Coffey International Limited · COFFEY INTERNATIONAL LIMITED Results for announcement to the market...

Transcript of Coffey International Limited · COFFEY INTERNATIONAL LIMITED Results for announcement to the market...

Coffey International Limited

ABN 16 003 835 112

Appendix 4E

and

Annual Report

Year Ended 30 June 2014

Page | 2

COFFEY INTERNATIONAL LIMITED Results for announcement to the market For the year ended 30 June 2014 Financial Results $A'000

Total revenue and other income

Decreased (8.8%) to 628,056

Fee revenue Decreased

(7.3%)

to 381,023

Earnings before Interest, Tax, Depreciation and Amortisation (EBITDA)

Increased 27.4% to 23,694

Earnings before interest and tax (EBIT)

Increased 57.2% to 14,495

Profit after income tax for the year

Increased 589.2% to 4,457

Profit after income tax for the year attributable to members

Increased 525.4% to 4,369

EBITDA before restructuring costs (underlying EBITDA)

Decreased (9.0%) to 26,162

Dividends

Amount

per security (cents)

Franked amount per

security (cents)

Interim dividend - Current year - Prior year

0 cents 0 cents

0 cents 0 cents

Final dividend - Current year - Prior year

0 cents 0 cents

0 cents 0 cents

NTA Backing

Jun-14 Jun-13

Net tangible asset backing per ordinary security 11.5 cents 10.2 cents Commentary on Results The commentary of the results for the year is contained in the 2014 Annual Report which should be read in conjunction with this Appendix 4E. The remainder of the information requiring disclosure to comply with listing rule 4.3A is contained in the attached Directors’ Report and audited Financial Report for the year ended 30 June 2014. Compliance Statement This report is based on audited accounts.

Page | 3

COFFEY INTERNATIONAL LIMITED Results for announcement to the market (continued) For the year ended 30 June 2014 EBITDA reconciliation

$’000 2014 2013

Profit/(Loss) for the year 4,457 (911)

Add back:

Net interest expense 8,130 10,005

Income tax expense 1,908 128

Depreciation and amortisation 9,199 9,381

EBITDA 23,694 18,603

Add back:

Restructuring costs 2,468 10,159

EBITDA before restructure costs 26,162 28,762 Underlying EBITDA has been disclosed as it is the key measure used by the Chief Executive Officer (as Chief Operating Decision Maker) and management to monitor and assess the operating performance of the business. Underlying EBITDA is calculated as profit before net financing costs, depreciation, amortisation and taxation and excludes restructuring costs. The Underlying EBITDA measure has not been subject to audit or review.

Every Coffey relationship is built on trust.

Trust that’s hard-earned through our proven expertise, our depth of global experience and our commitment to stay one step ahead.

Our specialists in geoservices, international development and project management work in partnership with our clients across the globe.

We create value throughout the project lifecycle in the mining; oil and gas; transport infrastructure and property industries.

We deliver vital international aid projects for our clients.

Our united group of specialists take enormous pride in collaborating with our project partners. By digging deeper. Thinking smarter. And seeing further.

All so we can deliver the smartest solutions, every time.

Financial calendar

11 August 2014 4 November 2014 31 December 2014 9 February 2015* 13 March 2015* 27 March 2015* 30 June 2015 10 August 2015* 11 September 2015* 25 September 2015* 3 November 2015*

FY2014 full year results announcement Annual General Meeting Half year end FY2015 half year results announcement Record date FY2015 interim dividend Interim dividend for FY2015 payable Financial year end FY2015 full year results announcement Record date FY2015 final dividend Final dividend for FY2015 payable Annual General Meeting

Coffey International Limited ACN 003 835 112

* Dates subject to change

Coffey Annual Report 2014 | 1

Contents

Letter from Chairman and Managing Director

Financial performance

Our people and safety

Our operations

Our industries

Our geographies

Our behaviours

Financial report

Shareholder information

2

6

9

12

16

18

20

21

116

2 | Coffey Annual Report 2014

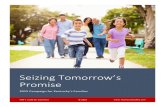

FY2014 saw the completion of a three year rebuilding process amidst tough trading conditions. We’ve established the fundamentals of our business and weathered a cyclical downturn to deliver considered, meaningful change. As a result, we’ve returned to profit and are now fully focused on delivering great client service to support the long term growth of our business.

Our return to profitability (with a net profit after tax of $4.4 million) was the result of concerted work in the first half to ensure the capacity of our Australian Geoservices business matched the market and improve utilisation across our operations. Our work to focus our business on three key portfolios is starting to show benefits, with Project Management returning to profitability and overall revenues stabilising. Our current structure is right for the market we’re in and provides the capacity to grow as new opportunities emerge.

While external factors continue to present challenges, we’ve done the work within the business to ensure we can now dedicate our time and energy to delivering client value and building a stronger sales culture to support long term sustainability and shareholder value.

Letter from Chairman and Managing Director

Managing Director John Douglas and Chairman John Mulcahy

Coffey Annual Report 2014 | 3

Safety

Our safety performance continued to improve during the year, with a Lost Time Injury Frequency Rate (LTIFR) of 0.64 as at 30 June, down from 1.43 the previous year and from a high of 6.0 in June 2010. The result reflected a continued focus on embedding our Health, Safety, Security and Environment (HSSE) Management System across all aspects of the business to ensure safety is at the core of everything we do. We’ve also improved the quality of safety reporting.

Fundamentals delivered

We’ve had three years of significant change, improving the business and establishing the fundamentals.

We’ve done this, while also dealing with major market challenges. We’ve established financial strength, reducing debt and overheads. Our safety disciplines are strengthened.

We are focused on three key businesses where we have a strong brand and deep expertise. With a stronger management team with clear accountabilities, and voluntary turnover significantly reduced, we have the team and capability we need to support our business success.

At the same time, we’ve completed market research that led to our FY2013 rebranding, consolidating our brand from nine different identities to two. This has reduced complexity for clients, improved opportunities for cross selling and provided greater focus and targeted account management on our five key industries of transport infrastructure, mining, oil and gas, property and international development.

Our client focus

We’re now well positioned to more fully focus on delivering for our clients. This is already showing results.

Coffey won two awards at the BRW Client Choice Awards in February, for the Best Consulting Engineering Firm – with revenue greater than $200 million, and Best Provider to the Primary Industry Sector. These awards reflect the importance we’re placing on offering great client service – as well as the technical excellence for which we are known – to help build the strong client relationships that support a sustainable business.

We’ve sought to build on that success and continue to improve our client relationships by improving our industry focus this year. We’re working to demonstrate our capability across the project lifecycle in all of these industries and are building greater collaboration across our businesses to deliver a more cohesive service offering for our clients.

With our business now strong, we’ll be looking to further enhance our client focus and improve our sales performance in FY2015 to create greater opportunities for growth and support shareholder value in the years ahead.

Financial performance

Our underlying earnings before interest, tax, depreciation and amortisation (EBITDA) was $26.2 million for the year, about 9% lower than the previous period. Importantly, our reported EBITDA was $23.7 million, with no restructuring costs in the second half. We can now invest more time on winning and delivering outstanding work for our clients. We’re now operating at the right capacity, while retaining the capability we’ll need to leverage opportunities for new work in the future.

We completed the portfolio changes implemented in FY2013 with the sale of Specialist Training Australia (STA) in the Middle East. The business was sold for a nominal value but the transaction released $1.5 million of working capital, reduced bank guarantees by $3.8 million and eliminated the risk of future losses as the business was wound down. This finalised our restructure to deliver a more streamlined, client focused business and coincided with the return to profitability of our Project Management business, after a sustained loss-making period.

We’ve also implemented strong balance sheet disciplines to reduce our net debt. We’ve actively managed our working capital, contributing to a reduction in net debt to $48.1 million. This leaves headroom in our funding facilities, which are in place until FY2016. And our bank guarantees are now more than 60% lower than their 2011 highs.

4 | Coffey Annual Report 2014

Operational performance

Geoservices revenue fell to $264.6 million, mainly due to a subdued Australian infrastructure market and uncertain global mining sector. While international Geoservices operations achieved an increase in revenue, our heavy exposure to the Australian market overshadowed these gains.

A range of external factors contributed to margin pressure, including project delays and cancellations in FY2013 and the first half of FY2014 and the poor performance of our Testing operations. Less work in the African junior mining sector, falling demand for environmental impact assessments in oil and gas and increased discounting also contributed. We’ve responded to these challenges during the year, either through changes to our business or the active management of risks associated with the end of the mining development boom. Our diversified revenue streams have partially offset the fall in demand in the mining sector, confirming the importance of building and maintaining capability across our five key industries.

Fee revenue was adversely affected by our Testing operations in the second half, with oil and gas projects coming to a close before expected new opportunities in transport infrastructure became available. However, there are early indications of growth in our consulting operations, showing some signs for optimism in Geoservices more broadly.

Our Project Management business returned to profitability, with revenue of $27.1 million. The business is now a small but effective part of our operations. Efficiencies were also achieved by improving systems and processes to manage non-recoverable costs.

Our International Development business grew strongly, with revenue climbing to $336.4 million. Now our largest part of the business, International Development’s long-term relationships with key clients and proven ability to achieve consistent results has supported our stability during the year. The business continues to develop strong relationships with the Australian Department of Foreign Affairs and Trade (DFAT), the US Agency for International Development (USAID) and the British Department for International Development (DFID).

The business has consistently delivered stable margins and has diversified its revenue streams from a heavy reliance on a few large US aid programs in previous years to a more balanced business spanning its three key clients, in addition to a number of other clients including global banks and philanthropic organisations.

The UK aid budget increased during the year, and with the restructuring of our UK operations now complete, we’re well positioned in this competitive market. In Australia, we’ve worked closely with our client as the country’s aid budget transitioned from AusAID to DFAT. In the US, we’ve continued to deliver a range of projects in our specialist area of strategic management and performance improvement, while also driving innovation through our new ‘scaling up’ service offering.

Dividend

As we continue to operate in an uncertain market, the Board has decided a dividend will not be paid this year. While our return to profit is welcomed, our debt reduction focus will deliver greater value over the long term to our shareholders. We believe this will not only support the achievement of future profits, but will create a better investment for our shareholders over time.

Remuneration

We continue to proactively manage our remuneration policy to ensure appropriate recognition and reward for our senior executives, in line with market expectations. This year saw only two service line executives achieve their short term incentives, based on the profitable performance of their businesses. However, both of these people only received 50% of their short term incentive payments due to minimum benchmarks set for overall company performance not being achieved.

Board changes

Stuart Black AM will retire from the Board at the 2014 Annual General Meeting. Stuart joined the Board in 2002 and chaired the Board Audit Committee until the formation of the combined Risk and Audit Committee in 2012. Stuart has been an important influence for the company during that time. His outstanding financial knowledge, strategic focus and business experience has been a great asset to the Board and we thank him for his commitment and support as a director.

Strategy and looking forward

There are many things to be optimistic about in FY2015, although the market continues to be very competitive in the Geoservices sector in particular. We’ve done the work to ensure the foundations of the business are strong and will actively manage the continuing uncertainty affecting the market. Effectively delivering on client expectations and understanding their concerns will be essential in this environment.

Letter from Chairman and Managing Director

Coffey Annual Report 2014 | 5

With our fixed costs reduced and organisational capability strengthened, we’ve got the right structure to support our business. However, a persistently high Australian dollar will reduce the benefit of Geoservices work overseas, limiting the positive impact of work we’re delivering in emerging markets.

There is good potential for continued growth in International Development, with changes to Australian Government aid priorities creating opportunities for private sector providers. In the UK, an increased aid budget will lead to potential new work for our European operations.

In FY2015, we’ll continue to develop our client service offering, with an emphasis on building greater collaboration across our businesses. We believe the benefits of our three years of change will allow us to put our energy where it can have the most impact in the year ahead. Our client focus and improved sales performance will be key drivers to deliver improved profitability and support a sustainable future for Coffey and our people.

Our people

We would like to thank our people for their outstanding work and dedication during the year. Coffey is built on the capability of our people and they have once again delivered outstanding work and value to our clients.

Standing (left to right): Susan Oliver, Guy Cowan, Leeanne Bond and Stuart Black AMSeated (left to right): Urs Meyerhans, John Douglas and John Mulcahy

Coffey Annual Review 2013 05

All of our businesses have schedules of contracted work for FY2014. The declining value of the Australian dollar, relative to the US dollar, is likely to work in our favour in winning new offshore work.

During the year just ended, we refreshed the Coffey brand, retiring the nine separate brands that existed earlier. Now there is one Coffey brand, with the exception of MSI, one of our International Development units, which has high recognition in the US market.

We have backed the brand refresh with six behaviours – effectively a shift in the Company’s culture – which are aimed at ensuring we deliver value for clients, and maintain safety and security as top priorities.

We anticipate this brand overhaul will be well-received by our clients in the coming months.

Undoubtedly, the global economy continues to be sluggish. The Australian economy is undergoing a substantial transition from the boom years of the early 2000s. Under such conditions, no one can provide certainty about future returns.

However, business opportunities continue to exist, particularly offshore.

We have won some of those opportunities. We are pursuing others.

We are confident the Company is on a stronger financial footing. And it is positioned for the current market, and for an upturn in the business cycle when it comes.

Recognising the contribution of staffWe recognise and acknowledge the contribution of Coffey’s staff during the year. The tough trading conditions have tested all of us.

Our performance, in these circumstances, is a credit to the commitment and effort of all our employees.

John Mulcahy John DouglasChairman Managing Director

International Development provides about 45% of total revenue, and about 30% of fee revenue. The sources of revenue are diversified, with about 70% of fee revenue earned from sources offshore (i.e. sources other than Australia).

International Development enjoyed a good year. The US-based business performed well in a tough market. The UK-based business recovered steadily. The Australian unit continued performing well.

More detail on the respective businesses is on pages 08 – 13 of this report.

Looking ahead to 2014Overall, the Company ends the year in a sound position relative to tough trading conditions.

Our fixed costs and net debt are lower. Our cost of borrowing is lower, and it will fall further in FY2014 when fixed interest debt arrangements entered into in 2008 come to an end.

Urs MeyerhansFinance Director

Rebelle MoriartyGroup Executive Human Resources

Chantalle MeijerGroup Executive Marketing & Communications

Group Management

John DouglasManaging Director

Coffey Annual Review 2013 05

All of our businesses have schedules of contracted work for FY2014. The declining value of the Australian dollar, relative to the US dollar, is likely to work in our favour in winning new offshore work.

During the year just ended, we refreshed the Coffey brand, retiring the nine separate brands that existed earlier. Now there is one Coffey brand, with the exception of MSI, one of our International Development units, which has high recognition in the US market.

We have backed the brand refresh with six behaviours – effectively a shift in the Company’s culture – which are aimed at ensuring we deliver value for clients, and maintain safety and security as top priorities.

We anticipate this brand overhaul will be well-received by our clients in the coming months.

Undoubtedly, the global economy continues to be sluggish. The Australian economy is undergoing a substantial transition from the boom years of the early 2000s. Under such conditions, no one can provide certainty about future returns.

However, business opportunities continue to exist, particularly offshore.

We have won some of those opportunities. We are pursuing others.

We are confident the Company is on a stronger financial footing. And it is positioned for the current market, and for an upturn in the business cycle when it comes.

Recognising the contribution of staffWe recognise and acknowledge the contribution of Coffey’s staff during the year. The tough trading conditions have tested all of us.

Our performance, in these circumstances, is a credit to the commitment and effort of all our employees.

John Mulcahy John DouglasChairman Managing Director

International Development provides about 45% of total revenue, and about 30% of fee revenue. The sources of revenue are diversified, with about 70% of fee revenue earned from sources offshore (i.e. sources other than Australia).

International Development enjoyed a good year. The US-based business performed well in a tough market. The UK-based business recovered steadily. The Australian unit continued performing well.

More detail on the respective businesses is on pages 08 – 13 of this report.

Looking ahead to 2014Overall, the Company ends the year in a sound position relative to tough trading conditions.

Our fixed costs and net debt are lower. Our cost of borrowing is lower, and it will fall further in FY2014 when fixed interest debt arrangements entered into in 2008 come to an end.

Urs MeyerhansFinance Director

Rebelle MoriartyGroup Executive Human Resources

Chantalle MeijerGroup Executive Marketing & Communications

Group Management

John DouglasManaging Director

John Mulcahy Chairman

John Douglas Managing Director

6 | Coffey Annual Report 2014

Financial performance

With a return to profit and reduced debt levels, we’ve stabilised the business in a constrained market.

Our revenue

Our total revenue of $628.1 million was 9% down on the previous year, reflecting the impact of external factors on our Australian Geoservices business. These included project delays and cancellations in FY2013 and the first half of FY2014 and the poor performance of our Testing operations. Less work in the African junior mining sector, falling demand for environmental impact assessments in oil and gas and increased discounting also contributed. This was partly offset by the growth of our International Development business.

Earnings performance

Underlying EBITDA was $26.2 million, down 9% on the previous period, with Geoservices margins adversely impacted by a range of external factors. However, reported EBITDA was up 27% to $23.7 million. There were no restructuring costs in the second half, reflecting the completion of portfolio changes and the achievement of the right structure across our business.

Our net profit after tax of $4.4 million was achieved despite continued tough trading conditions, reflecting improved efficiencies and better utilisation of our resources as a result of concerted work within the business to respond to market challenges and effectively manage organisational change.

Share sale facility

We launched an unmarketable parcel share sale facility in April, giving small parcel shareholders the chance to trade their shares without incurring brokerage and handling costs. The facility closed in June and saw our total number of shareholders fall by 22%. As a result, we have also reduced our ongoing administration costs.

* EBITDA - Earnings before interest, tax, depreciation and amortisation ** Underlying EBITDA - Earnings before interest, tax, depreciation and amortisation, before vendor earn-out, restructuring costs and asset impairment. A reconciliation of underlying EBITDA to reported net profits is provided in the Directors’ Report - Review of Operations.

$ million unless otherwise stated FY08 FY09 FY10 FY11 FY12 FY13 FY14

Total revenue 558.6 808.7 769.8 680.6 678.1 688.4 628.1

Fee revenue 376.6 510.4 475.7 423.6 421.5 411.0 381.0

EBITDA * 44.9 53.3 44.0 (39.7) (0.5) 18.6 23.7

Underlying EBITDA ** 44.9 55.4 47.9 32.3 39.7 28.8 26.2

Earnings before interest and tax 35.0 41.1 33.7 (50.0) (9.6) 9.2 14.5

Net profit after tax 15.3 16.4 13.8 (69.7) (34.5) (1.0) 4.4

EPS - cents per share 13.9 14.5 11.9 (52.9) (16.3) (0.4) 1.8

Net debt 93.9 92.8 100.5 121.2 66.0 58.0 48.1

Equity 196.1 191.1 198.2 122.4 133.4 137.2 140.3

Net debt / capital (equity + net debt) 31.9% 32.7% 33.6% 49.6% 33.1% 29.7% 25.5%

Seven year performance summary

Urs Meyerhans Finance Director

Coffey Annual Report 2014 | 7

Total Revenue ($m)

FY

0855

8.6

808.

7

769.

8

680.

6

678.

1

688.

4

628.

1

FY

11

FY

12

FY

13

FY

14

FY

10

FY

09

Underlying EBITDA** ($m)

9%

32.3

39.7

28.8

26.2

30.8

36.8

28.8

26.2

22.7

29.5

17.1

11.3 0.1

(0.3

)

(1.8

)

0.8

15.4

14.8

18.3 19

.1

FY

11

FY

11

FY

11

FY

11

FY

11

FY

12

FY

12

FY

12

FY

12

FY

12

FY

13

FY

13

FY

13

FY

13

FY

13

FY

14

FY

14

FY

14

FY

14

FY

14

Coffey Coffey Continuing Businesses

Geoservices Project Management

International Development

Fee revenue 79%

Reimbursable revenue 21%

Total Revenue by Business

Geoservices 42%

Project Management 4%

International Development 54%

Net Profit ($m)

15.3

16.4

13.8 4.

4

FY

08

FY

11(6

9.7)

(34.

5)

(1.0

)

FY

12

FY

13

FY

14

FY

10

FY

09$4.4m

8 | Coffey Annual Report 2014

Net debt

Our net debt improved during the year, falling 17% to $48.1 million at June 2014. Our strong financial discipline improved our cash position to ensure we are well positioned for the year ahead. Coffey’s net debt to underlying EBITDA sat at 1.83, within our self-imposed target range of 1-2 times.

As part of our active working capital management, we launched an internal campaign to reduce working capital days during the year, resulting in a renewed focus at all levels of the business. At the end of June, our working capital days sat at 54 compared to 61 days in FY2013. This was a significant achievement that reduced our cash demands and helped manage client default risk in an increasingly tough market.

We currently have headroom in our debt facilities and our bank guarantees have fallen significantly due to the sale of STA.

Our improved debt position is also reducing interest costs, with interest expense falling by $1.9 million for the year, 19% down on the previous year. This was supported by a reduced interest expense in the second half due to the maturing of a fixed interest rate swap taken out in 2008, above current market rates.

Risk management

Our Board continues to actively manage risk through the Risk and Audit Committee, which met 4 times during the year. We continue to manage financial risk through our Financial Market Risk Policy, including the management of foreign exchange and interest rate risks.

We recognise the competitive landscape has changed in recent years and effective risk management is more important than ever. At an operational level, we’re actively working to reduce geographic and market risk by diversifying our revenue streams and fostering collaboration across our three businesses. This is uncovering new revenue streams. We are targeting growth in geographies and industries where new work opportunities exist.

We’re also implementing a new internal program to improve our sales performance, with an emphasis on winning new work that delivers client value, builds long-term relationships and supports effective business development practices in tough markets. This is helping us deal with risks associated with increased price competition in the market by focusing our bidding process on the significant value we deliver our clients at every stage of the project lifecycle.

Our focus on managing project risk has seen our HSSE Policy continue to be embedded across all aspects of our operations to ensure a consistent approach to health and safety on each and every project.

Financial performance

Operating Cash Flow ($m)

$20.9m

38.1

34.2

15.9

21.8

18.1 20

.9

FY

08

FY

11(4

.9)

FY

12

FY

13

FY

14

FY

10

FY

09

Net Debt ($m)

$48.1m

93.9

92.8 10

0.5

121.

2

66.0

58.0

48.1

FY

08

FY

11

FY

12

FY

13

FY

14

FY

10

FY

09

Coffey Annual Report 2014 | 9

Business 30 June 2014 30 June 2013 Variance

Geoservices 1570 1700 130

Project Management 120 150 30

International Development 1970* 1700* 270

Corporate and functions 170 220 50

TOTAL 3830 3770 60

Our people and safety

Our people

Employee numbers stabilised during the year as capacity was matched to market demand and as the business returned to profit. Our voluntary staff turnover has remained low at 15.7% as at 30 June. This was a significant reduction from the FY2011 high of 34.6% and confirmed the success of improved HR services implemented in recent years.

We’ve concentrated on building our capability to support the growth of our operations in the future and maintain the depth of expertise for which we are known. Our Leading a Turnaround program was implemented to develop our leaders’ skills in winning work, leading people and business acumen to support strong decision making across all aspects of the business. This has been an important first step in further developing our client focus to improve sales performance and maximise efficiencies in our operations. With the program now complete, these leaders are playing an active role in building our client relationships in a competitive market.

We strengthened our management team during the year, confirming key appointments and improving our market focus. Rob Morris was confirmed as the Group Executive Environments in August and has taken a leading role in developing oil and gas opportunities for the business. Chantalle Meijer took on an expanded role as Group Executive Markets to further develop our market positioning through sales performance management. And post year end, Rhett Duncan was appointed as Group Executive Testing.

Chantalle Meijer Group Executive Markets

Rhett Duncan Group Executive Testing

Rebelle Moriarty Group Executive Human Resources

* International Development head count includes 1600 contracted employees, an increase from 1300 in June 2013

10 | Coffey Annual Report 2014

Our people and safety

Recognising our talents

Coffey’s people demonstrate technical excellence in all that they do, providing our clients with ingenuity and insight at all stages of the project lifecycle. Many of our staff were recognised for their contributions to their industries during the year, most notably:

Principal Jonathan Moss in the UK was awarded an Officer of the Order of the British Empire (OBE) for his work as part of the Provincial Reconstruction Team in Helmand, Afghanistan. His award was announced as part of the Queen’s Birthday Honours List in June.

Senior Principal Geotechnical Harry Poulos was elected as a Foreign Associate to the US National Academy of Engineering in February. The prestigious award recognises outstanding contributions to engineering research, practice or education and the pioneering of new and developing technologies or innovations. Professor Poulos’ election recognised his contribution to understanding foundation structure and ground support interactions.

Senior Principal Mickey Davachi from our Canadian operations was named the 2014 Calgary Geotechnical Society Engineer of the Year. The award is presented to an outstanding individual who has provided exceptional efforts, energy and contributions to the Art of Geotechnique in Calgary. Mickey won the award in May after being elected by his peers.

Senior Principal Michael Blackam won the Australian Water Association Best Journal Paper 2013-14 for his paper titled Source, Fate and Water-Energy Intensity in the CSG and Shale Gas Sector.

Environmental Scientist Keri Hartog won the Australian Contaminated Land Consultants Association Young Achiever Award for her presentation on gasworks remediation in Sydney, Australia.

Coffey Annual Report 2014 | 11

Safety is at the core of what we do and affects every one of our people, clients and stakeholders. We’ve improved our safety performance in FY2014, reducing our Lost Time Injury Frequency Rate (LTIFR) to 0.64. Our International Development and Project Management businesses were LTI free for the year.

This was a significant improvement compared to our LTIFR of 1.43 at June 2013 and 6.0 at June 2010. The fall reflected our continued work to further embed our Health, Safety, Security and Environment (HSSE) Management System across all aspects of our operations. The year saw a strong emphasis on process improvement, training and assurance editing, as well as improving the analysis of safety incidents to address lessons learned. The audit process has extended across our geographies to ensure a consistent approach to safety throughout our operations.

Our LTIFR is now well below our industry benchmark, with further initiatives in place for FY2015 to support the continued improvement of our safety performance.

Our safety performance

7.00

6.00

5.00

4.00

0.64

3.00

2.00

1.00

0Jun 10 Dec 10 Jun 11 Dec 11 Jun 12

LTIFR

LTIFR External Safety Benchmark

Dec 12 Jun 13 Dec 13 Jun 14

12 | Coffey Annual Report 2014

A sustainable business has strong foundations that allow its people to focus on the things that matter. We’ve done a lot to balance our business and build stability to support our people to deliver client value and win work.

Our client focus and understanding of the global markets we’re working in is driving growth opportunities for the future.

Our businesses

Contracted revenue

Our contracted revenue reflects a strong pipeline of work for our longer term International Development business, as well as a good foundation for our other businesses to win new work during the year. International Development has secured $230.7 million of contracted revenue, an increase from $164.9 million in June 2013.

Geoservices contracted fee revenue of $90 million reflects the short term nature of many contract awards for the business. While uncertainty remains in the Australian Geoservices market, this remains a positive start for the business as it increases its work winning focus.

Project Management’s contracted revenue of $15 million is in line with expectations and confirms its position as a small but important part of the business.

Ouroperations

Business FY2014 revenue FY2013 revenue

Geoservices $264.6 million $348.9 million

Project Management $27.1 million $32.6 million

International Development $336.4 million $306.9 million

TOTAL $628.1 million $688.4 million

Coffey Annual Report 2014 | 13

Geoservices

Challenging market conditions continued to affect our Australian Geoservices business during the year, with many projects being delayed or cancelled in FY2013 and the first half of FY2014. While this has affected revenue, which fell to $264.6 million, significant work has been done to match capacity to market demand while ensuring that we have the capability to grow as new opportunities emerge. The business’ underlying EBITDA was $11.3 million, down from $17.1 million the previous year.

The stabilisation of the business was impacted by the poor performance of our Testing operations. Project delays severely affected the business and while restructuring has limited the impact of market conditions, revenue results of our Testing operations were well below expectations. We initiated a management change for the business in February; Rhett Duncan was appointed as the new Group Executive Testing post year end. Rhett was previously General Manager South East Queensland (SEQ) Concrete for Holcim. The business continues to win work and should benefit from increased expenditure on roads by state and federal governments.

Less available work in the African junior mining sector also contributed to our Geoservices margins of 4%, as did falling demand for environmental impact assessment work in the Australian mining and oil and gas industries. In both cases we have reduced staff numbers to match capacity with demand. These subdued trading conditions over a sustained period have led to increased discounting within the market, creating greater competition for work. While these challenges remain, our diversified revenue streams are helping limit the impact of these factors while our increased focus on building sales capability will support our ability to compete in this market.

Our environmental services secured new oil and gas contracts in the Middle East, a key growth market for this industry. In Australia, the $15 million Caltex Europa III contract for site assessment and remediation services was a significant milestone. The PNG P’nyang project for Exxon also reflected our strength in providing environmental and social impact assessment for new oil and gas projects as we build on our existing presence in the Asia Pacific.

Workplace health and safety remains of vital importance not just for our own people, but for our clients as well. We’ve secured a number of new contracts for public sector clients in Australia delivering workplace health and safety services and hazardous material assessments. The growth of this service leverages our safety culture and ability to deliver workplace health and safety programs to support the safety of our clients and their assets.

Sukumar Pathmanandavel Group Executive Geomechanics

Dennis Hesketh Acting Group Executive Testing

Craig McCloskey General Manager Geoservices South America

Chris Fredericks General Manager Geoservices Africa

Bob Simpson President Geoservices Canada

Rob Morris Group Executive Environments

14 | Coffey Annual Report 2014

Project Management

The return to profit of our Project Management business confirmed our focused portfolio approach and reflected the commitment to achieve efficiencies through improved systems and better management of non-recoverable costs. While the business remains small with revenue of $27.1 million, it is now delivering positive returns. Its underlying EBITDA of $0.8 million confirmed the turnaround of the business and shows it is well positioned to build its market offering in the year ahead.

The Christchurch earthquake recovery has led to a range of complex projects being delivered concurrently. We’re working on a wide range of project management services in the earthquake affected area to ensure the rebuilding stays on track. Key projects include the Christchurch Transport Exchange, ‘An Accessible City’ program and Coastal Pathway Project. The $2.5 million River Avon Precinct project was also won during the year.

Ouroperations

Case study: Integrated services driving international growth

We’re fostering collaboration to create new service offerings and build opportunities for growth. Our environmental and international development experts have joined forces to bring together leading social performance services with extensive experience working in conflict and post-conflict zones.

We recently developed the Social Performance and Reputation Index (SPRI) to help foreign resource companies identify community perceptions and proactively manage their social performance in post-conflict regions.

The SPRI is currently being used in the oil and gas industry in Iraq. We’re working with our client to monitor the impact of their social investment activities and benchmarking performance against other companies in the region. The project is delivering independent, up-to-date information to support risk, reputation and social program management and assess the effectiveness of the client’s social programs. This means they can adapt to changes in community perceptions as they occur, supporting more effective, evidence-based decision making in a rapidly changing environment.

The Index combines the social impact assessment and stakeholder engagement capabilities of our Geoservices business with an understanding of the complex issues affecting post-conflict regions from our International Development business. It’s creating new business development opportunities in the Middle East and elsewhere, providing our oil and gas clients with an expanded service offering applicable to any stage of the project lifecycle.

Richard Biesheuvel Group Executive Project Management

Coffey Annual Report 2014 | 15

Glen Simpson Group Executive International Development

Marina Fanning Executive Vice President US subsidiary MSI

Larry Cooley President US subsidiary MSI

Kit Black General Manager UK

Sam Spurrett General Manager APAC

International Development

International Development has consistently delivered stable margins and a reliable pipeline of work to support our operations. This year saw the business grow as the foreign aid landscape in which our three key clients operate underwent a period of change. Our core specialty areas where we deliver much of our work remained central to our clients’ needs and ensured we were able to leverage new opportunities and weather uncertainty in other areas.

Our growth in revenue to $336.4 million and underlying EBITDA of $19.1 million reflected increases to the UK aid budget and additional revenue from our US operations. The Australian Government’s transition of its aid budget to the Department of Foreign Affairs and Trade commenced in September and has seen a reorientation of aid funding towards diplomacy, trade and security. While fewer new work opportunities emerged as the transition was completed, the continued focus on health and education projects in the future aligns with practice areas where we maintain strong experience and networks to support project delivery. The new policy setting is also creating new opportunities for private sector providers that offer certainty of delivery for modest margins.

We’ve installed new management in the UK to build on opportunities stemming from the current growth of the local aid budget. The UK Government has now achieved its overseas development aid budget target of 0.7% of Gross Net Income. This has seen growth in the number of projects available – particularly in Syria, Kenya and the Ukraine – in our core practice areas of governance, security and justice. We’ve been able to compete strongly in an increasingly competitive environment due to our strengths in these areas.

Our core US market of strategic management and performance improvement has continued to deliver a consistent pipeline of work despite austerity measures implemented by the US administration causing some uncertainty. Increasing competition has limited our scope to diversify across additional practice areas. However, our innovative work ‘scaling up’ projects to increase the scope of new, locally based initiatives has shown great potential. We’re increasing the difference these projects are making at a regional level. This demonstrates our unique expertise in creating greater benefits by leveraging good ideas on a bigger scale.

International Development also strengthened its collaboration with our Geoservices business during the year, building social performance management services that are already being implemented in the oil and gas sector in the Middle East.

16 | Coffey Annual Report 2014

Transport infrastructure: Increased state and federal infrastructure budgets in Australia announced in the second half show early signs of growth in the industry. In the highly competitive market we’re in, the challenge will be in converting opportunities into secured work. In Canada, there’s a strong pipeline of infrastructure work in Ontario, particularly relating to public transit projects. And in the UK, new opportunities in rail are starting to emerge.

With five industries across 80 countries, we’re building diversified revenue streams and collaborating between our business units. The broad scope of our operations has demonstrated a robust business model that will support sustainability as geographic and market fluctuations affect specific parts of our operations.

Mining: We’ve weathered the end of the mining development boom during FY2014 and maintained a presence in key mining markets. We’re working in mining across Australia, Africa and South America, in a range of commodity sectors. With the African mining sector in its early development and Australian resources projects moving from construction to operation, we’re drawing on our local knowledge and global expertise to support new work opportunities in the industry.

Oil and Gas: Contract awards in the Middle East, Papua New Guinea and Australia saw a continued presence in the oil and gas market this year. We’ve increased our market share in the Middle East, partly drawing on our local, social and political knowledge from working on international development projects in the region for more than 40 years. The quickly developing unconventional oil and gas market in Australia is presenting new opportunities in an industry we’ve been active in for many years.

))))

$

Project Management & Geoservices

Feasibility Planning &approvals

Design Construction Management &maintenance

Ourindustries

Coffey Annual Report 2014 | 17

Industry in focus: transport infrastructure in Australia

Transport infrastructure’s been quiet for a while, but things are changing. Budgets are growing and the pipeline of work in the industry is expected to increase. In Australia, we’ve been working on some of the biggest infrastructure projects across the country, from the Gladstone LNG project in Queensland to Department of Defence facilities across the nation.

As the $11.6 billion Infrastructure Growth Package is implemented by the Federal Government and New South Wales begins to invest $9 billion in public transport infrastructure and services, new projects are expected to begin. And in Western Australia, we’re already delivering environmental and heritage site investigations for the $1.12 billion NorthLinkWA project. The Main Roads WA project was awarded to BG&E this year and we’re working with them to prepare for the start of construction in 2016.

))))

$

Project Management & Geoservices

Feasibility Planning &approvals

Design Construction Management &maintenance

Property: Signs of growth in the Australian, African and UK markets started to emerge during the year. With our Project Management business now stabilised and delivering a profit, we’re well positioned to capitalise on new work opportunities. Retail and hospitality are strong emerging markets in Africa, while aged care, defence and education is expected to drive growth in Australia. And work in earthquake affected Christchurch – where we’ve been supporting the rebuild right from the start – is continuing to deliver a consistent pipeline of work.

International development: Our three key clients maintain their commitments to foreign aid and we’re working closely with them to deliver on their needs. Our growth and the achievement of consistent margins during FY2014 reflected the stability of our work in this industry. The experience of our international development teams in emerging markets is supporting collaboration opportunities within our business and driving new business development initiatives.

18 | Coffey Annual Report 2014

We’re working all over the world – just like our clients. Our people are local and understand the conditions. And our global reach means we can bring in reinforcements whenever they’re needed. We’re growing in the Middle East and Africa across several industries. And we’re building stronger links between our businesses to support our global presence.

Our global footprint is supporting the diversification of our business and reducing risks associated with local market fluctuations.

Ourgeographies

Countries where Coffey is currently operating

Coffey Annual Report 2014 | 19

In focus: Building client relationships across geographies

Virtual reality is changing project planning and operations. It’s allowing our clients to see further. And it’s taking us further – building client relationships across the world.

In 2014, we formally launched our virtual reality capability at the Australian Petroleum Production and Exploration Association (APPEA) Conference. It’s a capability we’ve been developing with our mining clients to support their mine planning – and we see the potential for other industries too.

We’re working with a major mining company across Africa and South America as they lead the charge in virtual reality, using the technology to improve their operations. We’ve helped

them bring an underground mine to life in Brazil, developing a conceptual mine design to support a feasibility study. And in Mozambique, we’ve helped improve complex surface drainage systems to drive efficiencies and reduce project risk.

This unique service offering, paired with the outstanding technical capability of our Geoservices team, is delivering project value for the client. We’re allowing them to really see and understand their challenges – and making the solutions clear.

When we deliver technical excellence, combined with innovation, we offer our clients a true partnership. And, in this case, that partnership has now spanned two continents. We’re showing our clients we work where they do – and deliver consistent results no matter where in the world they are.

BrazilMozambique

20 | Coffey Annual Report 2014

Our behaviours

IngenuityEncourage and explore new thinking,

ask yourself ‘have I provided the smartest solution here?’

DeliveryDo what you say you will; our actions always speak

louder than words

IntegrityTake responsibility for your

own actions; do the right thing (even if nobody is looking)

Intelligent RiskThink differently; make informed decisions to ensure we’re one step ahead of the competition

RespectValue and constructively engage with the contributions of others;

be mindful of your criticisms

CollaborationShare our ideas and knowledgewith clients – and each other –with an open- minded and real

generosity of spirit

Safety

Coffey Annual Report 2014 | 21

Coffey International Limited

Coffey Annual Report 2014 | 21

2014 Financial Report to Shareholders

Contents

Directors’ report 22 Notes to the financial statements

Directors’ report - Remuneration report 28 1 Summary of significant accounting policies 68

Lead auditor’s independence declaration 51 2 Critical accounting estimates and judgements 77

Corporate governance statement 52 3 Determination of fair value 78

Consolidated income statement 62 4 Operating segments 79

Consolidated statement of comprehensive income 63 5 Revenue and other income 82

Consolidated statement of financial position 64 6 Expenses 83

Consolidated statement of changes in equity 65 7 Net finance costs 83

Consolidated statement of cash flows 67 8 Income tax expense 84

Notes to the financial statements 68 9 Cash and cash equivalents 85

Directors’ declaration 112 10 Cash deposits 85

Independent auditor’s report 113 11 Trade and other receivables 85

Details of shareholders and shareholdings 115 12 Plant and equipment 86

13 Deferred tax assets and liabilities 87

14 Intangible assets 88

15 Trade and other payables 90

16 Employee benefits 90

17 Loans and borrowings 91

18 Dividends 92

19 Issued and fully paid up share capital 92

20 Reconciliation of profit after income tax to net cash flow from operating activities 93

21 Financial instruments 93

22 Director and executive disclosures 100

23 Remuneration of auditors 101

24 Contingent liabilities 102

25 Commitments 102

26 Earnings per share 103

27 Events occurring after the reporting date 103

28 Deed of cross guarantee 104

29 Parent entity disclosures 106

30 Share-based payments 106

31 Subsidiaries 110

22 | Coffey Annual Report 2014

Coffey International Limited Directors’ report

22 | Coffey Annual Report 2014

Your Directors present their report on the consolidated entity consisting of Coffey International Limited, domiciled in Australia, and the entities it controlled (Coffey or the Group) at the end of, or during, the year ended 30 June 2014. Directors The names and details of the company's Directors in office during the financial year and until the date of this report are as follows. Directors were in office for this entire period unless otherwise stated.

Non-executive Directors John Mulcahy (Chairman) Stuart Black AM Leeanne Bond Guy Cowan Susan Oliver

Executive Directors

John Douglas (Managing Director) Urs Meyerhans (Finance Director)

Principal activities During the year the Group provided specialist consulting services across its three businesses. These activities are summarised below by each key business segment:

Geoservices The Geoservices business comprises specialised geotechnical, environmental and mining consulting services, as well as materials testing and analysis. The business delivers services to public and private sector clients across resources, infrastructure and property. Offices are located across Asia Pacific, the United Kingdom, North and South America, Africa and the Middle East. International Development The International Development business delivers consulting and training services alongside governments and donor agencies to strengthen governance, promote economic growth, and create conditions for sustainable development. The business operates from regional offices based in Australia, the United States of America and the United Kingdom. Project Management The Project Management business provides project management and advisory services to public and private sector clients across the property and infrastructure project lifecycles. Offices are located throughout Australia, New Zealand and South Africa. Dividends No dividends were declared or paid in the current or prior year. Review of operations Fee revenue from operations of $381.0 million was down 7.3% ($30.0 million) on last year. This reflected continued subdued conditions in the Australian market which adversely impacted Geoservices. This was partly offset by an increase in earnings in New Zealand. Earnings before interest, tax, depreciation and amortisation (EBITDA) was $23.7 million for the year, including $2.5 million of restructuring. The restructuring of the business, which commenced in June 2013 and was concluded in December 2013, was undertaken to ensure the business is appropriately structured for the level of demand in the Australian market in the medium term. Staff numbers, through redundancy and natural attrition, have been reduced by 160 positions during FY2014. Net profit after tax of $4.4 million was an improvement on the prior year, which recorded a net loss after tax of $0.9 million. Net operating cash inflow of $20.9 million was adversely impacted by the payment of $6.3 million of redundancy costs (some of which were expensed in the prior financial year) and tough trading conditions in the Australian market. Gross debt decreased to $77.0 million (30 June 2013: $88.7 million) as a result of continued positive operating cashflows. The gearing ratio of net debt to equity plus net debt decreased from 30% to 26%. Interest expense reduced by 18% compared with the prior year, reflecting the reduced debt level, lower interest rates and the maturing of the Group’s interest rate swaps, which was entered into in 2008, in February 2014. Banking facilities remain in place through to February 2016. For additional commentary refer to the Letter to Shareholders from the Chairman and Managing Director, and the Financial Highlights section of this Annual Report.

Coffey Annual Report 2014 | 23

Coffey International Limited Directors’ report

Coffey Annual Report 2014 | 23

A reconciliation of net profit/(loss) after tax to EBITDA is shown below. EBITDA reconciliation

2014 2013 $’000 $’000

Profit/(loss) for the year 4,457 (911)

Add back: Net financing expense 8,130 10,005 Income tax expense 1,908 128 Depreciation and amortisation 9,199 9,381 EBITDA 23,694 18,603

Add back:

Restructuring costs 2,468 10,159

EBITDA before restructure costs 26,162 28,762 Earnings per share

2014 Cents

2013 Cents

Basic earnings per share 1.8 (0.4)

Significant changes in the state of affairs In the opinion of the Directors, there were no significant changes in the state of affairs of Coffey International Limited that occurred during the year under review, that were not otherwise disclosed in this report or the financial statements. Matters subsequent to the end of the financial year There were no matters or circumstances specific to Coffey that have arisen since 30 June 2014 that have significantly affected or may significantly affect the:

Group’s operations in future financial years; Results of those operations in future financial years; Group’s state of affairs in future financial years; or Group’s financial report at 30 June 2014.

Likely developments and expected results of operations Further information on likely developments in the operations of the consolidated entity and the expected results of operations have not been included in this report because the Directors believe including this information would likely result in unreasonable prejudice to the consolidated entity. Environmental regulation Coffey International Limited is committed to the protection of the environment; to the health and safety of its employees, contractors, customers and the public at large; and to complying with all applicable environmental laws, rules and regulations in the jurisdictions in which it conducts its business. The consolidated entity is not subject to significant environmental regulation in respect of its operations. There are small disposals of waste from the consolidated entity’s soil science laboratories. This waste is disposed under licence to an appropriate disposal facility.

24 | Coffey Annual Report 2014

Coffey International Limited Directors’ report

24 | Coffey Annual Report 2014

Directors’ qualifications, experience, other directorships and special responsibilities

John Mulcahy PhD, BE (Civil Eng) (Hons), FIEAust, MAICD Chairman, Age 64

Term: Non-executive Director since September 2009 (5 years), Chairman since November 2010

Independent: Yes

Committees: Chair Nomination Committee

Member Risk and Audit Committee Human Resources and Remuneration Committee

Directorships: Chairman of Mirvac Limited. Non-executive Director of ALS Limited, GWA Holdings Limited and Mirvac Funds Management Limited, and a Guardian of the Future Fund of Australia. Former Managing Director and Chief Executive Officer of Suncorp-Metway Limited.

Experience: John is one of Australia’s most respected corporate leaders, with almost 30 years of senior management experience having worked extensively in financial services and property investment. Before joining Coffey, he was Managing Director and Chief Executive Officer of Suncorp-Metway Limited. John has also held a range of senior executive roles at the Commonwealth Bank and Lend Lease Corporation.

John Douglas, BEng (Hons), MBA, MAICD Managing Director, Age 52

Term: Managing Director since March 2011

Independent: No

Committees: No Committee membership

Directorships: No other listed company directorships

Experience: John has over 25 years’ international experience in strategic consulting and senior management, as well as hands-on experience as a geotechnical engineer. Before joining Coffey, John was Executive General Manager of Boral Limited’s Australian Construction Materials business. In this role, he managed a business with a turnover of more than $2 billion spread across four business streams. Prior to working at Boral, John was a manager at Boston Consulting Group where he provided strategic advice to high profile companies across a wide range of industries and countries.

Urs Meyerhans CA (CH), MAICD Finance Director, Age 54

Term: Finance Director since February 2012

Independent: No

Committees: No Committee membership

Directorships: Former Finance Director of Wattyl Limited.

Experience: Urs joined Coffey as Chief Financial Officer (CFO) in early 2009 and was appointed Finance Director in early 2012. Urs has 30 years of senior finance and international general management experience in the resources, manufacturing, FMCG and professional services industries. His expertise includes capital management, strategic planning and restructuring, refinancing of debt requirements and merger and acquisitions. Urs also plays a key role in investor relationship management at Coffey as he did in his role at Wattyl Limited. Prior to joining Coffey, Urs was CFO of Swiss Aluminium Australia Limited, Group Financial Controller of WMC Resources Limited, CFO of United Group Limited and Wattyl Limited where he was appointed Finance Director in 2004.

Coffey Annual Report 2014 | 25

Coffey International Limited Directors’ report

Coffey Annual Report 2014 | 25

Stuart Black AM, FCA, FAICD Age 59

Term: Non-executive Director since March 2002 (12 years)

Independent: Yes

Committees: Member Risk and Audit Committee Human Resources and Remuneration Committee Nomination Committee

Directorships: Non-executive Director of Australian Agricultural Company Limited, NetComm Wireless Limited and the Country Education Foundation of Australia Ltd. Chair of Chartered Accountants Benevolent Foundation Ltd. Former acting Chair and current Director of the Accounting Professional and Ethical Standards Board Ltd. Past President of the Institute of Chartered Accountants in Australia.

Experience: Stuart is a prominent Chartered Accountant with extensive experience of working in professional services. His expertise includes strategic planning, governance, financial and management accounting and corporate advisory. Stuart is the former Managing Partner in the chartered accounting firm Chapman Eastway.

Leeanne Bond BEng (Chem), MBA, FIEAust, RPEQ, GAICDAge 49

Term: Non-executive Director since February 2012 (2 years)

Independent: Yes

Committees: Member Risk and Audit Committee Human Resources and Remuneration Committee

Directorships: Deputy Chair of the Territory Generation Corporation and a Non-executive Director of Liquefied Natural Gas Limited and JK Tech Pty Ltd (a wholly owned subsidiary of The University of Queensland). Former Non-executive Director of Tarong Energy Corporation Limited, Queensland Bulk Water Supply Authority (Seqwater) and subsidiaries and Australian Water Recycling Centre of Excellence Ltd. Former chair of the Brisbane Water Advisory Board, Brisbane City Council.

Experience: Leeanne is an experienced senior manager and independent company Director with particular expertise in engineering, business strategy, risk and innovation. She has Board experience in the energy, minerals and water sectors. From 1996 to 2006, Leeanne worked with Worley Parsons and played a key role in establishing and growing the business in Queensland, PNG and Northern Territory within a global context. During this period, she was responsible for negotiating project alliances, supervising projects and delivering commercial outcomes across the energy, minerals, infrastructure and water resources sectors.

Guy Cowan, BSc (Eng) (Hons), FCA, MAICD Age 63

Term: Non-executive Director since February 2012 (2 years)

Independent: Yes

Committees: Chair Risk and Audit Committee

Member Human Resources and Remuneration Committee

Directorships: Non-executive Director of UGL Limited and Queensland Sugar Limited. Former Non-executive Director of Ludowici Limited, Raisama Limited and Gold Oil PLC (UK).

Experience: Guy has worked extensively in the oil and gas industry, including more than 23 years working in senior international finance and strategy roles at Shell. This included the positions of Chief Financial Officer (CFO) of Shell Petroleum Inc. and CFO and Director of Shell Oil Company (USA). Guy joined the Fonterra Co-operative Group Limited in 2005 as CFO and was responsible for growth and investments in Latin America. He also worked as a chartered accountant with Price Waterhouse and KPMG.

26 | Coffey Annual Report 2014

Coffey International Limited Directors’ report

26 | Coffey Annual Report 2014

Susan Oliver, B Bldg (Melb Uni), FAICD Age 63

Term: Non-executive Director since October 2010 (4 years)

Independent: Yes

Committees: Chair Human Resources and Remuneration Committee

Member Risk and Audit Committee Nomination Committee

Directorships: Non-executive Director of CNPR Limited and Chair of Scale Investors Limited. Former Chair of Fusion Retail Brands Pty Ltd and a former Non-executive Director of VLine Corporation, Programmed Maintenance Services Limited, Transurban Group Limited, Just Group Limited, Centro Properties Group and MBF Australia Limited.

Experience: Susan has been a company Director for more than 18 years and has expertise in building profitable enterprise, restructuring and turnarounds. She has senior management experience in both public and private sectors spanning construction, urban renewal, policy, professional services, innovation and industry development. With a background in strategy, marketing, technology and scenario planning, Susan also manages her own advisory practice and start-up information technology companies. Susan also serves on the Victorian government advisory panel for small technologies and is founding Chair of an angel investor group.

Directors’ interests The relevant interest of each Director in the share capital of the companies within the consolidated entity, as notified by the Directors to the ASX in accordance with section 205G of the Corporations Act, at the date of this report is:

Coffey International Limited Ordinary shares Loan shares

Non-executive Directors

J Mulcahy 1,639,286 – S Black AM 287,027 – L Bond 150,000 – G Cowan 311,513 – S Oliver 320,000 –

Executive Directors J Douglas 7,294,707 4,595,273 U Meyerhans 1,000,000 2,410,364 Company Secretary Jennifer Waldegrave BBus, CA, GradDipACG, AGIA, MAICD Appointed Company Secretary of Coffey International Limited in March 2010. Jennifer is a member of the Governance Institute of Australia and the Australian Institute of Company Directors, and is a Chartered Accountant. She has over 25 years’ senior corporate experience in Australian and US listed companies and in her preceding role was Company Secretary for Australian listed company Wattyl Limited.

Coffey Annual Report 2014 | 27

Coffey International Limited Directors’ report

Coffey Annual Report 2014 | 27

Meetings of Directors The number of meetings of the Board of Directors and of each Board Standing Committee held during the year ended 30 June 2014, and the number of meetings attended by each Director is detailed below.

Board

Committees

HR & Remuneration Risk & Audit Nomination Director A1 B2 A B A B A B J Mulcahy 13 13 6 6 4 4 1 1 J Douglas 13 13 – 6 # – 4 # – 1 #

U Meyerhans 13 13 – 6 # – 4 # – 1 #

S Black AM 13 13 6 6 4 4 1 1 L Bond 13 13 6 6 4 4 – 1 #

G Cowan 13 13 6 6 4 4 – 1 #

S Oliver 13 13 6 6 4 4 1 1 1 “A” represents number of meetings eligible to attend and held while in office. 2 “B” represents number of meetings attended while in office. # Represents number of meetings attended although not a member of the Committee.

Insurance of officers During the financial year, the Group paid a premium to insure the Directors and Secretaries of the company and Group entities, key Executives and the General Managers of each of the businesses of the consolidated entity. The liabilities insured are legal costs that may be incurred in defending civil or criminal proceedings that may be brought against the Directors and/or officers of entities in the consolidated entity, and any other payments arising from liabilities incurred by the Directors and/or officers in connection with such proceedings, other than where such liabilities arise out of conduct involving a wilful breach of duty by the Directors and/or officers or the improper use by the Directors and/or officers of their position or of information to gain advantage for themselves or someone else or to cause detriment to the company. It is not possible to apportion the premium between amounts relating to the insurance against legal costs and those relating to other liabilities. Proceedings on behalf of the company No person has applied to the Court under Section 237 of the Corporations Act 2001 for leave to bring proceedings on behalf of the company, or to intervene in any proceedings to which the company is a party, for the purpose of taking responsibility on behalf of the company for all or part of those proceedings. No proceedings have been brought or intervened in on behalf of the company with leave of the Court under Section 237 of the Corporations Act 2001. Non-audit services The company may decide to employ the auditor on assignments additional to its statutory audit duties where the auditor’s expertise and experience with the company and/or the consolidated entity are important. Details of the amounts paid or payable to the auditor (KPMG) for audit and non-audit services provided during the year are set out in Note 23 ‘Remuneration of auditors’ in the notes to the financial statements. The Board of Directors has considered the position and, in accordance with the advice received from the Risk and Audit Committee, is satisfied that the provision of the non-audit services is compatible with the general standard of independence for auditors imposed by the Corporation Act 2001. The Directors are satisfied that the provision of non-audit services by the auditor, as set out in Note 23 ‘Remuneration of auditors’ in the financial statements, did not compromise the auditor independence requirements of the Corporations Act 2001 for the following reasons:

All non-audit services have been reviewed by the Risk and Audit Committee to ensure they do not impact the impartiality and objectivity of the auditor; and

None of the services undermine the general principles relating to auditor independence as set out in APES 110 Code of Ethics for Professional Accountants.

28 | Coffey Annual Report 2014

Coffey International Limited Directors’ report – Remuneration report

28 | Coffey Annual Report 2014

Remuneration Report FY2014 (audited) Executive Summary Key personnel changes in FY2014

Robert Morris was appointed to the role of Group Executive Environments on 12 August 2013. He was previously General Manager Environments Queensland and Papua New Guinea.

Michael Renehan, Group Executive Testing, ceased employment on 28 February 2014. He has been considered a former KMP in this report. Rhett Duncan was appointed to the role on 25 August 2014. Mr Duncan joined Coffey following a successful career at Holcim Pty Ltd. The terms of his appointment are in line with the remuneration arrangements for Executives as outlined in this report. He will be appointed as a KMP in the next reporting period.

Chantalle Meijer was appointed Group Executive Markets on 31 March 2014. Ms Meijer joined Coffey in December 2011 and was previously Group Executive Marketing & Communications.

There have been no changes in Non-executive Director membership during this reporting period.

Key remuneration decisions in FY2014

Fixed remuneration for Executive Directors and Executives has remained unchanged during the year, other than a market-based adjustment for one Executive. With the exception of this Executive and new Executives, salaries have been maintained at levels set in FY2012.

The Board awarded short term reward (STR) payments for two Executives who exceeded the minimum financial thresholds. Both STR entitlements were reduced by 50% due to Company performance. The full Board determined that no other Executive would receive an STR payment due to Company performance.

Nine Executives were awarded long term reward (LTR) grants in FY2014 with vesting subject to achievement of earnings per share (EPS) and total shareholder return (TSR) performance hurdles over three years, and continued service.

There was a 100% forfeiture of loan shares granted to all LTR participants under the FY2012 performance grant as performance hurdles were not achieved.

Non-executive Director fees have remained unchanged during the year. The aggregate Non-executive Director fee pool limit has also remained unchanged since the 2008 AGM.

Introduction This report provides an overview of Coffey’s Remuneration Policy and details Coffey’s Key Management Personnel (KMP) remuneration for the year ended 30 June 2014 (FY2014). For the purposes of this report, reference will be made to:

Key Management Personnel (KMP) – Non-executive Directors, Executive Directors and Executives

Non-executive Directors (NED) – Non-executive Directors

Executive Directors (ED) – Managing Director and Finance Director

Executives – Managing Director, Finance Director, Group Executive Service Lines and Group Executive Functions

Coffey Annual Report 2014 | 29

Coffey International Limited Directors’ report – Remuneration report

Coffey Annual Report 2014 | 29

The Remuneration Report is structured as: 1 Remuneration policy, practices and outcomes 2 Relationship between remuneration policy and company performance 3 The Board’s role in remuneration 4 Description of Non-executive Director remuneration 5 Description of executive remuneration 6 Director and executive remuneration details 7 Executive employment contracts 8 Legacy equity-based remuneration 9 Transactions with Key Management Personnel

1 Remuneration policy, practices and outcomes 1.1 Remuneration policy and practices The objective of Coffey’s remuneration policy is to ensure its remuneration practices attract, motivate and retain employees from a diverse range of backgrounds with the experience, knowledge, skills and judgment to drive the company’s performance. 1.2 Remuneration Summary in FY2014 The table on the following page compares an Executive’s contracted potential remuneration for FY2014 with the actual remuneration award for the year. The Contract total fixed remuneration (TFR) shows the fixed remuneration the Executive is entitled to receive for a full year of service under their employment contract, while the Actual TFR shows the fixed remuneration earned during FY2014 in the role of an Executive. The variable remuneration disclosures show the potential on-target and maximum STR and LTR awards for FY2014, compared with the actual STR and LTR award made during the year. The LTR awards are subject to performance hurdles measured over a three-year period and at risk of forfeiture if the hurdles are not met. The LTR awards are provided through a limited recourse loan, vested shares may only be exercised after repayment of this loan. As the LTR performance hurdles are measured over three years, the performance hurdles relating to the FY2012 LTR awards were measured during the year. 100% of the FY2012 performance shares were forfeited as the hurdles were not met. This disclosure is supplementary to the statutory remuneration reporting requirements which are contained in the Remuneration Summary Tables (shown in section 6.2 and onwards). The statutory remuneration table includes additional disclosures including non-monetary benefits related to car parking, long service leave accruals and termination payments. In addition, the impact of movements in LTR grants is shown at fair value in the statutory remuneration table rather the equivalent remuneration value.

30 | Coffey Annual Report 2014

Coffey International Limited Directors’ report – Remuneration report

30 | Coffey Annual Report 2014

Fixed

Remuneration Short Term Reward

Plan Long Term Reward Plan

TotalReward

FY14

Contract TFR1

Actual TFR2

On-target awardFY143

Maximum award

AvailableFY144

Award madeFY145

On-target & Maximum

award FY146

Forfeit of FY12

LTR grant7

Executive Directors

J Douglas Managing Director $800,000 $795,2218 $400,000 $600,000 $0 $400,000 0 $795,2218

U Meyerhans Finance Director $550,000 $550,000 $206,250 $309,375 $0 $206,250 $0 $550,000

Other Executives

S Pathmanandavel GE Geomechanics $400,000 $400,000 $100,000 $150,000 $0 $100,000 $0 $400,000

R Morris GE Environments $300,000 $259,7769 $66,3709 $99,5559 $0 $75,0009 n/a $259,7769

G Simpson GE International Development

$400,000 $400,000 $100,000 $150,000 $36,125 $100,000 $0 $436,125

R Biesheuvel GE Project Management $320,000 $320,000 $80,000 $120,000 $35,200 $80,000 n/a $355,200

C Meijer GE Markets $285,000 $258,07710 $64,705 $97,058 $0 $62,500 n/a $258,07710

R Moriarty GE Human Resources $365,000 $365,000 $91,250 $136,875 $0 $91,250 n/a $365,000

Former Executives

M Renehan GE Testing $330,000 $240,97811 $82,500 $123,750 $0 $82,500 $0 $240,97811