ColorLine årsrapport engelsk 2007

-

Upload

color-line -

Category

Economy & Finance

-

view

198 -

download

2

Transcript of ColorLine årsrapport engelsk 2007

COLOR GROUP ANNUAL REPORT 2007 // INTRODUCTION

Annual Report 2007

COLOR GROUP ANNUAL REPORT 2007

COLOR GROUP ANNUAL REPORT 2007 // INTRODUCTION

// INTRODUCTION // HIGHLIGHTS // SOCIETY AND THE ENVIRONMENT

// DIRECTORS’ REPORT AND ACCOUNTS

Principal fi gures and Key fi guresCOLOR GROUP ASA

DEVELOPMENT OF TRAFFIC

Passengers 4 294 691 4 279 868 4 433 072 4 211 284 4 241 870

Cars 879 458 828 284 809 188 823 029 818 467

Freight units (12m-equivalents) 176 634 192 412 177 195 158 357 142 223

PROFIT/LOSS (in NOK mill.) 1) (in EUR mill.)

Revenues 4 762 4 585 4 682 3 944 3 816 598

Operating expenses -4 003 -3 726 -3 740 -3 151 -2 963 -503

EBITDA 2) 759 859 942 793 853 95

Depreciation -399 -397 -495 -367 -367 -50

Charter, leasing expenses -65 -66 -77 -74 -37 -8

Operating income before write-down/loss/gain 296 396 369 352 449 37

Gain and loss on sales, write-downs 1 8

EBIT 296 396 378 353 457 37

Net fi nancial items -124 -31 -122 -89 -107 -16

Pre-tax income 171 365 256 263 349 21

Taxes -50 -104 -87 -94 -108 -6

Net income 121 261 169 169 241 15

BALANCE SHEET (in NOK mill.)

Current assets 1 879 1 534 615 769 549 236

Fixed assets 6 741 5 073 5 699 5 521 3 374 847

Total assets 8 620 6 608 6 314 6 290 3 923 1 083

Current liabilities 1 008 842 566 595 407 127

Long-term debt 4 863 2 928 3 216 3 270 1 361 611

Deferred taxes 574 599 557 512 432 72

Shareholders’ equity 2 005 2 074 1 973 1 912 1 720 252

Total liabilities and shareholders’ equity 8 620 6 608 6 314 6 290 3 923 1 083

LIQUIDITY (in NOK mill.) / SOLIDITY (%)

Cash and cash equivalents as at 31 Dec. 3) 1 307 1 463 1 508 1 465 631 164

Cash fl ow from operations 4) 694 793 865 714 816 87

Equity ratio % 23 31 31 31 44

Net interest-bearing debt 4 955 2 950 3 082 3 017 1 130 622

EMPLOYEES / SUNDRY EXPENSES

Number of employees 5) 3 967 3 821 3 827 3 268 3 065

Costs of wages 1 409 1 296 1 303 1 102 1 053 177

Port fees 152 143 138 121 114 19

Defi nitions:

1) Translated into EURO, exchange rate as at 31 Dec. 07.

2) Operating profi t/loss before ordinary depreciation and charter expenses

3) Including non-utilised credit facilities

4) EBITDA less charter expenses

5) Including part-time employees in 2007, 2006 and 2005.

IFRS NASACCOUNTING STANDARD

CONSOLIDATED 2007 2006 2005 2004 2003 2007

The introduction of “Color Magic” and “Color Fantasy”

marks a new era in quality cruises based on a regular

sailing schedule. The launching of the SuperSpeed concept

has revolutionised a 150-year old shipping tradition and

brought Norway closer to the European continent.

Industrial renewal on this scale requires innovation, and

the will and ability to implement the plan at all levels in

the organisation.

Trond Kleivdal, Group President

’’

’’

of quality cruises on the longer

voyages”, states Kleivdal.

FUTURE-ORIENTED

ENGAGEMENT

Norwegian industry is dependent

on effi cient transport routes to

its markets. Both Norway and the

EU have stated clearly that the

increasing transport requirements

in Europe must be solved by trans-

ferring freight transport from the

roads to sea and rail transport.

“This development is particularly

important for Norway as from a

geographic aspect, we are a

peninsular in relation to the rest

of Europe. Color Line has already

registered a considerable increase

in freight. Based on our modern

ports and ships, industrial enter-

prises now have access to an

effective, intelligent and reliable

transport system which has

effi ciently reduced the distance

between Norway and the conti-

nent. We have established effi cient

motorways at sea,” says Trond

Kleivdal.

Color Line’s engagement is also

important for the shore-based

tourist industry, bringing in large

volumes of tourists who arrive by

sea with their cars onboard.

“Our ships represent a consider-

able growth potential. With the in-

troduction of SuperSpeed, popular

summer and winter destinations

particularly in Norway and Den-

mark will now be regarded as close

to hand for large groups of the

population,” points out Kleivdal.

WELL-SHOD FOR FURTHER

GROWTH

Concurrently with the introduc-

tion of new tonnage and a new

organisation, Color Line will be

focusing on the company’s human

resources.

“We must be certain that we are

professional in our operations and

in the manner in which we take

care of our colleagues. For this

reason, we wish to establish good

platforms for further develop-

ment, competence enhancement

and career plans.” Kleivdal empha-

sizes that Color Line is dependent

on a competent and motivated

staff to enable the company to

fulfi l its ambitious vision.

“We are to be the best in

Europe in the fi elds of cruise and

sea transport, and this is why we

must also have the most motivat-

ed employees.”

Kleivdal underlines that the

measures taken in 2007 and in

the fi rst six months of 2008 have

created a solid foundation that will

secure lasting values for share-

holders as well as fulfi lling the

expectations of employees, pas-

sengers and society as a whole.

“We are now in a good position

and we are well shod for further

growth. Our investments will start

to give positive results towards the

end of 2008. Now is the time to

deliver the goods!” ■

During the period

2004 to 2008,

Color Line has in-

vested almost NOK

7.5 billion on four

custom-built ships,

and on modern ports and termi-

nals in Kristiansand, Larvik, Oslo,

Hirtshals and Kiel. The world’s two

largest cruise ships with car decks,

Color Magic and Color Fantasy,

revitalised the cruise traffi c be-

tween Oslo and Kiel in the autumn

of 2007.

In the spring of 2008, the trans-

port stages between Kristiansand,

Larvik and Hirtshals in Denmark

will also be renewed through the

introduction of the new transpor-

tation concept, SuperSpeed 1 and

SuperSpeed 2.

AN INDUSTRIAL VOYAGE

These new ships and port facili-

ties mark the start of a new era for

Color Line.

“Our industry is facing major

challenges both nationally and

internationally. Following compre-

hensive analyses, we decided some

years ago to meet these challenges

with bold initiatives. We decided to

renew our tonnage and to special-

ise in quality cruises and effi cient

transport”, says Trond Kleivdal,

Color Line’s Group President.

These strategic decisions were

followed up by fi rm action. New

ships were contracted and the

older tonnage was sold at prices

that exceeded book values. In

parallel with the development of

tonnage, Color Line implemented

essential organisational changes

in 2007.

“There was a requirement for

uniting energies. We now have a

keenly focused and transparent

organisation that is well suited for

effi cient transport on the short

services and for the organisation

During the course of 2008, Color Line will be in the fi nal stages of the most ambitious

investment programme in the history of the company. A new foundation has been laid,

based on innovation and the ability to implement such a wide-reaching plan. Color Line is

now ready to fulfi l its ambitious vision: To be the best shipping company in Europe in the

cruise and transportation sectors, having a base in Norway.

D

Time to deliver the goods

COLOR GROUP ANNUAL REPORT 2007 // INTRODUCTION

4 5

Trond Kleivdal, Group President

In addition, the reorganisation

provides openings for invest-

ments in new projects, report-

ing lines are improved and

distribution of responsibility

is clearly defi ned. To sum up,

the new organisation has enabled

Color Line to consolidate its vision

to be the best shipping company in

Europe in the fi elds of cruise and

transport.

CRUISE AND TRANSPORT

As a result of the reorganisation,

the subsidiary company Color Line

was split into two main business

areas, the Cruise Division which is

handled by Color Line Cruises AS

and subsidiaries, and the Trans-

port Division handled by Color Line

Transport AS and subsidiaries. All

employees on board the ships are

employed by Color Line Crew AS.

Color Group ASA holds all the

shares in the sub-group Color Line

AS which is the parent company of

the newly established companies

Color Line Cruises AS, Color Line

Transport AS and Color Line Crew

AS.

All fi nancing and appurtenant

fi nancial activities take place in

the parent company Color Group

ASA and the owner company

O.N. Sunde AS.

EXECUTIVE MANAGEMENT

Group management of Color Line

AS comprises seven units, head-

ed by Trond Kleivdal, the Group

President.

The business area Cruise is re-

sponsible for the Oslo – Kiel service

and for Color Line Germany. The

operative management for Color

Line Cruises is located in Oslo. The

Cruise Division is headed by Knut

Hals, Group Director.

In 2007, Color Group improved its effi ciency through the reorganisation of the subsidiary

company Color Line AS. The reason behind this process was to enable the company to

operate successfully in an increasingly competitive market and at the same time be in a

position to offer quality cruises and effi cient transport.

I

Reorganisation

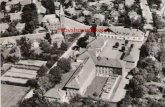

En bildetekst gjør seg altid godt,

og mener vi må ha det på slike

bilder.

COLOR GROUP ANNUAL REPORT 2007 // INTRODUCTION

6 7

Boge GulbrandsenGroup Director Strategy,

Market and Business

Development

Mette KrabberødGroup Director

Financial

Trond KleivdalGroup President

Color Line

Svein SørensenGroup Director

Color Line Marine

Laila ValdalGroup Director

Color Line Transport

Lasse Winge KristensenGroup Director

Human Resources

Knut HalsGroup Director

Color Line Cruises

Helge Otto MathisenGroup Director

Communications and

Public Relations

The business area Transport is

responsible for the Kristiansand –

Hirtshals service, the Larvik – Hirts-

hals service, the Sandefjord –

Strømstad service in addition to

Color Line Denmark, Color Line

Cargo and Color Hotel Skagen. The

operative management of Color

Line Transport is based in Sande-

fjord.

Laila Valdal is Group Director

for the Transport Division. The

other group directors are Svein

Sørensen, Color Line Marine AS,

Boge Gulbrandsen, Strategy, Market

and Business Development, Helge

Otto Mathisen, Communications

and Public Relations, Mette Krab-

berød, Financial and Lasse Winge

Kristensen, Human Resources. ■

COLOR GROUP ANNUAL REPORT 2007 // INTRODUCTION

8 9

Ships in operationColor Line is Norway’s largest and one of Europe’s leading cruise and ferry companies. The

company has a workforce of approx. 3 500 in four countries and with effect from March 2008,

operates seven ships on fi ve international services between seven ports in Norway, Germany,

Denmark and Sweden.

January February March April May June July August September October November December

M/S COLOR FANTASY

Oslo-Kiel

M/S COLOR FANTASY

Oslo-Kiel

M/S KRONPRINS HARALD

Oslo-Frederikshavn

M/S COLOR FESTIVAL

Kristiansand-Hirtshals

M/S CHRISTIAN IV

Larvik-Hirtshals

M/S PETER WESSEL

Sandefjord-Strömstad

M/S COLOR VIKING

Sandefjord-Strömstad

M/S BOHUS

Bergen/Stavanger-Hirtshals

M/S PRINSESSE RAGNHILD

Kristiansand-Hirtshals

F/F SILVIA ANA

Oslo-Kiel

M/S COLOR MAGIC

THE FLEET 2008

Year built: 2004, Aker Yards, Turku FinlandHome port: OsloTonnage: 75 027 GRTLength: 224 metresBeam: 35 metres

Draft: 6.8 metresClass: Det Norske VeritasMax. capacity: 2 700Passenger cars: 750Trailers: lane metres: 1 270

M/S COLOR MAGICYear built: 2007, Aker Yards, Turku FinlandHome port: OsloTonnage: 75 100 GRTLength: 224 metresBeam: 35 metres

Draft: 6.8 metresClass: Det Norske VeritasMax. capacity: 2 700Passenger cars: 550Trailers: lane metres: 1 270

M/S PRINSESSE RAGNHILDYear built: 1981/1982 HDW Kiel/Astilleros, Cadiz, SpainHome port: OsloTonnage: 35 855 GRTLength: 202.25 metres

Beam: 26.6 metres Draft: 6.5 metresClass: Det Norske VeritasMax. capacity: 1 515Passenger cars: 600Trailers: lane metres: 900

M/S SUPERSPEED 1Built: Aker Yards, Rauma, FinlandHome port: KristiansandTonnage: 33 500 GRTLength: 211.3 metresBeam: 26 metres

Draft: 6.5 metresClass: Det Norske VeritasMax. capacity: 1 929Passenger cars: 764Trailers: lane metres: 2 036

M/S SUPERSPEED 2Year built Aker Yards, Rauma, FinlandHome port: KristiansandTonnage: 33 500 BRTLength: 211.3 metresBeam: 26 metres

Draft: 6.5 metresClass: Det Norske VeritasMax. capacity: 1 929Passenger cars: 764Trailers: lane metres: 2 036

M/S COLOR VIKINGYear built 1985, Nakskov, DenmarkHome port: SandefjordTonnage: 19 736 BRTLength: 137 metresBeam: 24 metres

Draft: 5.64 metresClass: Det Norske VeritasMax. capacity: 1 720 Passenger cars: 350Trailers: lane metres: 490

M/S BOHUSYear built 1971, Aalborg, DenmarkHome port: SandefjordTonnage: 9 149 BRTLength: 123.4 metresBeam: 19.2 metres

Draft: 5.4 metresClass: Det Norske VeritasMax. capacity: 1 165 Passenger cars: 230Trailers: lane metres: 462

O.N. Sunde AS

O.N. Sunde AS is an investment company with

ownership interests in businesses engaged in ship-

ping, tourism, clothing, sports and leisure, property,

chemical industry and fi nancial investments. These

companies employ more than 6 000 persons.

O.N. Sunde has a 100 percent stake in Color Group

ASA which owns and operates Color Line AS. Most

of the group’s business takes place in Color Line AS,

Sunpor Kunststoff GmbH and Gresvig Holding AS.

COLOR GROUP ASA

Color Group ASA is engaged in the transport of pas-

sengers and freight, hotel operation, restaurants,

trade, entertainment and tour production. The

company has its head offi ce in Oslo and is an active

holding company for the wholly-owned subsidiary

company Color Line AS.

SUNPOR KUNSTSTOFF GMBH

This company is based in Austria, manufacturing

expanding polystyrene (EPS). This material is used

for insulation in buildings and as shock-absorbing

material for use in packaging and bicycle helmets.

GRESVIG HOLDING AS

This group comprises the business areas sports and

textiles and is one of the leading players in Norway

on the market for sports and leisure equipment

operating the chains G-Sport, Super G, Sportshuset

and Intersport. Voice Norge AS is also part of the

Gresvig Holding AS group. Voice Norge is mainly

engaged in the distribution and marketing of

private brands and other branded goods for which

the company has established exclusive distribution

in Norway through the four chain concepts VIC,

Match, Voice of Europe and Boys of Europe. ■

Group structure:

O.N. Sunde AS

Color Group ASATourism/Transport

Sunpor Kunststoff GmbHChemical industry

Alcam ASShipowning

ONS Invest AS

O.N. Sunde Eiendom AS

Gresvig Holding ASSport/Leisure

Voice Norge ASClothing distribution/Fashion

COLOR GROUP ANNUAL REPORT 2007 // HIGHLIGHTS

Highlights 2007

10 11

have been specially designed for

short cruises and adapted to tack-

le the logistic challenges of turning

around a ship in port and handling

several thousand passengers and

more than 500 vehicles in the

shortest possible time.

“Cooperating with effi cient land

organisations, we can if necessary

turn the ship around in Oslo or Kiel

in just two and a half hours. This is

impressively quick when you take

into account that the new ships

are two to three times larger than

the previous vessels and can take

almost twice as many passengers”,

explains the Captain.

AMONG THE WORLD’S BEST

Color Magic and Color Fantasy are

the world’s largest cruise ships

equipped with a car deck. From bow

to stern these ships are actually

twice the length of the Royal Palace

in Oslo and from keel to the high-

est point onboard, they are almost

as high as the Oslo City Hall. The 15

decks onboard contain everything

from the engine room and car deck

to cabins, suites, restaurants, shops,

spa and a broad range of entertain-

ment and leisure activities.

“Color Line’s ships have always

been well-run, but when you start

operating a completely new ship,

everyone is on their toes. Magic

and Fantasy can be compared

with the very best cruise ships in

the world. This creates anticipa-

tion and all crew members exert

themselves to do their very best”,

says Hansen.

NORWEGIAN FLAG AND CREW

As the ship’s master, Captain

Hansen frequently receives

positive feedback from Nor-

wegian and foreign guests

with regard to the ship and

its crew who are mainly

Norwegian or Scandina-

vian.

“To be able to operate a

ship with a Norwegian crew and

to sail under the Norwegian fl ag is

a considerable competitive advan-

tage. The fact that colleagues on

board and on shore speak the same

language contributes towards ef-

fi cient operation, but is also con-

nected with a feeling of ownership.

The crew feel a sense of ownership

to the ship and the company and

want to show that they are the best

in the world in the fi eld of short

cruises. Even the big international

cruise companies have started to

show interest in our activities to

see how we manage”, says Captain

Erling B. Hansen. ■

Just two days after

the celebrations, the

ship left on its maiden

voyage from Oslo to

Kiel with both guests

and a well-prepared

crew looking forward to a unique

experience.

“Running a cruise ship can be

compared with a giant jigsaw

puzzle where all the pieces must

fi nd their right place before every-

thing functions well. This has been

the case on board this ship right

from the start. It is all a question

of thorough planning and a real-

ly competent crew. When we left

port with a passenger complement

for the very fi rst time, every crew

member knew exactly what they

had to do”, says Erling B. Hansen,

Captain of Color Magic.

A HIGH LEVEL

When Color Line signed the con-

tract for the building of Color

Magic in May 2005, planning work

started up immediately, aimed at

putting the ship into operation

quickly, maintaining the same high

service level as on the sister ship,

Color Fantasy.

During the building period, the

Aker Yards’ shipyard in Rauma, Fin-

land, was visited on many occasions

in order to do everything possible to

make the ship even more effi cient

than its sister ship. Well in advance

of completion, a number of offi cers

and crew from the sister ship were

selected to crew the new ship.

“When you have been on board

a ship for a time, you will always

fi nd details that can be improved

in some way, particularly with re-

gard to effi cient operation”, says

Hansen, who was previously Cap-

tain on board Color Fantasy and

several other Color Line ships. As

a result of these adaptations, Color

Magic is equipped with a larger

logistics centre than on its sister

ship and one of the decks is used

for additional passenger cabins.

ADAPTED FOR SHORT CRUISES

Color Fantasy and Color Magic

The atmosphere in Kiel on Saturday, 15 September 2007 was charged with excitement

when an armada of leisure craft escorted M/S Color Magic into port. More than 150 000

spectators viewed the naming ceremony performed by the ship’s godmother Veronica

Ferres, either in the port itself or via big screens placed at different locations in the city.

J

A Magical start for Color Magic

13

COLOR GROUP ANNUAL REPORT 2007 // HIGHLIGHTS

12

Erling B. Hansen,

Captain, Color Magic

ration between Kristiansand and

Hirtshals on 13 March. SuperSpeed

2 will commence ferry operations

between Larvik and Hirtshals in

June.

DYNAMIC AND ELEGANT

The SuperSpeed ships are of mo-

dern design and have completely

new technological solutions. Com-

fort, capacity and effi ciency were

important themes when these ships

were planned. In addition, high im-

portance is attached to effi ciency

in the ports of Kristiansand, Larvik

and Hirtshals. These ships have a

fast turnaround time in port.

“SuperSpeed was created

through close cooperation be-

tween Color Line, the architect

and Aker Yards. These ships rep-

resent a high level of custom

building. No other ships can match

SuperSpeed’s combination of ef-

fi cient goods transport, comfort

and modern design”, emphasises

Laila Valdal.

She underlines that SuperSpeed

represents a large-scale long term

investment for Color Line both at

sea and ashore.

“We are building a new terminal

in Larvik and have invested in up-

grading work of the ports in both

Kristiansand and Hirtshals. In our

view, these investments are abso-

lutely necessary in order to secure

Color Line’s position on the market.

SuperSpeed is the cornerstone in

our transport sector and in com-

bination with the ferries in Sande-

fjord will ensure modern and ef-

fi cient operation for the future”.■

“SuperSpeed is the

ship of the future.

It carries a large

number of passen-

gers, cars and cargo

quickly and effi cient-

ly to the continent in an extremely

comfortable manner”, says Laila

Valdal, Group Director, responsible

for Color Line Transport AS and

godmother for SuperSpeed 1.

She goes on to explain that the

preferences of the travelling pub-

lic have changed in recent years,

particularly on the routes between

Larvik/Kristiansand and Hirtshals.

“Previously, we had a mixture of

transport and cruise guests. How-

ever, the requirement for fast and

effi cient transport between Nor-

way and the continent has shown

a steady increase. The introduction

of the SuperSpeed ferries shows

that Color Line takes guests’ re-

quirements seriously. SuperSpeed

is an innovative transport concept

which is effi cient, fast, smart and

comfortable”, says Valdal proudly.

IMPORTANT FOR

TRANSPORT AND THE

TOURIST INDUSTRY

The new SuperSpeed ships have

trebled Color Line’s freight capa-

city and the company expects a

major increase in freight volumes.

“Transferring freight from the

roads to seaborne and rail trans-

port will be an effi cient contri-

bution towards solving Europe’s

transport challenges”, says Laila

Valdal.

She points out that SuperSpeed

also represents an appreciable

growth potential for the land-

based tourist industry in Norway

and Denmark.

“For example, winter destina-

tions in Norway and the popular

tourist attractions on Jutland will

now be close at hand for Norwe-

gian and Danish tourists”, says

Valdal.

SuperSpeed 1 was put into ope-

With the introduction of the SuperSpeed ships, Color Line has renewed ferry transport

across the Skagerrak radically. SuperSpeed is a revolutionary transport concept and a

necessary investment for the future.

S

Investing in the future

COLOR GROUP ANNUAL REPORT 2007 // HIGHLIGHTS

14 15

Laila Valdal, Group Director

Color Line Transport For effi cient handling of the increased traffi c, Color Line has invested in a

completely new terminal in Larvik. The ports of Hirtshals and Kristiansand

have been upgraded, including an extension of the vehicle parking area.

Facts SuperSpeed● Length: 211 metres

● Kristiansand-Hirtshals: 3h 15min.

● Larvik-Hirtshals: 3h 45min

● Passenger cars: 764

● Max capacity: 1929

● Hazardous cargo allowed

● Trucker cabins: 54

● Effectly roll-on and roll-off

CONTINUITY AND

PREDICTABILITY

Eirik Borge explains that the com-

pany was faced with a major chal-

lenge in the spring of 2007 when

Color Line withdrew Color Travel-

ler from the service between

Larvik and Frederikshavn.

“We were left with one daily de-

parture by Peter Wessel which was

also laid up for periods. At the same

time, due to the work of extending

the ports, Color Line was obliged

to switch between Frederiks-

havn and Hirtshals. We handled

this by increasing road transport

and we are now looking forward to

the establishment of SuperSpeed

in Larvik. Two daily departures will

give us a high degree of continu-

ity and predictability and will make

it easier for drivers to plan their

driving times and rest periods in

conjunction with the departures”,

says Borge. He emphasises that

DHL is dependant on the regular

service of the SuperSpeed ferries,

even in inclement weather.

“These ships are constructed for

all year round service and we must

assume they will take Skagerrak

winters in their stride”, says Eirik

Borge with a smile. ■“For DHL Freight

Norway it is essential

that there is a well

functioning seaborne

transport system.

SuperSpeed gives

us greater fl exibility and stabili-

ty”, says Eirik Borge, CEO of DHL

Freight Norway.

He mentions several factors

which contribute towards simpli-

fying DHL’s everyday routines.

“SuperSpeed gives us four daily

departures and shorter transport

times between Norway and Den-

mark. This provides a considerable

increase in capacity and means

that we know there will always

be space for our vehicles, even in

the busy seasons. Frequent depar-

tures will probably also contribute

towards better balance in the dis-

tribution of freight, which will have

a positive impact on our working

schedule. Moreover, the new ter-

minals in Larvik, Kristiansand and

Hirtshals will contribute towards

even more rational and effi cient

freight transport on our part”, says

Borge.

AN IMPORTANT ADVANTAGE

The largest part of DHL Freight

Norway’s continental business is

conducted from its base in Lar-

vik, due to the concentration of

industry in the region. Eirik Borge

believes that SuperSpeed will

provide the region with a trading

advantage.

“We have already received in-

quiries from clients on the conti-

nent who now see the opportunity

of becoming established on new

markets”.

Borge is convinced that Super-

Speed will provide positive spin-off

effects for business, industry and

tourism in the region.

“SuperSpeed has brought us even

closer to the continent”.

With the introduction of SuperSpeed, Europe is just a short drive away. For DHL Freight

Norway the result is a distinct advantage – the SuperSpeed concept means that transport

times to and from the continent are shortened appreciably, says CEO Eirik Borge.

F

Continental pleasures

COLOR GROUP ANNUAL REPORT 2007 // HIGHLIGHTS

16 17

SuperSpeed – more than a ship. The SuperSpeed ferries will have two daily departures in each direction. Each departure is equivalent to the capacity of 14 Boeing 737 aircraft. On board the ferries there is a good selection of shops, restaurants, and lounges – everything to make a voyage across the Skagerrak a pleasant experience. Rolf Kjær, Director of newbuildings

’’’’

18 19

cost air travel, other cruise com-

panies, ferry companies and other

operators in the fi elds of holiday

and leisure.

At the same time the company

must relate to changed framework

conditions outside the control of

the group such as the continuing

high prices for oil and energy and

new tax legislation introduced in

order to meet global climate chal-

lenges.

A NEW ERA

In order to make the most of the

opportunities that lie ahead, Color

Line has invested in new ships and

concepts. New trends in holiday,

leisure and freight transport have

formed a basis for these invest-

ments. The new ships have a much

higher capacity and a higher level

of comfort than the ships they have

replaced. In order to utilize this ca-

pacity in a profi table manner, the

customer base must be extended,

new technology must be applied

and operations optimized. ■

In order to be in a position

to implement the renewal

of the company and to ope-

rate two concepts as profes-

sionally and cost effi ciently

as possible, a reorganisation

programme of Color Group was

implemented during the fi rst six

months of 2007.

TWO BUSINESS DIVISIONS

In the reorganisation process, the

subsidiary company Color Line

was divided into two divisions:

transport and cruise. On the le-

gal side, the group structure was

changed by means of a de-merger

of Color Line AS which, following

the restructuring process became

the parent company of Color Line

Cruises AS, Color Line Transport

AS and Color Line Crew AS. All sea-

going personnel in the group are

employed in the latter company.

In practice, the reorganisa-

tion means that the business

area cruise is responsible for the

Oslo-Kiel cruise service while the

business segment transport is

responsible for the Kristiansand

– Hirtshals, Larvik – Hirtshals and

Sandefjord – Strømstad services.

Cruise and transport take care of

the operative management in Oslo

and Sandefjord respectively.

A CHANGE IN THE

COMPETITION PATTERN

The background for the decision

to restructure the group is the fact

that competition and customers

requirements and anticipations

have changed dramatically in just

a few years. In the tourist market,

Color Line is competing with low

From December 2004 until May 2008, Color Line will have invested NOK 7.5 billion in

new ships, ports and concepts. This initiative implies specialization in effi cient transport

systems on the short routes and high quality cruise entertainment on the long routes.

I

Cultivating Concepts

COLOR GROUP ANNUAL REPORT 2007 // HIGHLIGHTS

There will still be gaming machines onboard ships

The new regulations represent a tightening up

of the rules and lay down specifi c requirements

for ships offering gaming machines. The aim

of the new act is to secure satisfactory public

control in order to prevent social problems, at

the same time avoiding foreign registration of

Norwegian ships. The new regulations are also

intended to prevent ship traffi c, established

mainly for gambling purposes.

The Inspectorate of Lotteries and Founda-

tions has prepared draft regulations covering

the type of gaming that would be allowed on

board ships- The draft has been distributed

for consultation by the Ministry of Culture and

Ecclesiastica. The new regulations may come

into force from 1. July 2008.

In October 2007 the Ministry of Culture

and Ecclesiastica issued new regula-

tions governing gaming machines on-

board ships. The new regulations re-

quire that ships that have gaming

machines onboard must operate regular

all-year round services between Norwe-

gian and foreign ports. The ships must

also have freight capacity for the large

scale transport of goods and vehicles.

20 21

COLOR GROUP ANNUAL REPORT 2007 // HIGHLIGHTS

We can now offer a choice selection of popular mountain destinations to a large market.Simen Bjørgen, The mayor of Lom

’’’’

Five million guest days

In 2007, Color Line brought in about

5 million guest days to the land-based

tourist industry in Norway. There is

also additional spending by foreign

tourists travelling by Color Line ships

who go ashore in Norway. 2008 will

be the fi rst complete year in which

both Color Fantasy and Color Magic

are in operation and it is expected that

German tourists travelling by these

ships will spend about NOK 750 mil-

lion in Norway. This is an increase of

more than 75 percent compared with

2004 which was the last complete

year of operation without the new

ships.

“A motorway” to Lom

At the food and tourist fair Grüne Woche in Berlin, the mayor of Lom, Simen

Bjørgen said that SuperSpeed is important and that the region will work

actively to attract round trip passengers to plan their route to include Lom

and Gudbrandsdalen when travelling from east to west.

“We have scenery, we have history and we can offer a wide range of

attractions. It is now up to the food and tourist industry in the region to take

an initiative”, said the mayor to Aftenposten. Bjørgen is of the opinion that the

tourist industry and other industries in Gudbrandsdalen will certainly benefi t

if passengers are encouraged to visit inland Norway after they arrive at the

ports of Larvik and Kristiansand.

A short journey to the ski slopes for 25 million Danes and Germans

In 2007, Color Line brought in

several hundred thousand guests

heading for the major ski resorts

in south Norway. in 2008 the new

SuperSpeed ships will represent a

considerable growth potential for the

important winter destinations which

will now be considered close to hand

for large groups of the population in

Denmark and Germany.

Spin-off effects in Larvik

The establishment of a new port in

Larvik for SuperSpeed 2 will have

major spin-off effects both in the port

and for the tourist industry in the

region. The SuperSpeed ferries have

no cabins and all overnight stays

will therefore be ashore. Moreover,

the concept represents effi cient and

regular logistics solutions to and

from the continent which will benefi t

business and industry in the entire

region.

The important round trip market

The Norwegian round trip market

represents approx. 2 million arrivals

each year and total holiday spending

of approx. NOK 15 billion. The intro-

duction of SuperSpeed will open up

one of the most important routes to

Hordaland and inner Rogaland from

Kristiansand through Setesdalen.

In this way Kristiansand will be the

gateway to west Norway.

Edmund H. Utne,

Director of Hotel Ullensvang, Hardanger

COLOR GROUP ANNUAL REPORT 2007 // SOCIETY AND THE ENVIRONMENT

“Color Line has developed into one of Europe’s leading cruise

ferry companies. The company operates at the intersection of

transport and tourism and plays an important part in bringing

foreign tourists into Norway”

Extract from the Government’s strategy for environmentally friendly growth of the maritime industries.

Society and the environment

’’

22 23

COLOR GROUP ANNUAL REPORT 2007 // SOCIETY AND THE ENVIRONMENT

24 25

Sold ships for more than NOK 1 billion in 2007In connection with the fl eet renewal

programme, Color Line sold four

of it’s ships in 2007. The market for

older tonnage was good in 2007 and

these sales brought in a total of more

than NOK 1 billion. All the ships were

sold above book value.

Kronprins Harald was sold to Irish

Ferries, Peter Wessel to MSC (Medi-

terranean Shipping Company) and

Silvia Ana was sold to Buquebus.

Finally, Color Festival was sold to

Corsica Ferries.

EngagementsThe employees on board Color Line’s

new ships have attended either the

cruise school or the SuperSpeed

school. In addition to providing

basic knowledge on Color Line and

its fl eet, the curriculum includes

“engagement” which is Color Line’s

core value. The objective is that

engaged employees are to contribute

towards the guests’ enjoyment so that

they want to repeat the experience.

An effi cient junctionHirtshals is a junction for traffi c be-

tween the Continent and Norway,

served by a four lane motorway and

rail connection leading right into the

port. In 2008 this port will be able to

handle more than 23 000 passengers

daily – equivalent to more than 156

full Boeing 737 aircraft.

A new turn-around proce-dure gave a cleaner portIn 2005, an investigation showed that

Color Viking’s propellers raised up sludge

from the sea bed in Sandefjord port. As a

result of this investigation, Color Line re-

vised the turn-around procedure by using

less engine power and by turning the ship

around further out in the port where the

water is deeper. A new investigation im-

plemented by Den Norske Veritas in 2007

shows that this has had a positive effect:

“No connection is shown between

the departures of Color Viking and an

increase in particle volume in waters in

port. It can therefore be concluded that

the implemented measure has had a

positive effect”.

The show with the largest audienceEvery evening at 7 pm and 9 pm

shows are performed in the show

lounge on board Color Magic and

Color Fantasy. The show programme

is changed in each direction, south-

bound and northbound. The lounge

has more than 500 seats and dur-

ing the course of the year, each of

the two shows are seen by approx.

200 000 guests – the largest audi-

ence of any performance in Norway.

Innovative and environ-mentally friendly“SuperSpeed is an innovative and en-

vironmentally friendly concept. It is

particularly gratifying that Color Line

has taken this wide-reaching initiative

in Norway. This is where we can be

best in competition with other coun-

tries”.

This is a quotation from a speech

by Dag Terje Andersen, the Minister

of Trade and Industry during the

foundation stone ceremony for the

new terminal at Revet in Larvik.

A popular workplaceDuring the course of the next three years, Norwegian shipowning companies will require

almost 4 000 new seamen. In order to meet this requirement, Maritime Forum started

up a major recruiting campaign aimed at encouraging more young people to choose a

career at sea. One of the campaign measures is the website www.ikkeforalle.no which

presents different professions at sea and the different shipowning companies.

Despite the keen competition for employees in the maritime sector, Color Line receives

considerably more applications then there are vacancies. On Maritime Forum’s

recruiting pages, the presentation of Color Fantasy is the most visited feature of all and

when the sister ship Color Magic was to be manned, 1 500 to 2 000 applications were

received despite the fact that very few jobs were advertised externally.

Color Line is a popular employer onshore as well. When Color Line advertised the

fi rst 20 jobs at the new customer centre in Larvik, more than 200 applications were

received.

Thank you for the gift!“Thank you for the gift Color Line!

We will do our utmost to utilize the

potential that SuperSpeed repre-

sents for industry and tourism in our

region”. This quotation is from a

speech by Erik Haatvedt, mayor of

Tinn municipality at the laying of the

foundation stone for the new termi-

nal at Revet in Larvik.

“In recent years the Norwe-

gian Tourist Industry has become

much more profi cient in working

together and in combining travel,

overnight stays and attractions”,

says Tuftin.

PRECISE MARKET

INFORMATION

The Color Magic naming cere-

mony was the initial step in the

Optima Germany project. However,

the project itself started in 2006.

One of the most important aims

of the pilot project was to obtain

precise factual information on the

German tourist market so that the

marketing of Norway could be as

effi cient as possible.

“With regard to what the Ger-

man market wants, we have now

progressed from guesswork to

knowledge so that jointly we can

build up and spread knowledge

of Norway in Germany and apply

effi cient marketing measures on

the market emphasises Tuftin.

MAKING NORWAY EASILY

AVAILABLE

When it comes to focusing on Nor-

way, Tuftin believes that Color Line

plays a very important part.

“There is no doubt that Co-

lor Line’s engagement in both

the new cruise ships to Germany

and the SuperSpeed concept be-

tween Norway and Denmark is an

extremely important factor for the

fl ow of tourists. These ships con-

tribute towards making Norway

easily accessible and this is one

of the most important factors

for increasing tourism”, says

Tuftin. ■

The event was co-

vered by no less than

7 German TV chan-

nels and 160 accredi-

ted journalists. A total

of NOK 15 million was

invested in this event which was

attended by, among others, Oslo

City, Fjord Norway, The Export

Council for Fish and numerous

other Norwegian organisations

and companies. The campaign is

part of the co-operation program-

me Optima Germany. The aim of

the project is to optimize market

communications based on Norway

as a branded product and to serve

as a new tool for product develop-

ment and host development in the

tourist industry in Norway.

Innovation Norway, Color Line

and other players in the tourist in-

dustry have agreed on the objec-

tive of increasing the number of

guest days for German tourists

in Norway by 100 000 each year

in the years ahead. From the time

Color Magic’s sister ship, Color

Fantasy was put into operation

on the Oslo – Kiel service in 2004,

the number of German passen-

gers has increased by about 50

percent. The potential is much

greater however. Germany is one

of the most important tourist

markets for Norway. Despite this,

Norway’s market share of foreign

travel from Germany is less than

1 percent.

AN ENORMOUS POTENTIAL

“This is not nearly enough in re-

lation to the enormous potential

represented by this market”, says

Per-Arne Tuftin, director of tou-

rism in Innovation Norway. One

of the most important criteria for

success in attracting more tourists

to Norway is a co-operation

constellation between tourist en-

terprises.

The naming ceremony for M/S Color Magic in Kiel on 15 September 2007, attended by

almost 150 000 people did not just mark the start-up of the operation of a brand new ship

between Norway and Germany. It also represented the most comprehensive Norwegian

marketing campaign in Germany in 2007.

T

Spin-off effects for tourism in Norway

COLOR GROUP ANNUAL REPORT 2007 // SOCIETY AND THE ENVIRONMENT

26 27

Political aims

Moving more goods traffi c from the roads to

seaborne transport is a political objective both

in Norway and in the EU. In 2007, Color Line

increased its total capacity for the transport of

passengers and goods. Both the SuperSpeed fer-

ries which take large quantities of freight from

the roads and the company’s cruise ships which

are equipped with spacious trailer and container

decks contribute towards this political aim.

A systematic charting of Color Line’s dis-

charge to sea and air took place last year. The

company is now well prepared to introduce fur-

ther environmental protection measures in the

years ahead. The company works to ensure that

all its activities have the least possible impact

on the environment on land, at sea and in the

air. This work takes place in close co-operation

or understanding with the authorities, the clas-

sifi cation company, research environments and

environmental organisations.

TRIPLED

The SuperSpeed ferry can accept three times

as many trailers as the ships they are replacing.

Based on a fully loaded ship, the CO2 discharge

per vehicle will be halved on the voyage from

Kristiansand to Hirtshals. Discharge from the

shopping centre, restaurants, entertainment

events and cabins is included. ■

formance in the operation of the

ships is registered in an electronic

non-conformance system (TQM)

which the ships and the land based

organization have access to. In this

system the non-conformance is

registered and deadlines are given

for the implementation of correc-

tive measures and in particular

who is responsible for implement-

ing these measures.

“In the case of minor non-

conformance, this can usually be

corrected onboard. If this is not

possible, the non-conformance

is taken over by the shore based

offi ce which will implement neces-

sary measures. In all cases, we look

for the cause of the non-conform-

ance and establish good solutions

on a permanent basis”, says the

Safety Manager.

ELECTRONIC

PREPAREDNESS SYSTEM

In order to strengthen prepared-

ness even further, Color Line is

in the process of installing a new

preparedness system (Crisis Issue

Manager). This is an effi cient

electronic system for use in

connection with warnings and

measures in the case of serious

occurrences and operational

faults.

“In the case of serious occur-

rences and operational faults it is

essential to involve the right per-

sons as quickly as possible and to

ensure that all those involved are

notifi ed immediately. Should an

operating fault lead to cancellation

or delay of a departure it is impor-

tant that the right people at the

port of arrival and in Color Line’s

administration are notifi ed so

that the situation can be handled

correctly”, says Hansen.

About 80 persons who all play

key parts in relation to the pre-

paredness plans at sea and at

shore are linked up to the web

based preparedness system which

also handles notifi cation by e-mail,

sms and speech messengers to all

those involved.

“For example key personnel

who are called out by the system

and requested to muster at a spe-

cifi c location, may reply by mobile

phone stating when they can be

present. All information is auto-

matic and is currently updated in

the preparedness system. In this

way, all those with access to the

system in a preparedness situation

will have an overview of who has

done what and who will be present

and where”, says Arild Hansen. He

goes on to state that in 2007 Color

Line has also introduced a new

electronic chemical register on all

ships. This system is a tool for the

control of all chemicals on board

the ships. ■

Color Line has a

long tradition of be-

ing one of the fi rst

to install equipment

for increased safe-

ty. Some years ago,

Color Line was the fi rst shipowning

company in the world to install

watertight barriers on car decks.

Detectors are installed in all

cabins and in all zones on all the

ships in the fl eet. Electronic moni-

tors on the bridge provide the

duty offi cers and the Captain,

who bears the responsibility for

safety onboard, with an overview

of the entire ship. In addition, all

crew members are drilled in safety

routines by means of practices at

least every other week.

GOOD SAFETY SYSTEMS

“The physical safety devices on

board are extremely reliable and

all crew members are trained in

safety procedures. However, it is

equally important to have a basis

in good systems and standards

that ensure that all safety assign-

ments are carried out correctly”,

says Safety Manager Arild Hansen

in Color Line Marine.

The basis for all safety work

onboard Color Line ships are the

international ISM-code and ISPS-

code which require shipowning

companies to establish a manage-

ment system which can be docu-

mented and verifi ed. Based on

these codes, safety manuals have

been prepared for each individual

ship. These cover all aspects of

safety on board. Procedures are

based on the ISM- and ISPS-codes

and are revised each year on four

levels: by the Captain on board,

the safety division in Color Line

Marine, the Shipping Directorate

and Det Norske Veritas (DNV).

REGISTRATION OF

NON-CONFORMANCE – AND

APPROPRIATE ACTION

In daily operations, any non-con-

Color Line gives priority to safety before all else. All the ships in the fl eet have their own

safety offi cers, and onshore the safety division in Color Line Marine ensures that safety

standards and systems are always updated and are complied with.

C

Safety before all else

COLOR GROUP ANNUAL REPORT 2007 // SOCIETY AND THE ENVIRONMENT

28 29

long term framework conditions

for Color Line’s operations inas-

much as the Government believes

it is important that subsidies are

balanced, that the net wages sys-

tem is continued through the intro-

duction of a tax scheme for ship-

owning companies modelled on

the equivalent European Scheme.

VALUABLE EXPERIENCES

The process with regard to the tour-

ist industry strategy is similar to the

maritime strategy and the require-

ments of the tourist industry have

to a great extent been heeded.

Strengthening the building up of

competence and providing favour-

able fi nancing schemes linked to in-

novation and creativity has served

to increase the feasibility of raising

the quality of products and services

to a level that will satisfy internation-

al market requirements. There is a

proposal for establishing a national

quality assurance scheme for tour-

ism in co-operation with the indus-

try. A new investment fund totalling

NOK 2.2 billion is to be established,

and tourism will be one of the high

interest areas with particular em-

phasis on projects with a network

dimension. This is in line with Color

Line’s tourist strategy. Subsidies

for brand building and marketing

of Norway as a tourist destination

have been strengthened. In the

Government budget for 2008, sup-

port for the marketing of Norway

was increased by NOK 15 million

up to NOK 215 million in 2008. This

means that support has been dou-

bled in the course of three years.

A separate section is to be estab-

lished in the Ministry of Trade and

Industry with special responsibility

for tourist policy, and co-operation

between the tourist industry and

the authorities is to be formalised

in the same manner as the mari-

time sector, through the Marut

organisation. ■

Both “a steady

course – the Govern-

ment strategy for

e nv i ro n m e n t a l l y

friendly growth in

the maritime indu-

stries” and “valuable experiences

– a national strategy for the tourist

industry” have an effect on the long

term framework conditions for Color

Line, one of Norway’s largest players

in both these segments.

STABLE AND COMPETITIVE

FRAMEWORK CONDITIONS

Proper management of Color

Line’s considerable investments in

new ships, concepts and infrastruc-

ture is conditional upon stable and

competitive framework conditions.

“The Government’s two strate-

gies for tourism and the maritime

industry respectively received

wide support in the Storting and

paved the way for long term and

comptetitive framework condi-

tions for Color Line” says the

Group Director for Communication

and Public Relations, Helge Otto

Mathisen.

“A STEADY COURSE”

The maritime strategy mentions

Color Line in particular: Color

Line AS has developed into one of

Europe’s leading cruise ferry com-

panies. The company operates in

the intersection between trans-

port and tourism and plays an

important part in bringing foreign

tourists into Norway.

Color Line is also mentioned in

the section “from road to sea”. If

more freight is to be seaborne the

infrastructure must be developed

to ensure an effi cient link-up be-

tween ports, roads and rail (inter-

modality). In this connection the

SuperSpeed concept is highlighted

as an important example of inno-

vation: With high freight capacity

and short turn around times in the

ports, Color Line has extended the

motorways on both sides of the

Skagerrak and has shortened tra-

velling time considerably.

“Steady course” will affect the

In 2007 the Government launched national strategies for the marine industries and the

tourist industry. Both shipping and tourism are included as two of the Government’s fi ve

priority industries in the Soria Moria declaration. These strategies focus on increased

value creation, profi tability and growth and set out clearly how the Government wishes to

achieve this aim.

B

Clear national strategies for shipping and tourism

New important portal for Norwegian tourist and travel companies

The new platform which is to be put into opera-

tion in 2009 will be a future oriented tool which

will contribute towards Color Line achieving its

target to be Europe’s best shipowning company

in the fi elds of cruise and transport. The new plat-

form will however also provide spin-off effects

in relation to the land based tourist industry.

Via the new portal, customers will be able to

reserve tickets for complete packages as is the

case today, but in addition, they will be able to

compose their holiday travel in detail and pay

for everything on the same site. Through the

new booking system, many Norwegian land

based tourist enterprises will have a unique

opportunity of reaching out to the Eu-

ropean tourist market in a business-

like and cost-effi cient manner. ■

After several months of planning, Color

Line selected the Group’s new booking

and Internet system in December

2007.

COLOR GROUP ANNUAL REPORT 2007 // SOCIETY AND THE ENVIRONMENT

30 31

Helge Otto Mathisen,

Group Director, Communications

and Public relations

COLOR GROUP ANNUAL REPORT 2007 // DIRECTORS REPORT AND FINANCIAL STATEMENT

Directors report and Financial statement

32 33

COLOR GROUP ANNUAL REPORT 2007 // DIRECTORS REPORT AND FINANCIAL STATEMENT

34 35

ent weather. The price of bunkers

was also higher in 2007 than in

the preceding year. Net fi nancial

items for the Group changed from

– NOK 31 million in 2006 to – NOK

124 million in 2007. The difference

is mainly due to positive results re-

lated to fi xed interest rate hedging

agreements and other currency/

derivative instruments, in addition

to increased fi nancing expenses in

connection with the renewal of the

fl eet.

The accounts have been closed

with a pre-tax result of NOK 171 mil-

lion and a result after tax of NOK

121 million. The equivalent fi gures

for 2006 were NOK 365 million

and NOK 261 million.

The parent company Color

Group ASA recorded a pre-tax re-

sult of NOK 29 million compared

with NOK 240 million in 2006. The

result after tax is NOK 21 million

in 2007 compared with NOK 173

million in 2006. The Directors pro-

pose that the profi t be transferred

to other equity.

At yearend, distributable equity

in the parent company totalled

NOK 598 million. For 2007, the

parent company will receive an

intercompany contribution from

the owner company in the amount

of NOK 22 million.

FINANCIAL MATTERS

Balance sheet and fi nancing

The Group focuses on long term

fi nancial fl exibility of action. In

2007, Color Group ASA extended

its bond loan COLG05 (maturing

in 2012) in the amount of NOK 123

million. The Groups’ bond loans are

registered on the Oslo Stock Ex-

change. As at 31 December 2007,

the outstanding amount in bond

loans totalled NOK 1 412 million. In

connection with the building of the

new terminal at Revet in Larvik,

Larviksterminalen AS (a subsidiary

company of Color Line Transport

AS) has established a 10 year draw-

ing rights facility with a 20 year

payment profi le in the amount of

NOK 240 million.

In 2005, Color Line AS con-

cluded an agreement with Aker

Finnyards Inc. for the building of a

cruise ferry which was delivered in

September in 2007 at a contract

price of approx. EUR 325 million.

A contract was also concluded for

the building of two Ro/Pax Super-

Speed ships at a contract sum of

approx. EUR 126.7 million per ship.

The ships are to be delivered dur-

ing the fi rst and second quarter of

2008 respectively. These ships are

fi nanced for approx. 80 percent

of the contract sum, maturing 12

years from date of delivery, with a

profi le as a 15 year loan.

As at 31 December 2007 the

Group’s balance totalled NOK

8 620 million. This represented

an increase of NOK 2 013 million

compared with 2006. The change

is mainly attributable to the effect

of the takeover of M/S Color Mag-

ic and the sale of M/S Kronprins

Harald and F/F Silvia Ana. As at

31 December 2007 shareholders’

equity totalled NOK 2 005 million

compared with NOK 2 074 mil-

lion in 2006. Equity ratio was ap-

prox. 23 percent compared with

approx. 31 percent in 2006. In its

loan agreements, the Group has

commitments linked to liquidity,

equity and debt servicing ratio. All

commitments were fulfi lled as at

31 December 2007.

Fleet planning

In connection with the renewal

programme for the fl eet and the

discontinuation of the Bergen/

Stavanger – Hirtshals service, M/S

Kronprins Harald, M/S Peter

Wessel, F/F Silva Ana and M/S Color

Festival were sold during the course

of 2007. M/S Kronprins Harald and

F/F Silvia Ana were handed over in

2007 and M/S Color Festival and

M/S Peter Wessel are to be handed

over in 2008. All ships were sold or

sales agreed at a gain in relation

to book value. The sales sums are

as follows: M/S Kronprins Harald:

EUR 43.6 million, M/S Peter Wessel

EUR 25 million, F/F Silvia Ana USD

16 million and M/S Color Festival

EUR 49 million. M/S Kronprins

Harald and F/F Silvia Ana were de-

livered in 2007 providing a book

value gain of approx. NOK 35 mil-

lion.

As a result of the discontinua-

tion of the West Coast Service, M/S

Prinsesse Ragnhild was transferred

to the Oslo – Hirtshals service.

Cash Flow

In 2007 the Group’s cash fl ow

from operational activities totalled

NOK 781 million. Net cash fl ow

from investing and fi nancing ac-

tivities totalled –NOK 802 million.

The Group’s total equity reserve,

including granted drawing rights

and liquid securities totalled ap-

prox. NOK 1 307 million as at 31

December 2007. Ordinary planned

instalments on the Group’s interest

bearing debt to credit institutions

in 2008 are approx. 336 million.

The fi nancial risk situation

The Group is exposed to foreign ex-

change risk due to fl uctuations in

NOK against other currencies, par-

ticularly USD, EUR and DKK. The

Group is also exposed to interest

risk and fl uctuations in the price

of bunker products. Color Group

practises an active fi nancial risk

ABOUT THE GROUP

Color Group ASA is the parent

company of Color Line AS. Color

Line AS is Norway’s largest, and

one of Europe’s leading cruise and

transportation companies. Color

Line offers market oriented and

profi table tourist and transport

services.

A reorganisation of Color Group

was implemented in 2007. The

subsidiary company, Color Line

was split into two main operative

divisions, the cruise division ope-

rated by Color Line Cruises AS

and subsidiary companies and the

transport division which is hand-

led by Color Line Transport AS

and subsidiary companies. All sea-

going employees in the Group are

employed by the newly established

company Color Line Crew AS. The

reorganisation was implemented

by means of a de-merger of Color

Line AS, with subsequent assign-

ment of shares in order to achieve

the present day group structure.

Color Group ASA own all the

shares in the sub-group Color Line

AS which is the parent company of

the newly established companies

Color Line Cruises AS, Color Line

Transport AS and Color Line Crew

AS.

The business area cruise is

responsible for the Oslo-Kiel

service, the Oslo-Hirtshals service

and Color Line Germany. The ope-

rative management of Color Line

Cruises is in Oslo.

The business area transport is

responsible for the Kristiansand

– Hirtshals service, the Larvik

-Hirtshals service, the Sandefjord

– Strømstad service and Color Line

Denmark, Color Line Cargo and

Color Hotel Skagen. The operative

management of Color Line Trans-

port is in Sandefjord.

Major changes are taking place

in European tourism and transport.

Color Line anticipates future growth

and further segmentation of the two

markets, cruise and transport. Cruise

offers a wide scope of activities and

entertainment on board where the

ship itself is the actual destination.

Transport offers a cost effi cient and

fast transport and cargo concept. By

focusing on high quality cruises on

the longest voyages and effi cient

transport services on the short voy-

ages, Color Line is well equipped to

meet future challenges. The number

of guests in 2007 was approx 4.3

million, a fi gure that is almost un-

changed compared with 2006. The

composition of tonnage differs in

2006 with M/S Color Traveller (re-

turned following the end of the

charter period in December 2006)

operating on the Larvik – Hirtshals

service, in addition to high capacity

on the Oslo – Kiel service from Sep-

tember 2007 with the launching of

M/S Color Magic and the phasing

out of M/S Kronprins Harald. Utilisa-

tion of freight capacity was higher in

2007 than in 2006. The Group car-

ried approx. 180 000 freight units (12

metre equivalents) in 2007.

In 2007, the Directors decided to

discontinue the West Norway ser-

vice. The fi nancial result for the West

Norway line had developed nega-

tively, primarily due to increased

operating costs in the form of the

signifi cantly higher price for bunkers,

the recent institution of NoX-tax and

an increase in sailing schedule inter-

ruptions due to inclement weather

involving many more cancellations

than anticipated.

PROFIT AND LOSS ACCOUNT

Changes in

accounting principles

Color Group ASA is a Norwegian

public limited company with its

head offi ce in Oslo, which up to and

including the year 2006 has pre-

sented its accounts in accordance

with NAS (Norwegian Accounting

standards). The consolidated ac-

counts for Color Group for the ac-

counting year 2007 with compara-

ble fi gures for 2006 and (balance

sheet) 2005 are submitted in ac-

cordance with IFRS (International

Financial Reporting Standards).

In connection with the switch to

IFRS the opening balance as at 1

January 2006 for Color Group has

been revised. The total effect for

the Group at the time of transfer

to IFRS was a negative charge on

equity in the amount of NOK 51.1

million.

Result for the Group

Operating income including gain

on the sale of capital acquisitions

totalled NOK 4 762 million in 2007

compared with NOK 4 585 million

in 2006. In 2007 the Group record-

ed an operating income before de-

preciation and charter expenses

of NOK 759 million compared with

NOK 859 million in 2006. Opera-

ting income in 2007 totalled NOK

296 million compared with NOK

396 million in 2006.

The fi nancial result for Color

Group ASA in 2007 was weaker

than the preceding year. The re-

duction is primarily ascribed to

non-recurring expenses in connec-

tion with the delivery of new ships

and the winding up of the Bergen/

Stavanger - Hirtshals service. Ope-

ration during the fi rst six months

of the year was also affected by

an extraordinary interruption in

operation of the Larvik – Hirtshals

service, lasting approx. one month

in addition to several cancellations

early in the year due to inclem-

Director’s report 2007COLOR GROUP ASA

COLOR GROUP ANNUAL REPORT 2007 // DIRECTORS REPORT AND FINANCIAL STATEMENT

36 37

creased total annual capacity for

the transport of passengers and

goods. With the introduction of the

SuperSpeed ferries, more goods

will be moved from the roads to

seaborne transport. This is a de-

clared political aim both in Norway

and in the EU. Color Line’s cruise

ships have spacious trailer and

container decks and combine

holiday and leisure activities in

parallel with large seaborne freight

capacities between Norway and

Germany.

Cost - and environmentally ef-

fi cient solutions have been imple-

mented in co-operation with leading

technological environments such

as Aker Yards, the marine engine

manufacturer Wärtsilä, Marine Tek

in Trondheim and Det Norske Veri-

tas. Replacing ships that are more

than 20 years old is in itself im-

portant for the environment. New

ships are environmentally effi cient,

they have effi cient hull designs and

modern propulsion machinery.

Guidelines for the operation of

the SuperSpeed ferries are stricter

than the requirements laid down

by Norwegian and international

authorities. For many years, Color

Line has used bunkers with a low

sulphur content and has imple-

mented a modern system for the

sorting of waste at source. In ad-

dition, the Company makes every

effort to reduce harmful discharge

to the air. This work takes place in

co-operation with, or in close un-

derstanding with authorities, the

classifi cation company, research

environments and environmental

organisations.

In 2007 Color Line has system-

ati-cally chartered the company’s

discharge to sea and air and is now

well prepared to introduce fur-

ther environmental measures in

the years ahead. The SuperSpeed

ferries can accept three times as

many trailers as the ships they re-

place. On a fully loaded ship, the

CO2 discharge per vehicle is halved

on the voyage from Kristiansand to

Hirtshals. This includes discharge

from the shopping centre, restau-

rants, entertainment and cabins.

A SuperSpeed ferry discharges

slightly more that 50 tonnes

of CO2 between Kristiansand

and Hirtshals. If the ship is fi lled

with passengers and passen-

ger cars only, a car containing

two adults and one child would

discharge the equivalent of ap-

prox. 70 kilos of CO2 between Kris-

tiansand and Hirtshals. Compared

with driving a car from Norway via

Sweden to Denmark, this discharge

fi gure is lower.

Color Line has installed environ-

mentally effi cient and fuel effi cient

combustion engines in its new

ships. The use of bunkers with a low

sulphur content in effi cient engines

results in low discharges of SOx.

The SuperSpeed ferries also use

diesel engines for the production of

energy onboard. Both propulsion

engines (main engines) and engines

for generating electricity (auxiliary

engines) are medium-speed diesel

engines. These engines can run on

heavy fuel, straight-run oils such

as light marine diesel (MDO) and in

the future also biodiesel subject to

certain criteria. Color Line wishes

to be among the fi rst to run marine

engines on a mixture of biodiesel

and present day fuel provided this

is aesthetically justifi able, available

on the market and conforms to the

recommendations of the authori-

ties and the engine manufacturer.

Color Line co-operates closely with

the Finnish marine engine manu-

facturer Wärtsilä in order to reduce

discharge to air.

THE BOARD OF DIRECTORS

AND SHAREHOLDERS

O.N. Sunde AS owns indirectly 100

percent of the companies 71 800

shares. O.N. Sunde AS is wholly

owned by Director and Group

president Olav Nils Sunde and his

family.

PROSPECTS/OCCURRENCES

AFTER BALANCE SHEET

DATE

Changed market conditions

The cruise and seaborne trans-

port industry is characterized by

a high level of investment result-

ing from an ongoing requirement

for the development of existing

tonnage and investments in new

tonnage. This places heavy de-

mands on cost management and

earning potential. The interna-

tional market for sea transport is

going through a period of major

change. In Europe, the increase in

low price air travel and the con-

siderable increase in the price of

fuel have contributed towards a

fall-off in the number of passen-

gers and an increase in operating

expenses. At the same time devel-

opments in the transport of goods

have been positive.

Strong focus on the environ-

ment by the authorities in the EU

and in Norway involving a defi ned

objective for the transfer of goods

traffi c from road to seaborne and

rail transport has contributed to-

wards stable and long-term frame-

work conditions for shipowners. It

is expected that there will be fur-

ther positive political measures in

the fi eld of transport and industry

which will strengthen the com-

petitiveness of seaborne transport

with particular emphasis on inter-

modality in the ports.

Sale of tonnage

In total in 2007, the company sold

or agreed to sell ships for more

than NOK 1 billion. The sale of

these ships is part of the compa-

ny’s comprehensive fl eet renewal

programme combined with the

decision to discontinue the West

Coast service. All ships have been

sold at a gain in relation to book

value. The market for second-hand

tonnage has been good, and Color

Line has sold off its older tonnage

in line with its adopted strategy

management strategy. This stra-

tegy is entrenched in the Board-

approved annual budgets. The

Group makes use of fi nancial in-

struments in order to curb the

risk of fl uctuations in the Group’s

cash fl ow. On balance sheet date,

approx. 35 percent of the Group’s

interest bearing debt was secured

through fi xed interest agreements.

The Group’s credit risk is moni-

tored systematically. The Group

has a limited market risk as its

business relates to a large number

of customers.

Continued operation

Based on the Group’s result and

its fi nancial position, the Directors

confi rm that the Annual Financial

Statement has been prepared un-

der the assumption of continued

operation as a going concern and

that the report provides a correct

picture of the parent companies

and the Group’s assets, liabilities,

fi nancial position and result.

WORKING ENVIRONMENT

AND PERSONNEL

As at 31 December 2007 the

Group employed a workforce of

3 967 employees, including those in

part-time positions. 2 853 persons

worked onboard the ships. In 2007

the average absence due to illness

in the Group was approx. 6.5 per-

cent for shore-based employees,

(7 percent in 2006) and approx.

9.8 percent for seagoing employ-

ees (11 percent in 2006). Absence

fi gures have been the subject of

special attention and a great deal

of work as been put in to the chart-

ing of causes of absence and in

effi cient measures to reduce this

percentage. This work will be in-

tensifi ed in 2008. This includes the

establishment of a new position as

health and environmental offi cer

in Color Line.

The Directors consider that the

working environment in the Group

is good and will continue to focus

a high level of attention on the

environment and on absence due

to illness in respect of both shore

based and seagoing personnel in

line with the company’s policy and

with trends in society.

EQUAL OPPORTUNITIES

It is Color Group ASA’s objective

that there shall be full equality

between female and male employ-

ees. The Group has taken steps to

ensure that no discrimination takes

place in this area. Of the 2 853 em-

ployees on board the ships, 1 276

are women. There are 286 leading

positions of which 42 are held by

women. The percentage of women

in leading positions on board the

ships is relatively low as technical/

maritime jobs have traditionally

been dominated by males and so

far few women hold the necessary

certifi cates.