Collect More, and Collect It More Easily: Best Practices for Condo/HOA Debt Collection

-

Upload

mike-fruchter -

Category

Law

-

view

129 -

download

1

Transcript of Collect More, and Collect It More Easily: Best Practices for Condo/HOA Debt Collection

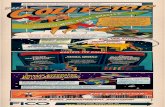

ASSOCIATION

COLLECTIONS

STRATEGIES 2015

Jed Frankel, Esq.

Eisinger|Brown|Lewis|Frankel|Chaiet

954/894 8000 x301

• This presentation is designed to provide general

information on the topic presented and is not rendering

any legal or professional services. Although these

materials are prepared by professionals, the content and

information provided should not be used as a substitute

for professional services, and such content and

information does not constitute legal or other professional

advice. If legal or professional advice is required, the

services of a professional should be sought.

SHOW ME THE MONEY!

FLORIDAThe Foreclosure State

Judicial Foreclosure Process

The Florida Bar News/February 15, 2013

• Foreclosures to remain high until 2016 or 2017

• Highest foreclosure rate in nation

• 3.11% of all housing units having some type of

foreclosure filing

• Still has more homes going in foreclosure than

coming out

• Foreclosures used take 169 days now take 853

days (third longest in nation)

• Backlog of 272,000 cases (down from 278,000)

“Florida now The Foreclosure State”

• The Miami Herald, Feb. 14, 2013, 10B

• First place in nation in foreclosure activity 1/2013

• Miami-Ft. Lauderdale-Pompano Beach – No. 2 in nation in foreclosure activity – 1 in 228 homes foreclosure filing

• Highest foreclosure rate in nation for 5th consecutive month

• 1/2013 – foreclosure filings up 12% from Dec. and up 20% from prior year

• 5 areas in top 10 nationwide

• Remains through 2015

QUESTIONS For Every Association

What do you

know about

unit/owner?

Bankruptcy?

Is Unit Vacant?

Is Unit Rented?

Is there a Bank

Foreclosure?

Why is Owner in

arrears?

Is there a rental market?

What is the condition of

the unit?

Long time owner or

speculator?

How long?

Time is not

on your side!

Each month lose assessments that will never be collected.

Bad debt expense that paying unit owners will ultimately make up.

Delinquent unit owners live for free.

Lengthening time until get a good, paying unit owner.

Delinquencies hurt resales.

What are the

goals?

Get rid of “deadbeat”

unit owner?

Recover as much

money as possible?

Take title to unit?

Rent out unit?

Get new, paying unit

owner?

Set example to other

unit owners?

HOW WE GET THERE

Teamwork

• Board of Directors

• Manager

• Accountant

• Attorney

• Unit Owners

Gameplan

• Agreed upon objective

• Focused to meet that objective

• Understand the conditions are

changing

• “Halftime” adjustments

Passive Approach = wait on the bank

• Let the bank foreclose – and take its time

• Bank, not association, pays for foreclosure lawsuit

• Have someone in unit

• No assessments paid

• Bank’s liability limited (Fla. Stat. 718.116)

Active Approach

• Association forecloses – need to move quickly

• Try to get title to unit - rent out, short sale

• Potential 3rd party purchaser

• Stabilize cash flow

• Encourage payment by unit owners

• Paying unit owners’ satisfaction –

• Stop the Bleeding

• Business Judgment Rule – protecting assets

• Does taking title impact Association’s ability to recover?

Passive vs. Active – Which is Better?

Short sales

• More Now

• Really at mercy of banks – few years ago were not

interested

• New owner for unit – paying market value NOT what

owed

• Bank writing off some of what it’s owed (but not releasing

personal liability)

• Association asked to take less than it MIGHT eventually

recover (personal liability possibility?) – Fla. Statutory cap

limits if first mortgage holder (bank) takes title

“Active” Passive Approach

• Requires bank foreclosure case

• Association does not file its own case

• “Encourage” bank to proceed quickly – $ to do so

• Case Management Conferences

• Default defendants for the bank

• Notice case for trial

WHAT ELSE WE CAN DO

Relief from bankruptcy

• Seek relief from stay

• Allow foreclosure to proceed

• Real Property to be sold

• No deficiency judgment

Deutsche Bank Sanctioned

Association got:

• Expedited Sale Date

• Bank ordered to pay

assessments

• Reimbursement of attorneys fees

and costs

Harris v. Liberty Community Management

• 702 F. 3d 1298 (11th Cir. Dec. 19, 2012)

• Management companies now exempt from FDCPA liability

• “so long as the collection of such assessments from

homeowners is not central to the management company’s

fiduciary obligations”

• Association itself can initiate collections efforts

Post-judgment remedies

• Personal liability for former unit owner(s)

• Florida Statutes §718.116(1)(a) & §720.3085(2)(a)

• Collections efforts

• Personal property

• Garnish accounts/wages