Concepts of Bot,Bolt,Boot

-

Upload

tarun-patel -

Category

Documents

-

view

5 -

download

0

description

Transcript of Concepts of Bot,Bolt,Boot

Slide 1

SNPIT&RC, UMRAKH

GUJARAT TECHNOLOGICAL UNIVERSITY

COMSTRUCTION PROJECT MANAGEMENT (2711401)

1M.E. CONSTRUCTION ENG. & MANAGEMENT1CONCEPTS OF BOT ,BOLT ,BOOTPREPAID BY:-PATEL TARUN J. (140490714006)Guided by:Mr. HIREN RATHODAssistant ProfessorCivil Eng. DepartmentS.N.P.I.T. & R.C.CONTENTBOT: DefinitionParticipants in BOT ProjectsRALATIONSHIP BETWWEN PRICIPAL PARTICIPENTS IN BOTCharacteristics of BOT ProjectThe major types of risk in BOT project areAdvantages of BOT ProjectsDisadvantages of BOT

Built-Own-Lease-Transfer :-(BOLT)Conceptual Framework Policies/Regulatory FrameworkBUILT OWN OPERATOR & TRANSFER(BOOT) STRUCTURE OF BOOT PROJECTSADVANTAGESDISADVANATES

Build-Operate-Transfer (BOT): DefinitionBOT:Build Set-up the facility and infrastructure, staff the development centre, and establish knowledge transfer Operate Manage the offshore organization: Program Management, Development, QA, maintenance, enhancements, and product support Transfer Register a new offshore subsidiary for the customer, transfer assets and handover operations

BOT PROJECTS The term BOT is used mainly in the area of infrastructure projects financed by the private sector. The economic environment today is suitable enough for the private sector to invest in infrastructure projects for the following reasons : Government policy aiming to increase the private sector participation. Modification in legislation and laws that encourage investments.Decrease in inflation rates. Availability of cheap and experienced work force.BOT has more than one definition. Here are a few :A model that entails a concession company providing the finance, design construction, operation, and maintenance of a privatized infrastructure project for a fixed period, at the end of which the project is transferred free to the host government.The granting of a concession by the government to a private promoter, known as the concessionaire, who is responsible for the financing, construction, operation, and maintenance of a facility over the concession period before finally transferring the fully operational facility to the government at no cost.A model or structure that uses private investment to undertake the infrastructure development that has historically been the preserve of the public sectorParticipants in BOT ProjectsThe implementation process of a BOT project involves many parties, including the government, promoter, construction contractor, operating firms, financiers and other parties. The main stakeholders in BOT projects are Government; promoter/concessionaire; lenders/financiers and the public. All of them have particular reasons to be involved in the project.Public Procurer/GovernmentProject sponsors/promotersLenders / financial InstitutionsRALATIONSHIP BETWWEN PRICIPAL PARTICIPENTS IN BOT

Characteristics of BOT Project BOT projects are financed on a project finance basis with limited recourse . Typically in limited recourse financing, the lenders provide debt to the concession company solely based upon expected cash flow/revenue generating capacity of the project. Financing is provided on the merit of the revenue generating capacity of the project rather than the assets of the concessionaire company. A key characteristic of BOT projects is raising of finance entirely by the private sector without the involvement of government. The private sector is fully responsible for a design, construction, finance and operation and maintenance. BOT projects are complex structures comprising multiple interdependent agreements among the various participants. BOT projects are typically large-scale infrastructure projects. Transaction costsamount on average 5 to 10% of total project cost. BOT projects are associated with uncertainties and high risk.BOT projects transfer the risk to the private sector. BOT formula can be applied to any sector of the economy. But it has been usedwidely in power plant sector, transportation and telecommunications

BOT Benefits Rapid scaling of operations Wider service offerings, quickly filling business model gaps Lower infrastructure set-up costs Reduced time to operations through utilization of knowledgeable 3rd party management resources responsible for: Real Estate Government rules and regulations Cultural transitionIT infrastructure procurementSecurity Etc.

The major types of risk in BOT project arePolitical riskCurrency and foreign exchange riskCost overrun riskDelay riskTariff adjustment riskMarket riskOperation riskForce manure riskAdvantages of BOT Projects Key advantages of privatization are as follows. The private firms are more efficient, hence project or service can be delivered at lower cost Private firms are more innovative in selection of design and operation phases of a project or service.The private sector invests directly in the development of infrastructure, thereby reducing public debt, balancing the budget deficit, and reduced role of public sector.

BOT projects create business opportunities for the local private sector, create employment avenues as well as attract substantial foreign direct investment.BOT projects help in facilitating transfer of technology by introducing international contracts in the host countriesDisadvantages of BOTTransaction costs are high, they amount to 5-10% of total project costNot suitable for smaller projectsThe success of BOT project depends upon successful raising of necessary finance. Various costs such as cost of construction, equipment, maintenance should be committed during the life of the project.BOT projects are successful only when substantial revenues are generated during the operation phase

Built-Own-Lease-Transfer :-(BOLT) The private participant will lease the facility to the government and government will pay the lease charges for a specific period and on the completion of the lease period the facility is transferred to the government.OrIt is a non-traditional procurement method of project financing whereby a private or public sector client gives a concession to a private entity to build a facility (and possibly design it as well), own the facility, lease the facility to the client, then at the end of the lease period transfer the ownership of the facility to the client.The operational and maintenance responsibility for the facility is the developers, as the facility is owned by them until the lease period ends.The lease period will see the client who in essence becomes the tenant of the facility, paying the developer a lease (monthly or annually) for the use of the facility at a predetermined rate for a fixed period of time. The lease payment becomes the method of repaying the investment, and ultimately rewarding the developers shareholders. At the end of the lease period, ownership of and the responsibility for the facility are transferred to the client from the developer at a previously agreed priceConceptual Framework

Policies/Regulatory FrameworkUsing BOLT model for social infrastructure, following policies must be followed by both public and private parties.After the identification of the project, the selection of private party should be purely based on negotiations rather than contract biddingThe government has to disclose the detail drawing and specifications of materials to be used. Also the duration of the completion of project is to be specified in the agreementThe private party should be selected through the negotiations from the contenders who satisfies the required criteria as well as have fair experience in such projects.The contender giving the least estimate should not be preferred always but the one giving the best quality of work within the stipulated time should be selected.During the construction stage, the State Government agency should monitor the work as per the design drawings and specifications.In case of delay in the construction work of project within the stipulated time, the private party may be penalized as per the concession agreement.The lease period of the project should start immediately after the project enters into its operational stage.

The concession period should be between 5-15 years.The rate of return to the private body should be at least 15-20 percent per annum according to the type of projectProvision of financial security should be there in the concession agreement in case of failure of payment of lease amount of governmentIn any case, including the change of the ruling party there should not be any alteration in concession agreement and the project cannot be terminated before the concession period.In case of natural calamities the duration of the construction stage can be altered.At the end of concession period the agreement is terminated and final ownership is transferred to the government

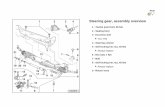

BUILT OWN OPERATOR & TRANSFER(boot)Under this scheme the private participant will get opportunity to own and operate the facility for some time and during this period the developer can commercially exploit the facility so developed . After the specified period the facility would be transferred to the government.STRUCTURE OF BOOT PROJECTSPROMOTEROPERATION CONTRACTOFF-TACKCONTRACTCONSTRUCTION CONTRACTCONSESSION AGREEMENTSUPPLY CONTRACTLOANAGREEMENTLOAN AGREEMENTSUPPLIERLENDERSINVESTERSUSERSOPERATORCONSTRUCTORThe following are some of a reasons why host governments adopt the boot project procurement strategy.The use of private sector financing provides new sources of capital and reduces public and direct spending.The development of project that would otherwise have to wait , and complete for ,scarce sovereign resource is accelerated.The use of private sector capital, initiative and know how reduces project construction costs, shortens schedules and improves operating efficiency.Project risk and burden that would otherwise have to be borne by the public sector is allocated to the private sector.The involvement of private sector and experienced commercial leaders ensures an in- depth review as an additional sign of project feasibility.CONDITIONS FOR SUCCESSFUL IMPLIMENTATION OF BOOT PROJECTCOUNTRYEconomic stabilityProject will to carry out the projectStock and capital marketsLegislative or judicial processPROJECTCLIENT

ADVANTAGESBOOT projects offer the possibility of realizing a project that would otherwise not be built.The willingness of equity investors and lenders to accept the risk indicates that the project is commercially viable. A BOOT project will help in a governments policy of in fracture privatization.The efficiency of the promoter and its economic interest in the design , construction and operation of the project will produce significant cost efficiencies to the principal when the concession period ends. DISADVANATESCommercial lenders and export credit guarantee agencies will be constrained by the same country risks.There will be no credibility if the government provides too much support to the promoter.A BOOT strategy is a highly complicated structure that requires detailed planning . time and money throughout the concession period . The promoter must have the commitment and interest to maintain the project.

Thank you