Corporate Presentation...Market Expansion 6 Pre-FY2013 FY2014 FY2015 FY2016 FY2017 FY2018 FY2019)...

Transcript of Corporate Presentation...Market Expansion 6 Pre-FY2013 FY2014 FY2015 FY2016 FY2017 FY2018 FY2019)...

Click to edit Master title style

Corporate Presentation

June 2019

2

65%10%

25%

Legacy Revenue

Consumables

Instruments

Diagnostics

B U S I N E S S O V E R V I E W C O R P O R A T E

Business Overview

At a Glance:

President and CEO: Chuck KummethHeadquarters: Minneapolis, MNNumber of Employees: ~2,100World Wide Presence: 35 Locations FY2018 Revenues: $643 millionNASDAQ: TECHMarket Cap: ~$7B

3

B U S I N E S S O V E R V I E W C O R P O R A T E

25%

37%

15%

23%

Academia

Pharma/Biotech

Distributors

OEM

$643MM

Revenue by Customer Type

4

B U S I N E S S O V E R V I E W C O R P O R A T E

57%

28%

15%

AmericasEMEAAsia

$643MM

Revenue by Geography

5

Pl

Top Strategies

Geographic ExpansionCore Product

Innovation

Culture Creation & Talent

Gap Filling M&A and Market Expansion

6

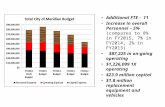

Pre-FY2013 FY2014 FY2015 FY2016 FY2017 FY2018 FY2019

Rev

enu

e ($

mill

ion

)

Org

anic

Gro

wth

(%

)

Disciplined M&A and Investment Strategy to Impact Growth

311358

452499

563643

522

0

5

10

15

0

200

400

600

800

FY13 FY14 FY15 FY16 FY17 FY18 FY19-9mo

7

~15%

Reagent Solutions

Diagnostics

Develop and manufactures biological reagents used in all aspects of life science research

Develops and manufactures controls, calibrators and diagnostic assays for the regulated diagnostic market

Manual and automated protein analysis solutions that improve the efficiency of process work streams & quantitate secreted proteins

GenomicsAdvanced, tissue morphology friendly RNA in situhybridization (ISH) assay for transcriptome analysis & prostate cancer molecular diagnostic

Analytical Solutions

Our New Segment Structure

Protein Sciences Segent

Diagnostics and Genomics Segment

Protein Sciences Segment

8

Serving All Aspects of Life Science

Basic Research

Applied Research

Life Science Tools

InstrumentsReagents Consumables

DiagnosticsClinical

ResearchPharma

Production

Pharma Development

Ap

plicatio

ns &

Markets

Pro

du

cts

9

Click to edit Master title style

Protein Sciences Segment

1 0

Proteins: High Value & High Growth Applications

Specialty MediaSupplements

Cell Therapy(GMP grade Proteins)

Proteins

Cancer Immunotherapy Research(Immune Checkpoint Proteins)

Bioprocessing(Growth Factors for large

scale Production)

1 1

Immunocytochemistry

Luminex® Assays

ArraysEllaTM

ELISA Assays

Blocking/NeutralizationAssays

Western Blot and Simple Western

Immunohistochemistry

Flow Cytometry

Antibodies: High Quality Reagents Drives Versatility in Applications

1 2

Current Areas of Growth

Epigenetics

Stem CellsCancer Research

Neurodegeneration

Small Molecules: Research Area Emphasis

Functions

Inhibitors

Activators

Agonists

Antagonists

Blockers

Modulators

Ligands

GMP Grade Reagents

1 3

Fully Validated

Manual

HomemadeAssays

Fully Automated

DuoSet®

FluorChemAlphaImager Single-Cell

Arrays Luminex®

Quantikine® Simple Plex ™

Simple Western™

Immunoassays: Different Users & Different Needs

1 4

Separation

Imaging

Analysis

Microfluidics

Immunoassay

Measurement

Proteins have complex structures

Analytical Solutions Division

14

1 5

Immune Cell Therapy Opportunities

Profiling CAR activity via

ACD technology

GMP Proteins

Assay/Ab platformsfor QC

Ella for CRSDetection/monitoring

Abs for T-Cell Activation using

QUAD Technologies

1 6

QuickGel™ Microparticles for Cell Therapy Applications

Only releasable, non-magnetic cell selection technology

Bringing automation and GMP-compliance to our magnetic bead-free cell separation

Revolutionizing the clinical workflow

Current RUO cell selection solution

Directly-conjugated antibodies

1 7

Click to edit Master title style

Diagnostics & Genomics Segment

1 8

Devens, MA

Devens, MA

Waltham, MA

Rennes, France

Milan, Italy

Newark, CA

Emeryville, CA

San Marcos, CA

Minneapolis, MN

Beijing, China

Diagnostics Genomics

Munich, Germany

Locations & Brands in Bio-Techne’s Diagnostics and Genomics Segment

1 9

• Point of Care

• Laboratory instrumentation

Biological components & Tests

• Cardiac Markers

• Lipids

• Specific Proteins

• Cancer Markers

• Toxicology

• TDM

• DOA

Instrument companiesCalibration and control products

• General Chemistry

• Hematology

• Diabetes (Blood glucose, HbA1c)

• Blood Gas/Electrolytes

• Immunochemistry

• Urine Chemistry/Urinalysis

• Coagulation

Diagnostics Division Overview

2 0

Genomics Division Overview: RNAscope - In-Situ Hybridization (RNA-ISH)

• Advanced Cell Diagnostics

• Technology allows both manual and automated gene expression analysis

• Optimized for single and multiplex analysis

• >25,000 off-the-shelf target probes

• RNAscope and BaseScope are current assays on the market

• Pharma Assay Services further deploys the technology to select customers

• Represents the most advanced RNA in situ hybridization (ISH) assay for

transcriptome analysis and gene quantitation while retaining tissue morphology

RNAscope® 2012

DNAFISH 1990s

RNA

ProteinIHC 1970s

RNAscope VENTANA LEICA

2 1

RNAscope Improvements: HiPlex Detection of 12 Neuronal Markers in Mouse Brain

Round 2 Round 2 Round 3DAPI images from Round 1-4

Image Registration

Select targetsSelect Pseudo colorSave composite

2 2

Key Properties

Frequency

Ability to Enrich or Select

Quality of Isolated Nucleic Acids

CTCs

Infrequent in early stages of disease

Yes

Good

cfDNA

Difficult to find within “noise” of

contaminating DNA

No

Poor due to enzymes exposure

Exosomes

Abundant

Yes

High quality-shielded

Liquid Biopsies: CTCs, cfDNA & Exosomes

2 3

The EPI Test

The EPITM risk score is used to risk stratify likelihood of high grade (GS > 7) prostate cancer on initial biopsy in men 50-years and older, with a PSA 2-10ng/mL.

The Workflow:

Intended Use:

Inclusion of EPI in 2019 NCCN Guidelines (Jan 2019)

2 4

Healthy Pipeline of Future Products for Different Markets and Applications Drive Growth

Commercial Channels UROLOGY NEPHROLOGY NEUROLOGY MEDICAL ONCOLOGY

PROSTATE CANCER BLADDER CANCER KIDNEY TX DEGENERATIVE, MENTAL

DISORDER

DETECTION Develop PSA ReplacementAlzheimer’s, Parkinson’s,

Other CDxScreening Panel, CDx

DIAGNOSISAlzheimer’s, Parkinson’s,

Other CDx

PROGNOSIS EPI Bladder Signature Breast Ca, Other CDx

TREATMENT SELECTION

EPI, EPI AS, ARv7, Other CDx

Bladder Signature Kidney SignatureAlzheimer’s, Parkinson’s,

Other CDx

Lung Ca Panel,EGFR/T790M, EGFRv3,

BRAF, 170 Gene Panel, CDx

PATIENT & TREATMENT

MONITORING

EPI AS, EPI TM, ARv7, Other CDx

Bladder Signature Kidney SignatureAlzheimer’s, Parkinson’s,

Other CDx

Lung Ca Panel,EGFR/T790M, EGFRv3,

BRAF, 170 Gene Panel, CDx

Ap

plic

atio

ns

Commercial Channels

2 5

Our Long Term Strategic Portfolio

ACD – Tissue Biopsy

Cell Culture/Therapy

Core Products

Instruments – Protein Analysis

Exosomes Dx – Liquid Biopsy

Bio-Techne Abs

2 6

Rev CAGR• Analytical Solutions +15-20%• Reagent Solutions +5-7%

Protein Sciences Segment +8-11%

• Diagnostics +4-6%• Genomics -- ACD +20-30%• Genomics – ExoDx ~ $150mm

Diagnostics & Genomics Segment ~ +20%

~$1.2B

As we look forward, our financial goals get larger

Revenue

FY13 FY16 FY18 FY23 FY13 FY16 FY18 FY23

~$0.5B

~40%OM

Adj. Operating Income

* All figures are expressed in millions.** Assumes no further unannounced acquisitions

OM% in 5yrs• Analytical Solutions ~ 30%• Reagent Solutions +50%

Protein Sciences Segment mid 40s%

• Diagnostics ~ 30%• Genomics -- ACD mid 30s%• Genomics – ExoDx ~ 30%

Diagnostics & Genomics Segment low 30s%

2 7

~1800

>300,000Products

~2,100Employees

>40Years

>500,000Citations

Our brands bring you >300,000 quality products

Nearly 2,100 employees globally

Our companies have been manufacturing and sourcing reagents for more than 40 years

Generated using our products

6 instrument platforms that leverage biological content

6Platforms

Global Footprint

North America, Europe, and Asia