Competitive Futures STEEP Report: The Future of Natural Resources

-

Upload

guest30e551 -

Category

Business

-

view

649 -

download

3

description

Transcript of Competitive Futures STEEP Report: The Future of Natural Resources

A monthly report to keep you thinking about the strategic impact of

society, technology, economics, ecology and politics.

Issue #2

This month’s issue:ECOLOGY :

RESOURCE SCARCITY

2007 - 2027

Think S.T.E.E.P. to anticipate future trends

RESOURCE SCARCITYA trend at the intersection of

Ecology & Economics

Nov. 2007 STEEP Report: At a glance

The Big PictureOverview

60 Seconds with the CEO

The TrendsOil: Volatile due to demand

Water: Actually scarceCoal: The dirty secret of the future

…and many others

What to do TodayStrategic implications

Recommendations

The Big Picture60 Seconds with the CEO

OverviewSystem MapThe Timeline

THIS MONTH’S ISSUEWhy We chose…

RESOURCE SCARCITY

Here at Competitive Futures, we like to think about real disruptions to industry, not just whether the next iPhone will make waffles.Since ecological sustainability is such a hot topic these days, we wanted to know if there is any validity to the assertion that global industry is “raping the planet of its resources.” In the Future Intelligence Method, we take nothing for granted until we check the trends, and so our questions for this STEEP Report were: •Which resources are we depleting? •What do we have in reliable quantity for the next 25 – 100 years? •When might we run out?•What does it mean for business?

For the purposes of this report, we are not interested in pollution and global warming – those are equally valid issues, but the question at hand is purely about which resources maybe become scarce in the mid- to long-term future.

Industry is not going to end due to a lack of natural resources anytime in the foreseeable future. The global warming trends are disturbing, pollution is still ugly (smell the air in Beijing!) but most industrial resources will be around long after you’ve retired.

Only two resources are at risk, and for different reasons – oil and water. There is plenty of oil in the earth’s crust to supply the world for decades – the problem is in skyrocketing global demand causing shortages that could make prices fluctuate wildly.

Water is far more disturbing an issue – it’s actually running out around the world. The world needs to work together to plan to conserve this vital resource, especially as Asian economies develop and the climate appears to fluctuate.

Ask yourself if your business could be at risk from these shortages (and don’t forget about pollution.)

OIL AND WATER. The only resources we are likely to lack in the next fifty years are the two substances for which

there is little substitute – petroleum and water. Your business will change as we seek substitutes for oil, and attempt to conserve water.

The Trends

Major resources, 2007 – 2027: the one page update.

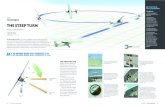

Trend #1: OIL – STILL PLENTIFUL, BUT UNSTABLE

They talk about oil scarcity, peak oil, and “what will we do after oil?”

COMPETITIVE FUTURES NEWSFLASH:

THE WORLD WILL NOT RUN OUT OF OIL

DURING YOUR CAREER!

The world has got DECADES of oil left. The problem is, as Chinese and Indian economies heat up, global demand for energy will outstrip refining capacity. When world demand outpaces global supply, the price can fluctuate wildly.

Also, most of the oil is located in politically unstable places, so when it looks like a source of oil supply might go nuts (i.e. Iran, Saudi Arabia) supply tightens up and the cost of a barrel of oil could vary considerably.

The future is not scarce oil, it’s unstable oil that should concern you. Some oil fields are dropping off in productivity, but in the near term, it’s the acute shortages that should concern you. War in Iran, nuclear exchange between Pakistan and India, OPEC restriction of capacity, economic expansion – these will keep oil unsteady through the next two decades.

Trend #1: OIL – STILL PLENTIFUL, BUT UNSTABLE

Look ma, no refining capacity! At only 3% over capacity, the likelihood is much higher of speculators panicking and driving oil prices sky high – even if for only a while.

Check out world refining capacity, according to British Petroleum

Ah, the good old days of 1990 – refining capacity is a comfortable 13% over supply.

World demand for energy increasing as China and India come on to W1 industrial status

109% capacity assumes petroleum companies will invest in additional refineries – but where?

Trend #1: OIL

Further out on the horizon, new technologies are coming online to make oil out a variety of unlikely sources.

Thermal depolymerization

Make light sweet crude out of tons of old

turkey guts. No, really!

Direct Carbon Fuel Cells -

Takes peat moss, cow manure, wood chips, anything carbon and converts it to fuel

How long before we gas our cars like Back to the

Future?

(Probably a while, but cool to think about)

Trend #2: WATER – THE REAL SCARCE COMMODITY

Here’s the one to panic about. We can debate global warming until we’re blue in the face. We can use solar panels to heat the house AND fuel the electric car. But there’s no replacing fresh water – which is only .007% of water on earth

• Fresh water is the most serious situation in terms of scarcity

• Water tables are falling on all continents

• Its lack will constrain agriculture and industry

• New technology to curb the problem (i.e. low power desalination) is years away

• Source of political instability

Water hotspots around the world – 2007 - 2027

Mexico city

Near East:Jordan, Syria, Israel – drinking from the same aquifer!

Egypt

Andalucia

Subsaharan Africa

Ogalalla Acquifer

N.S.W. Australia

China - $11 billion in lost manufacturing due to polluted water!

Trend #3: COAL – an endless supply

The world has between 150 and 250 years of coal - the material that built the 19th century will provide the majority of electricity for the 21st century

China and the United States have major surpluses – no end in sight

This will have a major impact on global warming and air pollution if the world uses old, dirty technologies. HOWEVER the FutureGen Plant (pictured) is a prototype of a coal fired power plant that will produce zero carbon and zero emissions. The project is expected to cost $1.5 billion, and no timeframe has yet been given as to when it will come online.

COAL – THE DIRTY SECRET OF THE FUTURE

Trend #4: Natural gas – plenty left

Mostly regional markets due to difficulties of transportMany deposits are located in a variety of politically-fractious areas – Russia, Iran, Middle EastUSA has 70 years of natural gas at current consumption ratesGlobal supply expected to continue for decades

Natural gas remains plentiful and will generally remain at parity in its position in the energy mix.

Trend #5: Minerals – driven by demand, not supply

Scarcity is only ever man-made when it comes to minerals. The only limiting factor is production capacity and industrial demand

U.S. Geologic Survey reports abundant supply of most precious metals for the foreseeable future

New mining techniques such as “Extremophile” mining, and “Swiss Cheese” drilling technologies will increase productivity of mining in the next 25 years

Trend #6: ARABLE LAND – no shortage.

The world has plenty of arable land and no shortage in sight – except for through disruptions caused by climate change.

Most agricultural failure caused by poor farming technique, climate changes, military conflict.

Only China is losing arable land, at the rate of 1% per year, primarily due to industrial pollution and water scarcity.

Trend #7: BIODIVERSITYIndustrialization has been accompanied by an increase of extinction – but few industries require tree frogs on a daily basis.

Polar bears are getting a raw deal, but from a purely industrial point of view, you likely won’t be affected. Not trying to be crass here, but industry is unlikely to be constrained by losing biodiversity.

It is still important – but businesses will not be affected in the same way petroleum shortage causes new technologies and methods.

What To Do Today

WHY THIS FUTURE IS DIFFERENT

Every business requires resources of some sort.

Economies live and die by reliable, inexpensive access to resources.

Shortages of resources will lead to increased tension of all kinds: ecological, economic, geopolitical.

Resources that were readily available in the 20th century may have entirely different costs associated with them in the 21st Century.

Some resources upon which we rely will fluctuate considerably in price and availability.

You need to know where you are most exposed to risk (and possibly, opportunity) from resource scarcity

– and what it could mean.

Strategic implications – why you should care

Micro-cities are on the rise; suburbs and exurbs will be more

expensive

China may not be a reliable place for

manufacturing if oil prices are liable to

skyrocket

We’ve used cheap oil and water to develop far away from the city centers. As petroleum becomes more expensive and its price fluctuates, living 25 miles from the city center will be more costly for workers, who will turn to micro-cities, satellite communities near urban areas. This will reshape the urban landscape – with major implications just by itself.

World 1 nations have shipped significant proportions of their manufacturing sector to China for the low cost of production. This depends on shipping that can get such goods back from China. As the proportion between supply and demand gets thinner, the cost of oil could be even less reliable, occasionally shooting into the stratosphere. This will make distant manufacturing less reliable.

Any product that depends on oil will be

impacted

Naturally, oil is used for more than putting in gas tanks. Plastics, other materials, and petrochemicals in general will vary wildly in price, impacting the supply chain of countless other industries. Is yours one of them?

Strategic implications – why you should care

Water. Where are you getting yours

from?

The end of Just-In-Time inventory?

Farms need it. Industry needs it. You need it to drink. There’s no replacement for water. This is a simple question, but if you have a serious need for water in your industry, what is your long-term plan?

Many manufacturers have come to rely on Just In Time inventory to control costs and meet customer demands. That relies on inexpensive shipping – which in turn relies on cheap oil. Even if oil is only periodically high priced, think of disruptions that could come to finely-tuned JIT inventory systems.

The Long Tail? What’s that?

Furthermore, we’ve heard about the rise of mass customization for years. Chris Anderson’s The Long Tail talks about “selling less of more,” meaning lots of personalized combinations for manufacturers. Again, this requires low inventory stocks and inexpensive shipping. With pricey oil, might we not be getting back to bigger inventories and fewer part numbers to keep end user prices low?

Strategic implications – why you should care

Geopolitical tension increases between

East and West

Even though many resources are artificially scarce through the market – competition will still be fierce, especially as China and India industrialize further. China has made 2500 deals with African nations to supply raw materials – sometimes at the expense of Western manufacturers. This may lead to increased geopolitical tension, and fiercer competition in general.

There’s little doubt that coal is the energy source of the future. It’s available, reliable, and the Chinese and Americans have centuries worth of it. Using 20th Century technology, this could be a disaster for pollution alone, without even mentioning global warming. Clean coal technology will no doubt be a trillion dollar opportunity.

Mega-sized business opportunity: Clean

up coal

Not every place is lacking in water. Southern California is parched; Vermont is soaked. Spain needs fresh water; England is so wet, it’s moldy. In the next 20 years, water will become a truly global issue, touching not only localities, but affecting policies at the national and global level. Regions that have not had to deal with the water issue may be drawn into the new politics.

Water goes from local issue, to global

commodity

Strategic implications – why you should care

The traveling salesman may be a thing of the past

The profit structure is about to be turned

on its head

Is your marketing based on salesmen driving their own cars for thousands of miles a month? Are your business development people road warriors with thousands of frequent flyer miles? Sharply fluctuating petroleum could make that kind of travel impossible – and disrupt your marketing!

Most 20th Century economic activity was based on access to cheap water and cheap oil. Today, skills and intellectual property have become expensive, while we take water and oil for granted. In the 21st Century – these will be the most expensive of commodities – turning our precious assumptions on their head. This is quite a major development all by itself…

Our major question in this STEEP report was whether resource scarcity might permanently constrain industries in coming years. Even with world economies chugging along as they are, most industries will be unimpeded by a permanent lack of resources. Water is the only thing that could run permanently dry, though this is more likely to affect poor countries first. Essentially, the global industrial system will not be stopped by a lack of resources in the foreseeable future. This doesn’t mean global climate change or pollution will stop…and maybe that’s the bigger point here.

Things could go on like this for years! (for better or for

worse)

Recommended options:What can you do today?

Think of a future of limited transportation – and think

LESS AND LOCAL

Water efficient buildings

Think systemically about price fluctuation and what

it means to you

Check your suppliers for what they think about this

issue

Even if these forecasts don’t apply directly to your organization, think about other stakeholders. Does your supply chain have a long term plan in place to deal with such shortages? What might you do with oil at five times its usual cost? What about natural gas? What do your customers think? Make sure you start contingency planning.

Globalization thus far has been about China and India – going wherever cheap labor is at. This relies on petroleum – you’ll be better off closer to your markets. Consider what it might mean to transition basic industry back to Western shores – we may be required to do so because of fluctuating petroleum.

In your processes or in your physical plant, think about converting to water saving systems, designs, architecture. This could be a source of cost-cutting that could confer competitive advantage over those who don’t take these forecasts seriously enough.

It may not just your business model – think broadly (STEEP) to figure out where you might be at risk in the resource intensive future. A company that makes mold injected plastic furniture will not be affected the same way as a doctor’s office by these forecasts. Make a list of what resources you use and forecast your own bumps in the road.

ContactFor more information or to discuss what

this means for you, contact:

[email protected](202) 508-1496