Completion Report - Asian Development Bank · Completion Report Project Numbers: 38264-013 and...

Transcript of Completion Report - Asian Development Bank · Completion Report Project Numbers: 38264-013 and...

Completion Report

Project Numbers: 38264-013 and 42208-013 Loan Numbers: 2478 and 2786 June 2016

Indonesia: Second Local Government Finance and

Governance Reform Program (Subprograms 1 and 2)

This document is being disclosed to the public in accordance with ADB’s Public Communications Policy 2011.

CURRENCY EQUIVALENTS

Currency Unit – rupiah (Rp)

At Appraisal At Project Completion 6 October 2008 31 December 2008 Loan 2478 Rp1.00 = $0.000104 $0.000090

$1.00 = Rp9,590 Rp11,000

At Appraisal At Project Completion 22 August 2011 31 December 2011

Loan 2786 Rp1.00 = $0.0001 $0.000109 $1.00 = Rp8,571 Rp9,163

ABBREVIATIONS

ADB – Asian Development Bank BAPPENAS

BPK

–

_

Badan Perencanaan Pembangunan Nasional (National Development Planning Agency) Supreme Audit Board

CSP DAK

- –

country strategy and program Dana Alokasi Khusus (Specific Allocation Fund)

DAU DBH

– _

Dana Alokasi Umum (General Allocation Fund) Revenue Sharing Fund

DG DID

– _

Directorate General regional incentive grant

DPOD DPR

– -

dewan pertimbangan otonomi daerah (regional autonomy advisory council) Dewan Perwakilan Rakyat (house of representatives)

FMIS – financial management information system GDP – gross domestic product GSFD

LGFGR1 LGFGR2

– –

–

Grand Strategy for Fiscal Decentralization Local Government Finance and Governance Reform Sector Development Program Second Local Government Finance and Governance Reform Program

LIBOR – London interbank offered rate MDWPC – Ministry for the Development of Women and Protection of Children MOF – Ministry of Finance MOHA – Ministry of Home Affairs NAPFD – National Action Plan for Fiscal Decentralization NSPK – Norma, standard, prosedur, dan kriteria (norms, standards,

procedures, and criteria) PDAM

PFM PIP

– _ _

perusahaan daerah air minum (state-owned water supply company) public financial management Government Investment Agency

PPPF – postprogram partnership framework RGPMS

RPJM – _

regional government performance measurement system Rencana Pembangunan Janka Menengah

(Medium-Term Development Plan) RPJMN – Rencana Pembangunan Janka Menengah Nasional

(National Medium-Term Development Plan) TA – technical assistance

NOTE

In this report, "$" refers to US dollars.

Vice-President S. Groff, Operations 2 Director General J. Nugent, Southeast Asia Department (SERD) Director K. Bird, Public Management, Financial Sector and Trade Division, SERD Team leader R. Hattari, Public Management Economist (Fiscal Management and

Social Security), SERD Team members L. Jovellanos, Senior Economics Officer, SERD R. Lacson, Operations Assistant, SERD

D. Simanjuntak, Senior Project Officer, Indonesia Resident Mission, SERD

In preparing any country program or strategy, financing any project, or by making any designation of or reference to a particular territory or geographic area in this document, the Asian Development Bank does not intend to make any judgments as to the legal or other status of any territory or area.

CONTENTS

Page

BASIC DATA i

I. PROGRAM DESCRIPTION 1

II. EVALUATION OF DESIGN AND IMPLEMENTATION 1

A. Relevance of Design and Formulation 2 B. Program Outputs 2 C. Program Costs and Disbursements 9 D. Program Schedule 10 E. Implementation Arrangements 10 F. Conditions and Covenants 10 G. Related Technical Assistance 10 H. Performance of the Borrower and the Executing Agency 11 I. Performance of the Asian Development Bank 11

III. EVALUATION OF PERFORMANCE 11

A. Relevance 11 B. Effectiveness in Achieving Outcome 11 C. Efficiency in Achieving Outcome and Outputs 12 D. Preliminary Assessment of Sustainability 12 E. Impact 12

IV. OVERALL ASSESSMENT AND RECOMMENDATIONS 13

A. Overall Assessment 13 B. Lessons 13 C. Recommendations 14

APPENDIXES

1. Design and Monitoring Framework 15 2. Policy Matrix (Subprogram 1) 20 3. Policy Matrix (Subprogram 2) 30 4. Status of Compliance with Loan Covenants 42 5. Summary of Key Laws and Regulations Concerning Decentralization 46 6. Technical Assistance Completion Report 48 (TA 7184-INO: Local Government Finance and Governance Reform) 7. Technical Assistance Completion Report 50 (TA 7452-INO: Support for Local Government Finance and Governance Reform 2) 8. Contribution to the ADB Results Framework 52

BASIC DATA A. Loan Identification 1. Country 2. Loan Number 3. Program Title 4. Borrower 5. Executing Agency 6. Amount of Loan 7. Program Completion Report Number

Indonesia Loan 2478-INO (Subprogram 1) Loan 2786-INO (Subprogram 2) Second Local Government Finance and Governance Reform Program Republic of Indonesia Directorate General of Fiscal Balance of the Ministry of Finance (MOF) Subprogram 1 Subprogram 2 $350,000,000 $200,000,000 1571

B. Loan Data 1. Fact-Finding – Date Started – Date Completed 2. Loan Negotiations – Date Started – Date Completed 3. Date of Board Approval 4. Date of Loan Agreement 5. Date of Loan Effectiveness – In Loan Agreement – Actual – Number of Extensions 6. Closing Date – In Loan Agreement – Actual – Number of Extensions 7. Terms of Loan – Interest Rate – Maturity (number of years) – Grace Period (number of years)

Subprogram 1 Subprogram 2 9 June 2008 9 May 2011 20 June 2008 13 May 2011 23 September 2008 11 August 2011 24 September 2008 12 August 2011 4 December 2008 4 October 2011 11 December 2008 2 November 2011 11 March 2009 2 February 2012 18 December 2008 5 December 2011 0 31 December 2008 31 December 2011 31 December 2008 31 December 2011 0 LIBOR-based 15 years 3 years

ii

8. Disbursements a. Dates

Subprogram 1 Subprogram 2

Initial Disbursement

19 December 2008 7 December 2011

Final Disbursement

19 December 2008 7 December 2011

Time Interval 0 0

Subprogram 1 Subprogram 2

Effective Date

18 December 2008 5 December 2011

Original Closing Date

31 December 2008 31 December 2011

Time Interval

0.43 months 0.85 months

b. Amount ($)

Category

Original Allocation

Amount Disbursed

Amount Cancelled

Subprogram 1 350,000,000 350,000,000 0

Subprogram 2 200,000,000 200,000,000 0

Total 550,000,000 550,000.000 0

C. Program Data

1. Program Cost ($)

Cost Appraisal Estimate Actual

Foreign Exchange Cost Subprogram 1 350,000,000 350,000,000 Subprogram 2 200,000,000 200,000,000 Total 550,000,000 550,000,000

2. Financing Plan ($)

Cost Appraisal Estimate Actual

Implementation Costs ADB Financed – Single Tranche Subprogram 1 350,000,000 350,000,000 Subprogram 2 200,000,000 200,000,000

Total 550,000,000 550,000,000

ADB = Asian Development Bank.

3. Cost Breakdown by Program Component

Component Appraisal Estimate Actual

Not applicable

iii

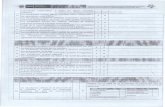

5. Program Performance Report Ratings

Implementation Period

Ratings

Development Objectives

Implementation Progress

Subprogram 1 From 01 December 2008 to 31 December 2008 S HS From 01 January 2009 to 31 January 2009 S HS Subprogram 2 No rating available for Subprogram 2 in eOps

HS = highly satisfactory, S = satisfactory

D. Data on Asian Development Bank Missions

Name of Mission

Date

No. of Persons

No. of Person-Days

Specialization of Members

a

Subprogram 1 Reconnaissance 1

b 11-21 Mar 2008 5 43 a, b, c, d, e

Reconnaissance 2b 13-18 April 2008 3 18 a, b, c

Reconnaissance 3b 12-16 May 2008 1 5 a

Fact-Finding 9-20 Jun 2008 6 72 c, e, f, g, h, i Appraisal 6-14 August 2008 3 27 c, e, f Review 15-18 December 2008 1 4 a Subprogram 2 Reconnaissance 28 Mar – 8 Apr 2011 5 60 j, k, l, m, o Fact-Finding 9 -13 May 2011 4 20 j, l, n, o Project completion Review

7-9 March 2016 2 6 k, p

a a = public sector management specialist, b = project officer (IRM), c = consultant (team leader TA 7010-INO),

d = senior capacity development specialist, e = economist (trade and finance), f = mission leader, g = sr. governance and capacity development specialist, h = consultant (TA 7010-INO), i = consultant, j = public management specialist, k = public management economist , l = sr. country economist, m = consultant (team leader TA 7184-INO), n = fiscal economist, o = counsel, p = senior economics officer.

b Mission fielded in conjunction with other on-going INO projects.

4. Program Schedule

Item Appraisal Estimate Actual

Release of Single Tranche Subprogram 1

31 December 2008

19 December 2008

Subprogram 2 31 December 2011 7 December 2011

I. PROGRAM DESCRIPTION

1. Indonesia’s decentralization program, which started in 1999, devolved more functional responsibilities, particularly on basic service delivery, to the local government. 1 With more responsibilities at local level, the central government has increased the share of inter-government transfer to total expenditure from 31% in 2001 to 48% in 2014. In addition, the central government has devolved the responsibility of administering local taxes to local governments since 2014. With increased responsibility and more funding, the local governments are expected to provide better basic service delivery while at the same time ensuring a strong governance aspect with complete fiduciary responsibility. 2. With decentralization, subnational governments assumed the key role in the delivery of core services, including education, health, and the development of basic infrastructure such as waterworks and roads. An important issue has been the impact of decentralization on the quantity and quality of those services. The performance of the regional governments can be evaluated from (i) an expenditure perspective (has there been an adequate increase in expenditures allocated to decentralized services, i.e., have funds followed functions?); (ii) an expenditure composition perspective (is there a desirable mix or composition of expenditures?); or (iii) a service delivery perspective (has the quality of services improved?). 3. The Second Local Government Finance and Governance Reform Program (LGFGR2), which was formulated as two single-tranche subprograms, supported the government’s decentralization reform program. The LGFGR2 period was envisaged as being from January 2006 to September 2011. In December 2008, the Asian Development Bank (ADB) approved a single-tranche loan of $350 million for subprogram 1 (January 2006–December 2008). 2 Subprogram 2, which was a single-tranche loan of $200 million and covered September 2009 to August 2011, was approved in October 2011.3 4. This program completion report gives an overview of the LGFGR2 and an evaluation of its initial impact and benefits. The updated design and monitoring framework is in Appendix 1, and the policy matrix and medium-term program is in Appendix 2 and 3.

II. EVALUATION OF DESIGN AND IMPLEMENTATION 5. LGFGR2 tackled major policy issues in a medium- to long-term framework to improve the implementation of the decentralization policy as envisioned in the Medium-Term Development Plan (RPJM), the National Action Plan for Fiscal Decentralization (NAPFD), and ADB’s country strategy and program (CSP) for Indonesia. 4 It strengthened government institutions that directly supported regional development, while deepening reforms in fiscal consolidation, good governance, public financial management, and service delivery down to the regional governments. LGFGR2 also complemented the broader policy support from the

1 In this document, “regional government” encompasses provinces, districts (kabupaten), cities, and municipalities

(kota), while “local government” covers districts (kabupaten), cities, and municipalities (kota). 2 ADB 2008. Report and Recommendation of the President to the Board of Directors: Proposed Loan and Technical

Assistance Grant to the Republic of Indonesia for Second Local Government Finance and Governance Reform Program (Subprogram 1). Manila.

3 ADB. 2011. Report and Recommendation of the President to the Board of Directors: Proposed Loan and Technical

Assistance Grant to the Republic of Indonesia for Second Local Government Finance and Governance Reform Program (Subprogram 2). Manila.

4 ADB. 2006. Country Strategy and Program: Indonesia, 2006–2009. Manila.

2

Development Policy Support Program (DPSP).5 ADB provided a comprehensive package of support for the government’s overall objectives of poverty reduction and equitable growth. 6. LGFGR2 is linked to the Local Government Finance and Governance Reform Sector Development Program (LGFGR1). 6 The details and lessons from LGFGR1 were fully considered in the development of LGFGR2; the two programs were integrally linked. In LGFGR1, the desired outcome was “increased accountability in the management of regional finances.” In LGFGR2, the outcome was broadened to having “improved organizational capacities and operating in a more transparent, effective and efficient policy and legal environment for fiscal decentralization, financial management and service delivery.” In LGFGR1, the desired longer-term impact was “more effective and efficient delivery of basic public services by regional governments.” The longer-term impact sought under LGFGR2 was broadly similar: “improved efficiency, effectiveness and interregional equity of regional government spending.” A. Relevance of Design and Formulation 7. The program was relevant for the country, with LGFGR2 being a continuation of ADB’s fiscal decentralization reform agenda. By focusing on the fiscal aspect, rather than the administrative and political, LGFGR2 aimed to assist national and subnational governments in implementing NAPFD, which is the key action plan document. Thus, LGFGR2 supported the government’s ongoing efforts to improve (i) regional autonomy and financing (by strengthening the intergovernmental financing policy framework, regional organizational systems, and regional revenue systems), (ii) governance and service delivery (by providing adequate financing and performance measurement), and (iii) capacity development (by improving public financial management and human capacity). Consistent with the priorities and directions set out in Indonesia’s plans and strategies, ADB, in its CSP, asserted its continued support for fiscal decentralization in Indonesia, and its goal of reducing poverty.7 B. Program Outputs 8. LGFGR2 supported the government in its efforts to make regional government spending and service delivery more efficient, effective, and equitable. It strengthened the organizational capacity of the regional governments and provided a more transparent, effective, and efficient policy and legal environment for fiscal decentralization, financial management, and service delivery. 9. LGFGR2 had six outputs, with clear objectives for each.

1. Decentralization framework and program management—strengthened management and coordination of fiscal decentralization matters

a. Ensure continued implementation of the medium- and long-term

decentralization agenda.

5 ADB. 2007. Report and Recommendation of the President to the Board of Directors on a Proposed Loan to the

Republic of Indonesia for the Third Development Policy Support Program. Manila (Loan 2394-INO for $200 million). 6 ADB. 2005. Report and Recommendation of the President to the Board of Directors on a Proposed Loan to the

Republic of Indonesia for the Local Government Finance and Governance Reform Sector Development Program.

Manila (Loan 2192-INO for $300 million). 7 ADB. 2008. Strategy 2020: Working for an Asia and Pacific Free of Poverty. Manila.

3

10. LGFGR2 helped the government to continue with its implementation of the fiscal decentralization agenda. In subprogram 1, the government, through the Ministry of Finance (MOF), updated the NAPFD. The reform continued into subprogram 2, where the government finalized the draft Grand Strategy for Fiscal Decentralization (GSFD). The GSFD has been used to set long-term directions for fiscal decentralization, influencing draft amendments to Law No. 33 Year 2004 on Fiscal Balance. The policy framework for decentralization has been strengthened with two additional components: (i) the National Medium-Term Development Plan (RPJMN) 2010–2014; and (ii) completion of academic papers for the preparation of amendments to Law No. 32 Year 2004 and Law No. 33 Year 2004.8 The latter documents (for which female representation was ensured in the drafting teams) have mainstreamed gender equity during their formulation, a process facilitated by the Ministry for the Development of Women and Protection of Children (MDWPC).

b. Streamline and strengthen coordination functions of relevant national government agencies.

11. In subprogram 1, MOF established the Directorate General for Fiscal Balance (DG Fiscal Balance), and gave it responsibility for leading the fiscal decentralization reform agenda. The role of DG Fiscal Balance as the coordinator for fiscal decentralization was further strengthened in subprogram 2. It led the (i) update of the NAPFD, (ii) the finalization of the GSFD, and (iii) the review of Law 33. DG Fiscal Balance also co-chaired meetings of the Regional Autonomy Advisory Council; provided leadership to ADB’s LGFGR Program (having been the executing agency for several ADB TA projects) and other development partner programs; coordinated both formally and informally with key central ministries and regional governments; and provided information on fiscal decentralization matters, especially through a chapter on fiscal decentralization in the Financial Notes for the 2011 Annual Budget.

2. Regional autonomy and local governance—clearer arrangements for regional administration to improve services and accountability

a. Improve the policy and legal framework to rationalize the number of

regional governments to increase efficiency while still providing for local representation

12. The proliferation of new regional governments has been an issue in Indonesia’s decentralization. Between 1999 and 2012, 205 new districts were established, consisting of 7 provinces, 164 districts, and 34 cities. This trend, partly an opportunistic response to fiscal incentives in the system, particularly the sharing of resource revenues, is widely perceived to have reduced the overall efficiency of regional governments. The government therefore undertook a series of activities to rationalize the process for new local government formation under LGFGR2. In subprogram 1, the government passed a new regulation on the evaluation of the performance of regional governments (including in relation to newly established governments and mergers). In subprogram 2, to control the increasing number of new local governments, efficient criteria for forming a new local government were included in the draft amendments of Law No. 32 Year 2004. The Grand Strategy on Regional Autonomy (Penataan Daerah) approved the inclusion of administrative guidelines for the processing and evaluation of applications for the formation of new local governments. The work undertaken under LGFGR2 is included in the revised law on local government, i.e. Law No. 23 Year 2014, which includes

8 For further details of the law, please refer to Appendix 5.

4

stricter criteria for establishing new local governments.

b. Increase clarity in the intermediate roles of provinces and governors

13. The initial decentralization reforms removed any hierarchical relationships between the provinces and the districts and cities, partly out of fear that strong provincial governments would spawn separatist movements. The special status Laws for Aceh and Papua and the general evolution of domestic politics removed that reason for eschewing a hierarchical vertical model. Law 32/2004 brought back different channels of hierarchical control by the provinces, including the annual approval of local government budgets. These reversals reflect the central government’s desire for enhanced oversight and control over local governments, and it used the provincial authorities, in particular the governor, as a proxy for central authority. In supporting this reform agenda, the government under LGFGR2 revised the government regulation on the roles and responsibilities of provincial governor to strengthen the role of governor (Government Regulation 23/2011); issued a joint circular letter between MOF, the Ministry of Home Affairs (MOHA), and the National Development Planning Agency (BAPPENAS) on the implementation of the GR 23/2011; and reflected changes in the desired role of provincial governors in the draft amendments to Law 32/2004.

c. Reform decentralized civil service arrangements to enhance flexibility and shift resources to more productive activities

14. The reform of decentralized civil service arrangements was also supported under LGFGR2. The government issued a new government regulation (GR No. 41/2007), which provided principles and guidelines on regional organizational structures, thus facilitating the reform of decentralized civil service arrangements. MOF has also reviewed the possibility of delinking the basic staffing allocation from the General Allocation Fund (DAU) to support more flexible regional organizational and staffing arrangements.

d. Improve clarity of expenditure assignments and service responsibilities across levels of government to improve efficiency and equity of expenditures

15. In fiscal decentralization, the best international practices show that “money follows function,” but in Indonesia, government functions are imprecisely defined. The old law on local government (Law No. 32 Year 2004) did not provide full clarification on the obligatory functions of the regional governments. Under subprogram 1, the government made such clarification by issuing Government Regulation 38/2007. In subprogram 2, the government (i) undertook a series of activities aimed at clarifying the roles and responsibilities for service delivery of all tiers of administration, and (ii) issued a framework for addressing lack of clarity and excessive overlapping in expenditure assignments across tiers of government. The result can be seen in the revised law on local government (Law No. 23 Year 2014), which replaced Law No. 32 Year 2004. The new law includes articles on expenditure responsibilities across tiers of government. This provides clarity on functional assignments at the local level and thus will improve basic service delivery at the subnational level. On the implementation level, under LGFGR 2, MOHA developed the norms, standards, procedures and criteria for basic service delivery, and 13 line ministries prepared minimum service standards for delivery of basic services, including integration of issues on domestic violence against women and children.

5

3. Intergovernmental fiscal system—enhanced equalization, predictability, and transparency in the release of fiscal transfers and shared revenues

a. Improve equalization and transparency of the General Allocation

Fund (DAU) 16. The equalization potential of the DAU has been improved. Presidential Decree 5/2010 (RPJMN 2010–2014) instructs the government to provide greater flexibility in the allocation of DAU funds by delinking wage payments from DAU allocations, thus releasing additional resources for poorer regions. In practice, the government has pegged the amount allocated to wage payments from the DAU to below 50% of the total allocation. The process will need to be completed with amendments to Law 33, legally delinking the wage component from the DAU formula. Improved transparency in the DAU allocation is now achieved by the recent publication of the national formula and weights used for the distribution of the DAU to provinces in the annual supplementary budget documents. Future reforms should consider removing adjustments that make grant allocation discretionary, thereby improving overall effectiveness of public expenditure.

b. Make provision for forward estimates of major transfers 17. Predictability in fiscal transfers has improved with the progressive incorporation of a system of forward estimates for all major grants into the budget formulation process. Although their importance varies greatly across jurisdictions, on average, central government transfers (including grants and revenue sharing from national taxes on resource industries) account for more than 80% of regional government revenue. With limited discretionary power over their own revenue sources, regional governments require predictability over the medium term on the assignment of central government transfers (both in terms of regular financial flows and the stability of the estimated annual amounts received). Acknowledging the importance of adequate fiscal information, the new budget manual requires the implementation of forward estimates for 3 years. The 2009 national budget already contained forward estimates of transfers to regions as a percentage of GDP. Further, MOF has included nominal forward estimates for each major transfer as part of the formulation of its medium-term expenditure framework.

c. Gradually reduce levels of central government funding in relation to activities that are legally regional government responsibilities

18. Under LGFGR2, the government sought to reduce central government expenditures on activities that had been legally assigned to the regional governments, so as to make room for higher priorities. In subprogram 1, the government issued a regulation that provided guidelines for managing the legitimate deconcentrated expenditures of the central government. This, along with the new GR 38/2007, provided a basis for identifying and gradually removing non-legitimate central government expenditures. At the subnational level, these regulations helped the regional government in enhancing the efficiency of their budget appropriation. Furthermore, in subprogram 2, the government reduced the number of deconcentrated expenditures at the Ministry of National Education. Specifically, the School Operational Assistance Program, which constituted more than 50% of the ministry’s deconcentrated expenditure, was moved from government deconcentrated funding to alternative funding, and thus devolved to the regional governments. This has improved the discretionary expenditure power of regional administrations from conditional education transfers.

6

d. Improve design and management of Specific Allocation Grant (DAK) funding

19. DAK is one of the key equalization grants given to regional government. Since the purpose of DAK is to assist local governments in improving their public service delivery, it should have an impact on the ground. MOF increased the amount of DAK from Rp1.1 trillion and 0.08% of GDP in 2001 to Rp21.2 trillion and 0.47% of GDP in 2008. However, DAK was having limited impact on the ground because of the crowding-out effect of deconcentration funds. With the reduction of deconcentration funds (as stated in para. 18), MOF under LGFGR2 pushed for more reform on DAK. In subprogram 1, MOF reduced non-legitimate central expenditures for the health, education, and infrastructure ministries by about Rp4.2 trillion, with DAK increasing by 24% in the 2008 budget. In subprogram 2, MOF continued to fine-tune DAK design by reviewing the systems and procedures and management of DAK transfers prepared and disseminated to inform DAK reform. Furthermore, MOF improved the disbursement process of DAK towards facilitating absorption of funds by regional governments and aligning disbursements with expenditure needs.

e. Test performance and sanctions-based elements of transfers 20. The government recognized the need to introduce a performance-based grant system as a part of the intergovernmental fiscal transfer system. To support this agenda, under subprogram 1, MOF prepared a policy paper on the possibility of increasing the use of incentives and sanctions to stimulate better results in areas such as the timely preparation of budgets and financial and performance reports, and the reduction of administrative outlays. Under subprogram 2, MOF introduced new incentives and sanctions, which were implemented on a trial basis; for example, timely submission of budgets and financial performance reports by the regional governments was enforced by sanctioning those that did not submit them on time.

f. Ensure smooth cash releases of shared revenue transfers to address delays and unevenness in regional government budgeting

21. Under LGFGR2, the regional governments ensured that releases of shared revenues were smooth and predictable. In addition, MOF made the release system more efficient, with smoother flows of fund releases being based on government regulations 142/2006 (natural resource revenues) and 217/2007 (oil revenues in Aceh province).

4. Own-resource revenues—more buoyant sources of local revenues to reduce dependency on fiscal transfers

a. Amend law 34/2000 on regional taxes and charges

22. Under LGFGR2, the government amended law 34/2000 on regional taxes and charges. The new law, Law 28/2009, devolved the main local taxes, such as property tax, to the regional government, going beyond the originally defined policy goals for this reform.

b. Implement a computerized system in MOF for receiving and processing regional tax laws.

23. Under LGFGR2, the new computerized system was fully implemented by 2011, resulting in a large decline in the backlog of processing regional taxes (50% of the end-2008 backlog was dealt with and the 2008 processing time was cut by 50%).

7

c. Develop a medium-term roadmap for decentralized tax reform

24. MOF has incorporated the medium-term roadmap for decentralized tax reform into the GSFD and NAPFD.

d. Gradually devolve the property tax to the regions

25. Gradual devolution of the land and building tax and the property transfer tax started in January 2011, upon enactment of Law 28/2009 on Regional Government Revenues and Charges. The government had planned to fully devolve the property transfer tax by the end of 2011 and expected to complete the devolution of the land and building tax by 2014. Significant supporting regulation in the form of a joint ministerial decree between MOF and MOHA (Joint Ministerial Decree 53/2010) clarifies the transfer of the property transfer tax to regional governments, detailing the responsibilities of each ministry to ensure a smooth transition. Approval of Joint Ministerial Decree 53/2010 devolved responsibility for the Property Transfer Tax to regional governments.

5. Regional reserves and debts—bolstering the management of regional reserves and debts

a. Improve monitoring and analysis of reserves accumulation in all

locations and develop policy responses to the recent high growth in reserves

26. In LGFGR2, the emergence of significant financial reserves in many regional governments became an important fiscal policy issue, and MOF developed systems for monitoring cash holdings in the banking system in response. Furthermore, MOF issued a decree that sets out the guidelines for the submission and publication of regional government debt data for better management of regional debt.

b. Develop improved data systems for monitoring subnational debt 27. The director general of treasury of MOF implemented a computerized debt management and financial accounting system. The system has been in full operation since 2010, providing useful data for the analysis of regional debt. The system receives data from the accounts receivable system and a Microsoft Excel-based system that is used to manage the on-lending of regional governments.

c. Pursue effective restructuring of the debts of state-owned water supply companies to improve the climate for new investment in water supply facilities

28. The difficult financial circumstances of many state-owned regional water supply companies (PDAMs) have severely hampered their ability to provide adequate water and sanitation infrastructure. Treasury regulation 53/2006 set out guidelines for rescheduling PDAM debts. Under subprogram 1, significant progress was made to restructure nonperforming PDAM debts with the passage of a new MOF decree 120/2008, which further streamlined application procedures with more generous debt rescheduling and relief arrangements to speed up debt restructuring. In subprogram 2, progress in the restructuring and rescheduling of nonperforming debts of PDAMs was adequate. Overall, Rp4.3 trillion of debt was restructured or rescheduled,

8

amounting to 58% of the total debt as of December 2010. In 2016, the government re-audited the total debt of PDAMs and verified that the amount is reduced to Rp3.8 trillion, which belongs to 107 PDAMs. The audit report shows out of 107 PDAMs, 86 will go through debt restructuring program and 21 have finalized their debt restructuring program. Due to this result, in early 2016, the government has decided to write-off all PDAMs debt by swapping all the PDAM’s debt into the government’s equity to PDAMs.

d. Finalize MOF decree providing for the use of DBH and DAU intercept mechanisms to repay debts

29. With an increasing number of tasks related to service delivery being undertaken at the subnational level and limited local budget capacity to meet the new demand, local governments need to be able to access local currency financing. This is essential in developing a credit culture among regional governments in Indonesia. To mitigate the risk on the private sector side, innovative local credit enhancement entities and techniques provided an assurance of payment. In return, more domestic commercial debt resources were mobilized to finance local government infrastructure projects. In this context, MOF finalized the design of a credit enhancement facility by providing an intercept mechanism for the revenue sharing fund (DBH) and general allocation fund (DAU). This intercept mechanism was designed to mitigate borrower credit risk as well as liquidity and market risk commonly observed in sub-sovereign lending. The intercept mechanism was used by the Government Investment Agency (PIP) when they lent to subnational governments.

e. Support development of a subnational bond market including enhanced support in selected pilot locations

30. Under LGFGR 2, the government introduced and continued to strengthen the regulatory framework for subnational borrowing. Thus, the new government regulation on subnational borrowing, i.e. GR 30/2011, was significantly improved to provide financial criteria for subnational borrowing. Furthermore, MOF helped a number of local governments, such as the city of Jakarta, in initiating the process of municipal bond issuance.

6. Human and systems capacity development, public financial management and accountability

a. Enhance involvement at the presidential level to improve funding

and coordination of central and donor efforts 31. The government continued to improve coordination of capacity building initiatives in public financial management (PFM). This strengthened the governance aspect of fiscal decentralization and improved the performance of local government. Under LGFGR2, MOHA drafted a presidential regulation, which resulted in the issuance of Presidential Regulation 59/2012 on the national framework for local government capacity building. Further, the National Medium-term Plan for 2010-14 synchronized PFM capacity in regional government. The government also encouraged line ministries and regional governments to strengthen their female staff capacity. As a result, the Ministry for the Development of Women and Protection of Children (MDWPC) and various provincial governments signed an MOU to advance women empowerment and protection of children.

9

b. Develop gender responsive budgeting

32. The government’s reform agenda mainstreamed gender aspects in policy formulation and moved towards the implementation of a gender responsive budget. A key achievement was the issuance of an MOF decree instructing line ministries to implement gender responsive budgeting. Furthermore, gender mainstreaming has been institutionalized for line ministry training through MOHA in coordination with MDWPC.

c. Develop a comprehensive plan to support implementation of the newly formed PFM regulatory regime in regional government

33. The government continued to train regional government officers on PFM. Training for human resources and system development in regional governments, including the preparation of training materials, increased, on average by 25% in 2012 to 2014, through MOHA and MOF. In addition, in 2011, a computerized financial management information system (FMIS) was fully implemented in 53 regional governments; partially implemented in 41; and initiated in 25, with free software available for expansion to all regional governments. By 2016, 425 regional governments have implemented a computerized FMIS. In addition, 5,657 local public finance officials were trained how to use the local government’s computerized FMIS in 2011. By 2016, the figure has increased to around 10,000 public finance officials.

d. Improve systems and coordination in collection and analysis of regional financial data

34. Delays in publishing consolidated regional government financial information have been progressively reduced. Budget approval information for regional governments is available for 100% of jurisdictions up to 2010, effectively reducing the delay in publication to one year. Budget realization data is also being published in a timely manner. The most recent web-published data indicates 514 regional government reports 2015 budgeted and realized data, displaying good performance in this particular area of the policy matrix.

e. Continue efforts to compare and publish benchmarked performance in service delivery (and other areas) between regions

35. A regional government performance measurement system was developed with a fully functioning centralized database, and trialed in 40 regional governments. Information and implementation kits and the software package (which runs on Microsoft Excel) were provided to almost all regional governments throughout the country. The system includes gender-related indicators such as female representation in local authorities and targets for capacity building. C. Program Costs and Disbursements 36. ADB supported the LGFGR2 program through two subprogram loans totaling $550 million. 37. Each loan was released in a single tranche. The loan of $350 million for subprogram 1 was disbursed on 19 December 2008, one day after loan effectivity, while the loan of $200 million for subprogram 2 was disbursed on 7 December 2011, two days after loan effectivity. The proceeds of the loans were disbursed according to ADB’s Simplification of Disbursement Procedures and Related Requirements for Program Loans.

10

D. Program Schedule 38. The program was implemented as planned from December 2008 to December 2011. E. Implementation Arrangements 39. The implementation arrangements were satisfactory. DG Fiscal Balance of the MOF was the executing agency. The implementing agencies were directorates of MOF, MOHA, and BAPPENAS. An LGFGR steering committee, chaired by DG Fiscal Balance, with MOHA and BAPPENAS officials as members, coordinated the implementation of the LGFGR program reform actions. F. Conditions and Covenants 40. The government satisfactorily fulfilled all 55 policy actions with 19 key triggers in subprogram 1 and 57 policy actions with 18 key triggers in subprogram 2. The policy actions selected were based on the sequence of reforms identified in the NAPFD and GSFD. 41. As domestic circumstances and development priorities changed, the policy triggers that had been approved for subprogram 2 in 2011 underwent minor revisions. A new policy reform on mainstreaming gender based budgeting at subnational levels was added. G. Related Technical Assistance 42. Three technical assistance (TA) grants were approved under LGFGR2: (i) a $700,000 project preparatory TA grant to prepare LGFGR2, (ii) a $1,500,000 policy and advisory TA grant approved on 4 December 2008 to support the ongoing development of the reform agenda in regional government financing and governance and its implementation, and provide timely policy advice to the government, and (iii) a $1,000,000 policy and advisory TA grant approved on 10 December 2009 to: (a) provide monitoring, coordination and support to attain all required actions under the subprogram 2 policy matrix, (b) strengthen approaches to coordinate fiscal decentralization policies, (c) reduce inconsistencies between sector and decentralization laws and related inconsistencies in budgets, (d) support further refinement and development of the regional government performance measurement system, and (e) support improved efficiency in the transmission, collation and analysis of financial information from regional governments.9 TA completion reports for the two policy and advisory TA grants are in Appendixes 6 and 7. 43. The project preparatory TA was approved on 3 December 2007, but the agreement was signed on 19 February 2008, delaying the commencement of implementation by two months. The TA was closed on 27 August 2010, 17 months after the original completion date. International consultants (16 person-months) and national consultants (33 person-months) were engaged as individuals according to ADB’s Guidelines on the Use of Consultants. Three books were published under the TA and were disseminated to relevant government agencies, regional governments, development partners, and academia. The TA was rated as successful.

9 ADB. 2007. Project Preparatory Technical Assistance to the Republic of Indonesia on Second Local government

Finance and Governance Reform Program. Manila (PPTA7010-INO, $700,000, funded by JSF, approved on 3 December); ADB. 2008. Policy Advisory Technical Assistance to the Local Government Finance and Governance Reform. Manila (PATA7184-INO, $1.5 million, approved 4 Dec 2008); ADB. 2009. Policy Advisory Technical Assistance to the Republic of Indonesia on Support for Local Government Finance and Governance Reform 2. Manila (PATA7452-INO, $1.0 million, approved 10 December 2009).

11

H. Performance of the Borrower and the Executing Agency 44. The government was committed to the reform agenda under the program. DG Fiscal Balance, as the executing agency for the program loan, is rated satisfactory. There was demonstrable progress in policy and institutional reforms in the MOF, MOHA, and BAPPENAS during and after the program. The intergovernmental transfer mechanism, transparency, and the ability of regional governments to increase their revenue have all improved. I. Performance of the Asian Development Bank 45. ADB provided appropriate assistance to the government in implementing the program and TA projects. Overall, the performance of ADB is rated satisfactory. During the processing of the program loan, ADB staff worked with their government counterparts at the MOF, MOHA, and BAPPENAS on reform areas that needed to be included in the policy matrix. During implementation, they also worked together to ensure that the actions were accomplished in a timely manner and would remain sustainable for future programs.

III. EVALUATION OF PERFORMANCE A. Relevance 46. The program design was “highly relevant” to the local government’s reform agenda and its goals of fiscal and administrative decentralization. The program loan is considered timely as it tried to meet the demand for better local public service delivery, particularly after the government’s 2001 “big bang” approach to deconcentration and decentralization. The program provided regulations requiring that regional governments prepare financial reports to account for financial management. Key regulatory reforms under LGFGR2 included revisions to DAK, the introduction of performance-based grants, issuance of a new Law on Local Taxes and Surcharges, a new regulation on subnational borrowing, and improvements in the capacity of local PFM officials. These reforms are a stepping stone for further reform enhancements, with LGFGR2 providing an opening for ADB to continue to work on the fiscal decentralization agenda at both national and subnational levels. A good example is ADB’s current work with the City of Jakarta on local tax reform, which is being funded by the Swiss Government.10 B. Effectiveness in Achieving Outcome 47. LGFGR2 was “highly effective” because it met the principal objectives of the program. The government appreciated ADB’s support in developing policies using national and international experts’ views on decentralization policy as it relates to fiscal decentralization. Otherwise, policies would have been developed based on the views of bureaucrats and academics. Also, donor support indirectly provided inputs for the blueprint strategy planning for DG Fiscal Balance. Through LGFGR2, the government has improved the regulatory framework for fiscal decentralization. As regards the coordination framework, the government has elevated the status of the Regional Autonomy Advisory Council (DPOD). Under Presidential Regulation No. 91/2015, the Vice President is now the head of DPOD instead of the Minister of Home

10

ADB. 2015. Capacity Building Technical Assistance to Republic of Indonesia on Tax Revenue Administration Modernization and Policy Improvement in Local Governments. Manila (CDTA 8877, for $5 million, funded by the Swiss Government, approved on January 25).

12

Affairs. Further, the government has put in place strict restrictions on the establishment of new local governments to control their proliferation. Law No. 23/2015 on Regional Autonomy, which details the criteria for establishing a new local government, has also helped to clarify the arrangements between national and subnational governments regarding functional assignments, which is the key to successful decentralization. In addition, LGFGR2 helped MOF to devolve the main local taxes, such as property taxes, to local governments. As regards intergovernmental fiscal arrangements, MOF is moving toward a performance based grant by reforming DAK and introducing a new regional incentive grant (DID). C. Efficiency in Achieving Outcome and Outputs 48. The program loan is assessed as “efficient” in achieving the outcome and outputs. The use of single-tranche subprograms, with agreed triggers to be completed before each subprogram was submitted to the ADB Board of Directors for approval, improved the efficiency of program implementation and strengthened the commitment of the government, which used its own resources up front. All the subprograms were completed on schedule, with loan effectiveness and disbursement fulfilled as agreed in the financing agreements. Proceeds for each subprogram were subsequently disbursed as budget support to defray government fiscal costs and administrative expenses incurred by the various financial institutions implementing the LGFGR2 reforms. D. Preliminary Assessment of Sustainability 49. LGFGR2 is considered likely sustainable. Laws, regulations, standards, systems, and supporting infrastructure were introduced. These enhanced the effectiveness and efficiency of the delivery of basic public services by strengthening the policy, legal, and regulatory frameworks for decentralization as well as developing local government capacities. These are significant accomplishments that require continued government commitment to enforce and enhance compliance with their application. The government has showed commitment in fine tuning its decentralization program by focusing on improving service delivery. For example, in 2016 the government increased the budget allocation for DAK to Rp209 trillion ($16 billion) from Rp26 trillion ($2 billion) in 2014. Moving forward, the capacity to enforce compliance needs to be strengthened further. Also, as described in para. 46, the reforms that were introduced in LGFGR2, such as the intergovernmental transfer and local taxes, continue to be implemented at national and subnational levels. These reforms are financed by either the government or other development partners. The addition of a post-program partnership framework to the LGFGR2 design helped maintain policy dialogue beyond program completion and ensured the continued implementation of reform activities. E. Impact 50. By setting up a strong regulatory framework for decentralization, LGFGR2 has had a positive impact on improving service delivery, finance, and governance at the local level. For example, the number of local governments that received a very high satisfaction rate on their service delivery, as measured by MOHA, has increased to 1 province and 65 districts and municipalities in 2012 from 0 provinces and 0 districts and municipalities in 2009. Further, the

13

number of local governments that received a “disclaimer” opinion11 from the Supreme Audit Board (BPK) has decreased from 36 local governments in 2006 to 3 in 2013. On finance, in 2015, to support better delivery at the local level, for the first time in the history of Indonesia, the national budget allocated to the subnational level is higher than the national level. This indicates the seriousness of the government in incentivizing local government to improve service delivery. These developments have had a direct positive impact on economic growth and poverty reduction.

IV. OVERALL ASSESSMENT AND RECOMMENDATIONS A. Overall Assessment 51. LGFGR2 was implemented as initially designed and was highly relevant to the government’s development strategy, ADB’s partnership strategy with the government, and ADB’s strategic objectives at the time of approval. Strong government commitment, a well-sequenced reform framework (NAPFD and GSFD), and effective high-level coordination among the ADB team and the executing and implementing agencies made LGFGR2 highly effective and efficient in achieving the designed outputs. With the achievement of the program outputs, the expected outcome was also achieved on schedule and within budget. The delivery of basic public services at the local level has become more effective and efficient through a better regulatory framework on decentralization and the increased capacity of local government in delivering those services. On that basis, the sustainability of the program is deemed likely. Overall, LGFGR2 is rated successful. B. Lessons 52. Keys lessons from LGFGR2 and the associated TA projects are as follows:

(i) Long-term perspective. The adoption of the NAPFD by MOF laid the foundation for developing DG Fiscal Balance’s blueprint for institutional transformation. The policy design of the blueprint has also benefited from inputs by ADB and other donors. Through the development of this blueprint, the government now has a set of long-term objectives to guide and shape medium-term policy design and implementation. ADB is currently a member of an informal development partners working group on decentralization.12

(ii) Flexibility in design. Fiscal decentralization is the process of decentralizing revenue raising and expenditure of moneys to a lower level of government while maintaining financial responsibility. The process is complex and involves major changes to the legal and regulatory framework, institutional arrangements, and human capacity. Hence, sufficient time must be allocated to program implementation. Design flexibility is also a key consideration. The use of the program cluster approach gave LGFGR2 implementers the opportunity to refine the policy actions proposed for succeeding subprograms to reflect the government’s achievements, changes in the policy and economic environment,

11

The Supreme Audit Board’s classification of audit opinions, from strongest to weakest, is as follows: (1) Unqualified (clean without exceptions) opinion, (2) Qualified (clean with exceptions) opinion, (3) Adverse opinion, and (4) Disclaimer opinion.

12 Development partners that are involved in the fiscal decentralization working group are Government of Australia, GTZ, UNDP, and the World Bank. The working group is currently led by UNDP.

14

and lessons from previous subprograms. (iii) Technical assistance resources. Under LGFGR2, the government adopted

legal, policy, and institutional measures, and established supporting infrastructure. Many of the concepts were relatively new and therefore required extensive consultation and coordination to ensure stakeholders’ understanding, acceptance, and adoption of the new measures. Substantial TA support was necessary to ensure that best practices were incorporated and then consolidated throughout implementation to achieve the intended results. LGFGR2 identified a program of TA projects at the outset to help implement the medium-term program and improve the likelihood of compliance with completed activities. The selection of individual consultants was based not only on merit but also on their perceived ability to work well with local counterpart staff and their sensitivity to the local culture. These criteria are considered essential for the successful transfer of knowledge.

C. Recommendations 53. Future monitoring. The progress of the fiscal decentralization reforms, including the LGFGR2 outputs already achieved, and the reform activities included in the post-program monitoring framework will require close monitoring. ADB TAs is guiding the completion of some key reform activities beyond LGFGR2. Maintaining the appropriate level of intergovernment transfers, such as DAK and DAU, will ensure the full achievement of the LGFGR2 outcome and impact. Key reform initiatives will require sufficient human capital with the expertise and the will to strengthen surveillance and enforcement. It is recommended that implementation of the decentralization reforms be closely monitored by MOF, MOHA, and BAPPENAS in close coordination with ADB.. 54. Further action or follow-up. LGFGR2 facilitated the implementation of important fiscal decentralization reforms. These included establishing a downward accountability mechanism to local government to improve service delivery; increasing the capacity of local government PFM officials; devolving responsibility for local taxes to local governments; linking better service delivery to incentives and punishing local governments that are not delivering; and continuing the reform of DAK to eventually be developed into a performance-based grant system (PBGS). Moving forward, the government would like to focus on supporting PBGS. Thus, further assistance will be needed (i) by the government to ensure that the funds are being managed well by the local governments; (ii) by DG Fiscal Balance to provide effective supervision; and (iii) for capacity building of the local government officials. It is recommended that the momentum of reform be sustained under the next fiscal decentralization program cluster and TA projects. The focus should be on improving public service delivery through better public financial management.

Appendix 1 15

DESIGN AND MONITORING FRAMEWORK

Design Summary Performance Indicators/Targets Achievements Source/s

Appraisal Status

Impact

More efficient effective, and equitable regional government spending

Over 60% citizen satisfaction with health and education services by 2011 (versus 58.1% satisfaction rating for health and 50.3% for education in 2007)

Less than 15% poor in the total population by 2011 (from 16.6% in 2007)

1 million more households gain access to piped water connection yearly, from a baseline of 9,449,505 in 2005

The World Bank discontinued the Governance and Decentralization Survey (GDS) in 2010. However, the national government has taken a national GDS.

Also, surveys have been done on the effectiveness of using PFM.

In 2014, 11% poor in the total population

In 2010, 25.56% of Indonesia's population had access to piped water.

Achieved Achieved Achieved

GDS

BPS

BPS

Outcome

Improved organizational capacity of regional governments, which operate in a more transparent, effective and efficient policy and legal environment for fiscal decentralization, financial management and service delivery

Increase in total DAK to 0.8% of GDP by 2011 from a baseline of 0.46% in 2008, at the expense of incorrect deconcentrated funds

Decrease in regional government reserves in local bank accounts to 2.5% of GDP or less by December 2010 from a baseline of 3.1% in November 2006

In the 2016 national budget, the ratio of DAK to total expenditure increased to 10.1% from an average of 2.1% from 2011 to 2015. Further, in 2016, the government has merged all deconcentrated funds under DAK.

In 2015, the ratio of regional government reserves in local banks was 2.4%.

Achieved Achieved

BPS, SIKD, MOF

MOF/BI monitoring system

16 Appendix 1

Design Summary Performance Indicators/Targets Achievements Source/s

Appraisal Status

Gradual increase in shares of regional government sector spending for health (7% of the total regional budget in 2004), agriculture (4%), infrastructure (17%), and environment and special planning (1%) at the expense of government administration spending (32%)

In 2014, sector spending for health was 10.2% of the total regional budget. Other spending was: agriculture (2%); housing and public facilities (17.1%); and environment (2%).

Achieved

SIKD, MOF

Outputs 1. Improved

management and coordination of fiscal decentralization by central Government

2. Better defined functional and organizational arrangements for regional governments

Issuance of NAPFD 2010-2014 in 2009

Regular meetings of DPOD board and technical team (at least three times a year in 2008 and four times a year from 2009 onward)

Approval of applications for new regions according to criteria set in grand strategy for all applications processed from January 2010 onward

More flexible arrangements for regional government staffing and organizational structures

In 2011, MOF revised NAPFD for 2010-2014

DPOD conducted regular meetings and the technical team also met.

In 2014, the new law on regional government (Law No.23/2014) set the criteria for applications for new regions.

The government has adopted two new laws on (i) regional government, and (ii) civil servants (issued in 2014), which gives more flexibility for staffing in local governments.

Achieved Achieved Achieved Achieved

Copy of NAPFD 2010-2014

Minutes of meetings and NAPFD implementation report

MOHA reporting or independent process review

Independent review of regulations and regional operating practices

Appendix 1 17

Design Summary Performance Indicators/Targets Achievements Source/s

Appraisal Status

3. Greater equity, predictability, and transparency in the release of fiscal transfers and shared revenues

4. Improved

access of regional governments to own-source revenues

5. Strengthened

management of regional reserves and debts

6. Improved

capacity development, public financial management, and accountability

Review of basic allocation and links to regional wages conducted by 2009

Latest formulas and weights used in determining fiscal capacity and needs published in budget documents from 2009 onward

Forward estimates prepared for all major transfers and shared revenues from 2010 onward

50% reduction in inappropriate deconcentration expenditure in 2 pilot ministries by 2011

Devolution of property tax and 2% yearly increase in collections from 2010 onward

85% of PDAM debts restructured and paid on time in relation to newly agreed arrangements by 2011

RGPMS performance data generated in 40 pilot districts by 2011

In 2008, the government reviewed the basic allocation and links to regional wages.

In 2011, MOF improved transparency in the DAU by publishing in the annual supplementary budget documents the latest national formula and weights used for the distribution of the DAU to provinces.

Forward estimates are now prepared for all major transfers.

In 2016, the government eliminated any new deconcentration expenditures in all line ministries.

In 2014, the government devolved all local taxes to local governments.

In early 2016, the government has decided to write-off all PDAMs debt by swapping all the PDAM’s debt into the government’s equity to PDAMs.

By 2011, RGPMS had been developed, with a fully functioning centralized database in 40

Achieved Achieved Achieved Achieved Achieved Achieved Achieved

Review report

Budget documents provided by MOF

MOF

MOF and sector ministry data

MOF data

MOF data

MOHA data

18 Appendix 1

Design Summary Performance Indicators/Targets Achievements Source/s

Appraisal Status

25% yearly growth in allocations in MOF and MOHA annual budget for human resources and systems development in regional governments from 2010 onward

Full implementation of regional government PFM capacity-building plan for LGFGR subprogram 2 by 2011

Reduction in number of regional government financial reports required by central government agencies

RGs.

By 2011, the government was committed to annual growth of at least 25% in funding over the next 3 years through MOHA and MOF (compared with actual 2008 levels) to support training for human resources and systems development in regional governments.

By 2016, 425 regional governments have implemented a computerized FMIS.

Delays in publishing consolidated RG information were progressively reduced from about 3 years to 1 year.

Achieved Achieved Achieved.

MOF, MOHA and central government budget data

MOHA monitoring and evaluation data

MOF data

Activities with Milestones Inputs Appraisal Actual 1.1 Ensure continued implementation of medium- and

long-term decentralization agenda. 1.2 Streamline and strengthen coordination functions

of relevant central government agencies. 2.1 Improve policy and legal framework to rationalize

the number of regional governments. 2.2 Clarify the intermediate roles of provinces and

governors. 2.3 Reform decentralized civil service arrangements to

enhance flexibility. 2.4 Clarify expenditure assignments and service

responsibilities across levels of government.

3.1 Improve equalization and transparency of DAU.

ADB Subprogram 1 TA grant to support implementation of reform measures in subprogram 2 TA grant to support medium-term implementation of the reform measures in subprogram 2 ADB Subprogram 2

$350 million $350 million $1.5 million $1.5 million $1 million $1 million $350 million $200 million

Appendix 1 19

Activities with Milestones Inputs Appraisal Actual 3.2 Make provision for forward estimates of major

transfers 3.3 Gradually reduce levels of central government

funding in relation to activities that are legally regional government responsibilities.

3.4 Improve design and management of DAK funding. 3.5 Test performance- and sanction-based elements

for transfers. 3.6 Ensure smooth cash releases of shared revenue

transfers.

4.1 Amend law 34/2000 on regional taxes and charges.

4.2 Implement computerized system in MOF for receiving and processing regional tax laws.

4.3 Develop a medium-term roadmap for decentralized tax reform

4.4 Gradually devolve the property tax to the regions. 5.1 Improve monitoring and analysis of reserves

accumulation in all locations and develop policy responses.

5.2 Develop improved data systems for monitoring subnational debts.

5.3 Pursue effective restructuring of PDAM debts. 5.4 Finalize and implement MOF decree providing for

use of DBH/DAU intercept mechanisms to repay debts.

5.5 Support development of subnational bond market in selected pilot locations

6.1 Continue efforts to compare and publish

benchmarked performance in service delivery (and other areas) between regions.

6.2 Improve funding and coordination of central and donor efforts to develop and roll out resources to support human and systems capacity building in the regions.

6.3 Develop a plan to support implementation of the newly reformed PFM regulatory regime.

6.4 Improve coordination in collection and analysis of regional financial data.

6.5 Develop coordinated approach to performance monitoring and evaluation.

BPS = Central Bureau of Statistics, DAK = special allocation fund, DAU = general allocation fund, DBH = revenue sharing fund, DG = directorate general, DPOD = Regional Autonomy Advisory Council, FMIS = financial management information system, GDP = gross domestic product, GDS = Governance and Decentralization Survey, LGFGR2 = Second Local Government Finance and Governance Reform Program, MOF = Ministry of Finance, MOHA = Ministry of Home Affairs, NAPFD = National Action Plan for Fiscal Decentralization, PDAM = state-owned water supply company, PFM = public financial management, RG = regional government, RGPMS = regional government performance measurement system, SIKD = regional financial information system.

20 Appendix 2

POLICY MATRIX (SUBPROGRAM 1)

Objective Subprogram 1 Actions

Taken/Results Achieved 2006–2008

Results Indicative Subprogram 2 Milestones and Triggers

2009–2011

1. Decentralization Framework and Program Management: Strengthening management and coordination of fiscal decentralization matters

1.1 Ensure continued implementation of medium- and long-term decentralization agenda

a. NAPFD 2005-2009 updated with options for revisions in the policy actions for the medium term reviewed

Accomplished a. Revised version of NAPFD issued covering the medium term 2010-2014 and continues to be regularly reviewed to monitor progress

b. Draft grand strategy document setting long-term direction for fiscal decentralization prepared under leadership of minister of finance

Accomplished b. Grand strategy document finalized and used to set long-term directions for fiscal decentralization

1.2 Streamline and strengthen coordination functions of relevant national government agencies

a. New Directorate General of Fiscal Balance established in MOF to provide leadership in the development of fiscal and governance aspects of decentralization

Accomplished a. DG Fiscal Balance, MOF, continues program leadership, including regular consultations with all stakeholders and transparent circulation of fiscal decentralization information on a regular basis, including a comprehensive annual report

b. Technical capacity development of DPOD secretariat commenced with preparation of a capacity development report and a 2-year training plan covering administrative, management, and policy coordination strengthening for DPOD

Accomplished b. Options for strengthening DPOD reviewed, capacity-building plan for DPOD secretariat finalized and implemented with marked growth in training and development opportunities for staff

Accomplished c. Board, technical team and working groups of DPOD meet (at least four annual meetings of board and technical team) with increased flow of recommendations to president

2. Regional Autonomy and Local Governance: Clarifying arrangements for regional administration to improve services and accountability

2.1 Improve policy and legal framework to rationalize number of regional

a. Government regulation 78/2007 enacted defining the criterion for establishment, breakup, and merger of

Accomplished a. Processing of applications for new regions occurs strictly in line with the new policy and regulatory regime

Appendix 2 21

Objective Subprogram 1 Actions

Taken/Results Achieved 2006–2008

Results Indicative Subprogram 2 Milestones and Triggers

2009–2011

governments to increase efficiency while still providing for local representation

regional governments

b. Government regulation 6/2008 on evaluation of performance of regional governments (including in relation to new establishment and merger) passed

Accomplished b. 75% of related DPR commission members and 25% of staff from relevant departments trained in new policies and legal framework

c. Work has started on draft grand strategy paper on territorial subdivision by MOHA

Accomplished c. Grand strategy paper on pemekaran (territorial subdivision) finalized along with any consequential legal instruments

2.2 Increase clarity in the intermediate roles of provinces and governors

a. Draft government regulation prepared to clarify the intermediate role of provinces and governors as part of review of law 32/2004 on regional administration

Accomplished a. Law 32/2004 amended clarifying role of province and governor

Accomplished b. Consequential amendments to lower regulations passed in support of law 32/2004 changes with implementation of new arrangements

2.3 Reform decentralized civil service arrangements to enhance flexibility and to shift resources to more productive activities

a. Government regulation 41/2007 on regional organizational structures passed setting guidelines for the organizational structuring of regional governments

Accomplished a. Basic (staffing) allocation delinked from DAU imparting flexibility to regional government staffing

b. Review of options for delinking the basic (staffing) allocation from the DAU in support of more flexible staffing and organizational arrangements begun in the regions

Accomplished b. Performance incentives tested with system of intergovernmental financing transfers to stimulate reduction in administrative costs and switching to higher priorities

2.4 Improve clarity of expenditure assignments and service responsibilities across levels of government to improve efficiency and equity of expenditures

a. Government regulation 38/2007 on assignment of expenditures among government tiers passed

Accomplished a. Framework for addressing inconsistencies finalized with implementation started

b. Study to identify inconsistencies between regulation 38/2007 and sector laws started and strategy to

Accomplished b. Further refinements in law 32/2004 and regulation 38/2007 or a presidential regulation passed to further

22 Appendix 2

Objective Subprogram 1 Actions

Taken/Results Achieved 2006–2008

Results Indicative Subprogram 2 Milestones and Triggers

2009–2011

rectify inconsistencies being developed

clarify assignments

c. Detailed review of inconsistencies in two pilot ministries (environment and communications) started and draft report and legal amendments being prepared

Accomplished c. At least 85% of ministries have reviewed, and drafted amendments to sector laws and regulations to make them consistent with regulation 38/2007

3. Intergovernmental Fiscal System: Enhancing equalization, predictability, and transparency in release of fiscal transfers and shared revenues

3.1 Improve equalization and transparency of the DAU, which is the major transfer mechanism used in the Indonesian system of intergovernmental financing

a. Review of options for the DAU basic allocation/links to regional wages completed with a view to removing perverse incentives to employ excessive staff in the regions and to free up more funds for distribution on an equalization basis

Accomplished a. Develop the legal basis to implement delinking of wage payments for the DAU providing an environment for flexible management of regional staffing levels without limiting access to the DAU, which will have more funds available for distribution on an equalization basis

b. “Hold harmless” clause in DAU formulation which favors better-off regions removed, significantly enhancing the equalization effects of the DAU with additional resources flowing to regional governments that are less well off

Accomplished b. Negative incentives associated with DAU like the adjustment fund removed

c. DAU formula reviewed in 2008 to improve equalization. Review covered (i) disparities in tax bases, (ii) inclusion of all revenue sources, (iii) definitions and indicators of expenditure needs

Accomplished c. Regular review of DAU formula made part of long-term capacity building of DG Fiscal Balance in MOF

d. Latest formulas and weights for fiscal capacity and needs published in 2008 budget documents

Accomplished d. Latest formulas and weights used are published in annual budget documents

3.2 Make provision for forward estimates of major transfers to enhance capacity for

a. Preliminary design work on preparing and publishing forward estimates for all major government transfers to the

Accomplished a. System of forward estimates fully designed and incorporated into budget and financial management

Appendix 2 23

Objective Subprogram 1 Actions

Taken/Results Achieved 2006–2008

Results Indicative Subprogram 2 Milestones and Triggers

2009–2011

medium-term planning and budgeting

regions completed as part of broader central government move to the MTEF system

information systems

Accomplished b. Forward estimates progressively prepared and published for all major transfers and shared revenues after further empirical studies

3.3 Gradually reduce levels of central government funding in relation to activities that are legally regional government responsibilities, to provide space for higher priorities

a. Government regulation 7/2008 sets out guidelines for managing deconcentrated expenditure (Dekon)

Accomplished a. At least a 50% reduction in incorrect Dekon expenditure identified in the two pilot ministries studied under subprogram 1

b. Savings of Rp 4.2 trillion in incorrect allocation of central government funds for financing of regional government responsibilities in the 2008 budget for health, education, and public infrastructure

Accomplished b. Ongoing analysis of Dekon reduction options in the context of preparing annual budgets, leading to consistent documented reductions over time across remaining ministries

c. Detailed mapping and data analysis undertaken in two pilot ministries (environment and education), with draft paper and recommendations on further reductions in incorrect allocation of funds to these central government ministries for financing related to regional government responsibilities prepared for the 2010 budget

Accomplished

3.4 Improve design and management of DAK funding, allowing improved targeting of investment expenditure to priority sectors in the regions

a. DAK increased by 24% in 2008 budget to Rp21 trillion, mainly targeting health, education, and infrastructure sectors

Accomplished a. Guidelines on the use, supervision, and monitoring of DAK transfers, with focus on nine key central ministries, prepared, disseminated, and widely used

b. Joint ministerial letter (MOF, MOHA, BAPPENAS) on strengthened monitoring and evaluation of the DAK signed

Accomplished b. Performance evaluation studies show evidence of improved targeting of priority sectors in DAK transfers

24 Appendix 2

Objective Subprogram 1 Actions

Taken/Results Achieved 2006–2008

Results Indicative Subprogram 2 Milestones and Triggers

2009–2011

c. Work on updating of MOF guidelines on DAK framework and guidelines undertaken by line ministries including consideration of joint ministerial letter on DAK preparation, monitoring, and evaluation

Accomplished

3.5 Test performance- and sanctions- based elements of transfers

a. Strategy paper prepared on concepts for increased use of performance incentives and sanctions regarding transfers (e.g., timely budgets and reporting, reduced administrative outlays, better resource allocation)

Accomplished a. Agreed new incentives and sanctions implemented on a trial basis initially

b. The paper in 3.5 (a) to include coverage of mechanisms for implementing sanctions where they already legally exist, e.g., timely reporting, repayment of debts

Accomplished b. Fully implement sanctions that already exist by law, including in relation to timely submission of budgets and SIKD information and for the intercept of transfer funds to repay central debts

3.6 Ensure smooth cash releases of shared revenue transfers to address delays and unevenness in regional government budgeting

a. MOF decrees 142/2006 (natural resource revenue) and 217/2007 (oil revenue in Aceh Province) passed to provide basis for smooth and timely flows of shared revenues

Accomplished a. Ongoing empirical reviews confirm that funds continue to flow to all regional governments on time and in predictable ways

b. Timely and predictable flow of funds to regional governments achieved in 2008 as required by the law

Accomplished

4. Own Source Revenues: Reducing dependency on fiscal transfers by developing more buoyant sources of local revenues

4.1 Amend law 34/2000 on regional taxes and charges

a. Amendments to law 34/2000 being considered by parliament including move to a closed-list approach for regional taxes and devolution of property tax

Accomplished a. Disseminate and implement 2008 amendments to law 34/2000

Accomplished b. Review law 34/2000 for further amendments in line with the roadmap for reform

Appendix 2 25

Objective Subprogram 1 Actions

Taken/Results Achieved 2006–2008

Results Indicative Subprogram 2 Milestones and Triggers

2009–2011

4.2 Implement computerized system in MOF for receiving and processing regional tax laws

a. Finalize design and procurement and commence development of the new system

Accomplished a. Fully implement the new computerized system leading to large decline in backlog in processing regional taxes (50% of end-2008 backlog removed and 2008 processing times cut by 50%)

4.3 Develop a medium-term roadmap for decentralized tax reform

a. Include in the draft grand strategy for fiscal decentralization medium- to longer-term directions in relation to taxes and charges policies for decentralized locations

Accomplished a. Have the roadmap formally approved and incorporated into the NAPFD and grand strategy for fiscal decentralization papers