Converging Worlds

-

Upload

josh-develop -

Category

Technology

-

view

266 -

download

2

description

Transcript of Converging Worlds

April 2012

At a glanceIndustry is radically reframing how it can increase productivity and improve the efficiency and stability of our vehicles, buildings, and electric grids.

Cities, campuses, and corporations need to manage energy use more actively and in a more aggregated way.

The first step in navigating the opportunities—for both buyers and sellers of products and services—is to start from within.

Converging worldsFive management principles from companies modernizing our vehicles, buildings, and electric grids

2 Converging worlds

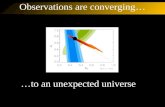

Nearly half of CEOs who participated in PwC’s 15th Annual Global CEO Survey are concerned about rising energy costs.1 With good reason: Price forecasts for all commodities are heading up, and energy prices top the charts (see Figure A). Energy—whether in the form of electricity, gas, oil, or fuel—is connected to a broad spectrum of other business issues, too, including climate change, natural resource constraints, food prices, water availability, political risk, and transportation challenges.

New products, services—even business models—are emerging from companies working to modernize our vehicles, buildings, and electric grids. These companies are envisioning new ways to create value for their customers by looking at problems in a more aggregated way. In this report, they tell how they need to work differently with their customers, suppliers, and others to shape their futures as market conditions evolve.

1 PwC, PwC’s 15th Annual Global CEO Survey, January 2012.2 US Department of Energy, Transportation Energy Data Book 2011, June 2011.3 US Department of Energy, Buildings Energy Data Book 2010, March 2011.4 MIT Sloan Management Review and Boston Consulting Group, Sustainability Nears a Tipping Point, January 2012.5 Texas Transportation Institute, Urban Mobility Report 2011, September 2011.

It’s no small task to save oil and energy—for the most part it requires making vehicles and buildings far more efficient than what we know today. Together, vehicles and buildings are among the most significant users of oil and energy in the United States: Transportation is responsible for 70% of petroleum consumption,2 and buildings account for 75% of electricity consumption.3

Growing concern about energy as a long-term business risk is why most companies want to take a more active role in managing their own energy use. Globally, about 70% of companies have sustainability initiatives of varying scopes in place, many with a conviction that managing energy use is necessary to remain competitive.4 For companies, the task of becoming more energy efficient is also tied to productivity and environmental benefits—but the energy efficiency is the easiest to quantify. An income-producing office for an average company, for example, spends about 30% of its operating costs on energy, but a third of that cost could be trimmed with commercially available technologies and active management. If that same company delivers goods in an urban area, it’s wasting an average of 22 days a year in traffic congestion, part of a total of $2.3 billion a year in unwanted congestion costs for US trucks.5 Technologies that help avoid congestion, then, not only make employees more efficient but can have other economic benefits too.

3 Converging worlds

Figure A. Key commodity prices are forecast to riseIndex, 2005 = 100World commodity prices are forecast to ride

0

50

100

150

200

250

300

350

400

45020

34

2031

2028

2025

2022

2019

2016

2013

2010

2007

2004

2001

1998

1995

1992

1989

1986

1983

1980

Source: Oxford Economics

Raw materials prices

Metals prices

Food prices

Energy prices

Progressive companies are looking for gains by tackling their transportation and building energy use as one larger issue rather than separate ones. They’re using technology in a broad range of activities to find the best ways to reduce cost, improve productivity, and minimize environmental impacts, including:

• Analyzing energy use for pricing and sourcing options with the lowest cost and the least environmental damage

• Identifying which facilities should produce their own energy supply or manage their own water use

• Tailoring logistics and fleet management to match the needs of each type of route and geographic region

• Examining use of office space, fleets, and other assets to eliminate waste and maximize utilization

4 Converging worlds

precision energy-management tools that analyze the energy use of each building system and notify a control center when HVAC, lighting, and data centers aren’t working optimally.

And it’s not just the technologies that are changing; business models are, too. Some solar companies, for example, are challenging conventional business models by leasing arrays rather than selling them, as a way to help customers manage up-front capital requirements. Transportation providers are investing in technologies that promote car sharing—targeting the market segments that can’t or won’t buy cars or those who realize their fleets are sorely underutilized. Such innovations reframe choices for customers and, as a result, reframe the competition, leading companies to anticipate new types of threats.

While innovation means new possibilities, it also means increased complexity for building and vehicle fleet owners and operators who will find themselves faced with successive waves of innovation. They will need to sort through products, services, and business models they’ve never seen before.

Their providers—those who are modernizing the electric system and making cars, trucks, and buildings several times more efficient than they are today—see the common goal. They see far greater potential for lower costs, greater productivity, and greater environmental benefits by completely redesigning solutions. They’re reframing their partnership networks and extending the roles they’ve traditionally played. When it makes sense, they’re partnering, mashing up technologies, and forming new business models. What’s emerging is an entirely new ecosystem where energy, information, building, and transportation technologies converge.

Technological evolution is at the heart of this change. For example, to work optimally, smart grids need smart buildings, but the legacy systems in most buildings aren’t up for the task. They simply weren’t designed for it. Now, cheap sensors that are making these building systems smarter can also connect building systems to each other and to other buildings—somewhat like nodes in a network. Tech-savvy providers are using these sensors to create things like

While innovation means new possibilities, it also means increased complexity for building and vehicle fleet owners and operators who will find themselves faced with successive waves of innovation. They will need to sort through products, services, and business models they’ve never seen before.

5 Converging worlds

Energy

•Renewableenergy•Distributedenergy•Smartgridtechnologies•Demandresponseandreal-timeelectricitypricing

Information

•Processorsandsensorsinmeters,cars,roads,andbuildings

•BigDatastorage,analytics,andmanagement

•AutomationcapabilitiesbuiltontheInternetofThings

There’s an entire ecosystem coming together around the promise of lower costs, greater productivity, and greater environmental benefits

What’s changing?

Market conditions

Technological evolution

3.Industryprovidesthetoolstomanagecomplexsystemsandlinkthemtogether.Whensynergiesexist,companiespartnerforgreaterbenefits,mashuptechnologies,andformnewbusinessmodels.

2.Marketsdriveadoption,andcombinationsofsolutionsaretailoredtouniquesettings.

4.Innovationsaddgreaterbenefits—butalsofargreatercomplexity—tobuildingandfleetenergymanagement.

1.Cheapandubiquitouscomputingandcommunicationsenableconvergencesacrossenergy,IT,building,andtransportationsystems.

Technology and business model innovation

Deployment and use

Building

•Certifiedgreenbuildings•Buildingenergymanagement•Demandresponseandreal-timeelectricitypricing

•Spaceutilizationandsharing

Transportation

•Intelligenttransportationsystems•Congestionandroad-chargingsystems

•Smartandconnectedvehicles•Alternative-fuelvehicles•Carsharing

What are customers looking for?Customersarelookingforanewtypeofvaluecreationwheresolutionscanbecustomized,linkedtogether,orcombinedforgreaterresults.

6 Converging worlds

Technological evolution is changing the very nature of how energy, information, buildings, and transportation are procured and managed. For example:

• Distributed energy generation is becoming cheaper and cleaner. Smart grids enable two-way conversations with companies and their utilities for real-time pricing. And energy will become easier to store, which may also change how it’s bought and sold.

• Vehicles and buildings are becoming part of a vast Internet of Things, in which any device can be addressed, monitored, controlled, and optimized. Data can be opened to third parties, allowing for aggregation, analysis, and reuse.

• Building operators are able to harness rich data streams that help them optimize energy and resource use, enhance comfort and productivity, and improve utilization rates.

• Smart and connected vehicles know where they can park, avoid traffic jams, or rent themselves out to other drivers or riders. Electric vehicles connect to the grid or to buildings—either of which could be designed to draw on a vehicle’s battery in ways that improve distribution and management of power.

As a result, both the nature of the products and services companies offer and how they operate and interact with suppliers, customers, and others will need to evolve.

How quickly will companies and their customers see real implications from these trends? “If you’re trying to replace the volume of coal-fired power plants and natural-gas-fired power plants, you’re talking about long time frames,” says Stephan Dolezalek, managing director of CleanTech at VantagePoint Capital Partners. “But if you’re talking about using existing systems to manage energy more efficiently, you may move much more rapidly than people would think.”

As with previous convergences enabled by technology, this one will require making organizational changes, bridging functional silos, and adopting different ways of thinking. “We need to think about organizational structure if we’re really going to embrace transformation,” says David Bartlett, vice president of industry solutions at IBM. “It’s never just about the technology; it’s about how we can step up to adopting it.”

“I look at some of the innovations out there, and I just think it’s kind of mind-boggling what’s going to happen. The possibilities are vast, and the combinations, exponential.”

—Carl Bass, Autodesk

7 Converging worlds

“Increasingly, the marketplace and the customers are looking for a new type of value creation, which is ‘I’d prefer not to deal with the complications of all those elements of the ecosystem. Help me string it together. Optimize it for me, and make it easier for me to access that value.’” —Mark Vachon, GE

Customers are looking for a new type of value creation To find out more about how companies are working differently to understand and shape their futures, PwC and GreenBiz selected a panel of leaders from 15 companies with a stake in the four domains showing the greatest potential for convergences: energy, information, buildings, and transportation.

We found common insights from our panel that we believe are useful to all companies as they work to understand their opportunities.

The panel told us how today’s circumstances are accelerating change and requiring them to work differently. These companies

1. Think systemically to capture technology and market shifts

2. Set a clear vision but prepare for multiple futures

3. Widen the circle of innovation and speed up the cycles

4. Look for opportunity in underutilized assets

5. Harness the value of Big Data

Their goal is to build organizational capabilities that bring returns to the business no matter how (or how quickly) technologies evolve.

We believe their insights should be of interest to any business leader who wants to reduce costs, mitigate risks, or contribute to overall profitability of the business—all while improving environmental outcomes. For those focused on mitigating risks or reducing costs in company operations, we hope you’ll see new ways of thinking about your business, assets, and partnerships. For those seeking to create new revenue opportunities, we hope you’ll be inspired as you envision your future and the capabilities you’ll need to achieve your objectives.

The sections that follow summarize our panels’ insights.

8 Converging worlds

Whether your company is building a new city, creating a transportation network, or changing your operations to reduce energy and waste, an integrative view can help you ensure you’re actually solving a problem, not creating a new or bigger one.

All of our panelists are working on innovative technologies, such as electric-vehicle charging systems, building analytics systems, or intelligent energy metering devices. But they’re also working on large cross-sector issues like modernizing the electric grid, tackling traffic gridlock, or building sustainable megacities, thinking that is supported by a market demand for smarter infrastructures (see Figure C). Taking an integrative approach allows them to move beyond individual products and services and to examine how a system’s parts influence one another and the whole.

Cisco explains how this way of thinking led to a co-creation process in the development of a Korean greenfield city, New Songdo City. One of the project’s requirements was that the city produce one-third less greenhouse gas emissions than a typical city its size. “The idea

was to engage new actors in the city planning process from the get-go,” says Gordon Feller, Internet Business Solutions Group at Cisco. “This included national government, local government, citizen organizations, technology companies, private developers, and public agencies that were established in the economic free zone. So we expanded the circle of partners and, in the process, were able to identify some breakthrough innovations.”

Cisco has staked its role in this ecosystem on owning the “urban operating system.” This assumes the growing viability of a cities-as-a-service approach, which is maturing alongside mobility-as-a-service and other business models that monetize service delivery alongside product sales. It also depends on integrating the products and services and know-how of a wide range of partners. It’s a radically new model for city managers and the companies (like Cisco) that sell to them. But it also forms the basis of Cisco’s strategy; it’s this kind of repositioning that is helping Cisco understand its role and define it further.

1. Think systemically to capture technology and market shifts

9 Converging worlds

“We see convergence as being literally the starting point and the end point, primarily because we think that’s where our customers are headed, and we want to be as responsive as possible to their demands. And one of their demands is: Break down the silos; bust the barriers.”

—Gordon Feller, Cisco

Figure B. A market shift toward smart infrastructure developmentSmart city smart infrastructure investment by industry, world markets: 2010-2020, in $ Billions

Source: Pike Research

Smart Cities

$0

$2

$4

$6

$8

$10

$12

$14

$16

$18

20202019201820172016201520142013201220112010

Source: Pike Research

Smart building

Smart transport

Smart utilities

Smart government

US

$ B

illio

ns

10 Converging worlds

In addition to thinking more systemically, companies are taking a longer-term view, creating one or more scenarios about where and how markets will change and about the opportunities. “Without a long-term view of where things are going and where you want them to go, I think it’s going to be very hard to end up really playing a central role in any of this,” says Bill Weihl, manager of energy efficiency and sustainability at Facebook. The social media company has been a leader in data center energy efficiency as well as in encouraging collaboration and transparency around solutions for data center energy use.

Once companies have a vision in mind, the business case for taking innovations to scale or to maturity becomes clearer. Boeing, for example, sees an opportunity to play a role in the utility space by working with the US Department of Defense to address its growing energy concerns both in

fixed military bases and in the field. “We crafted a strategy focused on leveraging things we do and things we own—particularly approaches that provide command and control to lots of objects inside a large network, like a smart grid,” says Tim Noonan of Phantom Works Ventures and Boeing Energy at Boeing.

Through a series of grants from the American Recovery and Reinvestment Act of 2009 (ARRA), as well as related projects and company investment, Boeing slowly began to develop an energy strategy that it is working to implement today. “We’ve explored a number of areas that we think have a lot of potential,” Noonan says. “Not all of them are going to pay off, but I think we placed some good bets across generation, transmission, distribution, storage, and carbon capture that have strong upside for us both strategically and financially.”

2. Set a clear vision but prepare for multiple futures

11 Converging worlds

Facilities and fleets

Whether it’s residential or commercial, there’s a constellation of new technologies for energy efficiency, generation, and demand response ready to connect systems like HVAC and lighting to the energy grid and communications network. The second piece is connecting grid appliances, like the electric vehicle to the facility.

Command & control center

Business customers, partners, and suppliers along the value chain

Large corporations and their network of suppliers already manage fleets and facilities in a range of operating environments. What’s new here is learning how data can accelerate innovation cycles.

Institutional and commercial campuses

Corporate campuses, colleges and military bases will gain more by taking a holistic view of possible technologies to connect and control critical systems. While a facility-by-facility approach could make sense, portfolio management can present more options for successive waves of innovation.

Cities and public works

Cities and regions are forming public-private organizations to manage entire portfolios of projects, many of which tackle traffic congestion, reliable and affordable electricity, and a smarter, greener urban living experience.

What’s your company’s role and the vision for your future?

“When you look at what Henry Ford did with the Model T, it opened up the highways for people. But our new model has to be a different model, and that different model has to address mobility challenges.”

—John Viera, Ford

12 Converging worlds

As part of their growth strategies, companies are identifying new opportunities to take advantage of their existing assets and expertise for innovation; but they’re also looking to nontraditional and unexpected sources to enhance what they already have to offer. “You’ve got to make money at the end of the day,” says Mark Vann of the Advanced Technology Government Business Development group at General Motors. “You need to find partners where there are synergies, where a group of us together can cost-justify making a leap in an investment or a technology.”

Companies we spoke with identify three types of collaboration that are fostering their innovation. The collaborations could be to build or manage electric grids, construct or operate smart buildings, design or manage cities’ infrastructures, provide integrated and adaptive transportation services, manage distributed and diverse energy systems, or more.

• Customers. First, companies are working more closely than ever with their customers to identify new opportunities to address their needs over the short and medium terms. While customers are looking for ways to succeed in an increasingly dynamic marketplace, they’re wary of companies that bring a one-size-fits-all, plug-and-play solution to the table. Forming close partnerships to seek innovative, flexible, yet

tailored solutions can overcome such obstacles. “I think there’s nothing that our clients distrust more than someone coming to them with ‘the solution,’ because we don’t know what the solution is going to be,” says David Pogue, national director of sustainability at CBRE. “We need to work with them on the opportunities, and together we need to determine the best solutions.”

• Internal. Second, they’re encouraging internal cross-functional collaborations to find fresh perspectives. Sometimes it involves technological cross-pollination. General Electric, for example, leveraged aerospace engineering from its aviation business, as well as materials science and mechanical engineering expertise from across the company to become the leading US wind turbine manufacturer. But technology solutions alone aren’t always sufficient, so companies are reaching into other parts of their businesses to find expertise on such things as customer service or marketing. “What we’re doing, of course, is expanding the circle beyond the engineers to people who are trained in other fields and who are also great sources of innovation,” says Cisco’s Feller.

3. Widen the circle of innovation and speed up the cycles

13 Converging worlds

• External. Finally, they’re looking to other players in their industries or in adjacent industries to take a broader, multidisciplinary approach to specific customer issues. At Microsoft, for example, this is creating new opportunities to work with utility and energy industry partners. “All of these folks are really deep energy experts who are now finding themselves in the software solution business at a level they never have been in before,” says Rob Bernard, chief environmental strategist at Microsoft. “And that’s where the partnership and the synergy come in—because we’re not a solutions company in the energy space. So it creates the opportunity and the conditions for a partnership.”

Where have we seen convergences like this before?We have seen technology convergences before, and those that have preceded may be instructive to understanding the business implications of today’s convergence. VantagePoint Capital Partners’ Stephan Dolezalek provides this perspective.

In the development of information technologies, we started with a mainframe computer that pushed information to a dumb terminal. We then migrated to ever-smaller, more-powerful microcomputing platforms that distributed computing power, reducing the need for those mainframes. But then we discovered that we wanted to reconnect things, which ultimately led to the development of the Internet. Now, we’ve come full circle, with massive numbers of devices talking to central computers in the cloud.

That piece, I think, represents the ultimate possibility for our physical infrastructure. As cities and companies start thinking about managing complex systems and acquire the tools that connect the systems together and manage distribution of power, they can do it on a building level or a community level and suddenly they’re efficiently managing electron flows, temperature, comfort levels, lighting—basically, the human experience.

Information technology continues to get bound ever more deeply into the Internet of Things. Today we have one Internet where we want very active involvement, control, and constant interaction. There will be a second layered Internet, where we want to minimize our interaction, as systems handle things automatically and provide us with the best user experience but do so in the background. The management of lighting, transport, and energy will be background managed through business services. If it can do what I need it to, without my having to interfere, that’s ultimately how energy and transport will be delivered to us.

As big incumbents try to move into that future, some of them will be able to capture the new technology and integrate it and others will be left behind. The only possible way that an incumbent can deal with this is to change from within by embracing it or just acknowledge that failure to change is, in almost every part of the global economy today, something that’s sure to lead to certain death.

14 Converging worlds

“We see this process of opening the system as actually accelerating the path to innovation.”

—Gordon Feller, Cisco

6 PwC, PwC’s 14th Annual Global CEO Survey, January 2011.

Across the board, companies are seeing their need for partnerships swell. “The larger the scale of these kinds of projects, the greater the number of players,” says Clay Nesler, vice president of Global Energy & Sustainability at Johnson Controls.

But a larger network of partners doesn’t have to mean the process slows down. In fact, many companies say they’re able to accelerate the process of innovation through collaborations that leverage partners’ expertise efficiently.

“I would say the velocity of work has increased quite a bit,” says Mary Beth Stanek, director of Federal Environmental & Energy Regulatory Affairs at General Motors. “You

have more groups working faster on advanced-technology collaboration so we can get to the market quickly. If you look at the Chevy Volt timing from inception to launch, it was probably one of the fastest vehicle launches we’ve ever done.”

Conditions are driving companies to look for opportunities to join together—to go to market with arms linked. It’s about companies’ using their combined capabilities to provide greater benefits for their customers than if each went it alone. This is a broad trend seen across all industries and echoed in other research. Forty percent of global CEOs now expect the majority of innovation in the future will be co-developed in collaborative networks outside their organizations.6

Our panelists said that both internal and external stakeholders are important partners in designing new strategies and ensuring their success. “You have to be flexible with regard to these types of partnership structures,” says Mark Vachon, vice president of ecomagination at GE. “We’ve focused not only on expanding the sources of innovation and technology but also on how we scale and commercialize the ideas we’ve partnered on.”

40%of global CEOs now expect the majority of innovation in the future will be co-developed in collaborative networks outside their organizations.

15 Converging worlds

Market acceleration led by governments

Business expects governments to be among the largest customers for clean, smart, and green solutions because of the need for infrastructure improvements. The world’s infrastructure investment needs for energy, road and rail transport, telecommunications, and water are likely to average 3.5% of world gross domestic product through 2030, or about US$71 trillion, OECD says.7 In some cases, the private sector will lead infrastructure projects, through public and private partnerships, as it has in the buildout of telecommunications networks in both developed and developing countries.

Around the world, government-supported drives are laying the groundwork for smart infrastructures, with investments in the modernization of electricity grids. Smart-grid investment in China will reach at least US$96 billion by 2020, as part of that country’s long-term stimulus plan.8 In the United States, US$4.5 billion was allocated to smart-grid initiatives under ARRA.

Large stimulus efforts have been accompanied by an array of federal and subnational government programs providing incentives designed to promote market acceleration, including:

• Production tax credits

• Cash grants and loans in lieu of tax credits

• Renewable-energy standards

• Regional cap-and-trade programs

• Feed-in tariffs

• Fuel efficiency standards

• Commercial benchmarking laws for energy use

• Guidelines that allow interval data from utilities to be open source and available to third parties

• Guidelines for privacy and data security of interval data

To accelerate change, industry working groups are working closely with government agencies on a wide range of industry standards that define the boundaries for collaboration and competition.

7 OECD, Infrastructure To 2030: Telecom, Land Transport, Water and Electricity, Volume 2, August 2007 and PwC, 10Minutes on Global Infrastructure, March 2010.

8 International Energy Agency, Technology Roadmap: Smart Grids, 2011.

$71TInvestment needed to improve basic infrastructure through 2030

16 Converging worlds

Entrepreneurs in both incumbent and start-up companies are looking for opportunities to identify and manage underutilized assets or to create products and services that optimize others’ underutilized assets.

Over the past few decades, information technology companies have turned to utilization to boost data center efficiency, create faster processors, and more. Today’s innovators look for opportunities where utilization can either reduce cost, increase revenue or both.

For example, in 2010, unused capacity on Amazon’s servers led the company to introduce its popular EC2 cloud offering, turning underutilized assets into a new revenue stream. Since EC2’s release, revenue jumped from $240 million in the third quarter of 2010 to $470 million in the third quarter of 2011.9

9 Andrew Hickey, “Amazon’s Q3 Cloud Revenue Skyrockets,” CNN, October 2011. 10 Cisco, European City Connects Citizens and Businesses for Economic Growth, October 2011.

In another example, the city of Amsterdam reduced the physical amount of office space it leases by 40% through a partnership with Cisco. The city now boasts modern and up-to-date work solutions, such as encouraging and enabling telecommuting, and creating flexible, shared workspaces. All told, the initiative is saving the city €10 million annually.10

Vehicle-sharing models take asset utilization to another level. Fleets of cars, bicycles, trucks, and other vehicles are available by the hour for individual use and are conveniently located throughout a community, campus, or city. While car sharing started with community member-based services, the concept has broad potential to change how cities, colleges, and corporations manage and maintain fleets. Vehicle owners see radically higher utilization and potential revenue, and users have new choices for how they use transportation.

4. Look for opportunity in underutilized assets

17 Converging worlds

Market barriers mean no easy entry

Finding the right economic model has been elusive in many smart, clean, and green ventures. Even when the economics make sense on paper, there is a mentality that needs to change, and it’s often hard to convince buyers that they should be the ones to go first.

Existing public policies and market structures can act as disincentives for change: most policies were designed for systems to work as they do now, not how they could in the future. We found broad recognition among our panelists that the right market incentives are critical to reducing commercial risk so they can take new ideas to scale.

For example, US commercial buildings waste about a third of the energy they consume, but there are few incentives for building owners to improve them. Typically, leases are written so that tenants are responsible for utility costs, while landlords are responsible for capital costs related to energy systems, such as HVAC maintenance or on-site generation. Because, in effect, the landlord pays for the project but the tenants receive the benefits, the landlord has no financial incentive for making efficiency improvements. “That’s one of the countertrends right now to buildings becoming smarter and more energy efficient—the investment realities in the marketplace aren’t supporting it,” says Bob Best, executive vice president of Jones Lang LaSalle.

The commercial building market isn’t the only place these problems exist. In the utility business, existing policies

and rate structures typically discourage power providers from supporting energy-efficiency efforts—at least on any meaningful scale. In other cases—e.g., vehicle efficiency standards or pricing and policies for on-site solar—technology has also changed faster than policy.

The picture is slowly changing, as companies seek opportunities to work with regulators and competitors to craft policies that support innovation and incentivize efficiency industrywide. For example, when FedEx wanted

to spur the development of electric-vehicle technologies for the tens of thousands of trucks it runs every day, it lobbied to raise federal fuel economy standards. By doing so, it gave technology and manufacturing companies a stronger incentive to develop and deploy efficient, electric-vehicle technologies. And when FedEx worked with Environmental Defense Fund on hybrid-electric vehicle

development for commercial trucks, it made the project non-proprietary to promote innovation and collaboration among manufacturers and operators to encourage widespread adoption. Using hybrid-electric and all-electric vehicles for light delivery is just one component of FedEx’s corporate strategy to reduce the use of petroleum; there’s another strategy for its heavy trucks and a third for its 700 planes. The company has improved energy efficiency every year since 2005, with a 15.1% improvement through fiscal year 2010.

Existing public policies and market structures can act as disincentives for change.

18 Converging worlds

One of the natural consequences of placing sensors throughout buildings, in vehicles, and within energy systems is the very large amounts of detailed data theses sensors generate. But we’re only beginning to see how this tsunami of data fosters new innovation. Saul Zambrano of Pacific Gas and Electric Company’s Customer Energy Solutions group sees potential. “The enhanced capability and the data sets that underlie it really are creating this new innovation cycle around smarter grids and smarter buildings,” he says.

This explosion of information, commonly referred to as “Big Data,” is ushering in a new type of analytics that enables management to make decisions with a precision comparable to scientific insight. The newest analytic methods use rigorous scientific techniques, including hypothesis formation and testing, statistical sampling, and visualization tools.

Data analytics can turn the invisible into the visible when partners come together to make sense of the data. IBM talks about an early facilities management implementation, which made use of 10,000 data sources to provide a robust picture of a facility’s operations. The value, however, came from applying the customer’s knowledge about priorities and needs alongside IBM’s analysis tools to provide actionable information about how to optimize the facility’s operations.

“We provided the IT constructs, but the facilities team was key in providing the experience and what type of rules made sense,” says IBM’s Bartlett. “I guess what they didn’t realize was the capability of IT to give them a command view, to give them visibility and automation that they hadn’t had before. So, they’re seeing the potential for new energy savings as a result.”

Data analytics can also provide insight into new products and services customers need. For CBRE, the opportunity lies in tapping into large data sets across its customers. “If I have all of the data for one client who owns 30 buildings in a portfolio, maybe then I can do a commodity buy for the energy for those buildings,” says Pogue of CBRE. “Right now, owners think of individual buildings, but what we want to do is begin to view the management and benefits in a more aggregated way.”

The potential for companies to use data more effectively can transform not only the products and services companies provide, but also how those companies organize to respond to business goals and customer need. As Zambrano says, “Historically, utilities were very silo structured. Analysis of the data that’s coming in is effectively going to require a shift in capability around horizontal management, and so, it’s part of the business change.”

5. Harness the value of Big Data

19 Converging worlds

11 Marc Gunther, “Why GM is working with car-sharing firm RelayRides,” GreenBiz.com, March 2012.

Is your strategy fit for the future?At the heart of convergences among energy, information, building, and transportation technologies is the potential for far greater economic and environmental benefits than we’ve seen before. Convergence represents an opportunity to define the direction of industry by harnessing the power of both technology change and business model innovation. In fact, innovation does not focus exclusively on new technology. Developing new business models and new strategies is every bit as important—sometimes more.

GM is just one company embracing the idea that both technology change and business model innovation must work side by side to create the future of the organization. Today, GM is—first and foremost—in the business of selling as many cars as it can. But it is also testing a car-sharing model that leverages its existing OnStar system; GM vehicle owners will soon be able to use OnStar to rent out their cars.11

Figure C. Radical ideas rely on a combination of technology change and business model innovation

Source: Davila, Epstein, and Shelton, Making Innovation Work: How to Manage It, Measure It, and Profit from It, August 2005.

Breakthrough ideasGame changers

Breakthrough ideasGame changers

Radical ideasNew businesses

Incremental ideasProtect/improve existing

New

Clo

se t

o ex

istin

g

Close to existing

New

Tech

nolo

gy

chan

ge

Business model change

“If I have all of the data for one client who owns 30 buildings in a portfolio, maybe then I can do a commodity buy for the energy for those buildings. Right now, owners think of individual buildings, but what we want to do is begin to view the management and benefits in a more aggregated way.”

—David Pogue, CBRE

20 Converging worlds

For companies that buy, own, or operate buildings and fleetsNearly every company has at least one facility, with its attendant energy, water, and resource needs. And most depend on transportation networks to deliver employees to their offices, if not also to deliver products and services to the market. Therefore, companies’ ability to function—and to do so profitably—depends on these systems and how efficiently they run.

What should you do now?

Determine the level of significance energy spending is to your business and whether your organization is prepared to see the larger potential benefits for your specific needs and circumstances. Buyers, owners, and operators of buildings and fleets can consider the following questions:

• Are the people who perform transportation, IT, and facilities management functions at your company up-to-date on these trends? What opportunities do they have to reduce business costs or improve efficiency in light of new developments?

• Have you considered what types of new skills your company will need? Are you supporting growth for your people in roles (such as building engineers or energy managers) that need to evolve or expand?

• How well do space planning and utilization metrics match your talent strategies? You might be sitting on space you don’t really need.

• Have you evaluated options to buy energy in different ways? Are you talking to current and potential new service providers about those options?

Taking action We see very different opportunities for buyers and sellers of energy, building, transportation, and information technology solutions. Here are some things to think about, based on where you think your biggest opportunities are.

21 Converging worlds

For providers, incumbents, and new market playersCustomers will help drive your new view of value creation, if you’re prepared to listen. Mark Vachon of GE put it this way: “It’s about listening to what trends are out there, and reverse engineering that capability back into the business. And so if you’re really listening these days, you’re hearing a lot more around ‘I need a solution. I need you to be part of solving my broader problem.’”

Meeting customer demands to solve broader problems and bring innovative solutions to the table requires companies to engage simultaneously in collaboration and competition—what some call “co-opetition.”12

In highly fragmented or immature markets, innovation skills and entry points will sort out who does what best—not unlike what we’ve seen in other sectors where digital and mobile technologies have initiated structural change.

What should you do now?

A structured approach to identifying and capturing value for your company begins with a few simple questions:

• What is your corporate view of this landscape—how energy, information, buildings, and transportation services are meshing together? What’s your company’s role in it all?

• Do you feel your organization’s innovation capabilities are a match for the nature of change in this space?

• Do you feel your marketing and sales approach is succeeding where smart, clean or green attributes should be part of the sales process?

• Are you comfortable that you are collaborating with the right network and identifying the right future partners?

Providers have phenomenal opportunities ahead as they come to understand and then shape their futures. Yet as Cisco’s

12 Eric Bloom, “In Smart Buildings, Co-opetition Is on the Rise,” Pike Research Blog, February 2012.

Get more in person and online

GreenBiz Group is engaging the business community on ways to accelerate convergence and reduce commercial risk for both users and providers of clean, smart, and green technologies. Join us in a series of GreenBiz VERGE events and online discussions.

To participate, see: www.greenbiz.com/verge

Feller, puts it: “Simply because you see the convergence doesn’t mean you’re equipped and capable to deal with it.”

Indeed, every company—no matter the motivation to act—should be looking beyond the technology changes and preparing itself organizationally to stay fit for the future, ready to adapt as conditions change.

22 Converging worlds

David Bartlett Vice President of Industry Solutions IBM

Carl Bass President and CEO Autodesk

Rob Bernard Chief Environmental Strategist Microsoft Corporation

Bob Best Executive Vice President, Energy & Sustainability Services Jones Lang LaSalle

Stephan Dolezalek Managing Director, CleanTech VantagePoint Capital Partners

Gordon Feller Internet Business Solutions Group Public Sector Practice Cisco Systems

Dave Gralnik Senior Vice President, Renewable Energy Services Jones Lang LaSalle

Mitch Jackson Vice President Environmental Affairs & Sustainability FedEx

Joe Mercurio Manager of Government & Military Fuel Cells & Electric Vehicle Programs General Motors

Clay Nesler Vice President, Global Energy & Sustainability Johnson Controls

Tim Noonan Vice President, Phantom Works Ventures and Boeing Energy Boeing

David Pogue National Director of Sustainability CBRE

Mary Beth Stanek Director of Federal Environmental & Energy Regulatory Affairs General Motors

Mark Vachon Vice President, ecomagination General Electric

PwC and GreenBiz Group

Advisory

Joel Makower, Chairman and Executive Editor, GreenBiz Group Clinton Moloney, US Sustainable Business Solutions, PwC Don Reed, US Sustainable Business Solutions, PwC Rob Shelton, US Growth & Innovation, PwC

Editorial, writing, design, and production

Eric Faurot, President and Chief Strategist, GreenBiz Group Peggy Fresenburg and Judy Traveny, US Studio, PwC Dee Hildy, US Thought Leadership, PwC Celeste LeCompte, Contributor Derek Top, Senior Editor and Program Director for VERGE, GreenBiz Group

Acknowledgments

During the preparation of this publication, we benefited greatly from interviews and conversations with the following executives.

Mark Vann Manager of Advanced Technology Government Business Development General Motors

John Viera Global Director, Sustainability and Vehicle Environmental Matters Ford Motor Company

Bill Weihl* Manager of Energy Efficiency and Sustainability Facebook

Saul Zambrano Senior Director, Products, Customer Energy Solutions Pacific Gas and Electric Company

*This interview was conducted in December 2011, before Bill joined Facebook.

23 Converging worlds

www.pwc.com/us/sustainability

©2012 PricewaterhouseCoopers LLP, a Delaware limited liability partnership. All rights reserved.

PwC refers to the United States member firm, and may sometimes refer to the PwC network. Each member firm is a separate legal entity. Please see www.pwc.com/structure for further details.

PwC United States helps organizations and individuals create the value they’re looking for. We’re a member of the PwC network of firms in 158 countries with close to 169,000 people. We’re committed to delivering quality in assurance, tax and advisory services. Tell us what matters to you and find out more by visiting us at www.pwc.com/US

This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. MW-12-0285

Kathy Nieland Sustainable Business Solutions, Practice Leader (504) 558 8228 [email protected]

Brian Carey US Advisory Cleantech Leader (408) 817 7807 [email protected]

Clinton Moloney US Sustainable Business Solutions (415) 498 8442 [email protected]

Don Reed US Sustainable Business Solutions (617) 530 4403 [email protected]

Rob Shelton US Growth & Innovation (408) 817 4251 [email protected]

To have a conversation about how we can help your company increase revenue, reduce cost, or manage risk through effective sustainability strategies, contact:

This publication is printed on Mohawk Options 100PC. It is a Forest Stewardship Council™ (FSC®) certified stock using 100% post consumer waste (PCW) fiber and manufactured with renewable, non-polluting, wind-generated electricity.