COMMONWEALTH OF AUSTRALIA Official Committee Hansard · Monday, 8 July 2002 SENATE— References E...

Transcript of COMMONWEALTH OF AUSTRALIA Official Committee Hansard · Monday, 8 July 2002 SENATE— References E...

COMMONWEALTH OF AUSTRALIA

Official Committee Hansard

SENATEECONOMICS REFERENCES COMMITTEE

Reference: Public liability and professional indemnity insurance

MONDAY, 8 JULY 2002

C A N B E R R A

BY AUTHORITY OF THE SENATE

INTERNET

The Proof and Official Hansard transcripts of Senate committee hearings,some House of Representatives committee hearings and some joint com-mittee hearings are available on the Internet. Some House of Representa-tives committees and some joint committees make available only OfficialHansard transcripts.

The Internet address is: http://www.aph.gov.au/hansard

To search the parliamentary database, go to: http://search.aph.gov.au

SENATE

ECONOMICS REFERENCES COMMITTEE

Monday, 8 July 2002

Members: Senator Collins (Chair), Senator Brandis (Deputy Chair), Senators Chapman, Cook, Ridgewayand Webber

Participating members: Senators Abetz, Boswell, Calvert, George Campbell, Carr, Cherry, Conroy, Coonan,Eggleston, Faulkner, Ferguson, Ferris, Forshaw, Harradine, Harris, Kirk, Knowles, Lightfoot, Mason,McGauran, Murphy, Murray, Payne, Sherry, Stot Despoja, Tchen, Tierney and Watson

Senators in attendance: Senators Brandis, Collins, Conroy and Ridgeway

Terms of reference for the inquiry:To inquire into and report on:

a) the impact of public liability insurance for small business and community and sporting organisations; and

b) the impact of professional indeminity insurance, including Directors and Officers Insurance, for smallbusiness;

with particular reference to:

c) the cost of such insurance;

d) reasons for the increase in premiums for such insurance; and

e) schemes, arrangements or reforms that can reduce the cost of such insurance and/or better calculate andpool risk.

WITNESSES

BAIN, Dr Robert, Secretary General, Australian Medical Association .................................................... 22

BAKER, Dr Kenneth, Chief Executive Officer, ACROD Ltd.................................................................... 70

BURTON, Ms Pamela, Legal Counsel, Australian Medical Association................................................... 22

BUTLER, Dr Robert John Francis, Executive Director, Australian Dental Association Inc.................. 33

CLARK, Mr David, Legal Officer, Local Government and Shires Association of New SouthWales................................................................................................................................................................ 13

DRUMMOND, Mr Robert, General Manager, Regulation, Insurance Council of Australia Ltd .......... 45

JAMVOLD, Mr Peter, Group Manager, Southern Division, Insurance Council of Australia Ltd ........ 45

JONES, Mr Raymond Lloyd, President, Insurance Council of Australia Ltd.......................................... 45

MARDEN, Mr Bernie, Secretary, Professional Standards Council........................................................... 78

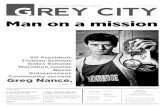

NANCE, Mr Gregory John, Chief Executive Officer, Surf Life Saving Australia ..................................... 1

ORTON, Mr Paul, General Manager Policy, Australian Business Ltd..................................................... 64

PERSSON, Ms Monica, Executive Manager, Audiological Society of Australia Inc. .............................. 33

REGAN, Dr Sean, Senior Policy Adviser, ACROD Ltd ............................................................................. 70

SEDGLEY, Dr Michael, Chairman of Council, Australian Medical Association..................................... 22

STEPHENS, Dr David Hector, Policy Consultant, Australian Council of Professions Ltd..................... 33

WILKINSON, Mr Warwick AM, Chairman, Professional Standards Council........................................ 78

Monday, 8 July 2002 SENATE—References E 1

ECONOMICS

Committee met at 9.19 a.m.

NANCE, Mr Gregory John, Chief Executive Officer, Surf Life Saving Australia

CHAIR—We will delay formally commencing the Senate Economics ReferencesCommittee’s inquiry into public liability and professional indemnity insurance but we willcommence with an informal briefing from our first witness, Mr Nance, from Surf Life SavingAustralia Ltd. Unfortunately, because the committee at this stage is not quorate, anysubmissions at this point will not attract parliamentary privilege. However, Mr Nance is awareof this issue and the committee should be happy to incorporate his remarks once it becomesquorate. Welcome to this briefing, Mr Nance. I look forward to the opportunity to hear from youin relation to your submission.

Mr Nance—I will briefly recount some facts about SLSA and our recent insurance historyand will then update the committee on our observations of what is going on at the moment. Weare a member based volunteer charitable organisation and have been around for nearly 100years. We provide a free rescue service on the nation’s beaches. Some 10 years ago, we decidedto pool our insurances because of increased premiums for public liability insurance. We do notreceive any public support or government support at any level for public liability. We pay for itourselves, which means the members pay for it.

Ten years ago, when we pooled our insurances, the national premium for public liabilityinsurance in surf was around $125,000. Today it is over $600,000 a year. Despite the pooling,we experienced an increase in the claims. Our premiums went up well before the HIHcollapse—we were never insured with HIH—and the September 11 disaster. As I have related inthe submission, we have put in a number of very strict risk management procedures within ourclubs. We have modified our activities to counter the increasing incidence of the claims.

The claims came from a range of areas. Mostly they were not in the surf but from incidentson the land, particularly slips and falls. In the last 3½ years, there have been 83 claims againstour public liability insurance, of which 21 have been in the water. Around one in four claimshave been in the surf, which is our primary area of responsibility, and the rest have occurred onthe land.

The predominant reasons for the land based claims have been for slips, falls and,occasionally, human error related to normal activities—just going about your daily life—in abuilding or near a building. We insure over 285 surf clubs and over 300 operating entities. Wehave about 110,000 members today. A variety of things go on in surf clubs. We are in a riskbusiness, and people lose their lives—occasionally our members, tragically, lose their lives, sowe will have some things going on—but it is distressing that the claims are coming from an areathat no-one foresaw, which is mostly slips and falls around the clubs. There are occupationalhealth and safety issues across the range of activities our members are involved in, and we havea duty of care to make the environment far safer for them.

An element in the increased premiums has been the number of claims from our members. Ofthose 83 claims, only eight—or one in ten—are from our members. Most are related to injuriessustained in the use of our inflatable rescue craft, the IRB. I am reasonably confident fromspeaking to our brokers that, with the risk management and the fact that we moved our

E 2 SENATE—References Monday, 8 July 2002

ECONOMICS

insurance offshore three years ago, the underwriters, who are all London based groups ofinsurers, will be able to successfully write our insurance at an affordable level again this year. Iam hopeful of that. But three years ago we were basically uninsurable in this country, evenwhen HIH was operating.

I will conclude by making some comments about the current situation as I see it. We arewatching the state legislation being put forward in New South Wales, in particular, and in otherstates, and we are very closely tracking what the states are doing. I applaud the New SouthWales state government for what they are doing. The first raft of legislation appears to me to bea pretty good shot at bringing the premiums down, although there are no guarantees. The secondrange of legislation that will be tabled in New South Wales, which will protect charitableorganisations like ours, is a must have as far as I am concerned. It should be consistent acrossevery state. You can protect the individuals, but unless you protect the charitable organisationswe will go out of business if we cannot insure our members. That is a responsibility that wemust apply to the membership of the organisation. We must give our individuals that degree ofassurance, otherwise they are not going to volunteer. If the organisation goes out of business,that is the end of us. Without public liability insurance we could not put patrols on the beach.There is no way we could do that. So we must have it, in whatever form. That is why, even asthe premiums went up, we have always met the bill.

I also applaud the Commonwealth for the amendments to the Trade Practices Act. I am nottoo sure where that is at, but giving force to the waivers helps an organisation like ours, whereour members all sign a waiver. Giving the force of law to that waiver not just for surf-lifesavingbut for sporting organisations and general risk businesses is another must. Those waivers havebeen around for a long time and they do not seem to have any clout when you get into a legalsituation. So I would like to think that the Commonwealth will see the Trade Practices Actamendments right through and also that the Commonwealth government continues to facilitateconsistent legislation across the states, which I know they are doing at the moment. I aminvolved in it and have been consulted, and I would ask that that continue. That is about all Ihave to say at the moment.

Senator RIDGEWAY—I have a number of things to ask about. I know that much of yoursubmission is based on the anecdotal evidence of what has been happening in the Surf LifeSaving Association over the past 10 years and longer. One of the difficulties from aparliamentary point of view is trying to put your finger on where the problems are. Given therange of measures that you would support both in terms of what is happening in New SouthWales and other states and the amendments to the Trade Practices Act and a range of othermeasures presumably being put forward by the federal government, do you think that theywould deal adequately with the problem of increasing premiums?

Mr Nance—No. My contact with the insurance industry through our brokers tells me thatthere are no guarantees—that is what they are consistently saying—with any of this legislation,state or federal, that premiums will come down. I have never heard one individual in theinsurance industry say that they would, which is a bit of a worry. However, practically, whenyou add it all up at the state and Commonwealth level, you would have to think that over timethe premiums would come down, because the number of claims should drop.

Monday, 8 July 2002 SENATE—References E 3

ECONOMICS

The practical problem under the current system can be seen in one of our claims which hasbeen settled—a $750,000 initial ambit claim. Someone fell over in a pool that was operatedjointly by a surf club and a council. The guy falls over and comes up with a $750,000 claim. Ofthe $750,000, $6,000 was for medical expenses; the rest was for pain and suffering and loss ofearnings. We settled it for a few thousand dollars. That $750,000 claim was on our books forover two years. You only have to have a few of those and all of a sudden, under the currentsystem, you are assessed as having a risk. The $750,000 is all they are worried about; all theyare worried about is settling it.

I do not think you are ever going to remove the individual’s right to sue; no-one is asking forthat. But until standards are applied and the individual’s ability to sue frivolously—and I viewthat one as a frivolous claim—is not there, an organisation like ours, or any other organisation,is always faced with that problem. In relation to those 83 claims, if we could not pool everyonetogether and we were just one small surf club there is no way we would be able to get insurancetoday. That is what is happening with a lot of very small organisations around the country.

So I do not think there are any guarantees at all. Until that system fundamentally changes,whereby a person can make an ambit claim and think they are going to be successful, I cannotsee how you are going to get a drop in the premiums. All the insurance companies are worriedabout is the number of claims that are lodged and what people are suing for in their claims—atthe moment, it is a lot of money.

Senator RIDGEWAY—What I am trying to establish is whether, in trying to come up withsome answers to the current problems in getting coverage, some of the immediate solutions onthe table are going to be effective in the long term. Given that premiums have been increasing ata dramatic rate over a long period of time—you talked about it going from $153,000 to nearly$600,000 over a 10-year period—is that going to continue as a trend in the future? Firstly, whatare the things that have contributed to you going offshore to get coverage? Secondly, arediscussions that you may have had with insurance groups providing incentives in relation toundertaking their own structural reform to deal with what I believe will continue to be aproblem in the future? I think we have short-term solutions and they have yet to be tested; afterthat, I suspect that premiums will continue to rise.

Mr Nance—The reason we went offshore was the market. Three years ago our then brokergave us a quote that was unaffordable. It was in the order of $900,000 a year. We said, ‘You’rekidding!’ So we changed brokers and the insurance was placed in London immediately. It hasstabilised at around $600,000 now, so it was the market forces offshore. I have never hadadequately explained to me how insurers assess the amounts for premiums. We had incompletedata 10 years ago; now, I have an excellent track on the data—that is, our claims, where they arecoming from and the nature of them. We have been tracking them over the last four to fiveyears. It is relatively accurate data and some of it is included in the submission.

Ten years ago we did not have any of that data and, as you changed companies, you tended toloose the history of them. So I have not had adequately explained to me how these premiumsare calculated. If they go back on your history—there is no relativity to your claims history as tohow the premiums are determined. In one case I was given a $900,000 quote and in the sameyear—three years ago—with a separate broker we were paying, I think, $500,000. So that is a

E 4 SENATE—References Monday, 8 July 2002

ECONOMICS

$400,000 differential assessed by the same industry on our premium. That blew me away. So Iam very cautious as to whether there will be any short-term fixes, even with the legislation.

The insurance industry itself certainly does require scrutiny going forward, but it is only onepart of the system. The legal profession is another part of the system. There is no doubt that thelegal profession’s ability to seek business through personal accident type of insurance is aliveand well in the community, and people are taking advantage of it. We have been on thereceiving end of a number of those types of claims. Various groups have approached me andasked the question, ‘Has your number of claims increased over the years?’ I have told them thatit has. The number of claims is stabilising now, but in that ten-year period it certainly increased.It peaked about three years ago. With 83 claims in 3½ years against our organisation—of whichthree out of four are land based and have nothing to do with Surf Life Saving’s core business—something has to change fundamentally in the system for us to survive long term. Somethinghas to change. The change can be effected through legislation and/or the insurance industryitself providing a better service and better premiums. At the moment, if we could not bring allof our surf clubs together under one umbrella, we would not get insurance. Individual surf clubscannot get it.

Senator RIDGEWAY—One of the things that you talk about as one of the possiblerecommendations is risk management education. Do you want to talk a little bit more aboutthat? I am interested in the idea, because a number of others have spoken about educationcampaigns and making people aware of rights, responsibilities and so on. What do you mean byrisk management education?

Mr Nance—In our case, it was definitely educating volunteer surf-lifesavers that this wasserious and we had to change the culture. What we could change was our culture of not caringabout the risks that were involved in the day-to-day running of a surf club. Consequently, wehad to embark upon a series of structured educational forums and activities right across ourorganisation, hitting right at the grassroots level to make sure that the individual surf clubmanagement or volunteer understood that, unless they changed the nature of their activities toensure that they covered all risk—that is, the signage was right, there was adequate maintenanceon the buildings, they did not let the surf club or its equipment or its members get involved inactivities that were not part of the core business—then we were in trouble going forward withour insurance.

We started that nearly four years ago and it has had a compounding effect. I know we havechanged our culture in terms of the management. Now, with the recent publicity nationally, ourmembers are very much focused on the proper running of the clubs in terms of managing theirrisk, bearing in mind that when we had our first risk management assessment, done by ourbrokers, they produced a manual. There was nothing new in any of that, but they made thecomment that, in the daily operation of a surf club, you are at risk all of the time. The interestingthing was that your major risk is actually in the water or in your patrolling environment, butyour claims are coming from other sources. Your biggest unknown, going forward, is what isgoing to happen in the water.

I always remembered those words and, when the Bondi incident happened at Waverley, withthe individual who became a quadriplegic, the words came home to haunt me. Although wewere not directly involved, here was a claim being made against a council operating flags and

Monday, 8 July 2002 SENATE—References E 5

ECONOMICS

lifeguards and it was for an accident in the water. That, to me, is the biggest unknown. Howmuch more of that is going to occur? It is a very uncontrolled environment in the surf; you canonly do so much. But risk management education for volunteer organisations is a must. It is onething you can control. We would not have got our insurance if we had not done it three or fouryears ago when we started. The brokers said, ‘You must do this.’ So we did it—and there is stillwork to be done. A volunteer joins a volunteer organisation not to do paperwork, not to worryabout processing an insurance claim. That is not where their loyalty lies. I will tell you that for afact. If you are in a volunteer organisation, that is the way it works. They volunteer for a corereason. In surf-lifesaving, it is not to process paperwork.

Senator RIDGEWAY—I will ask this final question, and there is probably a simple answerto it. You use the Bondi-Waverley case as an example. In relation to the surf-lifesavingassociations across the country, how do you delineate between your responsibilities in relationto public space, if you like, and what is under the control of a local government body, with thebeaches, patrolling and so on? Is there some sort of coordination of shared risk?

Mr Nance—Yes, exactly that; shared risk. In most of those claims against us, we and localgovernment are joined. I do not have the data at hand, but in 70 or 80 per cent of those claimswe are jointly involved.

Senator CONROY—Would you support then the proportionate liability concept?

Mr Nance—That happens now anyway, I think. The insurers negotiate an agreed wayforward; they negotiate either a settlement outside the legal system or, when there is a judgmentagainst us, an agreed share of what they are going to pay out. So, yes, I would support it. Theproblem for local government is that they are copping this all the time. It is a relatively newphenomenon for Surf Life Saving, but people know we are insured so they sue us. That is theproblem. The slips and falls are the classic cases. Essentially, councils own most of our surfclubs—they are on crown land and we lease them—so ultimately it is their responsibility, butwe are the tenants so we are automatically joined. Yes, I would support it, but I do not thinkthere is any formula that is going to solve the problem.

CHAIR—In relation to the Bondi case, how was it that solely Waverley Council wasinvolved?

Mr Nance—They have year-round, paid lifeguards—

CHAIR—Are they operated separately from the surf-lifesaving club?

Mr Nance—They are. We work on weekends and public holidays, although we do providelifeguard services through our state organisations. In Waverley Council’s case, they are operatedby the council—although they are all our members—so that was the reason they copped it. Thereason I am so concerned about that case is that it was an incident between the flags, allegedly.It is the subject of an appeal. A lot has been said about it but the principle worries me, and thatis along the lines of what I said before and of what the insurer said to me four years ago: ‘Yourreal risk is out there in the water.’ We provide a safe environment with the flags, but that doesnot mean things cannot happen between the flags. Over the last four years we have fought atleast two cases and challenged alleged incidents between the flags where action has been

E 6 SENATE—References Monday, 8 July 2002

ECONOMICS

brought against us. I know we have been successful in one, where a surfboard came inside theflags, allegedly, and hit an individual. The individual sued us alone, not the council, and it wasoverturned on appeal in New South Wales. We appealed it. We got a lot of expert evidence, andwe basically fought the case as a matter of principle.

Going forward, if we get involved in any water based incident in the future, we will never beable to insure against it—inside or outside the flags. That is our concern. Because of the natureof Australia’s beaches, we have always put the flags up to say to the public: ‘That is a safe placeto swim.’ Someone said to me the other day, ‘Just take the flags away.’ Good one; that is a reallygood solution! With it goes 100 years of credibility, and you just cannot do that in Australiansurfing conditions. We already pull out of the water over 12,000 people a year, and they aremostly from outside the flags. If we did not have flags, I do not know how we would be able tocontrol the situation. That was a deadset solution given to me by someone in Sydney: ‘Pull theflags down so you don’t have a risk.’

CHAIR—Is your point that swimming at the beach has an inherent risk and that what theflags represent is a safer area rather than a safe one?

Mr Nance—Yes. We will never say that nothing is going to happen between the flags. But itis a good bet that if you are swimming between the flags and you get into difficulties you aregoing to get rescued pretty quickly. And you should not get into difficulties because we put theflags in a safe area. If we think it is unsafe, we will not put the flags out; we will close thebeach.

CHAIR—But there is still a risk of a flying surfboard?

Mr Nance—There is still a risk. That can happen, yes. Although now there are demarcationareas—and if you have had a surf recently, you will have seen the buffer areas, which tend tomilitate against that risk. It works pretty successfully. It is when you get out into the regions thatyou tend to find that the board riders come up closer to the flags and can injure people. Theother problem is public awareness. Approximately one in five of the 50 to 60 people who drownin the surf nationally is a tourist—about which there is a lot of anecdotal evidence—who doesnot speak English. We will fight to the end of the earth to make sure that the flags remain aconstant of our safety services. But a case like the Waverley case puts that under threat, becauseit questions the fundamental principle of putting the flags out there. After that, we as anorganisation did a fair amount of soul searching, and we are 100 per cent behind our system andwill stick with it. We are not going to change it.

Senator CONROY—What is the definition of ‘when you put the flags up’? What does thatmean to you?

Mr Nance—That is where the patrol on that day and under those circumstances has made adecision that this is a safe area to swim, given all the circumstances.

Senator CONROY—In your mind what does ‘safe’ mean? What do you think you aresignifying to the public when you put the flags up?

Monday, 8 July 2002 SENATE—References E 7

ECONOMICS

Mr Nance—It means that the general public can go into that area and swim safely. There isnot no risk but the risk is reduced to being negligible. A negligible risk to, say, a person who isnot an expert swimmer or not a good swimmer is a different sort of risk to someone who reallyunderstands the surf, remembering we are dealing with the general public; you have to go forthe lowest common denominator. So you will find that our flags are set not necessarily wherethe best surf is at all but set where it is the safest place to surf. But there is a reasonable decisionbehind it that is based on the training of the individuals and, above all, their knowledge of thelocal surfing conditions.

Senator CONROY—The Waverley case is under appeal so I appreciate that this may putyou in a difficult position, but is looking for sandbars one of the issues when you plant theflags?

Mr Nance—One of the things you have to be very careful of is that as the tide changes and ifit is a largish surf that is breaking on sandbar type conditions it will present an inherent risk toanyone who is bodysurfing in the area. You have to be careful of that, and we often closebeaches because of the very dangerous breaks on the sandbanks. But a sandbank can change ina matter of seconds; it can collapse and change within a few minutes. The operationalconditions can change for a patrol and there is no way you can give minute to minuteconsideration to it. You have to observe it over a little bit of time. But our members, remember,are all locals and they understand the conditions, and they will generally—and, in ourestimation, all the time—do the right thing.

CHAIR—Of the 83 claims that we have been talking about, what proportion would youregard as frivolous?

Mr Nance—The slips and falls?

CHAIR—The total 83—21 of those were in the surf, weren’t they?

Mr Nance—Yes, they were in the water; they were water based. I think there was one casewhere a surfboat might have hit a board rider. You still get those odd ones. But to me, historyhas shown that those slips and falls will get settled out of court for a very small sum comparedto what was put on our books. A lot of those slips and falls were coming in the licensed clubs inQueensland. There were people making claims against those licensed clubs so they put camerasin. There is a lot more vigilant risk management based on the operation of the club, because theclub is part of the whole surf club scenario but the insurance is held by us. We have moved thatelement of the risk. Part of our risk management was to take those licensed clubs and put theminto a separate area of our insurance so that their risk did not translate across to a normal surfclub; slips and falls have got to be. There is the odd brawl or fight in a club; stuff like that goeson—not amongst our members but amongst the public—and then they end up suing us. Thatcould be eliminated, too, if you stopped people fighting. They are an element.

CHAIR—So you would say that, of the three-quarters of those claims that represent slips andfalls, you would regard a high proportion as frivolous?

Mr Nance—Definitely—based on the fact that they are settled for small amounts and that theinjuries are not normally that serious; some are, but most of the slips and falls are very minor

E 8 SENATE—References Monday, 8 July 2002

ECONOMICS

injuries. But the claims are very high in dollar proportions because of the way the system hasbeen operating, as I described before. People sort of put in an ambit claim. You cannot stop aperson’s right to do that; I understand that. They have got to be ambit claims. The $750,000claim on the pool that was settled for a few thousand dollars is a classic case, and that was a slipand fall. That was one of those 83.

Senator RIDGEWAY—Did you say that, as part of the risk management, on some beachesyou now have cameras? Is that what you said?

Mr Nance—We have cameras in the physical environs of some of the clubs, yes, inQueensland. They are quite publicly located, with signage and everything, normally in areaswhere the slips and falls are occurring. That is a direct result of the insurance activity, whereclaims are made.

Senator RIDGEWAY—How useful a method has that been?

Mr Nance—The cameras? Excellent; my word. It has turned up quite a few frivolous claims,and it has meant the insurer can tough it out. Often, the person will go away when theyintroduce the video. Unfortunately, you cannot have videos in all those circumstances; you justcannot afford it. Any insurer will tell you that is a tactical way ahead in areas of the slips andfalls, particularly when you have a controlled environment. An environment like ours is veryeasily defined. People can only walk in the clubs, but we have 285 of them. I think that, of the285, there would only be 20 to 30—and they would all be in Queensland—that would havecamera surveillance.

CHAIR—I also wanted to ask you about the wilful negligence test that you, amongst someothers, are promoting as one of the solutions. What do you say about the implications ofintroducing that test with respect to recklessness?

Mr Nance—Do you mean by ‘recklessness’ that someone is, by their own behaviour,reckless and then makes a claim?

CHAIR—No. I am saying that someone who is injured would need to demonstrate wilfulnegligence, whereas their injury may be the result of recklessness, but that they would no longerhave access—

Mr Nance—Their own or the organisation that they are—

CHAIR—The organisation’s.

Mr Nance—Not being a lawyer, if the individual who is taking an action against us—in oursituation, bearing in mind we are a safety organisation first and foremost—had to prove that wehad been wilfully negligent or had acted recklessly in whatever it was that we were being suedfor, then I would prefer to be in that environment than in an environment where they did nothave to prove that.

Monday, 8 July 2002 SENATE—References E 9

ECONOMICS

CHAIR—But in a sense what I am asking is: if the wilful negligence test were expanded toincorporate or to ensure that recklessness was a component of the definition, would that concernyou?

Mr Nance—I see what you are getting at.

CHAIR—Some of the arguments against that test are concerned that recklessness will not beaddressed and that people will not have an avenue to sue in relation to reckless behaviour unlessthey can also demonstrate that it was wilful negligence.

Mr Nance—I see. It is hard for me to comment on that. Our organisation has never supportedthe removal of the individual’s right to take an action. Someone better than me and myorganisation has to come up with a better test that will protect a charitable organisation likeours. There needs to be legislative reform. If it goes down that route—and it has been suggestedto us that it should—then that will help us to survive long term. I fail to see why a goodsamaritan, charitable, not-for-profit organisation should be laid bare—which is what ishappening—by a system that can clearly be corrected and fixed. To me, there is legislativereform that definitely can be done. Certainly, the insurance industry has to be held to account insome way—through some form of public scrutiny or accountability—because they are anotherfactor. The legal profession itself needs to be examined and maybe put under the same sort ofpublic scrutiny. It is all part of one system. But at the end of it all an individual should have theright to take action.

You would like to think that a charitable organisation like ours is always going to take thesafe option. We are only acting safely and in accordance with our charter. We are a humanitarianorganisation—we are not in it to make money; people volunteer their time. We are not unlikemany other charitable organisations in the country which are not-for-profit. The whole reasonthat I am sitting here talking you today is that there is a problem. We have suffered silently forover 10 years and now all of a sudden this whole issue is definitely on the public agenda. Weare asking that action be taken by government at all levels and also by the industries that areinvolved in it, otherwise, without that insurance, we cannot operate—no way.

There are many charitable organisations facing this right now that are not as large as us.Many of them have come and spoken to me one to one about what they are going to do. Theyare small organisations. They do not have the strength of numbers that we do. We arecommercially attractive to the insurance industry, because of the size of the premium, but if youare a small charitable organisation operating somewhere out there in the boondocks by yourselfthen you are just not going to be able to get the insurance at the moment. It is just unavailablenow. A few years ago you might have been able to get it, but it is just unavailable.

CHAIR—Looking at the situation a few years ago before you went offshore, was the brokeryou had within Australia before that time looking at HIH, at that stage?

Mr Nance—No.

CHAIR—Was that simply a result of HIH not venturing into that particular sector?

E 10 SENATE—References Monday, 8 July 2002

ECONOMICS

Mr Nance—No. That particular quote I got at that time was, I believe, a combination ofcompanies. The insurance for the year before had been written by an outfit in Australia that wasbacked overseas. It was not HIH. The way the insurance industry works is quite complicated,from what I can make out—they group their insurances and they reinsure. That particular year,with that very high quote, I think was going to be a combination still in Australia and someoffshore.

After the Waverley incident, the brokers in the UK who are working with our brokersinformed me that the Australian public liability scene is on the nose—I have got that in anemail, which is very encouraging. They are shifting the group of underwriters from the ones thatwrote it last year to another group, and they are reasonably confident they will get the insurancewritten for us. But I will not know whether we will get insurance at an affordable rate foranother two to three weeks. That is really what has to change. Every year we face this. It has tochange somehow. Somewhere along the line, this has to change. If I get the answer that wecannot get insurance I do not know what we are going to do.

CHAIR—So this is two to three weeks before the policy expires, is it?

Mr Nance—No. With our current brokers we have a condition that they have to give me thequote six weeks before the policy expires, so that gives me time to go elsewhere. I do not knowwhere but it gives me the time.

CHAIR—So in two to three weeks time you will get your six weeks notice.

Mr Nance—That is right. Either I will get a price that we can afford or I will have to gosomewhere else. At the moment, the options of that somewhere else are narrowing. Three orfour years ago there were options in Australia.

Senator RIDGEWAY—So shopping around is not an option.

Mr Nance—No. I do not know but I believe there are some American players coming intothe market, but they have not knocked on my door yet. A few brokers have knocked on mydoor, but I think they have all ended up in the same market over in London writing theinsurance. I had that experience three or four years ago. So the way the insurance industryworks is a bit of a mystery to me. There needs to be some public accounting of it. I notice fromthe public debate that that is happening, and that is great. But the fact of the matter is that, at thecoalface right at the moment, what I have just described to you is the situation. I do not think weare any different from any other organisation. I see different people coming forward, lining upin the media, saying that they cannot get the insurance or that it is unaffordable, or both.

Senator CONROY—The bungee jump is the example I always use regarding the capacity tosign away reasonable risk. If you do a bungee jump and the rope is a bit long, that is probablynegligence. But if you walk away from a successful bungee jump and your back is a bit sorebecause it has been stretched out a bit you would probably have to say, ‘That’s why you did it;’you can actually sign a form. The intent of the legislative change proposed and supported byeverybody is that you can sign away some risk. But, practically, how can you do it on a beach?

Monday, 8 July 2002 SENATE—References E 11

ECONOMICS

Mr Nance—You could not do it for the public, but it is very important for our members. Wehave always had a waiver in our membership form. As a result of our recent experiences andunder legal advice, we have strengthened that waiver into a very strong statement of waiving theindividual’s rights. The amendment to the Commonwealth trade practices legislation is veryimportant in securing that protection for organisations like ours. But, for the public, unless youhave a specific business situation—

Senator CONROY—Queuing up at the beach—you know, ‘Come and lie down and sign thisform.’ You would be running around on the beach signing forms. I am just trying to think howyou would make it work practically.

Mr Nance—You could not do it for the general public, which is the majority of our risk. Butcertainly for our members it is a very worthy piece of legislation, and I made a comment aboutthat at the start. I do not know the status of the trade practices legislation.

Senator CONROY—It has been tabled in parliament, in the House of Representatives.

Mr Nance—I would urge the Commonwealth government in a bipartisan way to see thatthrough, because it will shore up sporting organisations. If the definition could be as wide aspossible it would protect any member based charity like ours.

Senator CONROY—As President of Volleyball Victoria, I assure you that there is bipartisansupport for this.

CHAIR—There being no further questions, thank you very much, Mr Nance. Again, ourapologies for the informal nature of this session.

Mr Nance—That is all right. Thank you very much.

Proceedings suspended from 10.03 a.m. to 10.51 a.m.

E 12 SENATE—References Monday, 8 July 2002

ECONOMICS

CHAIR—Today the committee will begin its program of public hearings on its inquiry intopublic liability and professional indemnity insurance. The committee will hold further hearingstomorrow in Canberra and on Wednesday in Melbourne. It also plans to hold public hearings inSydney on 8 and 9 August. On 20 March 2002, the Senate referred the following matter to theSenate Economics References Committee for inquiry and report by 27 August:

(a) the impact of public liability insurance for small business and community and sporting organisations; and

(b) the impact of professional indemnity insurance, including Directors and Officers Insurance, for small business;

with particular reference to:

(c) the cost of such insurance;

(d) reasons for the increase in premiums for such insurance; and

(e) schemes, arrangements or reforms that can reduce the cost of such insurance and/or better calculate and pool risk.

The committee advertised the inquiry and called for written submissions. It wrote to numerousgovernment bodies, organisations and associations with an interest in this matter, alerting themto the inquiry and inviting them to make a submission. To date the committee has received 145submissions on this matter. The committee wishes to thank the many organisations andindividuals who have assisted the committee with its inquiry so far.

Before we commence taking evidence, I reinforce for the record that all witnesses appearingbefore the committee are protected by parliamentary privilege with respect to evidenceprovided. Parliamentary privilege refers to the special rights and immunities attached to theparliament or its members and others necessary for the discharge of parliamentary functionswithout obstruction or fear of prosecution. Any act by any person which operates to thedisadvantage of a witness on account of evidence given by that witness before the committee istreated as a breach of privilege. These privileges are intended to protect witnesses. I must alsoremind you, however, that the giving of false or misleading evidence to the committee mayconstitute a contempt of the Senate. Unless the committee should decide otherwise, this is apublic hearing and, as such, all members of the public are welcome to attend.

Before we commenced today, we had an informal briefing from those who were scheduled asour first witnesses: the Surf Living Australia Pty Ltd. There being no objection, the Hansardrecord of that briefing will be incorporated into the record.

Monday, 8 July 2002 SENATE—References E 13

ECONOMICS

[10.53 a.m.]

CLARK, Mr David, Legal Officer, Local Government and Shires Association of NewSouth Wales

CHAIR—Welcome. The committee prefers that all evidence be given in public, but if youwould like to give part of your evidence in private you may ask to do so and the committee willconsider such a request. The committee has your submission, No. 23. Are there any alterationsor additions you wish to make to your written submission?

Mr Clark—Let me deal with the first issue: there is nothing that I wish to say, other than inpublic. There is nothing in our submission that we wish to have changed.

CHAIR—I invite you to make a brief opening statement.

Mr Clark—The association welcomes the opportunity to speak to our submission to theinquiry. From my point of view, it is almost deja vu. This is my second session as legal officerfor the association. I was legal officer from 1985 to 1989 and then came back in 1992. One ofthe first jobs that I did when I joined the association in 1985 was to prepare a submission toanother government inquiry about the cost of public liability insurance for local government.The same issues that arose then seem to be coming back again. The only difference is that thesedays the cost of insurance is, unquestionably, much higher, and the number of people willing towrite insurance, particularly for local government, are becoming fewer and fewer.

We are now forced to buy any reinsurance from London. We cannot get an Australiancompany to insure a council in New South Wales. The only way that we can get public liabilityinsurance is by the formation of our own insurance pool, which most councils are now doing orhave done. Something like 135 of the 172 councils in New South Wales are in the biggestinsurance pool in the state, which is Statewide Mutual Insurance. There are a number of othersmaller pools. A couple of the larger councils, such as Sydney and Wollongong, are actuallyself-insurers from the public liability point of view. We have a problem with public liabilityinsurance in that the Local Government Act of New South Wales requires every council to carryan adequate amount of public liability insurance. We shudder to think what is going to happen ifwe reach a point where we cannot buy public liability insurance in the market, but themovement seems inexorably towards that situation at the moment.

We have always had the problem which I think a lot of public authorities, not just localgovernment authorities, have and that is what I choose to call the ‘tethered goat syndrome’. Weare here, we are on the ground, we cannot run away, we are perceived as having very deeppockets, whether we do or not, and we are seen as fair game by some members of thecommunity when anything comes up which is remotely related to the possibility of recoveringsome money. That by itself has made public liability insurance for local government the areaabout which we, as an organisation, are most concerned, rather than with the professionalindemnity side of this inquiry. By and large, we are reasonably well in control of professionalindemnity, but the public liability side is becoming more and more desperate.

E 14 SENATE—References Monday, 8 July 2002

ECONOMICS

We see that there is a need for more action in a number of areas. There is a need to definemore clearly the areas of responsibility of a public authority and, dare I say it, a need to limit theability of some of my professional colleagues to be creative in the way they cast their pleadings.There is also a need to make the public at large aware of the risks they accept when theyundertake certain activities—that there are things that people do that are inherently risky andshould not automatically attract a right to compensation merely because in the course ofundertaking that activity somebody gets injured. There are limits to that. In broad terms, that isan area that we see needs to be addressed. That more or less covers the broad thrust of thesubmission that is before the committee now.

CHAIR—Thank you. Your submission notes that many of the claims that councils aredealing with are small ones, most of which are deductible under the council’s policy. Has anythought been given to alternative means of dealing with small claims?

Mr Clark—A number of suggestions have been made. The most consistent one has beenthat, where there is a claim against a public authority, whether it be a council or anybody else,the claimant should need to meet some sort of—for want of a better expression—deductible,that a claimant should meet a certain proportion or a certain level of the claim up to a certainpoint before that claim against a public authority can proceed. For argument’s sake, if it is saidthat a claimant should bear the first $10,000 of a claim, given the number of smaller claims thatwe are now confronting—and they are the real problem areas, because so many of them arebelow the deductible and so many of them, when you look closely at the evidence that supportsthem, are, shall we say, questionable—the area of claim that is of most concern to us would besignificantly reduced.

CHAIR—I think in the earlier session we had it suggested that one of the issues is that, withrespect to small claims, the costs of processing the claim are significant, if not the largestcomponent of the claim. Rather than the current process for dealing with all claims, has anythought been given to whether there should be a small claims process? That would perhaps be acheaper option for processing these types of claims rather than just eliminating them from beingable to occur through a cap or a limit.

Mr Clark—We have not given a great deal of thought to that, because there is an inherentcost with any process like that and there is still going to be a measure of cost. Certainly it willnot be as high as the cost of contesting, say, a $10,000 claim through the court system as is theprocess now. That might involve a council in $20,000, $30,000 or $40,000 worth of legal costs.Quite often the commercial decision is made to settle these claims—even if they are, on the faceof them, spurious—because the cost of fighting is simply out of all proportion to the cost ofpaying the claim.

CHAIR—Yes. But apart from some of the measures that I think your submission alsosuggests—in terms of limiting some of these small claims or limiting the ability of a claimant tomake a claim—have other avenues been explored to, for instance, remove the frivolous claimsfrom that process and still allow claims that are small but not frivolous to occur?

Mr Clark—We have certainly come to the view that some process like that would be useful.We have not given a great deal of thought at this stage to how the process would be set up.

Monday, 8 July 2002 SENATE—References E 15

ECONOMICS

Senator BRANDIS—Mr Clark, you are a lawyer, aren’t you?

Mr Clark—I am.

Senator BRANDIS—You are aware, of course, that there is already a jurisdiction in courts todismiss frivolous or vexatious claims?

Mr Clark—There is.

Senator BRANDIS—So what do you propose when you speak of eliminating frivolousclaims? What additional mechanism do you propose beyond what the rules of court alreadyprovide for?

Mr Clark—As I just said to the chair, we have not really given any serious thought to whatthe alternative process would be. We see it as being useful to have an alternative process thatdoes not involve the necessity to bring into force the full litigious process.

Senator BRANDIS—But that is not up to you, is it?

Mr Clark—It is not up to us.

Senator BRANDIS—It is up to the claimant.

Mr Clark—To an extent, but if we are—

Senator BRANDIS—Unless—and some participants in this debate have suggested this, Iknow—one categorically prohibits certain classes of claims denominated either by type or byvalue.

Mr Clark—I do not think we would support that because we accept that the mere fact that aclaim is small does not necessarily mean that it is a frivolous.

Senator BRANDIS—That is right.

Mr Clark—But as things stand if there is a claim which is seen as frivolous it is up to thedefendant to plead that and to seek the court’s action to have the thing dismissed. That by itselfinvolves a level of cost which, even if the motion is successful and the court orders costs againstthe claimant, the respondent might not necessarily recover because of the financial status of theclaimant.

Senator BRANDIS—Yes, I understand that. Thanks.

Senator RIDGEWAY—I wanted to follow through on some of the evidence that you haveprovided in your submission about statistics held by Statewide Mutual Insurance—

Mr Clark—Yes, that is the big pool.

E 16 SENATE—References Monday, 8 July 2002

ECONOMICS

Senator RIDGEWAY—which deals with most of the local councils in New South Wales.Are you able to provide us with some of the information about the number of claims and thetypes of claims to give us an indication of the trend of those being settled outside of courts andthose that end up getting to court and being resolved in some form?

Mr Clark—I cannot give you details but from speaking to officers of Statewide—

Senator RIDGEWAY—Whilst I note in your submission that you talk about other factorsthat need to be looked at in terms of trying to provide a solution to the current problems andwhile I recognise that the issue is not simplistic, with regard to the issue of small councilshaving what is called a below council deductible element in their policies—that is, they pay thecost themselves and deprive themselves of the opportunities to provide other services—wouldn’t that necessarily mean that the number of claims being made is generally smaller andshould it not also mean that, in terms of either arrangements with the current insurer or anyonethat you might be shopping around with, on the basis of your history you must be in a goodposition to get lower premiums? I am trying to establish what is driving the premiums up,particularly for your member groups.

Mr Clark—It is the sheer volume of the small claims that seems to be driving premiums up.I do not know whether I have actually got the figures here.

Senator RIDGEWAY—There are probably a couple of things I want to find out. How manyare there? How many are dealt with under the policy arrangements? What is the cost impact ofthat on local governments right across New South Wales, for example? What are New SouthWales people being deprived of in terms of much-needed services that local governmentordinarily would provide?

Mr Clark—I have some statistics back in Sydney but unfortunately I did not put them in thefolder that I brought with me.

Senator RIDGEWAY—I would be interested in numbers, the types of claims that are beingmade, what is settled out of court, what cost and that sort of thing.

Mr Clark—If I can take that on notice, I will supply that to the committee when I get back. Ido have those figures and can make them available.

Senator RIDGEWAY—Okay.

Senator BRANDIS—Mr Clark, the problem is, I suppose, that if you identify the smallclaims as being the driver of upward cost pressures on premiums for your association, the smallquantum of the claims bears no necessary relationship to the validity of the claims. For instance,the worst possible example of gross negligence by one of your member associations or shiresmight cause a relatively small injury to a person who is a perfectly and properly entitledplaintiff. I am not suggesting a solution to you but I am calling to your attention the fact thatmerely to say that small claims are the driver of the cost pressures does not mean that thoseclaims are frivolous or unmeritorious. It is not immediately apparent to me how onediscriminates, without invoking some kind of judicial process, between meritorious small

Monday, 8 July 2002 SENATE—References E 17

ECONOMICS

claims and small claims that are essentially try-ons or, for that matter, big claims that areessentially try-ons.

Mr Clark—In some cases, it is very apparent. Of the cases the New South Wales courts havedealt with in the recent past, two at least did not get past the initial court hearing.

Senator BRANDIS—I understand that. But the point, and it is the point you made before, isthat you still have to be in court. The jurisdiction of the court has to be invoked before that canbe tested. It seems to me that, no matter what method you devise, if a person says, ‘I have aclaim which I wish to agitate,’ which you or one of your member associations as the respondentasserts is a frivolous claim, then a decision maker—whether a judicial decision maker or someother decision maker—has to go through a process of argument and reasoning to determinewhether or not the assertion that the claim is frivolous is made out. So you are in a litigioussituation the moment a claim is made.

Mr Clark—That is right. We are certainly in a dispute situation the minute the claim is made;whether it needs to be litigious is another issue, I would suggest.

Senator BRANDIS—One method that I know has been used in my state of Queensland, notjust in relation to local government cases but in general, is a compulsory reference to a mode ofalternative dispute resolution before the court is seized of a claim. That is quite often done incommercial disputes. Have you given some thought to that?

Mr Clark—As a body, the association has not given any particular consideration to whatmight be a useful alternative process, but certainly something like that does lend itself because,as you say, it seems to work in the commercial sphere.

Senator BRANDIS—Quite commonly, commercial courts will not allow commercial casesto proceed until there has been an attempt at a structured mediation to resolve the dispute—which is potentially much less costly than a full-blown trial.

Mr Clark—Certainly something like that would be useful.

Senator BRANDIS—But that is probably not going to get you over your problem with thesmall claims, though.

Mr Clark—It is not, but it might contain, at least to some extent, the cost of dealing withthose small claims. At least we would know that we would not have to spend $30,000 or$40,000 fighting the thing from beginning to end through the judicial process if we could spend$5,000 or $6,000 putting it through some sort of compulsory mediation or arbitration. We wouldmuch prefer to see that sort of situation than the present situation where, when we lock horns,we commit ourselves to spending large amounts of public money.

CHAIR—I want to backtrack to one issue which your submission and others raise in relationto the loss of the nonfeasance immunity. Could you take the committee back through preciselywhat occurred in relation to that High Court judgment, what was taken away and how youwould see the status quo being restored?

E 18 SENATE—References Monday, 8 July 2002

ECONOMICS

Mr Clark—What happened in Brodie v. Singleton Shire Council was that the High Courtruled that the principle of nonfeasance was no longer good law in Australia.

CHAIR—Can you describe what that principle referred to?

Mr Clark—It came to us from English law. It had its origins in about the 14th or 15thcentury, when local government in any form was not an organised force in the way it is todayand when communities basically banded together to provide whatever common infrastructurewas necessary. For example, a town would have some arrangement for looking after streets.There is a case on the law reports, somebody versus the men of Devon. That arose becausesomebody suffered an injury on a road in Devon and they sued every resident of the county ofDevon. The principle established in relation to that was that because these bodies, howeverformal or informal they were, were established for the common good and had limited resources,they would not be liable for injury suffered as a result of, basically, letting things go.

Nonfeasance simply means ‘not doing’, and it has come to be refined in relation to roads—again through a series of English cases—to say that a road authority which forms and maintainsa road is not liable if, as a result of natural degeneration, somebody using that road suffersinjury. But it is liable for misfeasance, by either not designing and building the road properly inthe first place or subsequently doing something to the road which was not done properly and theinjury flows from that. That was held to be good law in Australia by the High Court in a 1935decision, Buckle v. Bayswater Road Board, and was confirmed by the High Court in the early1950s in Gorringe v. The Transport Commission (Tas). Until 31 May last year, road authoritiesgenerally—not merely local government, but state government road authorities as well—haveproceeded on the basis that the nonfeasance immunity rule was available to them and theywould not be liable for injury suffered on the road unless they had actively done something tocause that injury. Now the High Court has told us that that is no longer good law.

Our immediate concern about nonfeasance and the loss of the immunity is that most councilsin New South Wales, certainly, and, I suspect, in the rest of Australia as well, have planned theirrisk management strategies around the availability of nonfeasance. Many of the claims that havebeen made against them in relation to road related incidents have been successfully contested onthe basis that the only thing that the road authority was guilty of was nonfeasance, notmisfeasance. Many of those claims, because they are not yet statute barred and have not actuallybeen through the courts so they have not actually been subjected to the judicial process, aregoing to have to be revisited. Something like 60 per cent of the claims made over the last fiveyears in New South Wales come into that category, and they are, notably, claims of a fairly lowlevel. A classic example was one that came across my desk recently. A woman in a largecountry town in New South Wales claimed against the council because she backed into a treeguard. She had lived in the town all her life. The tree guards had been around the trees in themain street for at least 20 years. The evidence available to the council was that she had simplymisjudged her approach to the parking space when she reversed into it, but she claimed that thetree guard was built in such a way that she was not aware of its presence and hit it as she backedin. The council is fighting that.

Senator BRANDIS—That is arguably in the category of a frivolous claim.

Monday, 8 July 2002 SENATE—References E 19

ECONOMICS

Mr Clark—It is arguably frivolous, but the council has been fighting that on the basis that itwas not guilty of misfeasance: that it acted reasonably in putting the tree guards there; they wereclearly visible to anyone paying proper attention; and, if the vehicle involved came intocollision with the tree guard, it was because the driver was negligent by not keeping a properlook out. That claim is still in the courts.

Senator BRANDIS—If we can identify two specific proposals arising from our discussions,I suppose you would say, first of all, that the definition of what is a frivolous claim ought to begiven a more robust and interventionist meaning than what is currently understood by theprohibition against frivolous and vexatious claims in the rules of court. Secondly, you seem tosee some light in my suggestion that, as in commercial cases—and so in claims against localauthorities—there ought to be some initial compulsory attempt to mediate the dispute before itis litigated. Those are two ideas.

Mr Clark—Yes, those two ideas are ones that we would very strongly support.

CHAIR—Let me explore one other issue about this nonfeasance immunity. Has it beenapplied solely to roads? Was it ever extended into the activities of charitable organisations?

Mr Clark—No, it is peculiar to road authorities.

Senator BRANDIS—With respect, I think you are being a bit hard on the High Court. Oneof the reasons the High Court decided those cases the way it did was that—

Senator CONROY—As a lawyer, declare that you are a member of that fraternity, SenatorBrandis!

Senator BRANDIS—it acknowledged that the distinction between what was ‘misfeasance’and what was ‘nonfeasance’ was so blurred at the edges that it had begun to almost entirely lackpractical utility.

Mr Clark—Speaking personally, I am very surprised that nonfeasance lasted as long as itdid.

Senator BRANDIS—In England the distinction between ‘nonfeasance’ and ‘misfeasance’did not really last after about the 1940s, did it? You might be familiar with the decision of theHouse of Lords in East Suffolk Rivers Catchment Board v. Kent et al.

Senator CONROY—Stop showing off!

Mr Clark—East Suffolk Rivers Catchment Board v. Kent was the classic case, but I thinkthere was statutory abolition in England in about 1964. Certainly the courts in New SouthWales—I do not know what it has been like in Queensland—have been very creative in findingways around the nonfeasance rule to the extent that we have, for instance—

Senator BRANDIS—You cannot blame the litigants for that, can you!

E 20 SENATE—References Monday, 8 July 2002

ECONOMICS

Senator CONROY—You always used to be able to appeal to the Privy Council.

Mr Clark—No, but with respect, I blame some creative pleading on the part of somelawyers. For argument’s sake, we have a decision in New South Wales that states that a tree in aroad is an artificial structure, and an artificial structure is not covered by the nonfeasance rule.

Senator BRANDIS—That might just be a stupid decision. You cannot blame the litigants, orindeed their lawyers, for taking advantage of a decision.

Senator CONROY—You started off by telling Mr Clark that he was being hard on the HighCourt. Now you are blaming the judges!

Senator BRANDIS—No, I am not. I am merely saying that the law is ultimately subject toparliament, as the courts declare it to be.

Senator CONROY—You said it was a stupid decision; we agree.

Senator BRANDIS—That does not mean one has to agree with every decision but, equally,you cannot blame the litigants for taking advantage of the law as declared by the courts.

Mr Clark—No, indeed. But I think the Smith and Hunters Hill case is a classic example ofhow some judges have been very creative in making sure that plaintiffs at the end of the day gettheir two bob’s worth.

Senator BRANDIS—I think that is right.

Senator RIDGEWAY—In the annexure to your submission, there is a list of localgovernment bodies and the range of problems that exist in getting coverage for public liability.What I have not found in your submission—and you might want to give some sort ofdescription—is how cover is procured at the current time for all the local government bodies inNew South Wales. Are they pooled at the moment? Have some of them decided to get together?Is there a comparative analysis of which ones work best in finding solutions? You have a rangeof things listed, from those councils that cannot get cover for everything from senior citizenfunctions through to Christmas carols events to other bodies that are potentially at risk and needcover for the same types of things. What is the difference between them? Are councils going todifferent insurers?

Mr Clark—No. I think you have misconstrued what we put in that submission. Those areexamples of community groups outside local government—albeit that they might be sometimessponsored by the local council. These are community groups that are coming to their councilsand saying, ‘We can’t buy public liability insurance anymore. Can you help us?’ The councilshave come to us as the peak body in New South Wales and said, ‘Is there anything that theassociations can do to help these people?’ At the moment, we cannot do anything because it isoutside the ambit of our powers.

It is there to give an example of the size of the problem that community groups in New SouthWales are having and it seems to us that a lot of the problem is coming from the fact that manyunderwriters that were previously writing policies in this area have now made the commercial

Monday, 8 July 2002 SENATE—References E 21

ECONOMICS

decision to get out of the field. These small community groups are not profit making and it isnot worth the while of these underwriters to write policies for these people anymore, even ifthey have no claims record at all; even if they are pure and unsullied and have never had a claimagainst them in their lives. I cannot imagine groups like quilters guilds and the local art classbeing seriously exposed to public liability risk, whereas I can see—for argument’s sake—thelocal trail riding organisation having some exposure. But whether it be the trail riding group orthe quilters guild, they are all in the same boat. None of them can buy public liability insurance.

Senator RIDGEWAY—So is pooling of the shared risk something that is normal in NewSouth Wales amongst local government bodies, given that you wrote a similar submission backin 1985?

Mr Clark—It has come to be the norm. The difference between now and 1985 is that in 1985there were companies in Australia that were still prepared to write public liability insurance forlocal government. Now there is no-one in New South Wales or in Australia for that matter thatwill write local governments public liability insurance. We have to go to London for it.

Senator RIDGEWAY—So it is predominantly being done through London now—offshore?

Mr Clark—Yes.

Senator RIDGEWAY—Okay. Thanks.

CHAIR—That concludes the questions. Thank you very much for your appearance, MrClark. Again, I apologise for the earlier delays.

E 22 SENATE—References Monday, 8 July 2002

ECONOMICS

[11.35 a.m.]

BAIN, Dr Robert, Secretary General, Australian Medical Association

BURTON, Ms Pamela, Legal Counsel, Australian Medical Association

SEDGLEY, Dr Michael, Chairman of Council, Australian Medical Association

CHAIR—Welcome. The committee prefers all evidence to be given in public but, if youwish, we will consider a request for any evidence to be given in private. The committee hasreceived your submission, No. 111. Are there any alterations that you wish to make to that? No.I invite you to make a brief opening statement, and we will move to questions after that.

Dr Sedgley—Thank you very much for agreeing to see us. The AMA is here today becauseof its concerns regarding the actual loss of large numbers of medical services in the community.Not only has the medical indemnity crisis rendered several areas of medical practice financiallyimpossible but also increasing litigation—win or lose—is placing larger and larger burdens onmedical practitioners, which is leading to very unsatisfactory working conditions. We have asituation where even the very beginnings of medical practice are threatened, with medicalstudents and their teaching becoming unsustainable for reasons of insurance. General practicetraining programs are threatened as general practice owners are no longer willing to employtrainees, and the reason for that is that they cannot get insurance.

Doctors, particularly in rural areas around the nation, are increasingly unable to afford thehuge hikes which are and which have been occurring in medical indemnity premiums.Examples of this are the rural specialist obstetricians in Victoria. They are now pretty muchforced to deny women the choice of private obstetric care. That has actually happened. Publichospital services in rural Victoria are also threatened. Many doctors in Queensland have beenunable to continue working, and you will have seen in the press that there is massive unrestacross the country. The collapse of UMP and the problems arising from that are just part of awider picture of crisis in provision of medical services in this country.

Government, philosophically, has decided to subsidise general practice and other privatepractice in Australia via the Medicare rebate system. This system has remained virtually frozencompared to the rises which have occurred in our medical indemnity premiums. An example ofthat is that last year the Medicare rebates went up by about 1.7 per cent across the board, asopposed to—and it varies a lot in different areas of my profession—a 30 per cent rise across theboard in medical indemnity premiums.

Government is currently considering measures to guarantee various immediate problems inour medical insurance industry, but these have been sufficient only to help many doctorscontinue working temporarily without fear of losing everything they own as a result of a lawsuit. These measures are only guarantees with the caveat that the medical profession—thedoctors—will eventually pay for them with interest. That concept, of course, has to be untrue; itis the patients, the sick people in the community, who will have to pay these levies in the end.Without proper long-term reform, and government subsidy in the meantime—while that is put

Monday, 8 July 2002 SENATE—References E 23

ECONOMICS

in place—many doctors are simply giving up practice. Some are stopping the private element oftheir practice and sending their patients into the public sector where, of course, they are insuredby the government. Postgraduate training programs are threatened; student teaching isthreatened.

We believe that the medical indemnity crisis threatens medical practice in Australia as weknow it and we are now at a crossroad. Do we go down the American path, which has involvedcrisis after crisis over the last 20 to 30 years, a huge loss of services and total unaffordability ofmany services to Americans? Do we go down the British path and completely nationalisemedicine? That, of course, means that the government pays for everything. Or do we find ourown uniquely Australian solution to the problem based on a public and private system of healththat is affordable to the community? I pose those questions. We would like to answer anyquestions you might have of us.

Senator BRANDIS—I do not profess to be an expert in medical insurance but I can tell youthat where I come from, in Brisbane, it is commonly said by people in the medical and legalprofessions that one of the main catalysts of this crisis—that is, the collapse of UMP—wasproduced by the fact that for years, in order to expand market share, UMP had been offeringunrealistically low premiums to members of the medical profession, which they were taking upwith alacrity. Ultimately, as a result of that commercial strategy, UMP found itself woefullyundercapitalised. What do you say about that?

Dr Sedgley—I do not think that we would disagree with that at all. What we are reallysaying, though, is that there is much more to the problem than just the collapse of UMP.

Senator BRANDIS—I am not suggesting that there is not.

Dr Sedgley—What we would like to see as a reform in the future is the medical defenceorganisations being more answerable to their members. We have been advocating that they beanswerable to APRA—the Australian Prudential Regulation Authority—in certain ways. We arelooking at a situation where some people say, ‘The doctors got a bargain, didn’t they?’ Theirpremiums are absolutely out of control at the moment, without even considering the levies thatare going to have to be found to pay for the results of this collapse. Our concern is that we in theprofession are small business people. Like anybody else, we will have to pass these costs on. Ifwe have to pass the cost of that collapse and the premium rises on to our patients then ourservices will become unaffordable.

Senator BRANDIS—Did you say that you are the chairman of the medical professionalindemnity taskforce of the AMA?

Dr Sedgley—Yes.

Senator BRANDIS—Surely you understand people—even though, obviously, you would notshare their cynicism—who say that, for years and years, doctors were in effect underchargingthemselves and paying uncommercially low premiums to UMP, and now they are coming alongand whingeing that they are paying too much. You say that you are paying too much, yet thereason the premiums are so much higher now is that, for all those years, they were too low. Youmust appreciate that some people are a bit cynical about doctors, if we were to put it that way.

E 24 SENATE—References Monday, 8 July 2002

ECONOMICS

Dr Sedgley—I do appreciate that. It is an argument that was applied to the collapse of HIHand to many insurers: they had been undercharging premiums to get other people out ofAustralia and developing, they hoped, a bigger membership so they could cope with theproblems that would arise from their very low premiums. I understand that absolutely. But if weare going to have medical practice survive, I think that our only way is to look forward. Thereare four factors that are said to have contributed to the collapse of UMP-AMIL. One of themwas the production of the new laws in New South Wales—the reforms. That meant that a lot ofcases were brought forward, so there was a bit of a surge in claims and that made a difference.

Senator BRANDIS—That was a one-off.

Dr Sedgley—That was a one-off. There was the collapse of HIH; that was a one-off.

Senator BRANDIS—Hopefully a one-off!

Dr Sedgley—One of the major problems is the enormous rise in the long-term care andrehabilitation costs of the severely disabled—that is an ongoing thing—and they are expandingand expanding. You will remember the Calandra Simpson case in New South Wales. I am notsure how much that cost UMP-AMIL but I think, by the time all the interest and legal fees werepaid, it was up to $19 million. I do not want to blow it out of proportion; the settlement itselfwas $12.9 million, I know, but there were other costs involved in that. If you divide thatamongst the number of obstetrician members of an MDO, how much money it is per doctor ismind-blowing. Of course, they have to then take that cost from the fees that they charge theirpatients. It is this side of it that we feel that we and the government could do something about.We cannot do anything about the poor management practices of the past; we are stuck withthem. We have to pick up from here and try to improve the situation for our patients.

Dr Bain—Perhaps a point worth making is that, through that period, the doctors’ costs andfees reflected the lower level of premium; the patients were as much beneficiaries of it as thedoctors were.

Senator BRANDIS—There is a time equity problem, isn’t there? It is all very well to saythat at that particular time that may be so, but it now has an equity effect some years later.

Dr Bain—Yes, it does, from both the patient’s and the doctor’s perspective. The patient had agood deal and the doctor had a good deal, with the benefit of hindsight, but now we are in asituation where hindsight has caught up with us and we have a completely unsustainablesystem.

Senator BRANDIS—I am a little struck by the irony: when Mr Whitlam toyed with the ideaof a national compensation scheme which, in some respects, resembled what the AMA isproposing, I do not think anybody in the community screamed louder than the doctors did. Theytalked about ‘socialised medicine’, I recall.

Dr Sedgley—We are not advocating a full national compensation scheme, although we mayneed to do that. We have to do something to preserve the affordability of our services. That ishow things are; they are as bad as that. Whatever the AMA did in the past, we have to look tothe future of medical services. We have a lot of support in the community, I believe—and from

Monday, 8 July 2002 SENATE—References E 25

ECONOMICS

lawyers and, hopefully, from politicians—for the concept of a scheme to cover the long-termcare and rehabilitation costs of people who have been injured and who have awards againstmedical defence organisations. That cost, I believe, at the moment—and these figures are real,but I do not know quite how accurate they are—would be about $77 million per year. That is thesort of cost that we believe the government actually needs to take out of the system to stabiliseit.