Consolidated Financial Results for the Fiscal Year Ended ... · If there is any discrepancy between...

Transcript of Consolidated Financial Results for the Fiscal Year Ended ... · If there is any discrepancy between...

1

Disclaimer: This financial information, a digest of Taisei Corporation's "Consolidated Financial Results for the Fiscal Year Ended

March 31, 2017" ("Kessan Tanshin") disclosed at the Tokyo Stock Exchange on May 12, 2017 was translated into English and

presented solely for the convenience of non-Japanese speaking users. If there is any discrepancy between Japanese "Kessan Tanshin"

and this document, Japanese "Kessan Tanshin" will prevail.

May 12, 2017

Consolidated Financial Results for the Fiscal Year Ended March 31, 2017 (FY2016)

[Japanese GAAP]

Listed company name: Taisei Corporation

Stock exchange listing: Tokyo Stock Exchange, 1st Section

Nagoya Stock Exchange, 1st Section

Stock code: 1801

Location of headquarters: Tokyo, Japan

Website: http://www.taisei.co.jp

Representative: Yoshiyuki Murata, President and Chief Executive Officer

Contact: Shuichi Okuda, General Manager of Accounting Department

TEL: 81-3-3348-1111 (from overseas)

Scheduled date for ordinary general

meeting of shareholders: June 29, 2017

Scheduled date for dividend payment: June 30, 2017

Scheduled date for submission of

securities report: June 30, 2017

Supplementary materials for

financial summaries: Yes

Financial results briefing: Yes (for analysts and institutional investors)

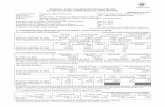

1. Consolidated financial results for the fiscal year ended March 31, 2017 (FY2016)

(From April 1, 2016 to March 31, 2017)

(1) Operating results (Millions of yen, rounded down)

(Percentages indicate changes from the same period in the previous fiscal year.)

Net sales Operating income Ordinary income

Net income

attributable to owners

of parent

% % % %

FY2016 (full year)

As of March 31, 2017 1,487,252 (3.8) 140,822 19.9 144,591 22.8 90,566 17.5

FY2015 (full year)

As of March 31, 2016 1,545,889 (1.7) 117,468 66.8 117,703 58.1 77,045 101.8

(Note) Comprehensive income: March 31, 2017 92,788 million yen 146.4% March 31, 2016 37,665 million yen 62.8%

Net income

per share

Diluted net income

per share Equity ratio

Recurring

profit/total assets

Operating

profit/net sales

yen yen % % %

FY2016 (full year)

As of March 31, 2017 78.57 - 16.7 8.5 9.5

FY2015 (full year)

As of March 31, 2016 65.85 - 15.3 6.9 7.6

(Reference) Equity in earnings of affiliates: March 31, 2017 1,378 million yen March 31, 2016 4,448 million yen

2

(2) Financial position (Millions of yen, rounded down)

Total assets Equity Equity ratio Equity per share

% yen

FY2016 (full year)

As of March 31, 2017 1,760,078 570,813 32.3 496.60

FY2015 (full year)

As of March 31, 2016 1,660,821 521,277 31.2 442.67

Reference: Shareholders’ equity

March 31, 2017 568,779 million yen March 31, 2016 517,875 million yen

(3) Cash flows (Millions of yen, rounded down)

Cash flows from

operating activities

Cash flows from

investing activities

Cash flows from

financing activities

Cash and cash

equivalents at end of

period

FY2016 (full year)

As of March 31, 2017 218,158 6,296 (60,061) 534,787

FY2015 (full year)

As of March 31, 2016 95,360 (25,070) (35,171) 371,730

2. Dividends (Millions of yen, rounded down)

Dividends per share (yen) Total

dividends

(annual)

Payout ratio (consolidated)

Ratio of

dividends to equity

(consolidated)

First

quarter-

end

Interim

-end

Third

quarter-

end

Year

-end

Total

(Full

year)

yen yen yen yen yen % %

FY2015 - 5.00 - 11.00 16.00 18,718 24.3 3.7

FY2016 - 8.00 - 12.00 20.00 22,907 25.5 4.3

FY2017 (Forecast) - 10.00 - 50.00 - 25.8

note

*The Company intends to conduct 1-for-5 consolidation of shares whose effective date will be October 1, 2017.

Therefore, the forecast amount of year-end dividends per share for FY2017 presented above reflects the impact of the

consolidation of shares and the amount of dividends for the full year is not presented (indicated by “-”). The forecast

amount of year-end dividends per share for FY2017 without reflecting the impact of the consolidation of shares is ¥10

and the amount of dividends per share for the full year of FY2017 is ¥20. For details, please refer to “Disclaimer

regarding appropriate use of forecasts and related points of note”.

3. Consolidated results forecast for the fiscal year ending March 31, 2018 (FY2017) (From April 1, 2017 to March 31, 2018)

(Millions of yen, rounded down)

(Percentages indicate the rate of change from the same period of the previous fiscal year)

Net sales Operating income Ordinary income Profit attributable to

owners of parent Net income

per share

% % % % yen

Cumulative total for the

six months 730,000 12.9 47,000 (10.5) 48,000 (4.8) 32,000 (9.1) 28.32

Fiscal year ending

March 31, 2018 1,610,000 8.3 125,000 (11.2) 126,000 (12.9) 87,000 (3.9) 387.62

* The forecast amount of net income per share for the full year of FY2017 reflects the impact of consolidation of shares. For details,

please refer to “Disclaimer regarding appropriate use of forecasts and related points of note”.

3

*Notes

(1) Changes in significant subsidiaries during the period

(Changes in specified subsidiaries accompanying changes in scope of consolidation): None

(2) Changes in accounting principles, changes in accounting estimates and restatements

(i) Changes in accounting principles due to revisions to accounting standards, etc.: Yes

(ii) Changes due to accounting principles other than (i): None

(iii) Changes in accounting estimates: None

(iv) Restatements: None

(3) Number of shares outstanding (common stock)

i. Number of shares outstanding at the end of period (including treasury stock)

As of March 31, 2017 1,146,752,860 shares

As of March 31, 2016 1,171,268,860 shares

ii. Number of treasury stock at the end of period

As of March 31, 2017 1,408,179 shares

As of March 31, 2016 1,370,964 shares

iii. Average number of shares during the period

As of March 31, 2017 1,152,619,443 shares

As of March 31, 2016 1,169,932,688 shares

4

Reference: SUMMARY OF NON-CONSOLIDATED FINANCIAL STATEMENTS

1. Non-consolidated financial results for the fiscal year ended March 31, 2017 (FY2016) (From April 1, 2016 to March 31, 2017)

(1) Operating results (Millions of yen, rounded down)

(Percentages indicate year-on-year changes.)

Net sales Operating

income

Ordinary

income Net income

% % % %

FY2016 (full year)

As of March 31, 2017 1,176,711 (3.7) 118,632 25.6 126,638 38.0 91,087 53.9

FY2015 (full year)

As of March 31, 2016 1,221,932 (2.3) 94,470 93.3 91,778 71.1 59,202 123.6

Net income per share Diluted net income per

share

yen yen

FY2016 (full year)

As of March 31, 2017 79.03 -

FY2015 (full year)

As of March 31, 2016 50.60 -

(2) Financial position (Millions of yen, rounded down)

Total assets Net assets Equity ratio Net assets per share

% yen

FY2016 (full year)

As of March 31, 2017 1,518,693 483,064 31.8 421.76

FY2015 (full year)

As of March 31, 2016 1,413,943 436,838 30.9 373.40

(Reference) Shareholders’ equity: March 31, 2017 483,064 million yen March 31, 2016 436,838 million yen

2. Non-consolidated results forecast for the fiscal year ending March 31, 2018 (FY2017) (From April 1, 2017 to March 31, 2018)

(Millions of yen, rounded down)

(Percentages indicate the rate of change from the same period of the previous fiscal year)

Net sales Operating income Ordinary income Net income Net income

per share

% % % % yen

Cumulative total for the

six months 610,000 18.2 44,000 (1.3) 45,000 (5.1) 30,000 (14.9) 26.55

Fiscal year ending

March 31, 2018 1,310,000 11.3 109,000 (8.1) 110,000 (13.1) 76,000 (16.6) 338.61

* The forecast amount of net income per share for the full year of FY2017 reflects the impact of consolidation of shares. For details,

please refer to “Disclaimer regarding appropriate use of forecasts and related points of note”.

* This Financial statement is exempt from audit procedures.

* Disclaimer regarding appropriate use of forecasts and related points of note

Taisei Corporation, at the Board of Directors meeting held on May 12, 2017, resolved to repurchase its own shares under Article 156,

as applied pursuant to paragraph 3, Article 165, of the Companies Act. The forecast amount of net income per share for the full year

of FY2017 in both consolidated and non-consolidated reflects the impact of share repurchase.

At the Board of Directors meeting, Taisei Corporation resolved to submit a proposal to the General meeting of Shareholders for the

consolidation of shares with a ratio of five shares to one share, effective October 1, 2017. The consolidation of shares is subject to

approval at the General meeting of Shareholders to be held on June 29,2017.

5

For reference purposes, when converted to the amount before the consolidation of shares, dividends per share and net income per

share are as follows.

1.Dividend forecast for the fiscal year ending March 31, 2018

Dividends per Share First Half:10 yen Full Year:10 yen Total:20 yen

2.Financial forecast for the fiscal year ending March 31, 2018

Net income per Share Full Year consolidation:77.52 yen non-consolidation:67.72 yen

Earnings forecasts in this document are based on information available at present and logical assessments and do not represent any

promise by the Company. Actual results can be materially different from expectations due to a variety of factors.

5

Overview of Consolidated Earnings Forecasts for Fiscal Year ending in March 31, 2018

(Unit: 100 million yen; amounts less than 100 million yen are rounded up to the nearest 100 million yen (partially adjusted for fractions))

Full fiscal year First two quarters Previous

fiscal year (From April

1, 2015 to

March 31,

2016)

Current fiscal year (From April 1, 2016 to March 31, 2017)

Next fiscal year (From April 1, 2017 to

March 31, 2018)

Current

fiscal year (From April

1, 2016 to

September

30, 2017)

Next fiscal year (From April 1, 2017 to

September 30, 2017)

Result

Forecast*

Result

Result

Over

previous

fiscal year

Over

forecast Result

Over

current

fiscal year

Forecast

Over

current

fiscal year

Amount of orders received

16,711 16,000 16,550 (161) 550 16,300 (250) 8,708 6,900 (1,808)

Civil engineering

4,445 3,700 4,276 (169) 576 4,100 (176) 2,013 2,210 197

Building construction

11,019 11,000 11,015 (4) 15 10,900 (115) 6,141 4,230 (1,911)

Real estate development

1,122 1,200 1,153 31 (47) 1,200 47 512 440 (72)

Other 125 100 106 (19) 6 100 (6) 42 20 (22)

Net sales 15,459 14,700 14,873 (586) 173 16,100 1,227 6,464 7,300 836

Civil engineering

4,339 4,200 4,229 (110) 29 4,300 71 1,811 2,000 189

Building construction

9,782 9,300 9,386 (396) 86 10,600 1,214 4,116 4,840 724

Real estate development

1,213 1,100 1,152 (61) 52 1,100 (52) 495 440 (55)

Other 125 100 106 (19) 6 100 (6) 42 20 (22)

Gross Profit % 12.8 13.3 15.2 2.4 1.9 13.0 (2.2) 14.3 12.2 (2.1) 1,976 1,960 2,263 287 303 2,100 (163) 922 890 (32)

Civil engineering

% 15.9 13.6 17.9 2.0 4.3 14.4 (3.5) 13.9 13.3 (0.6) 690 570 758 68 188 620 (138) 251 265 14

Building construction

% 10.6 12.0 13.1 2.5 1.1 11.5 (1.6) 13.5 11.2 (2.3) 1,039 1,120 1,226 187 106 1,220 (6) 556 540 (16)

Real estate % 19.0 23.6 22.5 3.5 (1.1) 22.7 0.2 21.2 18.2 (3.0) development 231 260 260 29 (0) 250 (10) 105 80 (25)

Other % 13.0 10.0 17.9 4.9 7.9 10.0 (7.9) 22.9 25.0 2.1 16 10 19 3 9 10 (9) 10 5 (5)

SG&A expenses % (5.2) (5.7) (5.7) (0.5) - (5.2) 0.5 (6.2) (5.8) 0.4 (801) (840) (855) (54) (15) (850) 5 (397) (420) (23)

Operating

income

% 7.6 7.6 9.5 1.9 1.9 7.8 (1.7) 8.1 6.4 (1.7) 1,175 1,120 1,408 233 288 1,250 (158) 525 470 (55)

Non-operating income

91 50 84 (7) 34 55 (29) 33 30 (3)

Non-operating expenses

(89) (80) (46) 43 34 (45) 1 (54) (20) 34

(Net financial revenue)

9 7 18 9 11 7 (11) 9 6 (3)

Ordinary

income

% 7.6 7.4 9.7 2.1 2.3 7.8 (1.9) 7.8 6.6 (1.2) 1,177 1,090 1,446 269 356 1,260 (186) 504 480 (24)

Extraordinary income 43 40 35 (8) (5) - (35) 34 - (34)

Extraordinary losses (42) (20) (129) (87) (109) (10) 119 (8) (10) (2)

Income before

income taxes and

minority interests

% 7.6 7.6 9.1 1.5 1.5 7.8 (1.3) 8.2 6.4 (1.8)

1,178 1,110 1,352 174 242 1,250 (102) 530 470 (60)

Income taxes and others

(410) (350) (448) (38) (98) (380) 68 (177) (150) 27

Net income % 5.0 5.2 6.1 1.1 0.9 5.4 (0.7) 5.5 4.4 (1.1)

768 760 904 136 144 870 (34) 353 320 (33)

Net income(loss)

attributable to

non-controlling

interests

2 - 2 (0) 2 - (2) (1) - 1

Net income

attributable to

owners of parent

% 5.0 5.2 6.1 1.1 0.9 5.4 (0.7) 5.4 4.4 (1.0)

770 760 906 136 146 870 (36) 352 320 (32)

* Forecasts for the fiscal year under review are the revised figures released on November 11, 2016.

6

Overview of Non-consolidated Earnings Forecasts for Fiscal Year ending in March 31, 2018

(Unit: 100 million yen; amounts less than 100 million yen are rounded up to the nearest 100 million yen (partially adjusted for fractions))

Full fiscal year First two quarters

Previous

fiscal year (From April

1, 2015 to

March 31,

2016)

Current fiscal year (From April 1, 2016 to March 31, 2017)

Next fiscal year (From April 1, 2017 to

March 31, 2018)

Current

fiscal year (From April

1, 2016 to

September

30, 2016)

Next fiscal year (From April 1, 2017 to

September 30, 2017)

Result

Forecast*

Result

Result

Over

previous

fiscal year

Over

forecast Forecast

Over

current

fiscal year

Forecast

Over

current

fiscal year

Amount of orders

received 13,518 13,000 13,482 (36) 482 13,300 (182) 7,233 5,400 (1,833)

Civil engineering 3,239 2,720 3,153 (86) 433 2,950 (203) 1,446 1,600 154

Domestic 2,854 2,650 3,411 557 761 2,600 (811) 1,739 1,400 (339)

Overseas 385 70 (258) (643) (328) 350 608 (293) 200 493

Building construction 10,070 10,000 10,088 18 88 10,000 (88) 5,712 3,750 (1,962)

Domestic 10,049 9,600 9,945 (104) 345 9,600 (345) 5,701 3,550 (2,151)

Overseas 21 400 143 122 (257) 400 257 11 200 189

Total 13,309 12,720 13,241 (68) 521 12,950 (291) 7,158 5,350 (1,808)

Real estate

development 89 200 139 50 (61) 260 121 36 30 (6)

Other 120 80 102 (18) 22 90 (12) 39 20 (19)

Net sales 12,219 11,600 11,767 (452) 167 13,100 1,333 5,162 6,100 938

Civil engineering 3,133 3,100 3,125 (8) 25 3,100 (25) 1,390 1,550 160

Domestic 2,931 2,900 2,980 49 80 2,900 (80) 1,314 1,440 126

Overseas 202 200 145 (57) (55) 200 55 76 110 34

Building construction 8,796 8,300 8,402 (394) 102 9,700 1,298 3,699 4,500 801

Domestic 8,705 8,100 8,191 (514) 91 9,600 1,409 3,663 4,450 787

Overseas 91 200 211 120 11 100 (111) 36 50 14

Total 11,929 11,400 11,527 (402) 127 12,800 1,273 5,089 6,050 961

Real estate development

170 120 138 (32) 18 210 72 34 30 (4)

Other 120 80 102 (18) 22 90 (12) 39 20 (19)

Gross Profit % 12.0 12.9 15.0 3.0 2.1 12.7 (2.3) 13.9 12.0 (1.9)

1,467 1,500 1,766 299 266 1,670 (96) 716 730 14

Civil engineering % 16.3 13.9 18.9 2.6 5.0 15.2 (3.7) 14.2 13.9 (0.3)

511 430 592 81 162 470 (122) 198 216 18

Building construction

% 10.5 12.0 13.0 2.5 1.0 11.3 (1.7) 13.5 11.1 (2.4) 920 1,000 1,089 169 89 1,100 11 499 500 1

Total % 12.0 12.5 14.6 2.6 2.1 12.3 (2.3) 13.7 11.8 (1.9) 1,431 1,430 1,681 250 251 1,570 (111) 697 716 19

Real estate development

% 13.9 50.0 50.6 36.7 0.6 42.9 (7.7) 35.7 30.0 (5.7) 24 60 70 46 10 90 20 12 9 (3)

Other % 10.0 12.5 14.3 4.3 1.8 11.1 (3.2) 17.2 25.0 7.8

12 10 15 3 5 10 (5) 7 5 (2)

SG&A expenses % (4.3) (4.8) (4.9) (0.6) (0.1) (4.4) 0.5 (5.3) (4.8) 0.5

(522) (560) (580) (58) (20) (580) (0) (270) (290) (20)

Operating income % 7.7 8.1 10.1 2.4 2.0 8.3 (1.8) 8.6 7.2 (1.4) 945 940 1,186 241 246 1,090 (96) 446 440 (6)

Non-operating income 54 90 118 64 28 50 (68) 77 30 (47)

Non-operating expenses (81) (70) (38) 43 32 (40) (2) (49) (20) 29

(Net financial revenue) 28 71 77 49 6 22 (55) 67 17 (50)

Ordinary income % 7.5 8.3 10.8 3.3 2.5 8.4 (2.4) 9.2 7.4 (1.8)

918 960 1,266 348 306 1,100 (166) 474 450 (24)

Extraordinary income 41 30 30 (11) (0) - (30) 29 - (29)

Extraordinary losses (42) (10) (7) 35 3 (10) (3) (2) (10) (8)

Income before

income taxes

% 7.5 8.4 11.0 3.5 2.6 8.3 (2.7) 9.7 7.2 (2.5) (61) 917 980 1,289 372 309 1,090 (199) 501 440

Income taxes and others (325) (290) (378) (53) (88) (330) 48 (148) (140) 8

Net income % 4.8 5.9 7.7 2.9 1.8 5.8 (1.9) 6.8 4.9 (1.9)

592 690 911 319 221 760 (151) 353 300 (53)

* Forecasts for the fiscal year under review are the revised figures released on November 11, 2016.

7

Management Targets

Taisei Corporation partially revised the management targets of the final year of Medium-term Business Plan (FY 2015–2017) as

follows;

Management Numerical Targets of Medium-term Business Plan (FY 2015–2017)

< Business target > Unit: ¥bn

Announcement May 13, 2016 Announcement May 12,2017

Consolidated Non-consolidated Consolidated Non-consolidated

Net sales 1,660 1,340 1,610 1,310

Operating income 115 96 125 109

Net income 75 64 87 76

Note: Consolidated net income is shown as profit attributable to owners of parent.

< Financial target >

Announcement May 13, 2016 Announcement May 12,2017

Consolidated Non-consolidated Consolidated Non-consolidated

Interest-bearing debt Less than 300 - Less than 260

< Capital policy and guidelines for return to shareholders >

Announcement May 13, 2016 Announcement May 12,2017

Consolidated Non-consolidated Consolidated Non-consolidated

Dividend payout 25% or more - 25.8%

ROE 8.0% or more - 14.8%

8

Consolidated financial statements

(1) Consolidated balance sheet

(Millions of yen)

As of March 31, 2016 As of March 31, 2017

Assets

Current assets

Cash and deposits 374,192 535,592

Notes receivable-trade and accounts receivable from

completed construction contracts 443,635 420,131

Costs on uncompleted construction contracts 84,548 67,053

Real estate for sale and development projects in progress 107,771 102,742

Other inventories 4,008 3,462

Deferred tax assets 28,071 28,046

Other 70,429 66,842

Allowance for doubtful accounts (353) (297)

Total current assets 1,112,304 1,223,572

Noncurrent assets

Property, plant and equipment

Buildings and structures 124,110 123,478

Machinery, vehicles, tools and fixtures 53,813 55,070

Land 121,155 119,825

Construction in progress 255 921

Accumulated depreciation (121,806) (123,314)

Total property, plant and equipment 177,528 175,982

Intangible assets 4,875 5,084

Investments and other assets

Investment securities 321,320 309,014

Net defined benefit asset 10,944 10,777

Deferred tax assets 627 3,029

Other 36,483 35,082

Allowance for doubtful accounts (3,262) (2,464)

Total investments and other assets 366,113 355,439

Total noncurrent assets 548,516 536,506

Total assets 1,660,821 1,760,078

9

(Millions of yen)

As of March 31, 2016 As of March 31, 2017

Liabilities

Current liabilities

Notes payable, accounts payable for construction contracts

and other 442,758 424,493

Short-term loans payable 108,981 114,600

Short-term non-recourse loans 100 10

Current portion of bonds 10,000 10,000

Lease obligations 259 269

Income taxes payable 23,633 31,138

Advances received on uncompleted construction contracts 160,172 175,689

Deposits received 120,205 171,132

Provision for warranties for completed construction 3,316 3,391

Provision for loss on construction contracts 22,117 15,666

Provision for loss on orders received 43 14

Other 36,190 40,497

Total current liabilities 927,777 986,994

Noncurrent liabilities

Bonds payable 40,000 30,000

Non-recourse bonds payable 500 500

Long-term loans payable 90,564 79,995

Long-term non-recourse loans payable 4,550 2,950

Lease obligations 546 482

Deferred tax liabilities 8,262 11,350

Deferred tax liabilities for land revaluation 4,188 4,184

Provision for directors' retirement benefits 411 431

Provision for loss on business of subsidiaries and affiliates 39 66

Provision for environmental measures 119 89

Provision for loss on Anti-Monopoly Act - 11,035

Net defined benefit liability 43,926 41,262

Other 18,657 19,921

Total noncurrent liabilities 211,766 202,270

Total liabilities 1,139,544 1,189,264

Net assets

Shareholders' equity

Capital stock 122,742 122,742

Capital surplus 104,464 85,150

Retained earnings 210,720 278,613

Treasury stock (394) (1,110)

Total shareholders' equity 437,533 485,395

Accumulated other comprehensive income

Valuation difference on available-for-sale securities 85,160 82,463

Deferred gain (loss) on hedges (213) (158)

Revaluation reserve for land 176 772

Foreign currency translation adjustment (2,158) (2,969)

Remeasurements of defined benefit plans (2,623) 3,275

Total accumulated other comprehensive income 80,342 83,383

Minority interests 3,402 2,034

Total net assets 521,277 570,813

Total liabilities and net assets 1,660,821 1,760,078

10

(2) Consolidated statement of income and consolidated statement of comprehensive income

Consolidated statement of income

(Millions of yen)

From April 1, 2015

to March 31, 2016

From April 1, 2016

to March 31, 2017

Net sales

Net sales of completed construction contracts 1,394,677 1,342,454

Net sales of development business and other 151,211 144,798

Total net sales 1,545,889 1,487,252

Cost of sales

Cost of sales of completed construction contracts 1,226,706 1,148,961

Cost of sales on development business and other 121,596 112,007

Total cost of sales 1,348,302 1,260,968

Gross profit

Gross profit on completed construction contracts 167,971 193,493

Gross profit on development business and other 29,615 32,791

Total gross profit 197,586 226,284

Selling, general and administrative expenses

Selling expenses 38,880 37,971

General and administrative expenses 41,238 47,490

Total selling, general and administrative expenses 80,118 85,461

Operating income 117,468 140,822

Non-operating income

Interest income 630 545

Dividends income 3,020 3,368

Foreign exchange gains - 2,275

Share of profit of entities accounted for using equity method 4,448 1,378

Other 1,019 803

Total non-operating income 9,119 8,371

Non-operating expenses

Interest expenses 2,795 2,156

Foreign exchange losses 4,771 -

Taxes and dues 726 758

Litigation settlement - 954

Other 589 734

Total non-operating expenses 8,884 4,602

Ordinary income 117,703 144,591

11

(Millions of yen)

From April 1, 2015

to March 31, 2016

From April 1, 2016

to March 31, 2017

Extraordinary income

Gain on sales of noncurrent assets 119 617

Gain on sales of investment securities 18 2,878

Gain on return of assets from retirement benefit trust 4,021 -

Other 143 32

Total extraordinary income 4,303 3,528

Extraordinary loss

Impairment loss 3,018 684

Loss on Anti-Monopoly Act - 11,640

Other 1,192 604

Total extraordinary losses 4,210 12,929

Income before income taxes and minority interests 117,796 135,189

Income taxes-current 33,332 45,505

Income taxes-deferred 7,663 (712)

Total income taxes 40,995 44,793

Net income 76,800 90,396

Net income (loss) attributable to non-controlling interests (244) (169)

Net income attributable to owners of parent 77,045 90,566

12

Consolidated statement of comprehensive income

(Millions of yen)

From April 1, 2015

to March 31, 2016

From April 1, 2016

to March 31, 2017

Income before minority interests 76,800 90,396

Other comprehensive income

Valuation difference on available-for-sale securities (26,048) (2,690)

Deferred gain (loss) on hedges (2) 2

Revaluation reserve for land 232 -

Foreign currency translation adjustment (341) (404)

Remeasurements of defined benefit plans (12,573) 5,922

Share of other comprehensive income of associates accounted

for using equity method (401) (437)

Total other comprehensive income (39,135) 2,391

Comprehensive income 37,665 92,788

Comprehensive income attributable to

Owners of the parent company shareholders 38,026 93,013

Minority interests (361) (225)

13

(3) Consolidated statement of changes in equity

Fiscal year ended March 31, 2016 (April 1, 2015–March 31, 2016)

(Unit: Million yen)

Shareholders' equity

Capital stock Capital surplus Retained earnings Treasury stock Total shareholders’

equity

Balance at the beginning of current

period 122,742 104,463 143,289 (355) 370,140

Cumulative effects of changes in

accounting policies -

Restated balance 122,742 104,463 143,289 (355) 370,140

Changes of items during the period

Dividends from surplus (11,699) (11,699)

Profit attributable to owners of parent 77,045 77,045

Purchase of treasury stock (39) (39)

Disposal of treasury stock 0 0 1

Retirement of treasury shares - Reversal of revaluation reserve for

land (31) (31)

Change of scope of consolidation 96 96

Change of scope of equity method 2,019 2,019 Net changes of items other than

shareholders’ equity (Note)

Total changes of items during the period - 0 67,431 (38) 67,393

Balance at the end of current period 122,742 104,464 210,720 (394) 437,533

Accumulated other comprehensive income

Minority

interests

Total net

assets

Valuation

difference on

available-for-

sale securities

Deferred gain

(loss) on

hedges

Revaluation

reserve for land

Foreign currency

translation

adjustment

Remeasurements of

defined benefit

plans

Total

accumulated

other

comprehensive

income

Balance at the

beginning of current

period 111,198 (4) (69) (1,485) 9,973 119,612 2,361 492,144

Cumulative

effects of changes

in accounting

policies

-

Restated balance 111,198 (4) (69) (1,485) 9,973 119,612 2,361 492,114 Changes of items

during the period

Dividends from

surplus (11,699)

Profit attributable

to owners of

parent 77,045

Purchase of

treasury stock (39)

Disposal of

treasury stock 1

Retirement of

treasury shares -

Reversal of

revaluation

reserve for land (10) (10) (41)

Change of scope

of consolidation 96

Change of scope

of equity method 7 (254) 24 (18) (241) 1,777

Net changes of

items other than

shareholders’

equity (Note)

(26,045) 45 232 (672) (12,578) (39,018) 1,040 (37,978)

Total changes of

items during the

period (26,037) (209) 246 (672) (12,597) (39,270) 1,040 29,163

Balance at the end

of current period 85,160 (213) 176 (2,158) (2,623) 80,342 3,402 521,277

(Note) Changes of items due to reversal of revaluation reserve for land are excluded.

14

Fiscal year ended March 31, 2017 (April 1, 2016–March 31, 2017)

(Unit: Million yen)

Shareholders' equity

Capital stock Capital surplus Retained earnings Treasury stock Total shareholders’

equity

Balance at the beginning of current

period 122,742 104,464 210,720 (394) 437,533

Cumulative effects of changes in

accounting policies 12 12

Restated balance 122,742 104,464 210,733 (394) 437,545

Changes of items during the period

Dividends from surplus (22,031) (22,031)

Profit attributable to owners of parent 90,566 90,566

Purchase of treasury stock (20,031) (20,031)

Disposal of treasury stock 0 0 0

Retirement of treasury shares (19,314) 19,314 - Reversal of revaluation reserve for

land (595) (595)

Change of scope of consolidation 14 14

Change of scope of equity method (71) (71) Net changes of items other than

shareholders’ equity (Note)

Total changes of items during the period - (19,314) 67,880 (716) 47,850

Balance at the end of current period 122,742 85,150 278,613 (1,110) 485,395

Accumulated other comprehensive income

Minority

interests

Total net

assets

Valuation

difference on

available-for-

sale securities

Deferred gain

(loss) on

hedges

Revaluation

reserve for land

Foreign currency

translation

adjustment

Remeasurements of

defined benefit

plans

Total

accumulated

other

comprehensive

income

Balance at the

beginning of current

period 85,160 (213) 176 (2,158) (2,623) 80,342 3,402 521,277

Cumulative

effects of changes

in accounting

policies

12

Restated balance 85,160 (213) 176 (2,158) (2,623) 80,342 3,402 521,289 Changes of items

during the period

Dividends from

surplus (22,031)

Profit attributable

to owners of

parent 90,566

Purchase of

treasury stock (20,031)

Disposal of

treasury stock 0

Retirement of

treasury shares -

Reversal of

revaluation

reserve for land 595 595 -

Change of scope

of consolidation 14

Change of scope

of equity method (1) (1) (73)

Net changes of

items other than

shareholders’

equity (Note)

(2,695) 55 (811) 5,899 2,447 (1,367) 1,079

Total changes of

items during the

period (2,697) 55 595 (811) 5,899 3,041 (1,367) 49,524

Balance at the end

of current period 82,463 (158) 772 (2,969) 3,275 83,383 2,034 570,813

(Note) Changes of items due to reversal of revaluation reserve for land are excluded.

15

(4) Consolidated statement of cash flows (Millions of yen)

From April 1, 2015

to March 31, 2016

From April 1, 2016

to March 31, 2017

Net cash flow from operating activities

Income before income taxes and minority interests 117,796 135,189

Depreciation and amortization 5,991 6,267

Impairment loss 3,018 684

Increase (decrease) in allowance for doubtful accounts (1,238) (853)

Increase (decrease) in provision for loss on construction

contracts (19,119) (6,451)

Increase (decrease) in net defined benefit liability (12,811) (2,662)

Increase (decrease) in provision for loss on Anti-Monopoly Act - 11,035

Interest and dividends income (3,651) (3,913)

Interest expenses 2,795 2,156

Foreign exchange losses (gains) 4,771 (2,275)

Loss (gain) on valuation of short-term and long-term

investment securities 303 217

Loss (gain) on sales of short-term and long-term investment

securities (18) (2,786)

Loss on valuation of real estate for sale and development

projects in progress 2,042 1,371

Loss (gain) on sales of noncurrent assets (66) (551)

Share of (profit) loss of entities accounted for using equity

method (4,448) (1,378)

Decrease (increase) in notes and accounts receivable-trade 47,085 23,431

Decrease (increase) in costs on uncompleted construction

contracts (7,243) 17,490

Decrease (increase) in real estate for sale and development

projects in progress (13,908) 3,090

Decrease (increase) in other current assets 28,305 3,346

Decrease (increase) in net defined benefit asset 25,863 166

Decrease (increase) in investments, other assets and other 5,938 1,405

Increase (decrease) in notes and accounts payable-trade (46,801) (18,138)

Increase (decrease) in advances received on uncompleted

construction contracts 22,460 15,540

Increase (decrease) in deposits received (21,806) 50,936

Increase (decrease) in other current liabilities 7,553 4,977

Other (18,319) 13,721

Subtotal 124,493 252,018

Interest and dividends income received 4,434 8,139

Interest expenses paid (2,973) (2,338)

Income taxes paid (30,594) (39,661)

Net cash provided by (used in) operating activities 95,360 218,158

16

(Millions of yen)

From April 1, 2015

to March 31, 2016

From April 1, 2016

to March 31, 2017

Net cash flow from investing activities

Decrease (increase) in time deposits (1,319) 1,652

Purchase of short-term and long-term investment securities (17,256) (2,097)

Proceeds from sales of short-term and long-term investment

securities 2,811 9,912

Purchase of property, plant and equipment and intangible assets (10,221) (7,226)

Proceeds from sales of property, plant and equipment and

intangible assets 486 4,155

Other 429 (99)

Net cash flow from investing activities (25,070) 6,296

Net cash flow from financing activities

Increase (decrease) in short-term loans payable (2,734) 17,075

Proceeds from long-term loans payable 31,100 32,950

Repayment of long-term loans payable (48,710) (54,975)

Proceeds from long-term non-recourse loans payable 1,500 -

Repayment of long-term non-recourse loans payable (100) (1,600)

Proceeds from issuance of bonds 9,956 -

Redemption of bonds (15,000) (10,000)

Purchase of treasury shares (39) (20,031)

Cash dividends paid (11,699) (22,031)

Other 554 (1,449)

Net cash flow from financing activities (35,171) (60,061)

Effect of exchange rate change on cash and cash equivalents (2,310) (1,382)

Net increase (decrease) in cash and cash equivalents 32,807 163,010

Cash and cash equivalents at beginning of period 337,166 371,730

Increase (decrease) in cash and cash equivalents resulting from

change of scope of consolidation 1,757 45

Cash and cash equivalents at end of period 371,730 534,787

17

(5) Segment Information

Reporting segment information (net sales and income (loss))

FY 2015 (April 1, 2015 – March 31, 2016)

(Millions of yen) Reporting Segment

Others (Note 1)

Total Adjustments

(Note 2)

Amounts on Quarterly

consolidated income statement

(Note 3)

Civil engineering

Building construction

Real estate development

Subtotal

Net sales

Sales on third party

433,924 978,176 121,305 1,533,406 12,482 1,545,889 – 1,545,889

Intersegment sales and transfers

21,787 37,306 6,333 65,427 2,351 67,779 (67,779) –

Total 455,712 1,015,483 127,639 1,598,834 14,834 1,613,668 (67,779) 1,545,889

Segment income 50,717 56,400 9,433 116,551 942 117,493 (25) 117,468

Others

Depreciation 2,693 2,119 1,159 5,972 93 6,066 (75) 5,991

Increase

(decrease) in

provision for loss

on construction

contracts

(2,290) (16,829) – (19,119) – (19,119) – (19,119)

Note 1: Businesses that cannot be classified into the company’s reporting segments are shown as “Others”.

This includes the incidental business of construction business such as cooperative research, technical service, and environmental measurement, and also, leisure-related business and other service business.

Note 2: The adjustments of segment income, (25 million yen), include elimination of intra-segment transaction.

Note 3: The segment income is adjusted in accordance with operating income on consolidated statement of income.

Reporting segment information (net sales and income (loss))

FY 2016 (April 1, 2016 – March 31, 2017)

(Millions of yen) Reporting Segment

Others (Note 1)

Total Adjustments

(Note 2)

Amounts on Quarterly

consolidated income statement

(Note 3)

Civil engineering

Building construction

Real estate development

Subtotal

Net sales

Sales on third party

422,847 938,548 115,225 1,476,621 10,630 1,487,252 – 1,487,252

Intersegment sales and transfers

26,608 39,167 6,539 72,315 2,398 74,714 (74,714) –

Total 449,456 977,716 121,765 1,548,937 13,029 1,561,967 (74,714) 1,487,252

Segment income 55,199 73,372 13,309 141,882 1,201 143,083 (2,261) 140,822

Others

Depreciation 2,926 2,304 1,113 6,344 90 6,434 (166) 6,267

Increase

(decrease) in

provision for loss

on construction

contracts

(6,663) 212 – (6,451) – (6,451) – (6,451)

Note 1: Businesses that cannot be classified into the company’s reporting segments are shown as “Others”. This includes the incidental business of construction business such as cooperative research, technical service, and environmental measurement,

and also, leisure-related business and other service business.

Note 2: The adjustments of segment income, (2,261 million yen), include elimination of dividends income from relation company. Note 3: The segment income is adjusted in accordance with operating income on consolidated statement of income.

18

Non-consolidated financial statements

(1) Balance sheet

(Millions of yen)

As of March 31, 2016 As of March 31, 2017

Assets

Current assets

Cash and deposits 322,199 486,206

Notes receivable-trade 7,554 19,771

Accounts receivable from completed construction contracts 367,089 329,705

Real estate for sale 51,484 43,260

Costs on uncompleted construction contracts 79,363 61,994

Development projects in progress 2,267 4,764

Deferred tax assets 24,991 25,001

Other 69,140 64,668

Allowance for doubtful accounts (164) (170)

Total current assets 923,926 1,035,202

19

(Millions of yen)

As of March 31, 2016 As of March 31, 2017

Noncurrent assets

Property, plant and equipment

Buildings 52,732 53,712

Accumulated depreciation (32,371) (33,334)

Buildings, net 20,361 20,378

Structures 2,673 2,672

Accumulated depreciation (2,276) (2,307)

Structures, net 396 365

Machinery and equipment 8,316 9,038

Accumulated depreciation (7,378) (7,473)

Machinery and equipment, net 938 1,564

Vehicles 372 341

Accumulated depreciation (250) (220)

Vehicles, net 122 121

Tools, furniture and fixtures 7,887 7,999

Accumulated depreciation (7,025) (7,153)

Tools, furniture and fixtures, net 861 845

Land 67,287 67,954

Construction in progress 143 799

Total property, plant and equipment 90,111 92,029

Intangible assets 2,186 2,406

Investments and other assets

Investment securities 285,676 277,849

Stocks of subsidiaries and affiliates 77,885 78,255

Investments in other securities of subsidiaries and affiliates 6,391 6,364

Current portion of long-term loans receivable from

subsidiaries and affiliates 8,697 8,993

Claims provable in bankruptcy, claims provable in

rehabilitation and other 75 67

Long-term prepaid expenses 434 397

Other 28,221 26,283

Allowance for doubtful accounts (9,662) (9,156)

Total investments and other assets 397,719 389,055

Total noncurrent assets 490,017 483,491

Total assets 1,413,943 1,518,693

20

(Millions of yen)

As of March 31, 2016 As of March 31, 2017

Liabilities

Current liabilities

Notes receivable-trade 87,528 84,936

Accounts payable for construction contracts 293,948 283,917

Short-term loans payable 64,505 70,261

Current portion of bonds 10,000 10,000

Lease obligations 178 199

Income taxes payable 21,490 28,833

Advances received on uncompleted construction contracts 149,157 166,471

Deposits received 155,192 210,814

Provision for warranties for completed construction 2,384 1,727

Provision for loss on construction contracts 21,347 14,968

Other 23,777 29,741

Total current liabilities 829,511 901,870

Noncurrent liabilities

Bonds payable 40,000 30,000

Long-term loans payable 63,590 54,714

Lease obligations 402 357

Provision for retirement benefits 14,845 20,865

Deferred tax liabilities 22,239 20,575

Provision for loss on business of subsidiaries and affiliates 1,225 1,139

Provision for environmental measures 105 70

Other 5,186 6,036

Total noncurrent liabilities 147,593 133,758

Total liabilities 977,105 1,035,629

Net assets

Shareholders' equity

Capital stock 122,742 122,742

Capital surplus

Legal capital surplus 66,832 30,686

Other capital surplus 37,650 54,481

Total capital surpluses 104,482 85,167

Retained earnings

Other retained earnings

Reserve for advanced depreciation of noncurrent assets 1,414 1,414

General reserve 62,500 94,500

Retained earnings brought forward 63,193 100,249

Total retained earnings 127,107 196,163

Treasury stock (394) (1,110)

Total shareholders' equity 353,937 402,962

Valuation and translation adjustments

Valuation difference on available-for-sale securities 82,900 80,101

Deferred gain (loss) on hedges - (0)

Total valuation and translation adjustments 82,900 80,101

Total net assets 436,838 483,064

Total liabilities and net assets 1,413,943 1,518,693

21

(2) Statement of income

(Millions of yen)

From April 1, 2015

to March 31, 2016

From April 1, 2016

to March 31, 2017

Net sales

Net sales of construction contracts 1,192,876 1,152,697

Net sales of development business and other 29,056 24,013

Total net sales 1,221,932 1,176,711

Cost of sales

Cost of sales of completed construction contracts 1,049,772 984,570

Cost of sales on development business and other 25,498 15,570

Total cost of sales 1,075,270 1,000,141

Gross profit

Gross profit on completed construction contracts 143,104 168,127

Gross profit on development business and other 3,558 8,442

Total gross profit 146,662 176,569

Selling, general and administrative expenses 52,192 57,937

Operating income 94,470 118,632

Non-operating income

Interest income 512 442

Interest on securities 13 3

Dividends income 4,269 8,796

Foreign exchange gains - 2,298

Other 615 270

Total non-operating income 5,411 11,811

Non-operating expenses

Interest expenses 1,555 1,124

Interest on bonds 452 379

Foreign exchange losses 4,880 -

Provision of allowance for doubtful accounts 22 -

Taxes and dues 726 758

Litigation settlement - 954

Other 466 588

Total non-operating expenses 8,103 3,805

Ordinary income 91,778 126,638

Extraordinary income

Gain on sales of investment securities 9 2,875

Gain on return of assets from retirement benefit trust 4,021 -

Other 77 73

Total extraordinary income 4,108 2,948

Extraordinary loss

Impairment loss 2,065 -

Loss on retirement of non-current assets 43 125

Loss (gain) on sales of short-term and long-term investment

securities 0 90

Loss (gain) on valuation of short-term and long-term

investment securities 303 217

Loss on related businesses 1,654 204

Other 118 63

Total extraordinary losses 4,186 700

22

Income before income taxes 91,700 128,886

Income taxes-current 26,065 38,238

Income taxes-deferred 6,433 (439)

Total income taxes 32,498 37,799

Net income 59,202 91,087

23

(3) Statement of changes in equity

Fiscal year ended March 31, 2016 (April 1, 2015–March 31, 2016)

(Millions of yen)

Shareholders' equity

Capital stock

Capital surplus Retained earnings

Legal capital

surplus

Other capital

surplus

Total capital

surplus

Other retained earnings

Total

retained

earnings

Reserve for

advanced

depreciation of

non-current

assets

General reserve

Retained

earnings

brought forward

Balance at the beginning of

current period 122,742 66,832 37,649 104,481 1,379 53,500 24,725 79,605

Changes of items during the

period

Provision of reserve for

advanced depreciation of

non-current assets 34 (34) -

Provision of general

reserve 9,000 (9,000) -

Dividends from surplus (11,699) (11,699)

Net income 59,202 59,202

Purchase of treasury stock

Disposal of treasury stock 0 0

Retirement of treasury

shares -

Transfer to other capital

surplus from legal capital

surplus -

Net changes of items other

than shareholders' equity

Total changes of items

during the period - - 0 0 34 9,000 38,468 47,502

Balance at the end of current

period 122,742 66,832 37,650 104,482 1,414 62,500 63,193 127,107

Shareholders' equity Valuation and translation adjustments

Total net assets Treasury stock

Total

shareholder’s

equity

Valuation

difference on

available-for-sale

securities

Deferred gain

(loss) on hedges

Total valuation

and translation

adjustments

Balance at the beginning of current period (355) 306,473 108,123 - 108,123 414,596

Changes of items during the period

Provision of reserve for advanced depreciation of non-current assets

- -

Provision of general reserve - -

Dividends from surplus (11,699) (11,699)

Net income 59,202 59,202

Purchase of treasury stock (39) (39) (39)

Disposal of treasury stock 0 1 1

Retirement of treasury shares - -

Transfer to other capital surplus from legal capital surplus

- -

Net changes of items other than shareholders' equity (25,222) - (25,222) (25,222)

Total changes of items during the period (38) 47,464 (25,222) - (25,222) 22,242

Balance at the end of current period (394) 353,937 82,900 - 82,900 436,838

24

Fiscal year ended March 31, 2017 (April 1, 2016–March 31, 2017)

(Millions of yen)

Shareholders' equity

Capital stock

Capital surplus Retained earnings

Legal capital

surplus

Other capital

surplus

Total capital

surplus

Other retained earnings

Total

retained

earnings

Reserve for

advanced

depreciation of

non-current

assets

General reserve

Retained

earnings

brought forward

Balance at the beginning of

current period 122,742 66,832 37,650 104,482 1,414 62,500 63,193 127,107

Changes of items during the

period

Provision of reserve for

advanced depreciation of

non-current assets -

Provision of general

reserve 32,000 (32,000) -

Dividends from surplus (22,031) (22,031)

Net income 91,087 91,087

Purchase of treasury stock

Disposal of treasury stock 0 0 Retirement of treasury

shares (19,314) (19,314)

Transfer to other capital

surplus from legal capital

surplus (36,146) 36,146 -

Net changes of items other

than shareholders' equity

Total changes of items

during the period - (36,146) 16,831 (19,314) - 32,000 37,055 69,055

Balance at the end of current

period 122,742 30,686 54,481 85,167 1,414 94,500 100,249 196,163

Shareholders' equity Valuation and translation adjustments

Total net assets Treasury stock

Total

shareholder’s

equity

Valuation

difference on

available-for-sale

securities

Deferred gain

(loss) on hedges

Total valuation

and translation

adjustments

Balance at the beginning of current period (394) 353,937 82,900 - 82,900 436,838

Changes of items during the period

Provision of reserve for advanced depreciation of non-current assets

- -

Provision of general reserve - -

Dividends from surplus (22,031) (22,031)

Net income 91,087 91,087

Purchase of treasury stock (20,031) (20,031) (20,031)

Disposal of treasury stock 0 0 0

Retirement of treasury shares 19,314 - - Transfer to other capital surplus from legal capital surplus

- -

Net changes of items other than shareholders' equity (2,799) (0) (2,799) (2,799)

Total changes of items during the period (716) 49,025 (2,799) (0) (2,799) 46,225

Balance at the end of current period (1,110) 402,962 80,101 (0) 80,101 483,064

25

Other

(1) (Consolidated) Amount of orders received, net sales and balance carried forward

(i) Amount of orders received

(Millions of yen, rounded down)

From April 1, 2015

to March 31, 2016

From April 1, 2016

to March 31, 2017

Change over

previous year

Rate of change

%

Civil engineering 444,462 427,594 (16,867) (3.8)

Building construction 1,101,915 1,101,472 (442) (0.0)

Real estate development 112,201 115,337 3,136 2.8

Other 12,482 10,630 (1,851) (14.8)

Total 1,671,061 1,655,035 (16,025) (1.0)

(ii) Net sales

(Millions of yen, rounded down)

From April 1, 2015

to March 31, 2016

From April 1, 2016

to March 31, 2017

Change over

previous year

Rate of change

%

Civil engineering 433,924 422,847 (11,077) (2.6)

Building construction 978,176 938,548 (39,627) (4.1)

Real estate development 121,305 115,225 (6,080) (5.0)

Other 12,482 10,630 (1,851) (14.8)

Total 1,545,889 1,487,252 (58,636) (3.8)

(iii) Balance carried forward

(Millions of yen, rounded down)

From April 1, 2015

to March 31, 2016

From April 1, 2016

to March 31, 2017

Change over

previous year

Rate of change

%

Civil engineering 653,053 657,801 4,747 0.7

Building construction 1,427,511 1,590,435 162,923 11.4

Real estate development 872 984 112 12.9

Other - - - -

Total 2,081,437 2,249,220 167,783 8.1

26

(2) (Non-consolidated) Amount of orders received, net sales and balance carried forward

(i) Amount of orders received

(Millions of yen, rounded down)

From April 1, 2015

to March 31, 2016

From April 1, 2016

to March 31, 2017

Change over

previous year Rate of change

% % %

Civil engineering (1)

Domestic public sector 162,873 12.0 223,649 16.6 60,775 37.3

Domestic private sector 122,485 9.1 117,434 8.7 (5,051) (4.1)

Overseas 38,522 2.8 (25,791) (1.9) (64,314) -

Subtotal 323,881 23.9 315,291 23.4 (8,589) (2.7)

Building construction (2)

Domestic public sector 143,084 10.6 249,146 18.5 106,062 74.1

Domestic private sector 861,818 63.7 745,419 55.3 (116,399) (13.5)

Overseas 2,071 0.2 14,281 1.0 12,209 589.3

Subtotal 1,006,974 74.5 1,008,847 74.8 1,872 0.2

Total (1) + (2)

Domestic public sector 305,957 22.6 472,796 35.1 166,838 54.5

Domestic private sector 984,304 72.8 862,853 64.0 (121,451) (12.3)

Overseas 40,594 3.0 (11,510) (0.9) (52,104) -

Subtotal 1,330,856 98.4 1,324,139 98.2 (6,717) (0.5)

Real estate development 8,894 0.7 13,886 1.0 4,991 56.1

Other 12,059 0.9 10,195 0.8 (1,863) (15.5)

Total 1,351,810 100.0 1,348,221 100.0 (3,589) (0.3)

Note: The percentages indicate the proportion.

Major new construction orders in fiscal period under review

JAPAN SPORT COUNCIL Construction work of New National Stadium (Phase 2)

Hotel Okura Co., Ltd. (Tentative name) Toranomon 2-10 Project

Mitsui Fudosan Co., Ltd. (Tentative name) Toyosu 2-chome 2-1 Station District

Redevelopment Project (AC Block)

East Nippon Expressway Company Limited Construction work of the Tokyo Outer Ring Road Oizumi

South

Tokyo Metropolitan Government Loop Road No.7 Underground Wide Area Regulating

Reservoir (Shakuziigawa Section) Project

27

(ii) Net sales

(Millions of yen, rounded down)

From April 1, 2015

to March 31, 2016

From April 1, 2016

to March 31, 2017

Change over

previous year

Rate of

change

% % %

Civil engineering (1)

Domestic public sector 207,798 17.0 186,725 15.9 (21,073) (10.1)

Domestic private sector 85,323 7.0 111,268 9.5 25,944 30.4

Overseas 20,202 1.6 14,544 1.2 (5,657) (28.0)

Subtotal 313,325 25.6 312,538 26.6 (786) (0.3)

Building construction (2)

Domestic public sector 118,363 9.7 116,786 9.9 (1,576) (1.3)

Domestic private sector 752,155 61.5 702,274 59.7 (49,881) (6.6)

Overseas 9,031 0.8 21,098 1.8 12,066 133.6

Subtotal 879,551 72.0 840,159 71.4 (39,392) (4.5)

Total (1) + (2)

Domestic public sector 326,162 26.7 303,512 25.8 (22,649) (6.9)

Domestic private sector 837,479 68.5 813,542 69.2 (23,937) (2.9)

Overseas 29,234 2.4 35,643 3.0 6,408 21.9

Subtotal 1,192,876 97.6 1,152,697 98.0 (40,178) (3.4)

Real estate development 16,996 1.4 13,817 1.2 (3,179) (18.7)

Other 12,059 1.0 10,195 0.8 (1,863) (15.5)

Total 1,221,932 100.0 1,176,711 100.0 (45,221) (3.7)

Note: The percentages indicate the proportion.

Major construction projects completed in fiscal period under review

Roppongi 3-chome East District Redevelopment Consortium

Roppongi 3-chome East District Redevelopment Project

New facility construction and communal facility construction

(District A, District B)

FANUC CORPORATION Construction work of FANUC CORPORATION Mibu Factory

(B section)

Okada Building Inc. MM Block 59 Division B Development Project (Provisional

name)

Kesennuma City, Miyagi Pref.

The site preparation for the Promotion of Collective Relocation

for Disaster Prevention and the Development project of Public

restoration housing, Kesennuma City

Urban Renaissance Agency

Integral work of construction and other related operations of

Northern hills Nobiru area earthquake disaster reconstruction

project at Higashimatsushima City

28

(iii) Balance carried forward

(Millions of yen, rounded down)

From April 1, 2015

to March 31, 2016

From April 1, 2016

to March 31, 2017

Change over

previous year

Rate of

change

% % %

Civil engineering (1)

Domestic public sector 308,042 15.7 344,966 16.2 36,923 12.0

Domestic private sector 216,874 11.0 223,040 10.4 6,165 2.8

Overseas 85,085 4.3 44,749 2.1 (40,336) (47.4)

Subtotal 610,002 31.0 612,755 28.7 2,752 0.5

Building construction (2)

Domestic public sector 277,995 14.1 410,355 19.2 132,360 47.6

Domestic private sector 1,069,206 54.4 1,112,351 52.0 43,145 4.0

Overseas 9,705 0.5 2,889 0.1 (6,816) (70.2)

Subtotal 1,356,907 69.0 1,525,596 71.3 168,688 12.4

Total (1) + (2)

Domestic public sector 586,038 29.8 755,321 35.4 169,283 28.9

Domestic private sector 1,286,081 65.4 1,335,392 62.4 49,310 3.8

Overseas 94,791 4.8 47,638 2.2 (47,153) (49.7)

Subtotal 1,966,910 100.0 2,138,352 100.0 171,441 8.7

Real estate development 297 0.0 366 0.0 68 23.1

Other - - - - - -

Total 1,967,208 100.0 2,138,718 100.0 171,510 8.7

Note: The percentages indicate the proportion.

Major new construction orders carried over into next fiscal period

MITSUBISHI ESTATE CO., LTD.・

Tokyo Chamber of Commerce and Industry ・

Tokyo Kaikan Co., Ltd.

Marunouchi 3-2 Project (tentative name)

Nishi-Shinagawa 1-chome Redevelopment Association Nishi-Shinagawa 1-chome Redevelopment Project (District A)

Mitsui Fudosan Co., Ltd.・MITSUBISHI ESTATE CO., LTD. TGMM Shibaura Project (working name), A Tower and Hotel

Central Nippon Expressway Company Limited Construction work of the Tokyo Outer Ring Road Main Line

Tunnel North Route Oizumi South

East Nippon Expressway Company Limited Construction work of the Tokyo-Gaikan Expressway Tajiri