CONTINUING DISCLOSURE REPORT...Dogwood Generating Facility Project Fredericktown Energy Center...

Transcript of CONTINUING DISCLOSURE REPORT...Dogwood Generating Facility Project Fredericktown Energy Center...

CONTINUING DISCLOSURE REPORT POWER PROJECT REVENUE BONDS

Dogwood Generating Facility Project

Fredericktown Energy Center Project

Iatan Unit 2 Project

Plum Point Project

Prairie State Project

FISCAL YEAR ENDING December 31, 2017

Prepared by:

Michael J. Loethen Chief Financial Officer & Vice President of Administrative Services

Updated May 31, 2018 This Continuing Disclosure Report (the “Report”) provides information and updates pertaining to certain MJMEUC projects that have been financed with bonds and is not intended to be an all-inclusive report regarding MJMEUC’s operations or financial position. This Report is delivered as required by MJMEUC pursuant to continuing disclosure undertakings entered into in connection with the issuance of its Power Project Revenue Bonds, and pursuant to Rule 15c2-12 of the Securities and Exchange Commission. Nothing contained in the undertaking or this document shall be deemed to be a representation by MJMEUC that the financial information and operating data included in this Report constitutes all of the information that may be material to a decision to invest in, hold or sell any securities of MJMEUC. The financial data and operating data presented in this document are as of the dates shown.

Under the terms of MJMEUC’s CONTINUING DISCLOSURE AGREEMENT, the Report is to be disseminated to the MSRB via EMMA not later than 5 months after the end of each of MJMEUC’s fiscal year (currently, by May 31). MJMEUC members’ audits required by this Report will be disseminated in conjunction with this Report or as soon as received.

Contents

Officers & Management Information ................................................................................. 2

Introduction ......................................................................................................................... 3

MJMEUC - Map of Project Locations & MPUA/MJMEUC Office .................................. 6

MJMEUC – Map of MoPEP Pool Participants and Unit Power Purchasers ...................... 7

MoPEP Facilities Bonds ..................................................................................................... 8

Dogwood Generating Facility .................................................................................10

Fredericktown Energy Center .................................................................................14

Iatan Unit 2 Project .............................................................................................................18

Plum Point Project ..............................................................................................................22

Prairie State Project.............................................................................................................28

Major Purchasers:

A. Missouri Public Energy Pool #1 (“MoPEP”) ........................................................34

B. MoPEP Large Pool Power Purchasers ..................................................................42

C. Large Unit Power Purchasers ...............................................................................48

• North Little Rock, AR (Unit Power Purchaser - Plum Point)............................50

• Osceola, AR (Unit Power Purchaser - Plum Point)............................50

• Poplar Bluff, MO (Unit Power Purchaser - Plum Point)............................50

• Kirkwood, MO (Unit Power Purchaser - Prairie State) ..........................54

• Hannibal, MO (Unit Power Purchaser - Prairie State) ..........................58

• Columbia, MO (Unit Power Purchaser - Iatan Unit 2, Prairie State) .....62

• Independence, MO (Unit Power Purchaser - Iatan Unit 2) ..........................68

MJMEUC 2017 Audited Financial Statements...................................................................76

1

Officers & Management Information

Missouri Joint Municipal Electric Utility Commission

1808 I-70 Drive S.W. Columbia, Missouri 65203 (573) 445-3279

2017-2018 MJMEUC Officers

Chair ............................................................................................... Chuck Bryant

Vice Chair ....................................................................................... Bruce Harrill

Secretary/Treasurer ......................................................................... Andy Boatright

Chair, Engineering Committee ....................................................... Bob Stevenson

Chair, Operating Committee ........................................................... Kyle Gibbs

Chair, Budget & Finance Committee ............................................. Richard Shockley

Chair, Power Contract Cities Committee ....................................... Chad Davis

Chair, MISO Committee ................................................................. Tad Johnsen

Chair, SPP Committee .................................................................... Steve Stodden

Member at Large............................................................................. Ron Scheets

Immediate Past Chair ...................................................................... Jim Gillilan

MJMEUC Management

President, Chief Executive Officer, and General Manager......... Duncan Kincheloe

Senior Vice President and Associate General Manager ............. Eve Lissik

Chief Operating Officer and Vice President of Engineering, Operations and Power Supply ................................................

John Grotzinger

Chief Financial Officer and Vice President of Administrative Services ..................................................................................

Michael J. Loethen

Financial Advisor

Ramirez & Co., Inc. New York, New York

Bond Counsel Trustee, Bond Registrar and Paying Agent Gilmore & Bell, P.C. Kansas City, Missouri

The Bank of New York Mellon Trust Company, N.A. St. Louis, Missouri

2

Introduction

MJMEUC

The Missouri Joint Municipal Electric Utility Commission, (“MJMEUC”), a body public and corporate of the State of Missouri, was created by contract as of May 1, 1979 (the “Joint Contract”) for the purpose of permitting cities, incorporated towns and villages of the State of Missouri that own and operate retail electric utility systems and that become parties to such contract (the “Contracting Municipalities” or the “Members”) to secure, by joint action among themselves, or by contract with other utilities, an adequate, reliable and economical supply of electric power and energy. The Joint Contract was entered into pursuant to the Joint Municipal Utility Commission Act, Sections 393.700 to 393.770, Revised Statutes of Missouri, as amended (the “Act”). Under the Act, MJMEUC may construct, operate and maintain jointly owned generation, transmission and distribution facilities and related resources for the benefit of its Members. MJMEUC has the authority to enter into contracts for power supply, transmission service, and other services necessary for the operation of an electric utility. Established by six charter Members, MJMEUC has grown to a membership of 70 municipally-owned retail electric systems ranging in size from 233 to 114,942 electric service meters, as of 2017 calendar year-end. In order to become a Member, a city, town or village requesting membership must execute and deliver a supplement to the Joint Contract, satisfy certain requirements for membership as set forth in the Joint Contract, and be approved by the affirmative vote of two-thirds of the MJMEUC Board of Directors. Under the Act and the Joint Contract, each Member is represented on the Board of Directors by a director and alternate director, and are eligible to participate in all activities undertaken by MJMEUC on behalf of its Members. In 1989, MJMEUC created two additional categories of membership to accommodate participation in MJMEUC’s power supply programs and projects by entities that do not quality for regular membership in accordance with the Act and the Joint Contract. The first additional category is referred to as “advisory membership,” and is open to municipalities located outside the State of Missouri who operate electric utility systems. The second additional category is referred to as “associate membership,” and is open to rural electric cooperatives located within or outside of the State of Missouri. MJMEUC’s Advisory Members currently consist of four municipally-owned retail electric systems located in the State of Arkansas. MJMEUC’s Associate Members currently consist of one rural electric cooperative located in the State of Missouri. MJMEUC Members’ and Advisory Members’ electric systems serve over 500,000 retail customers, and have a combined peak load of approximately 3,200 MW, as of 2017 calendar year-end.

3

ENERGY POOLS

There are three full requirements energy pools within MJMEUC: MoPEP, which consists of 35 municipal members, the Mid-Missouri Municipal Power-Energy Pool (“MMMPEP”), which consists of 13 municipal members and the Southwest Missouri Public Energy Pool (“SWMPEP”), which consists of two (2) municipal members. Missouri Public Energy Pool #1 MoPEP was formed for the benefit of those MJMEUC Members that are participating in MoPEP (the “Pool Power Purchasers”), pursuant to an agreement among MJMEUC and each Pool Power Purchaser (the “Pool Power Purchase Agreement”). MoPEP commenced operations on January 1, 2000. The Pool Power Purchase Agreement provides for MJMEUC to supply the full energy requirements of each Pool Power Purchaser. As of December 31, 2017, the Pool Power Purchasers currently consist of 35 of MJMEUC’s Members who take full requirements service from MoPEP. The Pool Power Purchaser Agreement does not have an established termination date and will remain in effect until cancelled as to all Pool Power Purchasers. The Pool Power Purchasers directed MJMEUC to acquire ownership interests and/or long-term capacity entitlements in several generating facilities, the first of which commenced operations in 2007. MoPEP operations are governed by a committee (the “Pool Committee”) consisting of one representative from each Pool Power Purchaser. Rates established by the Pool Committee for services to Pool Power Purchasers are based on recovery of all of MJMEUC’s expenses. Rates are established so as to charge each Pool Power Purchaser its proportionate share of all costs associated with MJMEUC’s performance under the Pool Power Purchase Agreement. If the Pool Power Purchase Agreement is cancelled by a Pool Power Purchaser for any reason, the Pool Power Purchaser must continue to pay MoPEP monthly charges designed to recover the Pool Power Purchaser’s allocable share of MJMEUC’s direct costs associated with the Pool Power Purchase Agreement. Only the Pool Power Purchasers, and no other MJMEUC Members, are responsible for MJMEUC’s obligations under the Pool Power Purchase Agreement. Each Pool Power Purchaser owns and operates an electric system for the distribution of electric power and energy, together with the additional facilities necessary to conduct its business. As of December 31, 2017, twelve Pool Power Purchasers operate electric generating facilities, all the capacity of which is dedicated solely to MoPEP. Retail electric service in areas adjoining the service areas of the Pool Power Purchasers is provided by investor-owned utilities (“IOUs”) or rural electric cooperatives which, in some instances, also serve a limited number of customers within the corporate limits of the Pool Power Purchasers. Missouri law controls the boundaries of an electric utility’s assigned service area, and changes to these boundaries must be approved by the Missouri Public Service Commission. Mid-Missouri Municipal Power-Energy Pool The second pool operated by MJMEUC is called the Mid-Missouri Municipal Public Energy Pool (“MMMPEP”). The original twelve municipal members of the MMMPEP pool entered into power

4

purchase contracts with MJMEUC for the full power requirements of their respective municipality. These contracts were originally for five years and were set to expire on May 31, 2018. MJMEUC and MMMPEP entered into a new contract in 2016 that extended the commitment of services for an additional ten years, now expiring on May 31, 2028. A thirteenth city joined MMMPEP as a member in 2016 and began receiving full requirements power in January 2018. Southwest Missouri Public Energy Pool The third pool operated by MJMEUC is called the Southwest Missouri Public Energy Pool (“SWMPEP”). On September 29, 2017, MJMEUC authorized the Missouri cities of Monett and Mt. Vernon (together, the “SWMPEP Cities”) to join MJMEUC and execute a power supply contract with the SWMPEP Cities. The SWMPEP Cities and MJMEUC have executed ten-year power purchase contracts for the full power requirements of their respective municipality. Supply pursuant to these contracts will begin in June 2020 and expires May 31, 2030. MPUA

The Missouri Public Utility Alliance (“MPUA”) represents community-owned (municipal) electric, natural gas, wastewater, and water utilities that work together for the benefit of their customers - customers who, in effect, "own" the utilities in their community. For many years, the vision of a strong, versatile and multi-faceted collaboration grew in the minds of municipal utility leaders from across Missouri. In October of 1998, the three member organizations of MPUA (Municipal Gas Commission of Missouri, Missouri Association of Municipal Utilities, and Missouri Joint Municipal Electric Utility Commission) voted to combine efforts and resources to better serve their members by establishing the umbrella of the Missouri Public Utility Alliance. MPUA is a trade name representing the nature of the partnership among the three legally distinct member organizations. Each organization maintains its own legal status and Board of Directors. A Joint Operating Committee, comprised of three Executive Committee members from each of the three organizations, provides guidance and cohesiveness to joint issues. An integrated set of budgets make the broad array of MPUA services available to all members of the three member organizations.

[The remainder of this page left purposely blank]

5

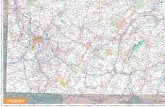

MJMEUC – Map of Project Locations & MPUA/MJMEUC Office

The Laddonia Project is a nominal 12 MW natural gas fired generating facility near the City of Laddonia, Missouri owned by MJMEUC. The generating facility, which commenced commercial operations in the third quarter of 2007, is included for illustration purposes only. MJMEUC has not issued any revenue bonds for the construction or operations for the Laddonia facility, and there are no continuing disclosure requirements related to this facility.

6

MJMEUC – Map of MoPEP Pool Participants & Unit Power Purchasers

Note: Effective June 1, 2017 Marceline is no longer a Unit Power Purchaser and was released of such obligations as a result of full assignment of its 4 MW capacity and energy offtake to MoPEP (see “Prairie State Project”).

7

MoPEP FACILITIES BONDS

MJMEUC has issued its MoPEP Facilities Bonds to finance the Fredericktown Energy Center and Dogwood Generating Facility. The MoPEP Facilities Bonds are payable from certain net revenues generated by MJMEUC from MoPEP under the Pool Power Purchase Agreement; revenues dedicated to repayment of debt issued for other specific projects (like Iatan Unit 2, Prairie State and Plum Point) are excluded as a source of revenue for repayment of MoPEP Facilities Bonds.

Bonds

Issue Date

Final

Maturity

Amount Outstanding as of

December 31, 2017* Power Supply System Revenue Bonds (MoPEP Facilities), Series 2011**

12/8/2011

12/1/2020

$ 2,175,000

Power Supply System Revenue Bonds (MoPEP Facilities), Series 2012**

3/28/2012

1/1/2021

$ 3,850,000

Power Supply System Revenue Bonds (MoPEP Facilities), Series 2017 (Refunding Bonds)***

12/21/2017

12/1/2036

$ 35,600,000

*Balances shown are net of any debt refunded amounts, as applicable. **Partially advance refunded with the Series 2017 bonds. ***Proceeds from the Series 2017 partially refunded certain MoPEP Series 2011 & Series 2012 Bonds.

Ratings:

Fitch Ratings: A Stable Outlook Moody’s Investor Services: A2 Stable Outlook

The Series 2011 Bonds were issued to finance MJMEUC’s costs to construct the Fredericktown Energy Center, to fund a debt service reserve for the Series 2011 Bonds, and to pay costs of issuance of the Series 2011 Bonds. The capacity and power of the MJMEUC ownership interest is fully dedicated to MoPEP power supply needs. The Series 2012 Bonds were issued to finance MJMEUC’s costs to acquire an undivided 8.2% ownership interest in the Dogwood Generating Facility, fund a debt service reserve, and pay costs of issuance. The capacity and power of the MJMEUC ownership interest is fully dedicated to MoPEP power supply needs. The Series 2017 Bonds were issued to advance refund and defease certain of MJMEUC’s outstanding Power Supply System Revenue Bonds (MoPEP Facilities), Series 2011 and Series 2012 and pay costs of issuance of the Series 2017 Bonds. The refunding was initiated by MJMEUC to achieve interest cost savings and reduce annual debt service requirements. MJMEUC reduced its MoPEP total debt service payments by approximately $3.7 million with this refunding.

8

[This page left purposely blank]

9

DOGWOOD GENERATING FACILITY

Introduction The Dogwood Generating Facility is a nominal 610 MW combined-cycle natural gas-fired electric generating facility located in Pleasant Hill, Missouri. As of April 30, 2018, MJMEUC owns an undivided 8.2% ownership interest in all of the assets, properties and rights related to the Dogwood Generating Facility. Five of the six co-owners of the Dogwood Generating Facility are public power entities. Below is the complete list of co-owners of the Dogwood Generating Facility.

Owner (April 30, 2018) Ownership Interest % MJMEUC 8.2% Kansas Power Pool 10.3% City of Independence, Missouri 12.3% Kansas City, Kansas Board of Public Utilities 17.0% Kansas Municipal Electric Agency (“KMEA”) 10.1% Dogwood Energy, LLC 42.1%

In March 2018, Dogwood Energy, LLC sold a 10.1% interest in the Dogwood Generating Facility to KMEA. Upon consummation of KMEA’s purchase, KMEA became party to, and is now bound by the terms of, the Participation Agreement among the co-owners. Dogwood Energy, LLC has publicly announced its intention to sell all or a part of its remaining interest in the Dogwood Generating Facility.

MJMEUC and Dogwood Energy, LLC, entered into an Asset Purchase Agreement, dated as of January 26, 2018, whereby MJMEUC plans to acquire an additional 8.2% undivided ownership interest in the Dogwood Generating Facility, for a total undivided ownership interest of 16.4% after the planned

10

acquisition is complete. The acquisition closed on May 31, 2018. MJMEUC funded the acquisition costs through the issuance of $26,605,000 principal amount of MoPEP Facilities Bonds, Series 2018, which closed on May 30, 2018. Following MJMEUC’s closing on the additional 8.2% undivided ownership interest, Dogwood Energy, LLC’s ownership interest will be reduced to 33.9%.

Participants

All of MJMEUC’s interest in the Dogwood Generating Facility has been dedicated to MoPEP.

Project Financing MJMEUC issued its MoPEP Facilities Series 2012 Bonds to finance MJMEUC’s costs to acquire an undivided 8.2% ownership interest in the Dogwood Generating Facility, fund a debt service reserve, and pay costs of issuance. The Series 2012 Bonds were originally issued in the principal amount of $32,950,000.

The Series 2017 Bonds were issued to advance refund and defease a portion of MJMEUC’s outstanding MoPEP Facilities Bonds, which included certain Series 2012 Bonds. (See “MoPEP Facilities Bonds”).

All anticipated capital costs are included in MJMEUC’s annual budget. Capital costs are funded through member rates. MJMEUC has available, and may use at its discretion, operating and maintenance accounts and reserve accounts for funding operating and capital costs.

Project Update Background

The Dogwood Generating Facility (“Dogwood”) is contained within a 67 acre parcel. The generating station includes two Siemens Westinghouse model 501FD2 gas-fired turbines that were upgraded in 2009 to model 501FD3 specifications, two Toshiba heat recovery steam generators (“HRSGs”), a Toshiba steam turbine, three generator step-up transformers, associated buildings, and ancillary support facilities. The generating station was constructed by Black & Veatch. Dogwood contracts with North American Energy Services (“NAES”) operating company to operate and maintain the plant on behalf of the ownership group. With duct-firing and power augmentation, the plant has a 650 MW nominal output capacity measured at 60 degrees and 60% humidity, and an annual average of approximately 635 MW. Dogwood primarily serves as an intermediate power supply resource for MoPEP.

Dogwood is within the Southwest Power Pool (“SPP”) Regional Transmission Operator (“RTO”) geographical footprint and participates in the SPP Day-Ahead Market. The plant is located adjacent to an existing substation owned and operated by KCP&L - GMO and includes three 161 kV interconnections and two 345 kV interconnections. The 161 kV steps down to 69 kV and has direct connection to MJMEUC’s MoPEP member, the City of Harrisonville, Missouri.

On March 1, 2014 Dogwood began operations in the newly formed SPP Day-Ahead Market (the “Market”). Dogwood continues to benefit from its place in the Market, especially when outages occur with the larger units in SPP and with its relative short startup time. There are additional generation opportunities when wind generation resources drop off from the grid.

11

Project Performance Summary

Dogwood’s overall 2017 operations met MJMEUC’s expectations with an operating availability factor of 88.5% for the year. Scheduled outages were completed during the year for repair and maintenance activities customary from time to time for a similarly designed facility. Dogwood had two outages scheduled and completed in 2017, one in spring and one in the fall. Both outages were routine 14-day scheduled outages where no major issues were found.

Opportunities for SPP to dispatch Dogwood were limited during the first three months of 2017 due to mild temperatures, high wind generation and a lack of large coal unit outages, even with low gas prices. The aforementioned spring 14-day scheduled outage started on March 25, 2017. The outage served primarily as a “tune-up” for summer operations, however, there was additional work completed on the heat recovery steam generators (“HRSGs”), also known as the boilers.

During the first quarter of 2018, Dogwood operated at a capacity factor 26.4% which equated to a total generation of 370,710 MWhrs which exceeded expectations. Expectations were exceeded as a result of a combination of strong market conditions due to colder temperatures, other unit outages in the region and a scheduled outage shift from March to April 2018.

NAES staff under the direction of Dogwood Management Company continues to provide excellent operational and project management services to the Dogwood Generating Facility owners. Dogwood Management Company works well with NAES on plant operations, Westar on the Energy Management of the unit, and Panhandle and Southern Star on gas contracts.

The Dogwood Generating Facility was awarded the highest safety award for all the combined-cycle plants of its size in the NAES fleet at the NAES Safety Conference in February 2017. Dogwood continues to have an excellent environmental and safety record and continues to be a valuable asset for MoPEP in SPP as well as providing great value to MJMEUC’s members.

Permits, Licenses and Approvals

All permits necessary for operation of Dogwood remain in place.

Capital Expenditures

MJMEUC’s share of capital improvements related to the Dogwood Generating Facility totaled $221,364 in fiscal year 2017. These costs were funded through rates and charges paid by MoPEP.

Reserve Accounts

MJMEUC has fully funded all required debt service reserves and operating and maintenance reserves required by the bond documents.

12

Performance Statistics The following chart summarizes 2017 operations and an update of operations through the first quarter of 2018 for Dogwood.

Thru 1Q 2018 2017 AnnualDogwood Net Generation (MWh) 370,710 1,133,000 Plant Capacity Factor 26.4% 19.9%Plant Operating Availability Factor 99.1% 88.5%Total Fuel Cost 8,660,313$ 27,087,574$

2017Operating ExpensesFuel & Transportation 2,221,163$ Other Variable Expenses and Commodities 144,404 Fixed Operating Expenses 1,034,422 Total Operating Expenses 3,399,989

Capital Costs and Reserve RequirementsNet Debt Service 2,245,595 Capital Expenditures 221,364 Total Capital Costs 2,466,959

Total Dogwood Project Annual O&M Costs 5,866,948$ Average Annual Busbar Cost ($/MWh) 64.19$

2017 AveragePower Purchaser Net Revenue Busbar ($/MWh)

MoPEP (Net of off system sales) 5,866,948$ $64.1991,399

MJMEUC Project Costs

ElectricitySold (MWh)

[The remainder of this page left purposely blank]

13

FREDERICKTOWN ENERGY CENTER

IntroductionThe Fredericktown Energy Center (the “Fredericktown Facility”) is a two-unit, 28 MW (combined) natural gas fired generating facility, and located in the City of Fredericktown, Missouri.

Participants All of MJMEUC’s interest in the Fredericktown Facility has been dedicated to MoPEP.

Project Financing

MJMEUC issued its MoPEP Facilities Series 2011 Bonds to finance MJMEUC’s costs to construct the Fredericktown Energy Center, to fund a debt service reserve for the Series 2011 Bonds, and to pay costs of issuance of the Series 2011 Bonds. The Series 2011 Bonds were originally issued in the principal amount of $17,060,000.

The Series 2017 Bonds were issued to advance refund and defease a portion of MJMEUC’s outstanding MoPEP Facilities Bonds, which included certain Series 2011 Bonds. (See “MoPEP Facilities Bonds”).

Owner Ownership Interest % MJMEUC 100.0%

14

Project Update Background

On January 31, 2013, turbines were operated up to full speed with no load for the first time. Additional third party electrical interconnection upgrades to connect the plant to the power grid, final tuning, testing and startup followed before Fredericktown Energy Center commenced operations at the end of June 2015. Compliance tests were completed for both turbines and submitted to the Missouri Department of Natural Resources for review. Test reports show the Fredericktown Energy Center units performed well below their permitted limits. To date, all permits necessary for operation of the Fredericktown Energy Center remain in place.

The Fredericktown Energy Center serves as an efficient natural gas peaking power supply resource within the MoPEP power supply portfolio and is interconnected into the SPP Regional Transmission Operator (“RTO”) geographical footprint and participates in the real-time market. The turbines have been equipped for remote operations from MJMEUC’s Columbia, Missouri office. SPP contacts MJMEUC’s energy schedulers when making notifications for unit operations. The energy schedulers then remotely start and operate the turbines for the required schedule based on SPP requirements.

MJMEUC has a maintenance agreement with Solar Turbines, Inc. (“Solar”), the turbines’ original equipment manufacturer (“OEM”). MJMEUC staff and the member cities of Macon and Fredericktown assist MJMEUC with operations of the Fredericktown Energy Center.

The Fredericktown Energy Center turbines successfully completed its second full year of operations in 2017. The Fredericktown Energy Center experienced increased operations in 2017 as SPP continued to request the unit to operate for peaking applications. The turbines short start time characteristics and flexible operating parameters have proven to be a reliable source to SPP and a valuable asset and resource mix to MoPEP.

During the first four months of 2017, Fredericktown Energy Center was available for operations in SPP. The winter cold temperatures in December and January typically provide the Fredericktown Energy Center the opportunity to generate in the real-time market. However, the two turbines saw limited operations in early January. With warmer mid-January temperatures, and high wind generation, loads were down and limited opportunities existed to generate in the SPP market. A scheduled short semi-annual inspection occurred during the week of April 10-14, 2017 and the units were promptly returned to service for SPP dispatching. Throughout 2017, the Fredericktown Energy Center units’ operating times increased as SPP continued to request their service for peaking applications.

During the first two months of 2018, both Fredericktown Energy Center’s turbines were dispatched several times, with a couple of continuous overnight operations. During the first three weeks of January 2018, the facility’s performance exceeded the hours of operations in 2017 with a 50% increase in generation output. The turbines continue to receiving dispatching requests in the SPP day-ahead and real-time markets. Their quick starting times, flexible operations and heat rate makes them a viable peaking asset to SPP.

15

Twice a year, spring and fall, the units are typically scheduled for short outages for preventative maintenance activities performed by the OEM, Solar Turbines, and all balance of plant maintenance activities are performed by MJMEUC staff and City of Macon staff.

Permits, Licenses and Approvals

All permits necessary for operation of the Fredericktown Energy Center remain in place.

Capital Expenditures

There were no capital improvement expenditures related to the Fredericktown Energy Center in fiscal year 2017. MJMEUC typically funds any capital improvement expenditures through MoPEP rates and charges.

Performance Statistics The following chart summarizes 2017 operations and an update of operations through the first quarter of 2018 for the Fredericktown Energy Center. The Fredericktown Energy Center includes two single-shaft turbine generators, each with a nominal net output capacity of approximately 12 MW to serve MoPEP peaking capacity needs.

Thru 1Q 2018 2017 AnnualFredericktown Net Generation (MWh) 3,539 2,225 Plant Capacity Factor 6.4% 1.0%Plant Operating Availability Factor 99.97% 97.95%Total Fuel Cost 38,081$ 147,553$

2017Operating ExpensesFuel & Transportation 147,553$ Other Variable Expenses and Commodities 29,494 Fixed Operating Expenses 258,674 Total Operating Expenses 435,721

Capital Costs and Reserve RequirementsNet Debt Service 1,246,530 Capital Expenditures - Total Capital Costs 1,246,530

Total Fredericktown Project Annual O&M Costs 1,682,251$

Power Purchaser Net RevenueMoPEP (Net of off-system sales) 1,682,251$

MJMEUC Project Costs

Sold (MWh)2,225

Electricity

16

[This page left purposely blank]

17

IATAN UNIT 2 PROJECT

Introduction

In August 2006, MJMEUC acquired an undivided interest in the Iatan Unit 2, a 870 MW (net) coal-fired generating plant constructed at the Iatan Station site in Platte County, Missouri (“Iatan Unit 2”). MJMEUC’s undivided interest in Iatan Unit 2 and certain associated common facilities entitles MJMEUC to approximately 102 MW (net) of the capacity and output of Iatan Unit 2 (the “Iatan 2 Project”). Iatan Unit 2 commenced operation in January 2011.

Kansas City Power & Light (“KCP&L”) is the majority owner and operator of the Iatan Station site and was the developer of the Iatan Unit 2. The current co-owners of Iatan Unit 2 are:

Owner Ownership Interest %

MJMEUC 11.8% Kansas Electric Power Cooperative 3.5 Empire District Electric Company 12.0 KCP&L Greater Missouri Operations Company 18.0 Kansas City Power & Light 54.7

MJMEUC continues to monitor project operations since construction was finalized in January 2011 and also retains an outside engineering consultant to provide additional monitoring of the Iatan Unit 2 Project operations.

18

Participants

Approximately 71 MW of the capacity of the Iatan 2 Project is assigned to the Missouri cities of Columbia and Independence (together, the “Iatan Unit Power Purchasers”) pursuant to separate unit-specific, life-of-unit, take-or-pay power purchase agreements between MJMEUC and each of the Iatan Unit Power Purchasers, and the balance of the capacity of the Iatan 2 Project (approximately 31 MW) is assigned to MoPEP to provide a portion of the electric power and energy requirements of those MJMEUC Members participating in MoPEP. Iatan Unit 2 Project MoPEP Cities: Albany, Ava, Bethany, Butler, Carrollton, Chillicothe, El Dorado Springs, Farmington, Fayette, Fredericktown, Gallatin, Harrisonville, Hermann, Higginsville, Jackson, La Plata, Lamar, Lebanon, Macon, Marshall, Memphis, Monroe City, Odessa, Palmyra, Rock Port, Rolla, Salisbury, Shelbina, St. James, Stanberry, Thayer, Trenton, Unionville, Vandalia, and Waynesville. Iatan Unit 2 Project Unit Power Participants: Cities of: Columbia and Independence.

Project Financing

Bonds Issue Date

Final Maturity

Amount Outstanding as of

December 31, 2017* Iatan 2 Project, Series 2009A ** 4/1/2009 1/1/2019 $ 4,485,000 Iatan 2 Project, Series 2014A (Refunding Bonds) 10/7/2014 1/1/2034 151,095,000

Iatan 2 Project, Series 2015A (Refunding Bonds) 11/5/2015 12/1/2038 80,265,000

* Balances shown are net of any debt refunded amounts, as applicable. ** Partially advance refunded with 2014A and 2015A Bonds.

Ratings: Fitch Ratings: A Stable Outlook

Moody’s Investor Services: A2 Stable Outlook MJMEUC issued its Series 2006 Bonds (fully retired in 2016; original principal amount of $182,385,000) and Series 2009 Bonds (original principal amount of $103,135,000) to finance MJMEUC’s share of costs to construct Iatan Unit 2 and certain associated common facilities. All necessary financing for construction of MJMEUC’s portion of Iatan Unit 2 is complete. Final construction costs of approximately $1.85B for completion cost of Iatan Unit 2, common facilities and initial coal inventory were determined in 2012 after procurement efforts closed out all contracts and purchase orders.

In fall 2014, MJMEUC issued the Series 2014A Bonds to advance refund a portion of its Power Project Revenue Bonds Series 2006A and Series 2009A. The advance refunding was initiated by MJMEUC to achieve interest cost savings and reduce annual debt service requirements. MJMEUC reduced its Iatan total debt service payments by approximately $23.9 million with this advance refunding.

19

In fall 2015, MJMEUC issued the Series 2015A Bonds to refund the remaining portion of its Power Project Revenue Bonds Series 2006A and a portion of its Power Project Revenue Bonds Series 2009A. The refunding was initiated by MJMEUC to achieve interest cost savings and reduce annual debt service requirements. MJMEUC reduced its Iatan total debt service payments by approximately $15.0 million with this refunding.

Project Update

Project Performance Summary

The Iatan Unit 2 operations exceeded performance expectations for 2017. Year-end performance summaries showed the unit achieving an annual equivalent availability factor (“EAF”) of 96.4% and capacity factor (“CF”) of 86.45% for the year. Iatan Unit 2 experienced only two forced outages, in February and in December, respectively. The outages were caused by tube leaks and boiler tube overheating stemming from exfoliation issues which have repeatedly affected the boiler in recent years. The facility’s capacity factor has underperformed as compared to previous years primarily due to the influx of wind into the SPP Region and transmission constraints in the Iatan Plant area.

Iatan Unit 2 is conducting its first steam turbine major overhaul during a scheduled spring outage, which began on March 3, 2018. Originally, the steam major overhaul was expected to be completed in approximately 70 days and return to service in mid-May. During disassembly of the turbine-generator several discovery items were identified, which increased the scope of work to be conducted. The largest discovery item related to the insulation in the generator rotor which resulted in a complete rewind of the rotor. As a result, the original return-to-operation date for Iatan Unit 2 is rescheduled for early June 2018. The scope of the outage work also includes replacing the platen and finishing superheater tubes. These tubes, as previously mentioned, have experienced exfoliation issues and their replacement is the critical path of the outage. Preplanning has kept the tube replacements on schedule to be completed well before all the steam turbine work thus not impacting startup schedules.

Coal inventories have remained consistent, BNSF rail deliveries have been good, and the plant has been able to manage its inventories. During the 2018 spring outage, there was a 14-day outage on the coal unloading system for repairs and upgrades. After that, rail deliveries resumed since Iatan Unit 1 was online.

Iatan Unit 2 remains fully compliant with all environmental permits and regulations. In addition, KCP&L has a strong safety culture as demonstrated by their continuous excellent safety record.

Capital Expenditures

MJMEUC’s share of capital improvements related to Iatan Unit 2 totaled $5,789,375 in fiscal year 2017. These costs were funded through rates and charges paid by MoPEP and the Unit Power Purchasers.

MJMEUC has fully funded all required debt service reserves and operating and maintenance reserves required by the bond documents.

20

Performance Statistics The following chart summarizes 2017 operations and an update of Iatan Unit 2’s operations through the first quarter of 2018.

Thru 1Q 2018 2017 AnnualIatan Unit 2 Net Generation (MWh) 919,117 6,671,662 Unit Capacity Factor 48.30% 86.45%Unit Operating Availability Factor 57.81% 96.35%Total Fuel Cost 12,637,878$ 89,858,525$

2017Operating ExpensesFuel & Transportation 9,362,314$ Other Variable Expenses and Commodities 572,963 Fixed Operating Expenses 5,046,066 Total Operating Expenses 14,981,343

Capital Costs and Reserve RequirementsNet Debt Service 18,587,735 Deposit to O&M Reserve and other Contingency Fund - Additions to Working Capital - Capital Expenditures 5,789,375 Total Capital Costs 24,377,110

Total Iatan Unit 2 Project Annual O&M Costs 39,358,453$ Average Annual Busbar Cost ($/MWh) 58.25$

2017 AveragePower Purchaser Net Revenue Busbar ($/MWh)

Columbia 7,862,873$ 56.62$ Independence 19,701,272 59.97$ MoPEP 11,794,310 56.62$ MJMEUC Total 39,358,455$

MJMEUC Project Costs

ElectricitySold (MWh)

138,870

675,718

328,542 208,306

21

PLUM POINT PROJECT

Introduction

In March 2006, MJMEUC acquired an undivided interest in the Plum Point Energy Station, a 665 MW (net) coal-fired generating plant recently constructed in northeast Arkansas (“Plum Point”). MJMEUC’s undivided interest in Plum Point entitles MJMEUC to approximately 147 MW (net) of the capacity and output of such generating plant (such interest is referred to herein as the “Plum Point Project”). The Plum Point Energy Station commenced commercial operations on September 1, 2010. The current co-owners of Plum Point are:

Owner Ownership Interest % MJMEUC 22.1% Municipal Energy Agency of Mississippi 6.0 Empire District Electric Company 7.5 East Texas Electric Cooperative, Inc. 7.5 Plum Point Energy Associates, LLC 56.9

In addition to its undivided ownership interest, MJMEUC also executed a long-term power purchase agreement with Plum Point Energy Associates, LLC (“PPEA”), a wholly-owned subsidiary of PPEA Holding Company, LLC, entitling it to 50 MW of capacity and energy from Plum Point. The capacity and energy supplied under the power purchase agreement with PPEA is dedicated to MoPEP. MJMEUC continues to monitor project operations since construction was finalized in September 2010 and also retains an outside engineering consultant to provide additional monitoring of the Plum Point Project (“Plum Point”), operations.

22

Participants

MJMEUC has assigned 127 MW of the capacity of the Plum Point Project to three of its Members (the Missouri cities of Poplar Bluff, Carthage and Malden) and to the four Advisory Members that are Arkansas Cities (the cities of North Little Rock, Osceola, Benton and Piggott) pursuant to separate unit power purchase contracts. On June 9, 2011, MJMEUC voted to approve a proposal from the City of Kennett, Missouri (“Kennett”) to terminate Kennett’s 20 MW unit power purchase contract associated with the Plum Point Project and to dedicate the full 20 MW of output to MoPEP to provide a portion of the electric power and energy requirements of the Pool Power Purchasers. In 2012, the Cities of Malden and Piggott agreed to assign 3 MW and 2 MW, respectively, for a combined 5 MW assignment to the City of Benton, Arkansas, effective April 1, 2014. Plum Point Project MoPEP Cities: Albany, Ava, Bethany, Butler, Carrollton, Chillicothe, El Dorado Springs, Farmington, Fayette, Fredericktown, Gallatin, Harrisonville, Hermann, Higginsville, Jackson, La Plata, Lamar, Lebanon, Macon, Marshall, Memphis, Monroe City, Odessa, Palmyra, Rock Port, Rolla, Salisbury, Shelbina, St. James, Stanberry, Thayer, Trenton, Unionville, Vandalia, and Waynesville. Plum Point Project Unit Power Participants: Missouri Cities: Carthage, Malden, and Poplar Bluff Arkansas Cities: North Little Rock, Osceola, Piggott, and Benton

Project Financing

Bonds Issue Date

Final Maturity

Amount Outstanding as of

December 31, 2017* Plum Point Project, Series 2009A (Federally Taxable Build America Bonds – Direct Pay)

8/20/2009 1/1/2039 $ 48,600,000

Plum Point Project, Series 2009B 8/20/2009 1/1/2037 4,860,000 Plum Point Project, Series 2014A (Refunding Bonds) 12/20/2014 1/1/2034 185,765,000

Plum Point Project, Series 2015A (Refunding Bonds) 12/17/2015 1/1/2036 37,215,000

* Balances shown are net of any debt refunded amounts, as applicable.

Ratings: Fitch Ratings: A Stable Outlook

Moody’s Investor Services: A3 Stable Outlook Standard & Poor’s Rating Service: A- Stable Outlook

MJMEUC issued its Series 2006 Bonds (original principal amount of $278,880,000) and Series 2009 Bonds (original principal amount of $53,460,000) to finance MJMEUC’s share of costs to construct Plum Point. All necessary financing for construction of MJMEUC’s portion of Plum Point is complete.

23

The 2009 Bonds were issued as direct pay Federally Taxable Build America Bonds (“BABs”), where MJMEUC is entitled to receive a 35% subsidy from the United States Federal Government. The United States Federal Government has been and is currently subject to the process of sequestration, whereby spending for many Federal programs, including BABs subsidy payments, have been reduced. MJMEUC’s subsidies were reduced by approximately 6.9% and 6.6% for 2017 and 2018 by the United States Government. MJMEUC is recovering these lost subsidies through member rates. In fall 2014, MJMEUC issued the Series 2014A Bonds to advance refund a portion of its Power Project Revenue Bonds Series 2006. The advance refunding was initiated by MJMEUC to take advantage of market rates at the time, achieve interest savings and an annual reduction in debt service. MJMEUC reduced its Plum Point total debt service payments by approximately $26.7 million from this advance refunding. In fall 2015, MJMEUC issued the Series 2015A Bonds to refund the remaining portion of its Power Project Revenue Bonds Series 2006. The refunding was initiated by MJMEUC to take advantage of market rates at the time, achieve interest savings and an annual reduction in debt service. MJMEUC reduced its Plum Point total debt service payments by approximately $4.5 million from this refunding.

Project Update Project Performance Summary

During the 2017 calendar year, Plum Point began with normal and consistent operation until local heavy rainfall in mid-January created standing water in the coal pile. Heavy rainfall continued in February, causing wet coal which reduced operations at Plum Point until a scheduled spring outage on March 4. During the scheduled spring outage, the Plum Point steam turbine unit was fully opened and inspected as part of its first major overhaul. During the inspection, additional maintenance needs were discovered which extended the length of the scheduled outage to 78 days and increased capital repairs beyond the original budget.

During the scheduled 2017 spring outage, Plum Point staff also addressed a number of generation issues throughout the facility. With the successful completion of the steam turbine major overhaul, Plum Point met performance expectations since returning to service in May and continued strong operational performance through the fall, when Plum Point took a 5-day outage to address boiler tube leaks. Since the 2017 fall outage, the facility has remained online for 165 consecutive days as of April 6, 2018. Favorable market conditions have also contributed to high output operations. Plum Point has maintained a capacity factor over 90% through mid-March 2018 and an equivalent availability factor (“EAF”) of 93% since June 2017.

Plum Point was taken offline on April 6, 2018 for a three-week scheduled spring outage to replace one-layer of selective catalytic reduction (“SCR”) catalyst. All other tasks scheduled during the outage were completed before the catalyst replacement creating opportunities to shorten the outage. New coal contracts with Cloud Peak Mines were favorably negotiated and in place for 2018. While BNSF rail deliveries have performed as expected, Plum Point has entered into an allowance agreement with BNSF. Under the

24

agreement, BNSF has identified a set monthly delivery allowance and any delivery beyond the allowance will result in a $4.00/ton credit to Plum Point. High capacity factors during the first 3 months of the year netted Plum Point over $1.5M dollars in savings.

The Plum Point Energy Station’s majority owner, Plum Point Energy Associates, LLC (“PPEA”), restructured its ownership in January 2018. PPEA, a wholly-owned subsidiary of PPEA Holding Company, LLC, was previously comprised of John Hancock Life Insurance and Ares Management L.P. Energy Investors Fund (“Ares EIF”). In January 2018, Starwood Energy Group Global acquired Ares EIF’s ownership in PPEA. Additionally, Plum Point Services Company, LLC, formed by PPEA to manage Plum Point operations under the Plum Point Management Agreement, announced PurEnergy Management Services (“PEMS”), a subsidiary of North American Energy Services (“NAES”) will succeed as Plum Point Energy Station’s Project Management Company.

The Plum Point employees continue to have an excellent safety record and the plant remains in compliance with all required permits. The plant continues to operate within its permitted limits with no major issues. In addition, employees of Plum Point’s operator, NRG Energy Services (“NRG”), continue to have an excellent safety record. Capital Expenditures

MJMEUC’s share of capital improvements related to Plum Point totaled $4,304,521 in fiscal year 2017. A $1.4 million refund was received by MJMEUC from the IRS for arbitrage rebate paid during the construction period, which was available and used for 2017 Plum Point capital expenditures. In addition, MJMEUC has available, and may use at its discretion, operating and maintenance accounts and contingency reserve accounts for funding certain operating and capital costs.

MJMEUC has fully funded all required debt service reserves and operating and maintenance reserves required by the bond documents.

[The remainder of this page left purposely blank]

25

Performance Statistics The following chart summarizes 2017 operations and provides an update of operations for Plum Point through the first quarter of 2018.

Thru 1Q 2018 2017 Annual

Plum Point Net Generation (MWh) 1,333,724 3,520,804 Plant Capacity Factor 92.20% 60.0%Plant Operating Availability Factor 99.43% 66.57%Total Fuel Cost 24,499,525$ 64,112,099$

2017Operating ExpensesFuel & Transportation 14,784,547$ Other Variable Expenses and Commodities 1,275,106 Fixed Operating Expenses 10,202,775 Total Operating Expenses 26,262,428

Capital Costs and Reserve RequirementsNet Debt Service 20,852,839 Deposit to O&M Reserve and other Contingency Fund - Capital Expenditures 4,304,521 Total Capital Costs 25,157,360

Total Plum Point Project Annual O&M Costs 51,419,788$ Average Annual Busbar Cost ($/MWh) 64.10$

MJMEUC Project Costs

2017 AveragePower Purchaser Net Revenue Busbar ($/MWh)

Benton 1,747,547$ 64.05$ Carthage 4,197,429 64.10$ Malden 1,397,285 64.02$ MoPEP 6,996,457 64.11$ North Little Rock AR 20,990,487 64.11$ Osceola AR 6,996,457 64.11$ Piggott AR 2,097,669 64.07$ Poplar Bluff 6,996,457 64.11$ MJMEUC Total 51,419,788$ 802,144

65,481 21,827

109,135 327,406

32,741 109,135

ElectricitySold (MWh)

27,284

109,135

26

[This page left purposely blank]

27

PRAIRIE STATE PROJECT

Introduction

In 2007, MJMEUC acquired an undivided interest in the Prairie State Energy Campus (“Prairie State”). Prairie State includes an approximately 1,600 MW (net) coal-fired, steam-electric generating station located in Washington, St. Clair and Randolph Counties, Illinois. Prairie State also includes transmission facilities to interconnect Prairie State with the grid at the delivery point; a water pipeline to the Kaskaskia River; a natural gas pipeline to deliver gas to the site; facilities for the disposal of coal combustion waste from the facilities; associated power plant facilities and equipment; and certain coal reserves, mine facilities, mining equipment and coal storage handling and conveying equipment. MJMECU’s undivided interest in Prairie State entitles MJMEUC to approximately 195 MW (net) of the capacity and output of Prairie State (the “Prairie State Project”). Prairie State Unit 1 commenced operations in June 2012 and Prairie State Unit 2 commenced operations in November 2012. On May 19, 2016, Lively Grove Energy Partners, LLC sold its 5.06 percent share of the Prairie State Energy Campus to the Wabash Valley Power Association (“WVPA”), a not-for-profit generation and transmission cooperative headquartered in Indianapolis, Indiana. Lively Grove Energy Partners, LLC’s transfer of shares to WVPA brings the campus fully under public power and rural electric cooperative ownership.

28

The current co-owners of Prairie State are as follows:

Owner Ownership Interest % MJMEUC 12.3% Wabash Valley Power Association 5.0 Northern Illinois Municipal Power Agency 7.6 Kentucky Municipal Power Agency 7.9 Southern Illinois Power Cooperative 7.9 Prairie Power, Inc. 8.2 Indiana Municipal Power Agency 12.6 Illinois Municipal Electric Agency 15.2 American Municipal Power 23.3

MJMEUC continues to monitor project operations since construction was finalized in November 2012 and also retains an outside engineering consultant to provide additional monitoring of the Prairie State operations.

Participants

MJMEUC has assigned approximately 109 MW (56%) of the capacity of the Prairie State Project to the Missouri cities of Columbia, Kirkwood, Hannibal, Fulton, Centralia and Kahoka pursuant to separate unit power purchase contracts. The balance of the capacity of the Prairie State Project (approximately 86 MW, or 44%) has been dedicated to MoPEP to provide a portion of the electric power and energy requirements of the Pool Power Purchasers.

Initially, the City of Marceline received a 4 MW (2%) share of the Prairie State Project pursuant to a separate unit power purchase contract. In 2013, MoPEP agreed to purchase the capacity and energy that Marceline received from the Prairie State Project until June 1, 2017, at which time this 4 MW of capacity was permanently assigned to MoPEP and Marceline was discharged from all obligations in connection with the Prairie State Project. MoPEP’s 86 MW, or 44%, of MJMEUC’s total output from the Prairie State Project referenced above includes the formerMarceline share.

Prairie State Project Missouri Public Energy Pool #1 Power Participants: Albany, Ava, Bethany, Butler, Carrollton, Chillicothe, El Dorado Springs, Farmington, Fayette, Fredericktown, Gallatin, Harrisonville, Hermann, Higginsville, Jackson, La Plata, Lamar, Lebanon, Macon, Marshall, Memphis, Monroe City, Odessa, Palmyra, Rock Port, Rolla, Salisbury, Shelbina, St. James, Stanberry, Thayer, Trenton, Unionville, Vandalia, and Waynesville.

Prairie State Project Unit Power Participants: Cities of: Centralia, Columbia, Fulton, Hannibal, Kahoka, Kirkwood, and Marceline (until 6/1/2017).

29

Project Financing

Bonds Issue Date

Final Maturity

Amount Outstanding

as of December 31, 2017

Prairie State Project, Series 2007A 9/26/2007 Retired $ 0 Prairie State Project, Series 2009A (Federally Taxable Build America Bonds – Direct Pay)*

12/17/2009 1/1/2042 184,890,000

Prairie State Project, Series 2010A (Federally Taxable Build America Bonds – Direct Pay) 12/10/2010 1/1/2042 71,875,000

Prairie State Project, Series 2015A (Refunding Bonds) 4/14/2015 12/1/2031 205,125,000

Prairie State Project, Series 2016A (Refunding Bonds) 3/10/2016 12/1/2041 252,745,000

Prairie State Project, Series 2017 (Refunding Bonds)** 12/21/2017 1/1/2029 26,640,000

* Includes the Series 2009A Bonds maturing January 1, 2029 in the principal amount of $30,845,000 that were partially advance refunded with Series 2017 Bonds on a crossover basis where the refunded Series 2009 Bonds are not legally or financially defeased and will remain outstanding until January 1, 2019 (see below for description of Series 2017 transaction). **Crossover advance refunding of Series 2009A Bonds, as described above.

Ratings: Fitch Ratings: A Stable Outlook

Moody’s Investor Services: A2 Stable Outlook

The Series 2007 (original principal amount $549,805,000), Series 2009 (original principal amount $207,920,000), and Series 2010 Bonds (original principal amount $78,005,000) were issued by MJMEUC to finance the costs of acquiring its interest in the Prairie State Project.

The 2009A and 2010A Bonds were issued as direct pay Federally Taxable Build America Bonds (“BABs”), where MJMEUC is entitled to receive a 35% subsidy from the United States Federal Government. The United States Federal Government has been and is currently subject to the process of sequestration, whereby spending for many Federal programs, including BABs subsidy payments, have been reduced. MJMEUC’s subsidies were reduced by approximately 6.9% and 6.6% for 2017 and 2018 by the United States Government. MJMEUC is recovering these lost subsidies through member rates.

In April 2015, MJMEUC issued the Series 2015A Bonds to advance refund a portion of its Power Project Revenue Bonds Series 2007A. The advance refunding was initiated by MJMEUC to take advantage of market rates at the time, achieve interest savings and an annual reduction in debt service. MJMEUC reduced its Prairie State total debt service payments by approximately $27.8 million from this advance refunding.

In March 2016, MJMEUC issued the Series 2016A Bonds to advance refund a portion of its Power Project Revenue Series 2007A Bonds. The advance refunding was initiated by MJMEUC to take advantage of market interest rates at the time, to achieve interest savings and reduce total debt service payments. MJMEUC reduced its Prairie State debt service payment by approximately $56.2 million from the advance refunding.

30

The Series 2017 Bonds were issued to advance refund on a crossover basis $30,845,000 of MJMEUC’s outstanding Power Supply System Revenue Bonds, Series 2009 Bonds maturing on January 1, 2029 (the “Refunded Bonds”) and pay costs of issuance of the Series 2017 Bonds. Proceeds of the Series 2017 Bonds and certain other funds were deposited in an escrow fund pledged to the owners of the Series 2017 Bonds and the owners of the Refunded Bonds for payment of: (i) interest on the Series 2017 Bonds to and including January 1, 2019 and (ii) to redeem the principal of the Refunded Bonds until the crossover date on January 1, 2019. The Refunded Bonds are not legally or financially defeased and will remain outstanding until the crossover date, at which point the funds held in escrow will be used to refund the principal amount of the Refunded Bonds and they will be removed from MJMEUC’s statements of net position. The refunding was initiated by MJMEUC to achieve interest cost savings and reduce annual debt service requirements. MJMEUC reduced its Prairie State total debt service payments by approximately $4.8 million with this refunding.

Project Update Background The ownership group governs the construction and operation of Prairie State through a non-profit corporation, Prairie State Generating Company, LLC (“PSGC”). Each Prairie State owner indirectly owns PSGC on a basis proportionate to their ownership interests and exercise control through a management committee (referred to herein as the “PSGC Board”) based on weighted voting proportionate to their voting interests.

Project Performance Summary – Unit 1 Prairie State Unit 1 experienced one boiler tube leak in January 2017 that was repaired quickly, and the unit returned to service. On March 4, 2017 the unit underwent its first steam turbine major overhaul during a scheduled spring outrage. During the 70-day outage, there were several plant repairs and upgrades completed in addition to the turbine work. The generator was upgraded, the boiler underwent maintenance, including a boiler tube material upgrade on the platen tubes. During the outage, maintenance beams and access panels were installed in the boiler to allow for quick repair access to reduce the length of future outages. The spring outage also included air pre-heater cold end basket replacements, SCR catalyst replacement and plant equipment inspections.

Following the 2017 spring outage, Prairie State Unit 1 performance achieved an equivalent availability factor (“EAF”) of 91% for the last 7 months of the year. Overall, Unit 1 completed the year with a 70.91% capacity factor and 72.88% EAF.

In 2018, the Prairie State Unit 1 completed a scheduled 28-day outage in early May. The scope of the scheduled outage largely included boiler inspections and completing maintenance and repairs as necessary, with a strong emphasis on preparing the boiler for 18-month cycles for scheduled outages going forward versus the previous practice of 12-month intervals for outages. The unit has since returned to service with expectations of running 18-months until the next scheduled outage in fall of 2019.

Project Performance Summary – Unit 2

During 2017, Prairie State Unit 2 experienced several small tube leaks creating forced outages but were quickly repaired. Many of the tube leaks occurred in the lower slope of the boiler, an area that was addressed in the 2017 fall outage. In late August 2017, a lightning arrestor on the generator setup

31

transformer (“GSU”) failed causing the unit to shut down for one week. Upon completion of the repairs, the unit operated until the scheduled annual 28-day outage in late September. During the scheduled outage, enhancements to the lower slope of the boiler were made to prevent tube leaks in that area of the boiler. Since that time, Prairie State Unit 2 has operated continuously and has not experienced additional tube leaks. Prairie State Unit 2 returned to service from its fall outage in late October 2017 and has continued to operate well since that time. Annual performance metrics of Prairie State Unit 2 included an EAF of 82.7% and capacity factor of 80.57%.

Prairie State Unit 2 will undergo its first steam turbine major overhaul during the next scheduled outage in fall 2018. The unit is scheduled to be down for 56-days for the outage. In addition to the steam turbine major overhaul, the Prairie State Unit 2 will undergo boiler inspections and necessary repairs to prepare the boiler for longer maintenance cycles. The Prairie State Unit 2 will explore extending the time between scheduled outages from 12-months to 18-months along with Prairie State Unit 1.

PSGC’s overall safety record for the Power Plant continues to be very good and PSGC staff continues to improve on its safety program with constant training and continuous evaluations and updates of all safety procedures.

Environmentally, there are no issues with either unit and the units remain compliant with all permit requirements.

Mine

Mine operations at Prairie State met performance expectations. The Lively Grove mine is considered one of the top mines in the state and country for operations and safety. Mine staff aim to improve coal quality in order to improve overall plant operations. Prairie State maintains an excellent safety record and safety remains a top priority for Prairie State.

The Mine continues with its outstanding mining operations. During 2017, the mine produced and delivered approximately 6.2 million tons of coal to the plant’s long term coal storage pile. During the four months of 2018, the mine produced and delivered approximately 2,233,000 tons of coal to the plant’s long term coal storage pile. The plant as of the end of April 2018, has an estimated coal inventory of 1,071,350 tons or approximately 50 days of coal available.

The overall safety record for mine continues to remain good with reportable accidents better than the industry standards for this type of mining facility.

Capital Expenditures

MJMEUC’s share of capital improvements related to Prairie State totaled $7,383,740 in fiscal year 2017. These costs were funded through rates and charges paid by MoPEP and the Unit Power Purchasers In addition, MJMEUC has available, and may use at its discretion, operating and maintenance accounts and contingency reserve accounts for funding certain operating and capital costs.

MJMEUC has fully funded all required debt service reserves, contingency reserves, and operating and maintenance reserves required by the bond documents.

32

Performance Statistics

The following chart summarizes 2017 operations and provides an update of operations for the Prairie State through the first quarter of 2018.

Thru 1Q 2018 2017 AnnualPrairie State UNIT 1 Net Generation (MWh) 1,543,256 ### 5,084,303 Unit 1 Capacity Factor 87.49% 70.91%Unit 1 Operating Availability Factor 89.88% 72.88%Total Fuel Cost 18,287,389$ 63,595,271$

Thru 1Q 2018 2017 AnnualPrairie State UNIT 2 Net Generation (MWh) 1,678,826 ### 5,732,676 Unit 2 Capacity Factor 96.14% 80.57%Unit 2 Operating Availability Factor 97.77% 82.70%Total Fuel Cost 19,893,876$ 71,705,224$

2017Operating ExpensesFuel & Transportation 16,784,169$ Other Variable Expenses and Commodities 3,865,328 Fixed Operating Expenses 15,677,840 Total Operating Expenses 36,327,337

Capital Costs and Reserve RequirementsNet Debt Service 49,943,810 Deposit to O&M Reserve and other Contingency Fund - Capital Expenditures 7,383,740 Total Capital Costs 57,327,550 Total Prairie State Project Annual O&M Costs 93,654,890$ Average Annual Busbar Cost ($/MWh) 70.11$

MJMEUC Project Costs

627,866 708,019 2017

0.47 0.53 ElectricityAverage Busbar

Power Purchaser Unit 1 Unit 2 Sold (MWh) Net Revenue ($/MWh)Centralia 6,439 7,262 13,701 960,563$ 70.11$ Columbia 160,991 181,544 342,535 24,014,074 70.11$ Fulton 32,198 36,309 68,507 4,802,815 70.11$ Hannibal 64,397 72,617 137,014 9,605,629 70.11$ Kahoka 6,439 7,262 13,701 960,563 70.11$ Kirkwood 80,495 90,772 171,267 12,007,037 70.11$ Marceline 4,622 5,211 9,833 787,459 80.08$ MoPEP 272,284 307,043 579,327 40,516,747 69.94$ MJMEUC Total 627,866 708,019 1,335,885 93,654,887$

33

A. MISSOURI PUBLIC ENERGY POOL #1 (“MoPEP”)

34

MoPEP Pool Member Cities

MoPEP participates in the following revenue bond projects: Dogwood, Prairie State, Iatan Unit 2, Plum Point, and Fredericktown

POOL POWER PURCHASERS

Peak Loads

City

2017 Peak Load

(MW)(1) Percent of Total

Rolla .................................................................................... 55.2 10.4% Lebanon ............................................................................... 55.0 10.4 Farmington .......................................................................... 46.8 8.8 Jackson ................................................................................ 38.0 7.2 Marshall............................................................................... 36.5 6.9 Harrisonville ........................................................................ 25.6 4.8 Chillicothe ........................................................................... 24.1 4.5 Macon .................................................................................. 18.8 3.5 Trenton ................................................................................ 16.9 3.2 Lamar .................................................................................. 14.0 2.6 Higginsville ......................................................................... 13.8 2.6 Ava ...................................................................................... 13.1 2.5 St. James .............................................................................. 13.0 2.5 Waynesville ......................................................................... 12.4 2.3 Fredericktown ..................................................................... 12.0 2.3 El Dorado Springs ............................................................... 11.7 2.2 Hermann .............................................................................. 11.3 2.1 Odessa ................................................................................. 11.2 2.1 Butler ................................................................................... 11.1 2.1 Carrollton ............................................................................ 10.3 1.9 Palmyra ............................................................................... 9.6 1.8 Bethany ............................................................................... 9.2 1.7 Monroe City ........................................................................ 9.2 1.7 Shelbina ............................................................................... 6.9 1.3 Fayette ................................................................................. 5.8 1.1 Memphis .............................................................................. 5.0 0.9 Vandalia .............................................................................. 5.0 0.9 Unionville ............................................................................ 4.7 0.9 Albany ................................................................................. 4.6 0.9 Salisbury .............................................................................. 4.4 0.8 Thayer ................................................................................. 4.0 0.8 Gallatin ................................................................................ 3.8 0.7 Rock Port ............................................................................. 2.9 0.5 Stanberry ............................................................................. 2.4 0.5 La Plata................................................................................ 2.3 0.4 Total .................................................................................... 530.6 100.0%

Total Pool Power Purchasers Served by MoPEP as of December 31, 2017 ........................................................................................

35

(1) Coincident peak occurred July 17, 2017.

35

Historical & Projected MoPEP Loads & Resources (1) (MW)

(1) Excludes new Members until the respective years in which they become Pool Power Purchasers. (2) Includes firm sales, 15% system reserve requirements, sales to MMMPEP of 35 MW through May 2018, and

planned sales to MMMPEP of 70 MW from June 2018 through 2021 and dropping to 35 MW for 2021-2024. (3) Includes firm power sales agreements, 57 MW of capacity from NC2, 50 MW of capacity from the Plum Point

Project and 3 MW of capacity from the Lamar Project, an additional 2.4 MW in December 2012 from Lamar Project expansion, an additional 2 MW in early 2018 from Lamar Project expansion, a power purchase agreement for 4 MW from the Prairie State Project in 2014 through June 2017, and an agreement for 3.8 MW from the Black Oak landfill in March 2015.

(4) The Iatan Unit 2 Project began service in January of 2011. MJMEUC transferred 20 MW of its ownership interest in Plum Point to MoPEP in June 2011, 41 MW from Unit 1 of the Prairie State Project in June 2012, 41 MW from Unit 2 of the Prairie State Project in November 2012 and 4 MW of the Prairie State Project in June 2017. MJMEUC completed its joint-ownership acquisition of Dogwood Generating Facility in the first quarter of 2012 and expects to acquire another 50 MW ownership interest with proceeds of the Series 2018 Bonds. The Fredericktown Energy Center commenced service in June 2015. MJMEUC expects to construct an additional unit at its Laddonia facility of 12 MW and commencing service in 2019.

(5) Beginning in 2017, includes 5% of the 20 MW of nameplate wind generation capacity and 10% of the 16 MW of nameplate solar generation capacity for a combined total of 3 MW of net capacity.

Fiscal Year Ending

December 31

Annual Peak Load

Peak Capacity

Requirement(2)

Dedicated Member

Capacity Contract

Purchases(3,5)

MJMEUC Owned

Capacity(4) Total

Capacity Surplus/ (Deficit)

Historical:

2013 518 631 348 240 196 784 153

2014 531 646 268 240 194 702 56

2015 526 640 268 244 218 730 90

2016 532 650 288 244 218 750 100

2017 531 646 284 244 222 750 105

Projected:

2018 557 710 284 246 272 802 92

2019 562 717 284 246 284 814 97

2020 568 723 284 246 284 814 91

2021 574 685 284 149 284 717 32

2022 580 691 284 149 284 717 26

36

MoPEP’s Diversified Resource Mix Includes:

Co-Gen Coal Hydro Landfill Gas Natural Gas Solar Wind

37

2013 2014 2015 2016 2017Revenues

Sale of Electricity Wholesale(1) 196,142,856$ 202,426,526$ 183,904,260$ 183,082,750$ 181,249,511$

Other Operating Revenue 6,273 3,407 967 773 580 Total Revenues 196,149,129 202,429,933 183,905,227 183,083,523 181,250,091

Expenses

Purchased Power 171,488,747 175,521,048 163,768,654 162,002,057 162,019,800 Power Generation 7,792,073 8,963,413 6,898,730 7,270,596 7,068,519 Future Recoverable Costs 10,157,455 7,593,282 1,817,586 498,678 (3,897,893)Other Operating Expenses 1,574,621 1,805,206 1,968,953 1,771,619 1,952,495 Depreciation 1,925,333 1,941,353 2,093,620 2,504,088 2,728,277

Total Operating Expenses 192,938,229 195,824,302 176,547,543 174,047,038 169,871,198

Operating Income 3,210,900 6,605,631 7,357,684 9,036,485 11,378,893

Interfund Transfers In/(Out) 3,353,270 (831,146) (811,804) (981,175) (961,834)Net Operating Income 6,564,170 5,774,485 6,545,880 8,055,310 10,417,059

Non-Operating Income/Expenses

Interest/Non-Operating Income 125,385 123,395 302,702 322,634 323,633 Interest/Non-Operating Expense (2,019,083) (1,817,169) (2,434,014) (3,470,877) (3,023,357)

Total Non-Operating (1,893,698) (1,693,774) (2,131,312) (3,148,243) (2,699,724)

Increase in Fund Equity 4,670,472 4,080,711 4,414,568 4,907,067 7,717,335

Fund Equity Beginning of Year 20,515,190 25,185,662 29,266,373 33,680,941 38,588,008

Fund Equity End of Year 25,185,662$ 29,266,373$ $ 33,680,941 $ 38,588,008 $ 46,305,343

(1) MoPEP sells electric in the energy market though Regional Transmission Operators (“RTOs”) and MoPEP purchases energy from theRTOs where MoPEP economically needs to receive the power.

Condensed Statements of Operations and Changes in Fund Equity(1)MoPEP POOL FUND

38

Average Cost of MoPEP Delivered Energy

YEAR $/MWh

2013 ...................................................... 65.98

2014 ...................................................... 67.79

2015 ...................................................... 63.37

2016 ...................................................... 62.42

2017 ...................................................... 63.64

The table above shows the system average rate for all energy delivered during the last five calendar years. Charges include all costs for capacity, energy, transmission, load monitoring, scheduling, dispatch and ancillary services and all administrative costs for managing MoPEP. System average rates include average bill credits for the use of Member Capacity. If MJMEUC did not apply such credits as an offset to MoPEP participants’ energy bills, MJMEUC’s average cost of delivered energy and annual revenues for MoPEP would be approximately 5-6 percent higher and MJMEUC’s operating expenses for MoPEP would be higher by an equal amount. NOTE: MoPEP’s average cost for years 2013 and 2014 are correctly stated above but were incorrectly reported higher at $68.82 and $67.85, respectively, in Official Statements for bond issues completed by MJMEUC in 2014 and 2015.

For Additional Information

Copies of MJMEUC’s audited financial statements may be obtained from Missouri Joint Municipal Electric Utility Commission, 1808 I-70 Drive S.W., Columbia, MO 65203 or website: www.mpua.org/Financials.php. This Report and prior years’ reports can be also found on Municipal Securities Rulemaking Board (“MSRB”) via Electronic Municipal Market Access (“EMMA”). In addition to this Report, annual audits for all Large Pool Power Purchasers, and Unit Power Purchasers, event notices, annual reports, and other materials are located on the MSRB website at www.emma.msrb.org.

Historical & Projected MoPEP Energy Requirements

Year

Historical Energy Requirements (MWh)

Year

Projected Energy Requirements (MWh)

2013 2,613,601 2018 2,662,000

2014 2,659,193 2019 2,695,000

2015 2,588,340 2020 2,683,000

2016 2,609,294 2021 2,710,000

2017 2,517,758 2022 2,737,000

39

MoPEP Member Capacity Through December 31, 2017

Facility

Fuel Type

Capacity (MW)

2017 Capacity Factor

Chillicothe Units 1 & 2 Natural Gas/Oil 80.0 <1.0%

Macon Gas Turbine Natural Gas 9.0 96.7%(1)

City of Higginsville Natural Gas 38.6 <1.0%

City of Jackson 10 units Oil 21.0 <1.0%

Other Peaking Units Natural Gas/Oil 135.3 <1.0%

Total Member Capacity ……………… 283.9 _______________

(1) The capacity of this unit is based upon a summertime rating, determined with evaporation at

100oF. At lower temperatures, the output of the unit is well above 9.0 MW, and the unit regularly produces 10 MW.

Litigation

At the time of delivery of this Report, MJMEUC certifies that other than matters disclosed in this Report, there is no material pending litigation relating to MJMEUC or its operations.

[The remainder of this page left purposely blank]

40

[This page left purposely blank]

41

B. MOPEP LARGE POOL POWER PURCHASERS

(OFFICIAL STATEMENT - APPENDIX B)

42

Large Pool Power Purchasers General Information Summary

RollaMunicipal Utilities

City of Lebanon

City of Farmington

City of Marshall

City of Jackson

GeneralYear Established 1945 1853 1891 1914 1905Service Area (sq. Miles) 11.6 19 5.2 10.5 10.7Fiscal Year End September-30 June-30 September-30 September-30 December-31

Fiscal Year 2017Peak Load - MW 67 57.5 49 37.2 37.4Residential Sales 92,153 74,781 76,745 46,684 71,506 Commercial Sales 132,824 52,992 37,828 56,541 45,718 Industrial Sales 54,651 115,128 105,387 65,443 22,800 Total Sales 279,628 242,901 219,960 168,668 140,024

Fiscal Year 2016Peak Load - MW 64 62.5 49 38.6 37.5Residential Sales 95,465 77,586 78,107 48,439 72,756 Commercial Sales 130,526 64,423 39,596 54,626 47,389 Industrial Sales 55,441 118,253 111,744 67,898 23,556 Total Sales 281,432 260,262 229,447 170,963 143,701

Fiscal Year 2015Peak Load - MW 67 65.5 49 38 37Residential Sales 103,558 79,917 82,259 48,121 72,624 Commercial Sales 129,933 63,904 32,437 54,973 47,423 Industrial Sales 56,815 117,232 117,317 70,222 26,074 Total Sales 290,306 261,053 232,013 173,316 146,121

Fiscal Year 2017Residential Sales $ 9,760 $ 7,624 $ 7,687 $ 5,730 $ 8,564 Commercial Sales 12,068 5,143 3,752 6,526 5,244 Industrial Sales 4,249 10,316 9,554 5,881 2,338 Other Sales 331 - 345 420 - Total Sales $ 26,408 $ 23,083 $ 21,338 $ 18,557 $ 16,146

Fiscal Year 2016Residential Sales $ 10,199 $ 7,642 $ 7,788 $ 5,922 $ 8,632 Commercial Sales 12,301 5,908 3,926 6,146 5,398 Industrial Sales 4,495 10,137 10,025 6,351 2,369 Other Sales 347 - 105 - - Total Sales $ 27,342 $ 23,687 $ 21,844 $ 18,419 $ 16,399

Fiscal Year 2015Residential Sales $ 10,759 $ 7,244 $ 8,108 $ 5,539 $ 8,540 Commercial Sales 12,226 5,466 4,035 6,016 5,315 Industrial Sales 4,600 9,364 10,081 5,939 2,561 Other Sales 349 - 11 - - Total Sales $ 27,934 $ 22,074 $ 22,235 $ 17,494 $ 16,416

(1) Other category includes City services* MoPEP Large Pool Participants are Cities with at least 5% of the total MoPEP peak load level for 2017.

Peak Load (in MW) & Energy Sales in (MWh)

Customer Revenues (in 000's)

43

Large Pool Power Purchasers Balance Sheet Summary (‘000s)

Fiscal Year 2017Assets: UNAUDITED

Utility Plant, Net $ 38,577 $ 1,277 $ 15,599 $ 18,126 $ 18,138 Cash and Investments 25,587 11,016 7,824 24,499 9,600 Other Assets 6,168 3,234 4,851 7,103 -

Total Assets 70,332 15,527 28,274 49,728 27,738 Deferred Outflows of Resources $ 806 $ 152 $ 207 $ 947

Total Assets & Deferred Outflows $ 71,138 $ 15,679 $ 28,481 $ 50,675 $ 27,738