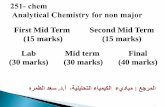

College Mid Term Report

-

Upload

disembrains -

Category

Documents

-

view

220 -

download

0

Transcript of College Mid Term Report

-

8/6/2019 College Mid Term Report

1/27

Manipal Institute of Technology

Department of Mechanical & Manufacturing Engineering

Name: Anuj Agarwal

Reg. no. : 70909238

Branch : Mechanical

Date of commencement of project: 17 th Jan 2011

Project Title: Online Retail Market UK

Company Name: Global Analytics

External Guide (Company) : G.Karthikeyan

Internal Guide: Amar Murthy

Contact number: (Present) +91-8056133497

Mail Id.: [email protected]

-

8/6/2019 College Mid Term Report

2/27

Online Consumer Credit Market

In UK

SYNOPSIS

1.Topic:

Online Consumer Credit Market in UK

2. Need for the project:

According to various estimate, nearly 4 Billion individuals living in the world are

underbanked i.e. a marginal access to banked facilities & often rejects by banks for

-

8/6/2019 College Mid Term Report

3/27

various bank products The underbanked buy money orders at convenience stores, cash

checks at check-cashing services, and borrow money through payday lending services or

rely on alternate financial services In each case they pay very high fees.

Through this project I would like study the customer credit market in UK and develop

various financial tools to enable the underbanked people avail loan at affordable rate of

interest and through flexible repayment modes.

3. Objective :

Research the financial needs of the underbanked people and develop tools to satisfy the

needs by providing short-term loans with multiple benefits, including flexible payment

alternative and access to credit at fair terms.

4. Methodology:

Analysis of Market Trends & Distribution Channels.

Applications of Statistical Methodology in Market Research

Applied Business Forecasting.

As a part of my project I would be required to thoroughly make use of concepts learned

in subjects like Discrete Mathematics, Management Information System, Operations

Research & Management, Engineering Economics and Organizational Behavior.

-

8/6/2019 College Mid Term Report

4/27

Market Research

Brief description about Underbanked :

The underbanked population is that segment of the market which does not

have access to regular bank services. These customers generally have an

insufficient credit rating due to which they are unable to get credit from

the regular financing institutions (like Banks etc.)

-

8/6/2019 College Mid Term Report

5/27

This segment of the market is mostly untapped, and has huge potential.

Since these customers are unable to get credit, they are willing to take high

interest loans to make purchases to satisfy their requirements.

In seeking ways to serve the under-banked, institutions are likely to derive

both financial and social benefits. The under-banked represent a large

marketas many as 40 million householdsand many under-banked

consumers have a strong interest in developing or expanding relationships

with mainstream financial institutions. Many want to improve their

financial health. For example, they want to get out of debt.

We would be targeting these customers specifically and provide them with

alternative ways to purchase products online.

UK demographics: A glance

Table 1 : Household expenditure by income, UK

-

8/6/2019 College Mid Term Report

6/27

-

8/6/2019 College Mid Term Report

7/27

Chart 1: Alternative Financial products usage

Source: Research report "Illegal lending in UK"

-

8/6/2019 College Mid Term Report

8/27

-

8/6/2019 College Mid Term Report

9/27

UK unbanked demographics: A glanceChart 2: Income Declines of Underbanked

Household type

Chart 3: Composition of Unbanked Households

-

8/6/2019 College Mid Term Report

10/27

-

8/6/2019 College Mid Term Report

11/27

Benefit types

Chart 5: Benefits Received by Underbanked

-

8/6/2019 College Mid Term Report

12/27

Understanding the Under-banked and Need for Alternate Payment Options:

Various studies say that there are 40 millions households which are under-banked.

The under-banked community behaves differently from their banked counterparts

and represents a different set of markets, likes and dislikes, financial situations.

They live in a cash economy, with many of their financial decisions driven by the

realities of their daily happening . Incomes are uncertain and they do not posses

strong assests and having cash in hand is comfortable for many.

Under-banked consumers are interested to learn in ways in which their finances

can be managed. Under-banked consumers need help getting out of debt and

learning how to use loans to build productive assets

In seeking ways to serve the under-banked, institutions are likely to derive both

financial and social benefits. The under-banked represent a large marketas

many as 40 million householdsand many under-banked consumers have a

strong interest in developing or expanding relationships with mainstream financial

institutions. Many want to improve their financial health. For example, they want

to get out of debt.

The under-banked have a marginal access to banked facilities & often rejects by

banks for various bank products The underbanked buy money orders at convenience

stores, cash checks at check-cashing services, and borrow money through payday

lending services or rely on alternate financial services In each case they pay very high

fees.

Conclusion :It is seen that due to this inability to be eligible to get loans from the traditional banks the

under-banked population isnt able to buy retail products. So by the research of the

current available financing options and retail scenario we can develop tools to satisfy the

needs by providing short-term loans with multiple benefits, including flexible payment

alternative and access to credit at fair terms.

-

8/6/2019 College Mid Term Report

13/27

UK Online Retail Market Overview

Over 50% of UK adults shop online

Online shopping constitutes about 10% of total retail sales in UK

UK online consumers spend about three times as that of US consumers

Currently 28 million people shop online in UK

Expected to grow with a CAGR of 10% for next five years

By 2014, about 37 million consumers shop online worth 56 billion pounds

Around 48% of UK consumers use the internet to make monthly purchases

Books, event tickets and clothing are top three categories in Europe

Three new emerging trends in online retail market in UK are: multichannelshopping, social commerce and mobile commerce

More than two-thirds of UK online consumers have a mobile phone that could be

connected to Internet

Around 50% of mobile internet shoppers in UK have purchased computers and

laptops

Retail Market

The UK retail market is set to increase in size by 15% over the next five years, taking its

value to just over 312bn.

Source: Datamonitor

UK Online Retail Market

According to the research conducted by the Centre for Retail Research for Kelkoo, UK

Retail sales totaled 38bn in 2009 , compared with a total for the whole of Europe of

127.7bn in 2009 .

According to Verdict research, 56.8% of online spenders are middle class and upper-

middle-class consumer in UK.

-

8/6/2019 College Mid Term Report

14/27

Retail Sales in UK

Between December 2009 and January 2010 total retail sales volume decreased by

1.8%, the largest decrease since June 2008.

Household goods stores showed the largest decrease since January 1988,

decreased by 18.9%.

Non-store retailing decreased by 3.2%.

The volume of retail sales in January 2010 was 0.9% higher than in January 2009.

Non-store retailing increased by 17%, the largest increase since, September 2004.

Retail Market Forecast UK

Retailing is the larger indicator of the economy recovery. It is expected that by

April/May'10 the retail sales would revive. Here is the forecast from Center for Retail

Research, UK ( http://www.retailresearch.org/ ):

Retail spending April/May 2010 - increases by 50%

Retail spending 2011 - increases by 20%

Forecast (2009-10, in volume, allowing for inflation)Category Increase/Decrease (%)Retail sales decrease by 0.8%-1.4%Food & drink increase by 0.4%Clothing and Footwear decrease by 2.8%Household, consumer goods decrease by 4.7%DIY/hardware decrease by 6.0%Entertainment decrease by 1.9%Books & stationery decrease by 1.9%Other decrease by 1.0%

Internet sales increase 55%*

*(includes retail merchandise only, not tickets or travel )

Online Retail Spending 1997-2013

http://www.retailresearch.org/http://www.retailresearch.org/ -

8/6/2019 College Mid Term Report

15/27

-

8/6/2019 College Mid Term Report

16/27

Online Retail advantages:

The main advantage of shopping online was the ability to use it at any time (55%)

and that it was less time-consuming (51%)

Online areas for improvement

Nearly a third of respondents highlighted that there was nothing to improve on the

websites that they were using to shop online. The main concern expressed was

regarding the need for better security of websites

Online Retailing Trends

The BRC-Nielsen Shop Price Index shows the price of shop goods were up 1.2%

from a year ago.

Sales over the internet account for less than 7% of total retail sales, despite strong

growth in recent years.

Coremetrics publishes some interesting aggregate data showing that the average

conversion rate across all industries in the UK is 3.04% with conversion rates

from natural search slightly higher at 3.16% for March 2009.

Average no. of items 2.35Average order value 57.09 pounds

Shopping cart conversion rate49.90%

Shopping cart abandonment 50.10% (65.61% in the US)

New visitor conversion rate 3.04%

People in the US people are buying 5.8 items per order compared to only 2.3 in the

UK.

Online shoppers were growing in confidence, with the proportion of them prepared tospend more than 1,000 or more on a single transaction rising from 12% in 2008 to

25% in 2009

UK consumers spent 38bn online in 2009, or an average of 1,102 per shopper,

according to the Centre for Retail Research (CRR).

Online sales now account for almost 10% of total retail sales in the UK

-

8/6/2019 College Mid Term Report

17/27

Additional stats on UK online retail market:

Online retail market in UK is expected t grow at a 10% CAGR over the next five

years, according to a recent Forrester study

UK online retail will hit 40 billion by 2014 and the number of online shoppers in

Britain will increase from 31 million to 40 million

By 2014, 37 million UK online buyers will spend 56 billion online (currently 28

million consumers)

48% of UK consumers use the internet to make a monthly online purchase thats

the highest number in Europe, with the European average being 32%

Over 50% of British adults shop online

Online shopping account for about 10% of total retail spending (excluding

groceries) in UK

Online shoppers in UK spend about three times that of US counterparts

Three emerging trends in UK online retail market:

1. Multichannel Shopping:

Social networking, gaming, text messaging, interactive TV, etc., are taking time

away from traditional media

2. Social Commerce:

With roughly 8% of all retailers' traffic coming from social networking sites in the

U.K. in fourth-quarter 2009 (and growing fast), marketers are starting to pay

attention. Retailers are engaging customers with reviews, ratings and referrals from

acquaintances, which seem to have a positive impact on conversions and loyalty

3. Mobile Commerce:

With faster networks and less apprehension around using online payments,

European consumers are likely to be ahead of their U.S. counterparts in this segment

-

8/6/2019 College Mid Term Report

18/27

The average UK household spends 980 a year online representing 10% of their

annual retail bill The most popular products are holidays music and films Research by Accenture found that poor customer service and limited product

offerings in the high street are increasing online shopping in the UK

Reasons for shopping online

65% avoid the queues/people

64% convenience

63% cheaper than the high street

60% less stressful

53% purchase from stores further away

54% easier to find bargains

91% have purchased an item before trying it on

71% happy to purchase from a non high street store

55% have purchased from a store they have never heard of before

-

8/6/2019 College Mid Term Report

19/27

Average six month spend per head online by category 1

Category

PayPal research

2009

PayPal research

2010

Year on year

differenceTravel 939 960 + 21

Financial services 764 748 - 16Grocery, food & drink 454 503 + 49Major purchases (e.g.

white goods, cars) 495 461

- 34

Technology 383 342 - 41Furniture and homewares 245 272 + 27Clothing 153 200 + 47General entertainment 132 131 - 1Small electrical appliances 101 122 + 27

Product Category Growth (2009)

Clothing, Footwear and Accessories

- Accessories

- Footwear

14%

68%

32%

Electricals 23%

Beers, Wines and Spirits 9%Gifts 56%

Source: Capgemini Report

Consumer Spending Patterns

Average Consumer spending in UK:

1 Source: https://www.paypal-press.co.uk/Latest-News/Over-five-million-adults-plan-to-

increase-their-spending-this-year-as-Britain-creeps-out-of-recession-cf.aspx

https://www.paypal-press.co.uk/Latest-News/Over-five-million-adults-plan-to-increase-their-spending-this-year-as-Britain-creeps-out-of-recession-cf.aspxhttps://www.paypal-press.co.uk/Latest-News/Over-five-million-adults-plan-to-increase-their-spending-this-year-as-Britain-creeps-out-of-recession-cf.aspxhttps://www.paypal-press.co.uk/Latest-News/Over-five-million-adults-plan-to-increase-their-spending-this-year-as-Britain-creeps-out-of-recession-cf.aspxhttps://www.paypal-press.co.uk/Latest-News/Over-five-million-adults-plan-to-increase-their-spending-this-year-as-Britain-creeps-out-of-recession-cf.aspx -

8/6/2019 College Mid Term Report

20/27

UK consumers topped the online retail spending in 2009 with an average annual spend of

1,102, (on an average 37 items each) compared to a European average of 774 on 20

items with an average cost per item of 39.

25% of UK shoppers are now prepared to spend 1,000 or more online in a single

transaction.

57% of UK consumers made online purchases, almost 20% higher than the

European average of 38%.

UK Retail Spending (using Debit cards)

2005 2006 2007 2008 %change 07-08

88.9bn 98.0bn 108.7bn 116.1bn 6.80%

UK Total Consumer Spending (using Debit cards)

2005 2006 2007 2008 %change 07-08169.5bn 195.5bn 224.0bn 245.4bn 9.50%

-

8/6/2019 College Mid Term Report

21/27

Major UK Retailers Finance Providers:

Retailer Finance Provider Year of Launch

Marks & Spencer M&S Money (in-house) (now

acquired by HSBC bank)

2003

John Lewis HSBC April 2004

Tesco Royal Bank of Scotland NA

Sainsbury HBOS NA

Debenhams GECF 2004

ASDA GECF 2004

Harrods GECF 2003

House of Fraser Barclay card June 2007

-

8/6/2019 College Mid Term Report

22/27

LAYAWAY

Key facts about market UK:

There are 24.5 million prepayment transactions made annually(2008-09) by 20

million UK consumers.

Nearly one in ten consumers who have made a prepayment over the last two

years(2008 and 2009) did not receive their order, which is around 1.8 million

people. Company insolvency is the reason given in one fifth of these cases.

The 1.8 million people who did not receive their order/product, just under half did

not receive any money back, with the average loss reported 242.17 each time.

The sectors where prepayment loss is most prevalent are:

1. Electrical goods, computers and domestic appliances (15 per cent of all

failed prepayments).

2. Books, music or other small personal entertainment items (15 per cent);

3. Clothing and textiles (12 per cent);

4. Furniture (11 per cent); and

5. Booking a flight, hotel or holiday (11 per cent).

6. Other sectors accounted for 25 per cent of all failed prepayments Overall, online sales account for 61 per cent of non-received prepayment

purchases.

Popular companies which went insolvent in the recent past.

Christmas Club savings firm Farepak, failed in Novemebre 2007 with some

38m of customers savings been taken.

Solar panel firm Solar Technik collapsed in March 2007, owing customers

around 265,000 in deposits and claims.

Money transfer firm First Solution Money Transfer was wound up in November

2007, owing some 3 million to 2,000 people in the Bangladeshi community of

east London, although a subsequent rescue package offers the promise of refunds.

-

8/6/2019 College Mid Term Report

23/27

Wedding list gift firm Wrapit ceased trading in August 2008, leaving 2,000

couples at risk of losing out on their wedding gifts and 100,000 guests at risk of

not getting their money back.

30,000 customers who booked holidays with XL Leisure Group , a travel

company which collapsed in September 2008, lost a total of 20 million.

Retailer MFI went into administration in November 2008, leaving around 30,000

customers with outstanding orders. Despite the company initially indicating that

customers would receive refunds, this now seems unlikely to happen.

Typical layaway plan in UK

Layaway period is 3-6 months

25% deposit (non-refundable)

Grace period of 7 days for customers who defaults in installments

Cancellation fee $25 (since no standard cancellation charges visible in uk, taking

reference from us market)

Monthly installments are based on purchase price.

Here's an example: laptop price - 300, deposit - 75 (25%), amount to be paid

in installment - 225, layaway period - 6 months, monthly installment - 37.50

( 75 for a 3 month plan)

Mark-up prices

Bluehippo was selling 'hp mini 5101' for $466.76, which was marked up by 10-15% (hp

mini 5101, which is sold in two configurations at $339 and $425)2

.

2 Reference: Http://Www.Robertjfunches.Com/Blog/2009/11/Putting-Computers-On-One-Year-Layaway/

http://www.robertjfunches.com/blog/2009/11/putting-computers-on-one-year-layaway/http://www.robertjfunches.com/blog/2009/11/putting-computers-on-one-year-layaway/ -

8/6/2019 College Mid Term Report

24/27

Analytics

-

8/6/2019 College Mid Term Report

25/27

Process Flow Diagram

Customer Pre-validation Rules Identity data providers-Credit Data Providers -

Treatment Wise Strategy How much amount to be paid Signing of agreement

Payment Collections

Pre-Validation Rules :

Preliminary checks to ensure whether the data is as per the specifications. Some of the checks are as follows :

o All the mandatory fields are populated like name, address. D.o.b, accountnum, email-id ..etc

o Whether the customer is employed or not.

o Requested loan amount /monthly income meets the required values.

Identity data providers:

Identity data providers are companies that provide validation of the data provided

by the customer. Companies get the validation done to ensure that the customer is

who he says he is. Validating the information provided by the customer against

electoral roll, British telecom directory and their already stored data does this.

These companies display the results instantly and provide a lot of additional

details when available including length of residency, age, listed telephone

numbers, other occupants, property description and property purchase price

Credit data providers:

There are various companies like Experian, Callcredit.These data providers get

back to us with an aggregate credit score which we use in our underwriting.

-

8/6/2019 College Mid Term Report

26/27

Treatment wise strategy:

Various Models are put in place to calculate an aggregate score which predict whether the

customer is going to default on his loan or not.

Each model consists of several variables that reflect the credit history of the customer and

also his general behavior in the past. The following is our decision tree or a treatment

wise strategy.

-

8/6/2019 College Mid Term Report

27/27

Stern Checks: Employment Check and Debit Card Check A thorough Process

Moderate Checks: Either an Employment check or a Debit Card Check

Lenient Check: Only a simple manual Check