COMPANY PROFILE - marketscreener.com · COMPANY PROFILE FANUC’s businesses were founded in 1956...

Transcript of COMPANY PROFILE - marketscreener.com · COMPANY PROFILE FANUC’s businesses were founded in 1956...

COMPANY PROFILE

FANUC’s businesses were founded in 1956 when it started to

develop numerical controls (NCs) and servo systems. FANUC

LTD was established in July 1972 when the Computing Control

Division became independent from FUJITSU.

Since its founding, FANUC has always emphasized research and

development in its management.

Keyaki

1

FINANCIAL HIGHLIGHTS FANUC LTD CONSOLIDATED BASISIn millions of yen and thousands of U.S. dollars except per share data.

Net salesNet incomeCash dividends

Per share Net income: Basic Fully diluted Cash dividends

Operating income to net sales

Millions of yen Millions of yen Millions of yen U.S. dollars

226,070 209,021 264,083 2,131,420

43,147 39,375 47,242 381,291

5,748 5,748 5,748 46,392

Yen Yen Yen U.S. dollars

180.2 164.4 197.3 1.592

24.0 24.0 24.0 0.194

31.6% 30.5% 33.3% 33.3%

1999 2000 2001

Thousands of

Note: The U.S. dollar amounts shown above and elsewhere in this annual report are converted from yen, for convenience only, at the rate of

¥123.9=U.S.$1.00.

Net sales (U.S.$ millions)

1997 1998 1999 2000 2001 1997 1998 1999 2000 2001 1997 1998 1999 2000 2001

Net income per share (Basic)(U.S.$)

Cash dividends per share(U.S.$)

1,4831.028

1.237

1.454

1.327

1.5920.18

0.19 0.19 0.19 0.19

1,863 1,8251,687

2,131

Years ended March 31

2

A MESSAGE FROM SENIOR MANAGEMENT

Based on its strength in research and devel-

opment, the FANUC Group is focussed on

the creation of new products with superior

global competitiveness. The FANUC

Group’s products are manufactured in its

highly efficient factories which feature

advanced robotization. The FANUC Group

is dedicated to expanding the global market

share of its products, with the extensive

sales and service network of FANUC in

Japan as well as that of its joint venture, GE

Fanuc Automation, and its subsidiary,

FANUC Robotics.

Fueled by vigorous investment in

Information Technology (IT) facilities, the

Japanese machinery industry prospered

during Japan’s fiscal year 2000. In general,

the machinery industry also remained

strong overseas. Under these favorable con-

ditions, the FANUC Group increased its

production capacity to meet an increased

number of orders. With respect to product

development, the Group successfully imple-

mented its basic R&D principles of “improv-

ing the reliability”, “cutting costs”, and

“designing with the minimum number of

parts”. The Group also made significant

efforts to cut expenses.

The FANUC Group posted ¥264,083 million

in sales for the fiscal year ending March

2001. Ordinary income was ¥93,104 million,

and net income was ¥47,242 million.

The world’s major economies are expected

to continue slowing during 2001. In antici-

pating of these difficult circumstances, the

FANUC Group will aggressively focus its

attention on its four key areas of “intelli-

gence” and “super-precision” in research &

development, “robotization” in production,

and greater IT sales & service. Additional

emphasis will be placed on the partnerships

among FANUC, GE Fanuc Automation, and

FANUC Robotics in the US and European

markets. The Group plans to initiate an

expansion of its sales & service facilities in

3

FANUC Headquarters

Asian and Oceanic markets.

The FANUC Group is committed to making

every effort to generate growth in its busi-

ness by expanding the global market share

for all of its products. We look forward to

the continued support and guidance of our

customers, shareholders, and stakeholders.

4

Ryoichiro NozawaChairman

Shigeaki OyamaPresident

Shimpei KatoSenior Executive Vice President

Dr. Eng. Yoshiharu InabaSenior Executive Vice President

Dr. Eng. Seiuemon InabaHonorary Chairman

Ryoichiro NozawaChairman

Shigeaki OyamaPresident

Shimpei KatoSenior Executive Vice President

Dr. Eng. Yoshiharu InabaSenior Executive Vice President

FA GROUP

Sales of FANUC CNCs and servo motors

expanded, especially in Japan.

New developments in 2000 included the ultra

compact and ultra thin FANUC Series 16i /18i

/21i -MODEL B CNC with networking capabili-

ties, enabling remote diagnosis from remote

locations by cellular phone. These new models

come standard with the ability to centrally con-

trol machine tools via Ethernet, resulting in a

dramatic improvement in machining productivi-

ty. Nano-meter* level control is possible in the

Series 16i-MODEL B, allowing high speed

machining of dies and parts with unprecedented

precision.

In the servo motor field, the new FANUC AC

SERVO MOTORαi series was developed to

succeed and improve on FANUC’s high-speed

and high-precision AC SERVO MOTORαseries,

which is recognized for its energy saving capa-

bility. The new motors are smaller in size, but

feature the same smooth revolution and quick

acceleration as existing FANUC models.

Another promising development is the low cost

and highly reliable positioning motor, FANUC

AC SERVO MOTOR βM series, ideal for con-

trolling peripheral equipment of smaller

machine tools. This servo motor series also has

the potential to meet demand for industrial

machines other than machine tools.

Overall, sales of the FA Group totaled ¥131,049

million, up 34.9% over the previous fiscal year,

accounting for 49.6% of the FANUC Group total sales.

* One billionth of one meter.

5

REVIEW OF OPERATIONS

FANUC Series 16i/18i/21i-MODEL B

The model is equipped with a high-speed PMCwith large capacity for reducing machining cycletime. Their built-in Ethernet communicationfunctions facilitate central management of themachines by networking.

FANUC SERVO MOTOR αi seriesThe line-up includes the AC SERVO MOTORαiseries in reduced length with higher output, theAC SPINDLE MOTORαi series featuring high-speed, high-acceleration and high output, and thespace and energy saving SERVO AMPLIFIERαiseries.

FANUC Linear Motor seriesThe Linear Motor series is ideal for ultra highspeed axis-feed with its high-acceleration andhigh-thrust capabilities. The series features highprecision and is almost free of maintenance,which has been realized through the eliminationof ball screws or other wear parts in its mechani-cal unit.

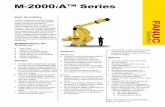

ROBOT GROUP

Driven by a strong recovery of sales in the

Japanese automotive industry, FANUC

robots continued to post robust gains in

Japan. Overseas sales also remained strong.

The new developments included the

FANUC Robot R-2000iA, a high-quality and

high-performance, multi-purpose intelligent

robot priced competitively for a variety of

applications including spot-welding, materi-

al handling*, assembly, and laser machining.

The FANUC robot product line has also

expanded with the addition of the FANUC

ROBOWELD i series, a robot welding sys-

tem that combines a robot and arc welding

equipment. The system makes it easier for

the robot controller to give commands to the

welding power supply, thereby improving

the operability.

Bolstered by strong orders from the IT

industries, sales of FANUC ROBOSHOT,

an electric plastic injection molding machine

with artificial intelligence, expanded signifi-

cantly, especially in the Japanese market.

Improvements to the FANUC SUPER-

SHOTα-100 iA, a linear motor driven elec-

tric super high-speed injection molding

machine, have transformed it into a volume pro-

duction model. The FANUC SUPERSHOT

α-100 iA features enhanced precision for

molding smaller parts, enabled by its super

high-speed injection capabilities.

The FANUC ROBOnano Ui , a super preci-

sion multi micro machine, was improved by

adding a function to automatically correct a

slight inclination of the spindle, thus

enabling increased precision in machining.

Based on an increasing number of sales

inquiries, the market for the super precision

multi micro machining is expected to grow.

Both FANUC ROBOCUT, a wire-cutting

electric discharge machine, and FANUC

ROBODRILL, a CNC drill, posted a sub-

stantial increase in both domestic and over-

seas sales.

Other developments include the addition of

new functions to the FANUC ROBOCUT

α-i A series to enhance its precision. New

models were also added to the line-up of the

high-speed, multi-purpose AI CNC drill,

FANUC ROBODRILL α-T14i B series.

The Robot Group accounted for 41.8% of the

FANUC Group 2000 total sales, or ¥110,270

million, an increase of 19.2% over the previ-

ous period.

* Material handling is an automatic transfer

of parts and workpieces.

6

7

FANUC Robot R-2000iAThe all-purpose intelligent robot comes withthe improved reliability and cost-effectivenessthat had already been established in the exist-ing S-420, S-420i, S-430i robots. The newlydeveloped robot controller R-J3iB is equippedwith the latest functions in servo, networkingand sensor control, designed to realize artificialintelligence of the robot.

FANUC Robot I-21iThe inteligent robot is equipped with vision and tactile sen-sors and performs sophisticated assembly jobs of a skilledworker. In assembly, the vision sensor enables the robot tohold the parts with accuracy and the tactile sensor ensuresthe smooth insertion of the parts. The robotization of theassembly line will help the customers in realizing a compet-itive production system.

FANUC ROBOWELD 100iAThe digital communication links the robot controller withthe welding power supply, integrating all of the robot, weld-ing power supply, torch, cable and wire feeder into a systempackage, which results in an improved welding quality. Thesystem comes with a built-in digital packaging capability toset and adjust the welding conditions with ease, therebybringing about high efficiency and productivity.

8

FANUC ROBOSHOT

S-2000i seriesThe electric injection molding machine with thehigh basic performance features the latest con-troller and servo system in its highly reliablemechanical unit. It also comes with enhanced AIfunctions that are unique to FANUC, realizing pre-cise and stable molding of parts, which havebecome increasingly specialized and complex.

FANUC ROBOCUTα-0i BThe small high-precision wire-cut EDM machinefeatures a 100% improvement in the best surfaceroughness. Its sales is expected to grow in highprecision markets including semi-conductor diesthat require smoother machining surface.

FANUC ROBODRILLα-T14i CThe CNC drill is equipped with the newest controllerand servo system for performing high-speed, high-pre-cision and high-efficiency machining. It is small butcapable of highly precise and powerful cutting, suitablefor a wide range of machining jobs including partsmachining such as drilling and tapping, 3-dimensionalmodel machining and electrode machining.

The FANUC CS 24i is a membership service, which pro-vides enhanced service based on computers andInternet. The new services, added to the existing nighttime telephone and parts ordering services, include the“Remote Diagnosis” that diagnoses the trouble of cus-tomers’ equipment from the computers at the FANUCheadquarters, the “Technical Information SearchSystem” that searches and displays the informationrequired for machine operation and maintenance, andthe “Repair Parts Ordering Service” that supplies cus-tomers with the parts via Internet. These new servicesare expected to increase customers’ confidence in theFANUC products.

9

Internet or�Telephone

Remote Diagnosis�Technical Information�Search System�Repair Parts Ordering�Service

Customer FANUC

CS 24i

SERVICE GROUP

The Service Group sales were ¥22,763 mil-

lion in fiscal year 2000, up 17.2% over the

previous year, accounting for 8.6% of total

Group sales. The Service Group was relocat-

ed in the 2000 fiscal year from the Hino

Complex in Tokyo to the Headquarters area

in Yamanashi Pref. adjacent to the Sales

Group, which has brought about the closer

relationship between them to further

enhance customer satisfaction.

Research and development is the foundation

of the FANUC Group’s pursuit of global

market share expansion. At the beginning of

the year, the annual development policy was

set forth at a meeting which included

FANUC, GE Fanuc Automation, a joint

venture responsible for the American and

European FA markets, and FANUC

Robotics, a FANUC subsidiary in charge of

the American and European robotic mar-

kets.

Based on the development policy, FANUC’s

Hardware, Servo, Robot, Robomachine and

Software Laboratories, and Software

Development Center strive to develop glob-

ally competitive products based on the key

focus areas of “intelligence” and “super pre-

cision”.

In addition to product development,

FANUC engages in research and develop-

ment for the future. The Basic Research

Laboratory participates in the Japanese

national R&D project on micro machines

and improved positioning capabilities of

MICRO ARM*1 developed by FANUC for

micro factories*2.

The Laser Laboratory pursues the develop-

ment of the highly efficient slab type*3 YAG

laser with 10kW output and laser diode exci-

tation*4 in the national “Photon Measurement

& Machining Project”.

FANUC also takes part in the national

“IMS*5 Holonic Manufacturing Systems

Project”*6.

*1 A robot with an arm length about the size

of a human finger.*2 A small factory about the size of a desk,

for example.*3 YAG (Yttrium, Aluminium and Garnet)

crystal that has the shape of a slab, capa-

ble of generating laser beam with a better

quality than the rod type, which brings

about higher machining capabilities.*4 The crystal is excited by a laser diode

(semiconductor laser) to generate the

laser beam.*5 An abbreviation of Intelligent Manufacturing

Systems, an international R&D project,

established to develop the next generation

manufacturing and machining technolo-

gies.*6 A production system with improved versa-

tility realized through each Holon, a pro-

duction element, making an autonomous

judgment and decision to cooperate with

each other. An intelligent robot is an

example of the production element.

10

RESEARCH & DEVELOPMENT

11

The ultra precise complex micromachine is a product of FANUC’sadvanced technologies in CNC,servo and machine, featuring fric-tion-free servo using air bearing.The machine is capable of stableparts machining in sub-micron orone 10 millionth meter level of pre-cision with the surface roughnessat a nano-meter level.

FANUC ROBOnano Ui

RESEARCH & DEVELOPMENT

12

MANUFACTURING GROUP ACTIVITIES

The Sales Group pursues vigorous sales

promotion activities to increase the mar-

ket share of the FANUC products. New

product shows are regularly held at a

building in the headquarters area which

has a magnificent view of Mt. Fuji, provid-

ing opportunities to demonstrate the

products to customers and to get business

inquiries.

Factories at the FANUC headquarters

include Electronics Factory, Servo Motor

Factory, Laser Factory, Robot Factory,

Injection Molding Machine Factory,

Robomachine Parts Factory, Robot Parts

Factory, Sheet Metal Factory, Servo

Motor Parts Factory and Press & Die

Cast Factory. In addition, there are

Tsukuba Factory in Ibaraki Prefecture,

Hayato Factory in Kagoshima Prefecture

and Printed Circuit Board Factory at the

Hino Complex in Tokyo.

Every factory is fully equipped with

advanced automation systems and dedi-

cated to the stringent quality control in

all processes from parts inspection to the

testing of finished products. On the pro-

duction lines, the automated assembly

system is introduced with a number of

robots to further enhance efficiency on

the shop floor.

Servo Motor Factory

Robot Factory

SALES GROUP ACTIVITIES

13

FIVE-YEAR SUMMARY FANUC LTD CONSOLIDATED BASIS

The U. S. dollar amounts are converted from yen, for convenience only, at the rate of ¥123.9=U. S. $1.00.

Millions of yen,except for per share data

Years ended March 31 1997 1998 1999 2000 2001 2001

Net sales 183,729 230,788 226,070 209,021 264,083 2,131,420

Operating income 57,095 76,047 71,421 63,659 87,902 709,459

Income before income taxes

and minority interests 59,077 76,527 76,343 67,043 78,948 637,191

Net income 30,492 36,709 43,147 39,375 47,242 381,291

Current assets 380,764 417,031 430,179 464,536 522,971 4,220,912

Current liabillties 49,371 62,385 47,704 47,577 68,422 552,236

Total assets 564,691 610,487 634,803 675,075 738,326 5,959,048

Shareholders’ equity 506,059 537,595 575,304 613,597 645,024 5,206,005

Per share of common stock:

Net income:

Basic 127.4 153.3 180.2 164.4 197.3 1.592

Fully diluted 127.3 153.3

Cash dividends 22.0 24.0 24.0 24.0 24.0 0.194

Shareholders’ equity 2,114.4 2,244.7 2,402.0 2,561.9 2,693.1 21.736

Thousands ofU.S. dollars,

except for pershare data

14

CONSOLIDATED BALANCE SHEETS

Millions of yen

March 31 2000 2001 2001

ASSETSCurrent assets:

Cash and cash equivalents 329,326 375,687 3,032,179 Receivables, trade:

Accounts and notes 65,272 88,550 714,689 Allowance for doubtful accounts (983) (2,049) (16,538)

Inventories (Note 4) 40,646 47,330 382,002 Deferred income taxes 8,781 9,389 75,779 Other current assets 21,494 4,064 32,801

Total current assets 464,536 522,971 4,220,912 Investments (Note 5) 23,955 37,229 300,476 Property, plant and equipment, at cost:

Land 88,597 92,371 745,528 Buildings 125,707 133,375 1,076,473 Machinery and equipment 66,936 68,975 556,699 Construction in progress 596 1,361 10,985 Less accumulated depreciation (113,222) (118,696) (957,998)

168,614 177,386 1,431,687 Intangible assets 1,417 740 5,973 Foreign currency translation adjustments 16,553

675,075 738,326 5,959,048 LIABILITIESCurrent liabilities

Payables, trade 15,630 21,823 176,134 Accrued income taxes 13,854 22,534 181,873 Other current liabilities 18,093 24,065 194,229

Total current liabilities 47,577 68,422 552,236 Long-term debt

Accrued severance indemnities 12,092 Allowance for employees’ retirement benefits 20,879 168,515 Other 89 1,929 15,569

Total long-term debt 12,181 22,808 184,084

Minority interests in consolidated subsidiaries 1,720 2,072 16,723

Shareholders’ equityCommon stock :

Authorized - 400,000,000 sharesIssued(¥50 par value) - 239,508,317 shares 69,014 69,014 557,014

Capital surplus 96,206 96,206 776,481 Retained earnings 448,402 489,669 3,952,131 Net unrealized holding losses on available-for-sale

securities (262) (2,115)Foreign currency translation adjustments (9,600) (77,482)Treasury stock, at cost :

2000 - 2,571 shares (25)2001 - 393 shares (3) (24)

Total shareholders’ equity 613,597 645,024 5,206,005 675,075 738,326 5,959,048

Commitments and contingent liabilities (Note 8) 1,258 1,164 9,395

See notes to the consolidated financial statements.

Thousands ofU.S. dollars

(Note 3)

15

CONSOLIDATED STATEMENTS OF INCOME

Millions of yen

Years ended March 31 1999 2000 2001 2001

Net sales 226,070 209,021 264,083 2,131,420

Operating costs and expenses:

Cost of goods sold 121,007 112,370 141,906 1,145,327

Selling, general and administrativeexpenses 33,642 32,992 34,275 276,634

154,649 145,362 176,181 1,421,961

Operating income 71,421 63,659 87,902 709,459

Other income (expenses):

Interest income 2,672 1,160 1,908 15,399

Equity in earnings of affiliates 2,444 2,403 2,827 22,817

Other, net (Note 10) (194) (179) 467 3,769

4,922 3,384 5,202 41,985

Extraordinary income (expenses):

Amortization of net retirement benefit obligation at transition (14,156) (114,253)

Income before income taxes and minority interests 76,343 67,043 78,948 637,191

Income taxes (Note 11):

Current 32,954 27,799 35,535 286,804

Deferred (413) (4,203) (33,923)

Income before minority interests 43,389 39,657 47,616 384,310

Minority interests in income of consolidated subsidiaries 242 282 374 3,019

Net income 43,147 39,375 47,242 381,291

Thousands ofU.S. dollars

(Note 3)

YenU.S. dollars

(Note 3)Amounts per share of common stock:

Basic earnings 180.2 164.4 197.3 1.59

Cash dividends 24.0 24.0 24.0 0.19

See notes to the consolidated financial statements.

16

CONSOLIDATED STATEMENTS OF CASH FLOWS

Cash flows from operating activitiesIncome before income taxes and minority interests 67,043 78,948 637,191 Adjustments to reconcile income before income taxes and minority interests to net cash provided by operating activities:

Depreciation and amortization 9,318 8,747 70,597 Interest and dividend income (1,370) (2,223) (17,942)Equity in earnings of affiliates, net (2,403) (2,827) (22,817)Increase in receivables, trade (6,355) (21,359) (172,389)Increase in inventories (6,039) (4,894) (39,499)Increase in payables, trade 7,004 5,063 40,864 Provision for accrued severance indemnities, net of payments 2,009 (12,170) (98,224)Provision for allowance for employees’ retirement benefits 20,801 167,885 Other (1,755) 6,566 52,994

Cash generated from operations 67,452 76,652 618,660 Interest and dividends received 1,608 2,261 18,249 Income taxes paid (29,025) (26,882) (216,965)Other (286) (84) (678)

Net cash provided by operating activities 39,749 51,947 419,266

Cash flows from investing activitiesPurchases of property, plant and equipment (8,813) (13,933) (112,454)Purchases of investment securities (398) (4,841) (39,072)Purchases of time deposits (345,734) (1,782) (14,382)Withdrawals of time deposits 351,554 19,139 154,471 Other (99) 472 3,810

Net cash used in investing activities (3,292) (945) (7,627)

Cash flows from financing activitiesProceeds from short-term borrowings 6,991 Repayment of short-term borrowings (9,256) (4) (32)Dividends paid (5,757) (5,756) (46,457)Other (41) (71) (573)

Net cash used in financing activities (8,063) (5,831) (47,062)

Effect of exchange rate changes on cash and cash equivalents (1,002) 1,189 9,596

Net increase in cash and cash equivalents 27,392 46,360 374,173 Cash and cash equivalents at beginning of year 301,934 329,326 2,657,998 Cash and cash equivalents at end of year 329,326 375,686 3,032,171

See notes to the consolidated financial statements.

Millions of yen

Years ended March 31 2000 2001 2001

Thousands ofU.S. dollars

(Note 3)

17

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

Millions of yen

Common stock 1999 2000 2001 2001

Balance at beginning of year 68,986 69,014 69,014 557,014

Common stock issued on conversion of bonds 28 Balance at end of year 69,014 69,014 69,014 557,014

Capital surplus

Balance at beginning of year 96,178 96,206 96,206 776,481

Common stock issued on conversion of bonds 28 Balance at end of year 96,206 96,206 96,206 776,481

Retained earnings

Balance at beginning of year 372,436 410,095 448,402 3,619,064

Net Income for the year 43,147 39,375 47,242 381,291

Cash dividends paid (5,748) (5,748) (5,748) (46,392)

Bonuses to directors and statutory auditors (219) (219) (220) (1,776)

Cumulative effect of adopting tax-effectaccounting 4,907

Increase due to newly consolidated subsidiaries 488 Other, net (9) (8) (7) (56)

Balance at end of year 410,095 448,402 489,669 3,952,131

Net unrealized holding losses on available-for-sale securities

Balance at beginning of yearNet change during the year (262) (2,115)

Balance at end of year (262) (2,115)

Foreign currency translation adjustments

Balance at beginning of yearNet change during the year (9,600) (77,482)

Balance at end of year (9,600) (77,482)

Treasury stock

Balance at beginning of year (5) (11) (25) (202)

Increase (decrease) (6) (14) 22 178

Balance at end of year (11) (25) (3) (24)

See notes to the consolidated financial statements.

1999 2000 2001

Number of shares of common stock (in thousands)

Balance at beginning of year 239,492 239,508 239,508

Common stock issued on conversion of bonds 16 Balance at end of year 239,508 239,508 239,508

Thousands ofU.S. dollars

(Note 3)

The U. S. dollar amounts are converted from yen, for convenience only, at the rate of ¥123.9=U. S. $1.00.

Years ended March 31

1. Basis of preparation The accompanying consolidated financial statementsof FANUC LTD (the “Company”) and its consolidatedsubsidiaries (together, the “Group”) have been pre-pared in accordance with accounting principles andpractices generally accepted in Japan and the regula-tions under the Securities and Exchange Law ofJapan, which may differ in certain material respectsfrom accounting principles and practices generallyaccepted in countries and jurisdictions other thanJapan.

In addition,the notes to the consolidated financialstatements include information which is not requiredunder accounting principles generally accepted inJapan but is presented herein as additional informa-tion.

2. Summary of significant accounting policies (a) Principles of consolidation The consolidated financial statements include theaccounts of the Company and, with minor excep-tions, its controlled subsidiaries(together, the“Group”), intercompany accounts and significantintercompany transactions have been eliminated inconsolidation.

The investments in subsidiaries not consolidatedand affiliated companies to which the Company isinfluential are, with minor exceptions, stated at theirunderlying equity value.

The excess of cost over underlying net assets atthe date of investment in subsidiaries is amortizedover a period of five years.

(b) Cash equivalents For purposes of the statements of cash flows, allhighly liquid investments, with a maturity of threemonths or less when purchased, are consideredcash equivalents.

The Group adopted a new accounting standard fora statement of cash flows in the preparation of theconsolidated financial statements for the year endedMarch 31, 2000.

(c) Translation of foreign currency accounts Effective April 1, 2000, current receivables andpayables and non-current monetary items denomi-nated in foreign currencies are translated intoJapanese yen at the exchange rates in effect at therespective balance sheet date. Prior to April 1, 2000,non-current monetary items denominated in foreigncurrencies were translated into Japanese yen at his-torical exchange rates.

The asset and liability accounts of the consolidatedsubsidiaries outside Japan are translated intoJapanese yen at the applicable fiscal year-end rates.Income and expense accounts are translated at theaverage rate during the year. Effective April 1, 2000,the resulting translation adjustments have beenrecorded as a component of shareholders’ equityunder foreign currency translation adjustments. Priorto April 1, 2000, the resulting translation adjustments

were recorded in assets as foreign currency transla-tion adjustments.

(d) Valuation of securities Effective April 1, 2000, the Group except for foreignsubsidiaries adopted a new accounting standard forfinancial instruments. The effect of this adoption wasto increase income before income taxes and minorityinterests for the year ended March 31, 2001 by ¥191million.

Effective April 1, 2000, securities other thaninvestments in affiliates have been classified as“Available-for-sale securities”, which are securitiesother than trading securities and securities beingheld to maturity. Available-for-sale securities are stat-ed at fair value with corresponding unrealizedgains/losses recorded directly in a separate compo-nent of shareholders’ equity. Available-for-sale securi-ties for which fair value is not readily determinableare stated at moving average cost.

Prior to April 1, 2000, listed securities were mainlystated at the lower of cost or market, cost beingdetermined by the moving average method andunlisted securities were stated at cost determined bythe moving average method.

(e) Allowance for doubtful accounts The allowance for doubtful accounts is provided at anamount that is deemed sufficient to cover estimatedfuture losses.

(f) Inventories Raw materials and purchased components are main-ly stated at cost determined by the most recent pur-chase price method.

Work in progress is stated at actual cost whichcomprises direct costs for material and labor costsand manufacturing overhead costs, including depre-ciation.

Finished goods are mainly stated at cost by theaverage method.

(g) Property, plant and equipment and depreciation Property, plant and equipment, including significantrenewals and additions, are stated at cost. Whenretired or otherwise disposed of, the cost and relateddepreciation are cleared from the respectiveaccounts and the net difference, less any amountrealized on disposal, is reflected in earnings.

Depreciation is computed principally by the declin-ing-balance method at rates based on the estimateduseful lives of the respective assets, which varyaccording to general class, type of construction anduse.

Maintenance and repairs, including minorrenewals and improvements, are charged to incomeas incurred.

18

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(h) Retirement benefits Effective April 1, 2000, the Group adopted a newaccounting standard for retirement benefits. Theeffect of this adoption was to decrease incomebefore income taxes and minority interests for theyear ended March 31, 2001 by ¥10,399 million. Theallowance for employees’ retirement benefits is pro-vided mainly at an amount calculated based on theretirement benefit obligation and the fair value of theplan assets. The net retirement benefit obligation attransition of ¥14,156 million was fully amortized forthe year ended March 31, 2001.

Prior to April 1, 2000, the accrued severanceindemnities was calculated to state the estimated lia-bility at the amount which would be required to bepaid if all employees eligible for the retirement planwere to terminate their employment voluntarily atthe balance sheet date.

(i) Leases Noncancelable lease transactions are accounted foras if they were operating leases regardless ofwhether such leases are classified as operating leas-es or finance leases except that lease agreementswhich stipulate the transfer of ownership of theleased assets to the Group are accounted for asfinance leases.

(j) Revenue recognition Generally, sales of products, other than those export-ed, are recognized in the accounts upon acceptanceby the customers. Export sales are recognized in theaccounts on shipment.

(k) Income taxes Effective April 1, 1999, the Group except for certainforeign subsidiaries adopted tax-effect accounting forincome taxes in accordance with a new accountingstandard issued by the Business AccountingDeliberation Council. This standard requires recogni-tion of income taxes by the asset-liability method.Under the asset-liability method, deferred tax assetsand liabilities are determined based on the differencebetween financial reporting and the tax basis of theassets and liabilities and are measured using theenacted tax rates and laws which will be in effectwhen the differences are expected to reserve. Thecumulative effect of this change is reported as“cumulative effect of adopting tax effect accounting”in the consolidated statements of shareholders’equity.

Prior to the adoption of tax effort accounting,income taxes for the Group except certain foreignsubsidiaries were calculated on taxable income andcharged to income.

(l) Appropriation of retained earnings Cash dividends, and bonuses to directors and statu-tory auditors are recorded in the financial year whenthe proposed appropriations of retained earnings areapproved by the Board of Directors and the share-holders’ meeting.

(m) Income per share Net income per share is based on the weightedaverage number of shares of common stock out-standing during the respective years. Fully dilutednet income per share is computed assuming that theconvertible bonds converted during the year or out-standing at the end of the year were converted atthe beginning of the year or from the time they wereissued, with an appropriate adjustment for the relat-ed interest expense, net of taxes, for the conversion.

Fully diluted net income per share for 1999, 2000and 2001 is not presented, since the convertiblebonds outstanding at April 1, 1998 were all convert-ed or redeemed during the year ended March 31,1999.

3. U.S. dollar amounts The Company and its consolidated subsidiaries inJapan maintain their books of account in yen. TheU.S. dollar amounts included in the accompanyingconsolidated financial statements and the notesthereto represent the arithmetic results of translatingyen into dollars at ¥123.9 = U.S.$1.00, the approxi-mate rate of exchange prevailing on March 31, 2001.

The U.S. dollar amounts are presented solely forthe convenience of the reader and the translation isnot intended to imply that assets and liabilitieswhich originate in yen have been or could readily beconverted, realized or settled in U.S. dollars at theabove or any other rate.

4. Inventories Inventories at March 31, 2000 and 2001, consistedof the following:

Thousands ofMillions of yen U.S.dollars

2000 2001 2001

Finished goods 24,573 24,646 198,918

Work in progress 13,493 17,161 138,507

Raw materials and supplies 2,580 5,523 44,577

40,646 47,330 382,002

19

20

5. Available-for-sale securities and investments

Market value at March 31, 2000 is summarized as follows:

Millions of yen

Book value Unrealized per balance Market gain

sheet value (loss) (Current assets) Marketable securities: Market value available - Bonds and debentures 8 8 0

8 8 0 (Non-current assets) Investments in securities,subsidiaries and affiliates: Market value available - Corporate shares 2,784 3,196 412

2,784 3,196 412 Market value not available 19,598

22,382

Fair value at March 31,2001 of available-for-sale securities issummarized as follows:

Millions of yen Kind of Acquisition Book value reflected Net securities cost in the balance

sheetAvailable-for-sale Equity securities with securities 330 487 157 unrealized gains Subtotal 330 487 157 Available-for-sale Equity securities with securities 2,454 1,852 (602) unrealized losses Subtotal 2,454 1,852 (602) Total 2,784 2,339 (445)

Thousands of U.S. dollars Kind of Acquisition Book value reflected Net securities cost in the balance

sheetAvailable-for-sale Equity securities with securities 2,663 3,931 1,268 unrealized gains Subtotal 2,663 3,931 1,268 Available-for-sale Equity securities with securities 19,807 14,948 (4,859) unrealized losses Subtotal 19,807 14,948 (4,859) Total 22,470 18,879 (3,591)

Available-for-sale securities with fair value not available at March 31,2001 is summarized as follows:

Millions of yen book value

Unlisted securities 126

Thousands of U.S. dollars book value

Unlisted securities 1,017

Investments at March 31,2000 and 2001,consisted of the following:

Thousands of Millions of yen U.S.dollars

2000 2001 2001 Investments in affiliates 19,556 29,432 237,546 Available-for-sale securities 2,784 2,339 18,878Other 1,615 5,458 44,052

23,955 37,229 300,476

6. Retirement benefits

The Group has defined benefit pension plans; the Company hasthe FANUC contributory pension plan to supplement the publicwelfare pension plan and the Group except for certain subsidiarieshas lump-sum severance indemnity plans.

The table below sets forth the plans’ funded status andamounts recognized in the balance sheet at March 31, 2001.

Millions Thousands ofof yen U.S. dollars

Projected benefit obligation (46,000) (371,267)Plan assets at fair value 23,285 187,934 Projected benefit obligation in excess of plan assets (22,715) (183,333)Unrecognized net actuarial losses 2,140 17,272 Unrecognized past service cost (304) (2,454)Allowance for employees’ retirement benefits (20,879) (168,515)

Pension costs related to the plans,including amortization of the unfunded projected benefit obligation for the year ended March 31, 2001 were as follows:

Millions Thousands ofof yen U.S. dollars

Current service cost 1,941 15,666 Interest cost 1,440 11,622 Expected return on plan assets (749) (6,045)Amortization of past service cost (10) (81)Amortization of net retirement benefit obligation at transition 14,156 114,253

Net pension cost 16,778 135,415

The Group’s assumptions as of March 31, 2001, which wereused in determining pension costs and allowance for employees’retirement benefits shown above were as follows:

Discount rate 2.7%~7.5% Expected rate of return on plan assets 2.9%~9.0% Allocation of retirement benefit cost Flat-allocation Years of amortization of past service cost 10 years

Years of allocation of actuarial losses 10 years

Years of amortization of net retirement benefit obligation at transition 1 year

21

7. Leases Property held under the finance leases which are not capital-ized as assets outstanding at March 31, 2000 and 2001 wereas follows:

2000Millions of yen

Acquisition Less Net carryingcost accumulated amount

amortizationMachinery and equipment 3,108 1,464 1,644

3,108 1,464 1,644

2001 Millions of yen

Acquisition Less Net carryingcost accumulated amount

amortizationMachinery and equipment 2,965 1,314 1,651

2,965 1,314 1,651

2001 Thousands of U.S. dollars

Acquisition Less Net carryingcost accumulated amount

amortizationMachinery and equipment 23,931 10,606 13,325

23,931 10,606 13,325

Interest has not been deducted in determining the aboveacquisition costs of machinery and equipment, and deprecia-tion charges.

Future rental payments, including interest, under financeleases outstanding at March 31, 2001 were as follows:

Thousands ofYear ended March 31 Millions of yen U.S.dollars2001 616 4,9722002 and thereafter 1,035 8,353

1,651 13,325

Depreciation charges, including interest, under finance leas-es for the years ended March 31, 2000 and 2001 were as fol-lows:

Thousands ofMillions of yen U.S.dollars

2000 2001 2001689 738 5,956

Future rental payments, including interest, under operatingleases outstanding at March 31, 2001 were as follows:

Thousands ofYear ended March 31 Millions of yen U.S.dollars2001 718 5,7952002 and thereafter 920 7,425

1,638 13,220

8. Contingent liabilities At March 31, 2001,contingent liabilities for guarantees ofhousing loans of employees to banks amounted to ¥1,164 mil-lion (U.S.$9,395 thousand).

9. Research and development expenses Research and development expenses charged to manufactur-ing costs and selling, general and administrative expenses forthe years ended March 31, 2000 and 2001 are summarized asfollows:

Thousands ofMillions of yen U.S.dollars2000 2001 2001

11,680 12,251 98,878

10. Other income (expenses)-Other, net Other, net for the years ended March 31, 1999, 2000 and2001, consisted of the following:

Thousands ofMillions of yen U.S.dollars

1999 2000 2001 2001Net foreign exchange losses - (395) - - Loss on sales and disposal of property, plant and equipment (302) (524) (350) (2,825)Write-down of investment securities (480) - - - Payments in connection with patent licenses - (400) - - Other, net 588 1,140 817 6,594

(194) (179) 467 3,769

11. Income taxes Income taxes deferred at March 31, 2000 and 2001 were composed of thefollowing:

Millions Thousands ofof yen U.S. dollars

2000 2001 2001Deferred tax assets: Accrued severance indemnities 3,716 - - Allowance for employees’retirement benefits - 7,474 60,323Intercompany profits on inventories and property, plant and equipment 2,643 2,606 21,033

Depreciation 1,906 2,160 17,433Inventories 1,363 1,516 12,236Accrued enterprise taxes 1,092 1,772 14,302Other 4,330 5,200 41,969Gross deferred tax assets 15,050 20,728 167,296Valuation allowance (936) (924) (7,457)Total deferred tax assets 14,114 19,804 159,839

Deferred tax liabilities: Undistributed earnings in investments in affiliated companies (4,661) (5,642) (45,537)

Other (287) (353) (2,849)Total deferred tax liabilities (4,948) (5,995) (48,386)Net deferred tax assets 9,166 13,809 111,453

The Company and its domestic consolidated subsidiaries are subject tocorporation income tax, inhabitants’ taxes and enterprise tax based onincome, which in the aggregate resulted in statutory tax rates of approxi-mately 41% for 2000 and 2001.

12. Segment information The Group focuses on the development and production of CNC systemsand related application products based on FANUC’s CNC systems technolo-gies.

Ultimately, FANUC CNC’s and related application systems are used inautomated production systems.

By concentrating on the development and production of CNC systemstechnologies and associated application systems,the Group maintains itsposition as a premier supplier to its customers of world-class CNC systemsand related applications across a broad array of automated production sys-tems.

<Geographic segment information>

2000 Millions of yen Other Eliminations

Japan America areas & Corporate ConsolidatedSales outside the Company 118,532 51,331 39,158 - 209,021Intersegment sales 44,489 1,760 900 (47,149) -

Total 163,021 53,091 40,058 (47,149) 209,021Operating expenses 108,192 47,741 36,523 (47,094) 145,362Operating income 54,829 5,350 3,535 (55) 63,659Assets 262,363 42,644 32,715 337,353 675,075

2001 Millions of yen Other Eliminations

Japan America areas & Corporate ConsolidatedSales outside the Company 158,616 56,033 49,434 - 264,083Intersegment sales 55,155 1,714 1,451 (58,320) -

Total 213,771 57,747 50,885 (58,320) 264,083 Operating expenses 135,745 53,479 45,667 (58,710) 176,181 Operating income 78,026 4,268 5,218 390 87,902Assets 292,990 52,675 38,243 354,418 738,326

Thousands of U.S. dollars 2001 Other Eliminations

Japan America areas & Corporate ConsolidatedSales outside the Company 1,280,194 452,243 398,983 - 2,131,420 Intersegment sales 445,157 13,834 11,711 (470,702) -

Total 1,725,351 466,077 410,694 (470,702) 2,131,420 Operating expenses 1,095,601 431,630 368,579 (473,849) 1,421,961 Operating income 629,750 34,447 42,115 3,147 709,459 Assets 2,364,730 425,141 308,660 2,860,517 5,959,048

22

<Sales to foreign countries>

2000 Millions of yen

America Europe Asia Other TotalSales to foreign countries 64,789 34,651 28,836 625 128,901Consolidated net sales 209,021Percentage of foreign salesto consolidated net sales 31.0% 16.6% 13.8% 0.3% 61.7%

2001 Millions of yen

America Europe Asia Other TotalSales to foreign countries 72,055 41,108 39,316 1,034 153,513Consolidated net sales 264,083Percentage of foreign salesto consolidated net sales 27.2% 15.6% 14.9% 0.4% 58.0%

2001 Thousands of U.S.dollars

America Europe Asia Other TotalSales to foreign countries 581,558 331,784 317,320 8,345 1,239,007Consolidated net sales 2,131,420Percentage of foreign salesto consolidated net sales 27.2% 15.6% 14.9% 0.4% 58.0%

13. Derivative information The Group has entered into foreign exchange forward contracts asa hedge against transactions in foreign currencies.The foreignexchange forward contracts are used by the Group to minimizeexposure and to reduce risk from exchange rate in the ordinarycourse of its worldwide operations.

14. Related party transactions Kunihiko Sawa, a director of the Company, is concurrently thepresident of Fuji Electric Co.,Ltd. At March 31, 2001, Fuji ElectricCo.,Ltd. held 4% of the total outstanding shares of common stockof the Company.

The principal transactions with Fuji Electric Co.,Ltd. at March31, 2001 were as follows:

Millions Thousands ofof yen U.S. dollars

Notes and accounts receivable,trade 11 89 Payables,trade 723 5,835 Other current liabilities 533 4,302

Sales to and purchases from Fuji Electric Co.,Ltd. for the yearended March 31, 2001 were as follows:

Millions Thousands ofof yen U.S. dollars

Net sales 16 129 Net purchases of raw materials 4,048 32,672 Net purchases of property,

plant and equipment 1,238 9,992

23

INDEPENDENT AUDITORS' REPORT

24

NON-CONSOLIDATED BALANCE SHEETS

ASSETS

Current assets:

Cash and cash equivalents 350,799 2,831,308

Receivables, trade:Accounts and notes 62,052 500,823

Subsidiaries and affiliates 3,901 31,485

Allowance for doubtful accounts (1,469) (11,856)

Inventories 30,367 245,093

Deferred income taxes 5,188 41,872

Other current assets 920 7,425

Total current assets 451,758 3,646,150

Investments and long-term loans :

Subsidiaries and affiliates 71,211 574,746

Deferred income taxes 9,459 76,344

Other 2,818 22,744

83,488 673,834

Property, plant and equipment, at cost :

Land 87,893 709,387

Buildings 121,669 981,993

Machinery and equipment 64,014 516,659

Construction in progress 1,348 10,880

274,924 2,218,919

Accumulated depreciation (111,633) (900,993)

163,291 1,317,926

Intangible assets 566 4,568

699,103 5,642,478

LIABILITIES

Current liabilities

Payables, trade:Accounts 12,662 102,195

Subsidiaries and affiliates 2,048 16,529

Accounts and notes payable, other 0 0

Accrued expenses 11,821 95,408

Accrued income taxes 21,119 170,452

Allowance for warranties 1,685 13,600

Other current liabilities 464 3,745

Total current liabilities 49,799 401,929

Allowance for employees’ retirement benefits 19,180 154,803

Retirement allowances for directors and

statutory auditors 1,805 14,568

Shareholders’ equity

Common Stock :Authorized - 400,000,000 sharesIssued(¥50 par value) - 239,508,317 shares 69,014 557,014

Capital surplus 96,057 775,278

Legal reserve 7,942 64,100

Retained earnings 455,568 3,676,901

Net unrealized holding losses on available-for-sale securities (262) (2,115)

Total shareholders’ equity 628,319 5,071,178

699,103 5,642,478

Millions of yenMarch 31, 2001

Thousands ofU.S. dollars

The U. S. dollar amounts are converted from yen, for convenience only, at the rate of ¥123.9=U. S. $1.00.

25

NON-CONSOLIDATED STATEMENTS OF INCOME

Net sales 214,072 1,727,780

Operating costs and expenses:

Cost of goods sold 113,943 919,637

Selling, general and administrativeexpenses 22,323 180,169

136,266 1,099,806

Operating income 77,806 627,974

Other income (expenses):

Interest income 775 6,255

Dividend income 2,360 19,048

Other, net 221 1,783

3,356 27,086

Extraordinary income(expenses):

Amortization of net retirement benefitobligation at transition (14,156) (114,253)

Income before income taxes 67,006 540,807

Income taxes:

Current 32,412 261,598

Deferred (5,556) (44,843)

26,856 216,755

Net income 40,150 324,052

Net income per share:

Basic 167.6 1.353

Fully diluted

Year ended March 31, 2001

Yen U.S. dollars

Millions of yenThousands ofU.S. dollars

26

GLOBAL NETWORK

Charlottesville

DetroitChicago

Kimhae

Beijing

London

Paris

Barcelona

Luxembourg

Stuttgart

Istanbul

Sofia

Milano

Shanghai

Hong Kong

Bangkok

Bangalore

Kuala Lumpur

Singapore

Johannesburg

Bandung

Manila

Sydney

Taipei

Taichung

FANUC Headquarters

□AMERICAGE Fanuc Automation Corporation**

Charlottesville, Virginia, U.S.A.Shareholding company

GE Fanuc Automation North America, Inc.**Charlottesville, Virginia, U.S.A.PLC and CIMPLICITY® development, manufacture,sale and serviceCNC manufacture, sale and serviceLaser sale and service

FANUC Robotics North America, Inc.*Detroit, U.S.A.Robot and robot system development, manufacture,sale and service

FANUC AMERICA CORPORATION*Chicago, U.S.A.CNC and laser service

□EUROPE, THE MIDDLE EAST and AFRICAGE Fanuc Automation Europe S.A.**

LuxembourgCNC manufacture, sale and servicePLC, CIMPLICITY® and laser sale and service

FANUC Robotics Europe S.A.*LuxembourgRobot system development, sale and serviceRobot sale and service

FANUC EUROPE GmbH*Stuttgart, GermanyManagement of subsidiary companies in EuropeRoboshot serviceRobocut and robodrill sale

FANUC FRANCE S.A.Paris, FranceCNC and laser service

FANUC GERMANY GmbHStuttgart, GermanyCNC and laser service

FANUC U.K. LIMITEDLondon, United KingdomCNC and laser service

FANUC ITALIA S.p.A.Milano, ItalyCNC and laser service

FANUC IBERIA, S.A.Barcelona, SpainCNC and laser service

FANUC TURKEY LTD.Istanbul, TurkeyCNC and laser service

FANUC BULGARIA CORPORATIONSofia, BulgariaCNC sale and serviceLaser service

FANUC SOUTH AFRICA (PROPRIETARY) LIMITEDJohannesburg, South AfricaRobocut and robodrill sale and serviceCNC and laser service

□ASIA and OCEANIAFANUC KOREA CORPORATION*

Kimhae City, KoreaCNC, robot system, robocut and robodrill manufac-ture, sale and serviceRobot, roboshot and laser sale and service

FANUC TAIWAN LIMITED*Taichung, TaiwanCNC manufacture, sale and serviceLaser service

FANUC INDIA PRIVATE LIMITEDBangalore, IndiaCNC manufacture, sale and serviceRobot and robomachine sale and service

BEIJING-FANUC Mechatronics CO., LTD.Beijing, ChinaCNC manufacture, sale and serviceRobot and robomachine sale and serviceLaser service

TATUNG-FANUC ROBOTICS COMPANYTaipei, TaiwanRobot system manufacture, sale and servicePLC sale and service

SHANGHAI-FANUC Robotics CO., LTD.Shanghai, ChinaRobot system manufacture, sale and serviceRobot and roboshot sale and service

FANUC HONG KONG LIMITEDHong Kong, ChinaRobot and robomachine sale and serviceCNC and laser service

FANUC THAI LIMITEDBangkok, ThailandCNC, robot and robomachine sale and serviceLaser service

FANUC SINGAPORE PTE. LTD.SingaporeCNC, robot and robomachine sale and serviceLaser service

FANUC MECHATRONICS(MALAYSIA)SDN. BHD.Kuala Lumpur, MalaysiaCNC, robot and robomachine sale and serviceLaser service

PT. Fanuc GE Automation IndonesiaBandung, IndonesiaFA engineeringCNC and PLC sale and serviceLaser service

FANUC OCEANIA PTY. LIMITEDSydney, AustraliaCNC, robot, robomachine and laser sale and service

FANUC PHILIPPINES CORPORATIONManila, PhilippinesCNC, robot and robomachine service

* Consolidated subsidiaries**Affiliates-equity method applied only

27

OVERSEAS SUBSIDIARIES & AFFILIATES

28

GE Fanuc Automation North America, Inc.is a subsidiary of GE Fanuc AutomationCorporation, a 50:50 joint venture establishedin 1986 with General Electric Company. Thecompany, also established in 1986 and head-quartered in Charlottesville, Virginia devel-ops, manufactures, sells, and provides main-tenance service for Programmable LogicControllers (PLC) and CIMPLICITY®, afactory monitoring and controlling softwarepackage. The company also manufactures,sells and provides maintenance service forCNCs as well as sells and services lasers.Taking advantage of expertise developed atGE and FANUC in manufacturing, sale anddevelopment, the company has establisheditself as the leader of the factory automationin the United States.

GE Fanuc Automation Europe S.A.

GE Fanuc Automation North America, Inc.

GE Fanuc Automation Europe S.A. wasalso established in 1986 as a subsidiaryof GE Fanuc Automation Corporation.Headquartered in Luxembourg, thecompany manufactures, sells and pro-vides maintenance service for CNCs, aswell as sells and provides maintenanceservice for PLCs and CIMPLICITY®.The company has established itself asthe leader in the European FA marketwith the expertise of GE and FANUC insales.

29

FANUC Robotics North America, Inc.

FANUC Robotics Europe S.A.

FANUC Robotics North America, Inc. origi-nated as GMFanuc Robotics Corporation, a50:50 joint venture with GM established in1982. The company became a fully owned sub-sidiary of FANUC in 1992. Headquartered inDetroit, the company has grown into thelargest robotic company in the UnitedStates, engaged in development, manufac-ture, sale and maintenance service of robotsand robot systems.

FANUC Robotics Europe S.A. started itsbusiness as a division of GMFanuc RoboticsCorporation and became a 100% subsidiaryof FANUC in 1992. Headquartered inLuxembourg, the company develops, sellsand provides maintenance service for robotsystems as well as sells and provides main-tenance service for robots. The company isvigorously expanding its market shares inEurope with close partnership withFANUC.

30

FANUC KOREA CORPORATION

FANUC TAIWAN LIMITED

FANUC KOREA CORPORATION wasfounded in 1978, first as a joint venturewith Whacheon Machinery Works Co.,Ltd., and later also with KOLON INTER-NATIONAL CORP. as another partner.The company became a subsidiary ofFANUC in 1998. Headquartered in KimhaeCity, the company engages in manufacture,sale, and maintenance service of CNCs,robot systems, Robocuts and Robodrills.Its business also includes sale and mainte-nance service of robots, Roboshots andlasers. The company enjoys an overwhelm-ing market share in the Korean market.

FANUC TAIWAN LIMITED wasestablished in 1986 as a subsidiary ofFANUC. Headquartered in Taichung,the company engages in manufacture,sale, and maintenance service of CNCsas well as maintenance service of lasers,enjoying an overwhelming market sharein the Taiwanese market.

31

Honorary Chairman Dr. Eng. Seiuemon Inaba

Chairman Ryoichiro Nozawa

President Shigeaki Oyama

Senior Executive Vice Presidents Shimpei Kato

Dr. Eng. Yoshiharu Inaba

Executive Vice Presidents Tetsuo Miyairi

Mitsuto Miyata

Yoshinori Kohzai

Senior Vice Presidents Hajimu Inaba

Mitsuo Kurakake

Atsushi Watanabe

Hideo Katsube

Hiroomi Fukuyama

Hajimu Kishi

Atsushi Shima

Hiroyuki Uchida

Tetsuro Sakano

Hiroshi Araki

Nobutoshi Torii

Vice Presidents Tadashi Sekizawa

Kunihiko Sawa

Masayuki Tomida

Takayuki Taira

Shin-ichi Tanzawa

Hideaki Inoue

Shunsuke Matsubara

Hideo Kojima

Yoshihiro Gonda

Standing Auditors Tsugumichi Yoshida

Nobuo Otsuka

Auditors Keizo Fukagawa

Yoshihiro Fukai

MANAGEMENT

32

CORPORATE DATA

Incorporated

May 12, 1972

Paid-in Capital

¥69,014 million

Common Stock

Authorized: 400,000,000 shares

Issued: 239,508,317 shares

Number of Shareholders

120,168

Stock Listing

Tokyo Stock Exchange

Transfer Agent

Tokyo Securities Transfer Agent Co., Ltd.

Headquarters

3580, Shibokusa Aza-Komanba, Oshino-mura,

Minamitsuru-gun, Yamanashi Prefecture

401-0597, Japan

Tel: (0555)84-5555

Fax: (0555)84-5512

WebSite: http://www.fanuc.co.jp

Major Shareholders

Fujitsu Limited 35.6%

Fuji Electric Co., Ltd. 4.4%

Japan Trustee Services Bank Ltd. 4.0%

Mizuho Trust & Banking Co., Ltd. 3.3%

retirement benefit trust (for Fujitsu Limited)

The Chuo Mitsui Trust and Banking

Company, Limited 3.1%

The Toyo Trust and Banking

Company Limited 2.4%

The Chase Manhattan Bank 2.4%

Note : The shares of FANUC LTD stock held by

Fujitsu Limited are part of that compa-

ny’s retirement benefit trust and are

deposited as trust assets at Mizuho Trust

& Banking Co., Ltd. retirement benefit

trust (for Fujitsu Limited). Voting rights

for the shares are exercised in accordance

with Fujitsu Limited instructions.

(As of March 31, 2001)

The Star of Hope

This report except cover is printed on recycled paper.

3580, Shibokusa Aza-Komanba, Oshino-mura,

Minamitsuru-gun, Yamanashi Prefecture 401-0597, Japan

Tel:(0555)84-5555 Fax:(0555)84-5512

WebSite:http://www.fanuc.co.jp

Printed in Japan