Comp Airlines

Transcript of Comp Airlines

No. 1/2002

Competitive AirlinesTowards a more vigorous competition policy in

relation to the air travel market

Com

petitive Airlines Tow

ards a more vigorous com

petition policy in relation to the air travel market

No. 1/2002

Kilpailuvirasto/KonkurrensverketPostbox 332, 00531 Helsinki, Finland

Telephone: +358 9 73 141Telefax: +358 9 7314 3405

http://www.kilpailuvirasto.fi/

KonkurrencestyrelsenNørregade 49, 1165 Copenhagen, DenmarkTelephone: +45 3317 7000Telefax: +45 3332 6144www.ks.dk

Konkurrensverket103 85 Stockholm, SwedenTelephone +46 8 700 1600

Telefax: +46 8 24 55 43www.kkv.se

KonkurransetilsynetPostbox 8132 Dep, 0033 Oslo, Norway

Telephone: +47 22 40 09 00Telefax: +47 22 40 09 99

www.konkurransetilsynet.no

SamkeppnisstofnunPostbox 5120, 125 Reykjavik, IcelandTelephone: +354 552 7422Telefax: +354 562 7442www.samkeppni.is

Report from the Nordic competition authorities

Pro

du

ksjo

n:

ww

w.k

urs

iv.n

o

Competitive AirlinesTowards a more vigorous competition policy

in relation to the air travel market

Report from the Nordic competition authorities

2

Contents

PREFACE.......................................................................................................................................... 4

EXECUTIVE SUMMARY .............................................................................................................. 5

Aviation is a network industry ................................................................................................ 5Merger and alliance control ..................................................................................................... 6Slot allocation procedures ........................................................................................................ 7Predatory behaviour ................................................................................................................. 7Frequent flyer programmes ...................................................................................................... 8Tariff consultations ................................................................................................................... 9State aid, public procurement, taxation, and subsidies ............................................................ 9Travel agent agreements, corporate discount schemes, and computer reservation systems .......................................................................................... 9Competition between airports ................................................................................................ 10Ground handling services ....................................................................................................... 10Concerted action is needed .................................................................................................... 11

1 INTRODUCTION ................................................................................................................. 12

1.1 Theoretical perspective .......................................................................................................... 121.2 Barriers to airline competition .............................................................................................. 131.3 Deregulation in the USA ........................................................................................................ 131.4 The European experience and outlook ................................................................................... 151.5 Outline .................................................................................................................................... 16

2 MARKET DESCRIPTION ................................................................................................. 18

2.1 Air travel demand in the Nordic countries ............................................................................ 182.2 The supply side: carriers operating in the Nordic countries .................................................. 22

3 LEGAL FRAMEWORK ...................................................................................................... 27

3.1 Community Law/EEA Law .................................................................................................... 273.2 Exemptions for the airline industry ....................................................................................... 293.3 Bilateral agreements ............................................................................................................... 303.4 National competition legislation ............................................................................................ 313.5 Aviation legislation and institutional conditions ................................................................... 37

4 TOPICS IN AVIATION ECONOMICS .............................................................................. 41

4.1 Aviation network economics ................................................................................................. 414.2 Price discrimination and economic welfare ........................................................................... 494.3 The cost structure of the airline industry ................................................................................ 524.4 Comparative airline productivity ............................................................................................ 60

3

5 TAXES, SUBSIDIES, AND PUBLIC CHARGES ............................................................. 67

5.1 Taxes and charges in Nordic aviation .................................................................................... 675.2 External costs of aviation ...................................................................................................... 745.3 State aid .................................................................................................................................. 75

6 BUSINESS CONDITIONS AND STRATEGIES............................................................... 77

6.1 Frequent flyer programmes .................................................................................................... 776.2 Corporate discount schemes ................................................................................................... 856.3 Travel agent agreements ........................................................................................................ 886.4 Corporate cards and related discounts ................................................................................... 916.5 Computerised reservation systems ........................................................................................ 926.6 Interlining ............................................................................................................................... 966.7 Airport capacity ................................................................................................................... 101

7 SUMMARY AND CONCLUSIONS .................................................................................. 109

7.1 Network economics and competition ................................................................................... 1097.2 Airline mergers and alliances ............................................................................................... 1117.3 Community and EEA Law ................................................................................................... 1117.4 Contestability and predation ............................................................................................... 1127.5 Scarcity of slots .................................................................................................................... 1137.6 Interlining and tariff consultations ....................................................................................... 1147.7 Frequent flyer programmes .................................................................................................. 1147.8 Corporate discount schemes ................................................................................................. 1167.9 Computerised reservation systems ....................................................................................... 1167.10 Corporate cards and electronic ticketing ............................................................................ 1167.11 Travel agent agreements ....................................................................................................... 1177.12 Taxes, subsidies, and public procurement............................................................................. 1177.13 Ground handling ................................................................................................................... 1177.14 The Nordic aviation market ................................................................................................. 118

LITERATURE .............................................................................................................................. 119

Preface

During their joint meeting in Skagen (Denmark) on 6-7 September 2001, the competition authorities of the Nordic countries established a task force to examine the degree of competition in Nordic aviation and to suggest measures to enhance it. Their report is hereby submitted. The analyses, conclusions and recommendations contained herein are unanimous.

The Nordic Task Force on Airline Competition has consisted of the following persons:

Lasse Fridstrøm (chairman), Norwegian Competition Authority, Frode Hjelde, Norwegian Competition Authority,Helle Lange, Danish Competition Authority,Erik Murray, Swedish Competition Authority,Antti Norkela, Finnish Competition Authority,Torben Thorø Pedersen, Danish Competition Authority,Niels Rytter, Danish Competition Authority,Catherine Sandvig, Norwegian Competition Authority,Marianne Skoven, Danish Competition Authority, andLine Solhaug, Norwegian Competition Authority.

The Nordic competition authorities are grateful for the assistance extended to the Task Force in theform of discussions with the Antitrust Division of the US Department of Justice (on 2 January2002), with the General Directorate for Competition of the European Commission (on 1 February2002), with the Scandinavian Airlines System (SAS) (on 21 January 2002), and with the GermanCompetition Authority (Bundeskartellamt) (on 15 March 2002).

The authors are also indebted to a number of researchers, consultants, colleagues, and advisors, fortheir written contributions, constructive criticism, and suggestions. They are especially grateful toProfessor Siri Pettersen Strandenes, Professor Frode Steen, and Professor Lars Sørgard of theNorwegian School of Economics and Business Administration, and to Dr. Peeran van Reeven ofthe Erasmus University.

Copenhagen/Helsinki/Oslo/Stockholm

18 June 2002

4

EXECUTIVE SUMMARY

1. The Nordic Task Force on AirlineCompetition has examined the aviation mar-kets in Denmark, Finland, Norway, andSweden, with a view to suggesting measuresto enhance competition.

2. The Task Force has focused on numerousbarriers to airline competition in theNorthern European region, as well as in awider pan-European or global perspective.

3. The Task Force believes that the Europeanaviation industry may be facing a period ofstrong consolidation over the next few years.Such consolidation may in some circum-stances have positive effects on economicefficiency. But in combination with the anti-competitive effects of the hub-and-spokemode of operation, of the frequent flyer pro-grammes, and of other restrictions on com-petition, the horizontal and vertical concen-tration in the aviation industry represents aformidable challenge to European competi-tion authorities at the national andCommunity level. A vigorous competitionpolicy will be required in order to enhance –or even preserve – the present degree ofcompetition in the air travel markets.

4. First of all, the competition authoritiesshould strengthen their efforts to enhancecompetition through• Adequate control of airline mergers and

alliances • Efficient interventions against predatory

pricing and other abusive behaviour• Efficient restrictions on frequent flyer pro-

grammes• Prohibition on airline price cooperation

through tariff consultations • Open and non-discriminatory business

conditions in travel agent agreements • Interventions against anti-competitive

effects of corporate discount schemes • Control of the configuration and use of

ticketing and computer reservation systems

5. Second, public regulations in all relevantareas should be developed in order to limittheir anti-competitive effects:• More efficient and non-discriminatory slot

allocation procedures • Enhanced competition between airports • Enhanced access to ground handling and

other infrastructure services • Competition neutral tax rules in aviation

and related activities

6. Third, governments should promote compe-tition through initiatives such as:• Reduced state aid and subsidies to airlines • Public procurement tendering that facili-

tates competition

7. Since many of these measures fall outsidethe scope of competence of national orCommunity competition authorities, concert-ed action will be needed between variousgovernment and Community agencies.

Aviation is a network industry 8. The aviation industry is characterised by

large network externalities, in the sense thatthe costs and revenues involved in carryingpassengers on different, interconnectedroutes are interdependent. There are, in otherwords, large economies of scale, scope anddensity present.

9. A particularly efficient way of organising anaviation network is the hub-and-spoke modeof operation. Rather than operating a largenumber of point-to-point, non-stop routes,the airline company channels all or mostpassengers through a «hub» airport, fromwhich all connections extend like the spokesof a wheel. In this way the number of differ-ent non-stop routes needed to serve all pos-sible pairs of destinations is drasticallyreduced, allowing for quite remarkable costsavings.

10. Judging by the experience earned through23 years of deregulated aviation markets inthe United States, the airline industry –when left without regulation – will tend toconsolidate into a few, large air carrier con-

5

cerns with continent-wide hub-and-spokenetworks.

11. While obviously economically efficient tothe individual carrier firm, the hub-and-spoke system of operation may have stronganti-competitive effects. The economies ofscope and density characteristic of thesenetworks are such as to grant the (one andonly) hub airline very considerable marketpower at and around its hub. Since differ-ent airlines choose to operate hubs at dif-ferent airports, the hub-and-spoke systemas operated among a set of large individualcarriers is liable to practically divide themarket between the airlines. Although thenetworks of different carriers overlap, veryfew origin-destination pairs, if any, willexhibit more than two carriers operatingnon-stop flights.

12. In Europe, the hub-and-spoke mode ofoperation has an even longer history thanin the US, having grown out of the pastregulatory framework and of the prevailinggeographic and political conditions, ratherthan as an autonomous market process.Each nation has had its own «flag carrier»,with a privileged position in and around itsdomestic market and frequently a largegovernment ownership share. More oftenthan not, flag carriers have been benefitingfrom considerable amounts of subsidies ordirect financial support from the state.

13. The flag carrier typically organises its net-work around a hub located near the nation-al capital or main business centre. At itshub airport, the flag carrier tends to haveconsiderable direct and indirect influenceon slot allocation practices, on ground han-dling services, and on other essential facili-ties. Backed by its own government, theflag carrier usually also tends to obtainprivileged positions in whatever bilateralaviation agreements are signed with othercountries. Each flag carrier thereforeenjoys considerable market power at andaround its domestic hub. Thus, althoughthere are almost as many flag carriers asthere are European nations, the competitionbetween them is severely restricted, as they

have been able to divide the marketbetween them to a very considerableextent. In many (short-haul) markets, themost effective competitor to the Europeanflag carrier is not another airline company,but a surface mode of travel, representedby a railway company, a bus service, or theprivate car.

Merger and alliance control14. More extensive networks are more attrac-

tive to customers and offer largereconomies of scope to the carrier. Airlinecarriers therefore form alliances in order toexploit each other’s networks and tostrengthen the competitive positions of allalliance partners. Establishing an alliancewith an «adjacent» carrier may also be anefficient way for competitors to divide themarket between them.

15. Bilateral aviation treaties often assure theaffected national flag carriers more or lessexclusive traffic rights between the twocountries. These rights might be forfeited ifthe flag carrier is merged with a foreignairline – whence the widespread practice offorming alliances rather than full-fledgedmergers between European airlines. In anopinion delivered by the Advocate Generalto the European Court of Justice on 31January 2002, it is proposed that individualmember states no longer be allowed toentertain such individual aviation treatieswith non-EU countries. To the extent thatthis view is upheld by the Court, it may beforeseen that the associated change in theregulatory regime will spark a developmenttowards massive consolidation withinEuropean aviation.

16. Faced with this scenario, it is essential thatEuropean competition and aviation authori-ties consider carefully all measures suscep-tible of opening the air travel markets andenhancing competition. While in terms ofcompetition and efficient resource alloca-tion, full-fledged mergers may well bepreferable to looser alliances, it is para-mount to the protection of consumers andother air travel customers that the resulting

6

number of European aviation concerns oralliances not become too low. The consoli-dation process must therefore be followedcarefully by the relevant competitionauthorities. Alliances should be treatedwith the same rigour as traditional mergers.

Slot allocation procedures17. The airport capacity constraints and the slot

allocation regimes and practices currentlyin effect in Europe constitute major barriersto entry and hence to competition and eco-nomic efficiency.

18. Incumbent airlines throughout Europeanairports benefit from so-called «grandfatherrights», by which they are entitled to therenewal of all slots for which the degree ofutilisation during the previous periodexceeds 80 per cent. In congested airports,this regime makes it quite difficult forpotential new entrants to obtain a sufficientamount of attractive slots. To add to theproblem, incumbent airlines may have anincentive to «babysit» some of their slots, i. e. to make use of them for the sole pur-pose of not having to relinquish them to acompetitor. While commercially expedient,such practices are obviously not compatiblewith an economically efficient resourceutilisation.

19. There is thus a pressing need for animproved and less discriminatory slot allo-cation procedure in all congested airports,which would facilitate market entry forsmaller airlines and other non-incumbentcarriers. Unfortunately, the remedy is lesseasily found than the diagnosis.

20. At present, the legal ownership to slots andthe rights attached to such ownership arematters of ambiguity. A prerequisite forarriving at a more efficient slot allocationis to determine unequivocally who ownsthe slots – the airline, the airport, or thegovernment. The Task Force appreciatesthe initiative of the European Commissionto clarify these questions.

21. Creating an open market for slots may

seem like an obvious solution to the eco-nomic efficiency problem. There may,however, be cases where open tradingwould not ensure equitable access to theaviation market for all carriers. Dominantairlines may be able to derive profit fromholding a slot that would otherwise becomeavailable to a competitor. They may there-fore be willing to bid up the price of cer-tain slots to a level that will deter potentialnew entrants.

22. One way to ease such a situation might beto use so-called blind bidding in periodicauctions. Here, the bidders’ identities arekept secret, so as to conceal whether thebids are made by new entrants or incum-bent airlines. In such a case, a strategy ofbuying up slots for less valuable uses inorder to preclude entry would becomerather more expensive, and hence less com-mon.

23. The traditional economic solution to con-gestion problems is marginal cost (peakload) pricing. Another way to bring marketforces to bear on the slot allocation systemcould therefore be to apply this principleand allow airport charges to vary over theday (between peak and off-peak).

24. As a minimum requirement for efficientand non-discriminatory airport slot alloca-tion, whatever formal or informal connec-tion might exist between the slot coordina-tor institute and the local flag carrier com-pany should be severed. Slot coordinatorsneed to be unquestionably neutral withrespect to all of their incumbent or poten-tial client airlines.

Predatory behaviour25. Prior to and shortly after the US deregula-

tion, it was generally thought that aviationmarkets would in general be highly con-testable, as it would be easy for any carrierto relocate aircraft and personnel so as toservice a new route. In practice, it hasturned out that the barriers to entry aremuch more important than previouslybelieved. Incumbent airlines can lower

7

their fares and/or increase their capacitypractically overnight, so as to raise the costand/or reduce the revenue of rival newentrants. Any potential new entrant would,of course, be aware of this, and hesitate tochallenge the incumbent carrier even if thelatter may be making a considerable profitin the current (monopolised) situation.

26. To increase contestability it might be desir-able to constrain the incumbent carriers’ability to abuse their dominant position bydumping their fares and/or boosting theircapacity in response to rival new entrants.National and Community competitionauthorities should keep a keen eye onpredatory pricing practices and preparecontingency plans to act against them atshort notice. The recent intervention byGermany’s Bundeskartellamt, requiringLufthansa to keep a e 35 fare diffferentialwith respect to Germania on the Berlin-Frankfurt route, is an example, the benefitsand possible drawbacks of which would beinteresting to follow.

27. The Council Regulation (EEC) No.2409/92 deals with fares and rates for airservices. To the Task Force, it appears clearthat this regulation ought not restrain thecompetence of national competition author-ities in relation to interventions againstpredatory pricing. To the extent that thisview is seen as contentious, we suggestthat the issue be examined further at theEuropean Community level.

28. Similar arguments apply to CouncilRegulation (EEC) No. 2408/92 on accessfor Community air carriers to intra-Community air routes. Given the specialcharacteristics of the aviation market, interventions against excess capacity mightbe appropriate in order to ensure competi-tion, in the event of a dominant carrier’spredatory behaviour.

Frequent flyer programmes29. Almost all major airlines offer their trav-

ellers a carefully designed frequent flyerprogramme (FFP). As intended, the FFPs

are without doubt very efficient means toenhance customer loyalty or fidelity. Theyconstitute another well thought-out strategyby which the carriers are able to practicallydivide the market between them and thuslessen the competition in each market seg-ment. As such, they are clearly at variancewith the spirit of competition law in mostcountries.

30. Most FFPs have the following characteris-tics in common: • «Discounts» are granted not in the form

of money, but in the form of free services,not necessarily of the same type as pur-chased. The frequent flyer points are noordinary rebate.

• To obtain free flights to more or less dis-tant destinations, the customer needs tosurpass certain thresholds in terms oftravel purchases. The customer thus hasan incentive to concentrate his purchasesto one or a few providers. The closer thecustomer gets to a threshold, the strongeris his incentive to buy another flight fromthat particular airline or alliance.

• The «discount» is given to the traveller,who – in the case of business travel –tends to differ from the purchaser. Thisgives rise to a pronounced principal-agentproblem, by which the decision maker(agent) is faced with a quite different setof incentives from those of his superior(principal). This may lead to a distorted(inefficient) resource allocation.

• Although in principle taxable in manycountries, the private use of frequent flyerpoints earned by an employee is in prac-tice rarely taxed, for lack of informationon the part of the government. This taxloophole is likely to aggravate the ineffi-ciency due to the principal-agent problem.

• Alliance airlines join their FFPs to offerattractive, extended networks to bonuspoint travellers. Smaller airlines oralliances have a distinct competitive dis-advantage. The FFPs are thus liable tostrengthen any dominant position and toreinforce the anti-competitive effects ofhub-and-spoke networks. They thereforeact as important barriers to entry.

8

31. Hence, all European competition authori-ties should consider critically the anti-com-petitive effects of FFPs on domestic routes.

Tariff consultations32. Commission Regulation (EEC) No.

1617/93, Art. 4, grants the airlines withinthe European Union a block exemption forconsultation on passenger tariffs with theaim of facilitating interlining. Airlines tendto argue that the IATA tariff consultations,in which airlines agree on a common set offares for fully flexible tickets, form aninextricable part of the interlining system.The Task Force, however, believes that asystem of posted prices for wholesale(inter-airline) purposes might be sufficientto maintain the interlining system withoutthe price collaboration. Such a systemwould mean less transparency of faresbetween airlines and hence probably moreintense competition, without jeopardisingthe efficiency gains connected with inter-lining.

State aid, public procurement, taxation,and subsidies33. Some airline carriers have continued to

receive substantial amounts of direct orindirect aid from the national government.Such transfers may destroy the level play-ing field between airlines and should beminimised.

34. In many countries, the public administra-tion is itself a major airline client. The TaskForce recommends that governments usetheir negotiating power to enhance compe-tition, by adhering to the following princi-ples in public procurement agreements:• Public purchases should, if possible, be ten-

dered in small portions, e. g. route by route,so that small size companies may bid.

• Preference clauses, if present, shouldadmit that, notwithstanding the publicprocurement deal, the government isalways free to make use of a cheaperand/or higher quality service that may beoffered by someone else.

• Fixed fares (over a certain time lapse) arepreferable to percentage discounts off thenominal fare. This is so because percent-age discount agreements tend to bid upthe fare for all those clients who do nothave a comparable agreement.

35. Tax rules applicable to the aviation indus-try and its related activities should be neu-tral with respect to, inter alia, in-houseproduction in a vertical chain compared tooutsourcing (confer para. 49 below).

Travel agent agreements, corporate dis-count schemes, and computer reserva-tion systems 36. Travel agent agreements sometimes pro-

vide incentives for an agent to concentratehis sales to one or a few larger airlines.Such contracts may be anti-competitive andin disagreement with the principles laiddown by the EU Commission in theVirgin/BA case on 14 July 1999. There isreason to question whether all carrier-agentagreements and practices have yet beenbrought in accordance with these princi-ples. Competition authorities should directattention to this problem and exert a morevigorous control.

37. Corporate discount schemes are agree-ments by which large airline customershave been able to negotiate lower (net)fares on all of or on certain parts of an air-line’s network. From a competition angle,these deals have ambiguous effects.

38. On the one hand, they reflect a certaintransfer of market power from the seller tothe buyer. As such, they can be viewed assound examples of enhanced competition.

39. However, many of these deals take formsthat engender important lock-in effects, aswhen the rebate is somehow progressive, i.e. the percentage discount given dependson the total volume of sales through a cer-tain period of time on a certain air travelnetwork. Such agreements provide anincentive for the buyer to concentrate hisdemand to one or a few carriers. Larger

9

carriers will obtain an inherent advantagecompared to smaller ones. Such corporatediscount schemes have, in other words,clear anti-competitive effects.

40. Corporate discounts may conceivably havethe effect of raising the price for all thosecompanies that do not benefit from them.Interestingly, there are even indications thatcorporate discount schemes may lead tohigher nominal fares in a duopoly situationthan in a comparable monopoly setting.This is so because the duopoly will putpressure on the percentage discount. Tocompensate for this, airlines may want toincrease their nominal fares. A monopolyairline, on the other hand, has a muchstronger negotiating position and need notagree to large discounts in order to keep itslargest corporate clients.

41. The computer reservation systems areessential facilities in the marketing of airtravel services. EU Council Regulation2299/89 stipulates a code of conduct forthese systems, meant to ensure fair andnon-discriminatory service. Informal infor-mation nevertheless suggests that, in manytravel agencies, these systems are operatedin ways that do leave something to bedesired in terms of neutrality and non-dis-crimination. A closer control with the waythese systems are used and operated mayseem appropriate. It is, e.g., essential thatall airline carriers enjoy equal opportunitiesfor presentation and sale to a client, andthat no airline carrier be able to access allthe information stored in an independenttravel agent’s data base and use it for theirown marketing purposes.

42. Electronic ticketing (e-ticketing) is becom-ing more widespread. In these cases, reser-vations are usually done over the Internet,and no hard-copy ticket is issued. To theextent that e-ticketing is not based on openstandards, but requires the traveller to holdan electronic card specific to a particularcarrier or alliance, such a ticketing systemmay be liable to restrict competitionbetween airlines. This is particularly so ife-ticketing is integrated with the airline’s

frequent flyer programme, by making use,e. g., of the FFP membership card.

43. Further investigations into the businesspractices surrounding computer reserva-tion systems, travel agent agreements, andticketing systems at a European levelwould be appropriate. Further analyseswould also be required in order to assessmore accurately the anti-competitive effectof corporate discount schemes and thepossible remedies for it.

Competition between airports44. While most of the larger European airports

are slot constrained, there are a number ofsecondary airports with ample slot capaci-ty. By offering inexpensive services, lessbusy airports might be able to attract sub-stantial volumes of traffic and therebyrealise considerable economies of scale andenhanced consumer satisfaction. Low costairlines have started to exploit this opportu-nity, challenging the traditional carriers andtheir hubs by offering point-to-point ser-vices between smaller airports.

45. The promise of this development is, howev-er, limited by the relative shortage of com-mercially independent airports. In manycases, all or most of a country’s airports areowned and operated through one (govern-ment) agency. To enhance competition, itmight be desirable for European govern-ments to pave the ground for behaviourallyindependent airports. Ideally, two adjacentand hence potentially competing airportsshould not have the same owner. In thisway, a certain amount of market pressuremight be brought to bear on the presentlyinefficient slot allocation procedures.

Ground handling services46. Ground handling services are essential to

all air carriers, although different airlinesdemand services of differing degree ofsophistication. «No frills» airlines, e. g.,typically do not require catering services,nor the more advanced baggage handlingsystems necessary for interlining.

10

47. Larger carriers typically operate their ownground handling services, sometimesthrough subsidiary companies. In manycases they offer their services also to com-peting airlines. From a competition point ofview, the problem arises when the onlyprovider of ground handling services at agiven airport is owned by a dominant hubcarrier. In such a case, small rival airlinesmay be confined to buy these services fromtheir dominant competitor.

48. There is thus a need for independentground handling services at most airports.In the opinion of the Task Force, a maxi-mally effective competition among serviceproviders and among airlines would, inprinciple, be achieved if (i) all ground han-dling service providers were legally andfinancially independent of the airline carri-ers, and (ii) all such providers wereensured free and unimpeded entry into themarket for ground handling services at anyairport. While it is difficult in practice toimagine a regulation in which carrierswould no longer be allowed to self-handle,the Task Force believes that the CouncilDirective 96/67/EC does not ensure suffi-ciently free access to the market for third-party ground handling services at allCommunity/EEA airports, and should beamended accordingly.

49. To the extent that providers integrated withor controlled by an airline do get to partici-pate in ground handling, it is important thatthe tax rules not favour such own-accountmodes of operation compared to outsourc-ing. If, e. g., independent ground handlingproviders are subject to output value addedtax (VAT), without the airline companies

being able to deduct the correspondinginput VAT, then larger carriers having theirown catering firm or department will havea distinct cost advantage compared tosmaller carriers which need to buy theseservices in the market, and which, on topof everything, may have to buy them fromtheir dominant competitor.

Concerted action is needed50. The obstacles to competition in European

aviation are such as to require a concertedaction by various government andCommunity agencies, including the compe-tition authorities, the transport authorities,the fiscal authorities, and the legislativebodies. Perhaps the single most importantbarrier to entry at the European level is theinsufficient availability of airport slots andthe notoriously inefficient method of allo-cation for this scarce resource. Thus, avia-tion authorities are called upon to imple-ment economically more efficient and lessdiscriminatory slot allocation regimes.Also, these authorities should pave theground for less discriminatory ground han-dling services. Competition authorities arecalled upon, inter alia, to intervene againstloyalty programs and predatory pricing andto ensure an adequate airline alliance andmerger control. Fiscal authorities shouldensure non-distortionary tax regimes inrelation to aviation and their related activi-ties. Legislative changes may in somecases be needed in order to ensure thatgovernment bodies have the provisionsnecessary to pursue an effective competi-tion policy towards the air travel industry.

11

12

The limited degree of competition in NorthernEuropean aviation is a matter of deep concernto the Nordic competition authorities.Subsequent to the SAS-Braathens merger inDecember 2001, very few routes within orbetween Denmark, Finland, Norway, andSweden have more than one airline companyoperating.

More generally, the Nordic competition author-ities would like to raise the issue of enhancingairline competition in a broader, pan-Europeanor global perspective.

1.1 Theoretical perspectiveMonopolies have an incentive to reduce theiroutput so as to be able to charge a price thatexceeds the marginal cost of production. Theygenerally also have the market power to do so.This behaviour gives rise to a so-called dead-weight loss, meaning that the sum of the con-sumer and producer surpluses becomes smallerthan achievable under free competition.Although the producer surplus does increase,this gain is usually more than outweighed by alarge loss on the part of consumers, some ofwhich have to pay more for the product thanthe marginal cost, while others are «priced offthe market», incurring a welfare loss given bythe difference between their willingness-to-payand the marginal cost of production.

Theoretical considerations thus lead us toexpect relatively high prices in monopolisticmarkets. Informal observation from the Nordicair travel markets happens to appear consistentwith such a prediction.

Another important objection against monopo-lies is that the incentive to cost efficient pro-duction is reduced. In the absence of competi-

tors, a firm may survive and earn a profit evenif it does not adhere to the most efficientmethod of production. Competitive pressurewill help resolve this problem.

There are, nevertheless, circumstances inwhich a monopoly may represent a more efficient technology of production than whatwould follow from open competition. The so-called natural monopolies are characterisedby their ability to produce a given output moreeconomically than any collection of independ-ent, smaller firms.

Several authors have pointed out that, as a network industry, aviation does in fact exhibitseveral characteristics typical of naturalmonopolies. Suffice it here to mention the keywords economies of scale, economies of scope, and economies of density.1

To reach a verdict on the overall merits ofcompetition versus monopolistic production,one must balance the deadweight loss and theinefficiency due to missing competitive pres-sure against the economies of scale, scope anddensity. In many cases, the outcome of thistrade-off will depend on the size of the market.In smaller markets, there is less room for effec-tive competition.

As applied, however, to the great bulk of theEuropean air travel market, the latest theoreti-cal and empirical insights appear to suggestthat the efficiency gains connected with com-petition more than outweighs the advantages ofmonopolisation. We believe there are substan-tial potential gains to be reaped from a signifi-cantly enhanced competition within Europeanaviation in general, and within the Nordic airtravel markets in particular.

1 A more thorough discussion will be offered in Chapter 4.

1. INTRODUCTION

1.2 Barriers to airline competition There are several circumstances that, separate-ly or in combination, serve to reduce the possi-bility of a more competitive air travel market.

Possible barriers to entry and to effective com-petition include the hub-and-spoke system ofairline operation, the economies of scale, scopeand density typical of aviation, the present andfuture airline mergers, alliances, and codeshare arrangements, the bilateral aviationtreaties between countries, the frequent flyerprograms (FFPs), the corporate discountschemes, the computer reservation systems(CRSs), the travel agent agreements, the slotallocation regimes, the IATA (interlining) tariffconsultations, the system of taxation and sub-sidisation, the structure of airport charges, thevertical integration between ground handlingand operations in the air, etc. In this report, allof these issues will dealt with in smaller orgreater detail.

1.3 Deregulation in the USAThe American airline industry was deregulatedin 1978. By comparison, the single Europeanaviation market has – in principle – been ineffect since 1997, and remains far from fullyderegulated in practice.

As a backdrop to our discussion of airlinecompetition in Europe, it may therefore seemfruitful to start by an examination of theAmerican experience. Drawing on the lessonslearnt during 23 years of a deregulated aviationmarket, one might be able to foresee certainpatterns of development, certain opportunities,or certain obstacles to competition, that are yetto manifest themselves clearly in Europe.

A bit simplified, we think the principal pointsto be noted relate to • hub-and-spoke operations,• contestability, • consolidation,• frequent flyer programs (FFPs), and • slot allocation regimes.

1.3.1 Hub-and-spoke operations

Shortly after the US airlines were granted com-plete freedom to organise their own operations,the hub-and-spoke network system became thestandard mode of operation for all major air-lines. Rather than operating a large number ofpoint-to-point, non-stop routes, the airlinecompany channels all or most passengersthrough a «hub» airport, from which all con-nections extend like the spokes of a wheel.This way the number of different non-stoproutes needed to serve all possible pairs of n destinations is drastically reduced, from n(n-1)/2 to n-1. This allows for quite remark-able cost savings on account of the economiesof scale, scope and density inherent in a network structure. A fuller account of theseconcepts is given in Chapter 4 below.

Thus, almost all major American airlines oper-ate one or more hubs (the exception being lowcost airlines such as Southwest). Different air-lines choose different airports for their hubs.The hub airline therefore tends to dominate itshub airport and the area around it. No otherairline is able to offer a comparable frequencyof service into or out of the hub. Owing to theimportant network economic effects at play,the hub airline will often be able to cross-subsidise feeder routes into the hub, so as toeffectively outdo any smaller rival airlinewhich may want to offer services on just oneor a few spokes.

In terms of competition, the hub-and-spokesystem of operation therefore amounts to afairly pronounced division of the market,between the major airlines operating differenthubs. In the US, there is hardly any example ofa city pair with more than two airlines operat-ing a non-stop connection. The US market fornon-stop flights is, in other words, charac-terised by local monopolies or, at best, duopo-lies. Since time sensitive business travellersusually require non-stop trips, it is fair to saythat the competition in the US market for busi-ness travel is severely restricted.

There are, however, usually a fairly large num-ber of airlines serving the same city pair byconnections via a third (hub) airport. These

13

connections are, of course, slower than thedirect flights. But since leisure travellers tendto be less concerned about travel time losses,the US market for leisure travel is generallyconsidered to be fairly competitive.

1.3.2 Contestability

Prior to and shortly after the deregulation, itwas generally thought that aviation marketswould in general be highly contestable, as itwould be easy for any carrier to relocate air-craft and personnel so as to service a newroute.

In practice, it has turned out that the barriers toentry are much more important than previouslybelieved. Incumbent airlines can lower theirfares and/or increase their capacity practicallyovernight, so as to raise the cost and/or reducethe revenue of rival new entrants. Any poten-tial new entrant would, of course, be aware ofthis, and hesitate to challenge the incumbentcarrier even if the latter may be making a con-siderable profit in the current (monopolised)situation.

1.3.3 Consolidation

Following a period of rather fierce competitionin the early phases of deregulation, the US air-line industry has consolidated into a few largecarriers with nationwide networks. As of theend of 2001, there were at present six large,«traditional» carriers operating in the USdomestic travel market:

• American Airlines (AA), • United Airlines (UA),• Delta Air Lines• Northwest Airlines (NWA),• Continental Airlines (CA), and• U S Airways (USAir).

In addition, there is a rapidly growing low-costcarrier operating, viz.• Southwest Airlines (SWA).

NWA and CA are, however, about to merge.Altogether, there are thus only six independent,larger carriers operating.

1.3.4 Frequent flyer programmes

Frequent flyer programmes originated in theUS in the early 1980s. Being based on non-linear bonus systems applicable to repeatedpurchases, they act as loyalty or fidelity discounts for the customers, providing thesewith a certain incentive to stick to one and thesame provider (see Section 6.1 below for amore in-depth description). FFPs are now anintegral part of any US airline’s marketingstrategy (except for low-cost carriers). Theyremain popular also with large parts of thepublic and with the political establishment.

Thus, although obviously liable to restrictcompetition, the FFPs have not been the sub-ject of any serious attempt at intervention onthe part of the US competition authorities.Since all major carriers operate comparableprogrammes, and since there are several carri-ers providing extended, nationwide services,FFPs are generally not seen as the most impor-tant obstacle to competition in the US domesticmarket.

1.3.5 Slot allocation regimes

As in Europe, the slot allocation process isgenerally governed by history and tradition(«grandfather rights»).

In principle, there is a market for (ownershipto) slots in the US. However, this market is notvery liquid, as the turnover is quite small. Fewslots are ever sold. The time restricted leasingof slots is much more common.

The reason is not hard to understand. Even if acarrier may take care not to sell its slot to anairline that competes in the same market, itcannot prevent the buyer to resell the slot at alater stage, possibly to a fierce competitor ofthe original owner.

This suggests that attractive slots will rarely besold to new entrants. Although the new entrantmay not be a menace to the airline offering theslot, it might be a threat to some other, incum-bent carrier. This incumbent carrier wouldtherefore normally be willing to bid up theprice considerably, in order to use or «babysit»

14

the slot and avoid the nuisance of enhancedcompetition. The slot seller will therefore beable to reap a higher benefit by offering to sellto an incumbent airline than to a new entrant. The principal lesson to be learnt is that astraightforward, market based system of slotownership will not necessarily result inenhanced competition or challenges to incumbent airlines.

1.4 The European experience and outlook

1.4.1 National carriers and hubs

In Europe, the hub-and-spoke mode of opera-tion has an even longer history than in the US,having grown out of the past regulatory frame-work and of the prevailing geographic andpolitical conditions, rather than as anautonomous market process. Each country hashad its own national airline, or «flag carrier»,with a privileged position in and around itsdomestic market and frequently a large govern-ment ownership share. More often than not,flag carriers have been benefiting from consid-erable amounts of subsidies or direct financialsupport from the state.

Even more importantly, they have, up untilrecently, been benefiting from very consider-able amounts of indirect government support,in the form of heavily protected domestic andinternational markets.

The flag carrier typically organises its networkaround a hub located near the national capitalor main business centre. At its hub airport, theflag carrier tends to have considerable directand indirect influence on slot allocation prac-tices, on ground handling services, and onother essential facilities. Backed by its owngovernment, the flag carrier usually also tendsto obtain privileged positions in whatever bilat-eral aviation agreements are signed with othercountries. Each flag carrier therefore enjoysconsiderable market power at and around itsdomestic hub.

Thus, although there are almost as many flagcarriers as there are European nations, thecompetition between them is severely restrict-

ed, as they have been able to divide the marketbetween them to a very considerable extent. Inmany (short-haul) markets, the most effectivecompetitor to the European flag carrier is notanother airline company, but a surface mode oftravel, represented by a railway company, abus service, or the private car.

1.4.2 Regulation and deregulation

While in the US deregulation of the aviationmarket was done so to speak overnight, theEuropean liberalisation process is much moregradual, extending over more than a decade. Itis, in fact, still to be completed.

Until 1992, air traffic to and from any singlecountry was generally regulated by bilateralaviation agreements, by which exclusive trafficrights were usually reserved for the flag carri-ers of the two respective countries.

In 1987, the European Council agreed on atriple package of measures to liberalise airtransport. The approach was to be one of step-wise relaxation of controls covering the keyareas of tariff approval, market access, capaci-ty, and the application of the competition rules.

The first package, effective January 1993,opened the market for international flightswithin the Community. Airlines were givengreater freedom to provide capacity to matchmarket demands. New, more flexible proce-dures for the approval of fares meant thatmember states could no longer block proposalsfor economic low fares. These measuresenabled smaller airlines that had previouslyconcentrated on domestic or regional servicesto operate on important intra-Communityroutes and gave them increased freedom tocharge the fares they wished and providecapacity to meet market demands.

The second package carried these reforms fur-ther by increasing market access and the rightof European airlines to carry traffic betweentwo other European countries as part of a flightoriginating in its home country (so-called FifthFreedom rights). Governments were no longerable of deny airlines entry if they fulfilled allthe technical and safety standards. The second

15

package also expanded the scope for fare dis-counting within certain geographic zones.

In the third and final package, which camefully into effect in April 1997, European carri-ers were granted full traffic rights within theEuropean Economic Area (EEA)2 – includingcabotage rights – and the ability to set fares.The single European aviation market, compris-ing a 370 million population, had become reality.

Thus, through the first, second and third pack-ages of liberalisation, most regulations imped-ing competition in European aviation havebeen lifted, although some of them still remain.Perhaps the most important of these are thebilateral aviation agreements still in effectbetween single European countries and nationsoutside the Community. Some of these havethe form of so-called «Open Skies» agree-ments, by which any carrier belonging to eitherone of the two countries enjoys unrestrictedtraffic rights between the countries. Otheragreements, however, are much more restric-tive, like the «Bermuda II» treaty currently ineffect between the US and the UK. Accordingto this agreement, only four carriers – twoBritish and two American – are allowed to flybetween London and the US.

Thus, bilateral aviation treaties still ensureEuropean flag carriers a considerable degree ofmarket protection as far as extra-Communityair services are concerned. The exclusive traf-fic rights granted under such treaties might beforfeited if the flag carrier is merged with aforeign airline – whence the widespread prac-tice of forming alliances rather than full-fledged mergers between European airlines. In an opinion delivered by the AdvocateGeneral of the European Court of Justice on 31January 2002, it is proposed that individualmember states no longer be allowed to enter-tain such individual aviation treaties with non-EU countries. To the extent that this view isupheld by the Court, and assuming that such a

decision will be followed by the conclusion ofOpen Skies agreements between the EU andother countries, it will, in principle, also openthe extra-Community aviation market to anyEuropean carrier. As such, it could be viewedas the final step toward deregulation of the avi-ation industry in Europe.

It will, however, not automatically meanenhanced overall competition. When bilateraltreaties are replaced by Community levelagreements with non-EU countries, a majorimpediment to mergers involving two or moreflag carriers will have been removed. It may beforeseen that such a change in the regulatoryregime will spark a development towards mas-sive consolidation within European aviation. While in terms of competition and efficientresource allocation, full-fledged mergers maywell be preferable to looser alliances, it is para-mount to the protection of consumers and otherair travel customers that the resulting numberof European aviation concerns or alliances notbecome too low.

1.5 OutlineThe remaining part of this report is outlined asfollows.

In Chapter 2, we offer a general description ofthe aviation markets in the Nordic countries3.

Chapter 3 describes the relevant competitionlaw currently in effect in the respective coun-tries. While, in most cases, competition law isin line with the legal framework of theEuropean Union (EU), there are some excep-tions and deviations to be noted.

Chapter 4 focuses on the economics of avia-tion, with particular emphasis on the conceptsof network economics, price discrimination,costs, and productivity.

Chapter 5 is a brief discussion of taxation andairport charging schemes, as they affect the

16

2 The European Economic Area comprises Norway, Iceland, and Liechtenstein in addition to the European Union (EU).3 Throughout this report, we limit our attention to Denmark, Finland, Norway, and Sweden. It has been beyond the scope of the Task Force’s work

to explicitly include Iceland, Greenland, and the Faroe islands.

incentives faced by clients and operators in theair travel market and the externalities connect-ed to airline operations.

In Chapter 6, we discuss the various possiblebarriers to competition inherent in the market-ing practices and mode of operation of modernairlines and airports. These barriers include fre-

quent flyer programmes, corporate discountschemes, travel agent agreements, fare cooper-ation, inefficient slot allocation, etc.

In Chapter 7, we summarise and conclude thediscussion, putting forward a set of recommen-dations to the Nordic and European authorities.

17

Denmark, Finland, Norway, and Sweden forma relatively homogeneous region in NorthernEurope. Their populations count, as of mid-2000, 5.3, 5.2, 4.4, and 8.9 million, respective-ly. While Denmark covers a relatively smallsurface and hence has a comparatively densepopulation, with 124 inhabitants per squarekilometre, the opposite is true of Finland,Norway, and Sweden, where the populationdensities are 15, 14, and 20 inhabitants persquare kilometre, respectively.

2.1 Air travel demand in the Nordiccountries

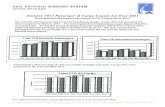

Figure 2.1 shows the level and development ofdomestic air traffic in the four countries overthe last few years. In 2000, more than 23 million domestic air trips were made in theNordic countries, i. e. almost one trip per capita.

One notes that Norway, despite being thesmallest country in terms of population, hasthe largest domestic market, followed bySweden. The Danish and Finnish domestic airtravel markets are comparatively small.

The national propensity to travel by air mustbe understood in relation to numerous, coun-try-specific characteristics, including geo-graphic extension or size, topography, popula-tion spread, surface transport level-of-service,economic factors, etc. Air travel has its com-parative advantage on longer distances, and/orin cases where, although the distance is shortas the crow flies, alternative travel modes areslow on account of topography or inefficientsurface transport networks. This probablyexplains the relatively high propensity to travelby air in Norway, and the low propensity inDenmark.

Figure 2.2 shows the densest single domestic

routes within each of the four countries. Onenotes that no less than five domestic routes inScandinavia exceed one million passengers peryear. Three of these routes are Norwegian.Oslo-Trondheim, Oslo-Bergen, and Stockholm-Gothenburg compete neck and neck to be thedensest route.

In Figure 2.3, we exhibit some main statisticsconcerning the size of the international airtravel market between the Nordic countries,and between each country and the EEA. Notethat intercontinental traffic is not included, norare those European trips that have one end out-side the EEA.

The largest country also has the largest interna-tional European traffic, totalling more than 14million passengers annually to/from the EEA.Of these, 4.6 millions travel to or from theother Nordic countries. In Denmark, there are4.1 million travellers to or from the Nordiccountries, while in Norway and Finland thefigures are 2.9 and 1.8 million, respectively.

The total international inter-Nordic trafficamounts to 6.7 million passengers per year4.Trips between the Nordic countries and theremaining EEA total almost 28 millions.Adding the 23 million domestic trips men-tioned above, we arrive at a total annual airtravel frequency of approximately 57 millions,not counting intercontinental trips or Europeantrips outside the EEA. This corresponds toapproximately 2.4 trips per capita.

In Figure 2.4, we show how the densest inter-Nordic and extra-Nordic5 routes compare tothe rest of Europe. Six routes between or intothe Nordic countries are among the top 24international routes in the Europe. Only four-teen international European routes are denserthan the Stockholm-Copenhagen route.

Some further statistics are given in Table 2.1.

18

2. MARKET DESCRIPTION

19

4 One half of the sum of the national figures, since each inter-Nordic passenger has been counted twice. 5 Routes between Nordic countries are shown by red bars, while routes into the Nordic region are represented by blue bars. Note that domestic

European routes are not taken account of. Some of these exceed three million annual passengers and are hence denser than the London-Dublinroute.

2129 20921769 1745 1654

23232640

2973 28723100

9280

982210222

10565 10536

65786794

72297613

7943

0

2000

4000

6000

8000

10000

12000

1996 1997 1998 1999 2000

1000 domestic

passengers

Denmark

Finland

Norway

Sweden

Figure 2.1: Domestic air passengers in Denmark, Finland, Norway, and Sweden1996-2000

590390

272208

107

640287

279210

207

13401330

1050790

700

13201190

870700

410

0 200 400 600 800 1000 1200 1400

Copenhagen-Aalborg

Copenhagen-Aarhus

Copenhagen-Karup

Copenhagen-Rønne

Copenhagen-Billund

Helsinki-Oulu

Helsinki-Rovaniemi

Helsinki-Kuopi

Helsinki-Jyväskylä

Helsinki-Vaasa

Oslo-Trondheim

Oslo-Bergen

Oslo-Stavanger

Oslo-Tromsø

Bergen-Stavanger

Stockholm-Gothenburg

Stockholm-Malmö

Stockholm-Luleå

Stockholm-Umeå

Stockholm-Östersund

1000 passengers during 2000

Figure 2.2: The five densest routes in Denmark, Finland, Norway, and Sweden, respectively

20

1999

0,00

1,92

0,43

1,51

1,76

1,171,92

1,27

1,13

8,21

3,94

5,66

9,99

1,76

0,43

0,05

0,130

2

4

6

8

10

12

14

16

Denmark Finland Norway Sweden

Mill passengers

To/from remaining EEA

To/from SwedenTo/from NorwayTo/from FinlandTo/from Denmark

Figure 2.3: International air traffic between each of the Nordic countries and the EEA, by countryof destination/origin. 1999. Source: Eurostat: International Transport by Air

0,0 0,5 1,0 1,5 2,0 2,5

London-Oslo

Helsinki-Stockholm

Oslo-Stockholm

London-Munich

Barcelona-London

Geneva-London

Copenhagen-London

Barcelona-Paris

Copenhagen-Oslo

Copenhagen-Stockholm

London-Zürich

Amsterdam-Paris

Brussels-London

Paris-Milan

London-Stockholm

Paris-Rome

London-Milan

London-Madrid

Paris-Madrid

London-Rome

Frankfurt-London

Paris-London

Amsterdam-London

Dublin-London

Mill passengers 2000

Figure 2.4: Densest 24 international city pairs in European aviation. Year 2000. Source: Association of European Airlines (AEA)

21

6 Including charter flights.

Table 2.1: Summary air traffic statistics for the Nordic countries, as of March 2002.

2.1.1 Denmark

In Denmark, the distances between the majorcities are short, and the bridge between theislands of Zealand and Funen, which opened in1997 for trains and in 1998 also for cars, hasshortened the time between the provinces byanother 1- 11/2 hours. This meant that thedomestic air traffic has decreased to an evensmaller level than before the opening, as threeroutes have been shut down due to the compe-tition from cars and trains. Today the domestic

air traffic involves six routes to and fromCopenhagen. Only 1.7 million people used theplane for domestic travelling in 2000, or 16.7per cent of all travellers, when internationaland charter passengers are included as well.The route with most passengers wasCopenhagen-Aalborg with just under 600 thou-sand passengers in 2000 (see Figure 2.2), followed by Copenhagen-Aarhus (400 thou-sand passengers).

Denmark Finland Norway Sweden

Passengers on scheduled domestic

routes in 2000

1 654 080 3 099 968 10 536 000 7 943 000

Domestic routes

6 21 112 Appr. 40

Passenger kms in 2000 (millions) 333 1 286 4 312 3 620

Passengers in 2000 (in per cent)

- scheduled domestic

- scheduled international

- charter flights

-

16.7

70.9

12.3

44.9

46.0

9.1

48.6

39.6

11.8

49.16

50.96

Regulated domestic routes (PSO)

0 0 50 10

Scheduled international routes out

of largest domestic airport

- Nordic routes

- other European routes

- intercontinental routes

-

Copenhagen:

111

26

65

20

Helsinki:

39

6

27

6

Oslo:

34

10

23

1

Stockholm/ARN

73

16

44

13

Scheduled international routes out

of second largest domestic airport

- Nordic routes

- other European routes

intercontinental routes

Billund:

15

5

10

0

Oulu:

1

1

0

0

Stavanger:

6

2

4

0

Göteborg:

27

8

18

1

Scheduled international routes out

of third largest domestic airport

- Nordic routes

- other European routes

intercontinental routes

Aarhus:

4

3

1

0

Turku:

2

20

0

Bergen:

5

1

4

0

Malmö/Sturup:

4

1

3

0

Gothenburg:

22

7 The Danish, Swedish and Norwegian states own 50.8 % of SAS, while private investors own 49.2% (see facts about SAS 2001/2002,www.sas.se). The Finnish state owns 58.4 % of Finnair, while private investors own the remainder.

8 EuroBonus and Finnair Plus are the frequent flyer programmes of SAS and Finnair, respectively.

2.1.2 Finland

Finland, on the other hand, is characterised byfairly large distances. Here, however, almostall the major cities are located relatively closeto each other in the southern part of the coun-try. There is thus very little air traffic betweenthe three largest cities in Finland. Despite therelatively sparse population none of the 21major domestic routes are run as public serviceobligation routes. In total, 3.1 million passen-gers travelled by air in 2000. This was a thirdmore than in 1996 and 44.9 per cent of thetotal air traffic, when international and chartertraffic is included. Helsinki-Oulu is by far thedensest route, carrying 600 thousand passen-gers in 2000, compared to only 300 thousandpassengers on the second largest route,between Helsinki and Rovaniemi.

2.1.3 Norway

In Norway, domestic air travel demand isunusually high, on account of the considerabledistances between the major cities and on therelatively low level-of-service offered by alter-native modes of transport. The main cities aresituated in the southern part of the country andalong the western coast, whereas the northernpart of the country has a very sparse popula-tion. As a consequence of the dependence onair transport in and to/from the more remoteareas, the Norwegian government has imposeda public service obligation on approximately50 of the 112 domestic routes. In 2000, 48.6per cent of all air passengers travelled ondomestic routes, totalling approximately 10.5million passengers. Oslo-Trondheim and Oslo-Bergen both have more than 1.3 million pas-sengers. The Oslo-Stavanger route comes third,with slightly more than a million.

2.1.4 Sweden

Domestic air traffic in Sweden is also affectedby the considerable distances between the mainpopulation centres. The main cities are foundin the central and southern part of the country,

while the northern part of the country is spare-ly populated. Here, the government hasimposed a public service obligation on 10 ofthe approximately 40 domestic routes (begin-ning in November 2002). The large distanceshave made the plane an important travel mode.In total, 7.9 million passengers travelleddomestically in 2000, the domestic trafficaccounting for 49.1 per cent of the total airpassenger number in Sweden. The densestroute is the one between Stockholm andGothenburg (1.32 million passengers), whileStockholm-Malmö comes in second (1.19 million).

2.2 The supply side: carriers operatingin the Nordic countries

2.2.1 Cooperation, integration, and domesticmarket performance

Traditionally the national flag carriers havebeen the biggest suppliers of domestic air trav-el services of the four countries. In Denmark,Norway, and Sweden the national carrier is theScandinavian Airlines System (SAS), while inFinland the national carrier is Finnair.7

More than 90 per cent of the domestic passen-gers in Finland fly Finnair. In comparison,SAS’ share of the domestic passengers inDenmark, Norway and Sweden is 60, 35, and74 per cent, respectively. In reality, SAS’ andFinnair’s market power is further strengthenedby cross-ownership and cooperation agree-ments with other airlines (see Table 2.2). BothSAS and Finnair have code-sharing agreementswith their cooperating airlines, just as it is pos-sible to collect EuroBonus or Finnair Pluspoints8 on flights with some of the cooperatingairlines. Code-share partners also often runadvertisement campaigns together.

These structures have led to a situation inwhich domestic competition is limited, notonly on the thinner routes, but on most of thedenser routes as well. Only in Sweden and

23

9 The Norwegian Competition Authority did not intervene against SAS’ acquisition of Braathens, since Braathens was a failing firm.10 Since 12 May 2002, Maersk Air no longer serves the domestic Danish market. 11 Air Botnia stopped domestic operations in 2002.12 Comparable data for British Airways have not been available. Their domestic market is, however, relatively small. Also, note that the figures for

Air France do not include flights to the French territories overseas. 13 Not including Widerøe flights.

Denmark do airlines compete, and only on alimited number of routes. In Norway, SAS andBraathens have been competing on severalroutes up until 2001. After the merger9, theyhold a 98 per cent market share. The competi-tion in Norway is thus practically non-existent,

and the same is true for Finland. The compet-ing company to Finnair, Air Botnia, has decid-ed to focus on regional traffic instead ofdomestic traffic, and the airline has stopped alldomestic operations.

In some cases, however, depending on the dis-tances and on the quality of transport infra-structure and level-of-service, surface travelmodes may be substitutable for air transportservices, at least within some traveller seg-ments. This is probably the case for some ofthe shorter air routes in Finland and Sweden,and to a lesser extent in Denmark and Norway.Hence, although there is no effective competi-tion between airlines, the market power of car-riers may be limited by the competitive chal-

lenge posed by railways, bus services, or evenprivate cars.

In Figure 2.5 an attempt is made to charac-terise the domestic market performance of theNordic flag carriers, i. e. the SAS Group andFinnair, compared to their French and Germancounterparts12. Here, we consider the «domes-tic» market of the SAS Group to consist of allflights inside Scandinavia (Denmark, Norway,and Sweden)13.

Table 2.2: The domestic airlines in Denmark, Finland, Norway, and Sweden

Country Airline Domestic share of

passengers (per cent)

Ownership and cooperation

Denmark

SAS 59.4 -

Cimber Air 24.1 Owned 26 % by SAS

+ cooperation with SAS

Maersk Air 16.510 Cooperation with SAS

Finland Finnair 91.9 -

Golden Air 5.7 Cooperation with Finnair

Air Botnia 2.411 Fully owned by SAS

Norway Braathens 50 Fully owned by SAS (as of 2002)

SAS 35 -

Widerøe 13 Owned 96.4 % by SAS

Other 2

Sweden SAS 74 -

Skyways 13 Owned 25 % by SAS

+ cooperation with SAS

Malmö Aviation 10

Other 3

24

After the SAS-Braaathens merger, the SASGroup probably enjoys the largest «domestic»market of any European carrier, in absolute,RPK14 terms as well as relatively speaking. Noother major European carrier has anywherenear 35 per cent of its activity in the domesticmarket.

The airport in Copenhagen, Kastrup, functionsas the main hub for SAS. It is also the biggestairport in the Nordic countries with 16.4 mil-lion passengers passing through in 2000. Thereare currently 111 international routes to andfrom the airport (see Table 2.1). Due to the

minimum amount of domestic air traffic theinternational travellers account for around 90per cent of the passengers, a very high percent-age compared to most other airports. Thismeans that a lot of the feeder traffic comesfrom the surrounding countries, primarily fromSweden and Norway. For that purpose, SAShas direct routes between Copenhagen and thesmaller Swedish and Norwegian cities, plus adense schedule between the three capitals. Onaccount of this extensive network, SAS is quitedominant in Kastrup airport, having 58 percent of the departures in 2000.

Figure 2.5: Domestic market performance of the Nordic, French, and German flag carriers. Source: Airlines’ annual reports for 2000.

SAS is just as dominant in their secondaryhubs, Arlanda airport in Stockholm andGardermoen airport in Oslo. This is also due tothe extensive network of domestic routes thatfeed passengers to SAS’ international routes toand from Arlanda and Gardermoen. This net-work has given SAS a dominant position in theair traffic within, between, into and out of thethree Scandinavian countries.

Finnair has a similar network of domesticroutes, which feeds passengers into their hub inHelsinki, from where 39 scheduled internation-al routes originate. This has also given Finnaira strong position in Finland. The carrier hasalso a set of European routes (12 in 2001) originating from Stockholm, and it also operates to Skavsta airport near Stockholm. To some extent it also feeds passengers toSAS’ routes from Stockholm and Copenhagen.

14 Revenue Passenger Kilometres.

25

SAS and Finnair both cooperate with other airlines. Where SAS is a member of the StarAlliance, a cooperation between fifteen air-lines, Finnair is a member of the other bigalliance, Oneworld, where eight airlines cooperate.

2.2.2 SAS in an international perspective 15

To get an idea of the positioning of theEuropean airlines, and in particular of SAS’position in this market, we present, in Table2.3, some key figures for 22 of the largest air-lines. The numbers are from 1995/1996. Even

Table 2.3: Descriptive statistics for 22 of the world’s largest airlines in 1995.

15 This section draws heavily on the report by Steen and Strandenes (2002), using parts of their text verbatim.

Airline Revenue

tonne kms

(millions)

Number of

passengers

(thousand)

Number of

employees

(units)

Per cent

internat’l

RTK

Stage

length

(kms)

Passenger

load

factor (%)

North America

American 17 660† 79 389† 90 980 36. 9 1 799 69†

United 19 637† 81 945† 80 902 42.3 1 683 72†

Delta 15 168† 97 271† 62 832 30.7 1 224 70†

Northwest 12 821† 52 722† 44 682 47.8 1 363 73†

US Air 5 949† 56 893† 43 614 7.4 904 69†

Continental 6 009† 35 986† 32.272 20.0 1 315 68†

Air Canada 3 453 12 801 20 503 67.3 1 536 63

Canadian 2 948 8 578† 13 228† 70.1 1 681 71†

Average North America 10 456 53 198 48 627 40.3 1 438 69.4

Asia-Pacific

Japan 10 204 28 880 20 482 85.6 2 348 68

Nippon 4 583 37 870 14 649 41.2 1 112 64

Singapore 9 512† 12 022† 13 258 100.0 4 300 74†

Korean Air 8 261 21 422 16 478 93.9 1 714 65

Cathay 7 092† 10 985† 15 657† 100.0 3 283 74†

Qantas 5 603† 15 551† 24 429† 79.5 2 064 72†

Thai 3 795 12 821 20 718 92.0 1 559 67

Average Asia-Pacific 7 007 19 936 17 953 84.6 2 340 69.1

Europe

Lufthansa@ 12 205 32 599 26 578 95.2 1 131 70

British Airways 12 215 35 000† 50 477 98.1 1 863 72†

Air France 9 701 14 498 36 384 91.1 1 846 71

SAS 2 195 19 828† 21 348† 83.1 728 64†

KLM 8 630† 12 285 26 385† 99.9 1 748 76†

Swissair 3 574 8 826† 16 520 99.0 1 268 64

Iberia 2 850 14 600† 22 500 79.6 1 194 70

Average Europe 7 339 19 662 28 599 92.3 1 397 69.6

Source: Oum and Yu (1998a), quoted by Steen and Strandenes (2002).

†1996 data@

Lufthansa went through dramatic restructuring during 1994-1995. Its Technical Services and Cargo divisions

became independent public limited companies on 1 January 1995. The parent company Lufthansa AG is now

purely a scheduled passenger airline company.

the newest studies of airlines (e.g. Ng andSeabright 2001) only include data up to 1995.Hence, since we are using secondary sources,all comparisons done here are based on data upto 1995. Note that, since then, the SAS Grouphas grown considerably through the acquisitionof Braathens.

As can be noted from Table 2.3, the US air-lines are the world’s largest. Only two of theEuropean carriers can compete among thetop ten, i. e. KLM and British Airways. SASis the smallest among the 22 carriers inTable 2.3 if we look at the revenue tonnekilometres figure, but ranks 11 in terms ofpassenger volume. This reflects the fact thatSAS has by far the lowest average stagelength, with only 728 kms, suggesting alsothat they have a cost disadvantage comparedto their competitors (see Chapter 4).

On the other hand, if we look at the employee/passenger ratio, the SAS figure (1.08) is bestin Europe if one disregards Lufthansa,whose data are not exactly comparable dueto their restructuring (see note to the table).

Actually, the SAS figure is closer to theNorth American average (0.91) than to theEuropean average (1.45). Air France hasmore employees compared to passengersthan any other carrier (2.51). The differencesbetween Europe and both North Americaand Asia-Pacific suggest a much higher pro-ductivity within the latter two industries.

The «Per cent internat’l RTK» statistic is thepercentage of the revenue tonne kilometresthat stems from international transport. TheNorth American carriers have a significantlysmaller international share than any of theother carriers: 40 per cent, as compared tothe European and Asian-Pacific averages of84 to 92 per cent. SAS has, along withIberia, the lowest international share of theirincome from abroad (83 per cent) amongEuropean carriers, but this figures is stillhigher than for any North American carrier.However, if we account for the fact thatSAS’ domestic market consists of threecountries, Denmark, Norway, and Sweden,their «domestic base» is much higher than17 per cent, as illustrated in Figure 2.5.

26

27

16 Art. 53 and 54 of the EEA Agreement follow Art. 81 and 82 of the EC Treaty verbatim. They have been implemented in Norwegian Lawthrough Act of 27 November 1992 No. 109.

3.1 Community Law/EEA LawArticles 81 and 82 of the EC Treaty, andArticles 53 and 54 of the EEA agreement16, setout general prohibitions on anti-competitiveagreements and abuse of dominant position.