade and foreign exchange services. CURRENT ACCOUNTS

Competitive Interest Rates Launched Crown | NRI Banking Product

CASA strategy of relatively higher interest rate of 5%-6%

Capitalized on the broad base network to acquire HNI accounts and build a client base for cross-selling opportunities

Mobile Banking

Launched in 2016; capitalized on cross-selling opportunities to existing and new customers

SAVING ACCOUNTS

FISDOM

App to provide investment solutions via the better understanding of clients objectives & priorities.

FINFIT

App based online wealth management platform to provide simple, jargon-free approach to managing money

Multi Function E-Lounge

Automated branch to provide advanced banking facilities- cheque deposit, passbook printing etc

Rupay Platinum Card

Introduced Rupay Platinum Card which can be used in e-commerce, point of sale & ATM

LVB UPAAY Dynamic Current Account

Balances in the linked SB account can be swept into the CA & balances in the CA above the threshold limit will be moved to the linked SB

UPI application of LVB NEW INITIATIVES

16

Significant potential for increasing CASA and NIM growth

37 44 58

16.67% 17.36%

19.11%

FY15 FY16 FY17

CASA (INR Bn) CASA Ratio

Robust growth in CASA with strategic efforts

400 460 481

92 96

121

FY15 FY16 FY17

# Branch CASA/ Branch (INR Mn)

Aggressive branch expansion with 25% of the branches as on March 2017 within 3 years of vintage

Improvement in branch productivity to drive future growth in CASA

Renewed focus on TASC Accounts- Trusts, Association & Societies, Schools, & Charitable Institutions

Significant NIM expansion expected from CASA initiatives; potential head room to give away some of the gains in NIM to add high-rated clients and reduce credit costs

360 Degree coverage of corporate customers to get Low Cost Deposits – Corporate Salary Account, operating Current Account, supporting fee based income growth out of FB and NFB business and Cash management services.

17

Focus on fee income products

*NPS: National Pension Scheme

3rd PARTY PRODUCTS TRANSACTION BANKING GROUP

New transaction banking vertical created

Boost non-interest income via booking of non-fund / off balance sheet business

Potential to significantly increase fee income via multiple product offerings

Key product offerings

Trade finance

Bill discounting

Guarantees

Letter of Credit

Cash management

Government banking

Traction with multiple recent business wins

Product Product Partners

Insurance

Life Insurance: Birla Sun Life, Max Life, DHFL Pramerica

General Insurance: Future Generali

Health insurance: Cigna TTK

Mutual funds and PMS

Sundaram Asset Management, UTI, Reliance Asset Management, 10 other affiliations

Credit cards SBI Cards and Payment Services Private Limited

National pension scheme

Money transfer Weizmann Forex

Life Insurance

78%

General Insurance

18%

Mutual Fund 2%

Forex 1%

NPS 0.1%

FY16 INR 62mn

Life Insurance

76%

General Insurance

15%

Mutual Fund 1%

Health Insurance

8%

NPS 0.1%

CAGR FY16-17: 60%

FY17 INR 99mn

*

18

Technology enabling automation and enhanced customer experience

DIGITAL BANKING AND

OMNICHANNEL PRESENCE

Strong presence across banking

mediums for a seamless customer

interface

BUSINESS INTELLIGENCE UNIT

Customer segmentation based on analytics

providing bespoke financial products and

services based on differentiated

requirements

AUTOMATED LOAN ORIGINATION

Uniform processing and standardised

enforcement of credit terms and reporting

improving productivity

MOBILE BANKING

Multifunction mobile app with intuitive

functions for a

state-of-the-art customer interface

SALES AUTOMATION

CRM Tool for salesforce automation and

leads management

UPGRADING CORE BANKING SUITE

Upgrade of the hardware and network setup to the

latest scalable technologies underway to enhance

core banking and internet banking platform for

long term sustainability

REVAMPED TECHNOLOGY

ARCHITECTURE

E LOUNGE

Automated branch for advanced banking

facilities such as cheque deposit with

T+1 clearing and passbook printing

Funds transfer pricing

Profitability Management System

Analytical Applications Infrastructure

Business Intelligence

ORACLE FINANCIAL PRODUCT SUITE

19

Revamped risk management framework

8

BRANCH SETUP

Exclusion of lending decision from branches

Branches will have authority to sanction only LADs, JDLs, and LAS, and government sponsored schemes

Centralization of the wholesale credit process to the Corporate Office

NEW RECOVERY VERTICAL

Separate Recovery vertical at Regional level and monitored at corporate level

Recovery agencies empanelled to assist the bank in reducing the TAT of recovery

Strong retail collections to ensure better repayment controls and diligence on customers to repay on time

NEW COMMERCIAL BANKING OPERATIONS DEPARTMENT

Separate specialised branches in 7 cities (covering all regions) to handle the entire Post Sanction Credit Operations pertaining to Corporate and MSME Segment

Relieve branches from credit & related operations and enhance focus on business

Commercial Branches to be monitored at Corporate Office

OVERHAUL OF RISK MANGEMENT SYSTEM

Appointment of CRO & strengthening of operations risk department

Developed risk management systems and new risk rating models

Comprehensive policies and procedures to identify, measure, monitor and control risk throughout organization

LAD: Loan against Deposits, JDL: Jewel Deposit loan, LAS: Loan against shares/securities

20

3. STABILISATION OF ASSET QUALITY

21

Stabilization in asset quality as a result of revamped risk management framework

2.75%

1.97%

2.67%

1.85%

1.18%

1.76%

FY15 FY16 FY17

GNPA NNPA

4.55 3.91 6.40

13.15 9.91

7.74

17.69

13.82 14.14

10.82%

7.04% 5.96%

FY15 FY16 FY17

Restructured Gross NPA Total stressed assets as % of net advances

60.84%

68.55%

59.51%

FY15 FY16 FY17

GNPA & NNPA Total stressed assets1 (INR Bn)

Provision coverage ratio2

1) Total stressed assets= Gross NPA+ Total restructured assets (including doubtful assets) 2) Provision Coverage Ratio = Provision/ Gross NPA

22

Conscious de-risking of portfolio 4

,546

3,9

13 6

,402

1,969

212

693

1,698

5,972

265

915

2,303

Gro

ss

NP

A F

Y1

5

Ad

ditio

ns

Upg

rad

atio

ns

Write

-off

s

Reco

very

/A

RC

Sa

le

Gro

ss

NP

A F

Y1

6

Ad

ditio

ns

Upg

rad

atio

ns

Write

-off

s

Reco

very

/A

RC

Sa

le

Gro

ss

NP

A F

Y1

7

INR Mn

Increase in slippages and GNPA due to clean-up of balance sheet in FY17 post Asset Quality Review by RBI

Sale of some NPAs to ARCs and upgradation of some stressed accounts via efficient recovery follow-up enabled stabilisation in asset quality

Credit monitoring and the follow up methodology has been further improved and enabled by technology

23

Diversification of portfolio risk

Top 5 Borrowers 55.3%

6-10 25.1%

11-15 15.1%

16-20 4.0%

Others 0.4%

Food Processing 20.6%

Other Non-food Credit 15.6%

Wholesale Trade 8.6%

Retail Trade 8.1%

Vehicles, Vehicle Parts & Transport Equipments

7.9%

Mining and Quarrying 6.2%

Other Retail Loans 5.3%

Textiles 5.0%

Chemicals & Chemical Products

4.6%

Other Industries 8.0%

Gems and Jwellery 3.2%

Agriculture & Allied Activities

3.2%

Other (Non-Industry) 3.6%

Restructured standard assets: Borrower concentration

GNPA: Industry concentration

Infrastructure 31.9%

Iron 27.9%

Power 8.1%

Metals & Minerals

6.6%

Shipyard 3.7%

Aluminium 4%

Food Processing 4.2%

Pharma 2.9%

Others 11.1%

Restructured assets: Industry concentration

GNPA: Borrower concentration

Top 5 Borrowers 47.4%

6-10 15.5%

11-15 8.7%

16-20 5.3%

Others 23.0%

Figures above for FY17

24

4. APPENDIX

25

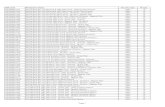

Balance Sheet

(INR Mn) FY15 FY16 FY17

Shareholders Funds 15,561 17,636 21,363

Share Capital 1,792 1,795 1,914

Reserves and Surplus 13,770 15,841 19,449

Deposits 219,642 254,310 305,534

Current Deposits 15,099 16,365 18,447

Saving Deposits 21,525 27,791 39,996

Term Deposits 183,018 210,154 247,090

Borrowings 4,581 7,230 17,731

Other Liabilities & Provisions 7,270 7,529 7,819

Total Liabilities and Shareholder Funds 247,054 286,705 352,447

Cash and Bank 13,187 13,686 16,239

Investments 60,512 65,454 86,517

Advances 163,520 196,437 237,289

Secured by Tangible Assets 155,222 188,786 233,146

Secured by Government 599 - -

Unsecured 7,700 7,651 4,143

Fixed Assets 2,434 3,670 3,591

Others 7,401 7,457 8,811

Total Assets 247,054 286,705 352,447

26

Income Statement

(INR Mn) FY15 FY16 FY17

Interest Earned 22,145 25,683 28,467

Interest Expended 16,879 19,230 20,640

Net Interest Income 5,267 6,453 7,827

Other income 2,840 3,045 5,028

Operating Income 8,107 9,498 12,854

Employee Expenses 2,384 2,754 3,347

Other Operating Expenses 2,146 2,674 3,167

Provisions & Contingencies 1,802 1,769 2,540

Exceptional Items (107) - -

Total Expenses 6,225 7,196 9,053

Tax 559 500 1,240

Net Profit 1,322 1,802 2,561

27

(%) FY15 FY16 FY17

CASA 16.7% 17.4% 19.1%

Yield on Advances 12.8% 12.2% 11.3%

Cost of Deposits 8.6% 8.2% 7.3%

Net Interest Margin 2.7% 2.8% 2.9%

Average Yield on Investments 8.1% 8.0% 7.6%

Credit / Deposit Ratio 75.2% 77.9% 78.4%

Cost / Income Ratio 54.6% 57.1% 50.7%

Tier-1 Ratio* 9.3% 8.7% 8.8%

Tier-2 Ratio* 2.0% 2.0% 1.6%

Capital Adequacy* 11.3% 10.7% 10.4%

GNPA 2.8% 2.0% 2.7%

NNPA 1.9% 1.2% 1.8%

Provision Coverage Ratio 60.8% 68.6% 59.5%

ROA 0.6% 0.7% 0.8%

ROE 10.8% 11.7% 14.4%

BVPS (INR /sh) 82.5 88.7 102.7

EPS (INR / sh) 9.2 10.1 14.1

Key Financial Metrics

* As per Basel III Credit / Deposit Ratio = Gross Advances / Deposits

28

CONTACT US

The Lakshmi Vilas Bank Ltd. Corporate Office LVB House, 4/1, Sardar Patel Road, Guindy, Chennai - 600032 Tamil Nadu, India Toll Free: 1800-425-2233 Email: [email protected]