COMPARISON OF VOLATILITY AND BETA OF IPO OF COMPANIES IN GRADE BUCKETS

-

Upload

anshuman-dutta -

Category

Education

-

view

1.384 -

download

1

description

Transcript of COMPARISON OF VOLATILITY AND BETA OF IPO OF COMPANIES IN GRADE BUCKETS

COMPARISON OF VOLATILITY AND BETA OF IPO OF COMPANIES IN GRADE BUCKETS

SUBMITTED BY215111050: SATHYANARAYANAN R

215111070: ANSHUMAN DUTTA215111091: SARANYAN V S

MBA II YEARDOMS-NITT

Introduction

• Initial Public Offerings (IPO) in the period of 2008-2012 immediately after the economic recession have become debatable due to the loss of investors' money, primarily the retail investors.

• Volatility of the stock prices which were offered during this period make for an interesting study.

• Whether IPO grading has any effect on the behavior of the companies' stock prices is also interesting. Comparing across grades would justify the fundamental strength of some companies.

• Comparison of stock price movement with Nifty index movement to identify the direction of movement

Literature review• LOWRY, M., OFFICER, M. S. and SCHWERT, G. W. (2010), The

Variability of IPO Initial Returns. The Journal of Finance, 65: 425–465. doi: 10.1111/j.1540-6261.2009.01540.x

• Saikat Sovan Deb, Vijaya B. Marisetty, Information content of IPO grading, Journal of Banking & Finance, Volume 34, Issue 9, September 2010, Pages 2294-2305, ISSN 0378-4266, 10.1016/j.jbankfin.2010.02.018.

• Christopher B. Barry and Robert H. Jennings, The Opening Price Performance of Initial Public Offerings of Common Stock, Financial Management, Vol. 22, No. 1 (Spring, 1993), pp. 54-63

Theory/Model

Volatility

• A statistical measure of the dispersion of returns for a given security or market index. Volatility can either be measured by using the standard deviation or variance between returns from that same security or market index. Commonly, the higher the volatility, the riskier the security.

• In other words, volatility refers to the amount of uncertainty or risk about the size of changes in a security's value. A higher volatility means that a security's value can potentially be spread out over a larger range of values.

• This means that the price of the security can change dramatically over a short time period in either direction. A lower volatility means that a security's value does not fluctuate dramatically, but changes in value at a steady pace over a period of time.

Beta/CAPM

• The Capital Asset Pricing Model (CAPM) is a model for pricing an individual security or portfolio. For individual securities, we make use of the security market line (SML) and its relation to expected return and systematic risk (beta) to show how the market must price individual securities in relation to their security risk class.

• The SML enables us to calculate the reward-to-risk ratio for any security in relation to that of the overall market. Therefore, when the expected rate of return for any security is deflated by its beta coefficient, the reward-to-risk ratio for any individual security in the market is equal to the market reward-to-risk ratio.

Data description

• Three companies are selected on a random basis under each IPO grades viz. 1 to 5.

• Historical share price data were collected from NSE India website for each company covering a period of 12 months from the date of share issue.

• Corresponding historical S&P CNX NIFTY index data are also collected from NSE India website.

• Open price: The price at which a security first trades upon the opening of an exchange on a given trading day.

• Close price: The final price at which a security is traded on a given trading day.

• Performance indicator: The Performance indicator displays a security's price performance as a percentage.

• Issue price: The price at which a new security will be distributed to the public prior to the new issue trading on the secondary market. Also commonly referred to as offering price.

• S&P CNX Nifty: It is a well diversified 50 stock index accounting for 22 sectors of the economy. It is used for a variety of purposes such as benchmarking fund portfolios, index based derivatives and index funds. It reflects the return one would get if investment is made in the index portfolios. As Nifty is computed in real-time, it takes into account only the price movements.

Index Return = (Current index- Prev. index)/ Prev. index.

• Actual historical volatility: It refers to the volatility of a financial instrument over a specified period but with the last observation on a date in the past. This is the standard deviation of the returns of the instrument.

• IPO grades: It is designed to provide investors an– Independent, reliable, relative and consistent

assessment of IPO

• The assessment is in relation to the universe of other listed equity securities in India.

• It is a one-time exercise done at the time of issuance.• Assessment includes

– Business prospects– Financial prospects– Management quality– Corporate governance

IPO Grade Assessment

5 Strong fundamentals

4 Above average fundamentals

3 Average fundamentals

2 Below average fundamentals

1 Poor fundamentals

Empirical analysis using analytical tools & Interpretation of Results obtained

Volatility

In the table 1, we can clearly find that the first day returns of the companies that went for IPO are abnormal. Considering the returns of the index, fluctuation of the prices seem to be curiously bizarre. This raises doubts that the stocks may be underpriced or overpriced deliberately. The trend almost continues till the end of the first month. This can be confirmed with the calculation of Historical Volatility.

S.No Company IPO grade Date of issueIssue price

(Rs)

IPO stock

returns

NiftyIndex returns

1 TARAPUR TRANSFORMERS LIMITED 1 18-May-10 75 -23.47 -1.27

2 ONELIFE CAPITAL ADVISORS LIMITED 1 17-Oct-11 110 32.68 -0.87

3 EDSERV SOFTSYSTEMS LIMITED 1 02-Mar-09 60 129.5 1.97

4 GOENKA DIAMOND & JEWELS LIMITED 2 16-Apr-10 135 -5.48 -0.21

5 TEXMO PIPES & PRODUCTS LTD 2 10-Mar-10 90 52.39 0.296 D B REALTY LIMITED 2 24-Feb-10 468 -2.52 -0.24

7 SANGHVI FORGING AND ENGINEERING LTD 3 23-May-11 85 31.76 -1.82

8 INNOVENTIVE INDUSTRIES LIMITED 3 13-May-11 117 -19.62 1.079 FUTURE VENTURES INDIA LIMITED 3 10-May-11 10 -18 -0.18

10 MUTHOOT FINANCE LIMITED 4 06-May-11 175 0.51 1.6811 PUNJAB & SIND BANK 4 30-Dec-10 120 5.96 0.6812 GODREJ PROPERTIES LIMITED 4 05-Jan-10 490 9.64 0.8713 L&T FINANCE HOLDINGS LIMITED 5 12-Aug-11 52 -3.75 -1.2714 MOIL LIMITED 5 15-Dec-10 375 24.01 -0.8715 COAL INDIA LIMITED 5 04-Nov-10 245 39.82 1.97

Actual historical Volatility ( based on Arithmetic

returns)

Month

S.No Company Day 1

return1 2 3 4 5 6

1 TARAPUR TRANSFORMERS LIMITED -23.47 6.29 1.58 1.79 1.76 1.41 3.35

2 ONELIFE CAPITAL ADVISORS LIMITED 32.68 11.87 4.61 4.21 3.15 5.02 9.69

3 EDSERV SOFTSYSTEMS LIMITED 129.5 31.01 4.27 4.45 3.78 4.17 3.86

4 GOENKA DIAMOND & JEWELS LIMITED -5.48 3.93 2.51 1.37 1.81 3.68 2.05

5 TEXMO PIPES & PRODUCTS LTD 52.39 13.30 2.44 3.24 2.75 1.24 4.59

6 D B REALTY LIMITED -2.52 1.98 0.94 1.48 1.57 2.00 3.22

7 SANGHVI FORGING AND ENGINEERING LTD 31.76 10.55 3.00 3.47 3.22 3.41 5.67

8 INNOVENTIVE INDUSTRIES LIMITED -19.62 5.33 2.03 2.56 2.36 2.92 1.44

9 FUTURE VENTURES INDIA LIMITED -18 4.73 2.50 2.36 1.99 2.11 1.02

10 MUTHOOT FINANCE LIMITED 0.51 2.96 2.28 1.81 3.13 1.97 2.27

11 PUNJAB & SIND BANK 5.96 2.14 2.15 1.33 1.57 1.54 1.50

12 GODREJ PROPERTIES LIMITED 9.64 2.47 1.83 1.42 1.13 1.67 2.50

13 L&T FINANCE HOLDINGS LIMITED -3.75 3.31 1.56 1.33 1.88 1.37 1.18

14 MOIL LIMITED 24.01 5.57 1.57 1.23 1.52 0.87 1.20

15 COAL INDIA LIMITED 39.82 9.00 1.29 1.14 3.22 1.84 1.76

Actual historical Volatility ( based on Arithmetic returns)

Month

S.No Company 7 8 9 10 11 12

1 TARAPUR TRANSFORMERS LIMITED 2.83 1.56 2.54 2.05 2.46 1.33

2 ONELIFE CAPITAL ADVISORS LIMITED 1.43 1.81 7.08 3.32 3.23 2.27

3 EDSERV SOFTSYSTEMS LIMITED 3.49 4.37 4.24 3.15 3.55 2.69

4 GOENKA DIAMOND & JEWELS LIMITED 3.16 5.56 2.11 3.60 2.70 3.11

5 TEXMO PIPES & PRODUCTS LTD 5.61 2.01 3.84 2.14 2.25 2.67

6 D B REALTY LIMITED 2.19 1.38 2.59 5.99 2.51 4.11

7 SANGHVI FORGING AND ENGINEERING LTD 4.43 3.02 7.23 4.03 5.46 4.09

8 INNOVENTIVE INDUSTRIES LIMITED 1.62 2.67 2.52 2.87 1.61 1.79

9 FUTURE VENTURES INDIA LIMITED 1.69 0.87 0.60 0.69 2.03 1.73

10 MUTHOOT FINANCE LIMITED 1.85 1.58 1.53 2.23 3.34 1.44

11 PUNJAB & SIND BANK 0.64 2.08 1.75 1.46 1.53 1.49

12 GODREJ PROPERTIES LIMITED 1.87 2.45 1.29 1.56 1.93 1.76

13 L&T FINANCE HOLDINGS LIMITED 2.14 1.85 1.35 1.28 1.35 0.97

14 MOIL LIMITED 1.76 2.28 0.95 1.75 1.05 1.59

15 COAL INDIA LIMITED 2.52 1.66 2.53 2.21 2.16 2.15

• The first month Volatility of the stock seem to indicate that there may be manipulations behind the changes in the stock prices.

• Such excessive price changes may lead to retail investors being affected. The first day return affects the volatility calculation to a large extent.

• A few companies in the list such as L&T, Muthoot finance and DB realty seem to have fluctuated to a lesser extent. But a majority of them, mainly those in the grade 1 (poor fundamentals) seem to be very volatile.

• But the historical volatility seems to stabilize over the coming months of 2 to 6, indicating a saturation period.

• In the months 7-12, companies seem to stabilize in a range and can be said to be not highly volatile. Volatility is observed to be concentrated mainly in the 1-2 region which is quite acceptable.

Month 1 2 3 4 5 6 7 8 9 10 11 12

IPO Grade 1 16.39 3.49 3.49 2.89 3.53 5.63 2.59 2.58 4.62 2.84 3.08 2.10

IPO Grade 2 6.40 1.96 2.03 2.05 2.31 3.29 3.65 2.98 2.84 3.91 2.49 3.30

IPO Grade 3 6.87 2.51 2.80 2.52 2.82 2.71 2.58 2.19 3.45 2.53 3.03 2.54

IPO Grade 4 2.52 2.09 1.52 1.95 1.73 2.09 1.45 2.04 1.52 1.75 2.27 1.56

IPO Grade 5 5.96 1.47 1.23 2.21 1.36 1.38 2.14 1.93 1.61 1.74 1.52 1.57

Month-wise Average Volatility

• If we perform a grade wise analysis, we can observe that the most volatile is grade 1, that too in the initial period.

• As we proceed towards better fundamentals, we can see lesser volatility.

• Grade 5 shows slight abnormality in the first month but quickly stabilizes in the coming months to become the least volatile grade in the months 2 to 12.

• Grade 4 almost stabilizes in the first month and maintains similar volatility throughout in the first year.

• Grades 2 and 3 seem to perform in a similar manner with moderate volatility in the months 2-12 with a higher volatility in the first month.

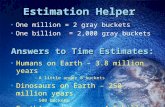

• The Volatility versus time graph is plotted in figure 1 to understand the comparison between grades. We can see that during months 2 to 12, all grades have similar volatility.

1 2 3 4 5 6 7 8 9 10 11 120.00

2.00

4.00

6.00

8.00

10.00

12.00

14.00

16.00

18.00

IPO Grade 1IPO Grade 2IPO Grade 3IPO Grade 4IPO Grade 5

Beta Analysis

S.No CompanyBeta value

(Unstandardized)

Beta value

(Standardised)

1 TARAPUR TRANSFORMERS LIMITED 0.919413 0.363

2 ONELIFE CAPITAL ADVISORS LIMITED 0.250058 0.049

3 EDSERV SOFTSYSTEMS LIMITED -0.14061 -0.03

4 GOENKA DIAMOND & JEWELS LIMITED 0.971757 0.345

5 TEXMO PIPES & PRODUCTS LTD 0.713958 0.159

6 D B REALTY LIMITED 0.751851 0.275

7 SANGHVI FORGING AND ENGINEERING LTD 0.386519 0.091

8 INNOVENTIVE INDUSTRIES LIMITED 0.397242 0.186

9 FUTURE VENTURES INDIA LIMITED 0.414221 0.242

10 MUTHOOT FINANCE LIMITED 0.659887 0.361

11 PUNJAB & SIND BANK 0.615028 0.475

12 GODREJ PROPERTIES LIMITED 0.651177 0.346

13 L&T FINANCE HOLDINGS LIMITED 0.718517 0.275

14 MOIL LIMITED 0.435293 0.258

15 COAL INDIA LIMITED 0.710486 0.543

• We can see that the movement of the asset is generally in the same direction as, but less than the movement of the benchmark, since it is in the range of 0 to 1. Only one stock moves in the opposite direction as compared to the index(Beta<0).

• One stock has beta close to 0 which indicates that the movement of the stock is uncorrelated with the movement of the benchmark index. Not much comparison could be done across grades prima facie. But Grade 4 seems to have a similar movement with respect to the index.

• The companies having more than average fundamentals follow the index more than those with less than average fundamentals.

Conclusion

• We can conclude that the stocks which have made IPO's during the research period of 2009-2011 have been heavily mispriced and underwent high fluctuations. They have been highly volatile during the first month but stabilized in a range during the upcoming months.

• The IPO's of companies which have poor fundamentals had the highest volatility among the different IPO grades during the first month.

• The companies having strong fundamentals were the least volatile during the months 2 through 12.

• Most companies across grades made movements in the direction of the benchmark index but less than the benchmark's movement in the 1-year period after its IPO even though fluctuations have happened.

References

• VIII. References:• 1.http://articles.economictimes.indiatimes.com/2013-01-03/news/36130545_1_ipos-

small-investors-issue-price• 2. http://en.wikipedia.org/wiki/Capital_asset_pricing_model• 3. http://www.sebi.gov.in/faq/ipograding.html• 4. http://www.investopedia.com/• 5. http://www.crisilratings.com/Crisil/capital-markets/ipo-grading.jsp?check=ipo

%20signup• 6. http://www.nseindia.com/products/content/equities/indices/s_n_p_cnx_nifty.htm• 7. http://en.wikipedia.org/wiki/Beta_(finance)• 8.

http://en.wikipedia.org/wiki/Rate_of_return#Logarithmic_or_continuously_compounded_return

• 9. http://en.wikipedia.org/wiki/Volatility_(finance)• 10.http://www.nseindia.com/live_market/dynaContent/live_watch/get_quote/

GetQuote.jsp?symbol=COALINDIA

![All Over You - punchdrunkband.compunchdrunkband.com/songpdfs/BobDylanSongs2019February.pdf · Buckets Of Rain . Bob Dylan [I] Buckets of rain, buckets of tears Got all them buckets](https://static.fdocuments.in/doc/165x107/5c72397c09d3f2601f8bc52b/all-over-you-buckets-of-rain-bob-dylan-i-buckets-of-rain-buckets-of-tears.jpg)