Consumption, Real GDP and Multiplier

description

Transcript of Consumption, Real GDP and Multiplier

Consumption, Real GDP and Multiplier

Chapter 12

ConsumptionReal Disposable Income Real GDP minus net taxes, or after-tax real income

Consumption Spending on new goods and services out of a household’s current income

Whatever is not consumed is saved Consumption includes such things as buying food and going to a concert

Saving

The act of not consuming all of one’s current income

Whatever is not consumed out of spendable income is, by definition, saved

Saving is an action measured over time (a flow)

Savings are a stock, an accumulation resulting from the act of saving in the past

Consumption Goods Goods bought by households to use up, such as food and movies

Consumption plus saving equals disposable income

Saving equals disposable income minus consumption

Investment Spending by businesses on things such as machines and buildings, which can be used to produce goods and services in the future

The investment part of real GDP is the portion that will be used in the process of producing goods in the future

Producer durables; nonconsumable goods that firms use to make other goods

Classical Model In the classical model, the supply of saving was determined by the rate of interest

The higher the rate, the more people wanted to save, and the less they wanted to consume

Keynesian View Keynes argued that: The interest rate is not the most important determinant of individual’s real saving and consumption decisions

Real saving and consumption decisions depend primarily on a household’s real disposable income

Keynesian Consumption function Keynes was concerned with changes in AD (AD= C +I+G+NX)

The relationship between amount consumed and disposable income

A consumption function tells us how much people plan to consume at various levels of disposable income

Autonomous Consumption The part of consumption that is independent of the level of disposable income

Changes in autonomous consumption shift the consumption function

45-Degree Reference Line - The line along which planned real expenditures equal real GDP per year

Dissaving

Negative saving; a situation in which spending exceeds income

Dissaving can occur when a household is able to borrow or use up existing assets

Average Propensity to Consume Average Propensity to Consume (APC) Real consumption divided by real disposable income

The proportion of total disposable income that is consumed

Average Propensity to Save Average Propensity to Save (APS)

Real saving divided by real disposable income(DI)

Saved proportion of real DI

Example of APC

Income increases by $6,000 to $60,000

C = $54,000 S = $6,000

Marginal Propensity to Consume

Marginal Propensity to Consume (MPC) The ratio of the change in real consumption to the change in real disposable income

Marginal Propensity to Save Marginal Propensity to Save (MPS) The ratio of the change in saving to the change in disposable income

The Multiplier Multiplier -The ratio of the change in the equilibrium level of real national income to the change in autonomous expenditures

The number by which a change in autonomous real investment or autonomous real consumption is multiplied to get the change in equilibrium real GDP

Multiplier Formula

It is possible that a relatively small change in consumption or investment can trigger a much larger change in real GDP

Multiplier example MPC = .9 and MPS =.1 1/1-.9=1/.1= 10 If 50 billion dollars is invested then it will

become 500 billion dollars in real GDP growth due to the Multiplier

Your turn to use multiplier MPC =.8 MPS=.2 50 billion is invested 1/1-.8 = 1/.2 = 5 5x50= 250 billion Now make a multiplier problem for a

friend.

Investment Investment is new expenditures on

buildings and equipments. It also includes changes in inventories,

or items produced but not sold by businesses

Investment Decisions Businesses have an array of investment

choices with varying rates of return (profit) Keynes believed that when interest rates

increase in the credit market planned investment decreased

Conversely, when interest rates decrease then planned investment increases

Therefore, there is a downward sloping investment curve

Investment shifts Investments may also shift due to: 1. Future expectations of future sales by

business people 2. Changes in productive technology 3. Increases or decreases in taxes

Adding investment Investment, or what is called autonomous

investment, is added to the Keynesian Income Model

It is parallel and above the consumption function line

It is labeled C + I The addition of Investment to Consumption

raises the level of RGDP or National Income at the equilibrium point of the 45 degree angle

The increases in Inventories

If consumers purchase fewer goods and services than anticipated this leaves firms with unsold products and inventories will rise

Businesses respond by cutting back production, to reduce unplanned business inventories, thus reducing RGDP

Decreases in Inventories If there are unplanned decreases in business inventories then business will increase production of goods and services and increase employment

Ultimately there will be an increase in real GDP

Government Spending Government spending, like investment

is considered autonomous (not determined by levels of disposable income)

G in the model includes federal, state and local government spending.

However, transfer payments, like social security are not included in G.

Government spending It is estimated that government expenditures

account for about 20% of GDP The Keynesian model assumes a lump sum

tax, which means that real GDP will be reduced by the amount of the lump sum tax. (This tax decreases C and I)

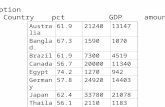

Foreign Sector The Foreign sector is determined by net

exports (exports - imports). Trade surpluses will increase the real GDP,

and trade deficits will decrease the RGDP The Foreign sector is also autonomous. Together C+I+G+NX are often given the

notation AE (All Expenditures) on the macro model.

Relationship between models The C+I+G+NX curve you studied in

Chapters 10 and 11 is directly related to the AE curve in the Keynesian income model

The major difference is that the Keynesian income model does not include price level changes of the first Macro model we learned.

Keynesian Assumptions

1. Businesses pay no indirect taxes (sales tax)

2. Businesses distribute all profits to shareholders

3. There is no depreciation4. The economy is closed; no foreign trade